Professional Documents

Culture Documents

Impact of Freezing The FCAs

Uploaded by

Ali Raza SultaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impact of Freezing The FCAs

Uploaded by

Ali Raza SultaniCopyright:

Available Formats

Australian Journal of Business and Management Research

Vol.1 No.6 [01-06] | September-2011

IMPACT OF FREEZING OF FCAS: THE CASE OF PAKISTAN

Hafiz Abdur Rashid (Corresponding Author) Hailey College of Commerce Faculty of Commerce, University of the Punjab, Lahore Pakistan E-mail: ha.rashid@hotmail.com Ali Raza Hailey College of Commerce, University of the Punjab, Lahore Pakistan E-mail: alihailian_100@yahoo.com Syed Usman Izhar Hailey College of Commerce, University of the Punjab, Lahore Pakistan Muhammad Waqas Baig Hailey College of Commerce, University of the Punjab, Lahore Pakistan

ABSTRACT Foreign investment and foreign exchange reserves have ample importance for developing countries. So, there is a needed to encourage the foreign and domestic investors whose confidence was suffer by the unexpected decision of freezing of FCAs. The purpose of this study was to identify the areas that were affected after the decision of freezing of FCAs. Moreover, the impact of freezing decision on economy of Pakistan also indicated. More sophisticated impact on banking sector, balance of payment, foreign exchange reserves, foreign debt, and foreign investment. Study found the negative impact of freezing decision of FCAs on foreign banking and positive impact on domestic banking but Pakistan banking sector was disconnected from the international banking; insatiability in balance of payment was increased; the foreign investment and exports was reduced. Resultantly, foreign exchange reserves were reduced and foreign exchange rates was increased. Therefore, it is suggested to increase the confidence of foreign investors in order to increase the foreign investment and foreign exchange reserves. Discussion of conclusions and recommendations were also provided. Keywords: FCAs, foreign exchange reserves, balance of payment, foreign investment and debt, & Pakistan

1. OVERVIEW / INTRODUCTION Banking system is serving as lifeblood for the financial system of Pakistan and facilitating each individual and corporate to complete the financial transaction. In 1990s banking sector was facing large ups and downs and numerous types of pressures. Firstly, the pressure of multi-pronged reforms introduced by SBP, implementing the requirement of enrichment of capital sufficiency, reinforced assets excellence, advance executive, enhancement of earnings and lessening the financial leverage of different types. Khan and Khan (2007); Hanif (2003) reported that great efforts were carried out for the development of banking sector by undertaking the financial reforms. Before the restructuring of financial system in Pakistan, banking system was facing a composite and complex situation but afterward an infrastructure has developed for the enlargement of banking sector, make it stronger and efficient, and to motivate the people for savings and investments. As they know that turnaround in banking sector was not expected until unless the completion of reforms. The first generation of reforms was completed in 1996 and banking sector became a bit stable but on the other hand the great fallout of freezing foreign currency accounts (FCAs) incident was happened in May, 1998. Freezing FCAs means non-operative or deactivation of foreign currency accounts. Foreign currency accounts are the symbol of foreign investment and financial stability of the economy of any country. Non-operating or freezing of FCAs discouraged the foreign investors, which caused serious financial crises in any developing country like Pakistan. In 28 May 1998, Pakistan tested its nuclear technology and made two atomic blasts at Chaghi Baluchistan in the reaction of nuclear tests by India. In result, international sanctions were imposed on Pakistan and the trust of foreign investors was lost. Resultantly, fear of decrease in foreign direct investment was increased, which might cause the default of the country. Therefore, FCAs were frozen to prevent the country by declaring emergency by the govt.

Australian Journal of Business and Management Research

Vol.1 No.6 [01-06] | September-2011

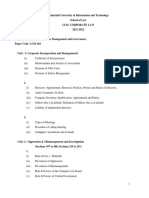

Freezing of FCAs tend toward weakening the process, erosion and disintermediation in the monetary structure of the Banks. Further, consecutively stagnation was existed in economical behavior and low expansion affected the demand for issuing credit services by the banking sector. It was stated that the drive for accountability and brought changes in the recovery of loans made it more difficult for the banking sector. Moreover, pressure on profitability enhancement of foreign and private banks was main cause of freezing of FCAs. In result, their expenditure ratio to earn profit was increased. Although, tempered down as the result of adjustment of their portfolios to fulfilling the demand of FCAs liquidation. On the other hand total administrative expenditure allowances and salaries was increased by the board and the performance of bank was going worst in this regard. The paper was purported to identify the impact of freezing on different economic and financial stability indicators of Pakistan such as: banking sector, balance of payment, foreign direct investment, exports, foreign exchange reserves, and exchange rate. Moreover, this study was hypothesized that decision regarding freezing FCAs had negative impact on banking sector, balance of payment, foreign direct investment, exports of Pakistan, foreign exchange reserves, and exchange rate. This identified impact will discourage to the government of Pakistan while taking such kind of decision in future and support to the policy makers while making such policies that will sustain the confidence of foreign investors and domestic investors. While reviewing the literature, researcher was unable to find ample literature on this topic, however, overview a combined form of introduction and literature was described in section 1, research questions were displayed in section 2; hypotheses was demonstrated in section 3, significance of FCAs was given in section 4; impact of freezing FCAs on banking sector in Pakistan was shown in section 5; impact on balance of payment of Pakistan was demonstrated in section 6; impact of FCAs on foreign debt and foreign investment was described in section 7; impact on foreign exchange reserves was illustrated in section 8 and conclusions and recommendations were described in section 9 of this study. 2. RESEARCH QUESTIONS Research questions of this study were: RQ1 What was the significance of FCAs? RQ2 What was the impact of freezing the FCAs on banking sector in Pakistan? RQ3 How much balance of payment was affected? RQ4 What was the impact of FCAs on foreign debt and foreign investment? RQ5 How the foreign exchange reserves were affected? 3. HYPOTHESIS OF THE STUDY Banking Sector Balance of Payment Foreign Investment Freezing FCAs Exports Foreign Exchange Reserves Fig-1 Foreign Exchange Rate

Fig 1 is demonstrating the variables of this study. Here, decision on freezing the FCAs is independent variable, whereas, banking sector of Pakistan, balance of payment, foreign investment, exports, foreign exchange reserves an rate are the dependent variables.

Australian Journal of Business and Management Research

Vol.1 No.6 [01-06] | September-2011

4. SIGNIFICANCE OF FCAS A huge adverse impact was put by the freezing of FCAs on the economy of Pakistan and it was a great failure of banking industry. FCAs affected more than USD$ 11 billion, approximately 100 billion Pakistani Rupees at the exchange rate of PKR 55/$. Annual inflows was decreased by USD$ 2.5 billion. Foreign remittances and foreign exchange reserves were reduced. Most of foreign banks were going to close their banking operation in Pakistan and some of them were going to amalgamate which limited the access to the international financial market. Actually this was not only the failure of commercial banking but it was the failure of the SBP prudential regulations because it is the higher regulatory authority of the commercial banking in Pakistan. Khan (1998) reported that this was only due to the adverse banking behavior of the higher regulatory authority of commercial banking. It was also stated that FCAs have great significance: to meet the obligations of debt payments along with the deficit of balance of payment; and they provide ample source of funds. Khan (1998) found the greatest bad impact of freezing the FCAs on the economy of a county. In the same manners, foreign exchange is directly related with FCAs but most of the investors used the black market to use the foreign exchange. Main reasons were: i. Economy of Pakistan was unable to provide the exchange rate hedge which was determined by FCAs; ii. The domestic real estate was refused to settle the agreement in foreign currency; iii. Freezing the FCAs losing the confidence splitting of all banking instruments; iv. Government manners were different with the foreign investors due to the fear of clash of capital market. Therefore, government discouraged the investors to trade in capital market. 5. IMPACT OF FREEZING FCAS ON BANKING SECTOR It was stated that freezing the FCAs has a constructive negative and positive impact on the foreign banks and domestic banks as well. Freezing FCAs had a positive impact on domestic banks because when the foreign currency accounts were frozen then domestic banking was flourished because foreign currency accounts were converted into the domestic currency and developed new accounts. This was the great chance for the growth of domestic banks due to ample funds. Kazami (2000) claimed that banks started advances loans to earn profit on low cost but in bulk. Many lottery schemes were announced by the different banks such as Habib Bank Limited, Muslim Commercial bank Limited and United Bank Limited in order to attract the mostly deposits of domestic and foreign banks. Moreover, wide ranges of efforts were made to enhance the branches network. The foreign banking felt the adverse effects of freezing of FCAs. After freezing the FCAs all accounts were converted into domestic currency or native currency. Due to this effect the largely foreign banks were going to lose their total deposits, which enabled the domestic banking to enhance their branches network as more as possible. According to Kazami (2000), the bank of America announced first time to shut down their banking operation in Pakistan. After that the international banks merger were going to be held. ANZ Banks was going to be merged with the standard chartered bank in Pakistan. Which latterly proved that the financially strongest financial bank in Pakistan. There were total 21 foreign banks in Pakistan at the time of freezing FCAs and it expended up to the more than 85 branches. After the freezing of FCAs, they remained less than dozen within next five years. Freezing of FCAs affected the 80% of their deposits which was reduced to the 80 billion most probably 48% of the total banking sectors deposit. Half of the banks were going to close their operation in Pakistan but the some of the banks were wants to remain in competition. They introduced the new innovative ideas to enhance their acceptability and introducing phone banking and as well as ATM setup. When froze the foreign currency accounts the foreign banks were going to shut down their operation and afterward when the restriction were taken up then they come back in competition with more innovative ideas and technological improvement. Detragiache (1994) stated that the foreign banks in any economy do not capture the money market of the economy. These banks update the technology of the global market and correlate with the international market and when the foreign banks will stop the operation in Pakistan its means that Pakistan economy will cut from global banking system. 6. IMPACT ON BALANCE ON PAYMENT (BOP) After 1990 the balance of current account was going to deficit in every year, and the capital account balance was not enough to meet the requirements of current account deficit. So, government of Pakistan decided to meet the deficit requirements from loans of different foreign organization and financial institutions like World Bank and IMF. As loans were increased the payment of interest and installments of loans also increased and a very complex situation was created. At that time the decision was made to freeze the FCAs in Pakistan of the Pakistani residents. Due to this effect the loans requirements were decreased as well as interest free foreign reserves were available to meet the deficit of current requirements. Pakistan balance of payment was going to be surplus. But surplus of balance of payment only remained till 1998. After that a negative impact was put on the balance of trade (current account) and net inflows (capital account) were decreased.

Australian Journal of Business and Management Research

Vol.1 No.6 [01-06] | September-2011

When FCAs were blocked then foreign exchange reserves of Pakistan were reduced from USD$ 1 billion to USD$ 500 million in November 1998. The imposition of capital control and confidence of private sector was discouraged, and different inflows dried up which accessed to the capital market. At that time, official debt of Pakistan exceeded 2 billion and foreign exchange reserves were exhausted. Therefore, Pakistan generated borrowing from different organizations but more borrowing from IMF in order to maintain or fulfill the requirements of balance of payment. Ismail (1999) stated that after May 1998, external payment arrangements of Pakistan became instable. Mostly, Pakistan has remained the victim of current account deficit and trying to execute this deficit through capital account because private direct investment was not enough to meet the shortage. Otherwise, the foreign exchange reserves were used to meet up the deficiency of current account. Therefore, balance of payment existed. Pakistan has paid approximately 3.3 billion dollar as payment of debt and interest in 1997-1998. It was deteriorated after the freezing the bank accounts of foreign currency and it became 800 million dollar in 19981999. Actually this was the shock due to freezing of FCAs. Table 1: Balance of Payment before and after the Freezing of FCAs Years Current Account Surplus and Deficit Capital Account Surplus and Deficit Exceptional Financing Changes In Foreign Exchange Reserves Source: (SBP Annual Report, 2003) (Ismail, 1999) 7. IMPACT OF FCAS ON FOREIGN DEBT AND FOREIGN INVESTMENT Borrowings from domestic financial institutions or from international foreign institutions are necessary to meet foreign deficit balances or internal financial requirements. It is also more important to manage the debt requirements from both domestic and foreign inflows. It helps to enhance the efficiency, resources allocation and enlargement. Debt management is the most important thing to manage the economy. But debt crises are dependent on the confidence of both creditor and borrower and borrowers ability to repay the interest payment and the installments (Ayaz, 1998). It is also stated that debt servicing diminishes the financial resources of the country, especially; it reduced the foreign exchange reserves of the economy. So, Pakistan should have to make amortization of loan and payment of interest. Consequently, it is required to borrow more short term loans to finance the loans installment and interest payment, which enlarge the rate of interest payment with limited time to repay with principle amount and interest payment. It tends toward the more financially instability of the economy and it lakes the growth or development projects (Ishfaq & Chaudhry, 1999). Pakistan was finding a short cut to reduce the borrowing from the domestic and foreign banks. They freeze the FCAs and got the maximum reserves that they required to meet the debt requirements and fulfilling the deficits. May this give surplus balance in that year but afterward Pakistan is facing the most of the problems. Like decrease in the foreign investment, and they have to borrow more debts in the upcoming year to meet the deficits but the debt has bad impact on the economy of Pakistan and it is necessary for the SBP (Central Bank of Pakistan) to make healthful policy not to reduce the debt instead of, debt must be finished from the economy of Pakistan forever (WILLIAMS, 2005). According to (Ayaz, 1998), in 1980 Pakistan have the total debt of $10 billion and in 1990 this amount was doubled but there was more than 2 times increase in debt in 1998 when the GOP (Government of Pakistan) decide to freeze of foreign accounts hat was $42 billion. In the 1980 the EDL (external debt and liabilities) was 200% to foreign exchange and this percentage was increased to 232% but due to the freeze of foreign currency account it jumped to 350% in the year of 1998. But one thing should be kept in mind that excess borrowing is the greater threat for the economy of the developing country and their revival. In 1998 Pakistan is not in a position to fulfill their debt needs and foreign exchange obligations. At that time, the country, took some important actions to meet the obligations. The FCAs were 9 million at that time of all residents accounts and more over the 2.4 billion dollar in all non-residents accounts. The Pakistani government froze all that account both resident and non-resident. After that, Pakistani government was succeeded to cope with the 1.5 billion dollars to the foreign institutional funds. Allow the entire resident and non-resident accounts holders to withdraw their balances in the local currency. In December 1999 Pakistan exchanged the other non-resident 1997 (1701) 1553 0 (148) 1998 (1580) (1267) 4101 1254 1999 (1856) (2278) 3966 1740 2000 (217) (4177) 3965 1358 2001 326 (643) 692 2088 2002 2833 1107 138 4809

Australian Journal of Business and Management Research

Vol.1 No.6 [01-06] | September-2011

bonds worth 160 million dollars. Another agreement with the commercial banks to help to meet the short term and medium financing whenever needed. Foreign investment also effected due to the freezing of FCAs because GDP growth started to decline and gross investments in each sector affected and go downward. Inconsistent policies of the government had significantly effect on the foreign investment and with this effect the confidence of the investors was declined. Private investment in 1990s was 6.8% of the GDP but after the Freezing FCAs it became less than 1.7% of the GDP. Some economic factors were also included to discourage the investors. There was a negative impact of freezing FCAs on FDI in the year of 1998 due to the nuclear test by the Government of Pakistan in response of India. There is recession period of Pakistan economy between the years of 1998 to 2000. There in net decrease in FDI $614 in just four years. This was only due to the freezing accounts by the GOP. Because of freezing of accounts affect the confidence of the investors. But after 2002 the good policy of the Pakistan Government leaves the positive impact on the economy of Pakistan which especially provides the confidence and secures the internal and external investors (Husain, 2006). Therefore, Hyder (2001) suggested that implementation of some regulations or reforms were requires to the government of Pakistan to remove the adverse impact on the foreign investor confidence. Some suggestions were: 1. Policy should be made regarding less custom duty on the import of heavy plant and machinery; 2. Real interest rates should be reduced to encourage investment; 3. Revise the public sector infrastructure and economic management; 4. Organize the credit facilities for the small and medium enterprises; 5. Granted the tax incentives; and 6. Introduction of Term finance certificates. 8. IMPACT OF FCAS ON FOREIGN EXCHANGE RESERVES Foreign exchange reserves are the currency or the monetary value of the other country which is acceptable by the concerned country, while you are traded something with them. Mostly these reserves are maintained by the countrys central bank. It may be called as reserves or foreign exchange reserves. Foreign exchange reserves are acting as the intermediary between two or more country. When, they are on trading agreement. They use the intermediate monetary term which is acceptable by the both country in exchange of trading goods and services. Those countries that have the surplus balance of foreign reserves get the confidence of the foreign investor. It encourages the private investment with full confidence, when as such situation arises like Pakistan it discourages the current and prospective investors e.g. freezing the FCAs. Globally, there was upward trend in the holding of foreign reserves and facility was provided to residents to open an account in foreign currency those days. The pool of reserves was available to trade freely all over the world. When such FCAs were blocked or froze then a negatively impact was put on foreign exchange reserves. Much surplus was obtained after the freezing of FCAs but it was only one-time benefit for the government of Pakistan because the investors confidence was lacking and foreign remittances and reserves were decreased. Now, too much time is needed to rebuild the confidence of the private investor. Williams (2005) reported that foreign exchange is most important factor to make the economy strong and FCAs are the huge source of creating foreign reserves. Hayder et al. (2003) expressed in concluding remarks that Pakistan economy suffers a lot since last decades when the private investment was blocked. Further, private investment will influence the growth rate of the economy and the most other sectors also, like; banking, agriculture, business as well as capital market. Private investment enhancement becomes more prosperity plan for the economy of the Pakistan. They have to develop a master plan for the revival of the private investment to stable and growth economy. In contrast, Mahmood et al. (2008) reported that economy of Pakistan will remain all the time under stress due to the high fiscal policies and unfair economic growth, insufficient employment opportunities and poverty levels. Therefore, different experimental decisions should be implemented by the government of Pakistani government in order to regulate the economy. 9. CONCLUSIONS AND RECOMMENDATIONS This paper fills the important gap in the literature regarding freezing the foreign currency accounts. The main theme was to identify the impact of freezing on different economic and financial stability indicators of Pakistan such as: banking sector, balance of payment, foreign direct investment, exports, foreign exchange reserves, and exchange rate. The results conclude that decision of freezing FCAs become the cause of huge disaster for the economy of Pakistan. Specifically banking sector domestic banks and foreign banks of Pakistan was greatly affected from this decision in positive and negative manners. A positive impact was found of this decision on domestic banks because it was a great chance of enhancement in branch networking. Whereas a negative impact was found on foreign banks and they were started to left or amalgamate. Resultantly, economy of Pakistan cut from the global banking system.

Australian Journal of Business and Management Research

Vol.1 No.6 [01-06] | September-2011

An adverse impact was found of freezing the FCAs on balance of payment of Pakistan. A vital role was played by the interest rate along with the decision of freezing FCAs and put a significant negative impact on foreign direct investment, foreign remittances, foreign exchange reserves and foreign exchange rate. Foreign exchange reserves were insufficient and demands were increased of foreign exchange, however, exchange rate was increased and the currency was also devaluated. Consequently, the imported goods were more costly due to the decrease in purchasing power to acquire foreign currency; the prices of commodities were going upward. In this result, the inflation rate was going upward and it was cost push inflation in the economy. Moreover, it was suggested by the researcher that: some policies are required which will be consistent and beneficial for the both government and investors; policy makers should have to implement such policy that will benefit to the economy for long run not for short run; Pakistan should have to enhance its export for increasing its foreign reserves and for that purpose the Pakistani Government should facilitate the exporters and reduce the tariff rate; borrow domestically to reduce the fiscal expenditures and to reduce the foreign debt; formed policies to reduce the capital outflows and encourage the capital inflows; create opportunity to invest like to least the energy crises and the revival of the industries which also provide the employment and reduce the unemployment rate; foreign remittances are mostly through the illegal ways like bill of exchange. Legalize these transactions to reduce the charges on transactions through bank to bank; Pakistani Government also enhances the relationship with the Financial Institution such as ADB (Asian Development Bank), IMF (International Monetary Fund), and with WB (World Bank); and further these thing which are the most important the political internal stability, which lead the confidence of the internal and external investors in the country (Williamson, 1998). REFERENCES 1. Ayaz, A. E. (1998). A Simulation Analysis of the Debt Prolem in Pakistan. The Pakistan Developoment Review, 37(4), 355-376. 2. Detragiache, S. B. (1994). The Role of Multilateral Institution in the Market for Sovereign Debt. The Scandinavian Journal of Economics , 96( 4),515-529. 3. Hanif. N, M. (2003). Restructuring of Financial Sector in Pakistan. The Journal of the Institute of Bankers in Pakistan, 1-29. 4. Husain, A. M. (2006). Choosing the Right Exchange Rate Regime for pakistan. SBP Research Bulletin. 5. Hyder, K. A. (2004). Why Pivate Invstment in Pakistan Has Collasped and How It Can Be Restored. Lahore journal of Economics , 107-128. 6. Hyder, Kalim & Ahmed, Q. M. (2003). "Why Private Investment In Pakistan Has Collapsed And How It Can Be Restored," MPRA Paper 16251, University Library of Munich, Germany, revised 01 Jan 2004. 7. Ishfaq. M. & Chaudhary, M. A. (1999). Fiscal deficits and Debt Dimension of Pakistan. The Pakistan Developmnt Review, 1067-1080 8. Ismail, H. A. (1999). Unsustainability of the Balance of Payments. policy paper No.16 . 9. Kazami, S. H. (2000). Foreign Banks in Pakistan. Retrieved from: http://www.pakistaneconomist.com/database2/cover/c99-20.asp 10. Khan, M. A., & Khan, S. (2007). Financial Sector Restructuring in Pakistan. MPRA Working Paper No. 4141, Retrieved from http://mpra.ub.uni-muenchen.de/4141/ 11. Khan, M. Z. (1998). Trasforming Banking in Pakistan. Retrieved from: http://www.adb.org/Documents/Books/Rising_to_the_Challenge/Pakistan/1-pak-mac.pdf 12. SBP. (2003). Annual Report. Retrieved from: http://www.sbp.org.pk/publications/index2.asp 13. Williams, D. M. (2005). Foreign Exchange Reserves: How Much is Enough? Twentieth Adlith Brown Memorial. Bahamas. 14. Williamson, J. (1998). Pakistan and World Economy.

You might also like

- Enhance Organizational Creativity and Performance: An Empirical Investigation" Has Been Accepted For Publication inDocument1 pageEnhance Organizational Creativity and Performance: An Empirical Investigation" Has Been Accepted For Publication inAli Raza SultaniNo ratings yet

- CSR and CFPDocument6 pagesCSR and CFPAli Raza SultaniNo ratings yet

- Comparison of Financial PerformanceDocument10 pagesComparison of Financial PerformanceSana SheikhNo ratings yet

- Financial Comparirison Between Private and Public BankDocument9 pagesFinancial Comparirison Between Private and Public BankAmit PratapNo ratings yet

- Leasing Companies ComparisonDocument6 pagesLeasing Companies ComparisonAli Raza SultaniNo ratings yet

- Attraction of Students Towards Beauty Products PDFDocument5 pagesAttraction of Students Towards Beauty Products PDFRizka Sarastri SumardionoNo ratings yet

- Venture Capital Sector - in PakistanDocument6 pagesVenture Capital Sector - in PakistanAli Raza SultaniNo ratings yet

- Financial Sector Reforms and ImpactsDocument12 pagesFinancial Sector Reforms and ImpactsAli Raza SultaniNo ratings yet

- Impact of Privatization On State Owned CompaniesDocument9 pagesImpact of Privatization On State Owned CompaniesAli Raza SultaniNo ratings yet

- Financial Performance of NBFCsDocument13 pagesFinancial Performance of NBFCsAli Raza SultaniNo ratings yet

- Financial Pefomance of LeasingDocument7 pagesFinancial Pefomance of LeasingAli Raza SultaniNo ratings yet

- Factors Attracting FDI Inflow in ChinaDocument10 pagesFactors Attracting FDI Inflow in ChinaAli Raza Sultani100% (1)

- Customer Satisfaction Towars Islamic BankingDocument9 pagesCustomer Satisfaction Towars Islamic BankingAli Raza SultaniNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tata Starbucks LTD A Strategic Analysis PDFDocument28 pagesTata Starbucks LTD A Strategic Analysis PDFAlia AkhtarNo ratings yet

- Unit 2 Kiều Văn Kiên - 1811110301Document3 pagesUnit 2 Kiều Văn Kiên - 1811110301Kiều Văn KiênNo ratings yet

- Fdi-Growth Nexus in Africa: Does Governance Matter?: University of Ibadan, NigeriaDocument25 pagesFdi-Growth Nexus in Africa: Does Governance Matter?: University of Ibadan, NigeriamusaNo ratings yet

- BajajcorpDocument317 pagesBajajcorpPrabha ChelladuraiNo ratings yet

- Brief History of Nestle Malaysia Management EssayDocument11 pagesBrief History of Nestle Malaysia Management EssaydluvjkpopNo ratings yet

- IATI Annual Review: Israel ICT IndustryDocument85 pagesIATI Annual Review: Israel ICT IndustrywolffffffNo ratings yet

- HFCL Annual Report 2016 17Document204 pagesHFCL Annual Report 2016 17abchbvNo ratings yet

- COHA Academic ReportDocument22 pagesCOHA Academic ReportadmincohaNo ratings yet

- Top Seven Changes in India's Business EnvironmentDocument12 pagesTop Seven Changes in India's Business Environmentamitsingla19No ratings yet

- TAPP Forum 2014 - Speech - JFC Pres. - AmCham Rhicke JenningsDocument4 pagesTAPP Forum 2014 - Speech - JFC Pres. - AmCham Rhicke JenningsArangkada PhilippinesNo ratings yet

- SWOT (Strength, Weakness, Opportunities and Threats) Analysis of Fast Moving Consumer Goods (FMCG) Industries in IndiaDocument10 pagesSWOT (Strength, Weakness, Opportunities and Threats) Analysis of Fast Moving Consumer Goods (FMCG) Industries in IndiaRonieeNo ratings yet

- Germany AnalysisDocument26 pagesGermany AnalysisSadaf Fayyaz100% (2)

- Globalization (Globalisation) in Its Literal Sense Is The Process of Transformation ofDocument21 pagesGlobalization (Globalisation) in Its Literal Sense Is The Process of Transformation ofsaraeduNo ratings yet

- Review of India's 25 Years of LPG ReformsDocument13 pagesReview of India's 25 Years of LPG ReformsHrashit IssarNo ratings yet

- Omnichannel Overview - Indian Retail Market 2018Document10 pagesOmnichannel Overview - Indian Retail Market 2018Mahima AgarwalNo ratings yet

- Investment Banking Industry Analysis Report PDFDocument46 pagesInvestment Banking Industry Analysis Report PDFricky franklinNo ratings yet

- DIPPDocument76 pagesDIPPchavvisaluja100% (1)

- Understanding India's Balance of PaymentsDocument19 pagesUnderstanding India's Balance of Paymentsthexplorer008No ratings yet

- Pestle Country Analysis Report Sip FinalDocument60 pagesPestle Country Analysis Report Sip FinalReem FatimaNo ratings yet

- Special GK Updates June BankersaddaDocument11 pagesSpecial GK Updates June Bankersaddabalu56kvNo ratings yet

- A Study of The Critical Success Factors and Drawbacks For Cross Border Investments - A Case For The Banking Sector in Zimbabwe.Document110 pagesA Study of The Critical Success Factors and Drawbacks For Cross Border Investments - A Case For The Banking Sector in Zimbabwe.Omen_Muza100% (1)

- Basic documents for NBFC registrationDocument4 pagesBasic documents for NBFC registrationJeny ShahNo ratings yet

- APPSC Material For The General StudiesDocument10 pagesAPPSC Material For The General StudiesSivakumar AkkariNo ratings yet

- Commercial Diplomacy and International BusinessDocument42 pagesCommercial Diplomacy and International BusinessLoredana GheorgheNo ratings yet

- NEATCM Document IDs and NamesDocument318 pagesNEATCM Document IDs and NamesSanjay GiriNo ratings yet

- IuvasDocument4 pagesIuvasDoina BegaNo ratings yet

- Unit 1 Stages of InternationalizationDocument15 pagesUnit 1 Stages of InternationalizationDivya KakranNo ratings yet

- Ministry of Education Fiji Year 13 Certificate Examination 2017Document45 pagesMinistry of Education Fiji Year 13 Certificate Examination 2017C3real KillerNo ratings yet

- Globalisation - A-Level EconomicsDocument15 pagesGlobalisation - A-Level EconomicsjannerickNo ratings yet

- LLM Corporate Law SyllabusDocument10 pagesLLM Corporate Law SyllabusCorpsons MgtNo ratings yet