Professional Documents

Culture Documents

Salary Pictorial Presentation

Uploaded by

Amit AggarwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salary Pictorial Presentation

Uploaded by

Amit AggarwalCopyright:

Available Formats

Govt Employee During the service

Fully Taxable Can get relief u/s 89

Other Employees

Fully Taxable Can get relief u/s 89

LEAVE ENCASHMENT

Govt Employee At the time of retirement Least of the following will be exempted --Amount actually received --Av salary x period of earned leave not exceeding 30 days in a year --Last 10 months salary -- Rs.300000 Fully exempted

Other Employees

Salary means Basic Pay + DA (if enters into future benefit)+commission fixed % on sale

Govt Employees

Fully exempted

GRATUITY

Employee covered under Gratuity Act

Least of the following will be exempted --Amount actually received --15/26 x every completed year of service in excess of six months --Rs.1000000

Other Employess

Employee not covered under Gratuity Act

Least of the following will be exempted --Amount actually received --10 months av salary x every completed year of service --Rs.1000000

In case of Employees covered under Gratuity Act :Salary means Basic Pay + DA (if enters into future benefit)

In case of Employees not covered under Gratuity Act :Salary means Basic Pay + DA+ commission fixed % on sale In case of Seasonal Employment 15 days converted into 7 days In case of Piece rate employees last three months salary to be considered

Uncommuted

For all employees taxable

PENSION

For Govt employees fully exemted Commuted

Employees receiving gratuity For other employees

1/3rd of the commuted value of pension is exemted

Employees not receiving the gratuity

of the commuted value of pension is exempted

Note: In case of Central Govt Employee joined after Jan 2004, the employee & employer has made an equal contribution which does not exceed 10% of salary previous year under Pension Scheme, the contribution made by Employer added into the salary of employee. Employee can clam the deduction for the contribution made by his employer as well as contribution made by him u/s 80CCD from his total income. Salary for this purpose = Basic Salary+ DA (if enters into future terms)

ALLWOANCES

Fully Exempted

Fully Taxable

Partially Exempted

Actual Amount received-Actual amount Spent for the purpose for which alloance received

Actual amount received from employer- amount specified

Any allowance paid to Indian citizen who is a Govt employee rendering services outside India

Any allowance paid to High Court Judge Fully Exempted

Sumptuary Allowance paid to a Judge of High Court or Supreme Court

Any Allowance to an employee working in United Nations Organsations

DA

City Compensatory Allowance Tiffen/Lunch Allowance Medical Allowance

Fully Taxable

Overtime Allowance Servant Allowance Warden Allowance

Family Allowance

Daily Allowances

Taxable = amt received-amt spent Taxable = amt received-amt spent Taxable = amt received-amt spent Taxable = amt received-amt spent Taxable = amt received-amt spent Taxable = amt received-amt spent Exempted up to Rs.100 p.m p c max up to 2 children

Conveyance Allowance

Partly Exempted -where amt spent will be exempted from the allowance received

Helper Allowance

Academic Allowance

Travelling Allowance

Uniform Allowance

Children Edu. Allowance

Partly Exempted

Children Hostel Allowance Tribal area allowance Underground Allowance Compensatory Field Area allowance

Exempted up to Rs.300 p.m p c max up to 2 children Exempted up to Rs. 200 p m Exempted up to Rs. 800 p m Exempted up to Rs.2600 p m Exempted up to Rs.1000 p m

Partly Exempted -- where amt is exempted up to specified limit

Special Compensatory highly active Field Area allowance Special Compensatory highly active Field Area allowance Counter insurgencey S. comp hilly area all. Border area Highly altitude

Exempted up to Rs.4200 p m

Exempted up to Rs.3900 p m Exempted up to Rs.300 to 7000 p m Exempted up to Rs.200 to 1300 p m Exempted up to Rs.1060 p m (upto 9000 to 15000 fr Rs. 1600 pm above 15000 ft Exempted up to Rs.3900 p m Rs 800 pm & rs 1600 pm to phisyically chalanged

Island duty all Travelling allowance

HOUSE RENT ALLOWANCES

If employee residing in his own house If employee residing in Ranted House

Fully Taxable Least of the following will be exempted -- Rent Actually received -- Rent paid 10% of salary -- 50% of salary in case of metro cities Or --40% of salary in case of other cities

Salary means = Basic Pay + DA( retirement benefit) + Commission fixed % on sale

Travelling Allowance in case of employee working in a transport company

Rs.6000 p m or 70% of allowance which is least is exempted from tax

Entertainment allowance

For Govt employee

For other Employees

1st include the amount in total salary Then give the deduction u/s16(ii) which is least of the following --Amt actually received --Rs. 5000 --20% of salary

Salary here means only basic salary Fully Taxable

PERQUISITS Rent Free Accommodation (TAXABLE IN ALL CASE :WHTHER SPECIFIED OR NON SPECIFIED EMPLOYEES)

Unfurnished

Furnished

Govt Employee

Other Employees

Un furnished value+10% of actual cost of the furniture provided or actual hire charges if taken on rent

As per Govt Rules -- License fee rent recovered from employee

If house is owned by employer

If the house provided by the owner is on rent

Population>25 lakh

Population >10 lakh<25 lakh

Population<10 lakh

Population>25 lakh

Population >10 lakh<25 lakh

Population<10 lakh

15% of salary-amt recovered from employee

10% of salary-amt recovered from employee

7% of salary-amt recovered from employee

Actual rent or 15% of salary whichever is lower

Actual rent or 15% of salary whichever is lower

Actual rent or 15% of salary whichever is lower

Note: In case of accommodation is provided in Hotel nothing is taxable if the accommodation is provided for 15 days & on transfer of employee from one place to another. But after 15 days, the least of the 24% of salary or actual amount paid on such accommodation will be taxable.

SALARY: BASIC PAY+DA+TAXABLE ALLOWANCES+LEAVE SALARY+COMMISSION+MONEATRY PAYMENT FROM EMPLOYER OTHER THAN CONTRIBUTION TO PF

Valuation of Domestic Servants (Gardener, Watchman, Servant) (TAXABLE IN CASE OF SPECIFIED EMPLOYEES)

Servants appointed by employee

Servants appointed by Employer

Exp. Paid by Employee

Exp. Paid or reimbursement by Employer

Exp. Paid by Employee

Exp. Paid or reimbursement by Employer

Value of Perks=Nil

Value of Perks= Actual cost incurred or reimbursed by employer

Value of Perks=Nil

Value of Perks= Actual cost incurred

Note: If the rent free accommodation is provided to employee along with facility of Gardner for the maintaince of the garden or for the ground attached with house the expenses paid to gardener should be included I the value of rent free accommodation. No extra treatment for the salary paid to gardener

Valuation of supply of gas, electricity or water supplied by employer (TAXABLE IN CASE OF SPECIFIED EMPLOYEES)

Provided from own Source

Provided from outside agency

Value of Perks= Manufactured cost to the employer- recovery from the employee

Value of Perks= Amt paid to suplierrecovery from the employee

Value of interest free loan: 1) calculate the outstanding balance for each month in the previous year 2) Interest rate for such type of loan of State Bank of India 3) Calculate the interest on the o/s balance with prevailing rate of interest 4) Value of perks = Interest calculated interest recovered from employee Note:Nothing is taxable if loans in aggregate do not exceed Rs 20000 and loan is provided for a treatment of specified disease likes neurological diseases, Cancer, AIDS, Chronic renal failure, Hemophilia are the specified diseases.

Use of movable assets

Use of laptops and computers

Use of Movable asset other than laptops

Assets owned by employer

Taxable = Nil

Provided from outside agency

Taxable = 10% of actual cost amt recovered from employee

Taxable = Rent paid or payable by employer amt recovered from employee

Sale of movable assets:

Sale of Computers and electronic

Motor cars

Any other asset

Value of Perks= Actual cost of asset50% as wear & tear- recovery from the employee

Value of Perks= Actual cost of asset20% as wear & tear- recovery from the employee

Value of Perks= Actual cost of asset10% as wear & tear- recovery from the employee

Valuation of educational facilities

Provided in the school owned by the employer

Provided in any other school

Children Cost of such education in similar school (an exemption of Rs. 1000 p.m. per child is available)

Other house hold member Cost of such education in similar school

Children Cost of such education (an exemption of Rs. 1000 p.m. per child is available)

Other house hold member

Cost of such education incurred

Leave travel concession sec 10(5)

Where journey is performed by air

Where journey is performed by rail

Where the place of origin of journey and destination are connected by rail and journey is performed by any other mode of transport

Where the place of origin of journey and destination are not connected by rail

Amount of economy class air fare of the national carrier by shortest route or amount spent whichever is less will be exempted

Amount of air conditioned 1st class fare of the Rail by shortest route or amount spent whichever is less will be exempted

Amount of air conditioned 1st class fare of the Rail by shortest route or amount spent whichever is less will be exempted

where a recognized public transport exists

where no recognized public transport exists

First class or deluxe class fair by the shortest route or the amount spent whichever is less

Air conditioned first class rail fare by the shortest route or the amount spent whichever is less.

Exemption is available in respect of amount spent on LTC if the following conditions are satisfied: 1)exemption can be claimed for two journeys in a block of four years and out of two journeys exemption for one journey can be claimed in the calendar year succeeding the end of the block. 2) Exemption is available only for two children but exemption will be available for all children born before October 1,1998 Block of Years, 2002-2005, 2006-2009, 2010-2013 (Calendar Year)

Medical Facilities Medical treatment of the employee or his family (spouse and children, dependent - parents, brothers and sisters)

hospital maintained by the employer

hospital not maintained by the employer but approved by the Govt, local authority, Chief Commissioner IN CASE OF SPECIFIED DEASES

Premium paid by an employer by chequ to General Insurance Corporation to effect/keep in force: Insurance on the health of his employees. Medical Insurance Premia

Any sum, not exceeding Rs. 15000 to any hospital, nursing home or a clinic OTHER THAN OWNED BY EMPLOYER OR SPECIFIED

exempted

exempted exempted exempted

Amount payable for treatment Outside India: Medical expenses - to the extent permitted by RBI. If Gross Total Income (before including the travel expenditure) of the employee, does not exceed Rs.2,00,000/-, then travel abroad for patient and one attendant - fully deductible. Stay abroad for patient and one attendant - permitted by RBI.

PROVIDENT FUND:

Employers Contribution to RPF in excess of 12% of salary is taxable Employees Contribution to RPF is available for deduction Interest credited to RPF in excess of 9.5% up to 31-08-2011 & 8.5% from 01-09-2010 is taxable

VALUATION OF MOTOR CARS

Owned or hired by employer

Owned by employee

Exclusively for official purpose

Nil. Taxable if specified document is maintained

Exclusively for official purpose

Nil. Taxable if specified document is maintained

Exclusively for pvt., purpose

Running & Maintenance exp actual +remuneration of Chauffeur + actual Wear & tear@ 10% p.a of cost or hire charges if car taken on hire charges

Exclusively for pvt., purpose

Actual expenditure incurred by employer (-) amount recovered from employee

Both official and Pvt. Purpose Both official and Pvt. Purpose

Running and maintenance expenses borne by Running and maintenance expenses borne by

Employer

Employee

Employer

Employee Up to 1.6 CC Engine No tax

Up to 1.6 CC Engine

Rs 1800p.m + for chauffeur Rs 900 p.m (-) amount recovered from employee shall be taxable

Rs 600p.m + for chauffeur Rs 900 p.m (-) amount recovered from employee shall be taxable Rs 900p.m + for chauffeur Rs 900 p.m (-) amount recovered from employee shall be taxable

Actual expenditure for official and personal (-) Rs 1800 p.m + Rs 900 p.m for driver Actual expenditure for official and personal (-) Rs 2400 p.m + Rs 900 p.m for driver

Above 1.6 CC Engine

Rs 2400p.m + for chauffeur Rs 900 p.m (-) amount recovered from employee shall be taxable

Above 1.6 CC Engine

Note: Other vehicles owned by employee but expenses met or reimbursed by employer taxable perks should be treated in excess of Rs. 600 p m

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Transport System in USADocument27 pagesTransport System in USAAnonymous 2HXuAeNo ratings yet

- FP 606Document1 pageFP 606kwincyNo ratings yet

- TopicsDocument12 pagesTopicsIvan MillanesNo ratings yet

- Dot Economic Benefits of Sustainable Streets PDFDocument43 pagesDot Economic Benefits of Sustainable Streets PDFJohn Tejada IIINo ratings yet

- Hari 1: East-West LineDocument5 pagesHari 1: East-West LineEriani WulandariNo ratings yet

- Road User TaxationDocument83 pagesRoad User TaxationDonny Dwi SaputroNo ratings yet

- CCTA Bus Map & Guide Provides Route DetailsDocument36 pagesCCTA Bus Map & Guide Provides Route DetailsNathan Scott NicholsNo ratings yet

- Bus Amp Coach Preservation March 2020Document78 pagesBus Amp Coach Preservation March 2020stupearlNo ratings yet

- ESSAY VstepDocument23 pagesESSAY VstepNamthip BeeNo ratings yet

- Urban BrochureDocument25 pagesUrban BrochureCarlos NietoNo ratings yet

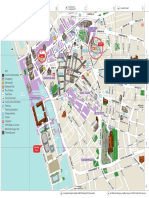

- Liverpool City Centre MapDocument1 pageLiverpool City Centre MapStudent of EnglishNo ratings yet

- Route From Botanical Garden To Terminal 1 IGI Airport - Delhi MetroDocument3 pagesRoute From Botanical Garden To Terminal 1 IGI Airport - Delhi MetrofisaNo ratings yet

- Miami to Orlando Bus Ticket ConfirmationDocument2 pagesMiami to Orlando Bus Ticket ConfirmationRosa Isela Terán MarimonNo ratings yet

- Perth CAT Timetable 203 20230702Document2 pagesPerth CAT Timetable 203 20230702Nadine SilvaNo ratings yet

- Khurana TiketDocument2 pagesKhurana TiketRAJU GHORPADE100% (1)

- Bus TerminalsDocument3 pagesBus TerminalsSaisriharsha DiddiNo ratings yet

- Impact of Bus Rapid Transit System (BRT) On Passengers' Satisfaction in Lagos Metropolis, NigeriaDocument17 pagesImpact of Bus Rapid Transit System (BRT) On Passengers' Satisfaction in Lagos Metropolis, NigeriaRico SwabeNo ratings yet

- Evaluasi Kinerja Bus Kota Yang Trayeknya Berhimpitan Dengan Batik Solo Trans (Studi Kasus: Koridor 1 Kartasura - Palur)Document13 pagesEvaluasi Kinerja Bus Kota Yang Trayeknya Berhimpitan Dengan Batik Solo Trans (Studi Kasus: Koridor 1 Kartasura - Palur)Agus TriyonoNo ratings yet

- Urban Transport Project White PaperDocument75 pagesUrban Transport Project White Paperhima_bindu_89No ratings yet

- An Assessment of The Business Case For CBTC-FTA-usa PDFDocument195 pagesAn Assessment of The Business Case For CBTC-FTA-usa PDFpoketupiNo ratings yet

- King Victoria Transit Hub Case StudyDocument36 pagesKing Victoria Transit Hub Case StudyYoghi KalamNo ratings yet

- Cebu's Major Infrastructure and Transport ProjectsDocument87 pagesCebu's Major Infrastructure and Transport ProjectsShih TzuNo ratings yet

- Draft: Journal Square 2060 Redevelopment PlanDocument44 pagesDraft: Journal Square 2060 Redevelopment PlanThe Jersey City IndependentNo ratings yet

- Public Transportation or Private TransportationDocument1 pagePublic Transportation or Private TransportationViona RezikaNo ratings yet

- Metro's Regional Transportation Improvement Program SubmissionDocument152 pagesMetro's Regional Transportation Improvement Program SubmissionMetro Los Angeles100% (1)

- ATHENS-VOLOS TRAVEL GUIDEDocument5 pagesATHENS-VOLOS TRAVEL GUIDEdjsmolituNo ratings yet

- Poster Phase 1Document1 pagePoster Phase 1Mapreidy M&SNo ratings yet

- Global Traffic Scorecard: INRIX Research - Trevor Reed - February 2019Document22 pagesGlobal Traffic Scorecard: INRIX Research - Trevor Reed - February 2019Jhon Anyersson Lopez ArdilaNo ratings yet

- Translink 2014 Annual ReportDocument104 pagesTranslink 2014 Annual ReportCKNW980No ratings yet

- The METROPOLITAN MANILA DEVELOPMENT AUTHORITY and BAYANI FERNANDO As Chairman of The Metropolitan Manila Development Authority, PetitionersDocument14 pagesThe METROPOLITAN MANILA DEVELOPMENT AUTHORITY and BAYANI FERNANDO As Chairman of The Metropolitan Manila Development Authority, PetitionersPatrick ParconNo ratings yet