Professional Documents

Culture Documents

Rates

Uploaded by

Zil ShahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rates

Uploaded by

Zil ShahCopyright:

Available Formats

Research Methodology

Bank Rate (Current Rate: 6.0%)

Bank Rate is the rate at which central bank of the country (in India it is RBI) allows finance to commercial banks. Bank Rate is a tool, which central bank uses for short-term purposes. Any upward revision in Bank Rate by central bank is an indication that banks should also increase deposit rates as well as Base Rate / Benchmark Prime Lending Rate. Thus any revision in the Bank rate indicates that it is likely that interest rates on your deposits are likely to either go up or go down, and it can also indicate an increase or decrease in your EMI. This is the rate at which central bank (RBI) lends money to other banks or financial institutions. If the bank rate goes up, long-term interest rates also tend to move up, and viceversa. Thus, it can said that in case bank rate is hiked, in all likelihood banks will hikes their own lending rates to ensure that they continue to make profit.

Cash Reserve Ratio CRR (Current Rate: 6.0%)

CRR means Cash Reserve Ratio. Banks in India are required to hold a certain proportion of their deposits in the form of cash. However, actually Banks dont hold these as cash with themselves, but deposit such case with Reserve Bank of India (RBI) / currency chests, which is considered as equivalent to holding cash with RBI. This minimum ratio (that is the part of the total deposits to be held as cash) is stipulated by the RBI and is known as the CRR or Cash Reserve Ratio. Thus, when a banks deposits increase by Rs100, and if the cash reserve ratio is 6%, the banks will have to hold additional Rs 6 with RBI and Bank will be able to use only Rs 94 for investments and lending / credit purpose. Therefore, higher the ratio (i.e. CRR), the lower is the amount that banks will be able to use for lending and investment. This power of RBI to reduce the lendable amount by increasing the CRR makes it an instrument in the hands of a central bank through which it can control the amount that banks lend. Thus, it is a tool used by RBI to control liquidity in the banking system.

N.R. Institute Of Business Management

Page 1

Research Methodology

Statutory Liquidity Ratio SLR (Current Rate: 24%)

SLR stands for Statutory Liquidity Ratio. This term is used by bankers and indicates the minimum percentage of deposits that the bank has to maintain in form of gold, cash or other approved securities. Thus, we can say that it is ratio of cash and some other approved securities to liabilities (deposits) it regulates the credit growth in India.

Repo Rate (Current Rate: 8.25%)

Repo (Repurchase) rate is the rate at which the RBI lends shot-term money to the banks against securities. When the repo rate increases borrowing from RBI becomes more expensive. Therefore, we can say that in case, RBI wants to make it more expensive for the banks to borrow money, it increases the repo rate; similarly, if it wants to make it cheaper for banks to borrow money, it reduces the repo rate

Reverse Repo Rate (Current Rate: 7.25%)

Reverse Repo rate is the rate at which banks park their short-term excess liquidity with the RBI. The banks use this tool when they feel that they are stuck with excess funds and are not able to invest anywhere for reasonable returns. An increase in the reverse repo rate means that

the RBI is ready to borrow money from the banks at a higher rate of interest. As a result, banks would prefer to keep more and more surplus funds with RBI.

Prime Rate or Prime Lending Rates (PLR)

Prime rate or Prime lending rates (PLR) refer to interest rates charged by commercial banks for their most credit-worthy customers. Generally credit-worthy customers consist of large corporations.

N.R. Institute Of Business Management

Page 2

Research Methodology

Deposit Rates

Interest rate paid by a depository institution on the cash on deposit.

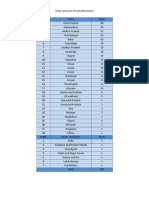

State Bank of India: Interest Rates on 1st April, 2011

Interest rates as on 1st April, 2011 on various loans in Personal Segment advances are as under

1. Home Loans Loan amount Up to Rs.30 lacs Interest rate during 1styear Interest rate during 2nd & 3 rd year Interest rate from 4th year onwards 2. Car Loans Loan amount Interest rate during 1styear Interest rate during 2nd & 3 rd year Interest rate for 4th & 5th year Interest rate for 6th & 7th year Used Cars Up to 3 years Above 3 years and up to 7 years 3. Two wheeler Up to 3 years 16.50% Page 3 15.50 % 15.75 % 11.25% 11.25% 11.00% 11.00% Below Rs.5 lacs 9.25% p.a. 10.25% p.a. Rs.5 lacs and above 9.25% p.a. 10.25% p.a. 9.75% 10.00% 10% 10.25% Above Rs. 30 lacs to Rs. 75 lac 8.75%. 9.50%. 8.75%. 9.50% 10% 10% 10.25% 10.25% Above Rs.75 lac to Rs.5 Cr. Above 5 cr.

N.R. Institute Of Business Management

Research Methodology 4. Education loans SBI Student Loans* up to Rs.4 Lac 12.00% Loans above Rs.4 Lac and up to 7.50 lacs 13.50% Loans above Rs.7.5. Lac- 12.5% 5. Personal loans Xpress credit (Demand Loan) Xpress credit (Overdraft) SBI Saral No Overdraft 16.75% 13.25% TO 15.25%

6. Loans against NSCs/KVPs/RBI Relief Bonds/Surrender value of SBI Life/LIC/SBI Magnums etc. Up to 3 years More than 3 years and up to 6 years 7. Loans against Gold Ornaments Up to Rs.1 lac:12.50% Above Rs.1 lac:13% 12.75% 12.75%

* 0.50% additional concession for girl students w.e.f.02.03.2009

Rates of AXIS BANK

Saving Account Deposit Interest Rate - 4% Rates Effective from: Friday, April 29, 2011

PERIOD DEPOSITS

INTEREST RATES ON DOMESTIC DEPOSITS (%) (p.a.) Interest Rate Interest Rates for Senior citizen on Deposits Below Rs 15 lakhs on Deposits of Rs 15 lakhs < Rs 50 Lakhs on Deposits of Rs 50 lakhs < Rs 1 Crore on Deposits below Rs. 50 lakhs on Deposits of Rs 50 lakhs < Rs 5 Crore Page 4

N.R. Institute Of Business Management

Research Methodology 7 days to 14 days 15 Days to 29 Days 30 days to 45 days 46 days to 60 days 61 days to less than 3 months 3 months to less than 4 months 4 months to less than 6 months 6 months to less than 9 months 9 months to less than 1 year 1 year to less than 14 months 14 months to less than 15 months 15 months to less than 18 9.00 9.00 9.00 10.00 10.00 9.00 9.00 9.00 10.00 10.00 9.25 9.25 9.25 10.25 10.25 8.50 8.50 8.50 9.50 9.50 7.75 7.75 7.75 8.75 8.75 6.75 6.75 6.75 6.75 6.75 6.25 6.25 6.25 6.25 6.25 4.00 4.00 4.00 4.00 4.00 3.50 3.50 3.50 3.50 3.50 3.00 3.00 3.00 3.00 3.00 2.50 2.50 2.50 2.50 2.50 2.00 2.00 -

N.R. Institute Of Business Management

Page 5

Research Methodology 18 months to less than 2 years 2 years to less than 30 months 30 months to less than 3 years 3 years to less than 5 years 5 years up to 10 years 8.50 8.50 8.50 9.50 9.50 8.50 8.50 8.50 9.50 9.50 8.50 8.50 8.50 9.50 9.50 8.50 8.50 8.50 9.50 9.50 9.00 9.00 9.00 10.00 10.00

Rates Effective from: Saturday, January 22, 2011 INTEREST RATES ON TAX SAVER DEPOSITS 5 years only (Amount Capped at Rs. 1 lac per customer per Financial INTEREST Year) Regular Depositor (Individual & HUF) Senior Citizen (Individual) (p.a.) 8.25 9.25 RATES (%)

N.R. Institute Of Business Management

Page 6

You might also like

- Group F - Eco61070h419Document39 pagesGroup F - Eco61070h419Zil ShahNo ratings yet

- State-Wise List of Constituencies IndiaDocument1 pageState-Wise List of Constituencies IndiaZil ShahNo ratings yet

- Switch Statements: Comparing Exact ValuesDocument11 pagesSwitch Statements: Comparing Exact ValuesZil ShahNo ratings yet

- Letter of RecommendationDocument1 pageLetter of RecommendationZil Shah100% (1)

- Root Meaning: A Concise Guide to Latin and Greek Word RootsDocument13 pagesRoot Meaning: A Concise Guide to Latin and Greek Word RootsSai Krishna LakkavajjalaNo ratings yet

- DecoderDocument15 pagesDecoderZil ShahNo ratings yet

- DURF Kasperczyk 2005 PaperDocument7 pagesDURF Kasperczyk 2005 Paperfizex22No ratings yet

- Letter of RecommendationDocument1 pageLetter of RecommendationZil ShahNo ratings yet

- Online Shopping: Benefits, Risks and Growth TrendsDocument11 pagesOnline Shopping: Benefits, Risks and Growth TrendsZil ShahNo ratings yet

- 1.5 SolutionSolution Sets of Linear EquationsDocument16 pages1.5 SolutionSolution Sets of Linear EquationsZil ShahNo ratings yet

- Letter of RecommendationDocument1 pageLetter of RecommendationZil Shah100% (1)

- SOP For AeronauticsDocument1 pageSOP For AeronauticsZil ShahNo ratings yet

- SRS Contents by ZilDocument2 pagesSRS Contents by ZilZil ShahNo ratings yet

- Rendell Company Case AnalysisDocument12 pagesRendell Company Case AnalysisZil ShahNo ratings yet

- Online Shopping: Benefits, Risks and Growth TrendsDocument11 pagesOnline Shopping: Benefits, Risks and Growth TrendsZil ShahNo ratings yet

- SDM Home AppliancesDocument17 pagesSDM Home AppliancesZil ShahNo ratings yet

- NucorDocument15 pagesNucorZil ShahNo ratings yet

- Women Growth in Corporate SectorDocument66 pagesWomen Growth in Corporate SectorZil ShahNo ratings yet

- Chapter 9 PBMDocument49 pagesChapter 9 PBMZil ShahNo ratings yet

- Use Case IdentificationDocument2 pagesUse Case IdentificationZil ShahNo ratings yet

- Questionnaire For ConsumersDocument3 pagesQuestionnaire For ConsumersZil ShahNo ratings yet

- Use Case IdentificationDocument2 pagesUse Case IdentificationZil ShahNo ratings yet

- Questionnaire For CHANNEL PARTNERSDocument3 pagesQuestionnaire For CHANNEL PARTNERSZil ShahNo ratings yet

- Effectiveness of Distribution Channel of Minute MaidDocument29 pagesEffectiveness of Distribution Channel of Minute MaidZil Shah0% (1)

- Paper Industry of South AfricaDocument142 pagesPaper Industry of South AfricaZil ShahNo ratings yet

- What Is Group Discussion? (GD) : Participation in A Systematic Way On A Particular Topic.Document21 pagesWhat Is Group Discussion? (GD) : Participation in A Systematic Way On A Particular Topic.Vighnesh RamNo ratings yet

- GCR Executive Summary GTUDocument18 pagesGCR Executive Summary GTUZil ShahNo ratings yet

- Assginment Product and Brand Management: Submitted To: Submitted byDocument42 pagesAssginment Product and Brand Management: Submitted To: Submitted byZil ShahNo ratings yet

- Volini Vs MoovDocument12 pagesVolini Vs MoovZil Shah100% (1)

- Surrogate AdvertisingDocument26 pagesSurrogate AdvertisingZil ShahNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- I Want The Earth Plus 5 Percent - EnglishDocument17 pagesI Want The Earth Plus 5 Percent - EnglishcomputerjinNo ratings yet

- Full Download Ebook PDF International Financial Management 14th Edition PDFDocument41 pagesFull Download Ebook PDF International Financial Management 14th Edition PDFjudi.hawkins74497% (33)

- aFM12 Test Bank PrefaceDocument10 pagesaFM12 Test Bank PrefaceLe Trung25% (4)

- Invoice - PDF NigdiDocument1 pageInvoice - PDF Nigdiavinash14 neereNo ratings yet

- CH 5 LS Practice HW QUIZDocument25 pagesCH 5 LS Practice HW QUIZDenise Jane RoqueNo ratings yet

- PD CRST 29feb2024Document34 pagesPD CRST 29feb2024Aaron GumisNo ratings yet

- Corporation Accounting - Retained EarningsDocument3 pagesCorporation Accounting - Retained EarningsGuadaMichelleGripalNo ratings yet

- Indian Bank Home LoanDocument60 pagesIndian Bank Home Loanriyazmaideen17No ratings yet

- Fin322 Week2 2018Document12 pagesFin322 Week2 2018chi_nguyen_100No ratings yet

- Missouri Direct Deposit FormDocument2 pagesMissouri Direct Deposit FormitargetingNo ratings yet

- Basic Financial StatementsDocument12 pagesBasic Financial StatementsChriszel Dianne DamasingNo ratings yet

- Crescent Jute Annual Report 2017 UpdatesDocument60 pagesCrescent Jute Annual Report 2017 UpdatesMuhammad SajidNo ratings yet

- Session 6Document10 pagesSession 6Talha JavedNo ratings yet

- PT Mulia Perdana's Financial StatementsDocument20 pagesPT Mulia Perdana's Financial StatementsMulia Ayu FadillahNo ratings yet

- Inisiatif Vol 2 No 1 Januari 2023 Hal 343-361Document19 pagesInisiatif Vol 2 No 1 Januari 2023 Hal 343-361Lasagna OoooNo ratings yet

- WK1 - MTTI Budgets Pack ExcelDocument7 pagesWK1 - MTTI Budgets Pack ExcelBinay BhandariNo ratings yet

- Grand Banks Yachts Limited Annual Report 2020Document184 pagesGrand Banks Yachts Limited Annual Report 2020WeR1 Consultants Pte LtdNo ratings yet

- Elements of Book-Keeping and Accountancy (Code No. 254) CLASS-IX (2021-22)Document4 pagesElements of Book-Keeping and Accountancy (Code No. 254) CLASS-IX (2021-22)Mandowara MadhavNo ratings yet

- Ho Responsibility PDFDocument61 pagesHo Responsibility PDFrose OneubNo ratings yet

- SBI Account Opening Form EnglishDocument17 pagesSBI Account Opening Form Englisharchana dodweNo ratings yet

- Infinity ProductDocument8 pagesInfinity ProductzardarwaseemNo ratings yet

- Financial Management LeasingDocument38 pagesFinancial Management LeasingKimberly MurrayNo ratings yet

- Notice: Banks and Bank Holding Companies: Formations, Acquisitions, and MergersDocument1 pageNotice: Banks and Bank Holding Companies: Formations, Acquisitions, and MergersJustia.comNo ratings yet

- Estate TaxDocument7 pagesEstate TaxMarie MAy MagtibayNo ratings yet

- C2 Course Test 1Document12 pagesC2 Course Test 1Tinashe MashoyoyaNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalrosdicoNo ratings yet

- PPA Notes Module 2Document22 pagesPPA Notes Module 2Community Institute of Management StudiesNo ratings yet

- DV, Ors Salary Claims of TeacherDocument2 pagesDV, Ors Salary Claims of TeacherClerica RealingoNo ratings yet

- Electronic Contribution Collection List SummaryDocument2 pagesElectronic Contribution Collection List Summarythyatira summerNo ratings yet

- 23 Risk Management and Hedging Strategies PDFDocument24 pages23 Risk Management and Hedging Strategies PDFemmadavisonsNo ratings yet