Professional Documents

Culture Documents

Tax Digest (Siao Tiao Hong V Cir)

Uploaded by

Alex CustodioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Digest (Siao Tiao Hong V Cir)

Uploaded by

Alex CustodioCopyright:

Available Formats

Siao Tiao Hong v.

CIR (1992) Doctrine: In order to avail of the benefits of section 331 [now section 203], one must file a return for the lending investors fixed tax; otherwise, an assessment made within the period provided for in Section 332 (a) [now section 222 (a)] which provides for exceptions as to period of limitation of assessment and collection of taxes.

Facts: [dates are important ] The petitioner is a real estate developer whose principal income is derived from rentals. He had several deposits and extended loans to his friends supposedly on accommodation and not for profit. He declared an income of P9,582 from rents and royalties and P5,540 as interest income from bonds, bank deposits, etc. in his ITR for the year 1958. On May 25, 1960, the BIR ordered an examination of his books in connection with the 1958 return. A month after, June 21, 1060, the Revenue Examiner recommended that the petitioner be assessed for: 1) a deficiency income tax of P1,068.79, and 2) fixed taxes as a lending investor at P300 each year for the years 1955-1959. The petitioner protested the accuracy of the assessment and requested a reexamination, which was thereafter granted. On November 3, 1961, after reexamination, the revenue examiner reported that there was no discrepancy on the said return. Despite such finding, the Regional Office of the BIR still sent him a letter, on June 2, 1961, demanding payment of P2,400 as lending investors fixed tax for the years 1953-1960. Almost a year after, May 30, 1962, the BIR brought a collection suit for the P2,400 fixed tax against the petitioner. The City Court dismissed the suit for being premature since no assessment was received by the petitioner. Hence, the case was not one of undisputed assessment within the jurisdiction of the court. The petitioner filed a formal protest to the assessment in August 1965 but was denied by the BIR Regional Office on March 1966. Such denial prompted him to file a petition for review with the CTA, which affirmed his liability for the lending investors fixed taxed. Now, the petitioner argues that such loans were only accommodations for his friends and not extended for profit. He also argues that, assuming he was liable for the fixed tax, the right to collect the same had already prescribed since no assessment for lending investors tax was made within the 5 year period from the filing of the petitioners income tax returns for the years 1953-1959. Issue: 1. Whether the petitioner is liable for lending investors tax 2. Whether the BIRs right to collect the same had prescribed

Held: 1. Yes. The bank deposits were not considered as loans in the sense that such would constitute the conduct of a lending business, on which the fixed tax is imposed. On the other hand, the loans he extended to several individuals are subject to lending investors tax. Evidence shows that these were not mere isolated transactions to his friends; his contention is belied by the fact that he collected interest from the borrowers and that such interests were reflected in his income tax return. 2. No. The period provided in Section 331 [now Section 203 I think] is inapplicable here since fixed taxes are not included in an income tax return and neither is it paid together with the income tax. The Code provides a different date for payment of fixed taxes, for which a separate return must be filed. The Court ruled that for prescription to have set in, he must have filed a return for the lending investors fixed tax; otherwise, an assessment may be made within the period provided for in Sec. 332 (a) [now section 222] which provides for exceptions as to the period of limitation of assessment and collection of taxes: (a) In case of a false or fraudulent return with intent to evade tax or of a failure to file a return, the tax may be assessed, or a proceeding in court for the collection of such tax may be begun without an assessment, at any time within 10 years after the discovery of the falsity, fraud, or omission. His omission to file a return was discovered on June 21, 1960, when the initial examination of books was conducted. The assessment for lending investors tax was made on June 2, 1961 (well within the 5 year period). The collection must be made within the 5-year period from the assessment. The running of the period was suspended on May 27,1963 when the complaint for collection was filed against the petitioner. The period ran again upon dismissal by the city court on July 14, 1965 and was stopped on October 27, 1966 when the CIR filed his answer to the petition for review brought by the petitioner before the CTA. All in all, a total of 3 years, 3 months and 8 days had elapsed. Therefore, the right of the CIR to assess and collect the lending investors fixed tax had not yet prescribed.

You might also like

- Inheritance Rights of Widow and Illegitimate RelativesDocument25 pagesInheritance Rights of Widow and Illegitimate Relativesmae annNo ratings yet

- Chattel MortgageDocument9 pagesChattel MortgageAlpha BetaNo ratings yet

- Zamora v. CaDocument7 pagesZamora v. CaCervus Augustiniana LexNo ratings yet

- Cpra Canon IiiDocument10 pagesCpra Canon IiiJane BanaagNo ratings yet

- Medical Negligence Case Against DoctorsDocument4 pagesMedical Negligence Case Against DoctorsIrish GarciaNo ratings yet

- Supreme Court rules mandamus improper remedy in estate disputeDocument3 pagesSupreme Court rules mandamus improper remedy in estate disputejamNo ratings yet

- CIR v. Dash Engg PH Inc (DEPI) : FactsDocument3 pagesCIR v. Dash Engg PH Inc (DEPI) : FactsTeodoro Jose BrunoNo ratings yet

- Pest MGMT Assoc V FPADocument1 pagePest MGMT Assoc V FPADave UrotNo ratings yet

- POLITICAL LAW AND PUBLIC OFFICERSDocument169 pagesPOLITICAL LAW AND PUBLIC OFFICERSTori PeigeNo ratings yet

- Specom SyllabusDocument6 pagesSpecom Syllabusiris virtudezNo ratings yet

- Propoerty Case DigestDocument40 pagesPropoerty Case DigestRam Pagong0% (1)

- Simplify surname changes for illegitimate childrenDocument2 pagesSimplify surname changes for illegitimate childrenPaulNo ratings yet

- Aisporna V Court of Appeals and The People of The PhilippinesDocument10 pagesAisporna V Court of Appeals and The People of The PhilippinesReth GuevarraNo ratings yet

- Gonzales vs. Land Bank of The Philippines: 20 Supreme Court Reports AnnotatedDocument6 pagesGonzales vs. Land Bank of The Philippines: 20 Supreme Court Reports AnnotatedJemNo ratings yet

- Bayanihan vs. BMG, G.R. 166337, March 7, 2005Document3 pagesBayanihan vs. BMG, G.R. 166337, March 7, 2005Angelette BulacanNo ratings yet

- Abacus Securities V AmpilDocument2 pagesAbacus Securities V AmpilAngelo TiglaoNo ratings yet

- Civil Forfeiture Case Proper Despite Lack of ConvictionDocument2 pagesCivil Forfeiture Case Proper Despite Lack of ConvictionAlexis Elaine BeaNo ratings yet

- Republic of the Philippines court addresses immorality complaintDocument5 pagesRepublic of the Philippines court addresses immorality complaintMac Burdeos CamposueloNo ratings yet

- Case Analyzes Extension of Service for Old Age Pension EligibilityDocument3 pagesCase Analyzes Extension of Service for Old Age Pension EligibilityTaz Tanggol Tabao-SumpinganNo ratings yet

- In Re PalagnasDocument2 pagesIn Re Palagnasralliv jacNo ratings yet

- Renato Tayag Vs Benguet ConsolidatedDocument6 pagesRenato Tayag Vs Benguet ConsolidatedAnonymous y3HylqBpu0No ratings yet

- Equitable PCI Bank V Ong (Bruno)Document3 pagesEquitable PCI Bank V Ong (Bruno)Teodoro Jose BrunoNo ratings yet

- Agency & TrustsDocument8 pagesAgency & Truststrinz_katNo ratings yet

- Olaco v. Co Cho ChitDocument2 pagesOlaco v. Co Cho ChitDGDelfinNo ratings yet

- Nestle Philippines Inc. v. Court of Appeals PDFDocument8 pagesNestle Philippines Inc. v. Court of Appeals PDFCJ RomanoNo ratings yet

- Case Digests - CIR V ManningDocument14 pagesCase Digests - CIR V ManningCheerly RosalNo ratings yet

- Complainant vs. vs. Respondent: Third DivisionDocument6 pagesComplainant vs. vs. Respondent: Third DivisionJinnelyn LiNo ratings yet

- ORTEGA VS CA - DigestDocument2 pagesORTEGA VS CA - DigestXing Keet LuNo ratings yet

- Jaca V PeopleDocument3 pagesJaca V PeoplelarrybirdyNo ratings yet

- COMSAVINGS BANK vs. SPS. CAPISTRANODocument3 pagesCOMSAVINGS BANK vs. SPS. CAPISTRANOmiles1280No ratings yet

- Rule 58 Paras Vs RouraDocument6 pagesRule 58 Paras Vs RouraDexter MantosNo ratings yet

- Supreme Court rules on release of seized rice shipmentDocument4 pagesSupreme Court rules on release of seized rice shipmentJarvy PinonganNo ratings yet

- Tamargo vs CA ruling on parental liabilityDocument3 pagesTamargo vs CA ruling on parental liabilityMaria Cherrylen Castor QuijadaNo ratings yet

- Business ContractsDocument5 pagesBusiness Contractskimuli FreddieNo ratings yet

- Philam Insurance Co vs. Parc Chateau CondominiumDocument4 pagesPhilam Insurance Co vs. Parc Chateau CondominiumBhenz Bryle TomilapNo ratings yet

- PNB Vs FF CruzDocument4 pagesPNB Vs FF CruzSu Kings AbetoNo ratings yet

- Holy Cross of Davao College Vs KAMAPIDocument2 pagesHoly Cross of Davao College Vs KAMAPIfranzadonNo ratings yet

- United Airlines v. CA, 2001Document7 pagesUnited Airlines v. CA, 2001Randy SiosonNo ratings yet

- Arbitration Law SummaryDocument6 pagesArbitration Law SummaryHazel Reyes-AlcantaraNo ratings yet

- Inheritance Rights of Aunt vs Nieces & NephewDocument2 pagesInheritance Rights of Aunt vs Nieces & NephewDiane Erika Lopez ModestoNo ratings yet

- 22 - Republic Vs Damayan - Remigio PDFDocument1 page22 - Republic Vs Damayan - Remigio PDFMarion Yves MosonesNo ratings yet

- 16 - Probate of The Will of ConsueloDocument6 pages16 - Probate of The Will of ConsueloAkagamiNo ratings yet

- Eduardo Prangan vs. NLRC, Et Al., G.R. No. 126529, April 15, 1998 G.R. No. 126529 April 15, 1998 EDUARDO B. PRANGAN, petitioner, vs. NATIONAL LABOR RELATIONS COMMISSION (NLRC), MASAGANA SECURITY SERVICES CORPORATION, and/or VICTOR C. PADILLA, respondents.Document3 pagesEduardo Prangan vs. NLRC, Et Al., G.R. No. 126529, April 15, 1998 G.R. No. 126529 April 15, 1998 EDUARDO B. PRANGAN, petitioner, vs. NATIONAL LABOR RELATIONS COMMISSION (NLRC), MASAGANA SECURITY SERVICES CORPORATION, and/or VICTOR C. PADILLA, respondents.Jacinto Jr JameroNo ratings yet

- Petitioners: National Development Company and New Agrix, Inc. Respondent: Philippine Veterans BankDocument1 pagePetitioners: National Development Company and New Agrix, Inc. Respondent: Philippine Veterans Bankhime mejNo ratings yet

- TECK SEING AND CO., LTD., Petitioner-Appellee. SANTIAGO JO CHUNG, ET AL., PartnersDocument5 pagesTECK SEING AND CO., LTD., Petitioner-Appellee. SANTIAGO JO CHUNG, ET AL., PartnersJemaima GalutNo ratings yet

- Fortune MedicareDocument2 pagesFortune MedicareMaree Aiko Dawn LipatNo ratings yet

- 5suntay V KeyserDocument2 pages5suntay V KeyserTristan HaoNo ratings yet

- Paguyo vs. Gatbunton mortgage foreclosureDocument2 pagesPaguyo vs. Gatbunton mortgage foreclosureps johnNo ratings yet

- 15 08 Makabali Et Al V CA, Et Al GR L-46877 January 22 1988Document1 page15 08 Makabali Et Al V CA, Et Al GR L-46877 January 22 1988Chamscb CNo ratings yet

- Herrera Vs Mago Gr231120 15jan2020Document13 pagesHerrera Vs Mago Gr231120 15jan2020CJ0% (1)

- Balanay, Jr. vs. Martinez, 64 SCRA 452, No.L-39247 June 27, 1975Document5 pagesBalanay, Jr. vs. Martinez, 64 SCRA 452, No.L-39247 June 27, 1975Ismael Catalino MaestreNo ratings yet

- Dino V Judal-LootDocument2 pagesDino V Judal-LootBeeya EchauzNo ratings yet

- Oriental Assurance vs. OngDocument2 pagesOriental Assurance vs. OngJohn Mark RevillaNo ratings yet

- 02 NG v. PeopleDocument2 pages02 NG v. PeopleKyle SubidoNo ratings yet

- Establishment of Non-Christina Upon Sites Selected by Provincial Governor. - With TheDocument2 pagesEstablishment of Non-Christina Upon Sites Selected by Provincial Governor. - With TheJude Chicano100% (1)

- U - Grounds For Disciplinary Proceedings Against LawyersDocument72 pagesU - Grounds For Disciplinary Proceedings Against LawyerssigfridmonteNo ratings yet

- PNB Vs Villa Digest and Full CaseDocument9 pagesPNB Vs Villa Digest and Full CaseAnonymous uQ6IcqNo ratings yet

- Tax DigestDocument16 pagesTax Digestybun100% (1)

- Tax Case DigestsDocument21 pagesTax Case Digestsannamariepagtabunan100% (3)

- PNB Tax Credit RulingDocument3 pagesPNB Tax Credit RulingAto TejaNo ratings yet

- SECREG Digest - Smolowe V Delendo CorpDocument3 pagesSECREG Digest - Smolowe V Delendo CorpAlex CustodioNo ratings yet

- RA 9522 Baseline LawDocument5 pagesRA 9522 Baseline LawAlex CustodioNo ratings yet

- UnclosDocument24 pagesUnclosAlex CustodioNo ratings yet

- Cemco Holdings v. National Life InsuranceDocument14 pagesCemco Holdings v. National Life InsuranceAlex CustodioNo ratings yet

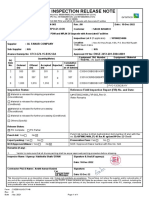

- IL#107000234686 - SIRN-003 - Rev 00Document1 pageIL#107000234686 - SIRN-003 - Rev 00Avinash PatilNo ratings yet

- Farinas V Exec Secretary 417 Scra 503Document2 pagesFarinas V Exec Secretary 417 Scra 503Charmaine Mejia100% (2)

- Cindy Hyde-Smith Opposes Reproductive Care Privacy RuleDocument11 pagesCindy Hyde-Smith Opposes Reproductive Care Privacy RuleJonathan AllenNo ratings yet

- Turkey Book 03 Internal Medicine PDFDocument47 pagesTurkey Book 03 Internal Medicine PDFPreaisNo ratings yet

- De Jure: Kottiah Vazha Yrl Devki and Others v. Arya Kandu Kunhi Knnan and OthersDocument25 pagesDe Jure: Kottiah Vazha Yrl Devki and Others v. Arya Kandu Kunhi Knnan and OthersShruti RaiNo ratings yet

- Miami Dade County Request For Hearing Parking TicketDocument1 pageMiami Dade County Request For Hearing Parking TicketRf GoodieNo ratings yet

- Bullying en La SecundariaDocument272 pagesBullying en La SecundariaGiancarlo Castelo100% (1)

- Peaceful Settlement of DisputesDocument12 pagesPeaceful Settlement of DisputesKavita Krishna MoortiNo ratings yet

- Gudani v. Senga, Case DigestDocument2 pagesGudani v. Senga, Case DigestChristian100% (1)

- Conviction of Gov't Officials for Unpaid BenefitsDocument35 pagesConviction of Gov't Officials for Unpaid BenefitsJoshua DulceNo ratings yet

- Kenfig Hill V CwmllynfechDocument1 pageKenfig Hill V CwmllynfechChris LeyshonNo ratings yet

- The Mystery of Royal AnointingDocument19 pagesThe Mystery of Royal AnointingIgnacioPérezBurgaréNo ratings yet

- OV-10A (Black Pony) Information SheetDocument14 pagesOV-10A (Black Pony) Information SheetSesquipedaliacNo ratings yet

- Contract of LeaseDocument2 pagesContract of LeaseChimboy BartolomeNo ratings yet

- The First American Among The Riffi': Paul Scott Mowrer's October 1924 Interview With Abd-el-KrimDocument24 pagesThe First American Among The Riffi': Paul Scott Mowrer's October 1924 Interview With Abd-el-Krimrabia boujibarNo ratings yet

- Employer Contractor Claims ProcedureDocument2 pagesEmployer Contractor Claims ProcedureNishant Singh100% (1)

- BPI V Far East MolassesDocument4 pagesBPI V Far East MolassesYodh Jamin OngNo ratings yet

- Active-And-Passive Exercise Shelby D1A023188Document2 pagesActive-And-Passive Exercise Shelby D1A023188Shelby SabitaNo ratings yet

- Dumaual - Crim Rev DigestsDocument18 pagesDumaual - Crim Rev DigestsJanjan DumaualNo ratings yet

- Hijab Final For 3rd ReadingDocument5 pagesHijab Final For 3rd ReadingErmelyn Jane CelindroNo ratings yet

- Syllabus - ECE 5520 Advanced Power ElectronicsDocument2 pagesSyllabus - ECE 5520 Advanced Power Electronicslamdinh261No ratings yet

- Republic vs. Court of Appeals - Docx GR No. L-61647Document10 pagesRepublic vs. Court of Appeals - Docx GR No. L-61647Friendship GoalNo ratings yet

- Chapter 18 - Enforcement of Law of WarDocument79 pagesChapter 18 - Enforcement of Law of WarwellsbennettNo ratings yet

- Quizzer rfbt1 PDFDocument8 pagesQuizzer rfbt1 PDFleighNo ratings yet

- Mirwaiz Yusuf ShahDocument2 pagesMirwaiz Yusuf ShahNandu RaviNo ratings yet

- ANFFl LYERS2012Document2 pagesANFFl LYERS2012Clifford ImsonNo ratings yet

- Fishing Vessel Factory Trawler 1288Document1 pageFishing Vessel Factory Trawler 1288Ramon Velasco StollNo ratings yet

- Finding Peace in John 16 33 - A Reflection On The Bible VerseDocument2 pagesFinding Peace in John 16 33 - A Reflection On The Bible VerseAlexie AlmohallasNo ratings yet

- DDoS Protection Bypass TechniquesDocument17 pagesDDoS Protection Bypass Techniqueskyoshiro67No ratings yet

- Quick Notes On Indeterminate Sentence LawDocument1 pageQuick Notes On Indeterminate Sentence LawJonas PeridaNo ratings yet