Professional Documents

Culture Documents

Sahaj2012 14

Uploaded by

DrPraveen Kumar TyagiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sahaj2012 14

Uploaded by

DrPraveen Kumar TyagiCopyright:

Available Formats

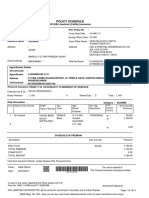

2012-13 ITR-1, PAGE 1

ITR-1

A1 FIRST NAME A3 LAST NAME

SAHAJ INDIAN INDIVIDUAL INCOME TAX RETURN AY 2012-13

A2 MIDDLE NAME A4 PERMANENT ACCOUNT NUMBER

A5 SEX

A6 DATE OF BIRTH

A7 INCOME TAX WARD/CIRCLE

; Male ; Female

D D MM Y Y Y Y

A9 ROAD/STREET A11 TOWN/CITY/DISTRICT

A8 FLAT/DOOR/BUILDING

A10 AREA/LOCALITY

A12 STATE

A13 PINCODE

A14 EMAIL ADDRESS

A15 RESIDENTIAL/OFFICE PHONE NO. WITH STD CODE A16 MOBILE NO. A17 Fill only one if you belong to 9 ; Government 9 ; PSU A18 Fill only one 9 ; Tax Refundable 9 ; Tax Payable 9 ; Nil Tax Balance A19 Fill only one 9 ; Resident A20 Fill only one: filed A21 If revised

Receipt Number of Original Return

9 9 9

; Others

153A/153C

; Non Resident 9 ; Resident but not ordinarily resident

9

Before due date-139(1)

After due date-139(4)

Revised Return-139(5) OR in response to notice

142(1)

148

and

D D MM Y Y Y Y

Date of Filing Original Return

PART B - GROSS TOTAL INCOME

B1 Income from Salary/Pension

NOTE Ensure to fill Sch TDS1 given in Page 2

Whole-Rupee(`) only. B1

7 If showing loss, mark the negative sign in bracket at left

B2 Income from One House Property B3 Income from other sources

NOTE Ensure to fill Sch TDS2 given in Page 2

B2 B3 B4 C2 80CCC C5 80D C8 80E C11 80GGA C14 C15

(-) (-) (-)

C3 80CCD C6 80DD C9 80G C12 80GGC

B4 Gross Total Income (B1 + B2 + B3)

PART C - DEDUCTIONS AND TAXABLE TOTAL INCOME

C1 C1

80C

C4 80CCF to C7 80DDB C10 80GG C13

C13 80U C14 Total Deductions ( Add items C1 to C13 ) C15 Taxable Total Income( B4 - C14 )

FOR OFFICIAL USE ONLY

(-)

STAMP RECEIPT NO. HERE

SEAL, DATE AND SIGNATURE OF RECEIVING OFFICIAL

PERMANENT ACCOUNT NUMBER

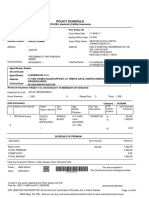

2012-13 ITR-1, PAGE 2

PART DTAX COMPUTATION AND TAX STATUS

D1 Tax Payable On Total Income(C15) to D3 D1 D4 Relief u/s 89 to D6 D4 D7 Total Interest u/s 234A/234B/234C to D9 D7 D10 Total Self Assessment Tax Paid to D12 D10 D13 Tax Payable ( D8-D12, If D8>D12) to D14 D13 Secondary & Higher Education Cess TOTAL TAX AND CESS ( D1+ D2 )

D2

Relief u/s 90/91

D3

Balance Tax After Relief ( D3-D4-D5)

D5

Total Tax and Interest (D6+D7)

D6

Total Advance Tax Paid

D8

Total TDS Claimed

D9

Total Prepaid Taxes ( D9+D10+D11)

D11

Refund ( D12D8, If D12 >D8 )

D12

D14

Bank Account Details ( Mandatory in all cases irrespective of refund due or not)

D15 ACCOUNT No. 9D16 MICR CODE 9D17 Type of account: 9 ; Current 9 ; Savings 9D18 Fill only one: Refund by 9 ; cheque or 9 ; deposited directly into your bank account 9D19 Exempt income only for reporting purposes

9

VERIFICATION

I, 9 son/ daughter of 9 solemnly declare that to the best of my knowledge and belief, the information given in the return is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2012-13. Place

D D MM Y Y Y Y

9 9

SIGN HERE

TRP Signature

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below Name of the TRP TRP PIN [ 10 Digit ] Amount to be paid to TRP

Sch IT - DETAILS OF ADVANCE TAX AND SELF ASSESSMENT TAX PAYMENTS

BSR CODE(col.i) DATE OF DEPOSIT(col.ii)

9

CHALLAN NO(col.iii)

TAX PAID(col.iv)

9

R1 R2 R3 R4 R5

D D D D D

D D D D D

MM MM MM MM MM

Y Y Y Y Y

Y Y Y Y Y

Y Y Y Y Y

Y Y Y Y Y

NOTE (1) Enter the totals of Advance Tax and Self Assessment Tax in D9 and D10 (2) Continue in Supplementary Schedule IT if you cannot fill within Sch IT

Sch TDS1 - DETAILS OF TAX DEDUCTED AT SOURCE FROM SALARY

TAN(col.i) NAME OF THE EMPLOYER(col.ii)

9 9

[As per Form 16 issued by Employer(s)]

TAX DEDUCTED(col.iv)

9

INCOME UNDER SALARY(col.iii)

S1 S2 S3

NOTE

TAN(col.i)

(1) Enter the total of column (iv) of Sch TDS1 and column (vi)of Sch TDS2 in D11 (2) Continue in Supplementary Schedule TDS1 if you cannot fill within Sch TDS1

Sch TDS2 - DETAILS OF TAX DEDUCTED AT SOURCE FROM INCOME OTHER THAN SALARY [As per Form 16A issued by Deductor(s)]

NAME OF THE DEDUCTOR (col.ii)

9 9

UNIQUE TDS CER. NO(col.iii)

9

DEDUCTED YEAR(col.iv)

TAX DEDUCTED(col.v)

9 9

AMT OUT OF(v) CLAIMED THIS YR(col vi)

T1 T2 T3 T4

Y Y Y Y

Y Y Y Y

Y Y Y Y

Y Y Y Y

NOTE (1) Enter the total of column (iv) of Sch TDS1 and column (vi)of Sch TDS2 in D11

(2) Continue in Supplementary Schedule TDS2 if you cannot fill within Sch TDS2

PERMANENT ACCOUNT NUMBER FIRST NAME MIDDLE NAME LAST NAME

AY 2012-13

SUPPLEMENTARY SCHEDULE TDS 1(To be used only after exhausting items S1-S3 of Schedule TDS1 in main form etc)

TAN(col.i) NAME OF THE EMPLOYER(col.ii)

9 9

INCOME UNDER SALARY(col.iii)

9

TAX DEDUCTED(col.iv)

S4 S5 S6 S7 S8 S9 S10 S11 S12 S13 S14 S15 S16 S17 S18 S19 S20 S21 S22 S23 S24 S25 S26 S27 S28 S29 S30

PERMANENT ACCOUNT NUMBER FIRST NAME MIDDLE NAME LAST NAME

AY 2012-13

SUPPLEMENTARY SCHEDULE TDS 2 (To be used only after exhausting items T1-T4 of Schedule TDS2 in main form etc)

TAN(col.i) NAME OF THE DEDUCTOR (col.ii)

9 9

UNIQUE TDS CER. NO(col.iii)

9

DEDUCTED YEAR(col.iv)

TAX DEDUCTED(col.v)

9 9

AMT OUT OF(v) CLAIMED THIS YR(col vi)

T5 T6 T7 T8 T9 T10 T11 T12 T13 T14 T15 T16 T17 T18 T19 T20 T21 T22 T23 T24 T25 T26 T27 T28 T29 T30 T31

YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY YYYY

PERMANENT ACCOUNT NUMBER FIRST NAME MIDDLE NAME LAST NAME

AY 2012-13

SUPPLEMENTARY SCHEDULE IT(To be used only after exhausting items R1-R5 of Schedule IT in main form etc)

BSR CODE(col.i) DATE OF DEPOSIT(col.ii)

9

CHALLAN NO(col.iii)

9 9

TAX PAID(col.iv)

R6 R7 R8 R9 R10 R11 R12 R13 R14 R15 R16 R17 R18 R19 R20 R21 R22 R23 R24 R25 R26 R27 R28 R29 R30 R31 R32

D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y D D MM Y Y Y Y

You might also like

- 4001 4607Document1,214 pages4001 4607DrPraveen Kumar TyagiNo ratings yet

- 3799 - 4000Document404 pages3799 - 4000DrPraveen Kumar TyagiNo ratings yet

- Itr 2Document7 pagesItr 2Mukesh GoelNo ratings yet

- InTech-Clinical Approach To The Repeat Breeder Cow SyndromeDocument27 pagesInTech-Clinical Approach To The Repeat Breeder Cow SyndromeDrPraveen Kumar TyagiNo ratings yet

- Hound of BaskervillesDocument28 pagesHound of BaskervillesNuestra Lengua Spanish CentreNo ratings yet

- Ameliorating Effect of Tulsi (Ocimum Sanctum) Leaf Powder On Pathology of Salmonella Gallinarum Infection in Broiler ChickensDocument5 pagesAmeliorating Effect of Tulsi (Ocimum Sanctum) Leaf Powder On Pathology of Salmonella Gallinarum Infection in Broiler ChickensDrPraveen Kumar TyagiNo ratings yet

- Hound of BaskervillesDocument28 pagesHound of BaskervillesNuestra Lengua Spanish CentreNo ratings yet

- AstrofncDocument5 pagesAstrofncDrPraveen Kumar TyagiNo ratings yet

- Sample Question Paper - 2011 Class - X Subject - Science (PHYSICS / CHEMISTRY)Document5 pagesSample Question Paper - 2011 Class - X Subject - Science (PHYSICS / CHEMISTRY)sohial133No ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Eileen Nauman-Medical AstrologyDocument363 pagesEileen Nauman-Medical Astrologyapollinia54100% (8)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Who Gsap 2017Document56 pagesWho Gsap 2017Mirzania Mahya FathiaNo ratings yet

- Accord Textiles LimitedDocument41 pagesAccord Textiles LimitedSyed Ilyas Raza Shah100% (1)

- Agile Data Warehouse Design For Big Data Presentation (720p - 30fps - H264-192kbit - AAC) PDFDocument90 pagesAgile Data Warehouse Design For Big Data Presentation (720p - 30fps - H264-192kbit - AAC) PDFMatian Dal100% (2)

- ASAP Current Approved Therapists MDocument10 pagesASAP Current Approved Therapists MdelygomNo ratings yet

- Unsettling Race and Language Toward A RaDocument27 pagesUnsettling Race and Language Toward A Ra1dennys5No ratings yet

- Maya Aztec Inca Reading HandoutDocument2 pagesMaya Aztec Inca Reading Handoutapi-234989244No ratings yet

- Investment Evaluation MethodDocument13 pagesInvestment Evaluation MethodBAo TrAmNo ratings yet

- The Ancient CeltsDocument2 pagesThe Ancient CeltsArieh Ibn GabaiNo ratings yet

- Fondazione Prada - January 2019Document6 pagesFondazione Prada - January 2019ArtdataNo ratings yet

- Uttarakhand NTSE 2021 Stage 1 MAT and SAT Question and SolutionsDocument140 pagesUttarakhand NTSE 2021 Stage 1 MAT and SAT Question and SolutionsAchyut SinghNo ratings yet

- A Reply - Lee Epstein, Gary KingDocument19 pagesA Reply - Lee Epstein, Gary KingAdam PeaseNo ratings yet

- Late Birth Registration Form for KenyaDocument2 pagesLate Birth Registration Form for KenyaSarati80% (5)

- Municipal Best Practices - Preventing Fraud, Bribery and Corruption FINALDocument14 pagesMunicipal Best Practices - Preventing Fraud, Bribery and Corruption FINALHamza MuhammadNo ratings yet

- Medicina Musica Amistad y Prejuicios BrahmsDocument3 pagesMedicina Musica Amistad y Prejuicios BrahmsBreen MisiNo ratings yet

- Hitachi Energy BESS PQpluSDocument9 pagesHitachi Energy BESS PQpluSelpancaseroNo ratings yet

- Day1 S2 Gravity IntroDocument21 pagesDay1 S2 Gravity IntroPedro Hortua SeguraNo ratings yet

- Penrock Seeds Catalogue Closing Down SaleDocument26 pagesPenrock Seeds Catalogue Closing Down SalePaoloNo ratings yet

- Second Assessment - Unknown - LakesDocument448 pagesSecond Assessment - Unknown - LakesCarlos Sánchez LópezNo ratings yet

- Akhtar Non IT RecruiterDocument3 pagesAkhtar Non IT RecruiterMohiddinNo ratings yet

- Tso C139Document5 pagesTso C139Russell GouldenNo ratings yet

- The Impact of E-Commerce in BangladeshDocument12 pagesThe Impact of E-Commerce in BangladeshMd Ruhul AminNo ratings yet

- Classical Dances of India Everything You Need To Know AboutDocument18 pagesClassical Dances of India Everything You Need To Know AboutmohammadjakeerpashaNo ratings yet

- The Crown - Episode 7Document7 pagesThe Crown - Episode 7Grom GrimonNo ratings yet

- Smart GridDocument22 pagesSmart GridSuman Jothi Gesan75% (4)

- Economics For Competition Lawyers - ADP Part OnlyDocument44 pagesEconomics For Competition Lawyers - ADP Part Onlyeliza timciucNo ratings yet

- FREE MEMORY MAPS FOR ECONOMICS CHAPTERSDocument37 pagesFREE MEMORY MAPS FOR ECONOMICS CHAPTERSRonit GuravNo ratings yet

- MCQ Human RightsDocument30 pagesMCQ Human RightsSameer PrasadNo ratings yet

- 19 Preposition of PersonalityDocument47 pages19 Preposition of Personalityshoaibmirza1No ratings yet

- InterContinental Global Etiquette Compendium FO backTVDocument12 pagesInterContinental Global Etiquette Compendium FO backTVGian SyailendraNo ratings yet

- Taylor Campbell FeatureDocument5 pagesTaylor Campbell Featureapi-666625755No ratings yet