Professional Documents

Culture Documents

Vat

Uploaded by

Nitin KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat

Uploaded by

Nitin KumarCopyright:

Available Formats

VALUE ADDED TAX

BY,

PRESENTATION ON

NITIN DWIVEDI (35) MMM-C

VAT Terminology

VAT Value Added Tax This is the new system being implemented from April 1, 2005 in A.P and other states. Unlike, Sales Tax, VAT is calculated based on Input & Output variation.

VAT Terminology Input Tax

INPUT TAX Input Tax is the Tax shown in our purchase bills. As per the norms, every trader need to show Tax separately and it is considered as Input Tax. Apart from Trade Purchases, Tax on Capital Goods purchases like A.C., Computers etc.. is also considered for this Input Tax.

VAT Terminology Output Tax

OUTPUT TAX Output Tax is the Tax charged on all the Taxable sales of a Vat Dealer.

Output Tax is the Tax charged on all the Taxable sales of a Vat Dealer.

For Ex. Tax shown by us our Output Tax and it becomes Input Tax for our customer.

VAT Applicability

Below 5 Lakhs turnover No Tax & No. Regn required. 5 40 Lakhs TOT will apply & VAT is optional. Above 40 Lakhs VAT will apply.

VAT Rates

There are three main rates for Input and Output Vat tax. 0% for Agriculture products. 1% for Jewellery 4% for Pharma, Computers, Soaps etc. 12.5% for FMCG, Automobile

Input Tax Amount Calculation

Month Purchases Gross Value X Rate of Tax For ex.: Input Tax = 10,00,000 * 0.04 = 40,000/Purchases, includes Trade purchases and Capital Goods purchases as per the existing VAT Rate.

Output Tax Amount Calculation

Month Sales X Rate of Tax Output Tax = 20,00,000 * 0.04 = 80,000/On the invoice, we should show, Items Amount, VAT Value and Total Value In case of discounts, it should be given before VAT.

Tax Credit

If Input Tax is greater than Output Tax, then we should not pay Tax to Government. This amount will be carried forward to the next month. This is the Tax Credit Amount. Input Tax 1,00,000/Output Tax 50,000/Tax Credit = Input Tax Output Tax = 1,00,000 50,000 = 50,000/-

Opening Stock Tax Calculation

For Ex: 10 Lakhs with 10% SST - 1 Lakh as Opening Stock VAT Claim. Opening Tax Credit arrived can be re-deemed as follows: Opening Stock tax will be deducted between Aug 2005 Jan 2006 as 6 monthly installments. If still, credit is there after Jan 2006, it will be carried forward and it can be adjusted upto Jan 2008. If still additional amount is there, it will be paid by Govt in Mar 2008

Tax Amount Calculation

Output Tax (Input Tax + Tax Credit + Opening Stock Vat Adjustment Amount)

VAT Equation Sales Value Purchase Value = G.P X VAT Rate. Tax Paid Date If not paid by 20th of the month then 5000/- penalty

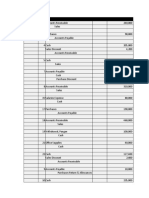

Opening Stock Value

6,00,000

Example

Month Purchases Sales

Tax Rate

10%

Claimed

60000

Input Tax

Output Tax

Tax Payable

Opening Stock 0 0 0 0 10000 10000 10000 10000 10000 10000 0 0

Tax Credit

April May June July August September October November December January February March

50000 100000 100000 100000 100000 100000 100000 100000 100000 100000 100000 100000

60000 200000 80000 80000 80000 80000 120000 80000 80000 130000 80000 100000

2000 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000 4000

2400 8000 3200 3200 3200 3200 4800 3200 3200 5200 3200 4000

400 0 0 0 0 0 0 0 0 0 0 0

0 -4000 -4800 -5600 -16400 -27200 -36400 -47200 -58000 -66800 -67600 -67600

Tips for VAT Accounting

In March 2005, it is suggested to reduce the stocks and do not purchase, unless, it is urgent. This way, we can reduce opening stocks for New Fin. Year. In April, May, June, July, We suggest to maintain balance of Purchases and Sales, which helps to plan Tax in a better way. From August onwards, you can reduce purchases, as Opening Stock Credit will be used from these months.

TYHAK YOU..

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- KKR Annual Review 2008Document77 pagesKKR Annual Review 2008AsiaBuyoutsNo ratings yet

- Pangan CompanyDocument18 pagesPangan CompanyWendy Lupaz80% (5)

- Principles of Banking MCQsDocument34 pagesPrinciples of Banking MCQsUmar100% (2)

- Unintended Consequences: by John MauldinDocument11 pagesUnintended Consequences: by John Mauldinrichardck61No ratings yet

- Sample Question AnswerDocument57 pagesSample Question Answerসজীব বসুNo ratings yet

- Journal Home GridDocument1 pageJournal Home Grid03217925346No ratings yet

- Preparing Financial StatementsDocument6 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Katanga Mining Limited Annual Information Form For The Year Ended DECEMBER 31, 2017Document68 pagesKatanga Mining Limited Annual Information Form For The Year Ended DECEMBER 31, 2017badrNo ratings yet

- Pag-IBIG Fund Public Auction Properties in Cavite, Laguna, Bulacan & Metro ManilaDocument24 pagesPag-IBIG Fund Public Auction Properties in Cavite, Laguna, Bulacan & Metro ManilaSilvino CatipanNo ratings yet

- SindzaBG - N1 - Represented by Stefan TzvetkovDocument18 pagesSindzaBG - N1 - Represented by Stefan Tzvetkovdusandjordjevic011No ratings yet

- Research Article On Growing of The Business Too Fast Resulting OvertradingDocument90 pagesResearch Article On Growing of The Business Too Fast Resulting OvertradingJayantha Chandrakumar KothalawalaNo ratings yet

- AFM ProblemsDocument4 pagesAFM ProblemskuselvNo ratings yet

- ppt4FEC - PPTM (Autosaved) BOUNCE (Autosaved)Document15 pagesppt4FEC - PPTM (Autosaved) BOUNCE (Autosaved)THE BANGALORIST Blr100% (2)

- Transfer of Property Act NotesDocument1 pageTransfer of Property Act NotesDEBDEEP SINHA0% (1)

- Project GuideDocument22 pagesProject GuideMr DamphaNo ratings yet

- Ch05-Accounting PrincipleDocument9 pagesCh05-Accounting PrincipleEthanAhamed100% (2)

- ADAMS - 2021 Adam Sugar Mills Limited BalancesheetDocument6 pagesADAMS - 2021 Adam Sugar Mills Limited BalancesheetAfan QayumNo ratings yet

- Lone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Document142 pagesLone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Texas WatchdogNo ratings yet

- Project-Study of Stock ExchangesDocument35 pagesProject-Study of Stock ExchangesMerwin AlvaNo ratings yet

- WUFC - Newsletter September 2014Document8 pagesWUFC - Newsletter September 2014whartonfinanceclubNo ratings yet

- Dr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawDocument9 pagesDr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawVimal SinghNo ratings yet

- Lec-2 - Chapter 23 - Nation's IncomeDocument33 pagesLec-2 - Chapter 23 - Nation's IncomeMsKhan0078No ratings yet

- Term Paper On The Topic Monetary Policy of Nepal 2080 - 81 Aadhar Babu KhatiwadaDocument15 pagesTerm Paper On The Topic Monetary Policy of Nepal 2080 - 81 Aadhar Babu KhatiwadaPrashant GautamNo ratings yet

- Donor S TaxDocument68 pagesDonor S TaxLuna CakesNo ratings yet

- Excel Solutions - CasesDocument25 pagesExcel Solutions - CasesJerry Ramos CasanaNo ratings yet

- Incometax Act 1961Document22 pagesIncometax Act 1961Mohd. Shadab khanNo ratings yet

- Earnings Per ShareDocument15 pagesEarnings Per ShareMuhammad SajidNo ratings yet

- SBD HPPWD Final2016Document108 pagesSBD HPPWD Final2016KULDEEP KAPOORNo ratings yet

- Vocabulary Power Through Shakespeare: David PopkinDocument19 pagesVocabulary Power Through Shakespeare: David PopkinimamjabarNo ratings yet