Professional Documents

Culture Documents

Corporate Finance First Course Toc

Uploaded by

Jawwad FaridCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

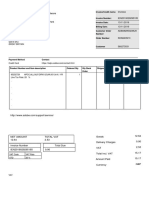

Corporate Finance First Course Toc

Uploaded by

Jawwad FaridCopyright:

Available Formats

CORPORATE

FINANCE

-

FIRST

COURSE

By Jawwad Ahmed Farid

C O R P O R A T E F I N A N C E : F I R S T C O U R S E

CONTENTS

SESSION

ZERO

LEARNING

OBJECTIVES

......................................................................................................

5

SESSION

I

FINANCIAL

CONCEPTS

.............................................................................................................

9

1.

Definitions

..........................................................................................................................................

9

i.

Operating

Cycle

..............................................................................................................................

9

ii.

Books

.............................................................................................................................................

9

iii.

Liquidity

.......................................................................................................................................

9

iv.

Financial

Structure

.......................................................................................................................

9

v.

Maturity

........................................................................................................................................

9

2.

Forms

of

Ownership

...........................................................................................................................

10

i.

Sole

Proprietor

.............................................................................................................................

10

ii.

Partnerships

................................................................................................................................

10

iii.

Corporations

..............................................................................................................................

11

iv.

Limited

Liability

Companies

(LLC's)

............................................................................................

11

3.

Financial

Statements

..........................................................................................................................

12

4.

The

Balance

Sheet

..............................................................................................................................

12

5.

The

Income

Statement

.......................................................................................................................

13

6.

Statement

of

Cash

Flows

....................................................................................................................

13

7.

The

Accounting

Notes

........................................................................................................................

14

SESSION

II

REVIEW

OF

FINANCIAL

STATEMENTS

.........................................................................................

15

1.

Assets

.................................................................................................................................................

15

i.

Current

assets

..............................................................................................................................

15

ii.

Property

Plant

&

Equipment

.......................................................................................................

16

2.

Depreciation

..........................................................................................................................................

17

3.

Liabilities

................................................................................................................................................

18

i.

Current

Liabilities

.........................................................................................................................

18

ii.

Long

Term

Liabilities

...................................................................................................................

19

4.

Net

working

capital

...............................................................................................................................

19

5.

Equity

.....................................................................................................................................................

19

i.

Shares

...........................................................................................................................................

20

ii.

Authorized

Shares

.......................................................................................................................

20

iii.

Issued

Shares

.............................................................................................................................

20

iv.

Treasury

Shares

..........................................................................................................................

20

v.

Preferred

Shares

.........................................................................................................................

20

vi.

Common

Stock

...........................................................................................................................

20

vii.

Retained

Earning

.......................................................................................................................

20

ix.

Bankruptcy

.................................................................................................................................

20

6.

Income

Statement

.................................................................................................................................

21

SESSION

3

RISK

AND

RETURN

.................................................................................................................

23

1.

Risk

&

Reward

....................................................................................................................................

23

i.

Important

Points

to

remember

....................................................................................................

24

2.

Return

....................................................................................................................................................

24

i.

Return

on

Equity

..........................................................................................................................

25

ii.

Return

on

Invested

Capital

&

ROE

..............................................................................................

25

Please

do

not

photocopy

or

distribute

without

permission.

All

rights

reserved

Alchemy

Software

Pvt

Limited.

http://FourQuants.com

Page

3

of

72

C O R P O R A T E F I N A N C E : F I R S T C O U R S E

iii. Payback period. ......................................................................................................................... 26

SESSION IV TIME VALUE OF MONEY: AN OVERVIEW ................................................................................... 27

1. Discount Rate ..................................................................................................................................... 27

i. Compounding ............................................................................................................................... 27

2. Time Value of Money ......................................................................................................................... 28

i. Examples ...................................................................................................................................... 31

3. Present Value in Action ...................................................................................................................... 34

4. Internal Rate of Return (IRR) .............................................................................................................. 35

i. Internal Rate of Return (IRR) and comments ............................................................................... 36

SESSION V OPPORTUNITY COST AND COST OF CAPITAL ................................................................................ 42

1. Opportunity Cost & Cost of Capital .................................................................................................... 42

i. Scenario 1 Understanding Opportunity Cost ............................................................................ 42

ii. Scenario 2 Understanding Cost of Capital ................................................................................ 42

2. Weighted Average Cost of Capital (WACC) ........................................................................................ 43

SESSION VI CASE STUDY: ELECTRONIC ARTS .............................................................................................. 47

1. Case Study .......................................................................................................................................... 47

2. Exhibits ............................................................................................................................................... 69

APPENDIX A ......................................................................................................................................... 71

DISCLAIMER .......................................................................................................................................... 72

Please

do

not

photocopy

or

distribute

without

permission.

All

rights

reserved

Alchemy

Software

Pvt

Limited.

http://FourQuants.com

Page

4

of

72

You might also like

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- Finance Dossier 2023-24Document141 pagesFinance Dossier 2023-24kanikabhateja7No ratings yet

- Global Aml CFT CPF and Kyc Policy 2022Document52 pagesGlobal Aml CFT CPF and Kyc Policy 2022tylor32No ratings yet

- Acca SBR - Book 3 - June 2022Document576 pagesAcca SBR - Book 3 - June 2022dabignoob123100% (2)

- Financial Reporting 2008Document6 pagesFinancial Reporting 2008zilchhourNo ratings yet

- Financial MGT Notes de Cours 2012-2013Document102 pagesFinancial MGT Notes de Cours 2012-2013Nino LANo ratings yet

- Bank Accounting Traning Material 2017Document138 pagesBank Accounting Traning Material 2017mintefikreNo ratings yet

- Medicine RCDocument67 pagesMedicine RCvinverma7No ratings yet

- Forming and Operating Hedge Fund PDFDocument44 pagesForming and Operating Hedge Fund PDFMary Samsung Mendoza100% (2)

- G10489 EC Intermediate Financial Reporting 2 PrimerDocument83 pagesG10489 EC Intermediate Financial Reporting 2 PrimerAlvin DantesNo ratings yet

- NCR User Manual PDFDocument124 pagesNCR User Manual PDFmartagobanaNo ratings yet

- Hedge Fund BookDocument44 pagesHedge Fund BookGabiNo ratings yet

- Lecturenote - 1966059717advanced Fianacial Accounting - DraftDocument211 pagesLecturenote - 1966059717advanced Fianacial Accounting - DraftBetelehem Zenaw100% (1)

- Capacity Building For Financial Literacy Programmes: Reserve Bank of IndiaDocument233 pagesCapacity Building For Financial Literacy Programmes: Reserve Bank of IndiaManisha GNo ratings yet

- 00 - 01 Clarke Brennan Objective Tests in Financial Accounting Corrected With SolutionsDocument218 pages00 - 01 Clarke Brennan Objective Tests in Financial Accounting Corrected With SolutionsPhương AnNo ratings yet

- Mastering Financial Management Demystify Finance and Transform Your Financial Skills of ManagementDocument265 pagesMastering Financial Management Demystify Finance and Transform Your Financial Skills of Managementsudheer2011100% (9)

- Finance CompendiumDocument42 pagesFinance CompendiumKolapalli AkhilNo ratings yet

- FinancialAccounting Book 2022Document305 pagesFinancialAccounting Book 2022Anastasia Airapetian100% (2)

- Economics Compendium 2023-24Document19 pagesEconomics Compendium 2023-24prasadNo ratings yet

- IRPS Ed 2 Dec 2011 ENGDocument103 pagesIRPS Ed 2 Dec 2011 ENGtaniaNo ratings yet

- Sample Reports PDFDocument182 pagesSample Reports PDFPaul MaldonatoNo ratings yet

- Summary Accounting 19-20Document48 pagesSummary Accounting 19-20Alexander BoshraNo ratings yet

- GGGI FinancePolicy v3-0 Council DG-Approved-Jul-2016Document44 pagesGGGI FinancePolicy v3-0 Council DG-Approved-Jul-2016Syed Fawad AhmadNo ratings yet

- Ministry of Revenues: Tax Audit ManualDocument304 pagesMinistry of Revenues: Tax Audit ManualYoNo ratings yet

- Monetrix - The Economics and Finance ClubDocument19 pagesMonetrix - The Economics and Finance ClubvidishaniallerNo ratings yet

- Ministry of Revenue Tax Audit Manual Part IDocument146 pagesMinistry of Revenue Tax Audit Manual Part IJamal75% (4)

- Counter-Fraud Framework Saudi Central BankDocument64 pagesCounter-Fraud Framework Saudi Central BankMNA SiddikiNo ratings yet

- Chapter - 2: Foreign Exchange Exposure and Risk ManagementDocument34 pagesChapter - 2: Foreign Exchange Exposure and Risk Managementanand vishwakarmaNo ratings yet

- Table of Contents - Chapter 14Document80 pagesTable of Contents - Chapter 14MATIULLAHNo ratings yet

- ITP No 979 English Version1Document93 pagesITP No 979 English Version1elias worku100% (3)

- Financial Confidence RealDocument103 pagesFinancial Confidence RealjakirNo ratings yet

- Accounting Principle OneDocument166 pagesAccounting Principle OneabdiNo ratings yet

- Financial Accounting and Reporting in Malaysia VOL 2Document121 pagesFinancial Accounting and Reporting in Malaysia VOL 2Mohd Harisi Rushdi100% (1)

- IT-AE-36-G05 - Comprehensive Guide To The Income Tax Return For Individuals - External GuideDocument106 pagesIT-AE-36-G05 - Comprehensive Guide To The Income Tax Return For Individuals - External GuideKriben RaoNo ratings yet

- Najma Business PlanDocument35 pagesNajma Business PlanISINYA PROPAGATORSNo ratings yet

- Procurement Policies and Procedures ManualDocument93 pagesProcurement Policies and Procedures ManualRachael FloraNo ratings yet

- Accounting Standards and Interaction With Corporate TaxDocument55 pagesAccounting Standards and Interaction With Corporate TaxWaqas AtharNo ratings yet

- RuPay Dispute Management Rules and Regulations 2.0Document164 pagesRuPay Dispute Management Rules and Regulations 2.0Pradeep Jogdankar100% (4)

- Updated Aml CFT HandbookDocument108 pagesUpdated Aml CFT HandbookBhoumika LucknauthNo ratings yet

- Basic Accounting and Financial ManagementDocument163 pagesBasic Accounting and Financial ManagementBernard Owusu100% (1)

- GshshahDocument113 pagesGshshahCiarie SalgadoNo ratings yet

- Financial Management - Rev - 04 19 19Document35 pagesFinancial Management - Rev - 04 19 19Zebib DestaNo ratings yet

- Debt Capital Market Conventions - May2013Document14 pagesDebt Capital Market Conventions - May2013kind.beach1199No ratings yet

- September 2005: (Draft)Document35 pagesSeptember 2005: (Draft)Chanpreet SinghNo ratings yet

- Book - AM - Final (6x9)Document335 pagesBook - AM - Final (6x9)ArsalanNo ratings yet

- Member HandbookDocument64 pagesMember HandbookJessicaNo ratings yet

- R12 Oracle Learning Management Student GuideDocument77 pagesR12 Oracle Learning Management Student Guidebeem100% (1)

- ThirteenwordretirementplanDocument48 pagesThirteenwordretirementplanGerryNo ratings yet

- Amended and Restated Bylaws of Alphabet IncDocument32 pagesAmended and Restated Bylaws of Alphabet IncHakeem AzmaNo ratings yet

- AcumaticaERP ImplementationChecklists Commerce EditionDocument94 pagesAcumaticaERP ImplementationChecklists Commerce EditioncrudbugNo ratings yet

- Attachment 2Document31 pagesAttachment 2Anna AkhayanNo ratings yet

- Sebenta Finance VTDocument63 pagesSebenta Finance VTmariaajudamariaNo ratings yet

- AAA Day1Document37 pagesAAA Day1Zi Yuan XuNo ratings yet

- Description: Tags: 031204ForProfitSchoolGuideDocument91 pagesDescription: Tags: 031204ForProfitSchoolGuideanon-639466No ratings yet

- Law InsolvencyDocument30 pagesLaw InsolvencyTawanda MahereNo ratings yet

- Corporate Finance BasicsDocument23 pagesCorporate Finance Basicspraveen bishnoiNo ratings yet

- 4 - Derivative Concept SummaryDocument39 pages4 - Derivative Concept SummaryDeepika JhaNo ratings yet

- Adv Fin Acc Sample 2014Document50 pagesAdv Fin Acc Sample 2014samuel hailuNo ratings yet

- CFPB Your-Money-Your-Goals Toolkit EnglishDocument284 pagesCFPB Your-Money-Your-Goals Toolkit EnglishMUHAMMAD AHSANNo ratings yet

- Treasury Crash Course 2nd Edition TOCDocument8 pagesTreasury Crash Course 2nd Edition TOCJawwad Farid0% (1)

- Interest Rate Modelling TOCDocument3 pagesInterest Rate Modelling TOCJawwad FaridNo ratings yet

- Setting Limits TOCDocument3 pagesSetting Limits TOCJawwad Farid0% (1)

- ICAAP Sample Credit Report TocDocument2 pagesICAAP Sample Credit Report TocJawwad FaridNo ratings yet

- ICAAP Overview Core Concepts TocDocument3 pagesICAAP Overview Core Concepts TocJawwad FaridNo ratings yet

- How To Construct A Black Derman Toy TOCDocument2 pagesHow To Construct A Black Derman Toy TOCJawwad FaridNo ratings yet

- Financial Modelling TocDocument4 pagesFinancial Modelling TocJawwad Farid100% (1)

- Basel III Liquidity Framework TocDocument2 pagesBasel III Liquidity Framework TocJawwad FaridNo ratings yet

- Credit Process TocDocument3 pagesCredit Process TocJawwad FaridNo ratings yet

- Calculating Value at Risk (VaR) TOCDocument3 pagesCalculating Value at Risk (VaR) TOCJawwad Farid50% (2)

- Craig Hanush Thompson, A044 854 402 (BIA Oct. 1, 2014)Document12 pagesCraig Hanush Thompson, A044 854 402 (BIA Oct. 1, 2014)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Persons Reporting Q&ADocument3 pagesPersons Reporting Q&ARachel LeachonNo ratings yet

- 23 September Paula Stratton - Has Received Documents For PID - Notification of Decision Not To Allocate A Disclosure SECOFFICIALSensitive ACCESSPersonalPrivacyDocument20 pages23 September Paula Stratton - Has Received Documents For PID - Notification of Decision Not To Allocate A Disclosure SECOFFICIALSensitive ACCESSPersonalPrivacyricharddrawsstuffNo ratings yet

- Cruise Control System CcsDocument2 pagesCruise Control System CcsciroNo ratings yet

- San Antonio Police Department Police Report On The Arrest of Daniel Pentkowski.Document2 pagesSan Antonio Police Department Police Report On The Arrest of Daniel Pentkowski.David ClarkNo ratings yet

- Vocabulary Monologue Your JobDocument2 pagesVocabulary Monologue Your JobjoseluiscurriNo ratings yet

- Lledo V Lledo PDFDocument5 pagesLledo V Lledo PDFJanica DivinagraciaNo ratings yet

- Development of Equation of Motion For Nonlinear Vibrating SystemsDocument45 pagesDevelopment of Equation of Motion For Nonlinear Vibrating SystemsSteve KrodaNo ratings yet

- RA11201 IRR DHSUD Act 2019Document37 pagesRA11201 IRR DHSUD Act 2019ma9o0No ratings yet

- Payroll Procedures: For Work Within 8 HoursDocument2 pagesPayroll Procedures: For Work Within 8 HoursMeghan Kaye LiwenNo ratings yet

- Aguinaldo DoctrineDocument7 pagesAguinaldo Doctrineapril75No ratings yet

- The Following Payments and Receipts Are Related To Land Land 115625Document1 pageThe Following Payments and Receipts Are Related To Land Land 115625M Bilal SaleemNo ratings yet

- Sample Blogger Agreement-14Document3 pagesSample Blogger Agreement-14api-18133493No ratings yet

- Deed of Absolute Sale of Real Property in A More Elaborate Form PDFDocument2 pagesDeed of Absolute Sale of Real Property in A More Elaborate Form PDFAnonymous FExJPnC100% (2)

- JEEVAN LABH 5k-10k 21-15Document1 pageJEEVAN LABH 5k-10k 21-15suku_mcaNo ratings yet

- And Prescribed by The National Office." (Italics and Emphasis Supplied)Document2 pagesAnd Prescribed by The National Office." (Italics and Emphasis Supplied)Ckey ArNo ratings yet

- Invoice: VAT No: IE6364992HDocument2 pagesInvoice: VAT No: IE6364992HRajNo ratings yet

- PIL PresentationDocument7 pagesPIL PresentationPrashant GuptaNo ratings yet

- Public Prosecutor: Section 24 Provides As UnderDocument12 pagesPublic Prosecutor: Section 24 Provides As UnderAkasa SethNo ratings yet

- Classical Liberalism, Neoliberalism and Ordoliberalism-Elzbieta MaczynskaDocument23 pagesClassical Liberalism, Neoliberalism and Ordoliberalism-Elzbieta MaczynskaSávio Coelho100% (1)

- Afu 08504 - International Capital Bdgeting - Tutorial QuestionsDocument4 pagesAfu 08504 - International Capital Bdgeting - Tutorial QuestionsHashim SaidNo ratings yet

- AWS QuestionnaireDocument11 pagesAWS QuestionnaireDavid JosephNo ratings yet

- Chap 013Document19 pagesChap 013Xeniya Morozova Kurmayeva100% (1)

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementjithaNo ratings yet

- Print For ZopfanDocument31 pagesPrint For Zopfannorlina90100% (1)

- DDR5 SdramDocument2 pagesDDR5 SdramRayyan RasheedNo ratings yet

- 04 Dam Safety FofDocument67 pages04 Dam Safety FofBoldie LutwigNo ratings yet

- List of Tallest Buildings in Delhi - Wikipedia, The Free EncyclopediaDocument13 pagesList of Tallest Buildings in Delhi - Wikipedia, The Free EncyclopediaSandeep MishraNo ratings yet

- JibranDocument15 pagesJibranMuhammad Qamar ShehzadNo ratings yet

- Rosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrDocument5 pagesRosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrEliza Den DevilleresNo ratings yet