Professional Documents

Culture Documents

Fin3000 Practice Questions ExamII Fall 09

Uploaded by

derango1Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin3000 Practice Questions ExamII Fall 09

Uploaded by

derango1Copyright:

Available Formats

Practice Questions for Finance 3000, Exam II, Fall 2009 Chapter 3 1.

Ratios are used to compare different firms in the same industry. TRUE 2. Financial ratios are used to weigh and evaluate the operational performance of the firm. TRUE 3. Liquidity ratios indicate how fast a firm can generate cash to pay bills. TRUE 4. A banker or trade creditor is most concerned about a firm's profitability ratios. FALSE 5. Ratios are only useful for those areas of business that involve investment decisions. FALSE 6. Debt utilization ratios are used to evaluate the firm's debt position with regard to its asset base and earning power. TRUE 7. The DuPont system of analysis emphasizes that profit generated by assets can be derived by various combinations of profit margins and asset turnover. TRUE 8. During disinflation, stock prices tend to go up because the investor's required rate of return goes down. TRUE 9. Analysts agree that extraordinary gains/losses should be excluded from ratio analysis because they are one time events, and do not measure annual operating performance. TRUE 10. Intangible assets are becoming an important part of the assets in a company's financial statements because accountants are recognizing the growing impact of brand names. FALSE 11. Absolute values taken from financial statements are more useful than relative values. FALSE

Page 1 of 34

12. Ratio analysis can be useful for A. historical trend analysis within a firm. B. comparison of ratios within a single industry. C. measuring the effects of financing. D. All of these are true. 13. In examining the liquidity ratios, the primary emphasis is the firm's A. ability to effectively employ its resources. B. overall debt position. C. ability to pay short-term obligations on time. D. ability to earn an adequate return. 14. Which of the following is not an asset utilization ratio? A. Inventory turnover B. Return on assets C. Fixed asset turnover D. Average collection period 15. A short-term creditor would be most interested in A. profitability ratios. B. asset utilization ratios. C. liquidity ratios. D. debt utilization ratios. 16. Which of the following is not considered to be a profitability ratio? A. profit margin B. times interest earned C. return on equity D. return on assets (investment) 17. Which two ratios are used in the DuPont system to create return on assets? A. Return on assets and asset turnover B. Profit margin and asset turnover C. Return on total capital and the profit margin D. Inventory turnover and return on fixed assets 18. The Bubba Corp. had earnings before taxes of $200,000 and sales of $2,000,000. If it is in the 50% tax bracket its after-tax profit margin is: A. 5% B. 12% C. 20% D. 25%

Page 2 of 34

19. A firm has a debt to equity ratio of 50%, debt of $300,000, and net income of $90,000. The return on equity is A. 60% B. 15% C. 30% D. not enough information 20. A firm has a debt to asset ratio of 75%, $240,000 in debt, and net income of $48,000. Calculate return on equity. A. 60% B. 20% C. 26% D. not enough information 21. For a given level of profitability as measured by profit margin, the firm's return on equity will A. increase as its debt-to-assets ratio decreases. B. decrease as its current ratio increases. C. increase as its debt-to assets ratio increases. D. decrease as its times-interest-earned ratio decreases. 22. ABC Co. has an average collection period of 60 days. Total credit sales for the year were $3,000,000. What is the balance in accounts receivable at year-end? A. $50,000 B. $100,000 C. $500,000 D. $80,000 23. Asset utilization ratios A. relate balance sheet assets to income statement sales. B. measure how much cash is available for reinvestment into current assets. C. are most important to stockholders. D. measures the firm's ability to generate a profit on sales. 24. XYZ's receivables turnover is 10x. The accounts receivable at year-end are $600,000. The average collection period is 36 days. What was the sales figure for the year assuming all sales are on credit? A. $60,000 B. $6,000,000 C. $24,000,000 D. none of these

Page 3 of 34

25. A decreasing average collection period could be associated with (select the one best answer) A. increasing sales. B. decreasing sales. C. decreasing account receivable. D. a and c. 26. If accounts receivable stays the same, and credit sales go up A. the average collection period will go up. B. the average collection period will go down. C. accounts receivable turnover will decrease. D. B and C. 27. Total asset turnover indicates the firm's A. liquidity. B. debt position. C. ability to use its assets to generate sales. D. profitability. 28. A firm has current assets of $75,000 and total assets of $375,000. The firm's sales are $900,000. The firm's fixed asset turnover is A. 3.0x B. 12.0x C. 2.4x D. 5.0x 29. A quick ratio that is much smaller than the current ratio reflects A. a small portion of current assets is in inventory. B. a large portion of current assets is in inventory. C. that the firm will have a high inventory turnover. D. that the firm will have a high return on assets. 30. A firm's long term assets = $75,000, total assets = $200,000, inventory = $25,000 and current liabilities = $50,000. A. current ratio = 0.5; quick ratio = 1.5 B. current ratio = 1.0; quick ratio = 2.0 C. current ratio = 1.5; quick ratio = 2.0 D. current ratio = 2.5; quick ratio = 2.0

Page 4 of 34

31. Investors and financial analysts wanting to evaluate the operating efficiency of a firm's managers would probably look primarily at the firm's A. debt utilization ratios. B. liquidity ratios. C. asset utilization ratios. D. profitability ratios. 32. An increasing average collection period indicates A. the firm is generating more income. B. accounts receivable are going down. C. the company is becoming more efficient in its collection policy. D. the company is becoming less efficient in its collection policy. 33. In addition to comparison with industry ratios, it is also helpful to analyze ratios using A. trend analysis. B. historical comparisons. C. neither; only industry ratios provide valid comparisons. D. both a and b. 34. If a firm has both interest expense and lease payments, A. times interest earned will be smaller than fixed charge coverage. B. times interest earned will be greater than fixed charge coverage. C. times interest earned will be the same as fixed charge coverage. D. fixed charge coverage cannot be computed. 35. A firm has operating profit of $120,000 after deducting lease payments of $20,000. Interest expense is $40,000. What is the firm's fixed charge coverage? A. 6.00x B. 2.33x C. 2.00x D. 3.00x 36. A firm has total assets of $2,000,000. It has $900,000 in long-term debt. The stockholders equity is $900,000. What is the total debt to asset ratio? A. 45% B. 40% C. 55% D. none of these 37. The higher a firm's debt utilization ratios, excluding debt-to-total assets, the A. less risky the firm's financial position. B. more risky the firm's financial position. C. more easily the firm will be able to pay dividends. D. none of these.

Page 5 of 34

38. If lease payments are reduced: A. times interest earned goes up. B. fixed charges coverage goes up. C. fixed charge coverage stays the same. D. fixed charge coverage goes down. 39. Industries most sensitive to inflation-induced profits are those with A. seasonal products. B. cyclical products. C. consumer products. D. high-profit products. 40. Replacement cost accounting (current cost method) will usually A. increase assets, decrease net income before taxes, and lower the return on equity. B. increase assets, increase net income before taxes, and increase the return on equity. C. decrease assets, increase net income before taxes, and increase the return on equity. D. None of these apply. 41. During inflation, replacement cost accounting will A. increase the value of assets. B. lower the debt to asset ratio. C. reduce incomes. D. all of these. 42. Income can be distorted by factors other than inflation. The most important causes of distortion for inter-industry comparisons are: A. timing of revenue receipts and nonrecurring gains or losses. B. tax write-off policy and use of different inventory methods. C. All of these. D. None of these. 43. Disinflation may cause A. an increase in the value of gold, silver, and gems. B. a reduced required return demanded by investors on financial assets. C. additional profits through falling inventory costs. D. None of these. 44. Disinflation as compared to inflation would normally be good for investments in A. bonds. B. gold. C. collectible antiques. D. text books.

Page 6 of 34

45. A company experiencing rapid price increases for its products would take the most conservative approach by using A. FIFO accounting. B. LIFO accounting. C. average cost accounting. D. a or c. 46. The ______________ method of inventory costing is least likely to lead to inflationinduced profits. A. FIFO B. LIFO C. Weighted average D. Lower of cost or market 47. A large extraordinary loss has what effect on cost of goods sold? A. raises it B. lowers it C. has no effect D. need more information 48. Which of the following is a potential problem of utilizing ratio analysis? A. trends and industry averages are historical in nature. B. financial data may be distorted due to price-level changes. C. firms within an industry may not use similar accounting methods. D. all of these. 49. If government bonds pay 8.5% interest and insured savings accounts pay 5.5% interest, stockholders in a moderately risky firm would expect return-on-equity values of A. 5.5% B. 6.5% C. 12% D. above 8.5%, but the exact amount is uncertain. 50. The most rigorous test of a firm's ability to pay its short-term obligations is its A. current ratio. B. quick ratio. C. debt-to-assets ratio. D. times-interest-earned ratio. 51. If the company's accounts receivable turnover is increasing, the average collection period: A. is going up slightly B. is going down C. could be moving in either direction D. is going up by a significant amount

Page 7 of 34

52. Historical cost based depreciation tends to _________ when there is inflation. A. lower taxes B. decrease profits C. increase profits D. increase assets

Page 8 of 34

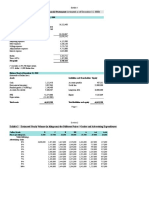

53. Refer to the figure above. Using the DuPont method, return on assets (investment) for Megaframe Computer is approximately A. 15% B. 25% C. 29% D. 35% 54. Refer to the figure above. Compute Megaframe's after tax profit margin. A. 10.0% B. 14.0% C. 15.4% D. 20.0% 55. Refer to the figure above. The firm's return on equity is A. 52.8% B. 55.6% C. 56.0% D. 100.0% 56. Refer to the figure above. The firm's average collection period is A. 30 days. B. 25 days. C. 14.4 days. D. 20 days. 57. Refer to the figure above. The firm's receivable turnover is A. 4.4x B. 10x C. 12x D. 14.4x 58. Refer to the figure above. Megaframe's quick ratio is A. 2:1 B. 1:1 C. 1.6:1 D. 10:1 59. Refer to the figure above. Megaframe's current ratio is A. 1.9:1 B. 1.625:1 C. 1.5:1 D. 3.2:1

Page 9 of 34

60. Refer to the figure above. What is Megaframe Computer's total asset turnover? A. 4.50x B. 3.6x C. 2x D. 1.76x 61. Refer to the figure above. The firm's debt to asset ratio is A. 56.1% B. 47.22% C. 33.33% D. none of these 62. Refer to the figure above. Times interest earned for Megaframe Computer is A. 4.5x B. 9x C. 11x D. 10x

Page 10 of 34

Page 11 of 34

63. Refer to the figure above. Compute Tew's after tax profit margin. A. 65.0% B. 27.3% C. 59.4% D. None of these. 64. Refer to the figure above. Using the DuPont method, return on assets (investment) for Tew is approximately A. 125% B. 34.1% C. 293.0% D. None of these. 65. Refer to the figure above. The firm's return on equity is A. 136.5% B. 135.29% C. 80.29% D. 57.5% 66. Refer to the figure above. The firm's receivable turnover is A. 5.0x B. 1.7x C. 6.25x D. 0.2x 67. Refer to the figure above. The firm's average collection period is A. 57.6 days. B. 222 days. C. 55.6 days. D. 6.3 days. 68. Refer to the figure above. The firm's inventory turnover ratio is A. 10x. B. 8x. C. 2.7x. D. 0.1x. 69. Refer to the figure above. The firm's fixed asset turnover ratio is A. 2.0x. B. 1.6x. C. 0.5x. D. 1.3x.

Page 12 of 34

70. Refer to the figure above. What is Tew's total asset turnover? A. 2.9x B. 1.3x C. 1.0x D. 1.25x 71. Refer to the figure above. Tew's quick ratio is A. 1.5:1 B. 1:1 C. 2:1 D. none of these 72. Refer to the figure above. Tew's current ratio is A. 1.5:1 B. 1:1 C. 2:1 D. none of these 73. Refer to the figure above. The firm's debt to asset ratio is A. 58%. B. 33%. C. 25%. D. 48%. 74. Refer to the figure above. Times interest earned for Tew Company is A. 6.8x B. 10.5x C. 25x D. 11.5x 75. Refer to the figure above. Fixed Charge coverage for Tew Company is A. 23x B. 13.6x C. 1.3x D. 8.0x

Page 13 of 34

Page 14 of 34

76. Refer to the figure above. Compute Marni's after tax profit margin. A. 7.5% B. 3.75% C. 50% D. None of these. 77. Refer to the figure above. Using the DuPont method, return on assets (investment) for Marni is approximately A. 200% B. 7.5% C. 3.75% D. None of these. 78. Refer to the figure above. The firm's return on equity is A. 75% B. 26.8% C. 13.4% D. 15% 79. Refer to the figure above. The firm's receivable turnover is A. 10x B. 8x C. 20x D. 12x 80. Refer to the figure above. The firm's average collection period is A. 18 days. B. 277 days. C. 139 days. D. 20 days. 81. Refer to the figure above. The firm's inventory turnover ratio is A. 10x. B. 5x. C. 0.4x. D. 0.1x. 82. Refer to the figure above. The firm's fixed asset turnover ratio is A. 3.1x. B. 1.5x. C. 2x. D. 0.1x.

Page 15 of 34

83. Refer to the figure above. What is Marni's total asset turnover? A. 13.3x B. 4x C. 1x D. 2x 84. Refer to the figure above. Marni's quick ratio is A. 0.79:1 B. 0.50:1 C. 1.84:1 D. none of these 85. Refer to the figure above. Marni's current ratio is A. 0.79:1 B. 0.5:1 C. 1.84:1 D. none of these 86. Refer to the figure above. The firm's debt to asset ratio is A. 44%. B. 33%. C. 19%. D. 34%. 87. Refer to the figure above. Times interest earned for Marni Company is A. 3x B. 5x C. 80x D. 6x 88. Refer to the figure above. Fixed Charge coverage for Marni Company is A. 15x B. 7.5x C. 0.9x D. 4.6x 89. If Randolph Co. has sales of $2,000,000, net income of $120,000, and total asset turnover of 2x, what is their ROA? A. 33% B. 17% C. 12% D. 6%

Page 16 of 34

90. If Baxter Unlimited has annual sales of $5,000,000 (80% on credit), and receivables equal to 35% of credit sales, what is their receivables turnover? A. 3.6 times B. 2.9 times C. 2.3 times D. 4.2 times 91. If Crossroads International has $3,000,000 in total sales (75% on credit) and receivables of $500,000, what is their average collection period? A. 80 days B. 60 days C. 61 days D. 81 days 92. All of the following are common examples of possible distortion in reported income except A. inflation B. treatment of nonrecurring items C. cash flow statements D. reporting of revenue 93. Trend and industry analysis provide all of the following information except A. benchmarking B. the progress of the company C. basis for decision-making about capital structure D. future information about the company 94. If Turnpoint Inc. has net income of $300,000, assets of $3,000,000, sales of $2,000,000, and debt of 1,300,000, what is their ROE? A. between 17-18% B. between 19-20% C. between 21-22% D. none of these

Page 17 of 34

95. Complete the following balance sheet for the Range Company using the following information: Debt to Assets = 60 percent Quick Ratio = 1.1 Asset Turnover = 5x Fixed Asset Turnover = 12.037x Current Ratio = 2 Average Collection Period = 16.837 days

Assume all sales are on credit and a 360-day year.

Page 18 of 34

Page 19 of 34

96. Follies Bookstore, the only bookstore close to campus, had net income in 2005 of $90,000. Here are some of the financial ratios from the annual report.

Using these ratios, calculate the following for Follies Bookstore: a) Sales b) Total assets c) Total asset turnover d) Total debt e) Stockholders' equity f) Return on equity

Page 20 of 34

Page 21 of 34

Chapter 5 97. Leverage is the use of fixed costs to magnify returns at high levels of operation. TRUE 98. Leverage works best when volume is increasing. TRUE 99. Operating leverage emphasizes the impact of using fixed assets in the business. TRUE 100. Financial leverage emphasizes the impact of using debt in the business. TRUE 101. Sales commissions and raw material are variable costs. TRUE 102. The contribution margin is equal to price per unit minus total costs per unit. FALSE 103. As the contribution margin rises, the breakeven point goes down. TRUE 104. Linear break-even analysis assumes that costs are linear functions of volume. TRUE 105. Linear breakeven analysis and operating leverage are only valid within a relevant range of production. TRUE 106. Financial leverage primarily affects the left-hand side of the balance sheet. FALSE 107. Operating leverage primarily affects the left hand side of the balance sheet while financial leverage affects the right hand side of the balance sheet. TRUE 108. The degree of financial leverage measures the percentage change in EPS for every 1 percent move in EBIT. TRUE 109. Operating leverage influences the bottom half of the income statement while financial leverage deals with the top half. FALSE

Page 22 of 34

110. Firms with cyclical sales should employ a high degree of leverage. FALSE 111. The interwoven boundaries of banks and different trading companies in Japan make it easier to acquire credit in Japan than in the U.S. TRUE 112. An example of an adjustment for a cash break-even analysis would be adding back increases in accounts receivable. FALSE 113. Degree of combined leverage considers the impact of a change in volume on the change in operating income. FALSE 114. The concept of operating leverage involves the use of __________ to magnify returns at high levels of operation. A. fixed costs B. variable costs C. marginal costs D. semi-variable costs 115. Which of the following questions does break-even analysis attempt to address? A. How much do changes in volume effect costs and profits? B. At what point does the firm break even? C. What is the most efficient level of fixed assets to employ? D. All of these 116. In break-even analysis, the contribution margin is defined as A. price minus variable cost. B. price minus fixed cost. C. variable cost minus fixed cost. D. fixed cost minus variable cost. 117. At the break-even point, a firm's profits are A. greater than zero. B. less than zero. C. equal to zero. D. Not enough information to tell 118. If a firm has a break-even point of 20,000 units and the contribution margin on the firm's single product is $3.00 per unit and fixed costs are $60,000, what will the firm's net income be at sales of 30,000 units? A. $90,000 B. $30,000 C. $15,000 D. $45,000 Page 23 of 34

119. If sales volume exceeds the break-even point, the firm will experience A. an operating loss. B. an operating profit. C. an increase in plant and equipment. D. an increase in stock price. 120. The break-even point can be calculated as A. variable costs divided by contribution margin. B. total costs divided by contribution margin. C. variable cost times contribution margin. D. fixed cost divided by contribution margin. 121. A highly automated plant would generally have A. more variable than fixed costs. B. more fixed than variable costs. C. all fixed costs. D. all variable costs. 122. If fixed costs rise while other variables stay constant A. the breakeven point rises. B. degree of operating leverage increases. C. total profit declines. D. all of these 123. If the price per unit decreases because of competition but the cost structure remains the same A. the breakeven point rises. B. the degree of combined leverage declines. C. the degree of financial leverage declines. D. All of these 124. If a firm has fixed costs of $30,000, a price of $4.00, and a breakeven point of 15,000 units, the variable cost per unit is: A. $5.00 B. $2.00 C. $.50 D. $4.00

Page 24 of 34

125. If a firm has fixed costs of $20,000, variable cost per unit of $.50, and a breakeven point of 5,000 units, the price is: A. $2.50 B. $5.00 C. $4.00 D. $4.50 126. If a firm has a price of $4.00, variable cost per unit of $2.50 and a breakeven point of 20,000 units, fixed costs are equal to: A. $13,333 B. $10,000 C. $30,000 D. $50,000 127. A firm with $50,000 in fixed costs breaks even on unit sales of 10,000, how many units must the firm sell to earn $20,000 in operating profits? A. 12,000 units B. 14,000 units C. 16,000 units D. There is not enough information to determine the unit sales required. 128. A firm has operating profits of $10,000 on unit sales of 5,000 units. Fixed costs are $30,000. What is the firm's break-even sales level? A. less than 4000 units. B. 4000 units. C. more than 4000 units D. There is not enough information to determine the unit break-even point. 129. A firm's break-even point will rise if A. fixed costs decrease B. contribution margins increase C. price per unit rises D. variable cost per unit rises 130. Davison Toaster Corp. sells its products for $100 per unit. It has the following costs:

The break-even point is A. less than 2500 units B. 2500 units C. more than 2500 units D. not enough information has been provided to determine the break-even point. Page 25 of 34

131. Which of the following is true about the concept of leverage? A. at the breakeven point, operating leverage is equal to zero. B. combined leverage measures the impact of operating and financial leverage on EBIT. C. financial leverage measures the impact of fixed costs on earnings. D. none of these 132. A weakness of breakeven analysis is that it assumes: A. revenue and costs are a linear (constant) function of volume. B. prices and costs increase when the economy is strong and confidence is high. C. cost of goods sold goes up as revenue increases. D. there is no weakness. 133. A high DOL means: A. there are high labor costs. B. there is high debt. C. there is a large amount of equity. D. there are high fixed costs. 134. Which of the following is concerned with the change in operating profit as a result of a change in volume? A. Financial leverage B. Break-even point C. Operating leverage D. Combined leverage 135. Cash breakeven analysis A. is helpful in analyzing the short-term outlook of the firm, particularly when it is in trouble financially. B. is important when analyzing long-term profitability. C. includes depreciation expense as a fixed cost when calculating the degree of financial leverage. D. None of these. 136. The degree of operating leverage may be defined as A. the percent change in operating income divided by the percent change in unit volume. B. Q (P-VC) divided by Q (P-VC) - FC. C. S - TVC divided by S - TVC - FC. D. all of these 137. Loretta & Nieces fixed costs are $200,000, including $20,000 of depreciation expense. The price of each unit sold is $12, and the variable cost per unit is $6. How many units must the firm sell to reach the cash break-even point? A. less than 33,333 units B. 33,333 units C. More than 33,333 units D. not enough information has been provided to determine the cash break-even point Page 26 of 34

138. Conservatively leveraged Firm C and highly leveraged Firm H operate at the same level of earnings before interest and taxes where the return on assets is greater than the cost of debt. A. Firm C will have a higher return on equity than H. B. Firm H will have a higher return on equity than C. C. The return on equity will not be affected by financial leverage. D. The return on equity will be the same at an equal level of earnings. 139. The degree of operating leverage is computed as A. percent change in operating profit divided by percent change in net income. B. percent change in volume divided by percent change in operating profit. C. percent change in EPS divided by percent change in operating income. D. percent change in operating income divided by percent change in volume. 140. Firm A employs a high degree of operating leverage; Firm B takes a more conservative approach. Which of the following comparative statements about firms A and B is true? A. A has a lower break-even point than B, but A's profit grows faster after the break-even. B. A has a higher break-even point than B, but A's profit grows slower after the break-even. C. B has a lower break-even point than A, but A's profit grows faster after break-even. D. B has a lower break-even point than A, and profit grows the same rate for both companies after the breakeven point. 141. Firms with a high degree of operating leverage are A. easily capable of surviving large changes in sales volume B. usually trading off lower levels of risk for higher profits. C. significantly affected by changes in interest rates. D. trading off higher fixed costs for lower per-unit variable costs. 142. Financial leverage deals with: A. the relationship of fixed and variable costs. B. the relationship of debt and equity in the capital structure. C. the entire income statement. D. the entire balance sheet. 143. A conservative financing plan involves A. heavy reliance on debt. B. heavy reliance on equity. C. high degree of financial leverage. D. high degree of combined leverage. 144. A firm's earnings per share is not impacted by its financing plan at the point when A. debt is equal to equity. B. return on assets equals return on equity. C. the cost of borrowed funds equals the return on equity. D. the cost of borrowed funds equals the return on assets.

Page 27 of 34

145. If EBIT equals $160,000 and interest equals $30,000, what is the degree of financial leverage? A. 5.33x B. 1.23x C. .8125x D. 4.33x 146. The degree of financial leverage is concerned with the relation between A. changes in volume and changes in EPS. B. changes in volume and changes in EBIT. C. changes in EBIT and changes in EPS. D. changes in EBIT and changes in operating income. 147. When a firm employs no debt A. it has a financial leverage of one. B. it has a financial leverage of zero. C. its operating leverage is equal to its financial leverage. D. it will not be profitable. 148. If a firm has the lowest possible degree of operating leverage and the lowest possible degree of financial leverage, then A. DOL equals 1, and DFL equals 0. B. DOL equals 0, and DFL equals 1. C. DOL equals 1, and DFL equals 1. D. none of these 149. Combined leverage is concerned with the relationship between A. changes in EBIT and changes in EPS. B. changes in volume and changes in EPS. C. changes in volume and changes in EBIT. D. changes in EBIT and changes in net income. 150. Which of the following is not true about leverage? A. operating leverage influences the top half of the income statement, determining EBIT. B. financial leverage deals with the bottom half of the income statement, determining EPS C. combined leverage utilizes the entire income statement, showing the impact of change in volume on EBIT. D. none of these 151. If the business cycle were just beginning its upswing, which firm would you anticipate would be likely to show the best growth in EPS over the next year? Firm A has high combined leverage and Firm B has low combined leverage. A. Firm A B. Firm B C. Indifferent between the two D. It depends on how much financial leverage each firm has. Page 28 of 34

152. Refer to the figure above. The Degree of Operating Leverage is A. 1.43x B. 1.56x C. 3.33x D. 2.22x 153. Refer to the figure above. The Degree of Financial Leverage is A. 1.29x B. 4.50x C. 3.50x D. 1.32x 154. Refer to the figure above. The Degree of Combined Leverage is A. 2.2x B. 1.9x C. 2.9x D. 2.0x

155. Refer to the figure above. This firm's break-even point is A. 4,800 units B. 14,634 units C. 7,142 units D. 18,000 units

Page 29 of 34

156. Refer to the figure above. The Degree of Operating Leverage (DOL) is A. 1.58x B. 1.95x C. 3.50x D. 1.40x 157. Refer to the figure above. The Degree of Financial Leverage (DFL) is A. 3.50x B. 1.40x C. 1.95x D. 1.58x 158. Refer to the figure above. The Degree of Combined Leverage (D.C.L.) is A. 3.08x B. 5.45x C. 2.73x D. 6.83x 159. Heavy use of long-term debt may be beneficial in an inflationary economy because A. the debt may be repaid in more "expensive" dollars. B. nominal interest rates exceed real interest rates. C. inflation is associated with the peak of a business cycle. D. the debt may be repaid in "cheaper" dollars. 160. Under which of the following conditions could the overuse of financial leverage be detrimental to the firm? A. Stable industry B. Cyclical demand for the firm's products. C. Upswing of business cycle. D. Low interest cost compared to return on assets 161. Firm A produces semiconductors using highly technical machinery; Firm B is a retail clothing store. Consider which firm employs a higher degree of operating leverage and then answer the following question: "Which of the following comparative statements about firms A and B is true?" A. A has a lower break-even point than B, but A's profit grows faster after the break-even. B. A has a higher break-even point than B, but A's profit grows slower after the break-even. C. B has a lower break-even point than A, but A's profit grows faster after break-even. D. B has a lower break-even point than A, and profit grows at the same rate for both companies after the breakeven point. 162. A factory which relies on highly technical machinery, may choose to reduce their overall leverage position by A. selling their machinery B. increasing their accounts receivable C. utilizing a higher level of equity D. decreasing their variable costs per unit Page 30 of 34

163. If TechCor has fixed costs of $80,000, variable costs of $1.20/unit, sales price/unit of $6, and depreciation expense of $25,000, what is their cash breakeven in units? A. 9,167 B. 11,458 C. 21,875 D. 45,833 164. Green Co. has total assets $550,000, a cost of borrowed funds of 7%, and an EBIT of $41,250. From a financial breakeven perspective, Green Co. is A. breaking even B. lower than the break even C. higher than the breakeven D. in need of new financing 165. From the following income statement, calculate: a) Degree of financial leverage. b) Degree of operating leverage. c) Degree of combined leverage.

Page 31 of 34

166. Heister Corporation produces class rings to sell to college and high school students. These rings sell for $75 each, and cost $35 each to produce. Heister has fixed costs of $50,000. a) Calculate Heister's break-even point. b) How much profit (loss) will Heister have if it sells 1,000 rings? 8,000 rings? c) Heister's president, J. R. D'Angelo, expects an annual profit of $100,000. How many rings must be sold to attain this profit?

Page 32 of 34

167. A new restaurant is ready to open for business. It is estimated that the food cost (variable cost) will be 40% of sales, while fixed cost will be $450,000. The first year's sales estimates are $1,250,000. The cost to start up this restaurant will be $2,000,000. Two financing alternatives are being considered: a) 50% equity financing and 50% debt at 12%, or b) all equity financing. Common stock can be sold at $5 per share. a) Compute the Operating Break-even point in dollars. b) Compute DOL. c) Compute DFL and DCL for both financing plans.

Page 33 of 34

Page 34 of 34

You might also like

- Saint Joseph College of Sindangan Incorporated College of AccountancyDocument18 pagesSaint Joseph College of Sindangan Incorporated College of AccountancyRendall Craig Refugio0% (1)

- FAR LONG QUIZ 2 Form AnalysisDocument17 pagesFAR LONG QUIZ 2 Form AnalysisshaniaNo ratings yet

- QuestionsDocument71 pagesQuestionsChan Chan50% (4)

- Chapter 6Document57 pagesChapter 6Léo Audibert75% (4)

- Optimize Working Capital & Cash Flow With Proven TechniquesDocument32 pagesOptimize Working Capital & Cash Flow With Proven TechniquesDaniella Zapata Montemayor100% (1)

- CBA Rural Bank HR Strategies During the PandemicDocument4 pagesCBA Rural Bank HR Strategies During the PandemicJamaica Elopre100% (1)

- Chapter 3-Predetermined Overhead Rates Flexible Budgets and Absorption Variable CostingDocument34 pagesChapter 3-Predetermined Overhead Rates Flexible Budgets and Absorption Variable CostingAbby NavarroNo ratings yet

- FINMANDocument1 pageFINMAN여자라라100% (1)

- JO QuizDocument2 pagesJO Quizrefhael jush babaoNo ratings yet

- How ROIC, Growth, and Cash Flow Relate for Company ValuationDocument2 pagesHow ROIC, Growth, and Cash Flow Relate for Company ValuationAlizahNo ratings yet

- Chap 8Document32 pagesChap 8huha4rever100% (3)

- MANACC Lesson 1 Introduction To Managerial Accounting Reviewer 1Document13 pagesMANACC Lesson 1 Introduction To Managerial Accounting Reviewer 1Rodolfo ManalacNo ratings yet

- MAS by Cabrera Answers To Multiple Choice QuestionsDocument16 pagesMAS by Cabrera Answers To Multiple Choice QuestionsLouella Gudes100% (5)

- Premiums and WarrantiesDocument3 pagesPremiums and WarrantiesMicaella Grande50% (2)

- HB - Forex Midterm 2021Document5 pagesHB - Forex Midterm 2021Allyssa Kassandra LucesNo ratings yet

- Cost Volume Profit AnalysisDocument7 pagesCost Volume Profit AnalysisMeng DanNo ratings yet

- 1Document8 pages1Mary Jescho Vidal AmpilNo ratings yet

- Quiz - Financial Statements With SolutionDocument6 pagesQuiz - Financial Statements With SolutionMary Yvonne AresNo ratings yet

- Examination About Investment 12Document4 pagesExamination About Investment 12BLACKPINKLisaRoseJisooJennieNo ratings yet

- Assignment QuestionsDocument13 pagesAssignment QuestionsAiman KhanNo ratings yet

- Business and Economic Statistics Quiz 01 06Document25 pagesBusiness and Economic Statistics Quiz 01 06Ariane GaleraNo ratings yet

- Case 7-20 Contact Global Our Analysis-FinalsDocument11 pagesCase 7-20 Contact Global Our Analysis-FinalsJenny Malabrigo, MBANo ratings yet

- Mancon Quiz 6Document45 pagesMancon Quiz 6Quendrick SurbanNo ratings yet

- Thrift Corp. Prepaid Expenses QuizDocument9 pagesThrift Corp. Prepaid Expenses QuizKristine VertucioNo ratings yet

- Module 13 Present ValueDocument10 pagesModule 13 Present ValueChristine Elaine LamanNo ratings yet

- Process Cost Systems ExplainedDocument52 pagesProcess Cost Systems Explainedchuchu0% (1)

- Compre ExamDocument11 pagesCompre Examena20_paderangaNo ratings yet

- I. Multiple Choice. Select The Best Answer Among The Options. Show/Give Your Solution IfDocument3 pagesI. Multiple Choice. Select The Best Answer Among The Options. Show/Give Your Solution IfBabi Dimaano Navarez100% (1)

- Acctax1 AY 2016-2017 ProblemsDocument77 pagesAcctax1 AY 2016-2017 ProblemsRebekahNo ratings yet

- 3FM AnswerDocument15 pages3FM AnswerRenzNo ratings yet

- Expenses Contribution MarginratioDocument3 pagesExpenses Contribution MarginratioMike Oshaunessy BaconNo ratings yet

- QS13 - Class Exercises SolutionDocument2 pagesQS13 - Class Exercises Solutionlyk0texNo ratings yet

- Sample ProblemsDocument7 pagesSample ProblemsArvin Kim AriateNo ratings yet

- Essay QuestionsDocument1 pageEssay QuestionsNicole Allyson AguantaNo ratings yet

- P1 1Document12 pagesP1 1Donna Mae Hernandez0% (1)

- Ratio Reviewer 2Document15 pagesRatio Reviewer 2Edgar Lay60% (5)

- Segment reporting and discontinued operationsDocument12 pagesSegment reporting and discontinued operationsAnalie Mendez100% (2)

- Intermediate Accounting Prac Mock ExamsDocument72 pagesIntermediate Accounting Prac Mock ExamsIris Claire ClementeNo ratings yet

- Acctg. QB 1-1Document8 pagesAcctg. QB 1-1Jinx Cyrus RodilloNo ratings yet

- Local Media7735387659572366861Document3 pagesLocal Media7735387659572366861heynuhh gNo ratings yet

- Taxation Cup SeriesDocument5 pagesTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- ExamDocument7 pagesExamKristen WalshNo ratings yet

- ObliCon Part 4Document2 pagesObliCon Part 4Wawex DavisNo ratings yet

- Orang Co. perpetual inventory system calculationsDocument3 pagesOrang Co. perpetual inventory system calculationsJobelle Candace Flores AbreraNo ratings yet

- Accounting - NotesDocument2 pagesAccounting - NotesRica CamonNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingValierry VelascoNo ratings yet

- Ae 114 - PrelimDocument8 pagesAe 114 - PrelimMa Angelica BalatucanNo ratings yet

- Mas Chapter 4 PDFDocument11 pagesMas Chapter 4 PDFAldrin LiwanagNo ratings yet

- Chapter 15 Managing ShortDocument44 pagesChapter 15 Managing ShortLede Ann Calipus Yap0% (1)

- Name: - : Problem 1Document2 pagesName: - : Problem 1Samuel FerolinoNo ratings yet

- Financial Statement Analysis QUIZZERDocument10 pagesFinancial Statement Analysis QUIZZERBRYLL RODEL PONTINONo ratings yet

- Accounting exam practice questions on corporations, financial statements, inventoryDocument11 pagesAccounting exam practice questions on corporations, financial statements, inventoryvonns80No ratings yet

- Mid CORFINDocument16 pagesMid CORFINRichard LazaroNo ratings yet

- Activity 3 FinMaDocument6 pagesActivity 3 FinMaDiomela BionganNo ratings yet

- MSQ-07 - Financial Statement AnalysisDocument13 pagesMSQ-07 - Financial Statement AnalysisMarilou Olaguir Saño0% (1)

- FS Analysis SimulatedDocument8 pagesFS Analysis SimulatedSarah BalisacanNo ratings yet

- 5 Question - FinanceDocument19 pages5 Question - FinanceMuhammad IrfanNo ratings yet

- Module 7 QuestionDocument21 pagesModule 7 QuestionWarren MakNo ratings yet

- MAS 1 PrelimDocument10 pagesMAS 1 PrelimRose Ann Moraga FrancoNo ratings yet

- Chap 013Document667 pagesChap 013Rhaine ArimaNo ratings yet

- Principles and Methods for Improving CollectionsDocument7 pagesPrinciples and Methods for Improving Collectionsrosalyn mauricioNo ratings yet

- Capital Structure and Firm Efficiency: Dimitris Margaritis and Maria PsillakiDocument23 pagesCapital Structure and Firm Efficiency: Dimitris Margaritis and Maria PsillakiRafael G. MaciasNo ratings yet

- تجربة الأردن في العمل المصرفي الإسلامي من حيث كفاءة أداء البنوك الإسلامية -دراسة حالة بنكDocument11 pagesتجربة الأردن في العمل المصرفي الإسلامي من حيث كفاءة أداء البنوك الإسلامية -دراسة حالة بنكMortaza AlbadriNo ratings yet

- (Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsDocument185 pages(Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsFaridElAtracheNo ratings yet

- Accounts - Past Years Que CompilationDocument393 pagesAccounts - Past Years Que CompilationSavya SachiNo ratings yet

- Exhibits and Student TemplateDocument7 pagesExhibits and Student Templatesatish.evNo ratings yet

- Pedro Santos' Transportation Business General Journal For The Month of JulyDocument8 pagesPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლNo ratings yet

- Dnata Campus To Corporate ProgramDocument28 pagesDnata Campus To Corporate ProgramAmit Kushwaha100% (1)

- Consolidated CSOFP of Jasin Bhd GroupDocument4 pagesConsolidated CSOFP of Jasin Bhd GroupNoor ShukirrahNo ratings yet

- Notes in Term Bonds and Serial Bonds (Discount or Premium)Document12 pagesNotes in Term Bonds and Serial Bonds (Discount or Premium)Jae GrandeNo ratings yet

- Cmfas M 9: OduleDocument23 pagesCmfas M 9: Odulezihan.pohNo ratings yet

- CTRN Citi Trends Slides March 2017Document18 pagesCTRN Citi Trends Slides March 2017Ala BasterNo ratings yet

- Ijaz KhanDocument78 pagesIjaz Khanwaqar ahmadNo ratings yet

- Credit Card Statement SummaryDocument6 pagesCredit Card Statement SummaryLim Su PingNo ratings yet

- Tips - Butler Lumber Company Case SolutionDocument18 pagesTips - Butler Lumber Company Case Solutionsara_AlQuwaifliNo ratings yet

- Ichimoku Trader - SignalsDocument6 pagesIchimoku Trader - Signalsviswaa.anupindiNo ratings yet

- Measuring Market Inefficiencies and the Case for Current Value AccountingDocument13 pagesMeasuring Market Inefficiencies and the Case for Current Value AccountingXinwei GuoNo ratings yet

- FM by Sir KarimDocument2 pagesFM by Sir KarimWeng CagapeNo ratings yet

- 25dairy Cow ModuleDocument47 pages25dairy Cow ModulericoliwanagNo ratings yet

- SalesBill VI 139 DigitallySignedDocument1 pageSalesBill VI 139 DigitallySignedKundariya MayurNo ratings yet

- ConsiderDocument284 pagesConsiderGhulam NabiNo ratings yet

- Corporate Management Accounting Merge Colour Deleted NotesDocument246 pagesCorporate Management Accounting Merge Colour Deleted Notesgautam shahNo ratings yet

- 09-MWSS2020 Part1-Notes To FSDocument44 pages09-MWSS2020 Part1-Notes To FSGabriel OrolfoNo ratings yet

- Term Plan 65yeras PDFDocument5 pagesTerm Plan 65yeras PDFRohit KhareNo ratings yet

- Principles of Financial Accounting 12th Edition Needles Solutions ManualDocument25 pagesPrinciples of Financial Accounting 12th Edition Needles Solutions ManualJacquelineHillqtbs100% (54)

- Zimbabwe TogetherDocument23 pagesZimbabwe TogetherLionel MasawiNo ratings yet

- L2 Certificate in Bookkeeping and Accounting PDFDocument26 pagesL2 Certificate in Bookkeeping and Accounting PDFKhin Zaw HtweNo ratings yet

- Negen Capital: (Portfolio Management Service)Document5 pagesNegen Capital: (Portfolio Management Service)Sumit SagarNo ratings yet

- EAE0516 - 2022 - Slides 15Document25 pagesEAE0516 - 2022 - Slides 15Nicholas WhittakerNo ratings yet