Professional Documents

Culture Documents

Understanding The Economy As A Series of Continuous Flows

Uploaded by

Aman Singh RajputOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Understanding The Economy As A Series of Continuous Flows

Uploaded by

Aman Singh RajputCopyright:

Available Formats

Understanding the economy as a series of continuous flows

The Simple Two Sector Model

Assume the economy is made up of two sectorsfirms and households. Firms produce products which they sell in the Product Market. Households buy products in the Product Market. Firms buy resources in the Resource Market. Households sell resources in the Resource Market.

The Simple Two Sector Model

The Two Sector Model

With a Financial Market Now assume that households do not spend all of their income, i.e., they save.

This represents a leakage from the circular flow.

Assume firms need capital to produce goods and services, thus they must engage in investment spending.

This represents an injection into the circular flow.

Financial intermediaries perform the function of bringing savers and investors together.

The Two Sector Model

With a Financial Market

The Three Sector Model

Our two sector model is not realistic in anything but the most primitive society. Lets assume we have a government sector. What do governments do?

They tax. (A leakage) They spend. (An injection)

How does the government affect our circular flow?

The Three Sector Circular Flow Model

The Four Sector Model

In the real world, no country exists in isolation. Nations of the world interact with one another by buying from and selling to each other. We buy imports from foreign countries. (A leakage) We sell exports to foreign countries. (An injection) Add imports and exports to our circular flow. How does the rest of the world affect the circular flow model?

The Four Sector Circular Flow Model

GDP in an Open Economy with Government

Government Spending and Taxes: Government spending and taxation policies affect equilibrium GDP in two important ways. First, government spending is part of autonomous spending , that is, it is an exogenous element of spending in the economy, as it directly adds demand for the economys current output of goods and services. Second, in deriving disposable income, taxes must be subtracted from NI, and government transfer payments (state pensions and unemployment allowances) must be added. Tax revenues may be thought of as negative transfer payments in their effect on desired aggregate spending. Tax payments reduce disposable income relative to NI; transfers raise disposable income relative to NI. Net taxes are total tax revenues received by the government minus total transfer payments made by the government. A governments plans for taxes and spending define its fiscal policy, which has important effects on the level of GDP in both the short and the long run. The Budget Balance: The budget balance is the difference between total government revenue and total government spending-or equivalently, net taxes minus government spending. When revenues exceed spending, the government is running a budget surplus and reverse is budget deficit and when there is neither deficit nor surplus then is called as balanced budget.

Government Spending and Taxes: The balance of trade responds to changes in GDP, the price level, and the exchange rate. Exports depend on spending decisions made by foreign consumers or overseas firms that purchase domestic goods and services. Therefore, exports are determined by influences outside of the home country. This is autonomous, or exogenous, spending from the point of view of the determination of domestic GDP. Imports, however, depend on the spending decisions of domestic residents. Most categories of spending have an import content-like outsourcing of products for making any finished goods like TV, ACs, Cars etc. Thus, imports rise when the other categories of spending rise. Because consumption rises when the income of domestic consumers rises, imports of foreign produced consumption goods, and of materials that go into the production of domestically produced consumption goods also rises with domestic income. Foreign GDP: An increase in foreign GDP, other things being equal, will lead to an increase in the quantity of domestic-produced goods demanded by foreign countries, that is, to an increase in our exports and vice-versa. Relative International Prices: Any change in the prices of home produced goods relative to those of foreign goods will cause both imports and exports to change. What circumstances will cause relative international prices to change? a) International differences in inflation rates, b) and changes in exchange rates. Exchange rate changes may be brought about by changes in interest rates implemented by the monetary authorities. The domestic currency will generally appreciate when the domestic interest rate is raised, and vice-versa.

Changes in Aggregate Spending

1. Fiscal Policy: what should the government do for increasing aggregate spending in an economy? Keynesian philosophy also to be dealt with. Changes in government spending Changes in tax rates ----Tax rates and the Multiplier ( the lower is the income tax rate, the larger is the simple multiplier as MPC will rise. Balanced budget changes ( changes made in spending and tax rate ) A balanced budget increase in government spending will have a mild expansionary effect on GDP, and a balanced budget decrease will have a mild contractionary effect. 2. Monetary Policy: It works via the effects of interest rates on aggregate spending. Interest rate changes effects consumption. Higher interest rate encourage people to cut their spending in order to save more and discourage borrowing in order to spend more. Higher interest rate also discourage investment. Interest rate changes lead to a shift in autonomous spending ( whether it be consumption, investment, or net exports)

You might also like

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- ch4 Government and The MacroeconomyDocument21 pagesch4 Government and The MacroeconomyNeeha KaziNo ratings yet

- IV Concepts of National Income, GDP, GNP, Circular FlowDocument8 pagesIV Concepts of National Income, GDP, GNP, Circular FlowPiyush AneejwalNo ratings yet

- Macroeconomics concepts and termsDocument12 pagesMacroeconomics concepts and termssymhoutNo ratings yet

- Shwe Htun AssignmentDocument8 pagesShwe Htun AssignmentDrEi Shwesin HtunNo ratings yet

- Fiscal Policy and Public Debt - RevisedDocument70 pagesFiscal Policy and Public Debt - Revisedtxn5j29mmqNo ratings yet

- Q. 1 Construct A Simplified Model of An Economic System and Explain The Circular Flow of Income. AnsDocument17 pagesQ. 1 Construct A Simplified Model of An Economic System and Explain The Circular Flow of Income. AnsMuhammad NomanNo ratings yet

- Module 1 MacroeconomicsDocument12 pagesModule 1 MacroeconomicsGagan H PNo ratings yet

- Introduction To Macroeconomics Basic Concepts and Scope of Macroeconomic Analysis What Is Macroeconomics?Document53 pagesIntroduction To Macroeconomics Basic Concepts and Scope of Macroeconomic Analysis What Is Macroeconomics?ZAKAYO NJONYNo ratings yet

- Macroeconomic Data (CH 20) PDFDocument11 pagesMacroeconomic Data (CH 20) PDFAlicia CataláNo ratings yet

- Module 2 National Income AccountingDocument12 pagesModule 2 National Income Accountingexequielmperez40No ratings yet

- MacroeconomicsDocument8 pagesMacroeconomicscamellNo ratings yet

- Aggregate Supply, Aggregate Demand and National OutputDocument43 pagesAggregate Supply, Aggregate Demand and National OutputChristian Jumao-as MendozaNo ratings yet

- Internals 1Document16 pagesInternals 1Pavan H.P.No ratings yet

- Notes Fiscal PolicyDocument12 pagesNotes Fiscal PolicyKrish Madhav ShethNo ratings yet

- Principles of Economics 4Document51 pagesPrinciples of Economics 4reda gadNo ratings yet

- Unit 13 Economic Fluctuations and UnemploymentDocument36 pagesUnit 13 Economic Fluctuations and Unemploymentzeus catNo ratings yet

- ECS2602 NOTES: ECONOMIC GROWTH, GDP, FISCAL & MONETARY POLICYDocument30 pagesECS2602 NOTES: ECONOMIC GROWTH, GDP, FISCAL & MONETARY POLICYSimphiwe NkosiNo ratings yet

- Introduction To MacroeconomicsDocument45 pagesIntroduction To MacroeconomicsAnkita MalikNo ratings yet

- G 12 Economcs 15Document12 pagesG 12 Economcs 15Abdallah HassanNo ratings yet

- Economic Issues PDFDocument10 pagesEconomic Issues PDFFathik FouzanNo ratings yet

- National Income: Understanding a Country's WealthDocument25 pagesNational Income: Understanding a Country's WealthSivaramkrishnanNo ratings yet

- Econ 203 Notes mt1Document6 pagesEcon 203 Notes mt1roudyjoezakhourNo ratings yet

- Be ImportantDocument17 pagesBe ImportantShriom RautNo ratings yet

- Chapter FourDocument41 pagesChapter Fourmikialeabrha23No ratings yet

- BUS 404 Chapter 3Document17 pagesBUS 404 Chapter 3R-540 Mahmud Hasan Batch-105-CNo ratings yet

- Unit 5me (New)Document6 pagesUnit 5me (New)Anuj YadavNo ratings yet

- Chapter Six - MacroeconomicsDocument66 pagesChapter Six - MacroeconomicsAlazar MebratuNo ratings yet

- Fiscal PolicyDocument24 pagesFiscal Policyરહીમ હુદ્દાNo ratings yet

- Lecture 2. Mr. AllicockDocument60 pagesLecture 2. Mr. AllicockPrecious MarksNo ratings yet

- Lect 2 Indian EconomyDocument23 pagesLect 2 Indian EconomySuhail BhatNo ratings yet

- Macroeconomic Policies: Introduction To Economics Government Revenue & Expenditure: The Fiscal SystemDocument3 pagesMacroeconomic Policies: Introduction To Economics Government Revenue & Expenditure: The Fiscal SystemShahzaib EhsanNo ratings yet

- ECON 1002 NOTES ON CHAPTERS 15-17Document52 pagesECON 1002 NOTES ON CHAPTERS 15-17sashawoody167No ratings yet

- Government's Three Key Economic FunctionsDocument10 pagesGovernment's Three Key Economic FunctionsNeel ChaurushiNo ratings yet

- Tema 1,2,3Document30 pagesTema 1,2,3SoniaNo ratings yet

- The International Economic Environment: Chapter - 3Document29 pagesThe International Economic Environment: Chapter - 3Tasnim IslamNo ratings yet

- ECO 102 NotesDocument76 pagesECO 102 NotesSabira RahmanNo ratings yet

- lecture1Document74 pageslecture1Edward Gabada JnrNo ratings yet

- MBA I Unit V Managerial EconomicsDocument11 pagesMBA I Unit V Managerial EconomicsSumitNo ratings yet

- MacroeconomicsDocument4 pagesMacroeconomicskuashask2No ratings yet

- Intermediate Macro Assignment Pp CopyDocument6 pagesIntermediate Macro Assignment Pp Copyha9443854No ratings yet

- Lecture - 3 - 4 - Determination of Economic ActivityDocument61 pagesLecture - 3 - 4 - Determination of Economic ActivityAnil KingNo ratings yet

- Macroeconomic Data (CH 20)Document11 pagesMacroeconomic Data (CH 20)Alicia CataláNo ratings yet

- Top 7 Measures To Correct Deficit Balance of PaymentsDocument6 pagesTop 7 Measures To Correct Deficit Balance of Paymentssanina100% (1)

- Unit 2 Circular FlowDocument62 pagesUnit 2 Circular Flowk pradeepaNo ratings yet

- Unit 2 Circular FlowDocument62 pagesUnit 2 Circular FlowAnshumaan PatroNo ratings yet

- Overview of MacroeconomicsDocument10 pagesOverview of Macroeconomicssnowblack.aggNo ratings yet

- Economic Issues IGCSE Business NotesDocument5 pagesEconomic Issues IGCSE Business NotesHiNo ratings yet

- C1 MacroDocument21 pagesC1 MacroIzmir MucaNo ratings yet

- Macroeconomic PrinciplesDocument128 pagesMacroeconomic PrinciplesTsitsi Abigail100% (2)

- Macroeconomics Review: Mr. Remigio G. TiambengDocument25 pagesMacroeconomics Review: Mr. Remigio G. TiambengPamela EuniseNo ratings yet

- Macroeconomics, GDP, Well-Being ExplainedDocument57 pagesMacroeconomics, GDP, Well-Being ExplainedSofia KNo ratings yet

- GR 10 Govt. (Macro) Eco PoliciesDocument4 pagesGR 10 Govt. (Macro) Eco PoliciesAditi JaysonNo ratings yet

- Economics AssignmentDocument10 pagesEconomics AssignmentRama ChandranNo ratings yet

- Fiscal PolicyDocument19 pagesFiscal PolicyShreya SharmaNo ratings yet

- Stages of Development of EconomicsDocument37 pagesStages of Development of Economicsaditya mhatreNo ratings yet

- Macro EconDocument128 pagesMacro EconDawne BrownNo ratings yet

- ECONOMIC ENVIRONMENT FOR BUSINESS FNLDocument12 pagesECONOMIC ENVIRONMENT FOR BUSINESS FNLTIBUGWISHA IVANNo ratings yet

- Government Macroeconomic AimsDocument14 pagesGovernment Macroeconomic Aimsv8qrf2w9zdNo ratings yet

- Fiscal Policy: Why It MattersDocument8 pagesFiscal Policy: Why It MatterspriyaNo ratings yet

- Class 1 BankingDocument18 pagesClass 1 BankingAman Singh RajputNo ratings yet

- What Is Macroeconomics? Its OriginDocument55 pagesWhat Is Macroeconomics? Its OriginAman Singh RajputNo ratings yet

- Using Personality Traits To Understand Behavior: For Personality Puzzle 4 Edition Ch. 7Document7 pagesUsing Personality Traits To Understand Behavior: For Personality Puzzle 4 Edition Ch. 7Aman Singh RajputNo ratings yet

- Ipl 2Document35 pagesIpl 2Aman Singh RajputNo ratings yet

- Properties of CorrelationDocument2 pagesProperties of CorrelationAman Singh RajputNo ratings yet

- Chapter 5Document10 pagesChapter 5Aman Singh RajputNo ratings yet

- Chapter 12Document27 pagesChapter 12Sajid BhatNo ratings yet

- Barter SystemDocument27 pagesBarter SystemimadNo ratings yet

- Keynes' Evolution of Macroeconomics from Say's Law to Aggregate DemandDocument70 pagesKeynes' Evolution of Macroeconomics from Say's Law to Aggregate DemandAman Singh Rajput100% (1)

- Income Determination in Short Run: Basic Model: Ae Y AE (C+I) Ae YDocument31 pagesIncome Determination in Short Run: Basic Model: Ae Y AE (C+I) Ae YAman Singh RajputNo ratings yet

- Chapter 8Document28 pagesChapter 8Aman Singh RajputNo ratings yet

- Baumols TheoryDocument35 pagesBaumols TheoryAman Singh Rajput100% (1)

- MIS PresentationDocument11 pagesMIS PresentationAman Singh RajputNo ratings yet

- Manageral EconomicsDocument7 pagesManageral EconomicsimadNo ratings yet

- Alternative To Profit MaximisationDocument11 pagesAlternative To Profit MaximisationAman Singh RajputNo ratings yet

- Product Line Pricing or Multi Product PricingDocument2 pagesProduct Line Pricing or Multi Product PricingAman Singh RajputNo ratings yet

- New Product PricingDocument18 pagesNew Product PricingAman Singh RajputNo ratings yet

- Baumol's Sales Revenue Maximization Model ExplainedDocument10 pagesBaumol's Sales Revenue Maximization Model ExplainedAman Singh RajputNo ratings yet

- MIS PresentationDocument11 pagesMIS PresentationAman Singh RajputNo ratings yet

- Demand ForecastingDocument15 pagesDemand ForecastingAman Singh RajputNo ratings yet

- The Credit Rating Agencies of Bangladesh and Around The World and Their FunctionDocument6 pagesThe Credit Rating Agencies of Bangladesh and Around The World and Their FunctionMd. Mustafezur Rahaman BhuiyanNo ratings yet

- Fa BobadillaDocument11 pagesFa BobadillaKamille ValdezNo ratings yet

- Types of Lending and Facilities PDFDocument18 pagesTypes of Lending and Facilities PDFKnowledge GuruNo ratings yet

- RELATIONAL MODEL Exercise in Database SystemsDocument3 pagesRELATIONAL MODEL Exercise in Database SystemsMalaikaNo ratings yet

- Drill AccountingDocument17 pagesDrill AccountingRobert CastilloNo ratings yet

- Overview On InvITsDocument4 pagesOverview On InvITssayliNo ratings yet

- Coaching Discussion 04 (Economics Problems) : R S R S R S R SDocument5 pagesCoaching Discussion 04 (Economics Problems) : R S R S R S R SLao GeneNo ratings yet

- Nikhil Equitas StatementDocument2 pagesNikhil Equitas Statementprem yadav100% (1)

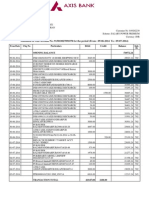

- Account StatementDocument2 pagesAccount StatementgobeyondskyNo ratings yet

- Bill Discounting Factoring & ForfaitingDocument34 pagesBill Discounting Factoring & Forfaitingdilpreet92No ratings yet

- Zimbabwean Banks Which Offer USD MasterCards or Visa Cards StartupBiz ZimbabweDocument1 pageZimbabwean Banks Which Offer USD MasterCards or Visa Cards StartupBiz ZimbabweemmaNo ratings yet

- Stonebridge Aquaforest Quote 19056Document2 pagesStonebridge Aquaforest Quote 19056coNo ratings yet

- Navi Loan Account StatementDocument2 pagesNavi Loan Account Statementashish singhNo ratings yet

- Pairs TradingDocument3 pagesPairs TradingmfearonNo ratings yet

- The Noble Group: Brienne Bowen, Emily Phipps, Adam Foley, Jeff Schroeder, Michael MalloyDocument12 pagesThe Noble Group: Brienne Bowen, Emily Phipps, Adam Foley, Jeff Schroeder, Michael MalloyKshitishNo ratings yet

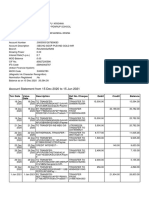

- Account statement for Mr. SAVARAPU KRISHNA from Dec 2020 to Jun 2021Document9 pagesAccount statement for Mr. SAVARAPU KRISHNA from Dec 2020 to Jun 2021SRINIVASARAO JONNALANo ratings yet

- (Kotak) Reliance Industries, October 29, 2023Document36 pages(Kotak) Reliance Industries, October 29, 2023Naushil ShahNo ratings yet

- Syllabus Math InvestmentDocument8 pagesSyllabus Math InvestmentMphilipTNo ratings yet

- BP Amoco PDFDocument35 pagesBP Amoco PDFPankhil Shikha100% (2)

- USAA HackingDocument6 pagesUSAA Hackingayina100% (1)

- Fina ManDocument20 pagesFina ManhurtlangNo ratings yet

- A Critical Assessment of Credit Policies and Facilities by Bank of BarodaDocument78 pagesA Critical Assessment of Credit Policies and Facilities by Bank of BarodaMayank100% (1)

- Seth Klarman Letter 1999 PDFDocument32 pagesSeth Klarman Letter 1999 PDFBean LiiNo ratings yet

- NeerajDocument2 pagesNeerajSheelu SinghNo ratings yet

- Investor Update (Company Update)Document34 pagesInvestor Update (Company Update)Shyam SunderNo ratings yet

- Daimler Q3 2011 Interim ReportDocument38 pagesDaimler Q3 2011 Interim ReportSaiful_Azri_1450No ratings yet

- Introduction to Capital Markets, Consumption, and InvestmentDocument26 pagesIntroduction to Capital Markets, Consumption, and InvestmentThuyển ThuyểnNo ratings yet

- FM Question BookletDocument66 pagesFM Question Bookletdeepu deepuNo ratings yet

- EMA-RSI-MACD 15min System - ProfitF - Website For Forex, Binary Options Traders (Helpful Reviews)Document5 pagesEMA-RSI-MACD 15min System - ProfitF - Website For Forex, Binary Options Traders (Helpful Reviews)Sonarat MoulnengNo ratings yet

- Cash FlowDocument24 pagesCash FlowMadhupriya DugarNo ratings yet

- Jamaica: A Guide to the Food & RestaurantsFrom EverandJamaica: A Guide to the Food & RestaurantsRating: 4 out of 5 stars4/5 (1)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (197)

- Proof of Heaven: A Neurosurgeon's Journey into the AfterlifeFrom EverandProof of Heaven: A Neurosurgeon's Journey into the AfterlifeRating: 3.5 out of 5 stars3.5/5 (165)

- Coastal Alaska & the Inside Passage Adventure Travel GuideFrom EverandCoastal Alaska & the Inside Passage Adventure Travel GuideNo ratings yet

- The Game: Penetrating the Secret Society of Pickup ArtistsFrom EverandThe Game: Penetrating the Secret Society of Pickup ArtistsRating: 4 out of 5 stars4/5 (131)

- Geneva, Lausanne, Fribourg & Western Switzerland Travel AdventuresFrom EverandGeneva, Lausanne, Fribourg & Western Switzerland Travel AdventuresNo ratings yet

- Hollywood & the Best of Los Angeles Travel GuideFrom EverandHollywood & the Best of Los Angeles Travel GuideRating: 4.5 out of 5 stars4.5/5 (2)

- Aruba, Bonaire & Curacao Adventure GuideFrom EverandAruba, Bonaire & Curacao Adventure GuideRating: 5 out of 5 stars5/5 (2)

- Nassau & the Best of the Bahamas Travel GuideFrom EverandNassau & the Best of the Bahamas Travel GuideRating: 5 out of 5 stars5/5 (1)