Professional Documents

Culture Documents

Vat 121

Uploaded by

arjunrulezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat 121

Uploaded by

arjunrulezCopyright:

Available Formats

FOR CANCELLATION OF VAT REGISTRATION [ See Rule 14 (2) ] 01.Tax Office Address: _____________________________________ _____________________________________ _____________________________________ 03.

Name : Address: 02 TIN I apply to cancel my VAT registration with effect from 04 Date: Reason(s) for the cancellation of registration: Delete (i) (ii) or (iii) if not applicable) (i) My business closed on: 05 Date: (ii) The value of my taxable turnover over the previous 3 calendar months was 06 Value: And the value of my taxable turnover over the previous 12 calendar months was 07 Value (iii) I request to cancel my voluntary registration which was registered with effect from. 08 Date: The value of my taxable turnover over the previous 3 calendar months was : 09 Value: The value of my taxable turnover over the previous 12 calendar months was: 10 Value: The reasons for the application under (i), (ii) or (iii) above are: I undertake that I must account for VAT on any stock or assets on hand on which I have received refund of input tax, and file a final tax return and pay the VAT due prior to the cance llation of my registration. 11 DECLARATION Istatus.of the above business hereby declare that the information given in this Form is true and corr ect. Signature & StampDate of declaration FORM VAT 121 Date Month Year Please see Notes on the Reverse of this Form Date Month Year 73 OFFICE USE ONLY Date of application received 12 Checked arrears of VAT .............................. Confirmation from Return Processing Section Tax Arrears ..... Final Return issued ....... Final Return Received....... For Verification YES/NO Date of cancellation from 13 Date of Form VAT 122 issued 14 Date of Form VAT 123 ( refusal of cancellation ) issued 15 Date of Form VAT 124 issued 16 ASST. COMMERCIAL TAX OFFICER, COMMERCIAL TAX OFFICER, PROCESSING AUTHORITY REGISTERING AUTHORITY ________________ CIRCLE. __________________CIRCLE. Box 01 Indicate name of the Tax Office. Box 02 Insert the TIN number which you will find on your VAT Certificate of Regi stration. Box 03 Insert the name and address shown on your VAT Certificate of Registration . Box 04 Insert the date from which you are requesting cancellation of your regist

ration. Box 05 Insert the date of the business ceased. Box 06 Insert the value of your taxable sales (excluding VAT ) for the previous 3 consecutive calendar months. Box 07 Insert the value of your taxable sales (excluding VAT) for the previous 1 2 consecutive calendar months. Box 08 Insert the date from which you were voluntarily registered. Box 09 Insert the value of your taxable sales (excluding VAT) for the previous 3 consecutive calendar months if you were voluntarily registered. Box 10 Insert the value of your taxable sales (excluding VAT) for the previous 1 2 consecutive calendar months if you were voluntarily registered. Box 11 Insert the name and title of the person making the declaration. Finally s ign and date of declaration. Box 12-16 ARE FOR COMPLETION BY THE TAX OFFICE.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Oilwell Fishing Operations Tools and TechniquesDocument126 pagesOilwell Fishing Operations Tools and Techniqueskevin100% (2)

- Message and Responses From TaoshobuddhaDocument4 pagesMessage and Responses From TaoshobuddhaTaoshobuddhaNo ratings yet

- Case Study - Succession LawDocument2 pagesCase Study - Succession LawpablopoparamartinNo ratings yet

- Mobil Oil v. DiocaresDocument2 pagesMobil Oil v. DiocaresAntonio Rebosa100% (2)

- MadBeard Fillable Character Sheet v1.12Document4 pagesMadBeard Fillable Character Sheet v1.12DiononNo ratings yet

- LESSON 2 - Nguyễn Thu Hồng - 1917710050Document2 pagesLESSON 2 - Nguyễn Thu Hồng - 1917710050Thu Hồng NguyễnNo ratings yet

- What Are Open-Ended Questions?Document3 pagesWhat Are Open-Ended Questions?Cheonsa CassieNo ratings yet

- Individual Assessment Forms1Document9 pagesIndividual Assessment Forms1Maria Ivz ElborNo ratings yet

- Navavarana ArticleDocument9 pagesNavavarana ArticleSingaperumal NarayanaNo ratings yet

- A Review Article On Integrator Circuits Using Various Active DevicesDocument7 pagesA Review Article On Integrator Circuits Using Various Active DevicesRaja ChandruNo ratings yet

- Álvaro García Linera A Marxist Seduced BookDocument47 pagesÁlvaro García Linera A Marxist Seduced BookTomás TorresNo ratings yet

- Supplier of PesticidesDocument2 pagesSupplier of PesticidestusharNo ratings yet

- Agriculture Term Paper TopicsDocument5 pagesAgriculture Term Paper Topicsfuhukuheseg2100% (1)

- ICE Learned Event DubaiDocument32 pagesICE Learned Event DubaiengkjNo ratings yet

- IB Diploma Maths / Math / Mathematics IB DP HL, SL Portfolio TaskDocument1 pageIB Diploma Maths / Math / Mathematics IB DP HL, SL Portfolio TaskDerek Chan100% (1)

- Sewing Threads From Polyester Staple FibreDocument13 pagesSewing Threads From Polyester Staple FibreganeshaniitdNo ratings yet

- Sky Education: Organisation of Commerce and ManagementDocument12 pagesSky Education: Organisation of Commerce and ManagementKiyaara RathoreNo ratings yet

- 2020052336Document4 pages2020052336Kapil GurunathNo ratings yet

- WEEK 4 A. Family Background of Rizal and Its Influence On The Development of His NationalismDocument6 pagesWEEK 4 A. Family Background of Rizal and Its Influence On The Development of His NationalismVencint LaranNo ratings yet

- Healthy Kitchen Shortcuts: Printable PackDocument12 pagesHealthy Kitchen Shortcuts: Printable PackAndre3893No ratings yet

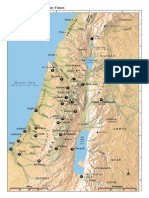

- Israel Bible MapDocument1 pageIsrael Bible MapMoses_JakkalaNo ratings yet

- Sale of GoodsDocument41 pagesSale of GoodsKellyNo ratings yet

- SK Council Authorizes New Bank AccountDocument3 pagesSK Council Authorizes New Bank Accountt3emo shikihiraNo ratings yet

- Principle of Utmost Good FaithDocument7 pagesPrinciple of Utmost Good FaithshreyaNo ratings yet

- Christian Mission and Conversion. Glimpses About Conversion, Constitution, Right To ReligionDocument8 pagesChristian Mission and Conversion. Glimpses About Conversion, Constitution, Right To ReligionSudheer Siripurapu100% (1)

- Case Digest in Special ProceedingsDocument42 pagesCase Digest in Special ProceedingsGuiller MagsumbolNo ratings yet

- Minsc and Boo's Journal of VillainyDocument158 pagesMinsc and Boo's Journal of VillainyAPCommentator100% (1)

- Week 5 WHLP Nov. 2 6 2020 DISSDocument5 pagesWeek 5 WHLP Nov. 2 6 2020 DISSDaniel BandibasNo ratings yet

- Unit 6 Lesson 3 Congruent Vs SimilarDocument7 pagesUnit 6 Lesson 3 Congruent Vs Similar012 Ni Putu Devi AgustinaNo ratings yet

- Chapter 3Document11 pagesChapter 3Leu Gim Habana PanuganNo ratings yet