Professional Documents

Culture Documents

Family Pension Scheme

Uploaded by

sukumarsukumaran0%(1)0% found this document useful (1 vote)

4K views14 pagesEMPLOYEES' FAMILY PENSION SCHEME-1995 Effective from :16th November, 1995 Purpose of the Family Pension Scheme To provide pension to Employee On death of employee provide pension to his family including children Thus Scheme makes provision for : Old age after retirement family after untimely death of employee.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEMPLOYEES' FAMILY PENSION SCHEME-1995 Effective from :16th November, 1995 Purpose of the Family Pension Scheme To provide pension to Employee On death of employee provide pension to his family including children Thus Scheme makes provision for : Old age after retirement family after untimely death of employee.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

4K views14 pagesFamily Pension Scheme

Uploaded by

sukumarsukumaranEMPLOYEES' FAMILY PENSION SCHEME-1995 Effective from :16th November, 1995 Purpose of the Family Pension Scheme To provide pension to Employee On death of employee provide pension to his family including children Thus Scheme makes provision for : Old age after retirement family after untimely death of employee.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 14

EMPLOYEES’ FAMILY PENSION

SCHEME-1995

Effective from :-

16th November, 1995

Purpose of the Family

Pension Scheme

• To provide pension to Employee

• On death of employee provide Pension to his

family including children

Thus Scheme makes provision for :

* Old age after retirement

* Family after untimely death of employee

PENSION FUND

Employer’s contribution - 8.33 % of basic

Central Govt.’s contribution – 1.16 % of basic

----------------------------------------

There is no Employee’s contribution

----------------------------------------

(Maximum contribution is made on basic Rs.6500/-)

Eligibility for monthly Pension

• Minimum service – 10 Years

(Except in case of permanent and total

disablement)

• Minimum contribution – 1 month

Monthly Pension for

member

Type of Pension Condition

1 Superannuation Pension 20 Yrs Service + Age 58 Yrs

2 Retirement Pension 21 Yrs Service + Age below 58 Yrs

3 Short Service Pension 10 Yrs but less than 20 yrs Service

4 Permanent & Total One month's contribution to Pension Fund,

Disablement Pension (irrespective of Pensionable service)

Withdrawal benefit Less than 10 years service

Pension amount

Pensionable salary x Pensionable service

Monthly Pension = ---------------------------------------------

70

*Minimum pension – Rs 928/- pm

*Permanent & Total Disablement- Min. Pension Rs.250/-pm

OPTIONS :-

• Option for commutation

• Option for Return on Capital

Option for Commutation

In lieu of monthly pension Members can opt to

commute maximum upto 1/3rd of his pension so

as to receive 100 times the monthy Pension so

commuted as commuted value of pension.

Balance pension will be paid on monthly basis.

Example :

Normal Pension is say Rs. 600/-. The pensioner

opts to commute 1/3rd of this pension. The

commuted value will be equal to 1/3 x 600 x 100=

Rs.20,000/- .This will be paid when option for

commutation is exercised.

The balance of pension will be paid on monthly

basis @ Rs. 400/- PM (Rs.600-200=400)

PENSION ON DEATH OF

MEMBER

1. Monthly Widow Pension

+

Monthly Children Pension

2. Monthly Orphan Pension

3. Monthly Nominee Pension

Widow pension

1 If employee died in Equal to monthly pension of Member as if he

service retired on dt. of death OR Rs.450/- p.m. OR

Amount in Table C whichever is more

2 If employee died after Equal to monthly pension of Member as if he

Service and before retired on dt. of exit OR Rs.450/- p.m. OR

attaining age of 58 Years amount in Table C whichever is more

3 If employee died after 50 % of Member's Pension

commencement of (Minimum Rs. 450/p pm)

monthly Pension

CHILDREN PENSION

Applicable Surviving children of the deceased

member

Pension 25 % of W idow Pension

( M inimum Rs. 150/- pm)

Eligibility * Maximum - 2 children

* Till age of 25 years

* Permanent & Total disabled children

will get pension irrespective of age and

no. of children.

ORPHAN PENSION

Applicable If widow pension is not payable

(i.e.no widow or widow remarried and

only children are there)

Pension 75 % of W idow Pension

( M inimum Rs. 250/- pm)

Eligibility * Maximum - 2 Orphan Children

* Permanent & Total disabled children

will get pension irrespective of age and

no. of children(Para 16(3)(e).

NOMINEE PENSION

Applicable If no living spouse or children

Pension Equal to Widow Pension

Option for Return on

Capital

Members can opt for reduce pension to avail Return on capital.

Sr.No. ALTERNATIVES REVISED PENSION RETURN ON CAPITAL

1 a) Revised Pension during lifetime 90 % of original 100 times of original

. of M ember + M onthly pension monthly pension on

b) Return on Capital on death of death of M ember to

member nominee

2 a) Revised Pension during lifetime 90 % of original 90 times of original

of M ember And lifetime of W idow M onthly pension to monthly pension on

M ember And on his death of widow/

death 80 % of original remarriage to nominee

monthly Pension to

W idow

3 Pension for fixed period of 20 yrs 87.5 % of monthly 100 times of original

(W hether member lives or dies pension for 20 yrs monthly pension at he

during the said period) ( After 20 yrs pension end of 20 years to

will cease) M ember if he is alive,

otherwise to Nominee

This is in addition to W idow/ Children/ Orphan normal pension on death of M ember

Remember ……..

Types of monthly pension

1. Monthly pension to member on his :

* Superannuation Pensions( 20yrs service + 58 yrs age)

* Retirement Pension ( 20 yrs service + Age below 58 yrs).

* Short service pension (10yrs but less than 20 yrs service)

Options :

Option for commutation

Option for Return on Capital

11. Monthly pension to Member on Permanent & total

disablement.(Minimum Rs.250/- p.m.)

3. Monthly pension to family upon death of member :

a) Widow Pension

b) Children Pension

c) Orphan Pension

4. Pension to nominee – If no family or unmarried

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BMA 12e PPT Ch13 16 PDFDocument68 pagesBMA 12e PPT Ch13 16 PDFLuu ParrondoNo ratings yet

- Case Study On Giberson Glass StudioDocument16 pagesCase Study On Giberson Glass StudioMahbubul Islam KoushickNo ratings yet

- Project ReportDocument2 pagesProject ReportTeja PalankiNo ratings yet

- Assignment 1Document8 pagesAssignment 1Gerson GloreNo ratings yet

- Public Finance SolutionDocument24 pagesPublic Finance SolutionChan Zachary100% (1)

- Sensitivity AnalysisDocument8 pagesSensitivity AnalysisFarhan Ahmed SiddiquiNo ratings yet

- Advanced Performance ManagementDocument22 pagesAdvanced Performance ManagementAli Tahir HashmiNo ratings yet

- Format For The Dissertation To Be Submitted by The Students: General InstructionsDocument20 pagesFormat For The Dissertation To Be Submitted by The Students: General InstructionsAnkit SinghNo ratings yet

- Annual Report: National Statistics Office, Malta 2012Document76 pagesAnnual Report: National Statistics Office, Malta 2012tomisnellmanNo ratings yet

- Ias 16 PpeDocument168 pagesIas 16 PpeValeria PetrovNo ratings yet

- Exhibitor List Inapa 2017Document24 pagesExhibitor List Inapa 2017Pandi Indra KurniaNo ratings yet

- Test 01Document16 pagesTest 01Dolly RizaldoNo ratings yet

- BSSRDocument113 pagesBSSRshannenNo ratings yet

- Income: According To Ordinary Concepts and Statutory Income. Income AccordingDocument194 pagesIncome: According To Ordinary Concepts and Statutory Income. Income AccordingHan Ny PhamNo ratings yet

- Lecture 3 - Chapter 2Document21 pagesLecture 3 - Chapter 2Ali AlluwaimiNo ratings yet

- Dodd - For Whom Are Corporate Managers TrusteesDocument20 pagesDodd - For Whom Are Corporate Managers TrusteesPleshakov Andrey100% (1)

- Presentation On Suc Leveling For Management of ResourcesDocument12 pagesPresentation On Suc Leveling For Management of ResourcesvankenbalNo ratings yet

- Module 4-Operating, Financial, and Total LeverageDocument45 pagesModule 4-Operating, Financial, and Total LeverageAna ValenovaNo ratings yet

- Economic Thought of Ibn KhaldunDocument15 pagesEconomic Thought of Ibn KhaldunSajjeevAntonyNo ratings yet

- Metric Value: Luxury Fitness SoulcycleDocument4 pagesMetric Value: Luxury Fitness SoulcyclekasataccountsNo ratings yet

- Corporate Governance IntroductionDocument34 pagesCorporate Governance IntroductionIndira Thayil100% (2)

- Ch27 Test Bank 4-5-10Document18 pagesCh27 Test Bank 4-5-10KarenNo ratings yet

- Chapter 2 - An Introduction To Coct Terms and PurposesDocument4 pagesChapter 2 - An Introduction To Coct Terms and Purposesنجم الدين طه الشرفيNo ratings yet

- House Bill 19-1258Document6 pagesHouse Bill 19-1258Michael_Lee_RobertsNo ratings yet

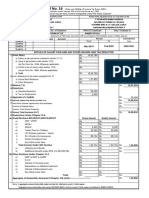

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Bea Jones Age 32 Moved From Texas To Florida inDocument1 pageBea Jones Age 32 Moved From Texas To Florida inhassan taimourNo ratings yet

- Assessment Task 2 - Workbook SP53 2020Document16 pagesAssessment Task 2 - Workbook SP53 2020Minh Y VoNo ratings yet

- Mj12e TB Ch13Document29 pagesMj12e TB Ch13George Edwards0% (1)

- Pre Final Round ReviewDocument14 pagesPre Final Round ReviewCheska JaplosNo ratings yet

- WWW - Referat.ro-Engleza Pentru AfaceriDocument22 pagesWWW - Referat.ro-Engleza Pentru Afacerirazvan65No ratings yet