Professional Documents

Culture Documents

Management Accounting/Series-3-2007 (Code3023)

Uploaded by

Hein Linn KyawOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management Accounting/Series-3-2007 (Code3023)

Uploaded by

Hein Linn KyawCopyright:

Available Formats

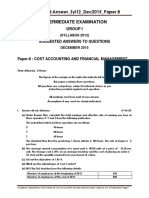

Management Accounting

Level 3

Model Answers

Series 3 2007 (Code 3023)

1 3023/2/06

ASE 3023 2 06 1

>f0t@W9W2`?[I]BkBw5k#

Management Accounting Level 3

Series 3 2007

How to use this booklet Model Answers have been developed by Education Development International plc (EDI) to offer additional information and guidance to Centres, teachers and candidates as they prepare for LCCI International Qualifications. The contents of this booklet are divided into 3 elements: (1) (2) Questions Model Answers reproduced from the printed examination paper summary of the main points that the Chief Examiner expected to see in the answers to each question in the examination paper, plus a fully worked example or sample answer (where applicable) where appropriate, additional guidance relating to individual questions or to examination technique

(3)

Helpful Hints

Teachers and candidates should find this booklet an invaluable teaching tool and an aid to success. EDI provides Model Answers to help candidates gain a general understanding of the standard required. The general standard of model answers is one that would achieve a Distinction grade. EDI accepts that candidates may offer other answers that could be equally valid.

Education Development International plc 2007 All rights reserved; no part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission of the Publisher. The book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover, other than that in which it is published, without the prior consent of the Publisher.

QUESTION 1 (a) Different types of standard may be set in a standard costing system. REQUIRED Explain the meaning and usefulness of: (i) (ii) attainable standards ideal standards. (3 marks) (3 marks)

(b) The behaviour of participants in a budgetary planning and control system will be an important factor influencing the effectiveness of the system. REQUIRED Discuss the human behavioural problems that may arise in the operation of a budgetary planning and control system. (8 marks)

(c) Identification of the principal budget factor is an important element in the budgeting process. REQUIRED (i) (ii) Define the term 'principal budget factor' and give an example. Explain the importance of the principal budget factor. (3 marks) (3 marks) (Total 20 marks)

3023/3/07/MA

MODEL ANSWER TO QUESTION 1 QUESTION 1 (a) (i) Attainable standards

Attainable standards are performance targets which assume efficient levels of operation but which include allowances for normal loss, waste and machine downtime. Attainable standards are intended to be challenging, i.e. probably above the current level of performance, but motivational in that they will be seen as achievable. (ii) Ideal standards

Ideal standards are performance targets which make no allowances for loss, waste or machine downtime, and which are, therefore, only attainable under the most favourable conditions. Ideal standards are intended to indicate what could be achieved but they may be unrealistic, and thus demotivational, if they are some way from current performance. (b) Human behavioural problems of budgeting

Imposing standards/budgets, i.e. without the participation (or with pseudo-participation) of those held responsible for their achievement. This is likely to be demotivational with adverse consequences for morale and performance. This result is especially likely if the budget is perceived to be unattainable. The incorporation of budget slack (i.e. understating revenue and/or overstating costs) by those involved in the setting of their budgets. This is to make budgets easier to achieve with the result that profit is not as high as it could be. Spending the budget amount, whether or not it is necessary/justified, so that the budget for the next period will not be reduced. Again, profit is not as high as it could be. Holding an individual accountable for adverse variances that are perceived by the individual to be uncontrollable or arising from unattainable standards. This again is likely to be demotivational.

(c) Principal budget factor The principal budget factor is the factor (aspect of business/resource) that will limit the activities of an organisation for the budget period. It is important that the principal factor is identified at the start of the budgeting process because it will influence all other budgets. Sales demand is often the factor that limits an organisation's activities and as a result the sales budget would be the first one prepared in such a situation with all other budgets following from that. However, availability of resources, for example skilled labour or production capacity, could at times limit the sales that could otherwise be achieved and could thus be the principal budget factor.

3023/3/07/MA

QUESTION 2 A company manufactures and sells a single product. The budgeted profit statement for the first trading period is set out below. Budgeted Profit Statement Sales Production cost of sales: Cost of production Closing stock Gross profit Non-production overheads Net profit

120,000

86,700 (1,700)

85,000 35,000 21,000 14,000

Notes: (i) Budgeted sales and production are 10,000 units and 10,200 units respectively (ii) It is estimated that the cost of production would total 83,060 if 9,500 units were produced (iii) Non-production overheads are fixed costs.

REQUIRED (a) Applying the high-low method to the above estimates of production costs, calculate: (i) (ii) the variable production cost per unit the total fixed production cost in the period. (3 marks) (2 marks)

(b) Prepare a revised budgeted profit statement for the period using marginal costing.

(8 marks)

(c) Explain fully, supported by appropriate calculations, how and why the net profit in the statement set out in the question above differs from that calculated in answer to part (b). (7 marks) (Total 20 marks)

3023/3/07/MA

MODEL ANSWER TO QUESTION 2 (a) (i) Variable production cost per unit

(86,700 - 83,060) (10,200 9,500 units) = 5.20 per unit (ii) Total fixed production cost

86,700 - (10,200 units 5.20 per unit) = 33,660

(b) Budgeted profit statement Marginal costing Sales Variable cost of sales: Variable production costs Closing stock Contribution Fixed costs: Production Non-production Net profit 20,000

53,040 (1,040)

52,000 68,000

33,660 21,000

54,660 13,340

(c) Profit difference The net profit using absorption costing differs from that determined using marginal costing where there is a change in the level of stockholding. This is because fixed production costs are included in the valuation of stock under absorption costing, whereas they are treated as a period cost under marginal costing. Thus, under absorption costing a share of the fixed production costs are included in the valuation of the closing stock of 200 units and thus carried forward to be charged against profit in a future period when the goods are sold. The share of costs carried forward is 660 [200 (33,660 10,200 units)] which accounts for the difference between the net profit under absorption costing of 14,000 and that under marginal costing of 13,340.

3023/3/07/MA

QUESTION 3 A company has three products (Product A, Product B and Product C). Selling price and variable costs of the products are as follows: Product A per unit 6.00 1.20 0.60 1.50 Product B per unit 9.00 2.40 1.00 2.40 Product C per unit 4.60 0.48 0.52 1.20

Selling price Direct materials: Material X Other materials Direct labour

Maximum available supplies of Material X (costing 6.40 per kg) and hours of direct labour (paid at 8.00 per hour) are expected to be 4,500 kg and 3,780 hours respectively in the following period. Other materials are freely available. Sales demand in the following period is expected to be: Product A 8,000 units Product B 6,000 units Product C 5,400 units

REQUIRED For the following period: (a) Determine the limiting factor. Show calculations clearly and fully justify your conclusion. (7 marks) (b) Prepare a production schedule with the objective of maximising profit. (9 marks) (c) Calculate the contribution of each product, and the total contribution, if the production schedule in your answer to part (b) above is followed. (4 marks) (Total 20 marks)

3023/3/07/MA

MODEL ANSWER TO QUESTION 3 (a) Resource requirements Product A 8,000 units 1.20 per unit = 9,600 8,000 units 1.50 per unit = 12,000 Product B 6,000 units 2.40 per unit = 14,400 6,000 units 2.40 per unit = 14,400 Product C 5,400 units 0.48 per unit = 2,592 5,400 units 1.20 per unit = 6,480

Material X

Direct labour

Total Material X required = 26,592 6.40 per kg = 4,155 kg Total direct labour required = 32,880 8.00 per hour = 4,110 hours The limiting factor is direct labour. The hours required to satisfy the sales demand (4,110) exceed the hours available (3,780) whereas sufficient quantities of Material X are available (4,500 > 4,155).

(b) Production schedule Product A 6.00 3.30 2.70 1.80 Product B 9.00 5.80 3.20 1.33 Product C 4.60 2.20 2.40 2.00

Selling price ( per unit) Variable costs ( per unit) Contribution ( per unit) Contribution ( per of labour) Priority (on the basis of contribution per of labour) Schedule: Product C Product A Product B hours 810 1,500 1,470 3,780

units 5,400 8,000 4,900 (1,470 hours 0.3 hours per unit)

(c)

Contribution 21,600 (8,000 units 2.70 per unit) 15,680 (4,900 units 3.20 per unit) 12,960 (5,400 units 2.40 per unit) 50,240

Product A Product B Product C Total

3023/3/07/MA

QUESTION 4 The following incomplete information is available for two periods: Period 1 Budget: Sales and production units Sales revenue () Variable cost of sales () Actual: Sales and production units Sales revenue () Variable cost of sales () Variances: Sales volume contribution variance () Selling price variance () A = Adverse F = Favourable 15,600 187,200 106,080 Period 2 18,000 219,600 127,800

16,220 214,865 111,438

2,346 A 2,433 F

REQUIRED (a) Calculate, for Period 1, the: (i) (ii) Budgeted selling price per unit Budgeted contribution per unit (1 mark) (2 marks) (3 marks) (3 marks) (3 marks)

(iii) Actual selling price per unit (iv) Sales volume contribution variance (v) Variable cost variance.

(b) Calculate, for Period 2, the: (i) (ii) Actual sales units Selling price variance. (4 marks) (4 marks) (Total 20 marks)

3023/3/07/MA

MODEL ANSWER TO QUESTION 4 (a) Period 1 (i) (ii) Budgeted selling price per unit = 12.00 (187,200 15,600 units) Budgeted contribution per unit = 5.20 [(187,200 - 106,080) 15,600 units]

(iii) Actual selling price per unit = 12.15 [(2,433 16,220 units) + 12.00 per unit] (iv) Sales volume contribution variance = 3,224 Fav [(16,220 15,600 units) 5.20 per unit]

(v) Variable cost variance = 1,142 Adv {111,438 [16,220 units (106,080 15,600 units)]} (b) Period 2 (i) (ii) Actual sales units = 17,540 units {18,000 units [2,346 (91,800 18,000 units)]} Selling price variance = 877 Fav [214,865 [17,540 units (219,600 18,000 units)]}

3023/3/07/MA

QUESTION 5 A company is considering a capital investment in order to increase profits over an expected project life of 5 years. The project would require an initial investment of 440,000 followed by expected incremental profits for the 5 years as follows: Year 1 Year 2 Year 3 Year 4 Year 5 20,000 40,000 70,000 55,000 30,000

The above profit figures, which are all in 'current' prices, are net of straight-line depreciation of the investment assuming a residual value at the end of Year 5 of 65,000 (in 'current' prices). Price inflation of 5% per annum is anticipated and the company's cost of capital, in 'money' (as opposed to 'real') terms is 15% per annum. Discount factors: Year 1 Year 2 Year 3 Year 4 Year 5 10% 0.909 0.826 0.751 0.683 0.621 15% 0.870 0.756 0.658 0.572 0.497 20% 0.833 0.694 0.579 0.482 0.402

REQUIRED (a) Calculate, for the capital investment project, the: (i) (ii) accounting rate of return (on average investment) undiscounted payback period (3 marks) (4 marks) (5 marks) (4 marks)

(iii) net present value (iv) internal rate of return.

(b) State whether, and explain why, the capital investment project is, or is not, worthwhile: (i) (ii) on the basis of net present value on the basis of internal rate of return. (2 marks) (2 marks) (Total 20 marks)

3023/3/07/MA

10

MODEL ANSWER TO QUESTION 5 (a) (i) Accounting rate of return

Average annual profit (000) = [(20 + 40 + 70 + 55 + 30) 5] 100% Average investment (000) [(440 + 65) 2] = 43 100% 252.5

= 17.0% (ii) Undiscounted payback period

Annual depreciation = (440,000 65,000) 5 = 75,000 Cash flows (000): Year 1 2 3 4 5 Each year 95 (20 + 75) 115 (40 + 75) 145 (70 + 75) 130 (55 + 75) 170 (30 + 75 + 65) Cumulative 95 210 355 485 655

Undiscounted payback = 3 years + [(440 355) 130] = 3.7 years (iii) Net present value Year 1 2 3 4 5 Cash flow (current) 000 95 1.05 115 1.05 145 1.05 130 1.054 170 1.055 Cash flow (money) 000 99.8 126.8 167.9 158.0 217.0 Discount factor 15% 0.870 0.756 0.658 0.572 0.497 Present value 000 86.8 95.9 110.5 90.4 107.8 491.4 less investment 440.0 net present value 51.4 positive

(iv) Internal rate of return Year 1 2 3 4 5 Cash flow (money) 000 99.8 126.8 167.9 158.0 217.0 Discount factor 20% 0.833 0.694 0.579 0.482 0.402 Present value 000 83.1 88.0 97.2 76.2 87.2 431.7 less investment 440.0 net present value 8.3 negative

3023/3/07/MA

11

CONTINUED ON THE NEXT PAGE

MODEL ANSWER TO QUESTION 5 CONTINUED Internal rate of return = 15% + 5% [51.4k (51.4k + 8.3k)] = 19.3%

(b) Whether, and why, the capital investment project is, or is not, worthwhile (i) On the basis of net present value the project is worthwhile because there is a positive net present value when the cash flows in 'money' terms are discounted at the cost of capital in 'money' terms. On the basis of internal rate of return the project is worthwhile because the internal rate (using 'money' cash flows) of 19.3% is above the cost of capital in 'money' terms of 15%.

(ii)

3023/3/07/MA

12

QUESTION 6 A company has two divisions, Division DA and Division DB. Division DA manufactures a component (Component C3) which is used by Division DB in the manufacture of one of its products (Product P9). 14,000 units of Component C3 are used by Division DB per period. One unit of Component C3 is required for each unit of Product P9. Variable costs are as follows: Component C3 15.20 per unit ------Product P9 -------24.70 per unit

Division DA Division DB (excluding Component C3)

Fixed costs of Division DA apportioned to Component C3 per period are 154,000. The transfer price is established as total cost + 30%. The selling price of Product P9 is 90.00 per unit. REQUIRED (a) Calculate: (i) (ii) the transfer price of Component C3

(2 marks)

the contribution per unit of: Component C3 to Division DA Product P9 to Division DB Product P9 to the company

(6 marks)

(b) Determine the effect on the contribution per unit of Product P9 to the company in each of the following circumstances: (i) (ii) if the basis for the transfer price is changed to total cost + 40% if the volume per period increases to 15,000 units (2 marks) (2 marks)

(iii) if the fixed costs of Division DA apportioned to Component C3 reduced to 147,000 per period. (2 marks)

Component C3 is also available to Division DB from an outside supplier for 30.00 per unit. REQUIRED (c) Calculate the effect on the total profit per period, of each division and of the company, if: Division DB was to purchase Component C3 from the outside supplier, and volume is 14,000 units per period, and fixed costs of Division DA are unchanged, and the basis for the transfer price would have been total cost + 30%, and Division DA would be unable to replace the sales. (6 marks) (Total 20 marks)

3023/3/07/MA

13

MODEL ANSWER TO QUESTION 6 (a) (i) Transfer price of Component C3 {[15.20 + (154,000 14,000 units)] 1.3} = 34.06 per unit (ii) Contribution per unit Component C3 to Division DA = (34.06 - 15.20) = 18.86 Product P9 to Division DB = [90.00 - (34.06 + 24.70)] = 31.24 Product P9 to the company = [90.00 (15.20 + 24.70)] = 50.10 (or 18.86 + 31.24)

(b) Effect on unit contribution (i) (ii) If transfer price is cost + 40% - NO EFFECT If volume is 15,000 units NO EFFECT

(iii) If fixed costs are 147,000 NO EFFECT

(c) Effect on profit Division DA: (14,000 units 18.86 per unit) = 264,040 less profit Division DB: [14,000 units (34.06 - 30.00 per unit)] = 56,840 more profit Company: [14,000 units (30.00 - 15.20 per unit)] = 207,200 less profit (or 264,040 - 56,840)

3023/3/07/MA

14

Education Development International plc 2007

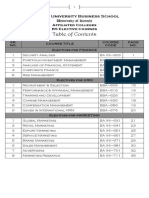

You might also like

- Management Accounting Level 3/series 2 2008 (Code 3023)Document17 pagesManagement Accounting Level 3/series 2 2008 (Code 3023)Hein Linn Kyaw100% (1)

- Management Accounting: Level 3Document18 pagesManagement Accounting: Level 3Hein Linn KyawNo ratings yet

- Management Accounting Level 3/series 4 2008 (3023)Document14 pagesManagement Accounting Level 3/series 4 2008 (3023)Hein Linn KyawNo ratings yet

- Management Accounting/Series-4-2011 (Code3024)Document18 pagesManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- Management Accounting: Level 3Document16 pagesManagement Accounting: Level 3Hein Linn Kyaw100% (1)

- Cost Accounting/Series-3-2007 (Code3016)Document18 pagesCost Accounting/Series-3-2007 (Code3016)Hein Linn Kyaw50% (6)

- Management Accounting Level 3: LCCI International QualificationsDocument17 pagesManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- Management Accounting: Level 3Document16 pagesManagement Accounting: Level 3Hein Linn KyawNo ratings yet

- Management Accounting: Level 3Document18 pagesManagement Accounting: Level 3Hein Linn Kyaw100% (3)

- Management Accounting Level 3/series 3 2008 (Code 3023)Document14 pagesManagement Accounting Level 3/series 3 2008 (Code 3023)Hein Linn Kyaw100% (2)

- Cost Accounting Level 3/series 4 2008 (3017)Document17 pagesCost Accounting Level 3/series 4 2008 (3017)Hein Linn Kyaw100% (1)

- Cost Accounting Level 3/series 3-2009Document19 pagesCost Accounting Level 3/series 3-2009Hein Linn Kyaw100% (2)

- Cost Accounting Level 3/series 2 2008 (Code 3016)Document18 pagesCost Accounting Level 3/series 2 2008 (Code 3016)Hein Linn Kyaw67% (3)

- Cost Accounting/Series-4-2011 (Code3017)Document17 pagesCost Accounting/Series-4-2011 (Code3017)Hein Linn Kyaw100% (2)

- Accounting/Series 2 2007 (Code3001)Document16 pagesAccounting/Series 2 2007 (Code3001)Hein Linn Kyaw100% (3)

- Accounting Level 3/ Series 4 2008 (3001)Document19 pagesAccounting Level 3/ Series 4 2008 (3001)Hein Linn Kyaw100% (1)

- Cost Accounting Level 3/series 4 2008 (3016)Document20 pagesCost Accounting Level 3/series 4 2008 (3016)Hein Linn Kyaw0% (1)

- Cost Accounting Level 3/series 2 2008 (Code 3017)Document18 pagesCost Accounting Level 3/series 2 2008 (Code 3017)Hein Linn Kyaw50% (2)

- Certificate in Management Accounting Level 3/series 3-2009Document15 pagesCertificate in Management Accounting Level 3/series 3-2009Hein Linn Kyaw100% (2)

- Accounting (IAS) /series 4 2007 (Code3901)Document17 pagesAccounting (IAS) /series 4 2007 (Code3901)Hein Linn Kyaw0% (1)

- Accounting Level 3/series 4 2008 (3012)Document13 pagesAccounting Level 3/series 4 2008 (3012)Hein Linn Kyaw100% (1)

- Accounting Level 3/series 2 2008 (Code 3012)Document16 pagesAccounting Level 3/series 2 2008 (Code 3012)Hein Linn Kyaw100% (2)

- Accounting Level 3: LCCI International QualificationsDocument17 pagesAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- ASE3003209MADocument11 pagesASE3003209MAHein Linn Kyaw100% (1)

- Book Keeping & Accounts/Series-3-2007 (Code2006)Document11 pagesBook Keeping & Accounts/Series-3-2007 (Code2006)Hein Linn Kyaw100% (3)

- Advanced Business Calculations/Series-4-2011 (Code3003)Document12 pagesAdvanced Business Calculations/Series-4-2011 (Code3003)Hein Linn Kyaw100% (12)

- Certificate in Advanced Business Calculations Level 3/series 3-2009Document18 pagesCertificate in Advanced Business Calculations Level 3/series 3-2009Hein Linn Kyaw100% (10)

- Cost Accounting Level 3/series 2-2009Document17 pagesCost Accounting Level 3/series 2-2009Hein Linn Kyaw100% (5)

- Management Accounting Level 3/series 3 2008 (Code 3024)Document12 pagesManagement Accounting Level 3/series 3 2008 (Code 3024)Hein Linn Kyaw100% (1)

- Book Keeping & Accounts/Series-2-2007 (Code2006)Document12 pagesBook Keeping & Accounts/Series-2-2007 (Code2006)Hein Linn Kyaw100% (2)

- Accounting Level 3/series 4-2009Document16 pagesAccounting Level 3/series 4-2009Hein Linn Kyaw100% (5)

- Management Accounting Level 3/series 4 2008 (3024)Document14 pagesManagement Accounting Level 3/series 4 2008 (3024)Hein Linn Kyaw50% (2)

- LCCI ACCOUNTING TITLEDocument9 pagesLCCI ACCOUNTING TITLEmappymappymappyNo ratings yet

- Business Statistics Level 3/series 3-2009Document20 pagesBusiness Statistics Level 3/series 3-2009Hein Linn Kyaw100% (2)

- Management Accounting Level 3/series 2 2008 (Code 3024)Document14 pagesManagement Accounting Level 3/series 2 2008 (Code 3024)Hein Linn Kyaw67% (3)

- Book-Keeping & Accounts Level 2/series 3 2008 (Code 2007)Document15 pagesBook-Keeping & Accounts Level 2/series 3 2008 (Code 2007)Hein Linn Kyaw100% (3)

- Business Statistics Level 3/series 2 2008 (Code 3009)Document22 pagesBusiness Statistics Level 3/series 2 2008 (Code 3009)Hein Linn KyawNo ratings yet

- Answers Series 3 2013Document8 pagesAnswers Series 3 2013Penny Pun100% (1)

- 2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersDocument15 pages2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersHon Loon SeumNo ratings yet

- Cost Accounting: Level 3Document18 pagesCost Accounting: Level 3Hein Linn KyawNo ratings yet

- Management Accounting: Level 3Document15 pagesManagement Accounting: Level 3Nida KhanNo ratings yet

- Lcci S3 2011Document15 pagesLcci S3 2011Cheryl Law 刘玟希No ratings yet

- SA Syl12 Jun2014 P10 PDFDocument21 pagesSA Syl12 Jun2014 P10 PDFpatil_viny1760No ratings yet

- 97 ZaDocument7 pages97 ZaMeow Meow HuiNo ratings yet

- Model Test Paper Problem1 (A)Document15 pagesModel Test Paper Problem1 (A)HibibiNo ratings yet

- AccountingDocument9 pagesAccountingVaibhav BindrooNo ratings yet

- Mock Test 2021 PMDocument5 pagesMock Test 2021 PMBao Thy PhoNo ratings yet

- MSc FINANCE UoW PMC Marking SchemeDocument8 pagesMSc FINANCE UoW PMC Marking Schemepinkwine2001No ratings yet

- Paper - 4: Cost Accounting and Financial Management Part I: Cost AccountingDocument0 pagesPaper - 4: Cost Accounting and Financial Management Part I: Cost AccountingP VenkatesanNo ratings yet

- Module Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceDocument9 pagesModule Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceRenato WilsonNo ratings yet

- Budget: Profit Planning and Control System: Learning ObjectivesDocument16 pagesBudget: Profit Planning and Control System: Learning ObjectivesFayz Sam0% (1)

- Ac1025 Excza 11Document18 pagesAc1025 Excza 11gurpreet_mNo ratings yet

- Objectives of BudgetingDocument13 pagesObjectives of BudgetingChandanN81No ratings yet

- AssignmentDocument7 pagesAssignmentsmmehedih008No ratings yet

- Exam 7 Jan 2020Document5 pagesExam 7 Jan 2020Leon CzarneckiNo ratings yet

- Analyze Cost Allocation Methods and Overhead VariancesDocument73 pagesAnalyze Cost Allocation Methods and Overhead VariancesPiyal Hossain100% (1)

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8Document15 pagesIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8JOLLYNo ratings yet

- f5 2010 Jun Q PDFDocument8 pagesf5 2010 Jun Q PDFcatcat1122No ratings yet

- Sample Paper Cost & Management Accounting Question BankDocument17 pagesSample Paper Cost & Management Accounting Question BankAnsh Sharma100% (1)

- 8508 Managerial AccountingDocument10 pages8508 Managerial AccountingHassan Malik100% (1)

- Ministry of Planning, Finance and Industry - Notification 86-2019 0Document2 pagesMinistry of Planning, Finance and Industry - Notification 86-2019 0Hein Linn KyawNo ratings yet

- Introduction To Statistics PGDBDocument42 pagesIntroduction To Statistics PGDBHein Linn KyawNo ratings yet

- Organization DataDocument23 pagesOrganization DataHein Linn KyawNo ratings yet

- Business Statstics/Series-3-2007 (Code3009)Document20 pagesBusiness Statstics/Series-3-2007 (Code3009)Hein Linn Kyaw100% (1)

- Book Keeping & Accounts/Series-2-2007 (Code2006)Document12 pagesBook Keeping & Accounts/Series-2-2007 (Code2006)Hein Linn Kyaw100% (2)

- Accounting/Series 2 2007 (Code3001)Document16 pagesAccounting/Series 2 2007 (Code3001)Hein Linn Kyaw100% (3)

- GMAT Reading ComprehensionDocument5 pagesGMAT Reading ComprehensionHein Linn KyawNo ratings yet

- Cost Accounting/Series-3-2007 (Code3016)Document18 pagesCost Accounting/Series-3-2007 (Code3016)Hein Linn Kyaw50% (6)

- Business Statstics/Series-4-2007 (Code-3009)Document22 pagesBusiness Statstics/Series-4-2007 (Code-3009)Hein Linn KyawNo ratings yet

- Management Accounting: Level 3Document18 pagesManagement Accounting: Level 3Hein Linn Kyaw100% (3)

- Book Keeping & Accounts/Series-3-2007 (Code2006)Document11 pagesBook Keeping & Accounts/Series-3-2007 (Code2006)Hein Linn Kyaw100% (3)

- Cost Accounting: Level 3Document19 pagesCost Accounting: Level 3Hein Linn Kyaw100% (1)

- Advanced Business Calculation/Series-4-2007 (Code3003)Document13 pagesAdvanced Business Calculation/Series-4-2007 (Code3003)Hein Linn Kyaw100% (6)

- Accounting/Series 3 2007 (Code3001)Document18 pagesAccounting/Series 3 2007 (Code3001)Hein Linn KyawNo ratings yet

- Accounting (IAS) /series 4 2007 (Code3901)Document17 pagesAccounting (IAS) /series 4 2007 (Code3901)Hein Linn Kyaw0% (1)

- Accounting/Series 4 2007 (Code3001)Document17 pagesAccounting/Series 4 2007 (Code3001)Hein Linn Kyaw100% (2)

- Book-Keeping and Accounts/Series-4-2011 (Code2007)Document16 pagesBook-Keeping and Accounts/Series-4-2011 (Code2007)Hein Linn Kyaw100% (1)

- Cost Accounting Level 3: LCCI International QualificationsDocument20 pagesCost Accounting Level 3: LCCI International QualificationsHein Linn Kyaw33% (3)

- Accounting (IAS) /series 4 2011 (Code3902)Document16 pagesAccounting (IAS) /series 4 2011 (Code3902)Hein Linn Kyaw75% (4)

- Accounting (IAS) Level 3: LCCI International QualificationsDocument14 pagesAccounting (IAS) Level 3: LCCI International QualificationsHein Linn Kyaw50% (2)

- Accounting/Series 4 2011 (Code30124)Document16 pagesAccounting/Series 4 2011 (Code30124)Hein Linn Kyaw100% (1)

- Business Statstics/Series-4-2011 (Code3009)Document18 pagesBusiness Statstics/Series-4-2011 (Code3009)Hein Linn KyawNo ratings yet

- Book Keeping & Accounts/Series-4-2007 (Code2006)Document13 pagesBook Keeping & Accounts/Series-4-2007 (Code2006)Hein Linn Kyaw100% (2)

- Cost Accounting/Series-4-2011 (Code3017)Document17 pagesCost Accounting/Series-4-2011 (Code3017)Hein Linn Kyaw100% (2)

- Advanced Business Calculations/Series-4-2011 (Code3003)Document12 pagesAdvanced Business Calculations/Series-4-2011 (Code3003)Hein Linn Kyaw100% (12)

- Lcci Level3 Solution Past Paper Series 3-10Document14 pagesLcci Level3 Solution Past Paper Series 3-10tracyduckk67% (3)

- Business Statistics Level 3: LCCI International QualificationsDocument22 pagesBusiness Statistics Level 3: LCCI International QualificationsHein Linn Kyaw100% (1)

- Management Accounting Level 3: LCCI International QualificationsDocument15 pagesManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (1)

- Vegetron Case StudyDocument2 pagesVegetron Case StudyMonika KauraNo ratings yet

- If NumericalsDocument13 pagesIf NumericalsArindam Chatterjee0% (1)

- Baker (Pp. 308-328)Document22 pagesBaker (Pp. 308-328)SofíaNo ratings yet

- R45 Private Equity Valuation Edited IFT Notes PDFDocument27 pagesR45 Private Equity Valuation Edited IFT Notes PDFAyush JhunjhunwalaNo ratings yet

- Financial Management ObjectivesDocument23 pagesFinancial Management ObjectivesAnandita Sharma0% (1)

- Personal Finance - Introduction Ver 0.4Document59 pagesPersonal Finance - Introduction Ver 0.4Aravind MenonNo ratings yet

- Ars R 2018Document478 pagesArs R 2018Hakenewerth QuentinNo ratings yet

- Analyzing Financial Statements True/False QuizDocument7 pagesAnalyzing Financial Statements True/False QuizDaniel HunksNo ratings yet

- Capital BudgetingDocument37 pagesCapital BudgetingJErome DeGuzman100% (3)

- Plant Design and Economics: Lecture - 5Document39 pagesPlant Design and Economics: Lecture - 5Sky LightsNo ratings yet

- Accounting and FinanceDocument6 pagesAccounting and FinanceAisha KhanNo ratings yet

- Fernholz 2008Document30 pagesFernholz 2008LameuneNo ratings yet

- Project Report Ratio Analysis of P&GDocument16 pagesProject Report Ratio Analysis of P&Gvedprakashyadav5053100% (1)

- Ch. 19 Capital Asset PricingDocument6 pagesCh. 19 Capital Asset PricingJesse SandersNo ratings yet

- Dividend DecisionDocument25 pagesDividend Decisionva1612315No ratings yet

- Elective Courses SyllabusDocument37 pagesElective Courses SyllabusAsif WarsiNo ratings yet

- Two key lessons from Hershey case on global expansionDocument24 pagesTwo key lessons from Hershey case on global expansionNida Maspo100% (3)

- A Study On Fluctuating INR and USD Currency Patterns: September 2018Document6 pagesA Study On Fluctuating INR and USD Currency Patterns: September 2018anon_652192649No ratings yet

- Understanding Hedge Funds and Hedge Fund StrategiesDocument8 pagesUnderstanding Hedge Funds and Hedge Fund Strategieshttp://besthedgefund.blogspot.com100% (1)

- Financial ManagementDocument248 pagesFinancial ManagementMadhurjya BoruahNo ratings yet

- Unit - 4, Financial Institution and MarketsDocument19 pagesUnit - 4, Financial Institution and Marketssagar mishraNo ratings yet

- Bonds & Stock ValuationDocument84 pagesBonds & Stock ValuationSaad ChishtyNo ratings yet

- Goals of Financial ManagementDocument22 pagesGoals of Financial ManagementBhuvanNo ratings yet

- Quick Tour of Microsoft Excel SolverDocument19 pagesQuick Tour of Microsoft Excel SolveradeelklNo ratings yet

- Portfolio ManagementDocument40 pagesPortfolio ManagementTOXIC GAMINGNo ratings yet

- ENME619.12 Fundamentals of Pipeline EconomicsDocument8 pagesENME619.12 Fundamentals of Pipeline Economicssalman hussainNo ratings yet

- Special Issues in Corporate FinanceDocument6 pagesSpecial Issues in Corporate FinanceMD Hafizul Islam HafizNo ratings yet

- CapitalizationDocument26 pagesCapitalizationSajalAgrawalNo ratings yet

- AD-I-137-F91 American LawbookDocument15 pagesAD-I-137-F91 American LawbookKllyMartinezMartinezNo ratings yet