Professional Documents

Culture Documents

Section A

Uploaded by

Arthi Rao KOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Section A

Uploaded by

Arthi Rao KCopyright:

Available Formats

1. Future Value. What is the future value of Answers a. $572 invested for 5 years at 15 percent compounded annually? b.

$449 invested for 15 years at 14 percent compounded annually? c. $270 invested for 7 years at 6 percent compounded annually? d. $1177 invested for 3 years at 13 percent compounded annually? 2. Present Value. What is the present value of a. $592 to be received 8 years from now at a 14 percent discount rate? b. $1167 to be received 7 years from now at a 12 percent discount rate? c. $1155 to be received 12 years from now at a 14 percent discount rate? d. $784 to be received 14 years from now at a 5 percent discount rate? 3. Future Value of an Annuity. What is the future value of a. $1176 a year for 13 years at 13 percent compounded annually? b. $663 a year for 10 years at 13 percent compounded annually? c. $360 a year for 8 years at 7 percent compounded annually? d. $338 a year for 11 years at 14 percent compounded annually? 4. Present Value of an Annuity. What is the present value of a. $387 a year for 5 years at a 9 percent discount rate? b. $798 a year for 13 years at a 11 percent discount rate? c. $754 a year for 11 years at a 11 percent discount rate? d. $550 a year for 8 years at a 11 percent discount rate? 5. How many years will it take to grow a. $974 to a value of 4,531.43 at a compound rate of 15 percent ? b. $371 to a value of 986.28 at a compound rate of 13 percent ? c. $841 to a value of 2,578.34 at a compound rate of 9 percent ? d. $421 to a value of 1,369.07 at a compound rate of 14 percent ? 6. Interest Rate. At what interest rate will it take to grow a. $374 to a value of 1,051.94 over 12 years? b. $640 to a value of 1,817.23 over 10 years? c. $372 to a value of 1,623.22 over 13 years? d. $527 to a value of 2,451.81 over 11 years? 7. Annuity. How many years will it take for a payment of a. $687 to grow to 9,090.91 at a compound rate of 14 percent? b. $800 from a future value of 10,586.21 at a compound rate of 14 percent? c. $536 from a future value of 8,621.75 at a compound rate of 14 percent? d. $231 from a future value of 1,496.94 at a compound rate of 13 percent? 8. Annuity. At what interest rate will a payment of a. $683 grow to 6,890.80 over a period of 7 years? b. $558 grow to 15,610.04 over a period of 14 years? c. $802 grow to 8,530.58 over a period of 8 years?

d. $721 grow to 6,884.91 over a period of 8 years? 9. Car Loans (Hint: P/Y12) How much is a car loan with a payment of a. $164 per month for 4 years at 4% interest per year? b. $530 per month for 2 years at 7% interest per year? c. $102 per month for 4 years at 5% interest per year? d. $367 per month for 3 years at 13% interest per year? 10. Car Loans. (Hint: P/Y12) How many months will you pay on a car loan of a. $14108 with a payment of 335.63 per month at 15% interest per year? b. $49544 with a payment of 1,378.85 per month at 15% interest per year? c. $10029 with a payment of 318.92 per month at 9% interest per year? d. $39241 with a payment of 1,721.56 per month at 5% interest per year? 11. Car Loans. (Hint: P/Y12) What is the interest rate on a loan of a. $8000 with a payment of 191.57 per month for 4 years? b. $16000 with a payment of 421.34 per month for 4 years? c. $24000 with a payment of 509.93 per month for 5 years? d. $32000 with a payment of 603.88 per month for 5 years? 12. Mortgages.(Hint: P/Y12, House Loan Amount/ (1 Down Payment %) What is the house cost on a 10 percent down mortgage with payments of a. $3,594.47 per month for 30 years at 4% interest? b. $8,105.55 per month for 15 years at 9% interest? c. $6,604.88 per month for 30 years at 15% interest? d. $9,128.23 per month for 15 years at 11% interest? 13. Mortgages. (Hint: P/Y12) What is the interest rate on a mortgage of a. $675439 with a payment of 3,625.90 for 30 years? b. $181181 with a payment of 2,292.38 for 15 years? c. $631658 with a payment of 5,543.25 for 30 years? d. $480403 with a payment of 5,162.44 for 15 years? 14. Mortgage. (Hint: P/Y12) What is the payoff on a 30 year, 6% original mortgage of a. $624552 with a payment of 3,744.50 with 12 years remaining? b. $190788 with a payment of 1,143.87 with 15 years remaining? c. $337857 with a payment of 2,025.62 with 11 years remaining? d. $713472 with a payment of 4,277.63 with 7 years remaining?

5-1A. (Compound interest) To what amount will the following investments accumulate? a. $5,000 invested for 10 years at 10 percent compounded annually b. $8,000 invested for 7 years at 8 percent compounded annually c. $775 invested for 12 years at 12 percent compounded annually

d. $21,000 invested for 5 years at 5 percent compounded annually 5-4A. (Present value) What is the present value of the following future amounts? a. $800 to be received 10 years from now discounted back to the present at 10 percent b. $300 to be received 5 years from now discounted back to the present at 5 percent c. $1,000 to be received 8 years from now discounted back to the present at 3 percent d. $1,000 to be received 8 years from now discounted back to the present at 20 percent 5-5A. (Compound annuity) What is the accumulated sum of each of the following streams of payments? a. $500 a year for 10 years compounded annually at 5 percent b. $100 a year for 5 years compounded annually at 10 percent c. $35 a year for 7 years compounded annually at 7 percent d. $25 a year for 3 years compounded annually at 2 percent 5-6A. (Present value of an annuity) What is the present value of the following annuities? a. $2,500 a year for 10 years discounted back to the present at 7 percent b. $70 a year for 3 years discounted back to the present at 3 percent c. $280 a year for 7 years discounted back to the present at 6 percent d. $500 a year for 10 years discounted back to the present at 10 percent A1. (Present and future values) a. What is the future value of $2,000 invested today if it earns 20% interest for one year? for two years? b. What is the present value of $2,000 discounted at 20% if it is received in one year? in two years?

You might also like

- Time Value of Money ProblemsDocument24 pagesTime Value of Money ProblemsMahidhara Davangere100% (1)

- Lat Soal Time Value of MoneyDocument3 pagesLat Soal Time Value of MoneyHendra G. AngjayaNo ratings yet

- Financial Management QsDocument4 pagesFinancial Management QsJM EyNo ratings yet

- Tutotial 2 - Time Value of Money FVPVDocument5 pagesTutotial 2 - Time Value of Money FVPVAmy LimnaNo ratings yet

- Calculating Time Value of MoneyDocument5 pagesCalculating Time Value of MoneyTherese Grace PostreroNo ratings yet

- Finance NotesDocument64 pagesFinance NotesRubén Darío AragónNo ratings yet

- Simple Interest and Compound InterestDocument3 pagesSimple Interest and Compound Interestvangakishore0% (1)

- Exercise 5 and 6Document6 pagesExercise 5 and 6Rayndo VarianNo ratings yet

- REVIEW OfficialDocument63 pagesREVIEW OfficialBao PNo ratings yet

- Time Value of Money QuestionsDocument8 pagesTime Value of Money QuestionswanNo ratings yet

- Assignment - Time ValueDocument8 pagesAssignment - Time ValueOssama FatehyNo ratings yet

- Practice QuestionsDocument30 pagesPractice QuestionsmichmagsalinNo ratings yet

- Topic 7: Financial MathematicsDocument3 pagesTopic 7: Financial MathematicsXaronAngelNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- TvmextraDocument8 pagesTvmextragl620054545No ratings yet

- Concepts 'N' Clarity: Time Value of MoneyDocument11 pagesConcepts 'N' Clarity: Time Value of MoneyKarla CorreaNo ratings yet

- Calculating present and future values of cash flows with compound interestDocument16 pagesCalculating present and future values of cash flows with compound interestneerajgangaNo ratings yet

- Time Value of Money Practice QuizDocument3 pagesTime Value of Money Practice QuizSanjay MehrotraNo ratings yet

- Simple Interest: Abhishek SharmaDocument13 pagesSimple Interest: Abhishek SharmaAbhishek BanoulaNo ratings yet

- Simple and Compound Interest: Winmeen VAO Mission 100Document13 pagesSimple and Compound Interest: Winmeen VAO Mission 100KruthickNo ratings yet

- Soal Risk and Return AnuitasDocument9 pagesSoal Risk and Return AnuitasRiottarooz PermanaNo ratings yet

- Final Practice QuestionsDocument32 pagesFinal Practice Questions282487239No ratings yet

- Fom 12 Midterm Review of AwesomenessDocument38 pagesFom 12 Midterm Review of AwesomenessSauel snyderNo ratings yet

- A.investment A Pays $250 at The Beginning of Every Year For The Next 10 Years (A Total of 10 Payments)Document4 pagesA.investment A Pays $250 at The Beginning of Every Year For The Next 10 Years (A Total of 10 Payments)EjkNo ratings yet

- Chap 5 6 Tutorial ClassDocument7 pagesChap 5 6 Tutorial ClassHonesty GunturNo ratings yet

- Engineering Economics Exam MidDocument7 pagesEngineering Economics Exam MidMark M.No ratings yet

- TVM Practice Questions Fall 2018Document4 pagesTVM Practice Questions Fall 2018ZarakKhanNo ratings yet

- Fundamentals of Corporate Finance, 2nd Edition, Selt Test Ch06 PDFDocument7 pagesFundamentals of Corporate Finance, 2nd Edition, Selt Test Ch06 PDFmacseuNo ratings yet

- Present Value - Extra Topic Chapt 9 12 AdvDocument5 pagesPresent Value - Extra Topic Chapt 9 12 AdvlokNo ratings yet

- Mid-Sem Answers and SolutionsDocument26 pagesMid-Sem Answers and SolutionsAmeer Zahar50% (2)

- StudentDocument29 pagesStudentKhang LeNo ratings yet

- Chapter 7 1 TaskDocument3 pagesChapter 7 1 Taskapi-3506421800% (1)

- Mid-Term Examination: University of Economics and Law - Vietnam National University - HCMCDocument7 pagesMid-Term Examination: University of Economics and Law - Vietnam National University - HCMCNgân Võ Trần TuyếtNo ratings yet

- School of Banking and Finance: Fins1613 Business Finance Practice QuestionsDocument30 pagesSchool of Banking and Finance: Fins1613 Business Finance Practice QuestionsLena ZhengNo ratings yet

- TVM Tutorial - Time Value of Money Concepts ExplainedDocument2 pagesTVM Tutorial - Time Value of Money Concepts ExplainedLeon BurresNo ratings yet

- TVM Chapter 3—The Time Value of Money AssignmentDocument9 pagesTVM Chapter 3—The Time Value of Money AssignmentGenesis E. CarlosNo ratings yet

- Local Media7735387659572366861Document3 pagesLocal Media7735387659572366861heynuhh gNo ratings yet

- Acounting QuestionsDocument5 pagesAcounting QuestionsZulqarnain JamilNo ratings yet

- Simple Interest and Compound InterestDocument2 pagesSimple Interest and Compound InterestsamdhathriNo ratings yet

- Quiz 501Document37 pagesQuiz 501Haris NoonNo ratings yet

- Calculus For Business Part 2 Time Value of MoneyDocument2 pagesCalculus For Business Part 2 Time Value of MoneyGletzmar IgcasamaNo ratings yet

- Quiz 1 - Finance Math ConceptsDocument2 pagesQuiz 1 - Finance Math ConceptsSauban AhmedNo ratings yet

- Quiz #3.2-Time Value of Money-SolutionsDocument2 pagesQuiz #3.2-Time Value of Money-SolutionsChrisNo ratings yet

- Simple Interest Questions and Answers PDFDocument9 pagesSimple Interest Questions and Answers PDFNiel Gupta0% (2)

- Apznzabaqearpefkn Hcmj5ev6iwe5rx70g7mkdovnxe3pa7ta Twqnbcpgkx4b8dlsvvuwlxldgtqnnnqekvmueiigzpewgmueffbhywd04ecgaai7ix5awzmbplwwtae0rnugdk8gtkxol Nklc3ed2ezepg8ddmblahyt Wjxrwsqgbuaesk6c0cejurkay6 Ukwgyls DnuqhpzDocument2 pagesApznzabaqearpefkn Hcmj5ev6iwe5rx70g7mkdovnxe3pa7ta Twqnbcpgkx4b8dlsvvuwlxldgtqnnnqekvmueiigzpewgmueffbhywd04ecgaai7ix5awzmbplwwtae0rnugdk8gtkxol Nklc3ed2ezepg8ddmblahyt Wjxrwsqgbuaesk6c0cejurkay6 Ukwgyls DnuqhpzHaise SasakiNo ratings yet

- Finite Mathematics 8Th Edition Rolf Test Bank Full Chapter PDFDocument48 pagesFinite Mathematics 8Th Edition Rolf Test Bank Full Chapter PDFTerryCoxfmat100% (8)

- Corpfin9 PDFDocument2 pagesCorpfin9 PDFLê Chấn PhongNo ratings yet

- OIS CBSE GR-8 Answer Key Compound Interest PDFDocument6 pagesOIS CBSE GR-8 Answer Key Compound Interest PDFlavaramNo ratings yet

- QuizDocument7 pagesQuizJennifer Rasonabe100% (1)

- PracticeDocument8 pagesPracticehuongthuy1811No ratings yet

- Name: - Score: - Calculate The Total Amount of Money You Have After You SavedDocument2 pagesName: - Score: - Calculate The Total Amount of Money You Have After You SavedZahid MarzukiNo ratings yet

- EconomicsDocument47 pagesEconomicsJennie VicentaNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Vacation Dividends: Use Dividends to Pay for the Rest of Your Vacations: Financial Freedom, #56From EverandVacation Dividends: Use Dividends to Pay for the Rest of Your Vacations: Financial Freedom, #56No ratings yet

- ADVANCED CREDIT REPAIR SECRETS REVEALED: The Definitive Guide to Repair and Build Your Credit FastFrom EverandADVANCED CREDIT REPAIR SECRETS REVEALED: The Definitive Guide to Repair and Build Your Credit FastRating: 5 out of 5 stars5/5 (3)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Chemistry Implementation: Name: Rasheed Campbell School: Kingston College Candidate #.: Centre #: 100057Document12 pagesChemistry Implementation: Name: Rasheed Campbell School: Kingston College Candidate #.: Centre #: 100057john brownNo ratings yet

- Gas Natural Aplicacion Industria y OtrosDocument319 pagesGas Natural Aplicacion Industria y OtrosLuis Eduardo LuceroNo ratings yet

- Gautam Samhita CHP 1 CHP 2 CHP 3 ColorDocument22 pagesGautam Samhita CHP 1 CHP 2 CHP 3 ColorSaptarishisAstrology100% (1)

- مقدمةDocument5 pagesمقدمةMahmoud MadanyNo ratings yet

- Interactive Architecture Adaptive WorldDocument177 pagesInteractive Architecture Adaptive Worldhoma massihaNo ratings yet

- Direct From: 1St Quarter 2020Document23 pagesDirect From: 1St Quarter 2020JeanNo ratings yet

- Progibb LV Plus PGR - Low Voc FormulationDocument2 pagesProgibb LV Plus PGR - Low Voc FormulationDodik Novie PurwantoNo ratings yet

- 1989 GMC Light Duty Truck Fuel and Emissions Including Driveability PDFDocument274 pages1989 GMC Light Duty Truck Fuel and Emissions Including Driveability PDFRobert Klitzing100% (1)

- Innovative Food Science and Emerging TechnologiesDocument6 pagesInnovative Food Science and Emerging TechnologiesAnyelo MurilloNo ratings yet

- Is.4162.1.1985 Graduated PipettesDocument23 pagesIs.4162.1.1985 Graduated PipettesBala MuruNo ratings yet

- Introduction To Finite Element Methods (2001) (En) (489s)Document489 pagesIntroduction To Finite Element Methods (2001) (En) (489s)green77parkNo ratings yet

- Project On Stones & TilesDocument41 pagesProject On Stones & TilesMegha GolaNo ratings yet

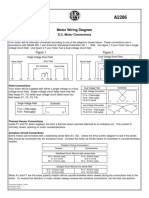

- Motor Wiring Diagram: D.C. Motor ConnectionsDocument1 pageMotor Wiring Diagram: D.C. Motor Connectionsczds6594No ratings yet

- Sto - Cristo Proper Integrated School 1 Grading Grade 9 Science Table of SpecializationDocument2 pagesSto - Cristo Proper Integrated School 1 Grading Grade 9 Science Table of Specializationinah jessica valerianoNo ratings yet

- Drugs Pharmacy BooksList2011 UBPStDocument10 pagesDrugs Pharmacy BooksList2011 UBPStdepardieu1973No ratings yet

- Air Arms S400 EXPDocument3 pagesAir Arms S400 EXPapi-3695814No ratings yet

- 2019 Course CatalogDocument31 pages2019 Course CatalogDeepen SharmaNo ratings yet

- Flowing Gas Material BalanceDocument4 pagesFlowing Gas Material BalanceVladimir PriescuNo ratings yet

- FP-XH PGRG eDocument936 pagesFP-XH PGRG ebvladimirov85No ratings yet

- Advanced Ultrasonic Flaw Detectors With Phased Array ImagingDocument16 pagesAdvanced Ultrasonic Flaw Detectors With Phased Array ImagingDebye101No ratings yet

- Nikola Tesla Was Murdered by Otto Skorzeny.Document12 pagesNikola Tesla Was Murdered by Otto Skorzeny.Jason Lamb50% (2)

- Reinforced Concrete Beam DesignDocument13 pagesReinforced Concrete Beam Designmike smithNo ratings yet

- Hyperbaric WeldingDocument17 pagesHyperbaric WeldingRam KasturiNo ratings yet

- Pitch Manual SpecializedDocument20 pagesPitch Manual SpecializedRoberto Gomez100% (1)

- The Simple PendulumDocument5 pagesThe Simple PendulumDexter TorringtonNo ratings yet

- SB Z Audio2Document2 pagesSB Z Audio2api-151773256No ratings yet

- Indian Patents. 232467 - THE SYNERGISTIC MINERAL MIXTURE FOR INCREASING MILK YIELD IN CATTLEDocument9 pagesIndian Patents. 232467 - THE SYNERGISTIC MINERAL MIXTURE FOR INCREASING MILK YIELD IN CATTLEHemlata LodhaNo ratings yet

- Feline DermatologyDocument55 pagesFeline DermatologySilviuNo ratings yet

- Virchow TriadDocument6 pagesVirchow Triadarif 2006No ratings yet

- CP 343-1Document23 pagesCP 343-1Yahya AdamNo ratings yet