Professional Documents

Culture Documents

Objectives and Purpose of Accounting

Uploaded by

Ella SimoneCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Objectives and Purpose of Accounting

Uploaded by

Ella SimoneCopyright:

PURPOSE of Accounting

Purpose means an intention, a goal or intended result of effort. The intention or purpose of accounting is to help various financial users see the over-all and/or true picture of businesses, organizations or entities in quantitative, economic and/or financial terms. The processes and activities involved in accounting help the business owners and users of financial information in surviving economically. People inside the organization must have the right information in the right time to monitor and keep due control in managing the affairs of the entity, and make decisions and implement strategies so to ensure that the entity continues to operate and remain in business year after year and so on and on. Thus, it is necessary that the financial information presented thru financial reports must be timely, understandable, relevant, reliable and complete.

OBJECTIVES of Accounting

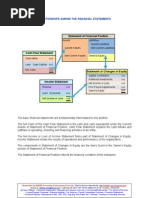

The objective of Accounting is to provide users with useful information for economic and decision-making study and judgments. Businesses are established for the purpose of earning profit. To determine whether the business earned profit or suffered losses is thru the preparation of the so-called Income Statement in which the revenues, gains, costs to operate and expenditures are shown. Income Statement is usually prepared periodically. Aside from determining profit or losses, it is also important to financial users to know the financial standing of the business. The so-called Statement of Financial Position (SFP) is prepared for this purpose. SFP formerly known as Balance Sheet shows the resources of the entity and the claims against these resources. Resources of the entity are called Assets while the claims against the assets by creditors and owners are the so-called Liabilities and Owners Equities (or Capital). SFP shows the financial condition of the entity on a particular day, and usually, it is prepared at the end of the period. The information provided helps the users evaluate the amounts, timing, and uncertainty of the entitys future cash receipts and disbursements. Cash-related activities of the entity are reflected thru the so-called Statement of Cash Flow. Future cash receipts and disbursements are planned thru the strategic planning activities made by management and key people inside the organization and expressed thru the budgeting process. Management, business owners and financial users also use various accounting data and financial reports in carrying-out efficiently, effectively and properly the day-to-day operations and affairs of the organization especially in managing, planning, organizing, monitoring and controlling its various transactions, economic events, and activities.

Researched by WBBBB Accounting & Management Services. Click & visit our internet site: http://wbbbb-ams.blogspot.com/ Email us: wbbbb.ams@gmail.com Call/Text CP: 0917 767 78 56 / 0908 741 97 42 Call DL: 378 54 04 Services Offered: Business Registration Management Advisory Services Accounting/Bookkeeping Tax Advisory/Services Loans/Projects Proposals External Auditing Tax Returns Payroll Computation Services Financial Statements Financial Reports Assistance to SEC, BIR, SSS, Pag-ibig, Phil-health, etc Tutorials, Training or Consulting Services

You might also like

- Conceptual Framework of AccountingDocument29 pagesConceptual Framework of AccountingAllen Darryl Valmoria100% (1)

- Lecture 1 Introduction To AccountingDocument72 pagesLecture 1 Introduction To AccountingLinnea KulunduNo ratings yet

- Topic One: Introduction To Financial AccountingDocument20 pagesTopic One: Introduction To Financial AccountingZAKAYO NJONYNo ratings yet

- 05: Accounting PrinciplesDocument26 pages05: Accounting PrinciplesMarlaNo ratings yet

- Accounting Principles Assignment - LO1Document9 pagesAccounting Principles Assignment - LO1Deb OraNo ratings yet

- Importance of Accounting for Business DecisionsDocument4 pagesImportance of Accounting for Business DecisionsRechie Gimang AlferezNo ratings yet

- AccountingDocument57 pagesAccountingReynaldo Jose Alvarado RamosNo ratings yet

- What Is AccountingDocument49 pagesWhat Is AccountingMay Myoe KhinNo ratings yet

- Phao Intorsuction AcccotuingDocument14 pagesPhao Intorsuction AcccotuingPhạm Thùy DươngNo ratings yet

- Assignment FA 01 Agnelo LoboDocument6 pagesAssignment FA 01 Agnelo LoboLily SequeiraNo ratings yet

- Introduction To Finance and AccountingDocument38 pagesIntroduction To Finance and AccountingDr.Ashok Kumar PanigrahiNo ratings yet

- Financial and Managerial Accounting AssignmentDocument10 pagesFinancial and Managerial Accounting AssignmentAbdul AhmedNo ratings yet

- Accounting Defination and Basic TermsDocument10 pagesAccounting Defination and Basic TermsJahanzaib ButtNo ratings yet

- Uniathena - Basic Accounting CourseDocument21 pagesUniathena - Basic Accounting CourseAdalia MahabirNo ratings yet

- Accounting Communicates Business ResultsDocument60 pagesAccounting Communicates Business Resultsharish100% (1)

- Lecture Week 1Document11 pagesLecture Week 1abdul rehmanNo ratings yet

- Nature and Context of AccountingDocument43 pagesNature and Context of AccountingpalpitopitooNo ratings yet

- Modules 1Document4 pagesModules 1JT GalNo ratings yet

- Meeting Agency Reporting RequirementsDocument21 pagesMeeting Agency Reporting RequirementslrrcenterNo ratings yet

- Lesson One AccountsDocument7 pagesLesson One AccountslucyotienoNo ratings yet

- DM102 WK1 13Document68 pagesDM102 WK1 13Licht ZoraNo ratings yet

- AccountingDocument129 pagesAccountingearl nerpio100% (1)

- Bridge Course Accounting and Finance: MBA Class of 2022Document20 pagesBridge Course Accounting and Finance: MBA Class of 2022Mahima GirdharNo ratings yet

- Financial Accounting (Notes)Document31 pagesFinancial Accounting (Notes)Riti Khandelwal100% (1)

- Unit 1 KMBN103Document16 pagesUnit 1 KMBN103Anuj YadavNo ratings yet

- Accounts 1Document14 pagesAccounts 1Piyush PatelNo ratings yet

- Financial Resources Is The Lifeblood of AnDocument14 pagesFinancial Resources Is The Lifeblood of AnDante RevamonteNo ratings yet

- INTRODUCTION TO ACCOUNTING - NotesDocument8 pagesINTRODUCTION TO ACCOUNTING - NotesSolostaticNo ratings yet

- Financial Accounting UpdatedDocument98 pagesFinancial Accounting UpdatedbalagurudevNo ratings yet

- Accounting and Book Keeping NotesDocument15 pagesAccounting and Book Keeping NotesWesley SangNo ratings yet

- GAURAVDocument12 pagesGAURAVSaurabh MishraNo ratings yet

- Ratio Analysis of CompanyDocument51 pagesRatio Analysis of CompanyMohammad Ajmal AnsariNo ratings yet

- A Study On Financial Statement Analysis in Mokshwa Soft Drinks at CoimbatoreDocument23 pagesA Study On Financial Statement Analysis in Mokshwa Soft Drinks at Coimbatorek eswariNo ratings yet

- Accounting For Managers ExtraDocument6 pagesAccounting For Managers ExtraNantha KumaranNo ratings yet

- A Study On Financial Statement Analysis in J.q.tyreDocument79 pagesA Study On Financial Statement Analysis in J.q.tyrek eswariNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- Cash Flow StatementDocument39 pagesCash Flow StatementBollu TulasiNo ratings yet

- AFM-Cash Flow StatementDocument14 pagesAFM-Cash Flow StatementkanikaNo ratings yet

- Basics of AccountingDocument97 pagesBasics of AccountingBlogylabNo ratings yet

- Financial Accounting NotesDocument44 pagesFinancial Accounting NotesVansh TayalNo ratings yet

- Synthesis Paper - Bookkeeping and Financial StatementsDocument2 pagesSynthesis Paper - Bookkeeping and Financial StatementsJeremie GloriaNo ratings yet

- Week 1 AccDocument24 pagesWeek 1 AccLawrence MosizaNo ratings yet

- Conecepts and Convention Journal NotesDocument25 pagesConecepts and Convention Journal NotesSWAPNIL BHISE100% (1)

- Understanding Financial Accounting FundamentalsDocument32 pagesUnderstanding Financial Accounting FundamentalsbhojNo ratings yet

- Definition of AccountingDocument16 pagesDefinition of AccountingPutrie Maamor MidtimbangNo ratings yet

- Financial AccountingDocument10 pagesFinancial AccountingMeenakshi SeerviNo ratings yet

- Financial Management ReportDocument27 pagesFinancial Management ReportCristine CatalunaNo ratings yet

- Day 2 Finman p2Document6 pagesDay 2 Finman p2Ericka DeguzmanNo ratings yet

- Financial statement analysis of Tensile Pro PipesDocument89 pagesFinancial statement analysis of Tensile Pro PipeseshuNo ratings yet

- A Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyDocument62 pagesA Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyeshuNo ratings yet

- Accounting Lecture 1Document7 pagesAccounting Lecture 1Hamza MajeedNo ratings yet

- Mustafa Akbarzai Full AnallysisDocument91 pagesMustafa Akbarzai Full AnallysisHashir KhanNo ratings yet

- Chapter 1: Introduction To AccountingDocument17 pagesChapter 1: Introduction To AccountingPALADUGU MOUNIKANo ratings yet

- Accounting System Importance for Business Management and GrowthDocument3 pagesAccounting System Importance for Business Management and GrowthHussain MuslimNo ratings yet

- AE13A Introduction To AccountingDocument33 pagesAE13A Introduction To AccountingSherylLiquiganNo ratings yet

- Objectives and Users of Accounting InformationDocument4 pagesObjectives and Users of Accounting InformationNidhi PrasadNo ratings yet

- BVNBNBDocument2 pagesBVNBNBAriadnaNo ratings yet

- Finance Manager Role in Business SustainabilityDocument10 pagesFinance Manager Role in Business SustainabilityImmanuel Billie AllenNo ratings yet

- Conceptual Framework - 0Document9 pagesConceptual Framework - 0alabaaleahmarieNo ratings yet

- BIR Form 1901Document1 pageBIR Form 1901Abdul Nassif Faisal80% (5)

- BIR Form No. 1901 Personal ExemptionsDocument1 pageBIR Form No. 1901 Personal ExemptionsBasil Maramag CastañoNo ratings yet

- PhilHealth Penalties For Non-Remitting and Non-Reporting EmployersDocument1 pagePhilHealth Penalties For Non-Remitting and Non-Reporting EmployersElla SimoneNo ratings yet

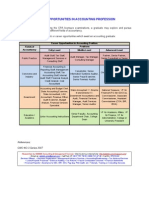

- Career Opportunities in Accounting ProfessionDocument1 pageCareer Opportunities in Accounting ProfessionElla SimoneNo ratings yet

- Relationships Among The Financial StatementsDocument1 pageRelationships Among The Financial StatementsElla Simone100% (1)

- DTI Business Name Application FormDocument2 pagesDTI Business Name Application FormYourtv Inyourpc100% (6)

- Relationships Among The Financial StatementsDocument1 pageRelationships Among The Financial StatementsElla Simone100% (1)

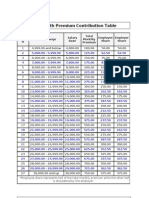

- Phil Health Contribution TableDocument1 pagePhil Health Contribution TableElla SimoneNo ratings yet

- Going Concern AssumptionDocument1 pageGoing Concern AssumptionElla SimoneNo ratings yet

- Diagram of Conceptual FrameworkDocument1 pageDiagram of Conceptual FrameworkElla Simone100% (4)

- SSS Contribution TableDocument1 pageSSS Contribution TableElla SimoneNo ratings yet

- Periodicity AssumptionDocument1 pagePeriodicity AssumptionElla SimoneNo ratings yet

- Economic Entity AssumptionDocument1 pageEconomic Entity AssumptionElla SimoneNo ratings yet

- Monetary Unit AssumptionDocument1 pageMonetary Unit AssumptionElla SimoneNo ratings yet

- Specialized Fields and Branches of AccountingDocument2 pagesSpecialized Fields and Branches of AccountingElla Simone100% (2)

- Forms of Business OrganizationDocument1 pageForms of Business OrganizationElla Simone100% (3)

- Accounting EquationDocument1 pageAccounting EquationElla SimoneNo ratings yet

- Nature of AccountingDocument2 pagesNature of AccountingElla Simone100% (5)

- Philippine Regulatory AuthorityDocument1 pagePhilippine Regulatory AuthorityElla SimoneNo ratings yet

- Accounting Processing CycleDocument1 pageAccounting Processing CycleElla SimoneNo ratings yet

- Definition of AccountingDocument1 pageDefinition of AccountingElla Simone100% (1)

- 17.defect Liability Period and Account Closing - en .Wan SaipallahDocument34 pages17.defect Liability Period and Account Closing - en .Wan SaipallaherickyfmNo ratings yet

- Man Acc Qs 1Document6 pagesMan Acc Qs 1Tehniat Zafar0% (1)

- Advanced Accounting: Corporate Liquidations and ReorganizationsDocument43 pagesAdvanced Accounting: Corporate Liquidations and ReorganizationsitaNo ratings yet

- Life Cycle Cost Analysis of Asphalt and Concrete PavementsDocument94 pagesLife Cycle Cost Analysis of Asphalt and Concrete PavementsPeteris SkelsNo ratings yet

- Measuring The Effects of Materialism, Self-Esteem and Influence of Other On Compulsive BuyingDocument104 pagesMeasuring The Effects of Materialism, Self-Esteem and Influence of Other On Compulsive BuyingSyed Hasnain Alam KazmiNo ratings yet

- Ability Abrogation Accent All Abject abrogation Accepted AccordionDocument12 pagesAbility Abrogation Accent All Abject abrogation Accepted AccordionMae Anthonette RamosNo ratings yet

- Session 13 14 Dividend Policy ClassDocument22 pagesSession 13 14 Dividend Policy ClassHenielene Davidson West PariatNo ratings yet

- S Glass Limited: Working Capital Management INDocument34 pagesS Glass Limited: Working Capital Management INtanu srivastava50% (2)

- 5 Steps To Negotiating PaymentDocument39 pages5 Steps To Negotiating PaymentThanh Loan100% (1)

- SUBHAM Micro Finance AssignmentDocument13 pagesSUBHAM Micro Finance AssignmentSubham ChoudhuryNo ratings yet

- General Principles of TaxationDocument25 pagesGeneral Principles of TaxationJephraimBaguyo100% (1)

- Barber Shop Business PlanDocument25 pagesBarber Shop Business PlanStephen FrancisNo ratings yet

- Secretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question Paper PDFDocument2 pagesSecretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question Paper PDFPratik TekawadeNo ratings yet

- Sales Case DigestDocument7 pagesSales Case Digestrian5852No ratings yet

- Vijay ResumeDocument2 pagesVijay ResumeVijay japalaNo ratings yet

- Technology Company FERFICS Secures EUR 1.7 Million Funding: News ReleaseDocument2 pagesTechnology Company FERFICS Secures EUR 1.7 Million Funding: News ReleaseRita CahillNo ratings yet

- Basu (2005) Reinventing Public Enterprises and Its Management As The Engine of Development and Growth PDFDocument15 pagesBasu (2005) Reinventing Public Enterprises and Its Management As The Engine of Development and Growth PDFlittleconspiratorNo ratings yet

- Understanding Basic Accounting TermsDocument17 pagesUnderstanding Basic Accounting TermsShoryamann SharmaNo ratings yet

- Dealership Application FormDocument3 pagesDealership Application Formudhayakumar uNo ratings yet

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Document4 pagesEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNo ratings yet

- Benefits and ServicesDocument26 pagesBenefits and ServicesSushmit ShettyNo ratings yet

- AccDocument6 pagesAccNeha DobeeNo ratings yet

- Referral AgreementDocument1 pageReferral AgreementVenkatesan Manaval100% (1)

- Trading Account PDFDocument9 pagesTrading Account PDFVijayaraj Jeyabalan100% (1)

- What Is A Journal Entry in AccountingDocument20 pagesWhat Is A Journal Entry in AccountingIc Abacan100% (1)

- Tax DoctrinesDocument67 pagesTax DoctrinesMinang Esposito VillamorNo ratings yet

- Talavera Senior High School: Municipal Government of Talavera Talavera, Nueva EcijaDocument32 pagesTalavera Senior High School: Municipal Government of Talavera Talavera, Nueva Ecijaanthony tabudloNo ratings yet

- No E-Mail Address Nationality Institution/Organization Position Country of Residence Parallel Session Full NameDocument3 pagesNo E-Mail Address Nationality Institution/Organization Position Country of Residence Parallel Session Full Namesono_edogawaNo ratings yet

- Test Bank For Analysis For Financial Management 10th Edition by Higgins PDFDocument18 pagesTest Bank For Analysis For Financial Management 10th Edition by Higgins PDFRandyNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)