Professional Documents

Culture Documents

Key Highlights of the Union Budget 2012-13

Uploaded by

Cn NatarajanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Key Highlights of the Union Budget 2012-13

Uploaded by

Cn NatarajanCopyright:

Available Formats

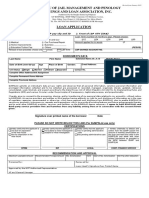

A FULL SERVICE CORPORATE LAW FIRM

SKJ Legal 2nd Floor, Kundan Chambers, Thube Park, Shivajinagar, Pune 411 005, MH, India. Tel: 020 30223654, Fax: 020 25536661 E. Mail: info@skjlegal.com Web site: www.skjlegal.com

KEY HIGHLIGHTS OF THE UNION BUDGET 2012-13

1] DIRECT TAX: Income tax exemption limit raised from Rs. 1,80,000/- to Rs. 2,00,000/-. Distinction between men and women has been removed so far as income exempt from tax is concerned. 10 % tax for 2-5 lakh income 20 % tax for 5-10 lakh income 30 % tax for income beyond Rs. 10 lakh Savings bank account interest up to Rs. 10,000/- exempted from tax. Deduction of upto Rs. 5000/- for preventive health check within health insurance benefit. Senior citizens are no longer required to pay advance tax, if they are not running any business/ profession.

2] SERVICE TAX: No change in corporate tax rate. Service tax rates, raised from 10 per cent to 12 per cent. No change in customs duty of 10 per cent on non-agriculture goods.

3] TAX REFORMS Direct Taxes Code (DTC) at earliest; GST network to be operational by August 2012. Central Excise and Service Tax being harmonized. A General Anti-Avoidance Rule (GAAR) to be introduced to counter aggressive tax avoidance. Tax relief for sectors like agriculture, infrastructure, mining, railways, roads, civil aviation, manufacturing, health and nutrition, and environment to get duty relief. Turnover limit for compulsory tax audit for SMEs has been raised from Rs 60 lakh to Rs 1 crore and exempt capital gains tax on sale of a residential property, if the sale consideration is used for subscription in equity of a manufacturing SME company for purchase of new plant and machinery. Greater scrutiny of closely-held companies for funds; Taxation of unexplained money, credits, investments, expenses at highest rate of 30 per cent irrespective of income slab.

4] SECURITY MARKET: Securities Transaction Tax [STT] reduced by 20 % (from 0.125 % to 0.1%) on cash delivery transactions. A new Rajiv Gandhi Equity Saving Scheme to allow income tax deduction to retail investors in stocks. Allowing Qualified Foreign Inventors (QFIs) to access Indian Corporate Bond market. Simplifying the process of issuing IPO and mandatory for companies to issue IPOs of Rs. 10 crore and above in electronic form through nationwide broker network of stock exchanges. Permitting two-way fungibility in Indian Depository Receipts subject to a ceiling with the objective of encouraging greater foreign participation in Indian Capital Market.

5] LAWS AND REGULATIONS: The Government proposes to bring following Bills in the Budget Session: The Micro Finance Institutions (Development and Regulations) Bill, 2012. The National Housing Bank (Amendment) Bill. 2012. The Small Industries Development Bank of India (Amendment) Bill, 2012. National Bank for Agriculture and Rural Development (Amendment) Bill, 2012. Regional Rural Banks (Amendment) Bill, 2012. Indian Stamp (Amendment) Bill, 2012. Public Debt Management Agency of India Bill, 2012.

6] GDP RATES: GDP growth rate pegged at 7.6 % in 2012-13. The current account deficit as a proportion of GDP for 2011-12 is likely to be around 3.6 % Subsidy Expenditure to be checked and higher tax revenues targeted; Rs. 30,000 crore to be raised from disinvestment.

7] FINANCE AND INFRASTRUCTURE SECTOR Introduction of Rajiv Gandhi Equity Saving Scheme: this scheme would allow for income tax deduction of 50 % to new retail inventors, who invest up to Rs. 50,000/- directly in equities and whose annual income is below Rs. 10 lakhs a scheme will have lock -in period of 3 years. Rs. 15,888 crore to be provided for capitalization of public sector banks and financial institutions. Infrastructure investment of Rs. 50 lakh crore in 12th plan period, with half from private sector; Tax free bonds of Rs. 60,000 crores to be allowed for financial infrastructure projects.

8] FOREIGN DIRECT INVESTMENT FDI in multi-brand retail and permitting foreign airlines invest in domestic players. External borrowings to the extent of USD one billion for aviation companies. Qualified Foreign Investors to get access to corporate bond market.

9] BUDGETED EXPENDITURE Total expenditure budgeted at Rs. 14,90,925 crore. Plan expenditure at Rs. 5,21,025 crore, 18 per cent higher than 2011-12 budget. Non-plan expenditure at Rs. 9,69,900 crore. 10] CERTAIN COMMODITIES TO COST MORE Cars: The finance budget has hiked the excise duty from 22% to 24% for cars with engines of between 1.2 and 1.5 litres. For cars powered by engines of 1.5 litres and above, the duty is now 27%. The custom duty has been increased from 60% to 75% for cars priced above $40,000/-. Auto companies may pass on the price hike to consumers. This hike might further impact the auto industry already reeling from a slowdown in sales. Imported bicycles: The basic customs duty on bicycles has been increased from 10% to 30%. Cigarettes: The basic excise duty on cigarettes, of more than 65mm length, has been increased by adding an ad valorem component of 10% to the existing specific rates. The ad valorem duty would be chargeable on 50% of the Retail Sale Price declared on the pack. Bidis: Increase in the basic excise duty on hand-rolled bidis from Rs. 8 to Rs. 10 per thousand and in respect of machine- rolled bidis from Rs. 19 to Rs. 21 per thousand. The existing exemption available to hand-rolled bidis for clearances up to Rs. 20 lakh bidis per annum is being retained. Jewellery: Branded silver jewellery has been exempted from excise duty. Excise duty of 1% was levied on branded precious metal jewellery in the last budget. Now, jewellery not bearing a brand name is also brought under its ambit. To simplify its operation and minimise its impact on small artisans and goldsmiths it has been proposed thato The duty is to be charged on the tariff value equal to 30% of the transaction value. o Small scale exemption to extend up to annual turnover not exceeding Rs. 1.5 crore for units having a turnover below Rs. 4 crore in the previous year o Turnover to be computed on the basis of tariff value o Onus of registration and payment is placed on the person who gets jewellery manufactured on job work 11] BLACK MONEY White paper on black money in current session of Parliament. Introduction of compulsory reporting requirement for assets held abroad. 3

Tax collection at source on high-value cash purchase of bullion, jewellery, immovable property, and trading in coal, lignite, and iron ore. The budget proposed relevant amendments in the law to compulsorily report assets and revenue held abroad and allowing for reopening of assessments up to 16 years in such cases.

12] AGRICULTURE Target for agricultural credit raised to Rs 5,75,000 crore. Interest subvention for short-term crop loans to farmers at 7 per cent interest continues; additional 3 per cent for prompt paying farmers. 13] TDS ON TRANSFER OF CERTAIN IMMOVABLEE PROPERTIES (OTHER THAN AGRICULTURAL LAND) TDS has been made mandatory for sale of immovable property of over Rs. 50 lakh in urban areas and Rs. 20 lakh in rural areas. For better compliance, it is also proposed to cover that registration officer appointed under the Indian Registration Act, 1908 (Registrar) shall not register the transfer of any immovable property where taxes are required to be deducted under this provision unless the transferee furnishes proof of deduction and payment of TDS.

14] RENTING OF IMMOVABLE PROPERTY SERVICE Constitutional validity of the levy of services tax on renting of immovable property has been the subject matter of litigation. The Judicial view, as is evident from various pronouncements of court judgments, is favourable towards revenue. Taking an overall view the Government has decided to waive the penalty for those taxpayers who pay the service tax due on the renting of immovable property service (as on06/03/2012) in full along with interest. For this purpose, a new section 80A is being inserted in the Finance Act, 1994. This scheme of penalty waiver will be open for a period of six months from the date of enactment of the Finance Bill, 2012.

15] INCOME FROM SALE OF SOFTWARE TO BE TAXED AS ROYALTY The Finance Bill, 2012 has introduced an amendment in Section 9 of the Income Tax Act, 1961 whereby an effort has been made to put an end to the contentious issue of taxation of royalties applicable to the software companies. The term royalty now specifically includes computer software. The effect of this amendment is that an Indian buyer, who buys software carrying a copyright from an overseas vendor for some consideration, will have to pay a withholding tax on such purchase. This amendment has been given a retrospective effect making it effective from 1st of June 1976.

16] PRICE HIKE LIKELY IN DRUG PRICES The duty on formulations has been increased from 5 per cent to 6 per cent, while on the active pharmaceutical ingredients (APIs) it has been raised by two per cent to 12 per cent. The service tax has also been hiked to 12%. The cumulative effect of this might result in pharmaceutical companies increasing the prices of drugs. The weighted average deduction on R&D continues to be at 200%, nothing new was added to this list. The government has now implemented Alternative Minimum Tax (AMT) for partnership firms as well and they would have to pay 18.5% AMT on book profits earned for the fiscal year. This would increase their tax outgo.

17] VODAFONE TAX CASE To get past the adverse court verdict in the Vodafone tax case on sale of capital assets in India outside the country, the government sought to amend the Income Tax Act retrospectively from 1962 to bring even 50-year-old deals under the scanner.

18] MEDIA INDUSTRY: Exemption of service tax on copyrights relating to recording of cinematographic films.

_____________________________________________________________________

Disclaimer The Budget highlights provided herein are intended for your general information only. The information and opinions contained herein are derived from public sources which we believe to be reliable and accurate but which, without further investigation, cannot be warranted as to their accuracy, completeness or correctness. It is not intended to be nor should be regarded as legal advice and no one should act on such information without appropriate professional advice. SKJ Legal accepts no responsibility for any loss arising from any action taken or not taken by anyone using the information contained herein.

You might also like

- IT&STDocument2 pagesIT&STPraveen DsouzaNo ratings yet

- India: Budget 2015-16 - For The Corporates: Corporate Tax RateDocument4 pagesIndia: Budget 2015-16 - For The Corporates: Corporate Tax RateraghuNo ratings yet

- Financial Budget 2013Document9 pagesFinancial Budget 2013Mitesh PanchalNo ratings yet

- General: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterDocument5 pagesGeneral: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterSuraj NaikNo ratings yet

- Finance Budget 2023Document4 pagesFinance Budget 2023SakshamNo ratings yet

- Budget Highlights February 2013: Economy Assessment: TaxesDocument3 pagesBudget Highlights February 2013: Economy Assessment: TaxesRobs KhNo ratings yet

- Budget-Dtc-Tax Exemption IncomeDocument35 pagesBudget-Dtc-Tax Exemption IncomeAnkit MachharNo ratings yet

- Union Budget 2013-14 - Highlights and AnalysisDocument28 pagesUnion Budget 2013-14 - Highlights and AnalysisNaureen FatimaNo ratings yet

- Analysis On Union Budget 2011Document7 pagesAnalysis On Union Budget 2011Dnyaneshwar BhadaneNo ratings yet

- India Highlights of Budget 2016 at A GlanceDocument5 pagesIndia Highlights of Budget 2016 at A GlanceKARTHIK145No ratings yet

- Budget Highlights 2011-12Document2 pagesBudget Highlights 2011-12JayNo ratings yet

- Roy Rolls Back Railway Fare Hike Proposed by TrivediDocument7 pagesRoy Rolls Back Railway Fare Hike Proposed by TrivediDr.V.Bastin JeromeNo ratings yet

- Budget NoteDocument4 pagesBudget NoteSunil SharmaNo ratings yet

- Union Budget 2012-13 Review: Ansaf PMDocument21 pagesUnion Budget 2012-13 Review: Ansaf PMAnsaf MohdNo ratings yet

- Despite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyDocument8 pagesDespite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyGurunam Singh DeoNo ratings yet

- 1.0 Direct Taxes: India Budget 2014 - 15 - in A NutshellDocument3 pages1.0 Direct Taxes: India Budget 2014 - 15 - in A Nutshell61srinihemaNo ratings yet

- Budget 14 AnalysisDocument19 pagesBudget 14 AnalysisSaurav BharadwajNo ratings yet

- Tax Reforms in India: Static DimensionsDocument11 pagesTax Reforms in India: Static DimensionsLeela LazarNo ratings yet

- Union Budget 2012 Highlights for CorporatesDocument10 pagesUnion Budget 2012 Highlights for CorporatesShivprasad ParnattiNo ratings yet

- Amity Global Business School, PuneDocument15 pagesAmity Global Business School, PuneChand KalraNo ratings yet

- Income Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationDocument10 pagesIncome Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationUmar SulemanNo ratings yet

- Tax Hand Book: Finance Bill 2016Document27 pagesTax Hand Book: Finance Bill 2016Rone garciaNo ratings yet

- Highlights of Budget 2011-2012: Compiled by:-CA. Puneet Duggal (F.C.A) M/S Fatehpuria Duggal & AssociatesDocument14 pagesHighlights of Budget 2011-2012: Compiled by:-CA. Puneet Duggal (F.C.A) M/S Fatehpuria Duggal & AssociatesPuneet DuggalNo ratings yet

- BUDGET 2017 by Taxpert Professionals Private LimitedDocument48 pagesBUDGET 2017 by Taxpert Professionals Private LimitedTaxpert mukeshNo ratings yet

- Budget Highlights 2012-13Document7 pagesBudget Highlights 2012-13Vikas JainNo ratings yet

- Budget BOOK FinalDocument19 pagesBudget BOOK FinalAmin ChhipaNo ratings yet

- Budget 2012Document20 pagesBudget 2012Dinu ChackoNo ratings yet

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocument5 pagesIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinNo ratings yet

- Budget Chemistry 2010Document44 pagesBudget Chemistry 2010Aq SalmanNo ratings yet

- Tax AmendmentsDocument5 pagesTax AmendmentsLipi ThapliyalNo ratings yet

- 2019 Budget Highlights: Key Features, Schemes & AnnouncementsDocument3 pages2019 Budget Highlights: Key Features, Schemes & AnnouncementskumsthegreatNo ratings yet

- BDO Budget Snapshot - 2012-13Document9 pagesBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- Impact of Budget 2014-15 on key sectorsDocument4 pagesImpact of Budget 2014-15 on key sectorsRaj AraNo ratings yet

- Budget Red Eye 2013Document5 pagesBudget Red Eye 2013Envisage123No ratings yet

- Budget Analysis Highlights Key Fiscal and Growth TargetsDocument11 pagesBudget Analysis Highlights Key Fiscal and Growth TargetsvenkatpogaruNo ratings yet

- Tax Icsi 2012Document84 pagesTax Icsi 2012Janani ParameswaranNo ratings yet

- Union Budget 2012-13 Pre-Budget Memorandum on Income Tax, Corporate Tax and Other Taxation MattersDocument29 pagesUnion Budget 2012-13 Pre-Budget Memorandum on Income Tax, Corporate Tax and Other Taxation Mattersnikhilsawant93No ratings yet

- Corporate Recovery and Tax Incentives For EnterprisesDocument5 pagesCorporate Recovery and Tax Incentives For EnterprisesIvy BoseNo ratings yet

- Tax FinalDocument21 pagesTax Finalshweta_narkhede01No ratings yet

- BudgetDocument21 pagesBudgetshweta_narkhede01No ratings yet

- India Union Budget 2011: "Quality Service Is Not What You Put Into It - It's What The Client Gets Out of It"Document41 pagesIndia Union Budget 2011: "Quality Service Is Not What You Put Into It - It's What The Client Gets Out of It"Jacob JheraldNo ratings yet

- Task 8Document23 pagesTask 8Anooja SajeevNo ratings yet

- Trabaho BillDocument14 pagesTrabaho BillAvia ColorNo ratings yet

- BUDGET 2011 BUDGET 2011: A BDO India SnapshotDocument12 pagesBUDGET 2011 BUDGET 2011: A BDO India SnapshotPritam NegiNo ratings yet

- Tax Reforms in PakistanDocument53 pagesTax Reforms in PakistanMübashir Khan100% (2)

- Intrim Union Budget 2019-20Document12 pagesIntrim Union Budget 2019-20Rukmani GuptaNo ratings yet

- Tax Commentary 2020Document85 pagesTax Commentary 2020Javed MushtaqNo ratings yet

- Expectations From BudgetDocument8 pagesExpectations From BudgetNehaNo ratings yet

- Budget 19-20 - ARU Advisers PDFDocument3 pagesBudget 19-20 - ARU Advisers PDFDevil KingNo ratings yet

- Budget - Salient Features - 2011!12!28 (1) .02Document3 pagesBudget - Salient Features - 2011!12!28 (1) .02Ruchira SonawaneNo ratings yet

- Key Highlights of Budget 2010-11Document27 pagesKey Highlights of Budget 2010-11bhavu_ashNo ratings yet

- Budget Analysis-2012 - T.P Ostwal & AssociatesDocument115 pagesBudget Analysis-2012 - T.P Ostwal & AssociatesvaidheiNo ratings yet

- Budget Analysis 2012Document26 pagesBudget Analysis 2012Rajpreet KaurNo ratings yet

- Budget Highlights BinlingualDocument9 pagesBudget Highlights BinlingualSakthi VelNo ratings yet

- Budget HighlightsDocument3 pagesBudget HighlightsSanket ShahNo ratings yet

- AcvdvdDocument4 pagesAcvdvdvivek kasamNo ratings yet

- Budget 2011Document4 pagesBudget 2011viv_nitjNo ratings yet

- Message For Children & YouthDocument17 pagesMessage For Children & YouthCn NatarajanNo ratings yet

- FAQ On ChequesDocument1 pageFAQ On ChequesCn NatarajanNo ratings yet

- FAQ On ChequesDocument1 pageFAQ On ChequesCn NatarajanNo ratings yet

- RTI Application For Provident FundDocument2 pagesRTI Application For Provident Fundshantikolli420No ratings yet

- Fundamental & Technical Analysis of Selected Commodities (Gold & Silver)Document4 pagesFundamental & Technical Analysis of Selected Commodities (Gold & Silver)Raghava PrusomulaNo ratings yet

- Financial Statement Analysis Part 2Document10 pagesFinancial Statement Analysis Part 2Kim Patrick VictoriaNo ratings yet

- G11 General-Mathematics Q2 L2Document7 pagesG11 General-Mathematics Q2 L2Maxine ReyesNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument15 pagesProject Report "Banking System" in India Introduction of BankingshabnammerajNo ratings yet

- Sevket - Pamuk - Prices in The Ottoman Empire - 1469-1914Document18 pagesSevket - Pamuk - Prices in The Ottoman Empire - 1469-1914Hristiyan AtanasovNo ratings yet

- OCA Circular No. 168-2023-ADocument3 pagesOCA Circular No. 168-2023-ANigel MascardoNo ratings yet

- OS at Hedge EquitiesDocument46 pagesOS at Hedge EquitiesEby JoseNo ratings yet

- Partnership Deed FormatDocument4 pagesPartnership Deed FormatPranathi DivakarNo ratings yet

- مصرف الانماء - 210625 - 100246 - 210627 - 120329Document1 pageمصرف الانماء - 210625 - 100246 - 210627 - 120329Nadia QusaiNo ratings yet

- SalaryMulti PurposeEmergencyHousingBusinessLAF SampleOnlyDocument3 pagesSalaryMulti PurposeEmergencyHousingBusinessLAF SampleOnlyDivine Grace Mandin88% (8)

- Quantitative Aptitude AssignmentDocument3 pagesQuantitative Aptitude AssignmentnikhilNo ratings yet

- Tax CalculatorDocument2 pagesTax CalculatorJeffree Lann AlvarezNo ratings yet

- CKSBDocument23 pagesCKSBayushiNo ratings yet

- WP392 PDFDocument41 pagesWP392 PDFnapierlogsNo ratings yet

- Cost of Capital of Godrej Properties LTD.: Using CAPM, WACC, DDM While Comparing With DLF LTDDocument23 pagesCost of Capital of Godrej Properties LTD.: Using CAPM, WACC, DDM While Comparing With DLF LTDChaitanya GuptaNo ratings yet

- How COVID Will Reshape Zimbabwe PropertyDocument9 pagesHow COVID Will Reshape Zimbabwe PropertyROMEO BONDENo ratings yet

- Law on Negotiable InstrumentsDocument15 pagesLaw on Negotiable InstrumentsJude Thaddeus DamianNo ratings yet

- PDIC Law Additional NotesDocument6 pagesPDIC Law Additional NotesBay Ariel Sto TomasNo ratings yet

- Chart of AccountsDocument55 pagesChart of AccountsSyed Shakir AliNo ratings yet

- Banking Law - PDF ProjectDocument18 pagesBanking Law - PDF ProjectNilotpal RaiNo ratings yet

- Ipo Prospectus GsDocument164 pagesIpo Prospectus GsSehrish MushtaqNo ratings yet

- Final Intership Report SampleDocument32 pagesFinal Intership Report SampleMaham QureshiNo ratings yet

- Topic 1 - Basics of Banking ServicesDocument6 pagesTopic 1 - Basics of Banking ServicesCarlos Pereira100% (1)

- Bjmpslai Loan Application Form New - Jan2023Document3 pagesBjmpslai Loan Application Form New - Jan2023Mae Loudy Arendon100% (1)

- Lecture 1-Principles of Financial EconomicsDocument15 pagesLecture 1-Principles of Financial Economics80tekNo ratings yet

- Initial Project Screening Method - Payback Period: Lecture No.15 Contemporary Engineering EconomicsDocument32 pagesInitial Project Screening Method - Payback Period: Lecture No.15 Contemporary Engineering EconomicsAfiq de WinnerNo ratings yet

- My Project of Vijaya BankDocument103 pagesMy Project of Vijaya Banktamizharasid100% (1)

- Asset Liability Management in YES Bank: A Final Project ReportDocument68 pagesAsset Liability Management in YES Bank: A Final Project ReportUjwal JaiswalNo ratings yet

- SC rules against Citibank in LTCP investment caseDocument3 pagesSC rules against Citibank in LTCP investment caseLorie Jean UdarbeNo ratings yet

- Keko - Final ThesisDocument82 pagesKeko - Final Thesisberhanu seyoumNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- The Hidden Wealth Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth Nations: The Scourge of Tax HavensRating: 4.5 out of 5 stars4.5/5 (40)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- Streetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessFrom EverandStreetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessNo ratings yet