Professional Documents

Culture Documents

UnionBudget2011-12 Travel Aviation

Uploaded by

Hari RaulvidOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UnionBudget2011-12 Travel Aviation

Uploaded by

Hari RaulvidCopyright:

Available Formats

An Overview

Key Expectations

Direct Tax Proposals

Indirect Tax Proposals

Our Offices

Union Budget 2011-12: Impact on Travel and Aviation Sector

Grant Thornton India. All rights reserved.

An Overview

Key Expectations

Direct Tax Proposals

Indirect Tax Proposals

Our Offices

An overview

The aviation industry in India is one of the sectors that has witnessed a constant pace of growth over the past several i d f h h l years. The open sky policy of the government has facilitated the entry of overseas players in the aviation sector in India following which there has been steady growth both in terms of g yg number of players and aircraft. This is reflected in a CAGR (Compounded Annual Growth Rate) of 16%. According to the Investment Commission of India, potential investment requirements in new aircrafts till the year 2020 could touch US$80 billion At present, private airlines account billion. present for over two-thirds of the domestic aviation market. The factors contributing to an increasing number of air travel passengers are as follows: 1. 1 The presence of multiple low cost airlines has resulted in competitive pricing of airfares; 2. The growing middle class and its purchasing power; and 3. Establishment of new airports and renovation/ restructuring of existing airports. The growth of the aviation sector and capacity expansion by b carriers h given rise to the f ll i challenges: i has i i h following h ll 1. Shortage of trained pilots and other technical personnel; 2. Inadequacy of infrastructure, despite the recent investments thi regard; nd in tm nt in this r rd and 3. Declining returns due to stiff competition and rising fuel costs. In order for the sector to continue the growth that it has thus f witnessed, it will be critical to address the above h far i d i ill b i i l dd h b challenges.

Grant Thornton India. All rights reserved.

An Overview

Key Expectations

Direct Tax Proposals

Indirect Tax Proposals

Our Offices

Key expectations

Investment linked tax incentive by way of a hundred percent deduction in the year of incurrence of capital e pe d tu e suc expenditure such as ground handling equipment, safety g ou d a d g equ p e t, sa ety equipment and upgrade of software. This will enhance the airlines ability to invest in adding / upgrading assets which is a key requirement. Infrastructure status for the Aviation sector in order to qualify f d d ti lif for deductions on profits and gains under S ti fit d i d Section 80-IA. Expenditure on training including any payments to aircraft manufacturers, training academy, in-house cost on training pilots, etc should be given a weighted deduction while computing taxable income. Rationalise taxes on Aviation Turbine Fuel (ATF), which constitutes over 40% of the operating cost by bringing the commodity under the declared goods category. Concessions in airport fees and other charges. Removal of service tax on the following: first and business class tickets; domestic travel., and navigation fees on landing, airport and air.

Grant Thornton India. All rights reserved.

An Overview

Key Expectations

Direct Tax Proposals

Indirect Tax Proposals

Our Offices

Direct tax proposals

1. There are no Di t T 1 Th Direct Tax p p l proposals specifically affecting the Travel and Aviation sectors. However, the following key changes applicable to all companies in general will affect this sector as well well. Increase in MAT rate from 18% to 18.5%. Since most airline companies are reeling under huge accumulated losses, there should not be any immediate additional cash outflow on account of this change. Reduction in surcharge from 7.5% to 5%. The reduction in effective corporate tax rate will not have an immediate impact on account of accumulated losses. 2. 2 The tax authorities h Th t th iti have b been given i additional powers to seek information regarding use of Double Taxation Avoidance Agreements. These powers could be used by the tax authorities to examine tax efficient structuring of aircraft leases, amongst other transactions.

Grant Thornton India. All rights reserved.

An Overview

Key Expectations

Direct Tax Proposals

Indirect Tax Proposals

Our Offices

Indirect tax proposals

The aviation industry has faced the brunt of the economic down turn and most players in the industry have incurred significant losses. However, rather than easing the burden on the industry, most of the indirect tax proposals seek to increase the tax incidence. The following changes have been proposed in the Finance Bill 2011:

Customs

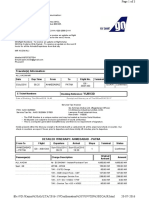

The rate of service tax on travel by air are being increased as follows:

SL 1 2 3 Travel Type Domestic Travel (Economy Class) International Travel (Economy Class) Domestic Travel (Other than Economy Class) Present Rate Rs. 100 Rs. 500 Rs. 100 Proposed Rate Rs. 150 Rs. 750 10%

A basic customs duty of 2 5% is being imposed on 2.5% imports of aircrafts for non-scheduled operations. The exemption from additional duty of customs (CVD) and special additional duty of customs (SAD) would continue. Exemption from education cess and secondary and higher education cess presently available to aircrafts is being withdrawn.

It is proposed that transport of goods by air would be considered as exports as long as the recipient of the service is located outside India. The existing requirement is that the whole or part of the services should have been performed outside India.

Service tax

It is proposed to exempt services for specified purposes provided within a port or an airport which are classified under the Works contract category.

Grant Thornton India. All rights reserved.

An Overview

Key Expectations

Direct Tax Proposals

Indirect Tax Proposals

Our Offices

Our offices

To know more about Grant Thornton, please visit www.wcgt.in or contact any of our offices listed below:

NEW DELHI National Office Outer Circle L 41 Connaught Circus New Delhi 110 001 T +91 11 4278 7070 GURGAON 21st Floor, DLF Square Jacaranda Marg DLF Phase II Gurgaon 122 002 T +91 124 462 8000 BENGALURU Wings, First Floor 16/1 Cambridge Road Halasuru Bangalore 560 008 T +91 80 4243 0700 HYDERABAD Uptown Banjara Road No 3 j Banjara Hills Hyderabad 500 034 T +91 40 6630 8230 CHANDIGARH SCO 17 2nd Floor Sector 17 E Chandigarh 160 017 T +91 172 4338 000 MUMBAI Engineering Centre, 6th Floor 9 Matthew Road Opera House p Mumbai 400 004 T +91 22 2367 1623 CHENNAI Arihant Nitco Park, 6th floor No.90, Dr. Radhakrishnan Salai Mylapore Chennai 600 004 T +91 44 4294 0000 PUNE 401 Century Arcade Narangi Baug Road Off Boat Club Road Pune 411 001 T +91 20 4105 7000

About Grant Thornton International Grant Thornton International is one of the worlds leading organisations of independently owned and managed accounting and consulting firms. These firms provide assurance, tax and specialist advisory services to privately held businesses and public interest entities. Clients of member and correspondent firms can access the knowledge and experience of more than 2400 partners in over 80 countries and consistently receive a distinctive, high quality and personalized service wherever they choose to do business. Grant Thornton International strives to speak out on issues that matter to business and which are in the wider public interest and to be a bold and positive leader in its chosen markets and within the global accounting profession profession. About Grant Thornton India Grant Thornton India is a member firm within Grant Thornton International. The Firm in India was established in 1935 & it is one of the oldest and most reputed accountancy firms in India. Grant Thornton India is also the leading firm in India advising business owners and entrepreneurs with international ambitions.

You might also like

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- Outsourcing of Core Legal Service Functions: How to Capitalise on Opportunities for Law FirmsFrom EverandOutsourcing of Core Legal Service Functions: How to Capitalise on Opportunities for Law FirmsNo ratings yet

- Foreign Direct Investment: ProductionDocument21 pagesForeign Direct Investment: ProductionAniket BardeNo ratings yet

- Foreign Direct Investments 1218215823748473 9Document33 pagesForeign Direct Investments 1218215823748473 9roopendrawardlawNo ratings yet

- Trade of India Fdi Uppcs 64Document10 pagesTrade of India Fdi Uppcs 64Girish JoshiNo ratings yet

- Budget Plan Financial GuidelineDocument12 pagesBudget Plan Financial GuidelineRahul DubeyNo ratings yet

- GST 28 Council Meeting: Highlights of The Decisions Taken by The GST Council in Its 28th MeetingDocument4 pagesGST 28 Council Meeting: Highlights of The Decisions Taken by The GST Council in Its 28th MeetingPC RKNo ratings yet

- CompanyInformation (Teaser) 20july2019 PDFDocument27 pagesCompanyInformation (Teaser) 20july2019 PDFAnkit BansalNo ratings yet

- Investor Presentation May 2016 (Company Update)Document29 pagesInvestor Presentation May 2016 (Company Update)Shyam SunderNo ratings yet

- India: Nat National Trade Facilitation Action Plan 2017-2020Document32 pagesIndia: Nat National Trade Facilitation Action Plan 2017-2020Shaji VkNo ratings yet

- International Finance - TCS Case StudyDocument22 pagesInternational Finance - TCS Case StudyPrateek SinglaNo ratings yet

- Company Information (Teaser) Version 2 - July 20, 2019Document27 pagesCompany Information (Teaser) Version 2 - July 20, 2019dhruvshah93No ratings yet

- Indian Aviation IndustryDocument7 pagesIndian Aviation IndustryAMAN KUMARNo ratings yet

- Research and Analysis of Indian AirlinesDocument48 pagesResearch and Analysis of Indian AirlinesArpana KarnaNo ratings yet

- FDI Guide: Types, Sectors, Benefits & Trends in IndiaDocument38 pagesFDI Guide: Types, Sectors, Benefits & Trends in IndiaAshish Jain100% (1)

- Fdi & FiiDocument38 pagesFdi & FiiJitendra KalwaniNo ratings yet

- FDI in IndiaDocument22 pagesFDI in IndiachaturvediprateekNo ratings yet

- Tax Commentary 2020Document85 pagesTax Commentary 2020Javed MushtaqNo ratings yet

- Chapter-4: Sector-Wise StrategiesDocument24 pagesChapter-4: Sector-Wise StrategiesAyoob AnsariNo ratings yet

- Ernst & Young Merchant Banking Services LLPDocument11 pagesErnst & Young Merchant Banking Services LLPManishNo ratings yet

- FDI in IndiaDocument4 pagesFDI in IndiaPratik RambhiaNo ratings yet

- FDI in India GuideDocument56 pagesFDI in India GuideKuntal DasNo ratings yet

- Q2 Result Presentation (Company Update)Document14 pagesQ2 Result Presentation (Company Update)Shyam SunderNo ratings yet

- Automobile Industry - Some Economic PoliciesDocument4 pagesAutomobile Industry - Some Economic PoliciesRenu PratapNo ratings yet

- Budget - Salient Features - 2011!12!28 (1) .02Document3 pagesBudget - Salient Features - 2011!12!28 (1) .02Ruchira SonawaneNo ratings yet

- D.O. No. Av-29011/75/2020-Er DateDocument6 pagesD.O. No. Av-29011/75/2020-Er DatekirtiNo ratings yet

- Budget NoteDocument4 pagesBudget NoteSunil SharmaNo ratings yet

- BDO Budget Snapshot - 2012-13Document9 pagesBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNo ratings yet

- Afm QT Ans June 2022Document12 pagesAfm QT Ans June 2022Bijay AgrawalNo ratings yet

- Licensing Agreement Negotiations Between Metro Corporation and Impecina Constructions S.ADocument9 pagesLicensing Agreement Negotiations Between Metro Corporation and Impecina Constructions S.Arohith06No ratings yet

- Mithra Mini Project 2019Document10 pagesMithra Mini Project 2019abhishekNo ratings yet

- Software Industry Detail AnalysisDocument66 pagesSoftware Industry Detail Analysisamit.c.parekh1317100% (7)

- Air India: Directors' ReportDocument8 pagesAir India: Directors' ReportSachin NarayankarNo ratings yet

- Budget Highlights 2012-13Document7 pagesBudget Highlights 2012-13Vikas JainNo ratings yet

- A PEST Analysis Is An Analysis of Airline IndustryDocument5 pagesA PEST Analysis Is An Analysis of Airline Industryerohu123456100% (1)

- What Is Turn-Key Project? What Are Its Advantages and Disadvantages?Document4 pagesWhat Is Turn-Key Project? What Are Its Advantages and Disadvantages?Kuthubudeen T MNo ratings yet

- Analysis of Tech Mahindra's Annual ReportDocument12 pagesAnalysis of Tech Mahindra's Annual ReportUtsabChakrabortyNo ratings yet

- FDI in IndiaDocument20 pagesFDI in IndiaSanjeet MohantyNo ratings yet

- Investing in India: Foreign Direct Investment - IntroductionDocument11 pagesInvesting in India: Foreign Direct Investment - IntroductionwjfrancisNo ratings yet

- Highlights of Budget 2011-2012: Compiled by:-CA. Puneet Duggal (F.C.A) M/S Fatehpuria Duggal & AssociatesDocument14 pagesHighlights of Budget 2011-2012: Compiled by:-CA. Puneet Duggal (F.C.A) M/S Fatehpuria Duggal & AssociatesPuneet DuggalNo ratings yet

- International Taxation in India - Recent Developments & Outlook (Part - Ii)Document6 pagesInternational Taxation in India - Recent Developments & Outlook (Part - Ii)ManishJainNo ratings yet

- Y y y y y y y y y y y y y y y yDocument32 pagesY y y y y y y y y y y y y y y ychandra4145No ratings yet

- CFRA Project PDFDocument14 pagesCFRA Project PDFSYKAM KRISHNA PRASADNo ratings yet

- Civil Aviation Sector Pranab Mukherjee: Airlines Get $1-Billion LiftDocument3 pagesCivil Aviation Sector Pranab Mukherjee: Airlines Get $1-Billion LiftakkirulzNo ratings yet

- Project Financing: Foreign Collaboration in A ProjectDocument10 pagesProject Financing: Foreign Collaboration in A ProjectAditi AgarwalNo ratings yet

- India Tax SystemDocument53 pagesIndia Tax SystemNiket DattaniNo ratings yet

- STPI Ready Reckoner 2007Document17 pagesSTPI Ready Reckoner 2007NirajNo ratings yet

- FDI in India-Pros & ConsDocument52 pagesFDI in India-Pros & ConsArpita ShahNo ratings yet

- What Are Foreign Direct Investments?Document16 pagesWhat Are Foreign Direct Investments?raghavendramishra0% (1)

- Summary of Thailand-Tax-Guide and LawsDocument34 pagesSummary of Thailand-Tax-Guide and LawsPranav BhatNo ratings yet

- MOF Circular 134-2008 ForeignCtr Tax Summary (En)Document4 pagesMOF Circular 134-2008 ForeignCtr Tax Summary (En)quangpqNo ratings yet

- TCS Annual Report Key Details: Revenue, Leadership, FinancialsDocument21 pagesTCS Annual Report Key Details: Revenue, Leadership, FinancialsdeepanshuNo ratings yet

- Financial Reports Review: Tech Mahindra and WiproDocument17 pagesFinancial Reports Review: Tech Mahindra and WiproSiddhesh GurjarNo ratings yet

- Swot Analysis of The Indian Aviation IndustryDocument1 pageSwot Analysis of The Indian Aviation IndustryTejas Soni0% (1)

- Taxsutra - CBDT's Proposal On Profit Attribution To PEs - Paving New PathwaysDocument5 pagesTaxsutra - CBDT's Proposal On Profit Attribution To PEs - Paving New PathwaysPiyush AggarwalNo ratings yet

- Foreign Capital Inflow in India & It's Implication For Macro EconomyDocument8 pagesForeign Capital Inflow in India & It's Implication For Macro EconomyAnimesh JainNo ratings yet

- Foreign CapitalDocument27 pagesForeign CapitalPraveen NairNo ratings yet

- Application of Preference Scheme in The Evalauation of Proposals and BidsDocument17 pagesApplication of Preference Scheme in The Evalauation of Proposals and BidsGerald MagingaNo ratings yet

- FDI Boon or Bane for IndiaDocument21 pagesFDI Boon or Bane for IndiaJunaid FarooqNo ratings yet

- Security Analysis and Portfolio Management: CMC Limited Assignment 1 (Part B)Document17 pagesSecurity Analysis and Portfolio Management: CMC Limited Assignment 1 (Part B)dipanshurustagiNo ratings yet

- Form ST-1Document4 pagesForm ST-1Suppy PNo ratings yet

- Taxi BillDocument3 pagesTaxi BillRanjan KumarNo ratings yet

- Malaysian Tax FrameworkDocument11 pagesMalaysian Tax FrameworkDylan Ngu Tung HongNo ratings yet

- Your Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan NovemberDocument3 pagesYour Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan Novemberkhair kamilNo ratings yet

- Monthly Journal - Dec, 15 IssueDocument152 pagesMonthly Journal - Dec, 15 Issuemaddy0808No ratings yet

- SpiceJet - E-Ticket - PNR F98SUW Ahmedabad-Port BlairDocument2 pagesSpiceJet - E-Ticket - PNR F98SUW Ahmedabad-Port BlairKrishNo ratings yet

- Dharwad Telecom DistrictDocument3 pagesDharwad Telecom DistrictNataraj RokhadeNo ratings yet

- Test PDFDocument3 pagesTest PDFkazim4ualiNo ratings yet

- MDR and Charges DetailsDocument2 pagesMDR and Charges DetailsHarsh TuliNo ratings yet

- TG1628 Kotak Life InsuranceDocument2 pagesTG1628 Kotak Life InsuranceAnandKumarPNo ratings yet

- Executive Summary: Sandeep Kumar & AssociatesDocument28 pagesExecutive Summary: Sandeep Kumar & AssociatesAarti YadavNo ratings yet

- Claim Refund of Excess Service Tax PaidDocument26 pagesClaim Refund of Excess Service Tax PaidNitin SrivastavaNo ratings yet

- GoibiboDocument3 pagesGoibiboAkshayJhaNo ratings yet

- Elmech EngineersDocument24 pagesElmech EngineersgsNo ratings yet

- DP ChargesDocument1 pageDP ChargesSubbuNo ratings yet

- Insurance D.B Essem-IIIDocument2 pagesInsurance D.B Essem-IIIAnonymous i3lI9MNo ratings yet

- AAI Airport Tariff Structure 2016Document30 pagesAAI Airport Tariff Structure 2016akshay royalNo ratings yet

- TDS FinalDocument28 pagesTDS FinalMajda MohamadNo ratings yet

- Gmail - Your Tickets PDFDocument2 pagesGmail - Your Tickets PDFJugJyoti BorGohainNo ratings yet

- Purchase Order: Page 1 of 24Document24 pagesPurchase Order: Page 1 of 24Joyal ThomasNo ratings yet

- Chemplast PA System AMC OfferDocument1 pageChemplast PA System AMC OffersatheeshNo ratings yet

- News Letter January 2017Document19 pagesNews Letter January 2017Sujata SinghNo ratings yet

- 8 Section 8 SCCDocument29 pages8 Section 8 SCCTRANSIT STRNo ratings yet

- Rialto Enterises SCNDocument10 pagesRialto Enterises SCNmahen3378No ratings yet

- GTCPhase4 - Terms N ConditionDocument28 pagesGTCPhase4 - Terms N ConditionMitraNo ratings yet

- Indiabulls Park Cost Sheet and Payment ScheduleDocument15 pagesIndiabulls Park Cost Sheet and Payment Schedulevikas2354_268878339No ratings yet

- ATS TriumphDocument4 pagesATS TriumphsandeeprazzNo ratings yet

- R-APDRP Part-B Works TendersDocument71 pagesR-APDRP Part-B Works TendersArvind YadavNo ratings yet

- Kotak Lifetime Income V13Document11 pagesKotak Lifetime Income V13skverma3108No ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document4 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)Deepak AgarwalNo ratings yet