Professional Documents

Culture Documents

Multinational Business Finance 12th Edition Slides Chapter 21

Uploaded by

Alli TobbaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Multinational Business Finance 12th Edition Slides Chapter 21

Uploaded by

Alli TobbaCopyright:

Available Formats

Chapter 21

Working Capital Management

Copyright 2010 Pearson Prentice Hall. All rights reserved.

Working Capital Management in the MNE

Working capital management in a multinational enterprise requires managing current assets (cash balances, accounts receivable, and inventory) and current liabilities (accounts payable and short-term debt) when faced with political, foreign exchange, tax, and liquidity constraints. The overall goal is to reduce funds tied up in working capital while simultaneously providing sufficient funding and liquidity for the conduct of global business. Working capital management should enhance return on assets and return on equity and should also improve efficiency ratios and other performance measures.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-2

Working Capital Management

The operating cycle of a business generates funding needs, cash inflows and outflows (the cash conversion cycle) and foreign exchange rate and credit risks. The funding needs generated by the operating cycle of the firm constitute working capital. The cash conversion cycle, a subcomponent of the operating cycle (working capital cycle), is that period of time extending between cash outflow for purchased inputs and materials and cash inflow from cash settlement.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-3

Working Capital Management

The operating and cash conversion cycles for Trident Brazil is illustrated in the following exhibit. This is decomposed into five different periods (each with business, accounting, and potential cash flow implications):

Quotation period Input sourcing period Inventory period Accounts payable period Accounts receivable period

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-4

Exhibit 21.1 Operating and Cash Cycles for Trident Brazil

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-5

Working Capital Management

Tridents three foreign subsidiaries each present a unique set of concerns. In practice, Tridents senior management in the parent company (corporate) will first determine its strategic objectives regarding the business developments in each subsidiary, and then design a financial management plan for the repositioning of profits, cash flows, and capital for each subsidiary.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-6

Exhibit 21.2 Tridents Foreign Subsidiaries

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-7

Restraints on Repositioning Funds

Fund flows between units of a domestic business are generally unimpeded, but that is not the case in a multinational business. A firm operating globally faces a variety of political, tax, foreign exchange, and liquidity considerations that limit its ability to move funds easily and without cost from one country or currency to another. These constraints are the reason that multinational financial managers must plan ahead for repositioning funds within an MNE.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-8

Constraints on Repositioning Funds

Political constraints can block the transfer of funds either overtly or covertly. Tax constraints arise because of the complex and possibly contradictory tax structures of various national governments through whose jurisdictions funds might pass. Foreign exchange transaction costs are incurred when one currency is exchanged for another. Liquidity needs are often driven by individual locations (difficult to conduct worldwide cash handling).

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-9

Conduits for Moving Funds by Unbundling Them

Multinational firms often unbundle their transfer of funds into separate flows for specific purposes. Host countries are then more likely to perceive that a portion of what might otherwise be called remittance of profits constitutes and essential purchase of specific benefits that command worldwide values and benefit the host country. Unbundling allows a multinational firm to recover funds from subsidiaries without piquing host country sensitivities over large dividend drains.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-10

Exhibit 21.3 Potential Conduits for Moving Funds from Subsidiary to Parent

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-11

International Dividend Remittances

Payment of dividends is the classic method by which firms transfer profit back to owners, be those owners individual shareholders or parent corporations.

International dividend policy now incorporates tax considerations, political risk, and foreign exchange risk, as well as a return for business guidance and technology.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-12

Working Capital Management

If Trident Brazils business continues to expand, it will continually add to inventories and accounts payable (A/P) in order to fill increased sales in the form of accounts receivable (A/R). These components make up net working capital (NWC): NWC = (A/R + inventory) (A/P)

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-13

Exhibit 21.4 Trident Brazils Net Working Capital Requirements

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-14

Working Capital Management

The previous exhibit illustrates one of the key managerial decisions for any subsidiary: Should A/P be paid off early, taking discounts offered by suppliers? The alternate form of financing for NWC balances is short-term debt In our example, Paraa Electronics CFO must decide which is the lower cost (short-term Mexican peso borrowings or the effective annual interest cost of supplier financing cost of carry). Clearly, there are issues such as access to local currency debt, or various intra-company financing alternatives that complicate the decision.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-15

Working Capital Management

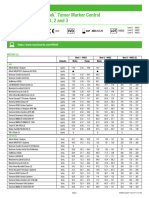

A common method of benchmarking financial management practice is to calculate the NWC of the firm on a days sales basis. An analysis of this metric in a global context shows that US firms have a typical days sales of 29, while the European group has a days sales of 75. Clearly, European-based (technology firms in this example) are carrying a significantly higher level of net working capital in their financial structures.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-16

Exhibit 21.5 Days Working Capital for Selected U.S. and European Technology Hardware and Equipment Firms

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-17

Working Capital Management

The MNE itself poses some unique challenges in the management of working capital. Many multinationals manufacture goods in a few specific countries and then ship the intermediate products to other facilities globally for completion and distribution. The payables, receivables, and inventory levels of the various units are a combination of intra-firm and inter-firm. The varying business practices observed globally regarding payment terms both days and discounts create severe mismatches in some cases.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-18

Exhibit 21.6 Tridents Multinational Working Capital Sequence

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-19

Working Capital Management Managing Receivables

A firms operating cash inflow is derived primarily from the collection of accounts receivable. Multinational accounts receivable are created by two separate types of transactions: Sales to related subsidiaries

Sales to independent or unrelated buyers

Management of accounts receivable form independent customers requires two types of decisions: What currency should the transaction be denominated? What should be the terms of payment?

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-20

Working Capital Management Inventory Management

Operations in inflationary, devaluation-prone economies sometimes force management to modify its normal approach to inventory management. In some cases, management may choose to maintain inventory and reorder levels far in excess of what would be called for in an economic order-quantity model. It is important to anticipate: Devaluation Price freezes

The implications of various forms of free-trade zones

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-21

Working Capital Management

A free-trade zone combines the old idea of duty-free ports with legislation that reduces or eliminates customs duties to retailers or manufacturers who structure their operations to benefit from the technique. Income taxes may also be reduced for operations in a free-trade zone.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-22

International Cash Management

International cash management is the set of activities determining the levels of cash balances held throughout the MNE (cash management) and the facilitation of its movement cross-border (settlements and processing). These activities are typically handled by the international treasury of the MNE.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-23

International Cash Management

The level of cash maintained by an individual subsidiary is determined independent of the working capital management decisions we have discussed. Cash balances, including marketable securities, are held partly to enable normal day-to-day cash disbursements and partly to protect against unanticipated variations from budgeted cash flows. These two motives are called the transaction motive and the precautionary motive.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-24

International Cash Management

Cash disbursed for operations is replenished from two sources:

Internal working capital turnover External sourcing, traditionally short-term borrowing

Efficient cash management aims to reduce cash tied up unnecessarily in the system, without diminishing profit or increasing risk, so as to increase the rate of return on invested assets.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-25

International Cash Management

Multinational business increases the complexity of making payments and settling cash flows between related and unrelated firms. Over time a number of techniques and services have evolved that simplify and reduce the costs of making these crossborder payments.

Four such techniques include:

Wire transfers Cash pooling Payment netting Electronic fund transfers

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-26

Exhibit 21.7 Decentralized versus Centralized Cash Depositories

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-27

Exhibit 21.8 Multilateral Matrix Before Netting (thousands of US dollars)

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-28

Exhibit 21.9 Calculation of Trident Intrasubsidiary Net Obligations (thousands of U.S. dollars)

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-29

Exhibit 21.10 Multilateral Matrix After Netting (thousands of US dollars)

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-30

Financing Working Capital

All firms need to finance working capital.

The normal sources of funds for financing short-term working capital are accounts payable to suppliers and loans against bank credit lines.

In some countries, such as the United States, borrowing is done by the firm issuing notes payable to banks and other creditors. In many other countries, short term borrowing is done on an overdraft basis.

In all cases, permanent working capital requirements, as opposed to seasonal needs, are at least partially financed with long-term debt and equity.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-31

Financing Working Capital

Some MNEs have found that their financial resources and needs are either too large or too sophisticated for the financial services available in may locations where they operate. One solution to this has been the establishment of an in-house or internal bank within the firm. Such an in-house bank is not a separate corporation; rather, it is a set of functions performed by the existing treasury department.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-32

Financing Working Capital

Trident Brazil sells all its receivables to the in-house bank as they arise, reducing some of the domestic working capital needs. Additional working capital needs are supplied by the in-house bank directly to Trident Brazil. Because the in-house bank is part of the same company, the interest rates it charges may be significantly lower than what Trident Brazil could obtain on its own. In addition to providing financing benefits, in-house banks allow for more effective currency risk management.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-33

Financing Working Capital

MNEs depend on their commercial banks to handle most of the trade financing needs, such as letters of credit, and to provide advice on government support, country risk assessment, introductions to foreign firms and banks, and general financing availability. The main points of bank contacts are correspondent banks, representative offices, branch banks, subsidiaries, and affiliates.

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-34

Mini-Case Questions: Honeywell and Pakistan International Airways Estimate what cash flows in which currencies the proposal would probably yield. What is the expected U.S. dollar value that would, in the end, be received? Do you think the services that Makran is offering are worth the costs? What would you do if you were heading the Honeywell SAC group negotiating the deal?

Copyright 2010 Pearson Prentice Hall. All rights reserved.

21-35

Chapter 21

Additional Chapter Exhibits

Copyright 2010 Pearson Prentice Hall. All rights reserved.

You might also like

- Multinational Business Finance Solution Manual 12th Edition by Etiman Stone Hill Moffitt Prepared by Wasim Orakzai IM Sciences KUST ISBN 0 321 1789Document229 pagesMultinational Business Finance Solution Manual 12th Edition by Etiman Stone Hill Moffitt Prepared by Wasim Orakzai IM Sciences KUST ISBN 0 321 1789Alli Tobba83% (12)

- Multinational Business Finance 12th Edition Slides Chapter 07Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 07Alli Tobba100% (1)

- Case StudyDocument2 pagesCase StudybombyĐNo ratings yet

- Practice Questions - International FinanceDocument18 pagesPractice Questions - International Financekyle7377No ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 17Document28 pagesMultinational Business Finance 12th Edition Slides Chapter 17Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 07Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 07Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 16Document24 pagesMultinational Business Finance 12th Edition Slides Chapter 16Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 02Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 02Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 18Document39 pagesMultinational Business Finance 12th Edition Slides Chapter 18Alli Tobba0% (1)

- Multinational Business Finance 12th Edition Slides Chapter 19Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 19Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 08Document44 pagesMultinational Business Finance 12th Edition Slides Chapter 08Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 03Document34 pagesMultinational Business Finance 12th Edition Slides Chapter 03Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 06Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 06Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 13Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 13Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 20Document32 pagesMultinational Business Finance 12th Edition Slides Chapter 20Alli Tobba100% (2)

- Multinational Business Finance 12th Edition Slides Chapter 11Document35 pagesMultinational Business Finance 12th Edition Slides Chapter 11Alli TobbaNo ratings yet

- Multinational Business FinanceDocument95 pagesMultinational Business FinancebhargaviNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 09Document34 pagesMultinational Business Finance 12th Edition Slides Chapter 09Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 01Document25 pagesMultinational Business Finance 12th Edition Slides Chapter 01Alli TobbaNo ratings yet

- 14 Interest Rate and Currency SwapsDocument45 pages14 Interest Rate and Currency SwapsJogendra BeheraNo ratings yet

- Exchange Rate DeterminationDocument18 pagesExchange Rate DeterminationBini MathewNo ratings yet

- Week 3 - Ch8 - Interest Rate Risk - The Repricing ModelDocument12 pagesWeek 3 - Ch8 - Interest Rate Risk - The Repricing ModelAlana Cunningham100% (1)

- Week 2 Managerial FinanceDocument64 pagesWeek 2 Managerial FinanceCalista Elvina JesslynNo ratings yet

- The Subsidiary As A PEDocument6 pagesThe Subsidiary As A PEJorish PaidestroNo ratings yet

- Euro Bond MarketDocument30 pagesEuro Bond MarketSharath PoojariNo ratings yet

- Lecture03 Parity StudentDocument23 pagesLecture03 Parity StudentMit DaveNo ratings yet

- FIxed Income PresentationDocument277 pagesFIxed Income PresentationAlexisChevalier100% (1)

- Finance - Module 7Document3 pagesFinance - Module 7luckybella100% (1)

- SM Multinational Financial Management ch09Document5 pagesSM Multinational Financial Management ch09ariftanur100% (1)

- Emerging Market Carry Trade ChangedDocument7 pagesEmerging Market Carry Trade ChangedYinghong chen100% (2)

- Libor Outlook - JPMorganDocument10 pagesLibor Outlook - JPMorganMichael A. McNicholasNo ratings yet

- IMEF Case 15 AnalysisDocument5 pagesIMEF Case 15 AnalysisHoward McCarthyNo ratings yet

- Financial Management Assignment: Prepared By, Rahul Pareek IMI, New DelhiDocument72 pagesFinancial Management Assignment: Prepared By, Rahul Pareek IMI, New Delhipareek2020100% (1)

- Exchange Rate Risk Assessment and Internal Techniques ofDocument19 pagesExchange Rate Risk Assessment and Internal Techniques ofSoumendra RoyNo ratings yet

- Global Investments PPT PresentationDocument48 pagesGlobal Investments PPT Presentationgilli1trNo ratings yet

- Capital Flow AnalysisDocument8 pagesCapital Flow AnalysisNak-Gyun KimNo ratings yet

- PFC Funds Power Projects in India; CRISIL AAA Rated Bond FeaturesDocument10 pagesPFC Funds Power Projects in India; CRISIL AAA Rated Bond FeaturesAnonymous 31fa2FAPhNo ratings yet

- Measuring Carry Trade ActivityDocument26 pagesMeasuring Carry Trade ActivityOkay KiygiNo ratings yet

- Money and Banking 2009 SpringDocument117 pagesMoney and Banking 2009 SpringborchaliNo ratings yet

- Financial Markets: Lectures 3 - 4Document48 pagesFinancial Markets: Lectures 3 - 4Lê Mai Huyền LinhNo ratings yet

- 6 International Parity Relationships and Forecasting Foreign Exchange RatesDocument57 pages6 International Parity Relationships and Forecasting Foreign Exchange Ratesreena2412No ratings yet

- Chapter 17Document20 pagesChapter 17Cynthia AdiantiNo ratings yet

- Measuring Exposure to Exchange Rate FluctuationsDocument6 pagesMeasuring Exposure to Exchange Rate Fluctuationsgeorgeterekhov100% (1)

- Fixed Rates Macro PolicyDocument10 pagesFixed Rates Macro PolicyJelenaJovanovicNo ratings yet

- Deutsche Bank and The Road To Basel - IIIDocument20 pagesDeutsche Bank and The Road To Basel - IIISHASHANK CHOUDHARY 22No ratings yet

- Add To Primex Longs: Securitization ResearchDocument8 pagesAdd To Primex Longs: Securitization ResearchMaxim TalonNo ratings yet

- Exchange Rates, Interest Rates, and Inflation RatesDocument19 pagesExchange Rates, Interest Rates, and Inflation RatesAnNa SouLsNo ratings yet

- Chapter 5: INTEREST RATE Derivatives: Forwards and SwapsDocument69 pagesChapter 5: INTEREST RATE Derivatives: Forwards and SwapsDarshan raoNo ratings yet

- Unit - Iii: Foreign Exchange Determination Systems &international InstitutionsDocument97 pagesUnit - Iii: Foreign Exchange Determination Systems &international InstitutionsShaziyaNo ratings yet

- Interest Rate SwapDocument7 pagesInterest Rate SwapAnonymous UJWnCouYNo ratings yet

- International Parity Relationships & Forecasting Exchange RatesDocument33 pagesInternational Parity Relationships & Forecasting Exchange RatesKARISHMAATA2No ratings yet

- 14 Interest Rate and Currency SwapsDocument28 pages14 Interest Rate and Currency SwapslalitjaatNo ratings yet

- 1310 - LIBOR $OFR Transition WebinarDocument23 pages1310 - LIBOR $OFR Transition WebinarChuluunbaatar UurstaikhNo ratings yet

- Chapter 06Document25 pagesChapter 06JON snowNo ratings yet

- Foreign Direct Investment and Cross Border InvestmentDocument34 pagesForeign Direct Investment and Cross Border InvestmentFrisancho OrkoNo ratings yet

- Chap10-Management of Translation ExposureDocument25 pagesChap10-Management of Translation ExposureOTNIEL ALBERT TANGEL ,No ratings yet

- Solutions Chapters 10 & 11 Transactions and Economic ExposureDocument46 pagesSolutions Chapters 10 & 11 Transactions and Economic ExposureJoão Côrte-Real Rodrigues50% (2)

- Interest Rate SwapsDocument12 pagesInterest Rate SwapsChris Armour100% (1)

- 426 Chap Suggested AnswersDocument16 pages426 Chap Suggested AnswersMohommed AyazNo ratings yet

- GS OutlookDocument30 pagesGS OutlookMrittunjayNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketFrom EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 20Document32 pagesMultinational Business Finance 12th Edition Slides Chapter 20Alli Tobba100% (2)

- Multinational Business Finance 12th Edition Slides Chapter 12Document33 pagesMultinational Business Finance 12th Edition Slides Chapter 12Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 11Document35 pagesMultinational Business Finance 12th Edition Slides Chapter 11Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 15Document24 pagesMultinational Business Finance 12th Edition Slides Chapter 15Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 13Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 13Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 09Document34 pagesMultinational Business Finance 12th Edition Slides Chapter 09Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 10Document35 pagesMultinational Business Finance 12th Edition Slides Chapter 10Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 04Document46 pagesMultinational Business Finance 12th Edition Slides Chapter 04Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 05Document54 pagesMultinational Business Finance 12th Edition Slides Chapter 05Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 06Document38 pagesMultinational Business Finance 12th Edition Slides Chapter 06Alli Tobba100% (1)

- Multinational Business Finance 12th Edition Slides Chapter 03Document34 pagesMultinational Business Finance 12th Edition Slides Chapter 03Alli TobbaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 01Document25 pagesMultinational Business Finance 12th Edition Slides Chapter 01Alli TobbaNo ratings yet

- Samsung Sustainability Report 2011Document94 pagesSamsung Sustainability Report 2011CSRmedia.ro NetworkNo ratings yet

- Samsung Sustainability Report 2011Document94 pagesSamsung Sustainability Report 2011CSRmedia.ro NetworkNo ratings yet

- Dual Trust DiagramDocument23 pagesDual Trust DiagramA & L BrackenregNo ratings yet

- Birth of The CISG - Its Applicability and NatureDocument12 pagesBirth of The CISG - Its Applicability and NatureAshi JainNo ratings yet

- FAR Assignment - 2Document7 pagesFAR Assignment - 2Melvin ShajiNo ratings yet

- Principle of Marketing - Pricing Context and ConceptsDocument18 pagesPrinciple of Marketing - Pricing Context and ConceptsDr Rushen SinghNo ratings yet

- GAFSP AR2018 - FinalDocument86 pagesGAFSP AR2018 - Finalkamba bryanNo ratings yet

- Advanced Marketing Management: Case Study: Culinarian Cookware: Pondering Price PromotionDocument3 pagesAdvanced Marketing Management: Case Study: Culinarian Cookware: Pondering Price PromotionKRISHNA YELDINo ratings yet

- Emailreceipt 201909034536403972Document1 pageEmailreceipt 201909034536403972komarr rrudinNo ratings yet

- CALAMBA NegoSale Batch 47005 010620-CompressedDocument8 pagesCALAMBA NegoSale Batch 47005 010620-CompressedDaniel BartoloNo ratings yet

- Women EntrepreneursDocument25 pagesWomen Entrepreneursnoufalnaheemkk786No ratings yet

- Samsung AC InvoiceDocument1 pageSamsung AC Invoiceavinash.tripathiNo ratings yet

- Che Guevara and The Political Economy of SocialismDocument31 pagesChe Guevara and The Political Economy of SocialismAlexAnfrunsNo ratings yet

- Studio Policy - Melody Piano EatonDocument2 pagesStudio Policy - Melody Piano Eatonapi-551533832No ratings yet

- NMIMS Banking Industry Analysis ReportDocument35 pagesNMIMS Banking Industry Analysis ReportGovind Chandvani100% (1)

- SembCorp KendalDocument34 pagesSembCorp KendalGrach MadiNo ratings yet

- Microeconomics 7Th Edition by Jeffrey M Perloff PDF Full ChapterDocument41 pagesMicroeconomics 7Th Edition by Jeffrey M Perloff PDF Full Chapterlinda.weinstein670100% (28)

- Mylan Write-Up Historicals and Sell RecommendationDocument1 pageMylan Write-Up Historicals and Sell RecommendationAdam SchlossNo ratings yet

- Tahi - HatiDocument53 pagesTahi - HatiZhanra Therese Arnaiz100% (1)

- MAS 8 Short-Term Budgeting and Forecasting FOR UPLOADDocument10 pagesMAS 8 Short-Term Budgeting and Forecasting FOR UPLOADJD SolañaNo ratings yet

- Exam 14 October 2012, Answers Exam 14 October 2012, AnswersDocument9 pagesExam 14 October 2012, Answers Exam 14 October 2012, AnswerscandiceNo ratings yet

- 52608500Document68 pages52608500Anjo Vasquez100% (1)

- Global Management Intel CaseDocument2 pagesGlobal Management Intel Caseapi-705719715No ratings yet

- Cambridge IGCSE™: Accounting 0452/22 March 2021Document19 pagesCambridge IGCSE™: Accounting 0452/22 March 2021Farrukhsg50% (2)

- Business Administration: Passed By: Castillo, Carmela Passed To: Sir Marjeric BuenafeDocument6 pagesBusiness Administration: Passed By: Castillo, Carmela Passed To: Sir Marjeric BuenafeCarmela CastilloNo ratings yet

- COVID-19 Supply Chain DisruptionDocument1 pageCOVID-19 Supply Chain DisruptionvikramNo ratings yet

- Inventory Management System of GrofersDocument66 pagesInventory Management System of Grofersvarsha meena100% (1)

- Valores de Referencia Tumorales Bio RadDocument3 pagesValores de Referencia Tumorales Bio RadorthincoatzaNo ratings yet

- Tugas Bahasa Inggris Week 3Document7 pagesTugas Bahasa Inggris Week 3alipelhanaNo ratings yet

- Deferred AnnuityDocument2 pagesDeferred AnnuitySharmin Reula0% (1)

- VN STEEL INDUSTRY ANALYSISDocument2 pagesVN STEEL INDUSTRY ANALYSISThanh Nguyen NgocNo ratings yet

- Assignment GE MckinseyDocument2 pagesAssignment GE MckinseyBhavana Watwani100% (1)