Professional Documents

Culture Documents

Forms of Business Organization

Uploaded by

Ella SimoneCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Forms of Business Organization

Uploaded by

Ella SimoneCopyright:

FORMS OF BUSINESS ORGANIZATION

The three primary forms of business organization are sole or single-proprietorship, partnership and corporation. SOLE OR SINGLE-PROPRIETORSHIP Businesses which owned by one person is called sole or single-proprietorship. The owner of this business is alternately called sole proprietor, entrepreneur, self-employed, businessman and related title. Those individual practitioners of their chose profession such as lawyers, doctors, CPAs, engineers and other professional also belongs to this form of entity. To establish a single proprietorship business is to register at the Department of Trade and Industry (DTI). Advantages Disadvantages

liable for all the business debts and obligations. Owners resources are limited (capital, skills, etc) All the losses are borne by the owner. Limited life the business is automatically ceases when the owner is dead or imprisoned or became insane.

Easiest to set-up only few legal requirements is Unlimited liability the owner is the one legally

needed to form the business. Only one person decides for the business, the owner. All the profits are goes to the owner. Not the business but the owner is the one taxed. Easy to dissolve.

PARTNERSHIP The entity is said to be a partnership when the business is formed by two or more person who agreed to contribute money, property, industry and intelligence to a common fund with the intention of dividing the profits among themselves. The owners are called partners. A partnership business is registered at Securities and Exchange Commission (SEC). Advantages

Easy to start can be formed by mere agreement of two or more person. Common pool of resources joint resources of capital, skills, etc. Profits are divided among partners. Taxed if formed as commercial partnership but taxexempt if professional partnership.

Disadvantages

Unlimited liability a general partner is legally liable

for the unsettled debts of the partnership All partners may be held liable for the action of one partner. Consensual and restricted transfer of ownership. Limited life insanity, incapacity or death of a partner terminates the partnership. Also, the disagreements among partners and change of partners may dissolve the partnership.

CORPORATION A corporation is an organization which is registered as an artificial person who does business under the operation of the law. Its artificial being or personhood is created thru Articles of Incorporation and By-Laws and are registered at Securities and Exchange Commission (SEC). Those who formed the corporation are called incorporators and the owners of its stocks or shares are called stockholders or shareholders. A corporation maybe registered as a profit or non-profit entity. Advantages

Limited liability shareholders are not legally liable for unpaid liabilities of the corporation. Power of succession corporation continues to exist in spite of death, withdrawal or changes of officers and stockholders. Greater pool of resources (skills, capitalization, etc) Renewable life may renew its registered life every 50 years.

Disadvantages

Costly and tedious to organize Only the BOD / authorized officers can bind contracts, and can decide for the corporation Shareholders have limited access and control over the operations and management.

Taxed are an income tax flat-rate of 30%

Researched by WBBBB Accounting & Management Services. Click & visit our internet site: http://wbbbb-ams.blogspot.com/ Email us: wbbbb.ams@gmail.com Call/Text CP: 0917 767 78 56 / 0908 741 97 42 Call DL: 378 54 04 Services Offered: Business Registration Management Advisory Services Accounting/Bookkeeping Tax Advisory/Services Loans/Projects Proposals External Auditing Tax Returns Payroll Computation Services Financial Statements Financial Reports Assistance to SEC, BIR, SSS, Pag-ibig, Phil-health, etc Tutorials, Training or Consulting Services

You might also like

- Chapter 4 Forms of Business OrganizationDocument19 pagesChapter 4 Forms of Business OrganizationJoy BeronioNo ratings yet

- Forms of Business OrganizationDocument19 pagesForms of Business OrganizationMylene Candido100% (2)

- Forms of Business OrgsDocument34 pagesForms of Business OrgsALfie MArk 사랑해요No ratings yet

- Types of Business EntitiesDocument6 pagesTypes of Business Entitiesmanjuashok100% (1)

- Introduction To Financial ManagementDocument43 pagesIntroduction To Financial ManagementHazel Jane EsclamadaNo ratings yet

- Nature of Business Types of BusinessDocument24 pagesNature of Business Types of Businesslisa langstonNo ratings yet

- Royal British College, Inc.: Business FinanceDocument4 pagesRoyal British College, Inc.: Business FinanceLester MojadoNo ratings yet

- Elements of Financial StatementsDocument3 pagesElements of Financial StatementsMargNo ratings yet

- Forms of Business Organization: Sole Proprietorship, Partnership & CorporationDocument31 pagesForms of Business Organization: Sole Proprietorship, Partnership & CorporationCindy ConstantinoNo ratings yet

- Types of Business OrganizationDocument8 pagesTypes of Business OrganizationMa Giselle Saporna Meneses100% (1)

- Org Man Module 10 Small Business Management and EntrepreneurshipDocument4 pagesOrg Man Module 10 Small Business Management and EntrepreneurshipJOHN PAUL LAGAONo ratings yet

- Basic FinanceDocument3 pagesBasic Financezandro_ico5041No ratings yet

- Fabm1 PPT Q1W2Document89 pagesFabm1 PPT Q1W2giselleNo ratings yet

- Chapter 1.the Financial SystemDocument88 pagesChapter 1.the Financial SystemDimple EstacioNo ratings yet

- What Are The Types of Business Organization? Differentiate EachDocument3 pagesWhat Are The Types of Business Organization? Differentiate EachCarmelle BahadeNo ratings yet

- 4 Forms of Business OrganizationsDocument30 pages4 Forms of Business Organizationsapi-2670235120% (1)

- Sole Proprietorship Guide - Everything You Need to KnowDocument15 pagesSole Proprietorship Guide - Everything You Need to KnowPARTH Saxena0% (1)

- ABM2 - FUNDAMENTALS OF ACCOUNING, BUSINESS AND MANAGEMENT Module 1 PDFDocument14 pagesABM2 - FUNDAMENTALS OF ACCOUNING, BUSINESS AND MANAGEMENT Module 1 PDFJeffrey AlcedoNo ratings yet

- Understanding Marketing FundamentalsDocument13 pagesUnderstanding Marketing FundamentalsAlma A CernaNo ratings yet

- Chapter-2 AccountingDocument28 pagesChapter-2 AccountingCatherine Rivera100% (1)

- Forms of Business OrganizationsDocument20 pagesForms of Business OrganizationsJc campos50% (2)

- Forms of Business OrganizationDocument13 pagesForms of Business OrganizationRaz Mahari67% (3)

- Acctg 1Document8 pagesAcctg 1justineNo ratings yet

- Arcega Valencia MV1TEM202 01Document35 pagesArcega Valencia MV1TEM202 01Melarose Tesorero PeñafielNo ratings yet

- Business Legal Forms of OwnershipDocument44 pagesBusiness Legal Forms of OwnershipNecie Nilugao Rodriguez100% (1)

- Module 2 ACCTG 1 A & B Partnership & CorporationDocument28 pagesModule 2 ACCTG 1 A & B Partnership & CorporationMary Lynn Dela PeñaNo ratings yet

- Basic Accounting Crash Course on Assets & LiabilitiesDocument5 pagesBasic Accounting Crash Course on Assets & LiabilitiesCyra JimenezNo ratings yet

- 3 Types of BusinessDocument3 pages3 Types of BusinessMichelle GoNo ratings yet

- Types of Business OrganizationDocument37 pagesTypes of Business OrganizationGladzangel Loricabv50% (2)

- Abm 12 Marketing q1 Clas5 Marketing-Principels v1-Rhea-Ann-navilla-1Document13 pagesAbm 12 Marketing q1 Clas5 Marketing-Principels v1-Rhea-Ann-navilla-1Primus RusellNo ratings yet

- Forms of Business OrganizationDocument21 pagesForms of Business OrganizationRosel SariegoNo ratings yet

- Difference Between Accounting and BookkeepingDocument3 pagesDifference Between Accounting and Bookkeepingwathiqahzainol100% (3)

- Activity 2 PDFDocument2 pagesActivity 2 PDFJOHN PAUL LAGAO100% (1)

- Fundamental of Accounting, Business, and Management 2 PDFDocument15 pagesFundamental of Accounting, Business, and Management 2 PDFElijah AramburoNo ratings yet

- Nature and Characteristics of The Business MarketDocument4 pagesNature and Characteristics of The Business MarketEdgar Junior PahonangNo ratings yet

- Module 1.2 THC3 Case (Profit Growth Survival Customers Environment)Document1 pageModule 1.2 THC3 Case (Profit Growth Survival Customers Environment)Louraine VicenteNo ratings yet

- Finance: Fig.1.1 Types of FinanceDocument8 pagesFinance: Fig.1.1 Types of FinanceKaren LacubanNo ratings yet

- Traits of A Successful EntrepreneurDocument2 pagesTraits of A Successful Entrepreneurzckid5136No ratings yet

- Good Governance & Social ResponsibilityDocument23 pagesGood Governance & Social ResponsibilityCristy RamboyongNo ratings yet

- Forms of BusinessDocument56 pagesForms of BusinessJoynul AbedinNo ratings yet

- Types of Business Sole Proprietorship Parntership Corporation Types of PartnershipDocument22 pagesTypes of Business Sole Proprietorship Parntership Corporation Types of PartnershipRoberta Gonzales Sison100% (1)

- Introduction To EntrepreneurshipDocument41 pagesIntroduction To EntrepreneurshipchinchouNo ratings yet

- Management Reporting SystemDocument6 pagesManagement Reporting Systemjudel Ariel100% (1)

- CashflowDocument6 pagesCashflowAizia Sarceda Guzman71% (7)

- Branches of AccountingDocument14 pagesBranches of AccountingSharif ShaikNo ratings yet

- Fundamentals of accounting, business and managementDocument10 pagesFundamentals of accounting, business and managementzahjNo ratings yet

- Lesson 4 - Forms of Business OrganizationDocument26 pagesLesson 4 - Forms of Business OrganizationLeizzamar BayadogNo ratings yet

- Chapter 1.3 - Forms of Business OrganizationDocument12 pagesChapter 1.3 - Forms of Business Organizationphilippn41925211No ratings yet

- Chapter 3 - Financial Planning Tools and ConceptsDocument42 pagesChapter 3 - Financial Planning Tools and Conceptsflorabel paranaNo ratings yet

- Sole ProprietorshipDocument10 pagesSole ProprietorshipJoynul Abedin67% (6)

- Business Ethics Core PrinciplesDocument21 pagesBusiness Ethics Core PrinciplesFrancisco, Noemi A.No ratings yet

- Features of Business PolicyDocument2 pagesFeatures of Business PolicyjessaNo ratings yet

- 3 Users of Accounting InformationDocument23 pages3 Users of Accounting Informationapi-267023512100% (1)

- MNGT28 CHAPTER 4 Models of Corporate GovernanceDocument9 pagesMNGT28 CHAPTER 4 Models of Corporate GovernanceSohfia Jesse VergaraNo ratings yet

- Romeo - BordalloJr.Argos and Littlewoods Price Fixing Arrangement Case AnalysisDocument2 pagesRomeo - BordalloJr.Argos and Littlewoods Price Fixing Arrangement Case AnalysisRomeo Bordallo Jr.No ratings yet

- Business Entity Guide - Compare Types, Advantages & DisadvantagesDocument13 pagesBusiness Entity Guide - Compare Types, Advantages & DisadvantagesmanjuashokNo ratings yet

- Forms of Business OwnershipDocument9 pagesForms of Business OwnershipNazifa AfrozeNo ratings yet

- Module 6 MadamDocument24 pagesModule 6 MadamLyceljine C. TañedoNo ratings yet

- Business Ethics - Module 1Document16 pagesBusiness Ethics - Module 1Rekha Madhu100% (1)

- FABM-1-Lesson-4Document58 pagesFABM-1-Lesson-4althearozs.grijaldoNo ratings yet

- BIR Form 1901Document1 pageBIR Form 1901Abdul Nassif Faisal80% (5)

- Diagram of Conceptual FrameworkDocument1 pageDiagram of Conceptual FrameworkElla Simone100% (4)

- BIR Form No. 1901 Personal ExemptionsDocument1 pageBIR Form No. 1901 Personal ExemptionsBasil Maramag CastañoNo ratings yet

- PhilHealth Penalties For Non-Remitting and Non-Reporting EmployersDocument1 pagePhilHealth Penalties For Non-Remitting and Non-Reporting EmployersElla SimoneNo ratings yet

- Going Concern AssumptionDocument1 pageGoing Concern AssumptionElla SimoneNo ratings yet

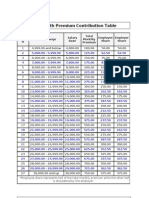

- Phil Health Contribution TableDocument1 pagePhil Health Contribution TableElla SimoneNo ratings yet

- Relationships Among The Financial StatementsDocument1 pageRelationships Among The Financial StatementsElla Simone100% (1)

- DTI Business Name Application FormDocument2 pagesDTI Business Name Application FormYourtv Inyourpc100% (6)

- Relationships Among The Financial StatementsDocument1 pageRelationships Among The Financial StatementsElla Simone100% (1)

- Monetary Unit AssumptionDocument1 pageMonetary Unit AssumptionElla SimoneNo ratings yet

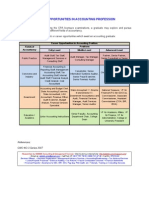

- Career Opportunities in Accounting ProfessionDocument1 pageCareer Opportunities in Accounting ProfessionElla SimoneNo ratings yet

- Objectives and Purpose of AccountingDocument1 pageObjectives and Purpose of AccountingElla Simone100% (1)

- SSS Contribution TableDocument1 pageSSS Contribution TableElla SimoneNo ratings yet

- Economic Entity AssumptionDocument1 pageEconomic Entity AssumptionElla SimoneNo ratings yet

- Periodicity AssumptionDocument1 pagePeriodicity AssumptionElla SimoneNo ratings yet

- Specialized Fields and Branches of AccountingDocument2 pagesSpecialized Fields and Branches of AccountingElla Simone100% (2)

- Accounting Processing CycleDocument1 pageAccounting Processing CycleElla SimoneNo ratings yet

- Definition of AccountingDocument1 pageDefinition of AccountingElla Simone100% (1)

- Accounting EquationDocument1 pageAccounting EquationElla SimoneNo ratings yet

- Philippine Regulatory AuthorityDocument1 pagePhilippine Regulatory AuthorityElla SimoneNo ratings yet

- Nature of AccountingDocument2 pagesNature of AccountingElla Simone100% (5)

- Solar Power Is The Last Energy Resource That Isn't Owned Yet - Nobody Taxes The Sun Yet.Document5 pagesSolar Power Is The Last Energy Resource That Isn't Owned Yet - Nobody Taxes The Sun Yet.Norhanifa HADJI AMERNo ratings yet

- Architecture FirmDocument23 pagesArchitecture Firmdolar buhaNo ratings yet

- Cost of DebtDocument3 pagesCost of DebtGonzalo De CorralNo ratings yet

- WordAds - High Quality Ads For WordPress Generate IncomeDocument1 pageWordAds - High Quality Ads For WordPress Generate IncomeSulemanNo ratings yet

- Marine Insurance Final ITL & PSMDocument31 pagesMarine Insurance Final ITL & PSMaeeeNo ratings yet

- Stann Creek PDFDocument199 pagesStann Creek PDFSeinsu ManNo ratings yet

- A Bibliography of China-Africa RelationsDocument233 pagesA Bibliography of China-Africa RelationsDavid Shinn100% (1)

- The Big Mac TheoryDocument4 pagesThe Big Mac TheoryGemini_0804No ratings yet

- 2020-2021 Tuition and Fee Rates Per Semester: Georgia Institute of TechnologyDocument2 pages2020-2021 Tuition and Fee Rates Per Semester: Georgia Institute of TechnologyAurangzaib JahangirNo ratings yet

- IEC 60050-151-2001 Amd2-2014Document8 pagesIEC 60050-151-2001 Amd2-2014mameri malekNo ratings yet

- San Beda UniversityDocument16 pagesSan Beda UniversityrocerbitoNo ratings yet

- Special Educational Needs, Inclusion and DiversityDocument665 pagesSpecial Educational Needs, Inclusion and DiversityAndrej Hodonj100% (1)

- Informative Speech OutlineDocument5 pagesInformative Speech OutlineMd. Farhadul Ibne FahimNo ratings yet

- AIESEC Experience-MBC 2016Document25 pagesAIESEC Experience-MBC 2016Karina AnantaNo ratings yet

- Effective Team Performance - FinalDocument30 pagesEffective Team Performance - FinalKarthigeyan K KarunakaranNo ratings yet

- Doctrines On Persons and Family RelationsDocument69 pagesDoctrines On Persons and Family RelationsCarla VirtucioNo ratings yet

- Housing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodDocument4 pagesHousing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodJoey AlbertNo ratings yet

- Exploratory EssayDocument9 pagesExploratory Essayapi-237899225No ratings yet

- Account statement for Rinku MeherDocument24 pagesAccount statement for Rinku MeherRinku MeherNo ratings yet

- Forest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Document2 pagesForest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Nikhil AgrawalNo ratings yet

- Case View With Rajat Gandhi - P2P Lending in India: Delivering Disruptive Innovation in Alternate Lending SpaceDocument16 pagesCase View With Rajat Gandhi - P2P Lending in India: Delivering Disruptive Innovation in Alternate Lending SpaceETCASESNo ratings yet

- The Last LeafDocument6 pagesThe Last LeafNam KhaNo ratings yet

- Website Vulnerability Scanner Report (Light)Document6 pagesWebsite Vulnerability Scanner Report (Light)Stevi NangonNo ratings yet

- Disaster Drilling Land RigsDocument21 pagesDisaster Drilling Land Rigsmohanned salahNo ratings yet

- Meeting Consumers ' Connectivity Needs: A Report From Frontier EconomicsDocument74 pagesMeeting Consumers ' Connectivity Needs: A Report From Frontier EconomicsjkbuckwalterNo ratings yet

- CH 07Document40 pagesCH 07Bobby513No ratings yet

- Usui MemorialDocument6 pagesUsui MemorialstephenspwNo ratings yet

- Eep306 Assessment 1 FeedbackDocument2 pagesEep306 Assessment 1 Feedbackapi-354631612No ratings yet

- United States v. Hernandez-Maldonado, 1st Cir. (2015)Document9 pagesUnited States v. Hernandez-Maldonado, 1st Cir. (2015)Scribd Government DocsNo ratings yet

- Square Pharma Valuation ExcelDocument43 pagesSquare Pharma Valuation ExcelFaraz SjNo ratings yet