Professional Documents

Culture Documents

CDLHT 120306 Oir

Uploaded by

Theng RogerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CDLHT 120306 Oir

Uploaded by

Theng RogerCopyright:

Available Formats

Singapore | REITs

Asia Pacific Equity Research

CDL HOSPITALITY | BUY

MARKET CAP: USD 1.3B AVG DAILY TURNOVER: USD 12M 6 Mar 2011 Company Update

DEVELOPMENT CHARGE HIKE FAVORS INCUMBENTS

Rise in DC greatest for hotels Possible pipeline from CDL unaffected Buoyant hotel demand

BUY (maintain)

Fair value add: 12m dividend forecast versus: Current price 12m total return forecast S$2.00 S$0.12 S$1.72 24%

Biggest DC hikes for hotels The development charge (DC) rates announced on last week saw an average increase of 15% for Hotels. We think this is worth mentioning as the next largest average increase was only 6% (Commercial), all other groups saw no changes, except for the 3% decrease for nonlanded Residential. The DC rate hike rates could have incremental impact on future hotel supply by increasing development costs. As an incumbent with 2.7k rooms in six high-end hotels in Singapore, including Orchard Hotel and Grand Copthorne Waterfront, CDLHT has an edge over potential entrants. The significant DC increase has marginally driven up the replacement cost of hotel rooms and thus would have a positive valuation effect on hotels and also on CDLHT. Possible pipeline from parent CDL As we have identified in our previous report, there are three hotels being developed by City Developments Ltd (CDL) which CDLHT could consider acquiring. These hotels should be opening over 2012 to 2015 and are not subject to the new DC increases. Through this, CDLHT has some cost advantage over other hotel companies which do not have a developer parent or associate that has already gotten provisional permission for the development of new hotels. Hotel demand will outstrip supply We are positive on the long-term prospects of the hospitality sector and believe that this year will set a new visitor arrival record over last years stellar 13.2m (up 13%). We project that hotel room demand will grow at 6.4% p.a. for 2012-2015, easily outpacing an estimated increase in hotel rooms of 3.8% p.a. In terms of supply dynamics, high-end hotels (4-star and above) are well-placed with an estimated increase of only 3.0% p.a. over the same period. Maintain BUY We maintain our BUY rating and our S$2.00 fair value estimate based on a Revalued Net Asset Value (RNAV) analysis. As a liquid counter with an existing supply of high-end hotels, and a developer parent with a potential pipeline unaffected by the new DC hike, CDLHT is well-placed to benefit from the still-growing tourism industry.

Key financial highlights Year Ended Dec 31 (S$m) Gross revenue Total property expenses Net property income Income available for distribution DPU per share (S cents) Cons. EPS (S cts) PER (x) P/NAV (x) ROE (%) Net income margin (%) FY10 122.3 -7.2 115.1 100.7 9.6 na 12.6 1.1 10.2 111.1 FY11 141.1 -5.9 135.2 118.1 11.0 na 9.7 1.1 11.7 124.9 FY12F 154.7 -6.4 148.3 128.2 12.0 11.0 14.6 1.1 7.5 75.8 FY13F 162.7 -6.6 156.1 134.5 12.7 11.1 13.9 1.0 7.8 75.6

Analysts Sarah Ong (Lead) +65 6531 9678 sarahong@ocbc-research.com Kevin Tan +65 6531 9810 kevintan@ocbc-research.com

Key information Market cap. (m) Avg daily turnover (m) Avg daily vol. (m) 52-wk range (S$) Free float (%) Shares o/s. (m) Exchange BBRG ticker Reuters ticker ISIN code GICS Sector GICS Industry Top shareholder S$1,655 / USD1,325 S$15 / USD12 8.7 1.345 - 2.12 67.4 964.8 SGX CDREIT SP CDLT.SI J85 Financials REITs Hospitality Hldgs32.5% 1m 3 0 3m 21 13 12m -8 -8

Relative total return Company (%) STI-adjusted (%) Price performance chart

Shar e Pr i ce (S$ ) 2.21 1.97 1.73 1.49 1.25 1.01 Mar -11 Jun-11 Aug-11

`

Index Level 3400 3020 2640 2260 1880 1500 Nov-11 Feb-12

Fair Value

CDREIT SP

FSSTI

Sources: Bloomberg, OIR estimates

Industry-relative metrics

P er c ent i l e 0t h 25t h 50t h 75t h 100t h

M k t Cap B et a ROE PE PB

Company

I ndust r y A v er age

Note: Industry universe defined as companies under identical GICS classification listed in exchanges in Asia Pacific. Sources: Bloomberg, OIR estimates

Please refer to important disclosures at the back of this document.

MITA No. 019/06/2011

OCBC Investment Research Singapore Equities

Development charge hike highest for hotels. The new development charge rate recently set on 29 February and starting from 1 March saw an increase of 15% for Hotels (grouped together with Hospitals). This is the largest increase among all the different land use groups. The rate increase will likely raise the cost of new hotel developments that have not yet received provisional permission from the URA. This may deter supply or reduce the competitiveness of such hotels after they are built.

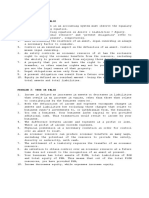

Exhibit 1: Hotels face largest development charge increase

Land use group Average DC rate per sqm of GFA (S$) Commercial Landed Residential Non-landed Residential Hotels / Hospitals Industrial Average change vs prev. revision (%) Commercial Landed Residential Non-landed Residential Hotels / Hospitals Industrial Source: URA, OIR Note: The average DC rates are calculated as a simple average of the DC rate applied in each of the 118 geographical sectors. "Average change vs previous revision" refers to an average of the percentage changes in each of the 118 grographical sectors. -4.4% 0.0% -15.3% -9.6% 0.0% -3.9% 0.0% -1.7% -4.3% 0.0% -1.6% 12.5% 8.5% 0.1% 0.0% 0.6% 12.9% 12.7% 0.0% 10.0% 12.7% 18.4% 10.6% 26.7% 8.3% 21.7% 16.5% 12.2% 7.0% 30.9% 5.6% 0.0% -3.0% 14.9% 0.0% 3,431 2,532 4,233 2,684 567 3,252 2,532 4,122 2,525 567 3,169 2,857 4,473 2,529 567 3,189 3,225 5,036 2,529 624 3,606 3,823 5,563 3,238 675 4,380 4,402 6,200 3,485 885 4,570 4,402 5,982 3,924 885 Mar-09 Sep-09 Mar-10 Sep-10 Mar-11 Sep-11 Mar-12

We have a rough estimate that the DC rise could result in an increase of the cost of developing new hotels by ~0.9%, assuming that 25% of a development is new build-up. This would imply that the value of current hotel stock should increase by approximately the same magnitude.

Exhibit 2: Example of effect of DC increase rise on new hotel developments

Parameters Asummptions % of new development that is additional build-up Original cost of developing hotel/number of rooms Total GFA (m2) of hotel/number of rooms Average new DC (S$/m ) Average original DC (S$/m ) Approximate change in DC (S$/m2) Calculations Increase in cost for new development % increase in cost for new development Source: OIR estimates =25%*30*439 =S$3,293 =S$3,293/S$350,000 =0.9%

2 2

25% S$350k 30 3,924 3,485 439

Pipeline from parent CDL not affected by hike. With a gross gearing of 25.2%, CDLHT has ~S$520m in debt headroom to finance yieldaccretive acquisitions. It hopes to target one to two acquisitions per year for this year and next. In Singapore, parent CDL has a pipeline of hotels coming on-stream in 2013-2015, and one or more of these may become acquisition targets.

OCBC Investment Research Singapore Equities

Exhibit 3: Potential hotels from parent City Developments Ltd

Project Name W HOTEL SENTOSA COVE ROBERTSON QUAY SOUTH BEACH Est. Opening Aug-12 2014 2015 No. of Rooms 240 310 701 Possible cost (S$m), assuming $500k/room -$800k/room 120-216 155-279 351-631

Sources: Company, CDL, CBRE, Horwath HTL, OIR estimates Note: Cost per room would be depend partly on the land's tenure.

We note that the cost of developing these hotels will not be affected by the DC rate increase. This implies some possible advantage for CDLHT versus many other hotel companies that do not have a developer parent/associate which is already developing a pipeline of hotels. Healthy demand growth will outstrip supply for hotel industry. Given that ~80% of CDLHTs revenues come from Singapore, the key driver for CDLHTs performance will be the performance of the local hotel industry. The hospitality sector is actively supported by the government and the Singapore Tourism Board (STB) has a target of 17m annual visitor arrivals by 2015, up from 13.2m in 2011. We believe that hotel room demand will grow at a CAGR of 6.4%, outstripping overall supply increases (CAGR: 3.8%) for 2012-2015. The new DC hike may slightly dampen the growth in supply. Based on our in-house database, high-end hotels (4-star and above) are better positioned in terms of oncoming supply, with an estimated room supply 3.0% increase p.a. for 2012-2015 versus a 5.6% CAGR for budget hotels. CDLHT, having six high-end hotels in Singapore that total 2.7k rooms, is in the better positioned sub-sector of the hotel space.

Exhibit 4: Slower room growth for high-end hotels versus budget hotels

Project Name Budget Budget YoY High-end High-end YoY All Hotels All YoY

EST. NUMBER OF HOTELS END 2011 237 71 308 END 2012 242 2.1% 75 5.6% 317 END 2013 247 2.1% 79 5.3% 326 END 2014 250 1.2% 84 6.3% 334 END 2015 250 0.0% 85 1.2% 335 EST. TOTAL ROOM SUPPLY END 2011 15.0k 33.1k 48.1k END 2012 16.0k 6.9% 34.0k 2.5% 50.0k END 2013 17.1k 6.5% 35.2k 3.8% 52.3k END 2014 18.6k 9.2% 36.6k 3.8% 55.2k END 2015 18.6k 0.0% 37.3k 1.9% 55.9k CAGR (2011-2015) 5.6% 3.0% Sources: URA, STB, CBRE, Horwath HTL, OIR estimates Notes: Hotels refers to all registered hotels, including backpackers' inns. A few hotel-equivalent properties are also included. Properties that serve primarily as serviced apartments are excluded.

2.9% 2.8% 2.5% 0.3%

3.9% 4.6% 5.5% 1.3% 3.8%

OCBC Investment Research Singapore Equities

Exhibit 5: Future hotel supply

Expected Opening 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 2013 2013 2013 2013 2013 Proposed Hotel Projects Location Estimated Type Budget Budget Budget Budget Budget Budget Budget Cavenagh Road Sentosa Sentosa Resorts World Sentosa (West Zone) The Quayside Isle (Sentosa Cove) Changi Business Park Avenue 1 Changi Business Park Avenue 1 Geylang Jalan Besar Bideford Road High-tier High-tier High-tier High-tier Budget Budget Budget Budget Budget No. of Rooms 363 186 405 86 100 285 -390 333 61 210 240 251 313 100 160 221 1,035 844 1,879 Budget Room Total High-end Rooms Total Rooms Total

PARKROYAL @ CBD Hotel (to be named) by HG Properties Days Inn Aqueens Hotel Jalan Besar Aqueen Hotel Paya Lebar Dorsett Regency Hotel Hotel Grand Central Redevelopment The Bay Hotel Movenpick Hotel Equarius Hotel/Spa Villas W Singapore Sentosa Cove UE BizHub East Modena (part of Changi City) Aqueen Hotel Geylang Aqueen Hotel Tyrwhitt Holiday Inn Express Singapore Orchard Road (former Wellington building) Traders Hotel (Redevelopment of Hotel Phoenix) One Farrer (part of Connexion) Hotel (to be named) Sofitel So Singapore Holiday Inn Express brand hotel Ramada Singapore Hotel (to be named) by Hotel Grand Central The Westin Singapore Capitol Laguna Hotel Hotel (to be named) by Far East Soho Hotel (to be named) by City Developments Ltd Hotel (to be named) by South Beach, JV of CDL

Upper Pickering Street Fairy Hill Point Balestier Road Jalan Besar Paya Lebar New Bridge Road

2013 2013 2013 2013 2014 2014 2014 2014 2014 2014 2014 2014 2015

Orchard Road Farrer Park Station Road Tanjong Pagar Road/Gopeng Street Robinson Road/Boon Tat Street Clemenceau Avenue/Havelock Road Balestier Road Cavenagh Road Asia Square Tower 2 (Marina View Parcel B) Stamford Road/North Bridge Road Laguna Golf Green Peak Seah Street Robertson Quay Beach Road

High-tier High-tier High-tier High-tier Budget Budget Budget High-tier High-tier High-tier High-tier High-tier High-tier

525 230 387 135 446 391 728 305 182 191 340 310 701 1,565 3,645 1,328 701 4,150 2,893 701 7,795 1,045 1,277 2,322

2012-2015 Total: Sources: URA, CBRE, Horwath HTL, OIR estimates

BUY CDLHT well-positioned hotel play. We maintain our BUY rating and fair value estimate of S$2.00 based on an RNAV analysis. Possible upside catalysts would be acquisitions. The new development charge hike increases the value of existing hotel stock and enhances the incumbents advantage of CDLHT over additional future supply. There is a pipeline of three hotels that it could acquire from its parent which are not directly affected by the DC hike. Moreover, CDLHT is in the high-end hotel space, which we believe has better supply-side dynamics than budget hotels.

OCBC Investment Research Singapore Equities

Company financial highlights

Income statement Year Ended Dec 31 (S$m) Gross revenue Total property expenses Net property income Net finance costs Manager's management fees Other expenses Net income bef. revaluation Revaluation gain on invstmt properties Total return after taxation Income available for distribution

FY10 122.3 -7.2 115.1 -16.6 -10.2 -1.4 86.9 51.4 135.9 100.7

FY11 141.1 -5.9 135.2 -13.2 -11.7 -2.8 107.6 73.2 176.3 118.1

FY12F 154.7 -6.4 148.3 -15.3 -12.7 -3.0 117.2 0.0 117.2 128.2

FY13F 162.7 -6.6 156.1 -16.7 -13.3 -3.2 123.0 0.0 123.0 134.5

Balance sheet As at Dec 31 (S$m) Investment properties Properties under development Cash (including restricted cash) Total current assets Total assets Current liabilities ex debt Debt Total liabilities Unitholders' funds Total equity and liabilities

FY10 1,787.1 0.0 67.8 82.7 1,869.9 21.8 381.1 409.7 1,460.2 1,869.9

FY11 2,029.8 0.0 70.5 88.5 2,118.5 23.6 534.8 570.8 1,547.7 2,118.5

FY12F 2,029.8 0.0 82.9 102.7 2,132.6 25.8 534.8 574.2 1,558.4 2,132.6

FY13F 2,029.8 0.0 93.8 114.6 2,144.5 27.2 534.8 576.3 1,568.2 2,144.5

Cash flow statement Year Ended Dec 31 (S$m) Net income of H-REIT Adjustments Operating income before working cap chgs Change in working capital Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities Change in cash Cash at beginning of period Cash at end of period

FY10 138.3 -26.7 111.6 4.7 116.3 -244.4 190.2 62.1 5.7 67.7

FY11 180.8 -49.2 131.6 -0.9 131.1 -166.2 37.8 2.7 67.7 70.5

FY12F 117.2 25.6 142.8 0.5 143.2 -11.1 -119.8 12.4 70.5 82.9

FY13F 123.0 27.5 150.4 0.3 150.7 -10.7 -129.1 10.9 82.9 93.8

Key rates & ratios DPU per share (S cents) NAV per share (S$) PER (x) P/NAV (x) NPI margin (%) Net income margin (%) Gross gearing (%) DPU yield (%) ROE (%) ROA (%) Sources: Company, OIR forecasts

FY10 9.6 1.5 12.7 1.1 94.1 111.1 20.4 5.6 10.2 8.0

FY11 11.0 1.6 9.8 1.1 95.8 124.9 25.2 6.4 11.7 8.8

FY12F 12.0 1.6 14.7 1.1 95.9 75.8 25.1 7.0 7.5 5.5

FY13F 12.7 1.6 14.0 1.1 95.9 75.6 24.9 7.4 7.9 5.8

Company financial highlights

OCBC Investment Research Singapore Equities

SHAREHOLDING DECLARATION: The analyst/analysts who wrote this report hold NIL shares in the above security.

DISCLAIMER FOR RESEARCH REPORT This report is solely for information and general circulation only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our written consent. This report should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities mentioned herein. Whilst we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. You may wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular needs, before making a commitment to invest in the securities. OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations together with their respective directors and officers may have or take positions in the securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally. Privileged / confidential information may be contained in this document. If you are not the addressee indicated in this document (or responsible for delivery of this message to such person), you may not copy or deliver this message to anyone. Opinions, conclusions and other information in this document that do not relate to the official business of OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations shall not be understood as neither given nor endorsed.

RATINGS AND RECOMMENDATIONS: - OCBC Investment Researchs (OIR) technical comments and recommendations are short-term and trading oriented. - OIRs fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month investment horizon. - As a guide, OIRs BUY rating indicates a total return in excess of 10% given the current price; a HOLD trading indicates total returns within +/-10% range; a SELL rating indicates total returns less than -10%. - For companies with less than S$150m market capitalization, OIRs BUY rating indicates a total return in excess of 30%; a HOLD trading indicates total returns within a +/-30% range; a SELL rating indicates total returns less than -30%.

Co.Reg.no.: 198301152E Carmen Lee Head of Research For OCBC Investment Research Pte Ltd

Published by OCBC Investment Research Pte Ltd

Important disclosures

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Spiceland SM ch11 PDFDocument79 pagesSpiceland SM ch11 PDFmas aziz100% (3)

- 003 Funac Topic 3 The Accounting Equation PDFDocument15 pages003 Funac Topic 3 The Accounting Equation PDFSarah Santos100% (1)

- Cashflow.comDocument40 pagesCashflow.comad9292No ratings yet

- Answers On Government GrantDocument12 pagesAnswers On Government GrantGabrielle Joshebed Abarico100% (1)

- Solutions Manual: Company Accounting 10eDocument63 pagesSolutions Manual: Company Accounting 10eLSAT PREPAU167% (3)

- Basic Accounting Course ModuleDocument5 pagesBasic Accounting Course ModuleBlairEmrallafNo ratings yet

- Double Protection Against StrokeDocument4 pagesDouble Protection Against StrokeTheng RogerNo ratings yet

- Lifestyle Gets Blame For 70Document3 pagesLifestyle Gets Blame For 70Theng RogerNo ratings yet

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- Singapore's IPO Market Roars Back To Life in H1, More Big ListiDocument2 pagesSingapore's IPO Market Roars Back To Life in H1, More Big ListiTheng RogerNo ratings yet

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- The Dangers in Rising Bond YieldsDocument2 pagesThe Dangers in Rising Bond YieldsTheng RogerNo ratings yet

- Lifestyle Gets Blame For 70Document3 pagesLifestyle Gets Blame For 70Theng RogerNo ratings yet

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- Danish Krone Stages Biggest Fall Vs Euro Since 2001Document2 pagesDanish Krone Stages Biggest Fall Vs Euro Since 2001Theng RogerNo ratings yet

- High Level of Iron and Manganese inDocument1 pageHigh Level of Iron and Manganese inTheng RogerNo ratings yet

- Weak Oil and Euro Drive Europe's QE-fuelled Rally: Greece Ukraine Quantitative EasingDocument3 pagesWeak Oil and Euro Drive Europe's QE-fuelled Rally: Greece Ukraine Quantitative EasingTheng RogerNo ratings yet

- Hedge Funds' Oil Shorts Reach Peak For The Year: David SheppardDocument3 pagesHedge Funds' Oil Shorts Reach Peak For The Year: David SheppardTheng RogerNo ratings yet

- Growth Hormone Guidance: Editor'S Choice in Molecular BiologyDocument2 pagesGrowth Hormone Guidance: Editor'S Choice in Molecular BiologyTheng RogerNo ratings yet

- Look Out Below If Gold Fails This Technical TestDocument2 pagesLook Out Below If Gold Fails This Technical TestTheng RogerNo ratings yet

- Colon CancerDocument12 pagesColon CancerTheng RogerNo ratings yet

- Look Out Below If Gold Fails This Technical TestDocument2 pagesLook Out Below If Gold Fails This Technical TestTheng RogerNo ratings yet

- That Police Officer IsDocument3 pagesThat Police Officer IsTheng RogerNo ratings yet

- Noble GroupDocument5 pagesNoble GroupTheng Roger100% (1)

- Good Intentions Paved Way To Market MayhemDocument3 pagesGood Intentions Paved Way To Market MayhemTheng RogerNo ratings yet

- Fight in Iraq Has Oil Traders Holding Their BreathDocument2 pagesFight in Iraq Has Oil Traders Holding Their BreathTheng RogerNo ratings yet

- S Merger Activity Back at The TrillionDocument3 pagesS Merger Activity Back at The TrillionTheng RogerNo ratings yet

- HereDocument2 pagesHereTheng RogerNo ratings yet

- 15% correction predicted as analysts disagree on stock market outlookDocument2 pages15% correction predicted as analysts disagree on stock market outlookTheng RogerNo ratings yet

- Top 10 Global Risks for 2014 According to World Economic Forum ReportDocument2 pagesTop 10 Global Risks for 2014 According to World Economic Forum ReportTheng RogerNo ratings yet

- Greenspan WorryDocument1 pageGreenspan WorryTheng RogerNo ratings yet

- Sellout AgainDocument2 pagesSellout AgainTheng RogerNo ratings yet

- MarketDocument2 pagesMarketTheng RogerNo ratings yet

- Markets Fear UDocument2 pagesMarkets Fear UTheng RogerNo ratings yet

- Credit CrunchDocument2 pagesCredit CrunchTheng RogerNo ratings yet

- Is the emerging market selloff a buying opportunityDocument1 pageIs the emerging market selloff a buying opportunityTheng RogerNo ratings yet

- Valuation of SharesDocument51 pagesValuation of SharesSwati GoyalNo ratings yet

- Analyzing Cash Flow StatementsDocument3 pagesAnalyzing Cash Flow StatementsBJNo ratings yet

- 11th Annual Benedict's PDFDocument15 pages11th Annual Benedict's PDFYugam RathiNo ratings yet

- Questions and AnswersDocument28 pagesQuestions and AnswersSamuel LeitaoNo ratings yet

- Financial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsiDocument18 pagesFinancial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsifitriEmpiiNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalShainaNo ratings yet

- Project On Hollow BricksDocument13 pagesProject On Hollow BricksSindhu Amal100% (1)

- Free Trial HandoutsDocument31 pagesFree Trial HandoutsCHRISTINE TABULOGNo ratings yet

- Financial Ratios TutorialDocument8 pagesFinancial Ratios TutorialCyrilraincream0% (1)

- Chapter 1 SolutionsDocument44 pagesChapter 1 Solutionsaevium0% (1)

- CHAPTER 10 - Changes in Accounting EstimateDocument8 pagesCHAPTER 10 - Changes in Accounting EstimateChristian GatchalianNo ratings yet

- Chap 4 - ActivitiesDocument3 pagesChap 4 - Activities31211022392No ratings yet

- Metaland Evaluates New Light Commercial Vehicle Project FinancialsDocument17 pagesMetaland Evaluates New Light Commercial Vehicle Project Financialsjjayakumar_vjNo ratings yet

- Tugas Kelompok - Corporate Financial Management.Document4 pagesTugas Kelompok - Corporate Financial Management.AgusSetiawanNo ratings yet

- BAO6504 Lecture 2, 2014Document20 pagesBAO6504 Lecture 2, 2014LindaLindyNo ratings yet

- Unit 16 HandoutDocument2 pagesUnit 16 HandoutNdila mangalisoNo ratings yet

- Loan ImpairmentDocument22 pagesLoan ImpairmentJEFFERSON CUTENo ratings yet

- Financial Analysis Ratios for Profitability & LiquidityDocument11 pagesFinancial Analysis Ratios for Profitability & LiquidityWILSON KosheyNo ratings yet

- PGFAP-Brochure v2Document15 pagesPGFAP-Brochure v2Art EuphoriaNo ratings yet

- Amortization vs Depreciation: Key DifferencesDocument2 pagesAmortization vs Depreciation: Key DifferenceshumaidjafriNo ratings yet

- Vdocuments - MX - Advanced Financial Accounting 1Document11 pagesVdocuments - MX - Advanced Financial Accounting 1Sweet EmmeNo ratings yet

- Practice Questions (All Topics)Document51 pagesPractice Questions (All Topics)cons theNo ratings yet

- Understanding Long-Lived AssetsDocument14 pagesUnderstanding Long-Lived AssetsmostakNo ratings yet

- Fundamentals of Accounting 2 - PrefinalsDocument3 pagesFundamentals of Accounting 2 - PrefinalsCary JaucianNo ratings yet