Professional Documents

Culture Documents

Case 5 - Optitech

Uploaded by

thrust_xoneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 5 - Optitech

Uploaded by

thrust_xoneCopyright:

Available Formats

Optitech Case Study Q1: We recommend Jim to follow the growth of his company via the acquisition strategy

because it will provide his company with the immediate growth and increase the market share. Jim has started the company from his parents garage and raise the $50MM company with his innovative ideas and hard work. His company is at the position where they have the opportunity to grow and become one of the benchmark companies in the mature toner cartridge manufacturing Industry. But the competition is intense and to compete against the companies like Xerox they need the high financial support. This financial support can only come with the help of acquisition with the opportunity for Jim to continue as the CEO of the company and contribute to the growth. Q2: The process to evaluate Optitech used by Shields and Company is quite elaborative starting with the Industry overview based on the Porter Five Forces followed by the financial assessment of the company, discussion with possible valuation of risks and finally providing with the strategic alternatives by considering the key scenarios for future success of the company. The methodologies used are guideline company analysis that compares Optitech with the public company of similar operations but, was the data compared reliable? Precedent transaction analysis that compares company price paid for the similar company and its financial performance but the public data on past transactions can be sometimes limited and misleading; specific dilution analysis that evaluate the effect of the transaction on shareholder value and to check whether EPS for buying shareholders will increase or decrease post-deal. And lastly they used the discounted cash flow analysis that depends upon the future cash flows, which can sometimes lead to erroneous decision. DCF method is directly related to whether one can predict the future cash flows accurately or not. Q3: Jim is facing a dilemma that every entrepreneur has to face at some point where growth of the company becomes a main problem. He needs to make a best decision that will affect his whole life. He needs to choose from the options to sell the company or grow through personal expense and acquisition. At this moment growing through acquisitions make sense because the industry is very mature and to competition is very intense. The company has the right opportunity and the team and they just need the resources. Q4: The company valuations should be optimal and precise because the future of an entrepreneur depends upon the recommendations and it seems like that Shield have provided Optitech with the detailed picture of their competencies and strength in order to take an apt decision. The most important factor that we will consider while choosing an investment banker is that they should have the industry experience. In the case of Optitech, Shields have the already a similar experience with Lexmark. Secondly, the company that could provide with the best team because synergy is the fundamental and since we are going to be spending a substantial amount of time with the banker we wont be able to trust them if there is no good understanding. Furthermore, an investment banker should have the negotiating experience that can be very handy while closing the deals. A good investment banker should always provide a safe exit strategy where it is crucial for a risk-taking entrepreneur in a mature market industry. Deepak DANG 1 ENPC EMBA6

You might also like

- Li S Paragon 6050 MarkedDocument10 pagesLi S Paragon 6050 MarkedSong LiNo ratings yet

- National Fabricators 1Document8 pagesNational Fabricators 1Sam Addi33% (3)

- Introduction To VC Business ModelDocument3 pagesIntroduction To VC Business ModelMuhammad Shahood JamalNo ratings yet

- Means For Achieving Strategie SDocument22 pagesMeans For Achieving Strategie SMichelle EsternonNo ratings yet

- Case Study-Finance AssignmentDocument12 pagesCase Study-Finance AssignmentMakshud ManikNo ratings yet

- Mba 7300Document2 pagesMba 7300Naman NepalNo ratings yet

- Is It Advantageous For A Company To Be Part of RPG Enterprise? Why and How? What Are The Concerns Being Addressed or Not Addressed?Document2 pagesIs It Advantageous For A Company To Be Part of RPG Enterprise? Why and How? What Are The Concerns Being Addressed or Not Addressed?karthikawarrier100% (1)

- Venture Capital Interview QuestionsDocument9 pagesVenture Capital Interview QuestionsducminhlnilesNo ratings yet

- A Letter From PrisonDocument2 pagesA Letter From PrisonLejla ArapcicNo ratings yet

- BCG What Really Matters For A Premium IPO Valuation July 2018 - tcm9 196864Document8 pagesBCG What Really Matters For A Premium IPO Valuation July 2018 - tcm9 1968649980139892No ratings yet

- PORES analysis entrepreneurial evaluation process assessing business ideasDocument7 pagesPORES analysis entrepreneurial evaluation process assessing business ideassonagreNo ratings yet

- Eps/Ebit Analysis For Hershey Co.: SfactoryDocument3 pagesEps/Ebit Analysis For Hershey Co.: SfactorySofiaNo ratings yet

- BYP9-6 Ethical case on budget miscalculationsDocument2 pagesBYP9-6 Ethical case on budget miscalculationsGrace MasdoNo ratings yet

- Financial Management E BookDocument4 pagesFinancial Management E BookAnshul MishraNo ratings yet

- Quantitative Strategic Planning MatrixDocument8 pagesQuantitative Strategic Planning MatrixHemasri ChinnuNo ratings yet

- Muhammad Burhan Roll # 15739: Corporate Governance AssignmentDocument2 pagesMuhammad Burhan Roll # 15739: Corporate Governance AssignmentMuhammad BurhanNo ratings yet

- Reasons Cisco may struggle with another ERP projectDocument2 pagesReasons Cisco may struggle with another ERP projectManisha Scrichand100% (1)

- Corporate Portfolio Analysis TechniquesDocument24 pagesCorporate Portfolio Analysis TechniquesSanjay DhageNo ratings yet

- GE Industry AnalysisDocument8 pagesGE Industry AnalysisTanvi Singh50% (2)

- Investment Management Interview QuestionsDocument5 pagesInvestment Management Interview QuestionsPierreNo ratings yet

- A Profile of Toyota's Production SystemDocument1 pageA Profile of Toyota's Production SystemZhen WuNo ratings yet

- Medical records project management questionsDocument46 pagesMedical records project management questionsOssama KheadryNo ratings yet

- Hertz QuestionsDocument1 pageHertz Questionsianseow0% (1)

- Case AnswersDocument1 pageCase Answersearth2558No ratings yet

- Sites AnswersDocument18 pagesSites AnswersDonna MarieNo ratings yet

- MBA AssignmentDocument2 pagesMBA AssignmentAnmol SharmaNo ratings yet

- NotesDocument7 pagesNoteschady.ayrouthNo ratings yet

- AutoZone S Stock PDFDocument3 pagesAutoZone S Stock PDFGeorgina AlpertNo ratings yet

- Case 2 Giovanni Buton (COMPLETE)Document8 pagesCase 2 Giovanni Buton (COMPLETE)Austin Grace WeeNo ratings yet

- Accounting Textbook Solutions - 53Document19 pagesAccounting Textbook Solutions - 53acc-expertNo ratings yet

- Financial Analysis of Reliance Steel and Aluminium Co. LTDDocument4 pagesFinancial Analysis of Reliance Steel and Aluminium Co. LTDROHIT SETHINo ratings yet

- 'BOOTS Pension Fund Management TO CHECKDocument2 pages'BOOTS Pension Fund Management TO CHECKMatsatka VitaNo ratings yet

- Bird in Hand PrincipleDocument8 pagesBird in Hand PrinciplerehansharifNo ratings yet

- Discussion 1 PmoDocument1 pageDiscussion 1 PmoKashyap ChintuNo ratings yet

- Pepsico-Employer Feedback FormDocument1 pagePepsico-Employer Feedback Formabhik0391No ratings yet

- SFA Matrix Learning Strategic ChoiceDocument5 pagesSFA Matrix Learning Strategic ChoiceAmna Mirza100% (1)

- Home DepotDocument7 pagesHome DepotAyu Eka PutriNo ratings yet

- Vers Hire Company Study CaseDocument11 pagesVers Hire Company Study CaseAradhysta SvarnabhumiNo ratings yet

- Sheth Model, Industrial Buyer BehaviourDocument9 pagesSheth Model, Industrial Buyer BehavioursolomonNo ratings yet

- Westpac Case Study: Creating a Sustainable BusinessDocument12 pagesWestpac Case Study: Creating a Sustainable Businessnicolaus copernicusNo ratings yet

- EasyJet Vs Transworld AutoDocument3 pagesEasyJet Vs Transworld AutoTvarita Jain BJ22103No ratings yet

- Biriyani by KiloDocument6 pagesBiriyani by KiloPoornima SisodiyaNo ratings yet

- Closing Case Chapter 14Document2 pagesClosing Case Chapter 14kelvin orongeNo ratings yet

- Valuing A Business: Corporate Finance Directors' BriefingDocument4 pagesValuing A Business: Corporate Finance Directors' BriefingRupika SharmaNo ratings yet

- How Lloyds TSB Achieved Success Under Brian PitmanDocument8 pagesHow Lloyds TSB Achieved Success Under Brian PitmanAmit SrivastavaNo ratings yet

- Case Study Que of Mozal ProjectDocument1 pageCase Study Que of Mozal ProjectSimran Malhotra0% (1)

- InterviewsDocument10 pagesInterviewsKristel Jean SalvadorNo ratings yet

- Poly Peck Case Question 1Document6 pagesPoly Peck Case Question 1sdfdsf100% (1)

- W.L GoreDocument15 pagesW.L GoreSophia Meza100% (2)

- Case Questions Laura Martin Real OptionsDocument2 pagesCase Questions Laura Martin Real OptionsLiya Mary VargheseNo ratings yet

- SG Cowen: A Case StudyDocument7 pagesSG Cowen: A Case StudyParv PandeyNo ratings yet

- The 2016 HEC-DowJones PE Performance Ranking ReportDocument6 pagesThe 2016 HEC-DowJones PE Performance Ranking ReportTDGoddardNo ratings yet

- Annual Report of InfosysDocument3 pagesAnnual Report of InfosysChirag GogriNo ratings yet

- Idic AuditDocument10 pagesIdic Auditapi-298467650No ratings yet

- The Short Book of Being an Investor not a Speculator: How to achieve a fair return from investment marketsFrom EverandThe Short Book of Being an Investor not a Speculator: How to achieve a fair return from investment marketsNo ratings yet

- Insanity Workout WorksheetsDocument2 pagesInsanity Workout WorksheetsLeonard Bradley Todd100% (1)

- Airbus vs. Boeing in Super Jumbos - A Case of Failed PreemptionDocument67 pagesAirbus vs. Boeing in Super Jumbos - A Case of Failed PreemptionmichaelshafiNo ratings yet

- Release Notes: Autovue Desktop Version 19.3: PackagingDocument28 pagesRelease Notes: Autovue Desktop Version 19.3: Packagingthrust_xoneNo ratings yet

- Readme AutoVueDocument1 pageReadme AutoVuethrust_xoneNo ratings yet

- Chapter 4 CVP AnalysisDocument40 pagesChapter 4 CVP Analysisthrust_xone100% (1)

- Statement of Results - 26 Weeks Ended 27 August 2011Document36 pagesStatement of Results - 26 Weeks Ended 27 August 2011thrust_xoneNo ratings yet

- DMA Case DataDocument1 pageDMA Case Datathrust_xoneNo ratings yet

- 2011 06-11-14!07!07 Master Analysis CarlucciosDocument13 pages2011 06-11-14!07!07 Master Analysis Carlucciosthrust_xoneNo ratings yet

- Factors Affecting Stock Markets in South AsiaDocument15 pagesFactors Affecting Stock Markets in South AsiaAli MohammedNo ratings yet

- Investment in Sbi Mutual FundDocument63 pagesInvestment in Sbi Mutual FundNavneetNo ratings yet

- Bachrach v. Seifert G.R. No. L-2659, October 12, 1950Document2 pagesBachrach v. Seifert G.R. No. L-2659, October 12, 1950Christian Paul LugoNo ratings yet

- The World Economy-27/04/2010Document2 pagesThe World Economy-27/04/2010Rhb InvestNo ratings yet

- Mock Exam Level II 2003 AnsDocument44 pagesMock Exam Level II 2003 Ansapi-3703582No ratings yet

- BAM PPT 2019-09 Investor DayDocument92 pagesBAM PPT 2019-09 Investor DayRocco HuangNo ratings yet

- Ratio Analysis Comparison Liberty Medical GroupDocument3 pagesRatio Analysis Comparison Liberty Medical GroupAprile AnonuevoNo ratings yet

- Chapter 12 Determinants of Beta and WACCDocument7 pagesChapter 12 Determinants of Beta and WACCAbdul-Aziz A. AldayelNo ratings yet

- Rethinking About The Abolition of The Doctrine of Consolidation of MortgagesDocument7 pagesRethinking About The Abolition of The Doctrine of Consolidation of Mortgagesআ.আ. মামুন100% (1)

- Pracc2 ReviewerDocument8 pagesPracc2 ReviewerLucas GalingNo ratings yet

- Hunt for Low-Price High-Value StocksDocument5 pagesHunt for Low-Price High-Value StocksPankaj ChandakNo ratings yet

- LeverageDocument2 pagesLeverageRahul ItankarNo ratings yet

- Mfi 2016 12Document98 pagesMfi 2016 12Subrata ChakrabortyNo ratings yet

- File investor complaint formDocument5 pagesFile investor complaint formnavin_netNo ratings yet

- Baroda Pioneer Asset Management Company LTDDocument2 pagesBaroda Pioneer Asset Management Company LTDALLtyNo ratings yet

- Ashok Leyland Ratio Analysis: Liquidity, Debt, Profitability Ratios Over TimeDocument9 pagesAshok Leyland Ratio Analysis: Liquidity, Debt, Profitability Ratios Over TimevayuputhrasNo ratings yet

- FIN 534 Homework Set 5 Week 10 SolutionDocument4 pagesFIN 534 Homework Set 5 Week 10 SolutionmarywimberlyNo ratings yet

- Chapter 02 - Stock Investment - Investor Accounting and ReportingDocument26 pagesChapter 02 - Stock Investment - Investor Accounting and ReportingTina Lundstrom100% (3)

- DerivativesDocument65 pagesDerivativesShreyas DongreNo ratings yet

- Fundflow and Cashflow DifferenceDocument4 pagesFundflow and Cashflow DifferencerakeshkchouhanNo ratings yet

- Adidas Anual Report 2011Document242 pagesAdidas Anual Report 2011EricNyoniNo ratings yet

- Notice: Self-Regulatory Organizations Proposed Rule Changes: National Life Insurance Co., Et Al.Document4 pagesNotice: Self-Regulatory Organizations Proposed Rule Changes: National Life Insurance Co., Et Al.Justia.comNo ratings yet

- The Impact of IFRS AdoptionDocument27 pagesThe Impact of IFRS AdoptionMichelle100% (1)

- Introducing The MIDAS Method of Technical Analysis Lesson 2Document4 pagesIntroducing The MIDAS Method of Technical Analysis Lesson 2King LeonidasNo ratings yet

- Practice QuestionsDocument4 pagesPractice QuestionsDimple PandeyNo ratings yet

- Price Action Cheatsheet PDFDocument19 pagesPrice Action Cheatsheet PDFash dustNo ratings yet

- Financing Methods in Professional Football: Dr. Zoltán Imre NagyDocument19 pagesFinancing Methods in Professional Football: Dr. Zoltán Imre NagyaldywsNo ratings yet

- ASBA Application Form Full PrintedDocument16 pagesASBA Application Form Full PrintedRexx MexxNo ratings yet

- ModularDocument16 pagesModularRafidah Mohamed RadziNo ratings yet

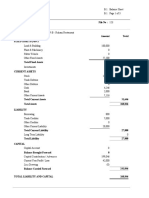

- Balance Shit!!Document3 pagesBalance Shit!!Irfan izhamNo ratings yet