Professional Documents

Culture Documents

E13-2 Selected 2010 Transactions of Darby Corporation

Uploaded by

Evelyn RoldanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E13-2 Selected 2010 Transactions of Darby Corporation

Uploaded by

Evelyn RoldanCopyright:

Available Formats

E13-2 The following are selected 2010 transactions of Darby Corporation. Sept. 1 Oct. 1 Oct.

Purchased inventory from Orion company on account for $50,000. Darby records purchases gross and uses a perio Issued a $50,000, 12-month, 8% note to Orion in payment of account. Borrowed $75,000 from the Shore Bank by signing a 12-month, zero-interest-bearing $81,000 note.

Instructions a. Prepare journal entries for the selected ttransactions above. The journal entries are Sep 1 Purchases Accounts Payable Oct 1 Accounts Payable Notes Payable Cash Discount on notes payable Notes Payable

50,000 50,000 50,000

In the periodic system inventory purchases are reco

50,000 The accounts payable is converted to notes payable 75,000 6,000

Oct 1

Face value is 81,000 and cash received is 75,000 so 81,000 difference is discount

b. Prepare adjusting entries at December 31. The adjusting entry would relate to accrual of interest Interest for 3 month on Orion note = 50,000 X 8% X 3/12 = Interest for 3 months bank note = 6,000 X 3/12 = The adjusting entry is Dec 31 Interest Expense 1,000 Interest Payable Dec 31 Interest Expense Discount on Notes Payable 1,500 1,500

1,000 1,500 Total interest is 6,000 which is the disco

1,000

c. Comute the total net liability to be reported on the december 31 balance sheet for: 1. the interest-bearing note. 2. the zero-interest-bearing note. 1. The net liability for interest bearing note = 50,000 principal + 1,000 interest = 51,000 2. The net liability for zero-interest bearing note = 81,000 - (6,000-1,500) = $76,500

chases gross and uses a periodic inventory system.

$81,000 note.

nventory purchases are recorded in Purchase account

s converted to notes payable

d cash received is 75,000 so

est is 6,000 which is the discount, so we calculate the amount for 3 months

You might also like

- E13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofDocument4 pagesE13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofChupa HesNo ratings yet

- Muh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9Document3 pagesMuh - Syukur (A031191077) Akuntansi Keuangan - Exercise E.12.9RismayantiNo ratings yet

- Bab 14Document4 pagesBab 14tutykaykay67% (3)

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 pagesChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- Intermediate Accounting: Assignment 2Document2 pagesIntermediate Accounting: Assignment 2Putri SerlyNo ratings yet

- 5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12Document14 pages5 - Lafidan Rizata Febiola - 041711333237 - Akm1 - M - Tugas Week 12SEPTINA GUMELAR R100% (1)

- Akuntansi Keuangan Ii Sesi 6Document5 pagesAkuntansi Keuangan Ii Sesi 6vidiamyNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- Problem: Andres Adi Putra S 43220110067 AKM2-Forum 6Document17 pagesProblem: Andres Adi Putra S 43220110067 AKM2-Forum 6tes doangNo ratings yet

- A1C019118 Jurati Latihan7Document6 pagesA1C019118 Jurati Latihan7jurati100% (1)

- CH 14Document71 pagesCH 14Febriana Nurul HidayahNo ratings yet

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Individual Assignments 2Document8 pagesIndividual Assignments 2Arista Yuliana SariNo ratings yet

- E21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnDocument3 pagesE21.4 (LO 2, 4) (Lessee Entries, Unguaranteed Residual Value) Assume That OnWarmthxNo ratings yet

- Tugas Ch. 15 - Week 10Document9 pagesTugas Ch. 15 - Week 10Lafidan Rizata FebiolaNo ratings yet

- Fix Asset&Intangible AssetDocument7 pagesFix Asset&Intangible AssetAdinda0% (1)

- Akuntansi KeuanganDocument11 pagesAkuntansi KeuanganDyan NoviaNo ratings yet

- DDDocument4 pagesDDAmelia Salini100% (1)

- Lafidan Rizata Febiola - 041711333237 - 5 - Tugas Akm 1 Week 11Document12 pagesLafidan Rizata Febiola - 041711333237 - 5 - Tugas Akm 1 Week 11Lafidan Rizata Febiola100% (4)

- Ch14 180205115701 Answers For The Practice QuestionsDocument72 pagesCh14 180205115701 Answers For The Practice QuestionsMikaela O.No ratings yet

- Tugas Jatuh Tempo Sesi 9Document8 pagesTugas Jatuh Tempo Sesi 9Araminta DewatiNo ratings yet

- ch17 180206123815 PDFDocument75 pagesch17 180206123815 PDFYeni Amelia100% (1)

- Soal Debt InvestmentDocument5 pagesSoal Debt InvestmentKyle Kuro0% (1)

- A311Chapter 10 ProblemsDocument43 pagesA311Chapter 10 ProblemsVibria Rezki Ananda0% (1)

- Aset TetapDocument9 pagesAset TetapMAYONA MEGAHTANo ratings yet

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Erika Christina - LD53 - Latihan KPDocument14 pagesErika Christina - LD53 - Latihan KPNatasha HerlianaNo ratings yet

- Ch10 - Soal Dan LatihanDocument29 pagesCh10 - Soal Dan Latihanevelyn aleeza100% (3)

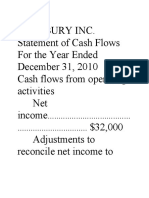

- Lansbury Inc cash flow analysisDocument10 pagesLansbury Inc cash flow analysis/// MASTER DOGENo ratings yet

- Acct 201 3nd AssingnmentDocument2 pagesAcct 201 3nd Assingnmentapi-280585803No ratings yet

- Soal Latihan Chapter 16Document8 pagesSoal Latihan Chapter 16Alifia Aprizila0% (2)

- VivaldiDocument3 pagesVivaldiAlia Azhara100% (1)

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Document5 pagesRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTANo ratings yet

- Soal Latihan Minggu 4Document9 pagesSoal Latihan Minggu 4Alifia AprizilaNo ratings yet

- Week 2 Homework (Chap. 4) - PostedDocument4 pagesWeek 2 Homework (Chap. 4) - PostedMs. Nina100% (5)

- Latihan PAK Pert 5Document3 pagesLatihan PAK Pert 5Yudi HallimNo ratings yet

- AKM 2 - Forum 7 - Andres - 43220110067Document13 pagesAKM 2 - Forum 7 - Andres - 43220110067tes doangNo ratings yet

- Tugas Akuntansi Menengah Ii Dilutive Securities & Earnings Per ShareDocument2 pagesTugas Akuntansi Menengah Ii Dilutive Securities & Earnings Per ShareClarissa NastaniaNo ratings yet

- Week13 SolutionsDocument14 pagesWeek13 SolutionsRian RorresNo ratings yet

- Bond journal entriesDocument3 pagesBond journal entriesAsuna SanNo ratings yet

- Latihan Kas PiutangDocument2 pagesLatihan Kas Piutangrismaaai0% (1)

- TaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1Document6 pagesTaufiqAlInsanSiahaan - Tugas Akuntansi Keuangan Menengah 1taufiq al insanNo ratings yet

- Tugas Ch.14Document6 pagesTugas Ch.14Chupa HesNo ratings yet

- Capitalization of Interest and Depreciation CalculationDocument7 pagesCapitalization of Interest and Depreciation Calculationfabiarachid100% (1)

- E15-2 (Recording The Issuance of Ordinary and Preference Shares) AbernathyDocument5 pagesE15-2 (Recording The Issuance of Ordinary and Preference Shares) AbernathyAsuna SanNo ratings yet

- Week1 SolutionsDocument14 pagesWeek1 SolutionsM Mustafa100% (1)

- Ch23 StudentSolutionsDocument14 pagesCh23 StudentSolutionsMegan Collins100% (4)

- Exercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueDocument9 pagesExercises: Ex. 9-143-Lower-Of-Cost-Or-Net Realizable ValueManuel Magadatu100% (1)

- TR 2 IndahDocument3 pagesTR 2 IndahIndahyuliaputriNo ratings yet

- Acct 557Document5 pagesAcct 557kihumbae100% (4)

- KIeso Chapter 18 Part 1Document8 pagesKIeso Chapter 18 Part 1Pelangi DiamondNo ratings yet

- 302 CH 14 Class ProblemsDocument7 pages302 CH 14 Class ProblemsBettie Sanchez100% (1)

- AKM - Kelompok 5Document8 pagesAKM - Kelompok 5lailafitriyani100% (1)

- Tugas AKM II Kel. 1 (Ch. 13 Current Liablities & Contigencies)Document7 pagesTugas AKM II Kel. 1 (Ch. 13 Current Liablities & Contigencies)Rafika RizkiaNo ratings yet

- Intermediate AccountingDocument88 pagesIntermediate AccountingTiến NguyễnNo ratings yet

- Chapter 2: Current Liabilities, Provisions, and ContingenciesDocument14 pagesChapter 2: Current Liabilities, Provisions, and ContingenciesGirma NegashNo ratings yet

- Acc102 W4Document26 pagesAcc102 W4Moheb RefaatNo ratings yet

- Chapter 3 Current LiabilitiesDocument21 pagesChapter 3 Current LiabilitiesEzy playboy100% (2)

- Lesson 1 - Intro To LiabilitiesDocument21 pagesLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoNo ratings yet