Professional Documents

Culture Documents

Prestige Data Services

Uploaded by

Subrata DassOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prestige Data Services

Uploaded by

Subrata DassCopyright:

Available Formats

1.

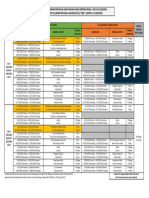

Going by the current financial condition of Prestige Data services (PDS), it is currently a liability to the parent company Prestige Telephone Company. PDS is showing operating loss for every month in the first quarter of 2003. However it is seen that Commercial sales for this company are rising (even though the rise is very marginal) and the overall losses are going down month by month. Some steps can be taken by the board to reduce the overall losses could include Increase usage of unused hours by increasing sales promotion Moving to a two shift operation rather than 24 hour operations Moving to a Contribution method of accounting instead of the absorption method to have better idea of breakeven point etc 2. Let us break our mixed cost elements into variable and fixed cost. We see that there is one Mixed cost element here Operations Salary ( The fixed part is due to the 6 people working and the variable part is due to the paid hourly helps ) Using the high low method we have the variable portion of operations salary as Varop =(30264-29184)/(361-360)=24 FixedOp=30264-24*361=21600. Power is another variable cost. Per unit cost of power is coming out as either Month Total Hours Total Cost Per Unit Cost Jan 329+32=361 1633 1633/361=4.52 Feb 316+32=348 1592 1592/348=4.57 Mar 361+40=401 1803 1803/401=4.496 On an average we can see that the approximate variable cost per unit for power is coming out as 4.5 So the Variable costs total = 24+4.5 =28.5 Per unit cost of commercial service is 800/hr. Less variables costs of 28.5 makes contribution margin for each hour of commercial services =800-28.5=771.5 =Contribution Margin per unit for commercial services. Fixed Cost Space Costs 9240 Computer Lease 95000 Maintenance 5400 Depreciation Comp 25500 Office eqp & Fix 680 OperationsFixed 21600 Systems Dev 12000 Administration 9000 Sales 11200 Materials (Fixed) 9000 Sales Promo (Fixed) 8000 Corporate Services 15000 Total 221620

Approximations used Materials is approximated to be fixed at 9000 and Sales promo is approximated to be fixed at 8000. Similarly Corporate Services is approximated to be fixed at 15000. Total Fixed Cost is 221620. However out of this approximately 82000 is for Intra-Company services. Out of this 82000 again we have 205 hours of variable cost, each hour amounting to 28.5 =205X28.5 = 5842.5 So total Fixed cost for commercial services = (221620-(82000-5842.5)) =145462.5 Therefore Breakeven Volume = Fixed Cost / Contribution Margin = 145462.5/771.5=188.54 hours 188.54 hours of commercial Service @ 800/ hr = 188.54X800 = 150832 3.a. Commercial Hours in March 2003=138 Increasing price reduces demand by 30% hence demand = 138X.7 = 97 Hrs (Approx) Increased Price =1000 . Contribution Margin =1000-28.5=971.5 Therefore revenue =97X971.5=94235.5 Currently the Revenue is (800-28.5) X138 = 106467 Hence current is better 3.b Commercial Hours in March 2003 =138 Reducing price increases demand by 30 %, hence demand =1.3X138=180 hrs (Approx) Decreased price =600 hence Contribution Margin =600-28.5=571.5 Therefore revenue =180X571.5=102870. Still less than 106467 which is the current demand hence not feasible 3.c Increased promotion would increase sales by 30%. So demand =180 Hrs So Revenue =180 X (800-28.5) = 138,870 So revenue that can be spent on promotion =138870-106467=32403 3.d Reduced commercial sales hrs =138X.8 =111 (approx.) So Revenue =111 X (800-28.5) = 85636 which is (106467-85636)=20831 less than present 4. The method of costing used by PDS here is a full absorption one which is not amenable to CVP and is also known as historical costing method. Some Fixed cost might not get reflected due to unused capacity and it might show a higher profit due to this. A better method may be to move to the contribution method of accounting system which gives us a better estimate of the breakeven point and overall costing

You might also like

- Prestige Telephone CompanyDocument13 pagesPrestige Telephone CompanyKim Alexis MirasolNo ratings yet

- Assignment - Group 2 - Prestige Telephone CompanyDocument4 pagesAssignment - Group 2 - Prestige Telephone Companyjohnychauhan1No ratings yet

- Prestige Telephone Company (Solutions)Document4 pagesPrestige Telephone Company (Solutions)Joseph Loyola71% (7)

- 16-2 Prestige Telephone CompanyDocument3 pages16-2 Prestige Telephone CompanyYJ26126100% (5)

- Case 16-2Document3 pagesCase 16-2gusneri100% (1)

- PrestigeDocument10 pagesPrestigeSumit ChandraNo ratings yet

- Prestige Telephone Company Case StudyDocument4 pagesPrestige Telephone Company Case StudyNur Al Ahad92% (12)

- Prestige Telephone CompanyDocument5 pagesPrestige Telephone CompanyCylver RoseNo ratings yet

- Prestige TelecommsDocument4 pagesPrestige TelecommsLBS17100% (1)

- Salem CaseDocument4 pagesSalem CaseChris Dunham100% (3)

- Prestige Telephone Company (Online Case Analysis)Document21 pagesPrestige Telephone Company (Online Case Analysis)astha50% (2)

- Prestige Telephone Company - Question 1Document1 pagePrestige Telephone Company - Question 1Kim Alexis MirasolNo ratings yet

- Prestige Telephone CompanyDocument2 pagesPrestige Telephone Companygharelu10100% (1)

- Case Solution Prestige Telephone ComapnyDocument2 pagesCase Solution Prestige Telephone Comapnygangster91No ratings yet

- Case Study - Prestige Telephone Co.Document12 pagesCase Study - Prestige Telephone Co.James Cullen100% (3)

- Case Study: Danshui Plant No2Document3 pagesCase Study: Danshui Plant No2Abdelhamid JenzriNo ratings yet

- Solutions Huron AutomotiveDocument13 pagesSolutions Huron Automotiveshreyansh1200% (1)

- Wlatham SolutionDocument3 pagesWlatham Solutionadi_santhi100% (7)

- Hanson Case AnalysisDocument3 pagesHanson Case AnalysisMonika100% (1)

- Selligram Case Answer KeyDocument3 pagesSelligram Case Answer Keysharkss521No ratings yet

- WalthamMotors CaseAnalysisDocument9 pagesWalthamMotors CaseAnalysisabeeju100% (5)

- Draft For Phone RevisionsDocument10 pagesDraft For Phone RevisionsHualu Zhao100% (1)

- Prestige FinalDocument11 pagesPrestige FinalRahul Tiwari0% (2)

- Dhanshui PlantDocument7 pagesDhanshui PlantAkanksha Nikita Khalkho100% (1)

- Alberta Gauge Company CaseDocument2 pagesAlberta Gauge Company Casenidhu291No ratings yet

- Ma Case WriteupDocument4 pagesMa Case WriteupMayank Vyas100% (1)

- Case: Danshui Plant No. 2: Presented By:-Group 9Document7 pagesCase: Danshui Plant No. 2: Presented By:-Group 9LOKESH YADAV100% (2)

- Huron Automotive Company - ExcelDocument6 pagesHuron Automotive Company - Excelanubhav110957% (7)

- MACS WAC Waltham Motors 12040029Document5 pagesMACS WAC Waltham Motors 12040029Zargham ShiraziNo ratings yet

- Danshui Plant 2Document13 pagesDanshui Plant 2Bernard EugineNo ratings yet

- Mridula Icecream Case !Document1 pageMridula Icecream Case !Preetam JogaNo ratings yet

- Danshui Plant 2Document1 pageDanshui Plant 2Ankit VermaNo ratings yet

- Accounting Report - Prestige Telephone CompanyDocument15 pagesAccounting Report - Prestige Telephone CompanyMuhaizarMarkamNo ratings yet

- Superior ManufacturingDocument5 pagesSuperior ManufacturingCordel TwoKpsi TaildawgSnoop Cook100% (4)

- SectionB Group16 DanshuiDocument5 pagesSectionB Group16 DanshuiRishabh Vijay100% (1)

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionKaushal Agrawal100% (1)

- Danshui Plant No 2Document5 pagesDanshui Plant No 2Thao Nguyen100% (2)

- Joint Cost SignatronDocument8 pagesJoint Cost SignatronGloryNo ratings yet

- Danshui Plant 2 - Group 6 - Section BDocument13 pagesDanshui Plant 2 - Group 6 - Section BSoumyajit Lahiri100% (8)

- Salem TelephoneDocument7 pagesSalem TelephoneGilbert LabossiereNo ratings yet

- Johnson BeverageDocument6 pagesJohnson BeverageShouib Mehreyar100% (1)

- Case Study - Destin Brass Products CoDocument6 pagesCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNo ratings yet

- Project - Rosemont Hill Health CenterDocument9 pagesProject - Rosemont Hill Health CenterDamian G. James100% (3)

- Forest GumpDocument12 pagesForest Gumpɹɐʞ Thye100% (2)

- Case 5-35 Midwest Office Products (MOP)Document13 pagesCase 5-35 Midwest Office Products (MOP)Anish Timilsina100% (2)

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionAmruta Turmé100% (2)

- Merrimack Tractors and MowersDocument10 pagesMerrimack Tractors and MowersAtul Bhatia0% (1)

- Destin Brass FinalDocument10 pagesDestin Brass FinalKim Garver100% (2)

- Salem Telephone Company Case StudyDocument4 pagesSalem Telephone Company Case StudyTôn Thiện Đức100% (4)

- Salem Telephone CompanyDocument13 pagesSalem Telephone Companyahujadeepti2581No ratings yet

- Management Accounting Assignment 1: Group No 24Document7 pagesManagement Accounting Assignment 1: Group No 24SaumyaKumarGautamNo ratings yet

- ON Prestige Telephone CompanyDocument5 pagesON Prestige Telephone CompanyNivedita NandaNo ratings yet

- Case Study Salem TelephoneDocument3 pagesCase Study Salem TelephoneahbahkNo ratings yet

- Case Study Salem TelephoneDocument3 pagesCase Study Salem Telephoneahbahk100% (2)

- Salem CaseDocument4 pagesSalem CaseNathan YanskyNo ratings yet

- 16 2 Prestige Telephone CompanyDocument3 pages16 2 Prestige Telephone CompanyAnunobi JaneNo ratings yet

- Case 16 2 - Prestige 4343 Additional NotesDocument3 pagesCase 16 2 - Prestige 4343 Additional NotesFedro SusantanaNo ratings yet

- Prestige Telephone CompanyDocument2 pagesPrestige Telephone CompanyArbaz AbbasNo ratings yet

- Prestige AMA Case StudyDocument9 pagesPrestige AMA Case StudymansNo ratings yet

- Salem Telephone CompanyDocument10 pagesSalem Telephone CompanyMicah ThomasNo ratings yet

- Fashion Retail Scenario in IndiaDocument8 pagesFashion Retail Scenario in IndiaSankeitha SinhaNo ratings yet

- Coke Vending Machine - Price DifferentiationDocument6 pagesCoke Vending Machine - Price DifferentiationSubrata Dass50% (2)

- Decision at The Top - Group 2 Version 2.0Document33 pagesDecision at The Top - Group 2 Version 2.0Subrata Dass100% (2)

- Strategic AnalysisDocument3 pagesStrategic AnalysisSubrata DassNo ratings yet

- Part 2 Petrol HistoryDocument4 pagesPart 2 Petrol HistorySubrata DassNo ratings yet

- Quiz 4.2Document5 pagesQuiz 4.2Quân TrầnNo ratings yet

- Squared-Online BrochureDocument16 pagesSquared-Online BrochureMohsinKhalid0% (1)

- Oracle Property Management User GuideDocument442 pagesOracle Property Management User GuidemanjucaplNo ratings yet

- Food Safety Culture Module BrochureDocument8 pagesFood Safety Culture Module Brochurejamil voraNo ratings yet

- RFP Template Government ModelDocument19 pagesRFP Template Government ModellgdkulclsubucvhgdjNo ratings yet

- Distribution Network DesignDocument18 pagesDistribution Network DesignAnik AlamNo ratings yet

- Completing The Audit: ©2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/ElderDocument41 pagesCompleting The Audit: ©2006 Prentice Hall Business Publishing, Auditing 11/e, Arens/Beasley/ElderJohn BryanNo ratings yet

- Chapter 18 ControllingDocument24 pagesChapter 18 ControllingAsad Uz Jaman100% (2)

- Alphasol International Group Profile: Tel: +251 114 701858 Fax: +251 114 702358 Mobile +251 920745948, EmailDocument16 pagesAlphasol International Group Profile: Tel: +251 114 701858 Fax: +251 114 702358 Mobile +251 920745948, EmailsachinoilNo ratings yet

- Takwim Akademik Diploma Ism FT 2023 2024 Pindaan 1Document1 pageTakwim Akademik Diploma Ism FT 2023 2024 Pindaan 1Raihana AzmanNo ratings yet

- Diamond Eagle Acquisition Corporation S-4Document15 pagesDiamond Eagle Acquisition Corporation S-4Carlos JesenaNo ratings yet

- Budget Circular No 2018 4 PDFDocument245 pagesBudget Circular No 2018 4 PDFJoey Villas MaputiNo ratings yet

- Splunk Test Blueprint Architect v.1.1Document4 pagesSplunk Test Blueprint Architect v.1.1Devang VohraNo ratings yet

- Business Strategies Marketing Programs at 3MDocument3 pagesBusiness Strategies Marketing Programs at 3MHarshNo ratings yet

- Corporate Governance Government MeasuresDocument9 pagesCorporate Governance Government MeasurestawandaNo ratings yet

- Fundamentals of Supply Chain Management FinalDocument243 pagesFundamentals of Supply Chain Management FinalPranay Sharma100% (1)

- Gap Analysis Against ClausewiseDocument4 pagesGap Analysis Against ClausewiseElias JarjouraNo ratings yet

- Brand StrategyDocument4 pagesBrand StrategyKrati BhargavaNo ratings yet

- BBA Admin & Finance Ahmed-Yasin Hassan Mohamed ObjectiveDocument4 pagesBBA Admin & Finance Ahmed-Yasin Hassan Mohamed ObjectiveAhmed-Yasin Hassan MohamedNo ratings yet

- IT402 Module 2 UpdatedDocument41 pagesIT402 Module 2 Updatedabanoub khalaf 22No ratings yet

- AFAR8718-Foreign-Currency-hedging SolutionsDocument2 pagesAFAR8718-Foreign-Currency-hedging SolutionsGJames ApostolNo ratings yet

- T3TMD - Miscellaneous Deals - R10Document78 pagesT3TMD - Miscellaneous Deals - R10KLB USERNo ratings yet

- Graded Questions Solutions 2023Document27 pagesGraded Questions Solutions 20232603803No ratings yet

- Project Report On Entrepreneurial Journey of A Local EntrepreneurDocument12 pagesProject Report On Entrepreneurial Journey of A Local EntrepreneurSai KishanNo ratings yet

- BS Mumbai English 14-12Document20 pagesBS Mumbai English 14-12jay pujaraNo ratings yet

- ''HR Outsourcing in India ResearchDocument77 pages''HR Outsourcing in India ResearchSami Zama100% (2)

- The Kurt Salmon Review Issue 05 VFSP PDFDocument68 pagesThe Kurt Salmon Review Issue 05 VFSP PDFDuc NguyenNo ratings yet

- Special Purpose Vehicle in Project Finance - Group 1-Batch 2Document10 pagesSpecial Purpose Vehicle in Project Finance - Group 1-Batch 2Blesson PerumalNo ratings yet

- Gujarati EntrepreneursDocument7 pagesGujarati EntrepreneursPayal ChhabraNo ratings yet

- Management TheoryDocument33 pagesManagement Theoryravishverma21No ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterFrom EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterRating: 3.5 out of 5 stars3.5/5 (487)

- All You Need to Know About the Music Business: Eleventh EditionFrom EverandAll You Need to Know About the Music Business: Eleventh EditionNo ratings yet

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- The United States of Beer: A Freewheeling History of the All-American DrinkFrom EverandThe United States of Beer: A Freewheeling History of the All-American DrinkRating: 4 out of 5 stars4/5 (7)

- All The Beauty in the World: The Metropolitan Museum of Art and MeFrom EverandAll The Beauty in the World: The Metropolitan Museum of Art and MeRating: 4.5 out of 5 stars4.5/5 (83)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Pit Bull: Lessons from Wall Street's Champion TraderFrom EverandPit Bull: Lessons from Wall Street's Champion TraderRating: 4 out of 5 stars4/5 (17)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- All You Need to Know About the Music Business: 11th EditionFrom EverandAll You Need to Know About the Music Business: 11th EditionNo ratings yet

- The Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportFrom EverandThe Formula: How Rogues, Geniuses, and Speed Freaks Reengineered F1 into the World's Fastest Growing SportNo ratings yet

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewFrom EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewRating: 4.5 out of 5 stars4.5/5 (26)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- An Ugly Truth: Inside Facebook's Battle for DominationFrom EverandAn Ugly Truth: Inside Facebook's Battle for DominationRating: 4 out of 5 stars4/5 (33)