Professional Documents

Culture Documents

Thesun 2008-12-24 Page19 Malaysia To Ride Out Bumpy Economic Journey Next Year

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2008-12-24 Page19 Malaysia To Ride Out Bumpy Economic Journey Next Year

Uploaded by

Impulsive collectorCopyright:

Available Formats

theSun | WEDNESDAY DECEMBER 24 2008 19

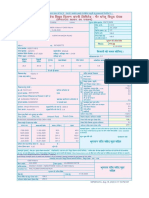

business news KLCI

Sensitivity by

Company Price (RM) Change (RM) KLCI Points

MISC 8.40 -0.25 -1.73

IOICorp 3.54 +0.10 -1.14

Sime 5.40 -0.10 -1.12

Malaysia to ride out ‘bumpy’

BAT 46.00 +2.00 +1.06

DiGi 21.50 +0.70 +1.01

TNB 6.00 +0.10 +0.81

PBBank 8.60 -0.10 -0.66

KLK 8.75 -0.20 -0.40

BJToto 4.70 +0.14 +0.35

Commerz 5.85 -0.05 -0.31

economic journey next year Others

KLCI 871.16

-2.13

-0.14

-2.27

KUALA LUMPUR: Malaysia has used to churn economic activities. into sectors like construction,

strong fundamentals which make The banking sector remains strong residential, transport, investment, and

the economy resilient enough to get with a low non-performing loans training and information technology.

through next year when the fallout of (NPLs) level of 2.5% and risk weighted As for inflation, the government

the global economic slowdown begins capital ratio (RWCR) of 13.2%, which has projected that the level could be

to take effect. is more than the 8% international in the range of 3-4% for next year,

Analysts’ said the ongoing requirement level. subject to the continuing downtrend

economic measures are expected to However, Malaysia is not an in the global crude oil prices.

help drive the country through the exception in having to face the current Malaysia’s inflation rate rose to a

“bumpy” journey next year, no thanks challenging time with the 2009 Budget new 26-year high of 8.5% in July 2008,

to the United States and the massive having already indicated slower growth. driven by the escalating cost of fuel

failure of its financial system. In line with regional peers, the and electricity.

Even before the crisis, it was still a GDP growth for next year has been In an effort to curb rising inflation,

difficult year as the government had revised to 3.5%, with the government “jump-started” by the increase in

to contend with rising crude oil prices confident of achieving 5% for 2008. retail fuel prices up to RM2.70 per

which touched US$147 (RM514.50) In the wake of a fall in most litre, Bank Negara Malaysia reduced Toshiba

per barrel in July before receding to commodity prices in mid-2008 due the Overnight Policy Rate (OPR) by 25

US$36.50 (RM127.75) just last week. to the lack of global demand, the basis points to 3.25% in November. bullish

As if this was not enough, the government realised potential federal It was the first such cut since April despite

United States sub-prime crisis boiled earnings would be squeezed while at 2006. global

over soon after the tabling of the the same time having to continue to Crude oil prices are now hovering

2009 Budget on Aug 29, spreading its spend for mass development. below US$40 (RM140) per barrel, slowdown

ill-effects all around the globe. The fiscal deficit for 2009 is dropping significantly from its all time pg 19

As a policy response towards high of US$147 per barrel recorded

the global financial crisis, Malaysia A prudent fiscal move is that in July this year. The petrol price at

unveiled a stimulus package, injecting the government will review pump was reduced to RM1.80 on Dec

RM7 billion into the economy to some projects and give priority 15, the fifth time since the increase of

ensure sustained growth. 78 sen in June 2008.

“Extraordinary times require to those that can be speeded As for crude palm oil (CPO) prices,

extraordinary measures,” said Deputy up with high multiplier effects, the government is working with its

Prime Minister and Finance Minister besides having low import Indonesian counterpart to stabilise the

Datuk Seri Najib Abdul Razak. ingredients. price at RM2,000-2,600 a tonne level.

Pragmatic government policies and Among the other measures

prudent measures practised by Bank projected at 4.8%, the same level as taken to reduce supply is the oil

Negara and relevant agencies, such this year. At this level, the government palm replanting programme while

as the Securities Commission, have will carry on implementing an promoting the usage of bio-diesel

made the country’s financial system “expansionary” fiscal policy, which is from palm oil to increase demand.

stable. also being adopted by other countries The CPO prices have fallen by

The country’s financial and at present. almost 60% from a record high of

property markets are not surrounded In the 2009 Budget, the government RM4,486 per tonne in March after

by speculative bubble symptoms as in has indicated that it had the flexibility the global economic crisis hit the

the 1997/98 Asian Financial crisis. to implement high impact projects commodity market. market, the government on Oct 20 investment in the midst of global

Furthermore, analysts say, less through savings from the oil subsidy. As for domestic economic announced the injection of RM5 economic slowdown.

than 5% of Malaysian assets are It must be noted that there is no activities, the government will give billion into Valuecap Sdn Bhd, the There would also be full

exposed to the US economy. change in the total amount to be spent extra attention to generate growth, government investment agency, import duty exemption on raw

Malaysia is also not exposed to under the 2009 Budget. as international trade and external to buy undervalued stocks in the materials and intermediate

the “complex and uncontrollable” The government allocated RM207.9 demands gets slower. local bourse. goods to be used for domestic

innovative financial products which billion for the 2009 Budget, of which This time around, the government Valuecap’s portfolio has grown manufacturing activities.

finally became the main cause of the RM154.2 billion is for operating has said the “export-led recovery” from RM5 billion initially to RM8 The total FDI for the

US sub-prime crisis. expenditure and RM53.7 billion for policy could not be implemented as billion now. January to August period in the

Malaysia’s capital market, development. successfully as during the 1997/98 To attract Foreign Direct manufacturing sector was RM36.8

meanwhile, is largely based on A prudent fiscal move is that the crisis. Investment (FDI), the government billion, surpassing last year’s

Syariah principles, which requires government will review some projects The government also realises on Nov 14 announced pre- figure of RM33.4 billion.

“proper” debt level and financial and give priority to those that can that slower economic growth could emptive measures, among others, However, International Trade

management. be speeded up with high multiplier see a reduction in job creations, manufacturing licences would and Industry Minister Tan Sri

In addition, the country has a effects, besides having low import thus projecting the unemployment be issued automatically effective Muhyiddin Yassin said there might

total funding of about 37% to gross ingredients. rate of about 4-4.5%, a level that the from Dec 1. be some impact next year or the

domestic product (GDP), indicating The RM7 billion savings from the government said was “manageable”. The move is aimed at following year on FDI due to the

that it has ample liquidity that can be oil subsidy would then be channelled In an effort to stimulate the capital cushioning the impact on economic slowdown. – Bernama

You might also like

- FinalsDocument205 pagesFinalsall in one67% (3)

- A Walk On The (Asian) Wild Side: James Chanos Kynikos AssociatesDocument24 pagesA Walk On The (Asian) Wild Side: James Chanos Kynikos AssociatessubflacherNo ratings yet

- 7 Aacb 8 FCDocument1 page7 Aacb 8 FCAmaryNo ratings yet

- The Rise and Fall of The Shadow Banking System, Zoltan PozsarDocument14 pagesThe Rise and Fall of The Shadow Banking System, Zoltan Pozsared_nyc100% (1)

- HayGroup Job Measurement: An IntroductionDocument17 pagesHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- 02 Bear Stearns Case StudyDocument13 pages02 Bear Stearns Case Studydinieus100% (1)

- 2007 - Subprime - Shorting Home Equity Mezzanine Tranches 1 PDFDocument73 pages2007 - Subprime - Shorting Home Equity Mezzanine Tranches 1 PDFknightridNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- GSTR3B 24agppp8172k1zp 032021Document2 pagesGSTR3B 24agppp8172k1zp 032021Nanu PatelNo ratings yet

- IBM - Using Workforce Analytics To Drive Business ResultsDocument24 pagesIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorNo ratings yet

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- GSTR3B 07arbpb8459q1z8 122021Document2 pagesGSTR3B 07arbpb8459q1z8 122021Ajit GuptaNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch08Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch08Kevin Molly Kamrath0% (1)

- GSTR3B 06DKXPK3659H1ZH 032021Document2 pagesGSTR3B 06DKXPK3659H1ZH 032021Sahal RizviNo ratings yet

- Risk Management For Enterprises and Individuals, V. 1.0 - AttributedDocument1,260 pagesRisk Management For Enterprises and Individuals, V. 1.0 - AttributedAlfonso J Sintjago100% (3)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- HBR - HR Joins The Analytics RevolutionDocument12 pagesHBR - HR Joins The Analytics RevolutionImpulsive collectorNo ratings yet

- Financial Markets and Institutions Global 8th Edition Mishkin Test BankDocument8 pagesFinancial Markets and Institutions Global 8th Edition Mishkin Test Bankmolossesreverse2ypgp7100% (31)

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Finance with E-Banking ModuleDocument23 pagesGlobal Finance with E-Banking Moduletammy a. romuloNo ratings yet

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- StudentDocument34 pagesStudentKevin CheNo ratings yet

- Financial CrisisDocument40 pagesFinancial CrisisShahidAthaniNo ratings yet

- Test Bank For Financial Institutions Markets and Money 11th Edition KidwellDocument5 pagesTest Bank For Financial Institutions Markets and Money 11th Edition KidwellSally Bullman100% (28)

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- Islamic Financial Services Act 2013Document177 pagesIslamic Financial Services Act 2013Impulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- Daily & Technical Update Februari 07, 2023Document9 pagesDaily & Technical Update Februari 07, 2023Teja HusadaNo ratings yet

- Pay Date Amount Paid Cac No. Punch Date: UrbanDocument1 pagePay Date Amount Paid Cac No. Punch Date: UrbanPooja DevariyaNo ratings yet

- DatasheetDocument2 pagesDatasheetKurdo KurdNo ratings yet

- Apr 2021 GSTR - 3BDocument2 pagesApr 2021 GSTR - 3BIncome TaxNo ratings yet

- GSTR3B 21ahhpn3658h1zd 062021Document2 pagesGSTR3B 21ahhpn3658h1zd 062021GOOGLE NETNo ratings yet

- O&M Vidisha bill details for July 2020Document1 pageO&M Vidisha bill details for July 2020Anshul ShrivastavaNo ratings yet

- GSTR3B 09aaopj3054f1zo 052022Document3 pagesGSTR3B 09aaopj3054f1zo 052022Suhail KhanNo ratings yet

- Fundcard: HDFC Sensex ETFDocument4 pagesFundcard: HDFC Sensex ETFChittaNo ratings yet

- GLOBAL AMITY INSURANCE QUOTE FOR HONDA CITYDocument1 pageGLOBAL AMITY INSURANCE QUOTE FOR HONDA CITYoniNo ratings yet

- BJXDocument12 pagesBJXRichy GarciaNo ratings yet

- Urban: Pay Date Cac No. Amount Paid Punch DateDocument1 pageUrban: Pay Date Cac No. Amount Paid Punch DateK CHOUDHARYNo ratings yet

- 2024-01-15 - GK - 03 Kontrakan Jati KramatDocument1 page2024-01-15 - GK - 03 Kontrakan Jati Kramatnuke.rachmasariNo ratings yet

- Stupa Model - pdf3Document1 pageStupa Model - pdf3elzaNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- UntitledDocument10 pagesUntitledOuerghi KarimNo ratings yet

- Commute Sampleletter2Document2 pagesCommute Sampleletter2WajahatNo ratings yet

- GSTR3B 07arbpb8459q1z8 092021Document2 pagesGSTR3B 07arbpb8459q1z8 092021Ajit GuptaNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3BpkberliaNo ratings yet

- GSTR-3B FILINGDocument2 pagesGSTR-3B FILINGJaideep MishraNo ratings yet

- 2 SK 3919Document1 page2 SK 3919gicaNo ratings yet

- GSTR3B 09BRLPG6171R1ZX 062023Document3 pagesGSTR3B 09BRLPG6171R1ZX 062023ravinakhanhifiNo ratings yet

- GSTR3B 21ahhpn3658h1zd 022022Document2 pagesGSTR3B 21ahhpn3658h1zd 022022GOOGLE NETNo ratings yet

- Anandamoyee Sanitation Tobin Road Finall BillDocument1 pageAnandamoyee Sanitation Tobin Road Finall Billakash.c.2005No ratings yet

- ND GSTR 3b Jun (1), K, KDocument2 pagesND GSTR 3b Jun (1), K, KRajeev kumar AgarwalNo ratings yet

- Daily - April 26-27, 2011Document2 pagesDaily - April 26-27, 2011JC CalaycayNo ratings yet

- ICICI Prudential Growth Inst I Rating Fund Performance History Risk ReturnDocument6 pagesICICI Prudential Growth Inst I Rating Fund Performance History Risk ReturnRavindra MisalNo ratings yet

- GSTR3B_06AAJFK2610F1ZR_062023Document3 pagesGSTR3B_06AAJFK2610F1ZR_062023tingu gangNo ratings yet

- Oct 2023Document2 pagesOct 2023mahantayya021291No ratings yet

- Pay Date Amount Paid Cac No. Punch Date: UrbanDocument1 pagePay Date Amount Paid Cac No. Punch Date: UrbanMONISH NAYARNo ratings yet

- Public Saas Company Benchmarking: Are You On Track For A Successful Ipo?Document5 pagesPublic Saas Company Benchmarking: Are You On Track For A Successful Ipo?ddubyaNo ratings yet

- Urban: Pay Date Cac No. Amount Paid Punch DateDocument1 pageUrban: Pay Date Cac No. Amount Paid Punch DateDivyansh JohriNo ratings yet

- Laptop Request InvoiceDocument1 pageLaptop Request InvoiceMark DelaNo ratings yet

- GSTR3B 29alqpm0868b1zu 062022Document3 pagesGSTR3B 29alqpm0868b1zu 062022ThangaiSiddharthNo ratings yet

- MOS Field Effect Transistor 2SK3919: SMD Type IC Mosfet SMD TypeDocument1 pageMOS Field Effect Transistor 2SK3919: SMD Type IC Mosfet SMD Typeserrano.flia.coNo ratings yet

- 2SK3919Document1 page2SK3919serrano.flia.coNo ratings yet

- Bank of Rajsthan (Final)Document8 pagesBank of Rajsthan (Final)Jeffrey RobinsonNo ratings yet

- Activity Statement SummaryDocument9 pagesActivity Statement SummaryAlexandru SimaNo ratings yet

- GSTR3B 09aaeci2181f2zn 052022Document2 pagesGSTR3B 09aaeci2181f2zn 052022Pushan SrivastavaNo ratings yet

- Floor plan layout with room dimensionsDocument6 pagesFloor plan layout with room dimensionsAlain Joy FUENTES AMÉZQUITANo ratings yet

- GSTR3B 18actpi6464p1zk 022023Document3 pagesGSTR3B 18actpi6464p1zk 022023IMRADUL HUSSAINNo ratings yet

- ValueResearchFundcard AxisBluechipFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard AxisBluechipFund DirectPlan 2019mar04ChittaNo ratings yet

- GSTR-3B Filing for May 2021Document2 pagesGSTR-3B Filing for May 2021Biswajit DasNo ratings yet

- SMD MOSFET Datasheet - 2SK3918 TO-252 N-Channel Power TransistorDocument1 pageSMD MOSFET Datasheet - 2SK3918 TO-252 N-Channel Power TransistorfreddyNo ratings yet

- GSTR3B 06aakfh0743f1zn 072023Document3 pagesGSTR3B 06aakfh0743f1zn 072023hecllp.ggnNo ratings yet

- A ModelDocument1 pageA ModelRivqy AsegafNo ratings yet

- En An Ce / Co Nti Nu Ed: Silicon PNP Epitaxial Planar TypeDocument4 pagesEn An Ce / Co Nti Nu Ed: Silicon PNP Epitaxial Planar TypeGeovanny SanJuanNo ratings yet

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDocument1 pageThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNo ratings yet

- Afsar EnterprisesDocument2 pagesAfsar EnterprisesMohitNo ratings yet

- GSTR3B 09aaopj3054f1zo 072023Document3 pagesGSTR3B 09aaopj3054f1zo 072023Suhail KhanNo ratings yet

- Ess Pee Sep2022Document3 pagesEss Pee Sep2022Logesh Waran KmlNo ratings yet

- GSTR3B_32AAFFN1158H1ZK_122023Document3 pagesGSTR3B_32AAFFN1158H1ZK_122023AneeshNo ratings yet

- GSTR3B 37adcfs8516j1zp 032020Document2 pagesGSTR3B 37adcfs8516j1zp 032020ravi kiranNo ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- GSTR3B 29aaacq3842r1zr 092023Document3 pagesGSTR3B 29aaacq3842r1zr 092023vasanth.sNo ratings yet

- ΝΕΟΜΑ course 8Document24 pagesΝΕΟΜΑ course 8Leo LTNo ratings yet

- KPMG CEO StudyDocument32 pagesKPMG CEO StudyImpulsive collectorNo ratings yet

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDocument5 pagesIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorNo ratings yet

- HayGroup Rewarding Malaysia July 2010Document8 pagesHayGroup Rewarding Malaysia July 2010Impulsive collectorNo ratings yet

- Global Added Value of Flexible BenefitsDocument4 pagesGlobal Added Value of Flexible BenefitsImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Emotional or Transactional Engagement CIPD 2012Document36 pagesEmotional or Transactional Engagement CIPD 2012Impulsive collectorNo ratings yet

- Stanford Business Magazine 2013 AutumnDocument68 pagesStanford Business Magazine 2013 AutumnImpulsive collectorNo ratings yet

- Flexible Working Good Business - How Small Firms Are Doing ItDocument20 pagesFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorNo ratings yet

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- 2012 Metrics and Analytics - Patterns of Use and ValueDocument19 pages2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- TalentoDocument28 pagesTalentogeopicNo ratings yet

- US housing market correction timelineDocument7 pagesUS housing market correction timelinePuneet ButaneyNo ratings yet

- The impact of Hernando de Soto's The Mystery of Capital after ten yearsDocument8 pagesThe impact of Hernando de Soto's The Mystery of Capital after ten yearsireqNo ratings yet

- PS2 Behavioral IeDocument5 pagesPS2 Behavioral IePablo BozaNo ratings yet

- 12 Financial CrisisDocument15 pages12 Financial CrisisRazvan Stefan RaduNo ratings yet

- Spain: Can The House Resist The Storm?Document2 pagesSpain: Can The House Resist The Storm?BorjaNo ratings yet

- Lecture Notes For Mathematical Methods in Financial EconomicsDocument23 pagesLecture Notes For Mathematical Methods in Financial EconomicsAnonymous DLEF3GvNo ratings yet

- MHBA 2023 Buyer's Guide FOR DIGITAL LOW-RESDocument43 pagesMHBA 2023 Buyer's Guide FOR DIGITAL LOW-RESAhmad FirooziNo ratings yet

- Analysis The BankDocument25 pagesAnalysis The BankMonica Rogoz100% (5)

- Neither A Borrower Nor A Lender BeDocument2 pagesNeither A Borrower Nor A Lender BeMarianna GarridoNo ratings yet

- Basel III and Its Implications On Banking SectorDocument56 pagesBasel III and Its Implications On Banking Sectoradityavikram009No ratings yet

- 1204-05282 Forest - Dyer V Wheeler Et Al PDFDocument49 pages1204-05282 Forest - Dyer V Wheeler Et Al PDFStatesman Journal100% (1)

- CIT Files BankruptcyDocument2 pagesCIT Files BankruptcyAdam HollierNo ratings yet

- AIG's Dangerous Collapse - by Daniel R. Amerman, FSU Editoria..Document10 pagesAIG's Dangerous Collapse - by Daniel R. Amerman, FSU Editoria..Todd BengertNo ratings yet

- UBS Classaction Lawsuit Securities Litigation 1:07-CV-11225-RJSDocument423 pagesUBS Classaction Lawsuit Securities Litigation 1:07-CV-11225-RJSTBNo ratings yet

- Causes, Mechanisms and Consequences: Short-Termism in BusinessDocument52 pagesCauses, Mechanisms and Consequences: Short-Termism in BusinessChristlyn Joy BaralNo ratings yet

- Dissertation Financial MathematicsDocument7 pagesDissertation Financial MathematicsCustomWritingPapersSingapore100% (1)

- Lehman Brothers PublicationDocument20 pagesLehman Brothers Publicationsiti hardiantiNo ratings yet

- Document (1) : Article: The Consumer Debt Crisis and The Reinforcement of Class Position, 40 Loy. U. Chi. L.J. 557Document39 pagesDocument (1) : Article: The Consumer Debt Crisis and The Reinforcement of Class Position, 40 Loy. U. Chi. L.J. 557Huyền MinhNo ratings yet