Professional Documents

Culture Documents

5 Uncoordinated Supply Chain

Uploaded by

Akash ShejuleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 Uncoordinated Supply Chain

Uploaded by

Akash ShejuleCopyright:

Available Formats

Uncoordinated Supply Chain

By

Prof. M. K. Tiwari

Dept of IE&M

IIT Kharagpur

Co-ordination In Supply Chain

Coordination in Supply Chain Refer as the coordination

of information, materials and financial flow between

organizations in supply chain.

Brings many organizations as an united team with well

established communication channels and optimized

resource allocation.

Why Supply Chain Suffers?

When each member of supply chain tries to maximize

their own profit.

When each member or group of supply chain tries to

optimize individually instead of coordinating their

efforts.

Why Coordination is Important in SCM?

Communication and Coordination among members of

a supply chain enhances its effectiveness which lead

to the benefit of whole supply chain.

For success in the global marketplace requires whole

supply chains to compete against other supply chains.

Kind of coordination involve in SC

Horizontal Coordination

Coordination among entities involve at same level

of Supply Chain.

Example: Coordination between supplier to supplier or within the firm.

Vertical Coordination

Coordination among entities involve at different

levels of Supply Chain.

Example: Coordination between supplier to retailer or distributor to retailer

Problems in SCM due to Low Involvement

of coordination

1. Location Decision of Franchisees of One

Organization

2. Warehouse Decision for Organization

3. Lot sizing problem with deterministic demand

4. Demand Forecasting in Supply Chain

5. Product Pricing and Marginal cost Problem between

Suppliers and Retailers

6. Lot sizing problem with stochastic demand in a

News-vendor environment

Location Decision of Franchisees

of One Organization

Location Decision of Franchisees of One

Organization

A franchise has multiple outlet to serve customers,

spread out over a town, a city or country.

Problem for franchise is, where they have to locate

their franchisees to get maximum profit in Supply

Chain.

In two ways they can select location

Two or more Franchisees whose location are coordinated by

Franchisor.

Two or more Franchisees that control their own location.

Example: Location Decision of Franchisees

Isaacs Ice Cream had been selling ice-creams in the

city, now Isaac wanted to expand his market to reach

summertime tourist by selling his ice-creams through

small-carts along the boardwalk on 4 mile beach.

Isaac company decided to open two franchisees on

the beach in 4 mile boardwalk.

Example: Location Decision of Franchisees

Now Isaac company has two option to establish these

franchisees;

Two Franchisees whose locations are coordinated

by Isaac company (Franchisor).

Two Franchisees that control their own locations.

Example: Location Decision of Franchisees

Suppose that a franchisor wishes to open two ice

cream parlor along a stretch of road 4-mile long.

Potential customers cluster with mile marker [MM]

0,1,2,3 & 4 and each cluster has n number of

customer.

Customer demand is sensitive primarily to distance

traveled by customer.

Example: Location Decision of Franchisees

MM 00

n

customer

MM 01

n

customer

MM 02

n

customer

MM 04

n

customer

MM 03

n

customer

4 Mile Beach with n customers on each clusters

1 Mile 2 Mile 3 Mile 4 Mile

Franchisee 1 Franchisee 1

Case 1: Franchisor choosing location for both Franchisees

Case 2: Two Franchisees that control their own locations

Franchisee 1

Franchisee 2

Two Franchisees whose locations are

coordinated by Franchisor

If the franchisor can locate these franchisees anywhere

on the 4-mile of the road, the franchisor will try to

maximize total demand of supply chain.

Demand for franchise will be maximized when the

franchise 1(F1) is located at MM1 and franchise 2(F2)

is located at MM3.

Two Franchisees whose locations are

coordinated by Franchisor

Total demand depends on distance traveled by customer,

hence, Demand D given as;

For Franchise 1 demand D

1

1

( 1) ( 0) ( 1)

2

Number of customer on each mile

Constant, 0

Constant, 4

na

D na b na b b

n

a a

b b

= + +

=

= >

= >

4

0

( )

i

i

D na b d

=

=

where d=distance traveled by customer

Two Franchisees whose locations are

coordinated by Franchisor

For Franchise 2 demand D

2

2

( 1) ( 0) ( 1)

2

Number of customer on each mile

Constant, 0

Constant, 4

na

D na b na b b

n

a a

b b

= + +

=

= >

= >

( 1) ( 0) ( 1) ( 0) ( 1)

(5 3)

D na b na b na b na b na b

D na b

= + + + +

=

Total demand for Supply Chain;

Two Franchisees that control their own

locations

In this case, both franchisee try to maximize their own

profit and demand, knowing that the other franchisee

exists and reacting accordingly.

In this case best location for each one is MM2 and if

both franchisees chooses MM2 then;

Total demand D;

( 2) ( 1) ( 0) ( 1) ( 2)

(5 6)

D na b na b na b na b na b

D na b

= + + + +

=

Warehouse Decision for

Organization

Warehouse Decision for Organization

The warehouse is a point in the logistics system where

a firm stores or hold raw materials, semi finished

goods or finished goods.

The firms can use distributed warehousing or

centralized warehousing for storage system.

Example: Warehouse Decision for

Organization

Isaacs Ice Cream has grown and now selling their

products over the other state through 200 retail-

outlets, which are equally distributed between these

two states.

In first state, Isaac company leased warehouse space

near each shop.

In second state, Isaac company tried storing goods for

all 100 shops in that state at a central location.

Example: Warehouse Decision for

Organization

In second state, company pays only for storage space

and ordering and receiving costs.

Firm has always carried safety stock to protect

against unusual high demand.

In centralized warehousing, two benefits are

involved;

Economies of scale in setup costs and holding costs

Risk pooling in stochastic demand environment

Economic Order Quantity Costs

Benefits of centralized warehousing in terms of

economies-of-scale given by EOQ,

For distributed warehousing;

D Annual Demand

H hoslding Costs

S Setup Costs

N Number of Clients

=

=

=

=

1 2

2 / , 2 / ................., 2 /

;

2 /

N

R R R

D

EOQ DS H EOQ DS H EOQ DS H

For N Clients

EOQ N DS H

= = =

=

Economic Order Quantity Costs

Benefits of centralized warehousing in terms of

economies-of-scale given by EOQ,

For Centralized Warehousing

;

2( ) /

C

For N Clients

EOQ ND S H =

D Annual Demand

H hoslding Costs

S Stup Costs

N Number of Clients

=

=

=

=

In this condition supplier combine the whole demand

instead of single client demand.

Economic Order Quantity Costs

The saving percent for centralized warehousing with

respect to distributed warehousing;

2 / 2 /

% 100

2 /

( ) 2 /

% 100

2 /

% 100

% 1 100

N DS H NDS H

Saving

N DS H

N N DS H

Saving

N DS H

N N

Saving

N

N

Saving

N

=

| |

=

|

|

\ .

EOQ of

Distributed SC

EOQ of

Coordinated SC

Numerical Example: Economic Order

Quantity Costs

With regard to EOQ costs, Saving %= [1-(N)/N]x100

Number of Clients Cost Saving %

2 29.29

3 42.26

4 50.00

5 55.28

6 59.18

7 62.20

8 64.64

9 66.67

10 68.38

Number of Clients Cost Saving %

11 69.85

12 71.13

20 77.64

25 80.00

40 84.42

50 85.86

100 90.00

1000 96.84

2500 98.00

Solving as

Saving %=(1-N/N)*100

=(1- 7/7)*100

=(1-0.3779)*100

=62.20%

Risk pooling benefits in Centralized

Warehousing: Newsvendor Environment

Suppose that i

th

firm choosing its optimal order

quantity has expected overage and underage costs

equal to K

i

.

Where

i

is firms is standard deviation of demand

And K is constant.

For distributed SC

Each client has same overage and underage cost per

unit, but with normal probability demand distribution

with mean and variance

2

;

For N client overage and underage cost = NK

Risk pooling benefits in Centralized

Warehousing: Newsvendor Environment

For Centralized SC

If supplier combines the demands of its all clients N,

Normal probability demand distribution with mean N and

variance N

2

,

For N client overage and underage cost ,

2

&

&

% 1 100

Overage Underage Costs K N

Overage Underage Costs NK

N

Saving

N

o

o

=

=

| |

=

|

|

\ .

Risk pooling benefits in Centralized

Warehousing: Safety Stock & Service Level

The safety stock equals to z, where z represents the

number of standard deviation over the mean to

achieve a desired cycle service level,

In distributed warehousing system,

Safety Stock Level for Supply Chain = zN

In centralized warehousing system,

Supplier combines the demand for all clients

Safety Stock Level for Supply Chain = zN

Risk pooling benefits in Centralized

Warehousing: Safety Stock & Service Level

Saving Cost % for it coordinated SC,

Service Levels can improve in centralized warehousing system

by improving z value in centralized warehousing;

% 1 100

N

Saving

N

| |

=

|

|

\ .

old new

new old

z N z N

z Nz

o o =

=

Standard

deviation in

distributed SC

Standard

deviation in

coordinated SC

Numerical Example: Cycle Service Level Z

new

Number of

Clients

70.00%

Z

old

= 0.5244

80.00%

Z

old

=0.8416

90.00%

Z

old

=1.2816

2 77.08% 88.30% 96.50%

3 81.81% 92.75% 98.68%

4 85.29% 95.38% 99.48%

5 87.95% 97.01% 99.79%

6 90.05% 98.04% 99.92%

7 91.73% 98.70% 99.97%

8 93.10% 99.14% 99.99%

9 94.22% 99.42% 99.99%

10 95.14% 99.61% 100.00%

15 97.51% 99.94% 100.00%

25 99.56% 100.00% 100.00%

50 99.99% 100.00% 100.00%

100 100.00% 100.00% 100.00%

Service levels from Z

table

2 , at z =0.5244 ;

2 *

0.7416

At 0.7416 Service level=77.08%

old

new old

new

For clients

z z

z

=

=

Lot sizing problem with

deterministic demand

Coordinated Lot Sizes with Deterministic

Demand

Some product has an expensive setup cost and a very

fast production rate.

And it is cheapest to produce it in lot size instead of

producing small number size.

It is optimal for the suppliers lot size of production

(lot size for supplier) to be an integer multiple of the

retailers lot size.

Total annual supply chain setup cost and holding cost

are given as;

Coordinated Lot Sizes with Deterministic

Demand

( )

1

..........(1)

2 2

s s r r

n Q

D D Q

TC S H S H

nQ Q

| | | | | |

| |

= + + +

| | | |

\ .

\ . \ . \ .

Annual demand

Supplier's setup cost

Retailer's setup cost

Supplier's holding cost

Retailer's holding cost

Retailer's order size

Supplier's integer lot-size multiplier

Supplier's lot-size

s

r

s

r

D

S

S

H

H

Q

n

nQ

=

=

=

=

=

=

=

=

the greatest integer x x = s

(

( )

Supplier's annual setup costs

1

Supplier's annual average holding costs

2

Retailer's annual setup costs

Retailer's annual average holding costs

2

s

s

r

r

D

S

nQ

n Q

H

D

S

Q

Q

H

| |

=

|

\ .

| |

=

|

\ .

| |

=

|

\ .

| |

=

|

\ .

Coordinated Lot Sizes with Deterministic

Demand

Differentiate equation (1) of total supply chain annual

setup and holding cost TC with respect to Q;

( )

2 2

2 2

1

..........(1)

2 2

( 1)

............................(2)

2 2

(2) 0;

( 1)

0;

2

s s r r

s s r r

s s r

n Q

D D Q

TC S H S H

nQ Q

DS n H DS H TC

Q Q n Q

Putting equation equal to

DS n H DS TC

Q Q n Q

| |

| | | |

| |

= + + +

|

| | |

\ .

\ . \ .

\ .

| |

= + +

|

c

\ .

| |

|

= +

|

c

\

\ .

2 2

0

2

( 1)

2 2

r

s s r r

H

H DS DS H

n

Q n Q

|

+ =

|

.

= +

Coordinated Lot Sizes with Deterministic

Demand

2

2

( 1) ;

2

2

s r r

r

s

r

DS DS H

n n n n

DS

H Q

H

(

(

( = +

(

(

2

2

( 1) ;

2 2

s r r

s

DS nH H

n n n

H Q

(

= +

(

2

2

2

s

s

DS

n n

H Q

=

2

2

2

0...................(3)

s

s

DS

n n

H Q

=

2

=

r

r

DS

Q

H

Coordinated Lot Sizes with Deterministic

Demand

2

2

2

2

2

(3);

2

0.......................(3)

;

4

;

2

2 1

1 1 4 1

2

We have to maximize the lot-size;

8 1

1 1

2

s

s

s

s

s

s

From equation

DS

n n

H Q

By Formula

b b ac

x

a

DS

n

H Q

DS

n

H Q

-

-

=

=

(

= +

(

(

(

= + +

(

(

(

Suppliers

multiple

Integer for

Quantity

Coordinated Lot Sizes with Deterministic

Demand

When the parties optimize independently, the retailer

orders Q

*

and the supplier orders (n

*

Q

*

),

where,

*

2

Q =

r

r

DS

H

2

8 1

1 1

2

s

s

DS

n

H Q

-

-

(

(

= + +

(

(

(

and

Coordinated Lot Sizes with Deterministic

Demand

When they optimize jointly, they go through these steps;

1:

4 ( ) 1

1 1 0,

2

s r s

r s

Step

S H H

n Max

S H

-

(

(

(

( = + +

`

(

(

)

*

*

2:

and ( 1)

s

r s r

Step

S

S S H n H H

n

= + = +

*

2

S

Q D

H

=

Therefore;

Numerical Example: Coordinated Lot Sizes

with Deterministic Demand

For example, consider a product with annual demand

D=25,000 unit, S

s

=$200, S

r

=$40.50, H

s

=$2.00, and

H

r

=$2.50;

( )

*

2

*

*

1 8 25000 200

1 1

2 2 900

1

1 5.07

2

3

n

n

n

(

| |

= + +

( |

|

(

\ .

(

= +

(

=

* *

3 900

2700 Unit

s

s

Q n Q

Q

= =

=

*

2 2500 40.5

900 Unit

2.5

Q

= =

Therefore;

Hence;

Numerical Example: Coordinated Lot Sizes

with Deterministic Demand

( )

*

*

3 1 900

25000 25000 900

200 2 40.50 2.5

3 900 2 900 2

$5902

TC

TC

| |

| | | | | |

= + + +

|

| | |

\ . \ . \ .

\ .

=

If they Jointly optimize their lot-size;

| |

*

1 4 200(2.5 2)

1 1 0,

2 40.50 2

1

1 2.42 1

2

n Max

n

-

(

(

= + + (

(

`

)

( (

(

= + =

(

Numerical Example: Coordinated Lot

Sizes with Deterministic Demand

*

2 25000 240.5

2193 Unit

2.5

Q

= =

*

*

and ( 1)

200

40.50 and (1 1)2.0 2.5

1

$240.5 and $2.50

s

r s r

S

S S H n H H

n

S H

S H

= + = +

= + = +

= =

*

2

S

Q D

H

=

Numerical Example: Coordinated Lot

Sizes with Deterministic Demand

Retailer orders 2193 unit and so does the supplier

orders 1x2193=2193 unit and total setup and holding

cost = $5483, and its 7.1 % lower than individual

optimized order quantity holding and setup cost.

In jointly optimization retailers holding and setup

cost is increase and so it should be compensate by

supplier by giving some quantity discount to retailer.

Numerical Example: Coordinated Lot

Sizes with Deterministic Demand

Benefits of lot-sizing;

S

s

/S

r

Q

new

/Q

old

Cost Saving

%

1 1.41 5.72

2 1.73 13.40

3 2.00 20.00

4 2.24 25.46

5 2.45 30.01

10 3.32 44.72

15 4.00 52.94

20 4.58 58.34

50 7.14 72.53

100 10.5 80.29

( )

( )

Cost Saving

Cost Saving

1 2 1 (

1 2 1 2

)

s

s r r

r

s

s r

r

r

S S

S S S

S

S

S S

S

= +

= + +

| | (

+

+

| (

\ .

| | (

| (

\ .

Demand Forecasting in Supply

Chain

Coordinated Demand Forecasting

Demand of products varies from downstream to

upstream in supply chain due to bullwhip effect in

supply chain.

As demand of products varies in supply chain, So

forecasting of demand of product also varies from

downstream to upstream.

Due to lack of communication between retailers,

distributor, wholesaler and supplier demand

forecasting may suffer in supply chain.

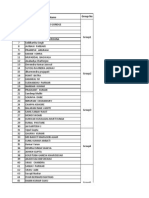

Example: Coordinated Demand Forecasting

Wholesaler and Retailer work individually without sharing any information

Retailers Wholesaler

Periods Customer's Next Period Onhand Back Order Order Placed In-transit Next Period On-hand Back Orders Order In-Transit

Order(B) Forecast(C) Inventory(D) (E) (F) Inventory(G) Forecast (I) (J) Placed(K) Inventory(L)

0 5 0 0 5 (H) 5 0 0 5

1 5 5 5 0 0 0 0 10 0 0 0

2 5 5 0 0 5 5 5 5 0 0 0

3 5 5 0 0 5 5 5 0 0 5 5

4 5 5 0 0 5 5 5 0 0 5 5

5 5 5 0 0 5 5 5 0 0 5 5

6 20 20 0 15 35 5 35 0 30 65 65

7 20 20 0 30 20 50 20 15 0 5 5

8 20 20 0 0 20 20 20 0 0 20 20

9 20 20 0 0 20 20 20 0 0 20 20

10 20 20 0 0 20 20 20 0 0 20 20

11 50 50 0 30 80 20 80 0 60 140 140

12 30 30 0 40 10 70 10 70 0 0 0

13 30 30 0 0 30 30 30 40 0 0 0

14 30 30 0 0 30 30 30 10 0 20 20

15 30 30 0 0 30 30 30 0 0 30 30

16 10 10 20 0 0 0 0 30 0 0 0

17 10 10 10 0 0 0 0 30 0 0 0

18 50 50 0 40 90 30 90 0 60 150 150

19 10 10 0 20 0 60 0 90 0 0 0

20 10 10 30 0 0 0 0 90 0 0 0

Total 385 70 175 410 395 150 490

Table 1

Next period

Forecast=Current

consumers Demand

Example: Coordinated Demand Forecasting

Wholesaler and Retailer sharing consumers demand information

Retailers Wholesaler

Periods Customer's Next Period Onhand Back Order Order Placed In-transit Next Period On-hand Back Orders Order In-Transit

Order(B) Forecast(C) (D) (E) (F) Inventory(G) Forecast Inventory(I) (J) Placed(K) Inventory(L)

0 5 0 0 (H) 5 0 0 5

1 5 5 0 0 5 5 5 5 0 0 0

2 5 5 0 0 5 5 5 0 0 5 5

3 5 5 0 0 5 5 5 0 0 5 5

4 5 5 0 0 5 5 5 0 0 5 5

5 5 5 0 0 5 5 5 0 0 5 5

6 20 20 0 15 35 5 20 0 30 50 50

7 20 20 0 30 20 50 20 0 0 20 20

8 20 20 0 0 20 20 20 0 0 20 20

9 20 20 0 0 20 20 20 0 0 20 20

10 20 20 0 0 20 20 20 0 0 20 20

11 50 50 0 30 80 20 50 0 60 110 110

12 30 30 0 40 10 70 30 40 0 0 0

13 30 30 0 0 30 30 30 10 0 20 20

14 30 30 0 0 30 30 30 0 0 30 30

15 30 30 0 0 30 30 30 0 0 30 30

16 10 10 20 0 0 0 10 30 0 0 0

17 10 10 10 0 0 0 10 30 0 0 0

18 50 50 0 40 90 30 50 0 60 110 110

19 10 10 0 20 0 60 10 50 0 0 0

20 10 10 30 0 0 0 10 50 0 0 0

Total 385 65 175 410 220 150 455

Table 2

Example: Coordinated Demand Forecasting

Equations for Table 1;

For Retailer,

Next period forecast= Consumer current demand

C5 = B5

*

On-hand Inventory =

Max[( Previous On-hand Inventory + Previous In Transit

Inventory Previous Back order Current Consumer

demand),0]

D5= MAX(D4 + G4 E4 B5, 0)

= Max(0+5-0-5,0) = 0

*

Back Order =

Max[( Previous Backorder + Current Consumer demand

Previous On-hand Inventory Previous In Transit Inventory),

0]

E5 = MAX( E4 + B5 D4 G4, 0) = Max(0+5-0-5, 0) = 0

*

Order Placed by Retailer =

Max[( Next Period forecast (On-hand Inventory +

wholesalers Previous Backorder Retailers Previous

Backorder)), 0]

F5 = MAX ( C5 (D5 + J4 E5), 0) = Max[5-(0+0-0), 0] = 5

Example: Coordinated Demand Forecasting

*

In Transit Inventory for Retailer =

Min[( Order Placed by Retailer + Wholesalers Previous

Backorder), (Wholesalers On-hand Inventory + wholesalers

In Transit Inventory)]

G5 = MIN (F5 + J4 , I4 + L4)= Min(5+0, 0+5)= 5

Equations for Table 1;

For Wholesaler;

*

Next Forecast = Order Placed by Retailer

H5 = B5

Example: Coordinated Demand Forecasting

*

Wholesalers On-hand Inventory =

Max[( Previous On-hand Inventory + Previous In Transit

Inventory Previous Backorder Order Placed by Retailer ) ,

0]

I5 = MAX ( I4 + L4 J4 F5 , 0 ) = Max(0+5-0-5, 0)=0

*

Wholesalers Backorder =

Max[( Wholesalers Previous Backorder + Order Placed by

Retailer - Previous Wholesalers On-hand Inventory

Previous Wholesalers In Transit Inventory) , 0]

J5 = MAX ( J4 + F5 I4 L4 , 0 ) = Max(0+5-0-5, 0)= 0

Example: Coordinated Demand Forecasting

*

Order Placed by Wholesaler =

Max[( Next Period forecast (Wholesalers Current On-hand

Inventory Current Backorder for Wholesaler) , 0]

K5 = MAX ( H5 (I5 J5) , 0 )=Max[5-(0-0), 0]= 5

For Table 2,

Everything will remain same except Next period forecast of

wholesaler.

Next Period forecast for wholesaler = Current Consumer

demand

H5 = B5

Example: Coordinated Demand Forecasting

Example: Coordinated Demand Forecasting

From table 1, wholesalers forecast equal to the order

received from retailer in current period.

And therefore wholesalers on-hand inventory is very

high due to low information sharing between them.

From table 2, retailer and wholesaler are sharing the

information of customer demand.

Therefore wholesalers forecasting is equal to

retailers forecasting.

When demand information is shared, the wholesalers

total on-hand inventory held over 20 periods is 42%

smaller.

In the uncoordinated case wholesaler overreacting to

the retailers catch-up order and assuming that

consumer demand will be larger in future.

Example: Coordinated Demand Forecasting

= (395-230)/395 = 42%

Product Pricing and Marginal cost

Problem between Suppliers

and Retailers

Coordinated Pricing

Pricing of products is important factor for demand

and demand vary according to pricing.

The Supply Chain loses money when the firms do not

coordinate their pricing.

In traditional way, supplier first set the wholesale

price and the retailer react accordingly and set his

own price according to his marginal cost.

Coordinated Pricing

In pricing, can explain by taking two cases;

Case 1: A System with One Retailer and One Supplier

Case 2; A System with One Retailer and N-1 Supplier

Suppose

P = Retail Price of Product

Q = Quantity Sold

Retailer's Demand Curve;

900 2 .......(4) P Q =

Case 1: A System with One Retailer and

One Supplier

Let Marginal cost for supplier and retailer equal to

$90 and $10 respectively.

Total Revenue for Retailer = PxQ

Marginal Revenue for Retailer is the derivative of

total revenue (eq.1) with respect to Q;

2

900 2 ................(5) P Q Q Q =

Retailer's Marginal Revenue 900 4 .......(6) Q =

Case 1: A System with One Retailer and

One Supplier

Taking Retailer and supplier as a one firm.

Total Marginal Cost for Supply Chain=$90+$10

=$100

Optimal quantity Q

*

given as;

Total Channel profits = Q(P-C) ..(7)

= 200[500-($90+$10)]=$80,000

Where C = Supply Chain Marginal Costs

*

900 4 100

200 Unit

900 2 200 $500

Q

Q

P

=

=

= =

Case 1: A System with One Retailer and

One Supplier

Taking Retailer and supplier as two individual part of

Supply chain.

From eq.6, wholesaler know that Retailer will set

marginal cost according to wholesalers price charged.

So, 900-4Q=10 + W

Where W = Wholesale price charged

Therefore demand curve for Supplier;

W = 890 4Q (8)

Therefore suppliers total revenue W x Q = 890Q-4Q

2

Marginal Costs = 890 8Q (9)

From this equation;

90 = 890 8Q

(As marginal cost for supplier is $90)

Q

*

= 100 Unit

W

*

= 890 4 x 100 (From Equation 8)

W

*

= $490

Total revenue of Supplier = 100[$490 - $90] = $40,000

(From eq. 7)

Case 1: A System with One Retailer and

One Supplier

Case 1: A System with One Retailer and

One Supplier

Retailer also will sell same quantity as suppliers.

Retail Price P = 900 2 x 100

Retail Price P

*

= $700

(From equation (4))

Total revenue for Retailer = 100[$700-($10+$490)]

= $20,000

Total Channel Profit = $40,000 + $ 20,000

= $ 60,000

Which is 33% lesser than coordinated pricing, Cooperative

optimization produces more than independent optimization

would produce.

Case 2: A System with One Retailer and N-1

Supplier

Now in this case, One Retailer and N-1 Suppliers are

involve.

In this, supply chain consisting of one retailer, and

retailers supplier and retailers suppliers supplier and so

on.

In this case Retailers linear demand curve given as;

Where (a, b>0 )

(Retailer faces a deterministic linear demand curve of the form of P

1

)

..........(10) P a bQ =

Case 2: A System with One Retailer and N-1

Supplier

Now let represent the system profit under

coordination pricing and represent the system profit

under uncoordinated pricing.

Let C

i

be the marginal cost of firm i (i=1,2,3N)

and where i = 1 denotes the retailer, i = 2 denotes

the retailers supplier and i = 3 denotes the retailer's

suppliers supplier.

C

H

U

H

Case 2: A System with One Retailer and N-1

Supplier

denote the price charged by firm i.

is a decision variable and represent the quantity

sold to the final customer.

represent the optimal quantity for profit

maximization.

i

P

*

Q

Q

Case 2: A System with One Retailer and N-1

Supplier

For Coordinated Supply Chain

If there is coordination among the N firms, all the N

firms are considered as one organization,

Thus Marginal revenue;

and Marginal Cost given as;

Retail Price given as;

( ) ( )

2

2

..............(11)

P Q aQ bQ a bQ

Q Q

c c

= =

c c

arginal cost=

i

i

M C

1

P

1

( ) / 2 .......(12)

i

i

P a C = +

With the exception of firm N(the most upstream member of

supply chain), C

i

doest not include the purchase price.

Let Pi denote the pricing charge by firm i.

The decision variable Q represents the quantity sold to the final

customer and Q* represents the optimal(profit-maximizing)

quantity.

The retailer faces a deterministic linear demand curve of the form

of

P

1

=a bQ

( )

1

equatingMarginal revenue 2 with marginal cost ( ),

2

TheValueof Qputtinginequation(10)

2 2

i

i

i i

a bQ C we get

a C

Q

b

a C a C

P a bQ a b

b

=

| | +

= = =

|

|

\ .

Case 2: A System with One Retailer and N-1

Supplier

For Coordinated System, Value of eq. (12) putting in eq.

(10);

So, total Profit given as;

C

H

( )

( )

*

2

2

i

i

i

i

a C

a bQ

a C

bQ a

+

=

+

=

*

1

( ) .........(14)

c i

i

Q P C H =

*

1

............(13)

2

N

i

i

Q a C

b

| |

=

|

\ .

th

th

*

Marginal Cost For i Firm

Price Charged by i Firm

Quantity Sold

Optimal Quantity For Profit Maximization

i

i

C

P

Q

Q

=

=

=

=

Case 2: A System with One Retailer and N-1

Supplier

From equation 13 and 14;

Total profit in coordinated Supply Chain;

1

2

1

( )

2

1

2 2

1

2 2

1

4

N

c i i

i

i

N

i

i i

i

i

N

i

i

i

i

N

i

i

a C P C

b

a C

a C C

b

a C

a C

b

a C

b

| |

H =

|

\ .

| | +

| |

=

|

|

|

\ .

\ .

| |

| |

=

|

|

|

\ .

\ .

| |

=

|

\ .

2

1

1

..............(15)

4

N

c i

i

a C

b

=

| |

H =

|

\ .

Case 2: A System with One Retailer and N-1

Supplier (For Uncoordinated Supply Chain)

The tier 1 supplier(i=2) knows that the retailer will chose the

quantity by equating its marginal revenue with its marginal cost.

Marginal revenue= P

1

= a-2bQ

Marginal cost =C

1

+P

2

where C

1

= marginal cost of retailer

a-2bQ = C

1

+P

2

P

2

=( a-C

1

)-2bQ

C

2

= marginal cost of retailers supplier

C

3

= marginal cost of retailers suppliers supplier

Continuing in this fashion up the supply chain, we get

1

1

1

2 ...............(16)

where m=1,2,3......N and where m is m firm

m

m

m i

i

th

P a C bQ

=

| |

=

|

\ .

( ) ( )

2

2 2 1

1

2 3 2

1 3 2

3 1 2

3 1

3 1 2

Marginal revenueof 2

( ) 4

Marginal cost

( ) 4

[ ( )] 4

[ ( )] 2

P PQ a C Q bQ

Q Q

a C bQ

P P C

a C bQ P C

P a C C bQ

P a C C bQ

c c

( = =

c c

=

= +

= +

= +

= +

Case 2: A System with One Retailer and N-1

Supplier

Putting m=N+1;

1

1

1

1

*

1

2

0

2 0

1

.................(17)

2

N

N

N i

i

N

N

N

i

i

N

i

N

i

P a C bQ

but P

a C bQ

Q a C

b

+

=

+

=

=

| |

=

|

\ .

=

| |

=

|

\ .

| |

=

|

\ .

System contain One

Retailer and N-1

Suppliers therefore

P

N+1

=0

Case 2: A System with One Retailer and N-1

Supplier

The Profit of Firm m equals;

Putting all values;

*

1

( )

m

U m m m

Q P P C

+

H =

P

m+1

=

1

2

m

m

i

i

a C bQ

=

| |

|

\ .

1

* 1 * *

1 1

2 2

m

m m

m m

U i i m

i i

Q a C bQ a C bQ C

= =

(

(

| | | |

H =

(

( | |

\ . \ .

P

m

P

m+1

{ }

1

* 1 * *

1 1

2 2

m

m m

m m

U i m i

i i

Q a C C bQ a C bQ

= =

(

(

| | | |

H =

(

( | |

\ . \ .

Case 2: A System with One Retailer and N-1

Supplier

From above equations;

{ }

1

1 1

m m

i m i

i i

a C C a C

= =

| | | |

=

| |

\ . \ .

* 1 * *

1 1

2 2

m

m m

m m

U i i

i i

Q a C bQ a C bQ

= =

(

(

| | | |

H =

(

( | |

\ . \ .

( )

* * 1 *

2 2

m

m m

U

Q bQ bQ

H =

* 1 *

2 (2 1)

m

m

U

Q bQ

H =

( )

2

1 *

2

m

m

U

b Q

H =

Case 2: A System with One Retailer and N-1

Supplier

Putting Value of from equation (17);

Profit For firm m;

2

1

1

1

2

2

m

N

m

U i

N

i

b a C

b

=

| |

| |

H =

|

|

\ .

\ .

*

Q

2

1

2

1

2

2

m

m

N

U i

N

i

a C

b

=

| |

H =

|

\ .

2

2 1

1

2

...........(18)

4

m

m N

N

U i

i

a C

b

+

=

| |

H =

|

\ .

Multiplying

by 4 in

numerator &

denominator

Similarly total profit for Supply Chain;

Putting values of these profits;

1 2

..........

m

U U

H = H + H + + H

Case 2: A System with One Retailer and N-1

Supplier

2 2

2 2 3 2

1 1

2 2

4 2 2 1

1 1

2 2

4 4

2 2

........

4 4

.............(19)

N N

N N

U i i

i i

N m N

N N

i i

i i

a C a C

b b

a C a C

b b

= =

+

= =

| | | |

H = +

| |

\ . \ .

| | | |

+ +

| |

\ . \ .

( )

( )

2

2 2 3 2 1

1

2

2 2 0 1 2 1

1

2

1 1

2 2

1

2

2 2

1

2

2 2

1

1

2 2 ... 2

4

1

2 2 2 2 ... 2

4

1 2 1

2

4 2 1

1

2 2 1

4

1

2

4

N

N N N

U i

i

N

N N

i

i

N

N

N

i

i

N

N N

i

i

N

N N

i

i

a C

b

a C

b

a C

b

a C

b

a C

b

t

=

=

+

=

+

=

| |

( = + + +

|

\ .

| |

(

= + + + +

|

\ .

(

| | | |

=

( |

|

\ .

\ .

| |

(

=

|

\ .

| |

=

|

\ .

2 2

2

2 2 2

1

2

1

2 2

4

N

N

N N

i

i

a C

b

=

(

| |

( =

|

\ .

2 2

2 2 2

1 1

2

2 2 2

1

2 2 2

2

2 2 2

2

2

2 2

SystemProfit Ratio

1 1

2 2

4 4

1

2 2

4

4 4

1

1 2 2

2 2

4 4

2 2

2 2

2 4 2 4

4 2 4

2 2 1

2 1

C U

U

N N

N N

i i

i i

N

N N

i

i

N N

N N

N N

N N

N N

N

N N

N

a C a C

b b

a C

b

= =

=

H H

=

H

| | | |

(

| |

\ . \ .

=

| |

(

|

\ .

+

(

= = =

(

+

=

+

=

Case 2: A System with One Retailer and

N-1 Supplier

sum series will become geometric series and after

summing this series by geometric sum;

System Profit Ratio in Coordinated SC vs. Uncoordinated

SC is

U

H

2

2 2 2

1

1

(2 2 ) ......(20)

4

N

N N

U i

i

a C

b

=

| |

H =

|

\ .

2 2

2 2 1

Profit Ratio

2 1

N N

C U

N

U

H H +

= =

H

Lot sizing problem with stochastic

demand in a News-vendor

environment

Coordinated Lot Sizing with Stochastic

Demand in Newsvendor Environment

Problem arises when a retailer must make a one-time

purchase of a single product to meet uncertain

demand.

Problem of deciding the size of a single order that

must be placed before observing demand when there

are overage and underage costs.

Let O = the overage cost per unit

U = the underage cost per unit

F(Q

*

)= U/(O+U),

where F(x) = Cumulative distribution function over random

demand X.

P

s

& P

r

be the price charged by Supplier and Retailer.

C

s

& C

r

be the manufacturing cost for supplier &

retailers cost per unit

Q

c

*

& Q

u

*

optimal quantity in coordinated and

uncoordinated system respectively.

Coordinated Lot Sizing with Stochastic

Demand in Newsvendor Environment

For Uncoordinated SC

If retailer acts independently, its underage and

overage costs are;

Where V = salvage value of any unsold unit

Coordinated Lot Sizing with Stochastic

Demand in Newsvendor Environment

( ) ...............(21)

u r r s

U P C P = +

.............(22)

u r s

O C P V = +

( ) | | ( )

;

( ) .....(23)

u u u r r s r

Ratio

U O U P C P P V + = +

Coordinated Lot Sizing with Stochastic

Demand in Newsvendor Environment

For Coordinated SC

And if the firm coordinate in supply chain, the

systems underage and overage costs are;

( )

...........(25)

c r s

O C C V = +

( )

...........(24)

c r r s

U P C C = +

( ) | | ( )

;

( ) .....(26)

c c c r r s r

Ratio

U O U P C C P V + = +

f(x) is the density function of random demand X.

In independent optimization, total profit ;

Coordinated Lot Sizing with Stochastic

Demand in Newsvendor Environment

*

( )

u

Q H

| |

*

*

*

* * * *

0

*

0

( ) ( ) ( ) ( ) ( )

( ) ( ) ........(27)

u

u

u

Q

u u u u u u s s u

Q

Q

r r s u r

Q xU Q x O f x x Q U f x x P C Q

P C C Q P V F x x

( H = c + c +

= c

} }

}

Expected profit:

f(x) = density function of random demand x

( ) ( ) ( )

0

( ) ( )

Q

Q

P Q xU Q x O f x dx QUf x dx

= +

} }

( )

( )

( )

( )

( )

0 0

(1) 2 3

0

*

0 0

*

0 0

* *

( ) ( ) ( ) ( )

0 ( ) ( )

( ) ( ) ( )

( ) ( )

( )

( )

Q Q

Q

Independent of Q

Q

Q

Q Q

Q

Q

P Q x U O f x dx OQf x dx QUf x dx

P Q

Now O f x dx Uf x dx

Q

OF Q Uf x dx Uf x dx Uf x dx

OF Q U f x dx U f x dx

P Q

OF Q U UF Q f

Q

= + +

c

= +

c

= + +

= +

c

= +

c

} } }

} }

} } }

} }

0

( ) 1 x dx

| |

=

|

\ .

}

For maximum Profit:

F(Q*) is the cumulative distribution function over random

demand x.

( )

( )

* *

*

( )

0

0 ( )

( )

P Q

Q

OF Q U UF Q

U

F Q

O U

c

=

c

= +

=

+

In case of Un Coordinated

Optimal quantity = Q

u

*

Underage cost per unit = U

u

= P

r

-C

r

-P

s

Overage cost per unit = O

u

= C

r

+ P

s

V

So

In case of Coordinated

Optimal quantity = Q

u

*

Underage cost per unit = U

c

= P

r

-C

r

-C

s

Overage cost per unit = O

u

= C

r

+ C

s

V

*

( )

u

u

u u

U

F Q

O U

=

+

*

( )

c

c

c c

U

F Q

O U

=

+

Un coordinated system:

The total profit

( )

( )

*

*

* *

*

*

* * * *

0

Supplier profit

Retiler profit

* * *

0 0

*

0

( ) ( ) ( ) ( ) ( )

( ) ( ) ( ) ( )

( ) ( )

u

u

u u

u

u

Q

u u u u u u s s u

Q

Q Q

u u u u u u s s u

Q

Q

u u u

Q xU Q x O f x x Q U f x x P C Q

x U O f x x O Q f x x Q U f x x P C Q

Q U O x f x

( H = c + c +

= + c c + c +

H = + c

} }

} } }

}

*

*

* * *

0

4

1 2

3

( ) ( ) ( )

u

u

Q

u u u u s s u

Q

Part

Part Part

Part

x Q O f x x Q U f x x P C Q

c + c +

} }

Now integrating by parts

Part-1

.

du

uvdx u vdx vdx dx

dx

(

=

(

} } } }

( )

( )

( ) | |

( )

( ) ( )

*

* * *

*

*

*

*

0

0 0 0

0

0

* *

0

* *

0

( )

( ) . ( )

( ) ( )

( ) ( )

( ) ( )

u

u u u

u

u

u

u

Q

u u

Q Q Q

u u

Q

Q

u u

Q

u u u u

Q

u u u u u u

U O x f x x

x

U O x f x x f x x dx

x

U O xF x F x dx

U O Q F Q F x dx

U O Q F Q U O F x dx

+ c

(

(

c

(

= + c c (

c

(

(

= +

`

)

(

= + (

(

= + +

}

} } }

}

}

}

Part 2

Part 3

( )

*

*

0

* *

( )

u

Q

u u

u u u

O Q f x x

O Q F Q

= c

=

}

*

* *

*

*

*

*

0 0

*

0 0

* *

( )

( ) ( ) ( )

( ) ( )

1 ( )

u

u u

u

u

u u

Q

Q Q

u u

Q

Q

u u

u u u

Q U f x x

Q U f x x f x dx f x dx

Q U f x dx f x dx

Q U F Q

= c

(

= c + (

(

(

= (

(

( =

}

} } }

} }

Putting all the value, we get

( ) ( ) ( )

( )

| | ( ) ( )

( ) ( )

( ) ( )

*

*

*

*

* * * * *

0

* * *

* * * *

0

*

0

*

0

( ) ( ) ( )

1 ( )

( ) ( )

0 ( )

( )

putting the va

u

u

u

u

Q

u u u u u u u u u u

u u u s s u

Q

u u u u u u u u u u s s u

Q

u u u u s s

Q

u s s u u u

Q U O Q F Q U O F x dx O Q F Q

U Q F Q P C Q

U O U O Q F Q U O F x dx U Q P C Q

U O F x dx Q U P C

U P C Q U O F x dx

t = + +

( + +

= + + + +

= + + +

= + +

}

}

}

}

( ) | | ( )

*

u u

* *

0

lueof U andO , weget

( )

u

Q

u r r s u r

Q P C C Q P V F x dx t =

}

For coordinated:

The profit

( )

*

*

* *

*

* * *

0

* *

0 0

1 2

3

( ) ( ) ( ) ( )

( ) ( ) ( )

c

c

c c

c

Q

c c c c c c

Q

Q Q

c c c c c c

Q

Q xU Q x O f x x Q U f x x

U O xf x x Q O f x x Q U f x x

( H = c + c

= + c c + c

} }

} } }

Now integrating

Part 1

Part 2

( )

( )

( ) ( )

( ) ( ) ( )

*

* * *

*

*

0

0 0 0

* *

0

* *

0

( )

( ) ( )

( )

( )

c

c c c

c

c

Q

c c

Q Q Q

c c

Q

c c c c

Q

c c c c c c

U O xf x x

x

U O x f x x f x x dx

x

U O Q F Q F x dx

U O Q F Q U O F x dx

= + c

(

(

c

(

= + c c (

c

(

(

(

= + (

(

= + +

}

} } }

}

}

*

*

*

0

* * *

0

( )

( ) ( )

c

c

Q

c c

Q

c c c c c

Q O f x x

Q O f x x Q O F Q

= c

= c =

}

}

Part 3

* *

* *

*

*

* *

*

0 0

*

0 0

* *

( ) ( )

( ) ( ) ( )

( ) ( )

1 ( )

c c

c c

c

c

c c c c

Q Q

Q Q

c c

Q

Q

c c

c c c

Q U f x x Q U f x x

Q U f x x f x x f x x

Q U f x x f x x

Q U F Q

= c = c

(

( = c + c c

(

(

( = c c

(

( =

} }

} } }

} }

Thus the profit is

( )

( )

( )

( )

( )

( )

( )

( )

( ) ( )

*

*

*

* * * *

0

* *

*

0

* *

0

( )

1

( )

,

( )

c

c

c

Q

c c c c c c c c c

c c c

Q

c c c c

c c

Q

c r s r c r

U O Q F Q U O F x dx Q O F Q

Q U F Q

U Q U O F x dx

Putting thevalueof U and O we get

Q P C C Q P V F x dx t

= + +

+

= +

=

}

}

}

Now the profit change due to coordination:

( ) ( )

( ) ( )

| | ( )

( )( ) ( )

( ) ( ) ( )

( )( )

*

*

*

*

*

*

* *

*

0

*

0

* *

* * *

* *

( )

( )

( )

( ) . ( )

c

u

c

u

c

u

c u

Q

r s r c r

Q

r r s u r

Q

r s r c u r

Q

Q

r r c u c

Q

r r s

r c u

r

Q Q

P C C Q P V F x dx

P C C Q P V F x dx

P C C Q Q P V F x dx

Now

P V F x dx P V Q Q F Q

P C C

P V Q Q

P

t t t A =

(

( =

(

(

(

(

(

( =

(

(

(

( s

(

s

}

}

}

}

V

| |

|

\ .

( ) ( )( )

( )( ) ( )

*

*

*

*

* *

* *

1

2

( ) ( )

( ) ( )

2 1,

0

This equation proves that pr

c

u

c

u

Q

r c u r r s

Q

Q

r r s c u r

Q

Part

Part

P V F x dx Q Q P C C let eqn A

Now

P C C Q Q P V F x dx let eqn B

Here Part Part fromeqn A

thus

t

t

(

( s

(

(

( A =

(

s

A >

}

}

ofit in coordinated supply chain is always more

than profit of uncoordinated supply chain.

So the coordination always leads to a improved profit

The order size will be increased if there is

coordination between to firms because C

s

<P

s

.

The suppliers profit increase with joint

optimization, but retailers profits decrease.

Therefore some profit of supply chain should be

redistributed towards the retailer.

Coordinated Lot Sizing with Stochastic

Demand in Newsvendor Environment

If demand is uniformly distributed between a and

b, the expected profit for the uniform distribution

with ordering quantity Q;

Coordinated Lot Sizing with Stochastic

Demand in Newsvendor Environment

( )

1

0

for a x b

f x

b a

for other x

s s

.

( )

( )

Pr ( ) ( )

( )

1

( ) ( )

( )

Q b

a Q

Q

a

x x

a a

ofit xU Q x O f x dx QUf x dx

UQ U O F x

Now

F x f x dx dx

b a

x a

F x

b a

= + (

= +

= =

} }

}

} }

In case of Coordinated SC

( ) ( )

( )

( )

( )

( )

( )

( )

2

2 2

2

2 2

2

2

( )

2 2

Q

a

Q Q

a a

Q

a

x a

Q QU U O dx

b a

U O

QU xdx adx

b a

U O

x

QU a Q a

b a

U O

Q a

QU aQ a

b a

U O

Q a

Q QU aQ let eqn c

b a

t

t

= +

(

+

=

(

(

(

+

| |

( =

|

(

\ .

( +

| |

= +

( |

\ .

+

(

= +

(

}

} }

For optimal condition

( )

( )

( )

( )

*

*

*

*

2

*

Now putting the value of Q in equation c, we get

b-a

( ) =aU+

2 U+O

U

F Q

O U

Q a U

b a O U

U b a

Q a

O U

U

Q t

=

+

=

+

= +

+

Example: Lot Sizing with Stochastic

Demand in Newsvendor Environment

For Numerical example:

In this example we can use MS Excel commands

to solve this problem.

Commands involved in MS Excel for solving this

problem are;

NORMSDIST

NORMDIST

NORMINV

Derivation of formulas used in profit calculations

when doing numerical examples.

( )

( )

( )

( ) ( )

( ) ( )

( ) ( ) ( ) ( ) ( )

( ) ( ) ( ) ( )

( ) ( ) __

Q

Q

Q Q Q Q

Q

Q Q Q

Q Q

xU Q x O f x dx QUf x dx

O U xf x dx QO f x dx QU f x dx f x dx f x dx

O U xf x dx QO f x dx QU f x dx f x dx

O U xf x dx Q O U f x dx QU

t

= + (

(

= + + +

(

(

(

= + +

(

(

= + +

} }

} } } } }

} } } }

} }

_( ) let eq D

For coordinated case

Let demand density function normally distributed with mean ,

standard deviation

So

( )

2

2

2

1

( )

2

x

f x dx e

o

o t

=

let

x

z

dz dx

o

o

=

=

Now putting the value of f(x) and dx in equation D, we get

( ) ( )

( ) ( )

( )

( )

( )

* 2

* 2

* * 2 2

3

1 2

2

2

2 2

*

( ) ( )

1

1

( ) ( )

2

1

( )

2

1 1

2 2

( )

Q Q

Q z z

z z

z z z z

s

O U xf x dx Q O U f x dx QU

Part

O U xf x dx O U z e dz

O U z e dz

O U e dz z e dz

O U F z

t

o o

o t

o

t

o

t t

= + +

(

+ = + +

(

(

(

= + +

(

(

(

= + +

(

(

= + +

} }

} }

}

} }

* 2

2

1

2

z z

ze dz o

t

(

(

(

}

The

( )

* 2

2

2

2

1

2

* *

2

1

2

1

( ) ( )

z z

Q

w

s

s s

Now

ze dz

z

let w

dw zdz

Q

e dz f

SothePart

O U F z f z

o

t

o

| || |

| |

\ .\ .

=

=

| |

=

|

\ .

(

= +

}

}

* 2

2

2

( ) ( )

1

( )

2

( ). ( )

Q

z z

Part

Q O U f x dx

Q O U e dz

Q O U F z

o

o t

= +

= +

= +

}

}

Thus the total profit

( )

( )

( )

* * *

* *

*

* *

1 2 3

( ) ( ) ( ). ( )

, 0,1, 0

.

s s s

part part part

O U F z f z Q O U F z QU

Q Q

O U NORMSDIST NORDIST

Q

Q O U NORMSDIST Q U

t

o

o

o o

o

= + +

( = + + +

(

| | | |

= +

( | |

\ . \ .

| |

+ +

|

\ .

Numerical Example

Uncoordinated and coordinated supply chain:

1. Demand function is normally distributed

2. Demand function is uniformly distributed between a to b.

Example 1

Demand is normally distributed.

Mean () = 1000 units

Standard deviation() = 500 unit

Supplier manufacturing cost (Cs)= $20

Retailer supplier cost (Cr) = $20

Retailer price of product (Pr) = $100

Price charged by supplier (Ps) = $50

Product salvage value V = $10

Solution:

U

u

= Pr Cr Ps = 100-20-50 =$30

O

u

= Pr Cr Ps = 20 + 50 - 10 = $60

U

c

= Pr Cr Cs = 100 20 20 =$60

O

c

= Cr + Cs V = 20+20-10 =30

Using Excel

Q

u

*= NORMINV(1/3, 1000,500) = 784.63= 785

Using table, in cumulative std. normal , z value corresponding to

(FQ

u

*=0.333) is -0.43

*

30 1

( ) 0.333

30 60 3

u

u

u u

U

F Q

O U

= = = =

+ +

*

*

*

1000

0.43

500

785

u

u

u

Q

z

Q

Q

=

~

Now in case of uncoordinated

Retailer Profit

( )

( )

( ) ( ) ( )

( )

2

2

* * * *

u u

* *

u

( ) ( )

1

using ( )

2

Finally we will reach to the following formula

= O ( ) ( ) O

O

Q

u u u

Q

x

u s s u s u

u

xU Q x O f x dx QU f x dx

f x e

x

z

U F z f z Q U F z Q U

Q Q

U NORMSDIST NORMDIST

o

o t

o

t o

o

o o

+ (

=

=

( + + +

| | | |

= +

|

\ . \ .

} }

( )

*

* *

* *

.

Note here F = Cumulative distribution function =

u u u

Q

Q O U NORMSDIST Q U

Q Q

NORMSDIST

o

o o

(

( |

| |

+ +

|

\ .

| | | |

| |

\ . \ .

( )

2

*

*

*

2

( ) StandardNormaldistributionfunction

1

2

s

z

s

f z

Q

NORMDIST

f z e

o

t

=

| |

=

|

\ .

| |

= |

|

\ .

Now

Q* = 785

*

*

785 1000

0.43

500

Q

z

o

=

* *

* *

( ) ( ) 0.333598

( ) ( ) 0.363714

s

s

So

F z NORMSDIST z

f z NORMDIST z

= =

= =

So

U

= (30+60) [1000*0.333598 500*0.3]-

785*(60+30)*0.333598+783*30

= $13638 ( Retailer profit )

Supplier profit = (Ps - Cs)Q* = (50 - 20)*785 = 23550

Total channel profit = Retailer profit + Supplier profit

= 13638 + 23550 = $37188

For Coordinated

Using table, z value corresponding to [F(Q*)=2/3 is 0.43.

So

( )

( )

*

*

60 2

60 30 3

Using Excel

2

Q ,1000, 500 1215

3

c

U

F Q

O U

NORMINV

= = =

+ +

= =

*

*

*

1000

0.43

500

1215

Q

z

Q

Q

=

=

Similarly in case of profit formula for channel,

( )

( )

( )

( )

( )

* *

* * *

* *

* * *

*

( ) ( )

( )

For calculation in Excel

( ) ( )

( )

1215 1000

0.43

500

T c c s s

c c s c

T c c

c c c

O U F z f z

Q O U F z Q U

O U NORMSDIST z NORMDIST z

Q O U NORMSDIST z Q U

Nowz

t o

t o

(

= +

+ +

= +

+ +

= =

T

= (60+30)[1000 NORMSDIST(0.43)- NORMDIST(0.43)]

- 1215 (60+30) NORSDIST(0.43) + 1215*60

T

= $43579

Now =

c

-

U

= 43579 37188 = $6391

% Increase in profit due to coordination

= (6391/37188)*100 = 17.18%

If the demand is uniformly distributed between 5000 to 15000

unit.

Case 1: Uncoordinated

a = 5000, b= 15000

U

u

= $30 O

u

= $60

*

*

( )

30

5000 (15000 5000)

30 60

8333

u

u u

U

Q a b a

U O

Q units

= +

+

| |

= +

|

+

\ .

=

So retailer profit:

( )

( )

( )

( )

2

2

2

15000 5000 30

30 5000

2 30 60

$200000

u

u

u u

b a U

U a

U O

(

= +

(

+

(

(

= +

(

+

(

=

Supplier profit =

( Ps Cs ) * Q

u

* = (50 - 20) * 8333 = $249990

Total channel profit

= retailer profit + supplier profit = $200000 +$249990 = $449000

Case- II: Coordinated

U

c

= $60, O

c

= $30

Q* = 5000 + (15000 - 5000) * [60 / (30+60)] = 11667 units

( )

( )

( )

( )

2

2

Total profit

2

15000 5000 60

5000 60 $500000

2 60 30

c

c

c c

b a U

U a

O U

= +

+

= + =

+

So change in profit

=

c

-

u

= $500000 - $449000 = $51000

% increase (due to coordination in Supply Chain)

= ( /

u

)*100 = (51000/449000)*100 = 11.35%

Summary

In supply chain management, communication and

coordination can greatly enhance the effectiveness

of Supply Chain.

Through coordination we can improve total profit

of supply chain management, inventory control,

pricing control and demand forecasting.

In SCM, the actions of rational managers of firms

independently create natural inefficiencies.

By coordination and communication we can

reduce these inefficiencies.

As with any group of entities, when all member

effectively integrated their efforts, synergies may

emerge and SC profit also increase.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Practice 1cDocument11 pagesPractice 1csalmapratyush0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Critical Flash Over of A Sphere Gap Using IVGDocument5 pagesCritical Flash Over of A Sphere Gap Using IVGSelva Kumaran0% (1)

- Microprocessor 8085 - NotesDocument36 pagesMicroprocessor 8085 - NotesDr. N.Shanmugasundaram92% (72)

- Anna Hazare's Anti-Corruption MovementDocument55 pagesAnna Hazare's Anti-Corruption MovementAkash ShejuleNo ratings yet

- 22 7 2014Document4 pages22 7 2014Akash ShejuleNo ratings yet

- Mondelēz International Well-Being Goals: ( Measured Against Total Production)Document1 pageMondelēz International Well-Being Goals: ( Measured Against Total Production)Akash ShejuleNo ratings yet

- Addressing ModesDocument12 pagesAddressing ModesAkash ShejuleNo ratings yet

- Final CadburyDocument29 pagesFinal CadburyjibujameskNo ratings yet

- Spartan and Spartan-XL FPGA Families Data Sheet: Product SpecificationDocument83 pagesSpartan and Spartan-XL FPGA Families Data Sheet: Product SpecificationAkash ShejuleNo ratings yet

- DAC0808Document12 pagesDAC0808Andrés ProañoNo ratings yet

- Spartan and Spartan-XL FPGA Families Data Sheet: Product SpecificationDocument83 pagesSpartan and Spartan-XL FPGA Families Data Sheet: Product SpecificationAkash ShejuleNo ratings yet

- MASM(Microsoft Macro AssemblerDocument31 pagesMASM(Microsoft Macro AssemblerAkash ShejuleNo ratings yet

- Kto12 Probability and StatisticsDocument40 pagesKto12 Probability and Statisticsjun del rosarioNo ratings yet

- Introduction to Econometrics: Class Size and Educational OutputDocument70 pagesIntroduction to Econometrics: Class Size and Educational OutputAshley NguyenNo ratings yet

- Answers Consulting Feedback Software Tutorials Links: Structural Equation Modeling Using AMOS: An IntroductionDocument47 pagesAnswers Consulting Feedback Software Tutorials Links: Structural Equation Modeling Using AMOS: An IntroductionOscar EsparzaNo ratings yet

- Latent Class Cluster AnalysisDocument21 pagesLatent Class Cluster AnalysisNico ProkopNo ratings yet

- Final Project PDFDocument56 pagesFinal Project PDFAbbas AlkhudafiNo ratings yet

- Course Dairy For V SemesterDocument84 pagesCourse Dairy For V Semestershreeshail_mp6009No ratings yet

- Research ProposalDocument15 pagesResearch ProposalYasantha ChanakaNo ratings yet

- The Impact of Implementing Standard Operating Procedures and Supervision On Employee PerformanceDocument8 pagesThe Impact of Implementing Standard Operating Procedures and Supervision On Employee PerformanceLiu YuXinNo ratings yet

- Test of HypothesisDocument48 pagesTest of HypothesisSAEEDAWANNo ratings yet

- QE-Graphene Band PDFDocument21 pagesQE-Graphene Band PDFunistarNo ratings yet

- 3 - Introduction To Inferential StatisticsDocument32 pages3 - Introduction To Inferential StatisticsVishal ShivhareNo ratings yet

- Inferential StatisticsDocument29 pagesInferential StatisticsLUMABAD CENYERNNo ratings yet

- Ignou Mba Ms08 Solved AssignmentDocument10 pagesIgnou Mba Ms08 Solved AssignmentWahidMS100% (1)

- Applied AI - Machine Learning Course Syllabus PDFDocument22 pagesApplied AI - Machine Learning Course Syllabus PDFAkash Raghavendra Kathavate Dept of TENo ratings yet

- Required Travel Distance and Exit Width For Rooms Determined by Risk-Based Evacuation Safety Design MethodDocument14 pagesRequired Travel Distance and Exit Width For Rooms Determined by Risk-Based Evacuation Safety Design MethodCallany AnycallNo ratings yet

- Calculator Techniques - NewDocument108 pagesCalculator Techniques - NewJohn Anthony JuanitasNo ratings yet

- Env Professional Stats 0505 0Document59 pagesEnv Professional Stats 0505 0Eugine BalomagaNo ratings yet

- StudySchemeEconomics BZUDocument26 pagesStudySchemeEconomics BZUTipu SultanNo ratings yet

- Probability A Lively IntroductionDocument547 pagesProbability A Lively IntroductionVictor Hugo Rizzo100% (2)

- FM070 FCAA98 Off-PrintDocument26 pagesFM070 FCAA98 Off-Printinsightstudios33No ratings yet

- 2011 Mathematics HCI Prelim Paper 2Document5 pages2011 Mathematics HCI Prelim Paper 2ShaphynaNo ratings yet

- UNSIGNALIZED INTERSECTION THEORYDocument49 pagesUNSIGNALIZED INTERSECTION THEORYGaurav VermaNo ratings yet

- Dynamic Comfort Criteria For Structures - BRE, 2011Document60 pagesDynamic Comfort Criteria For Structures - BRE, 2011tmaNo ratings yet

- Statistics and Probability ReviewerDocument6 pagesStatistics and Probability ReviewerKlynox MalanumNo ratings yet

- ...Document11 pages...Kaira SabieNo ratings yet

- STIMULI To The REVISION PROCESS An Evaluation of The Indifference Zone of The USP 905 Content Uniformity Test1Document21 pagesSTIMULI To The REVISION PROCESS An Evaluation of The Indifference Zone of The USP 905 Content Uniformity Test1jljimenez1969No ratings yet

- Week5 BAMDocument48 pagesWeek5 BAMrajaayyappan317No ratings yet

- COMSATS University Islamabad, Wah Campus Terminal Examinations Spring 2020 Department of MathematicsDocument6 pagesCOMSATS University Islamabad, Wah Campus Terminal Examinations Spring 2020 Department of MathematicsJUNAID SIALNo ratings yet