Professional Documents

Culture Documents

Balance of Payments

Uploaded by

Sachin GoyalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance of Payments

Uploaded by

Sachin GoyalCopyright:

Available Formats

CHAPTER 4 BALANCE OF PAYMENTS

BALANCE OF PAYMENTS: is a statistical statement that systematically summarises for a specific time period, the economic transactions of an economy with the rest of the world. The balance of payments Statistics in India is a systematic record of Indias international economic transactions of residents with the rest of the world on account of merchandise, services, unrequited transfers and transfers of capital. Residents cover nationals as well as non-nationals residing in the country. Foreign students, tourists, foreign diplomatic officers and international institutions are not considered to be residents but diplomatic officers and armed forces of the country, stationed abroad, are treated as residents notwithstanding their physical location. Indias balance of payments statistics presented in this section are derived for the most part from Exchange Control Records and the basic data on most of the official transactions, not routed through the banking channels, are obtained from the Government agencies and the Reserve Bank of India. Based on this information, Reserve Bank of India periodically releases the revised/updated data through its Press Release. These data are also revised/updated in the RBI monthly Bulletin and RBIs website (www.rbi.org.in) Format of presentation of Balance of Payments have been changed by R.B.I. from July,1996. Revised series in the new format has been given for the year 2000-01 to 2009-10. Concepts and Definitions of various terms appearing in the Tables of the Chapter are discussed below Current Account Economic transactions that enter the current account are presented in two parts viz., i) Merchandise and ii) Invisibles. A surplus on current account leads to an acquisition of assets or repayment of debts previously contracted and a deficit involves withdrawal of previously accumulated assets or is met by borrowings. Merchandise - It comprises imports and exports of movable goods. Imports are inclusive of insurance and freight. Although these two elements come, strictly speaking, under the category of services, exports are shown free on board, by removing the estimated portion of freight and insurance from those exports that are booked on cost Insurance and freight basis. Merchandise credit relates to export of goods while merchandise debit represent import of goods. Invisibles Travel Credit - This item represents foreign tourists expenditure during their stay in India, expenditure incurred by resident travellers abroad and on the debit side it covers exchange sold for private and official travel. Transportation - Transportation covers receipts and payments on account of international transportation services. Insurance- Insurance comprises receipts and payments relating to all type of insurance services as well as reinsurance. Investment Income - Receipts include interest earned on the investments of RBI and on holdings of SDRs, and payments include interest and commitment charges on foreign loans, on purchases from the IMF and those on cumulative allocation of SDRs. Govt. not included elsewhere - The item includes receipts and payments on account of maintenance of embassies and diplomatic missions and offices of international institutions as well as receipts and payments on government account not included elsewhere. Miscellaneous- This item covers, receipts and payments in respect of all other services such as communication services, construction services, software services, technical know-how, royalties etc. Transfers of payments - (official, private) represent receipts and payments without a quid pro quo. Official transfer receipts represent contra entries for cash receipts and value of aid received in kind from foreign Governments and 47

institutions and debits cover contributions to international organisations and official grants in cash or kind extended to foreign Government. Private transfer receipts include repatriation of savings, remittances for family maintenance, contributions and donations to religious and charitable institutions etc. Receipts also include imports under P.L.480, Title II Programme. Since April 1964, receipts and payments of pension and retirement benefits etc. on private account are also covered under this head. Private transfer receipts also include the contra entry on account of Gold and Silver brought in by Indians returning from abroad. This treatment is effective from the inception of this scheme (i.e. 1992-93 onwards). Since 1996-97 it also includes contra entry for local withdrawals from NRE accounts and local redemptions of NRNRD accounts. Investment Income transactions are in the form of interest, dividend, profit and others for servicing of capital transactions. Investment income receipts comprise interest received on loans to non-residents, dividend/profit received by Indians on foreign investment, reinvested earnings of India FDI companies abroad, interest received on debentures, floating rate notes (FRNs), Commercial Papers (CPs), fixed deposits and funds held abroad by ADs out of foreign currency loans/export proceeds, payment of taxes by non-residents/refunds of taxes by foreign governments, interest/discount earnings of RBI investment etc. Investment income payments comprise payment of interest on nonresident deposits, payment of interest on loans from non-residents, payment of dividend/profit to non-resident share holders, reinvested earnings of the FDI companies, payment of interest on debentures, FRNs, CPs, fixed deposits Government securities, charges on Special Drawing Rights (SDRs) etc. Foreign Investment has two components, namely, foreign direct investment and portfolio investment. Foreign direct investment (FDI) to and by India up to 1999-2000 comprise mainly equity capital. In line with international best practices, the coverage of FDI has been expanded since 2000-01 to include, besides equity capital, reinvested earnings (retained earnings of FDI companies) and other direct capital (inter-corporate debt transactions between related entities). Data on equity capital include equity of unincorporated entities (mainly foreign bank branches in India and Indian bank branches operating abroad) besides equity of incorporated bodies. Data on reinvested earnings for the latest year (2002-03) are estimated as average of the previous two years as these data are available with a time lag of one year. In view of the above revision, FDI data are not comparable with similar data for the previous years. In terms of standard practice of BoP compilation, the above revision of FDI data would not affect Indias overall BoP position as the accretion to the foreign exchange reserves would not undergo any change. The composition of BoP, however, would undergo changes. These changes relate to investment income, external commercial borrowings and errors and omissions. In case of reinvested earnings, there would be contra entry (debit) of equal magnitude under investment income in the current account. Other capital reported as part of FDI inflow has been carved out from the figure reported under external commercial borrowings by the same amount. Other Capital by Indian Companies abroad and equity capital of unincorporated entities have been adjusted against the errors and omissions for 2000-01 and 200102. Portfolio investment mainly includes Flls investment, funds raised through GDRs/ADRs by Indian companies and through offshore funds. Data on investment abroad, hitherto reported, have been spilt into equity capital and portfolio investment since 2000-01. External assistance by India denotes aid extended by India to other foreign Governments under various agreements and repayment of such loans. External Assistance to India denotes multilateral and bilateral loans received under the agreements between Government of India and other Governments/International institutions and repayments of such loans by India, except loan repayment to erstwhile Rupee area countries that are covered under the Rupee Debt Service. Commercial borrowings cover all medium/long term loans. Commercial Borrowings by India denote loans extended by the Export Import Bank of India [EXIM Bank] to various countries and repayment of such loans. Commercial Borrowings to India denote drawls/repayment of loans including buyers credit, suppliers credit, floating rate notes (FRNs), commercial paper (CP), bonds foreign currency convertible bonds (FCCBs) issued abroad by the Indian corporate etc. It also includes India Development Bonds (IDBs), Resurgent India Bonds (RIBs) and India Millennium Deposits (IMDs). A short term loan denotes drawls in respect of loans, utilized and repayments with a maturity of less than one year.

48

Banking capital comprises of three components: a) foreign assets of commercial banks (ADs) (b) foreign liabilities of commercial banks (ADs), and (c) others. Foreign assets of commercial banks consist of (i) foreign currency holdings, and (ii) rupee overdrafts to non-resident banks. Foreign liabilities of commercial banks consists of (i) Non-resident deposits, which comprises receipt and redemption of various non-resident deposit schemes, and (ii) liabilities other than non-resident deposits which comprises rupee and foreign currency liabilities to non-resident banks and official and semi-official institutions. Others under banking capital include movement in balances of foreign central banks and international institutions like IBRD, IDA, ADB, IFC, IFAD etc. maintained with RBI as well as movement in balances held abroad by the embassies of Indian in London and Tokyo.

Non-resident deposits: Credits under this item include remittances received towards various non-resident deposit schemes viz., Foreign Currency Non-Resident Account (FCNRA) - discontinued in various phases up to August, 1994, foreign Currency Non-Resident Deposits (Banks) (FCNRB) introduced in May, 1993, Non Resident (External) rupee Account (NR(E)RA) (Since February, 1970), Non-resident Non-repartriable Rupee Deposits (NRNRD) introduced in June, 1992, foreign Currency (Banks and Others) Deposits (FCBOD) (discontinued in July, 1993) and Foreign Currency Ordinary non-repartriable deposits (FCON) (discontinued in May, 1994).Credits also include interest accrued and credited to these deposits accounts during the year. Debits denote redemption of these deposits. Others: These include movement in balances of foreign central banks and international institutions like IBRD, IDA, ADB, IFC, IFAD etc. maintained with RBI as well as movement in balances held abroad by the Embassies of India in London and Tokyo. This also includes movements in technical credit granted to the erstwhile East European countries and their investments in Government Treasury Bills and deposits with the Government.

Rupee Debt Service: Interest payments on and principal repayments on account of civilian and non-civilian debt in respect of Rupee Payment Area (RPA), are clubbed together and shown separately under this item. This is in line with the recommendation of the High Level Committee on Balances of Payments (Chairman: Dr. C. Rangarajan). Other capital: comprises mainly the leads and lags in exports receipts (difference between the custom data and the banking channel data).This is a residual item and includes all capital transactions not included elsewhere. It particularly includes funds held abroad, advance receipts under deferred exports, Indias subscription to International institution, quota payments to IMF, delayed export receipts, remittances towards recouping the losses of branches/subsidiaries etc. Movement in Reserves: Movements in the reserves comprises changes in the foreign currency assets held by the RBI and SDR balances held by the Govt. of India. These are recorded after excluding changes on account of valuation. Valuation changes arise because foreign currency assets are expressed in US dollar terms and they include the effect of appreciation/ depreciation of non-US currencies (such as Euro, Sterling, and Yen) held in reserves. The tables included in this chapter have been prepared keeping in view the following points. 1. Interest accrued during the year and credited to NRI deposits has been treated as notional outflow under invisible payments and added as reinvestment in NRI deposits under Banking Capital-NRD. The term Non-monetary Gold Movement has been deleted from invisible in conformity with the IMF Mannual on BOP (5th edition) from May 1993 onwards these entries have been included under merchandise. Since 1990-91 the value of defence related imports are recorded under imports (merchandise debit) with credits financing such imports shown under Loans (External commercial Borrowings to India) in the capital account. Interest payments on defence debt owed to the General Currency Area (GCA) are recorded under Investment Income Debit and principal repayments under debit to Loans (External Commercial Borrowings to India). In the case of the Rupee Payment Area(RPA, interest payment on and principal repayment of debt is clubbed together and shown separately under the item Rupee Debt Service in the capital account. This is in line with the recommendations of the High Level Committee on Balance of Payments (Chairman: Dr.C. Rangarajan)

2.

3.

49

4.

In accordance with the provisions of IMFs Balance of Payments (5th Edition).gold purchased from the Government of India by the RBI has been excluded from the BOP statistics. Data from the earlier years have, therefore been amended by making suitable adjustments in Other Capital Receipts and Foreign Exchange Reserves. Similarly itemSDR Allocation has been deleted from the table. In accordance with the recommendations of the Report of the Technical Group on Reconciling of balance of Payments and DGCI&S Data on Merchandise Trade, data on Gold and silver brought in by the Indians returning from abroad have been included under import payments with the contra entry under Private Transfer Receipts since 1992-93 In accordance with the IMFs Balance of Payments Manual (5th Edition),compensation of employees has been shown under head Income with effect from 1997-98: earlier, compensation of employees was recorded under the head Services-miscellaneous Since April 1998,the sales and purchases of foreign currency by the Full Fledged Money Changers(FFMC)are included under travel in services Exchange Rate: Foreign Currency transactions have been converted into rupees at the par/central rates upto June 1972 and on the basis of average of the banks spot buying and selling rates for sterling and the monthly averages of cross rates of non-sterling currencies based on London market thereafter. Effective march 1993, conversion is made by crossing average spot buying and selling rate for US dollar in the forex market and the monthly average of cross rates of non-dollar currencies based on the London market.

5.

6.

7.

8.

Highlights Contribution of Current Account in the overall balance of Payments from 2001-02 to 2003-04 was positive but decreased in subsequent years. Merchandise which includes imports and exports of movable goods is a major contributor to Current Account component was negative in 2001-02 and continued in the negative state in all the subsequent years, which show value of imports, are growing at a much faster rate than that of exports. The contribution of Capital Account is positive in Balance of Payments. The growth (% of increase over the previous year) of Capital Account was 27.5 % in 2002-03, 47.5% in 2003-04 and 62.3% in 2004-05.However in 2005-06 the Capital Account decreased by 16.69% over the previous year. It again recovered and registered an impressive 81.9 % increase (over the previous year) in 2006-07 and then increased by 110 % (over the previous year) in 2007-08,before showing a ve rise in 2008-09 (provisional figure) The contribution of Foreign Investment in capital Account is reflecting a mixed trend. For some years the growth is positive whereas for others it is decreasing. Over the Years maximum loans have been utilized from World Banks International Development Association followed by International Bank for Reconstruction and Development and then loan from Japan. Over the years, the percentage of loans and grants utilized to Authorized amount varies from 60% to 99.9 %.

This chapter contains the following tables: Table 4.1-Overall Balance Of Payments Table 4.2 (A) External Assistance-Authorisations Classified By Source Table 4.2 (B) External Assistance Utilisation Classified By Source

50

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Return of Income FilingDocument13 pagesReturn of Income FilingSachin GoyalNo ratings yet

- 1.permanent Account Number (Pan)Document10 pages1.permanent Account Number (Pan)akashNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Std11 Acct EMDocument159 pagesStd11 Acct EMniaz1788100% (1)

- Independence Movement of IndiaDocument18 pagesIndependence Movement of IndiaSachin GoyalNo ratings yet

- ACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarDocument14 pagesACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarchimbanguraNo ratings yet

- Banking Products Assignment FINAL 2Document19 pagesBanking Products Assignment FINAL 2satyabhagatNo ratings yet

- Angelica S. Rubios: Problem 10-19Document4 pagesAngelica S. Rubios: Problem 10-19Angel RubiosNo ratings yet

- Chapter 11Document16 pagesChapter 11Imtiaz AliNo ratings yet

- Accounting For Intercompany Transactions - FinalDocument15 pagesAccounting For Intercompany Transactions - FinalEunice WongNo ratings yet

- Simple and Compound Interest Lesson PowerPoint NotesDocument16 pagesSimple and Compound Interest Lesson PowerPoint NotesManahil AasimNo ratings yet

- PPF - Short NotesDocument1 pagePPF - Short NotesPoorani SundaresanNo ratings yet

- Financial Statement Analysis GuideDocument19 pagesFinancial Statement Analysis GuideHazel Jane EsclamadaNo ratings yet

- MATH 121 Chapter 1 Notes PDFDocument16 pagesMATH 121 Chapter 1 Notes PDFZabdiel GaliciaNo ratings yet

- Question bfc44602 Engineeringeconomy Protected UnlockedDocument7 pagesQuestion bfc44602 Engineeringeconomy Protected UnlockedImran RozmanNo ratings yet

- Presentation On Partnership by Prof. Aliakhbar JumraniDocument57 pagesPresentation On Partnership by Prof. Aliakhbar JumraniKim Israel100% (1)

- Edu Loan For Foreign StudyDocument17 pagesEdu Loan For Foreign StudyGurbani Kaur SuriNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document6 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Joydip DattaNo ratings yet

- Analysis of Hofstede's 5-D Model in SAUDI ARABIADocument9 pagesAnalysis of Hofstede's 5-D Model in SAUDI ARABIAKhloud Uitm100% (3)

- Topic Two Financial Mathematics/Time Value of MoneyDocument43 pagesTopic Two Financial Mathematics/Time Value of Moneysir bookkeeperNo ratings yet

- 12th Commerce Secretarial PracticeDocument25 pages12th Commerce Secretarial PracticeShahzad Shaikh55% (11)

- DebenturesDocument12 pagesDebenturesNamrata DasNo ratings yet

- RIO MortgagesDocument5 pagesRIO MortgagesMichael NealeNo ratings yet

- Fulfilling obligations and presumptions of paymentDocument19 pagesFulfilling obligations and presumptions of paymentChristian Royd PantojaNo ratings yet

- Bank Central Asia TBK: 9M20 Review: Solid Capital and PPOPDocument7 pagesBank Central Asia TBK: 9M20 Review: Solid Capital and PPOPHamba AllahNo ratings yet

- Cash Poolg CMdfsDocument88 pagesCash Poolg CMdfsLaurentiu SavaNo ratings yet

- Other Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateDocument18 pagesOther Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateZaaavnn VannnnnNo ratings yet

- Direct and Indirect Cost QuizDocument7 pagesDirect and Indirect Cost QuizakashNo ratings yet

- STC-NMB BANK - May 2020 PDFDocument13 pagesSTC-NMB BANK - May 2020 PDFaashish koiralaNo ratings yet

- Personal Loan Agreement FormDocument3 pagesPersonal Loan Agreement FormJovel ContratistaNo ratings yet

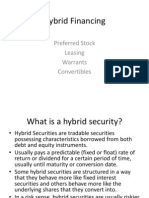

- Hybrid Financing: Understanding Preferred Stock, Leasing, Warrants and ConvertiblesDocument33 pagesHybrid Financing: Understanding Preferred Stock, Leasing, Warrants and ConvertiblesKim Aaron T. RuizNo ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- Asymmetric Information Financial IntermediationDocument28 pagesAsymmetric Information Financial IntermediationLus PMwnkNo ratings yet

- Discount, Denoted by D Which Is A Measure of Interest Where The Interest IsDocument3 pagesDiscount, Denoted by D Which Is A Measure of Interest Where The Interest IsNguyễn Quang TrườngNo ratings yet

- Growth of Money Market in IndiaDocument6 pagesGrowth of Money Market in IndiaAbhijit JadhavNo ratings yet