Professional Documents

Culture Documents

Cost Accounting

Uploaded by

himanshugupta6Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting

Uploaded by

himanshugupta6Copyright:

Available Formats

INTRODUCTION TO COST ACCOUNTING

1-2

Meaning and Scope of Cost Accounting

Cost accounting is the process of determining and accumulating the cost of product or activity. It is a system of accounting, which provides the information about the ascertainment, and control of costs of products, or services. Cost Accounting is accounting for cost aimed at providing cost data, statement and reports for the purpose of managerial decision making.

1-3

Cost Accounting - Meaning

Cost accounting is concerned with recording, classifying and summarizing costs for determination of costs of products or services, planning, controlling and reducing such costs and furnishing of information to management for decision making

1-4

Contd

The Institute of Cost and Management Accounting, London defines: Cost accounting is the process of accounting from the point at which expenditure is incurred or committed to the establishment of its ultimate relationship with cost centres and cost units. In the widest usage, it embraces the preparation of statistical data, application of cost control methods and the ascertainment of profitability of activities carried out or planned.

1-5

Scope of Cost Accounting

Following functional activities are included in the scope of cost accounting:

Cost book-keeping: It involves maintaining complete record of all costs incurred from their incurrence to their charge to departments, products and services. Such recording is preferably done on the basis of double entry system. Cost system: Systems and procedures are devised for proper accounting for costs. Cost ascertainment: Ascertaining cost of products, processes, jobs, services, etc., is the important function of cost accounting. Cost ascertainment becomes the basis of managerial decision making such as pricing, planning and control.

1-6

Scope contd..

Cost Analysis: It involves the process of finding out the causal factors of actual costs varying from the budgeted costs and fixation of responsibility for cost increases. Cost Comparisons: Cost accounting also includes comparisons between cost from alternative courses of action such as use of technology for production, cost of making different products and activities, and cost of same product/ service over a period of time. Cost Control: Cost accounting is the utilisation of cost information for exercising control. It involves a detailed examination of each cost in the light of benefit derived from the incurrence of the cost.

1-7

Scope contd.

Cost Reports: Presentation of cost is the ultimate function of cost accounting. These reports are primarily for use by the management at different levels. Cost Reports form the basis for planning and control, performance appraisal and managerial decision making.

1-8

Objectives of Cost Accounting

Cost accounting has the following main objectives to serve: Determining selling price, Controlling cost Providing information for decisionmaking Ascertaining costing profit Facilitating preparation of financial and other statements.

1-9

Importance / Advantages of Cost Accounting

1. To the Management

Helps in ascertainment of cost Aids in Price fixation Helps in Cost reduction Elimination of wastage Helps in identifying unprofitable activities Helps in checking the accuracy of financial account Helps in fixing selling Prices Helps in Inventory Control Helps in estimate

1-10

Importance / Advantages of Cost Accounting

2. To the Employees

Incentive Bonus Higher earnings through time and motion study Overtime payments Benefit of job evaluation Continuous employment and job security

1-11

Importance / Advantages of Cost Accounting

To the Creditors Can access more information in comparison to Financial accounts To ascertain the solvency, profitability To the Government More taxes through higher production Useful in preparing import and export policy To the Society Lower prices through cost reduction Better quality of products and services

1-12

Functions of Cost Accounting

Ascertainment of cost of product: Cost Accounting ascertains cost of production of each job, process, or work order by applying different methods of cost accounting, such as job costing, process operation costing, contract costing etc. according to the suitability and needs of the organization.

Fixation of selling prices: Cost accounting helps to find out cost of production and fixation of selling prices of the product or process job or operation. It also helps in preparing necessary tenders or quotations.

Measurement of efficiency: Cost accounting measures the efficiency of each product, process or departments by applying standard cost method.

1-13

Functions contd.

Cost control procedure: Cost accounting controls cost by setting standards and compared with the actual. The deviation between them are identified and if required necessary controlling measures may be taken. Reporting to the Management: Cost accounting reports to the management periodically which may be monthly, quarterly or half yearly. According to the reports of the cost accounting, the management takes necessary decisions.

1-14

Role of Cost Accounting in Decision Making

Cost Accounting can help management to achieve the following: Formulating and implementing plans and budgets that motivate employees towards the achievement of company goals. Establishing cost tracking methods that allow control of operations, cost savings and improvements in quality. Controlling inventory cost, minimizing inventory investment, and determining the cost of each product and service.

1-15

contd..

Pricing product and services in ways that are congruent with organizational goals. Make prudent decisions that impact both short-term and long-term revenues and expenses. It helps the business to know its BEP (Break even point) i.e. helps the business knowing the minimum output required to carry on the business / to earn the profits.

1-16

Limitations of Cost Accounting

Not exact Science: Like any other accounting system, Cost Accounting is not an exact science but an art, which has developed through theories and practices. Solution not Available: The cost accounting provides information for taking decisions, but does not give the exact solution to the problem. Historical Data: Cost data are essentially post facto and historical in nature. Expensive: Installation of cost accounting system is costly, which small firms cannot afford to have. Before installing, care must be exercised to ensure that the benefit derived is more than the cost on investment.

1-17

Limitations contd.

System is more Complex: As the cost accounting system involves number of steps in ascertaining costs such as collection, classification of expenses, allocation and apportionment of expenses, users consider it as a complicated system. Lack of Accuracy: The accuracy of cost accounting gets distorted due to use of estimated costs.

Inapplicability of costing method and technique: Technique and methods of cost accounting differ from organization to organization. One standard method is not adequate for all the requirement of different organizations. It depend on the nature of business and the type of service/product manufactured by the firm.

Requirement of Reconciliation: Information and results provided by financial accounting differs from cost accounting. Thus preparation of reconciliation statements is necessary to find out correctness of the two before taking any decision.

1-18

Limitations contd.

Lacks social Accounting: Social accounting is outside the scope of cost accounts. Cost accounting fails to take into account the social obligation of the business. Duplication of Work: It involves duplication of work, as organisation has to maintain two sets of accounts i.e. Financial Account and Cost Account. Based on estimates: Indirect costs are not charged fully to a product or process. It is charged to all the products and processes on the basis of estimates. Actual cost varies from estimated cost. Due to these limitations, all cost accounting results are taken as mere estimates. Does not include all items of expense and income: Items of purely financial nature such as interest, financial charges, discount and loss on issue of shares and debentures, etc. are not taken into consideration in Cost Accounting.

Types of Cost & Elements of Cost

1-20

Cost- Meaning

"Cost is a measurement, in monetary terms, of the amount of resources used for the purpose of production of goods or rendering services

Cost means the amount of expenditure (actual or notional) incurred on, or attributable to, a given thing.

Total cost = quantity used * cost per unit (unit cost)

1-21

Cost Concepts

Cost object Cost unit Cost centre Profit centre

1-22

Cost object

It is an activity or item or operation for which a separate measurement of costs is desired E.g. the cost of operating the personnel department of a company, the cost of a repair fob, and the cost for control

1-23

Cost unit

Cost unit is a form of measurement of volume of production or service. This unit is generally adopted on the basis of convenience and practice in the industry concerned

Example: cost per table made, cost per metre of cloth

1-24

Cost centre

Any unit of Cost Accounting selected with a view to accumulating all cost under that unit. The unit may be a product, a service, division, department, section, a group of plant and machinery, a group of employees or a combination of several units. This may also be a budget centre E.g. the rent, rates and maintenance of buildings; the wages and salaries of strorekeepers

1-25

Profit centre

It is location or function where managers are accountable for sales revenues and expenses E.g. division of a company that is responsible for the sales of products

1-26

Cost Terminology

COST: Cost means the amount of expenditure incurred on a particular thing. COSTING: Costing ascertainment of costs. means the process of

COST ACCOUNTING: The application of cost control methods and the ascertainment of the profitability of activities carried out or planned. COST CONTROL: Cost control means the control of costs by management. Following are the aspects or stages of cost control.

1-27

Cost Terminology contd..

JOB COSTING: It helps in finding out the cost of production of every order and thus helps in ascertaining profit or loss made out on its execution. The management can judge the profitability of each job and decide its future courses of action. BATCH COSTING: Batch costing production is done in batches and each batch consists of a number of units, the determination of optimum quantity to constitute an economical batch is all the more important.

1-28

Elements of Cost

Elements of cost

Materials

Labour

Expenses

Direct

Indirect

Direct

Indirect Direct

Indirect

1-29

Material

The substance from which the finished product is made is known as material.

(a) DIRECT MATERIAL: is one which can be directly or easily identified in the product Eg: Timber in furniture, Cloth in dress, etc.

(b) INDIRECT MATERIAL: one which cannot be easily identified in the product. Eg: At factory level lubricants, oil, consumables, etc. At office level Printing & stationery, Brooms, Dusters, etc. At selling & dist. level Packing materials, printing & stationery, etc.

1-30

Labour

The human effort required to convert the materials into finished product is called labour. a. DIRECT LABOUR: is one which can be conveniently identified or attributed wholly to a particular job, product or process. Eg: wages paid to carpenter, fees paid to tailor, etc. b. INDIRECT LABOUR: is one which cannot be conveniently identified or attributed wholly to a particular job, product or process. Eg: At factory level foremens salary, works managers salary, gate keepers salary,etc At office level Accountants salary, GMs salary, Managers salary, etc. At selling and dist.level salesmen salaries, Logistics manager salary, etc.

1-31

Expenses

These are those expenses other than materials and labour. a. DIRECT EXPENSES: are those expenses which can be directly allocated to particular job, process or product. Eg : Excise duty, royalty, special hire charges, etc. b. INDIRECT EXPENSES: are those expenses which cannot be directly allocated to particular job, process or product. Eg: At factory level factory rent, factory insurance, lighting, etc. At office level office rent, office insurance, office lighting, etc. At sales & dist.level advertising, show room expenses like rent, insurance, etc.

1-32

Cost accumulation

Prime cost = direct materials + direct labour + direct expenses

Production cost = Prime cost + factory overhead OR = Direct materials + Conversion cost *Conversion cost is the production cost of converting raw materials into finished product

Total cost = Prime cost + Overheads (admin, selling, distribution cost) OR = Production cost + period cost (administrative, selling, distribution and finance cost) *Period cost is treated as expenses and matched against sales for calculating profit, e.g. office rental

COST CLASSIFICATION ON THE BASIS OF

1-33

Nature / Elements Function Direct & Indirect Variability Controllability Normality Time Planning and Control Managerial Decision Making

1-34

ON THE BASIS OF NATURE / ELEMENTS

Materials:- Cost of materials used for the manufacture of a product, a particular work order, or provision of a service. Example: Cloth for making a dress, stores used for maintaining machines and buildings such as lubricants, cotton waste, bricks etc. Labour Expenses

1-35

ON THE BASIS OF FUNCTION

Production Costs :- All costs incurred for production of goods are known as production costs. Administrative Costs :- Costs incurred for administration are known as administrative costs. Examples of these costs are office salaries, printing and stationery, office telephone, office rent, office insurance etc. Selling and Distribution Costs :- All costs incurred for procuring an order are called as selling costs while all costs incurred for execution of order are distribution costs. Market research expenses, advertising, sales staff salary, sales promotion expenses are some of the examples of selling costs. Transportation expenses incurred on sales, warehouse rent etc are examples of distribution costs. Research and Development Costs :- In the modern days, research and development has become one of the important functions of a business organization. Expenditure incurred for this function can be classified as Research and Development Costs.

ON THE BASIS OF DIRECT AND INDIRECT

1-36

Direct costs:- Direct costs that can be easily and conveniently traced to a unit of product or other cost objective. Examples: direct material and direct labor Indirect costs:- Indirect costs cannot be easily and conveniently traced to a unit of product or other cost object. Example: manufacturing overhead

1-37

ON THE BASIS OF VARIABILITY

Fixed costs / Period Costs: Out of the total costs, some costs remain fixed irrespective of changes in the production volume. The feature of these costs is that the total costs remain same while per unit fixed cost is always variable. Examples of these costs are salaries, insurance, rent, etc. Variable costs: These costs are variable in nature, i.e. they change according to the volume of production. Semi variable costs: Certain costs are partly fixed and partly variable. In other words, they contain the features of both types of costs. These costs are neither totally fixed nor totally variable. Maintenance costs, supervisory costs etc are examples of semi-variable costs. These costs are also called as stepped costs.

1-38

ON THE BASIS OF CONTROLLABILITY

Controllable costs: These costs are regulated or controlled by specified member of an organisation. Most of the variable costs are controllable. Generally direct material, direct labor and direct expenses are controlled by the lower level of the management. Uncontrollable costs: These are those which can not be controlled or influenced by a conscious management action. Most of the fixed costs are uncontrollable. For example factory rent, managers salary etc.

1-39

ON THE BASIS OF NORMALITY

Normal costs: It is the cost which is normally incurred at a given level of output. These costs are part of cost production. Example: repairs, maintenance, salaries paid to employees. Abnormal costs: It is the cost which is not normally incurred at a given level of output. These costs are not charged to the cost of production. It is transferred to the costing profit and loss account. Example: destruction due to fire, shut down of machinery, lock outs, etc.

1-40

ON THE BASIS OF TIME:

Historical costs: These are the costs which are incurred in the past, i.e. in the past year, past month or even in the last week or yesterday. The historical costs are ascertained after the period is over. In other words it becomes a post-mortem analysis of what has happened in the past. Pre determined costs: These costs relating to the product are computed in advance of production, on the basis of a specification of all the factors affecting cost and cost data.

ON THE BASIS OF PLANNING AND CONTROL:

1-41

Budgeted costs: Budgeted Costs are costs which have been estimated, possibly by using Forecasted Costs. Standard costs: It is a predetermined calculation of how much cost should be under specific working conditions. It is based on technical studies regarding material, labor and expenses. The main purpose of standard cost is to have some kind of benchmark for comparing the actual performance with the standards.

1-42

ON THE BASIS OF MANAGERIAL DECISION MAKING

Marginal costs: Marginal cost is the change in the aggregate costs due to change in the volume of output by one unit. For example, suppose a manufacturing company produces 10,000 units and the aggregate costs are Rs. 25,000, if 10,001 units are produced the aggregate costs may be Rs. 25,020 which means that the marginal cost is Rs. 20. Differential costs: Differential costs are also known as incremental cost. This cost is the difference in total cost that will arise from the selection of one alternative to the other. In other words, it is an added cost of a change in the level of activity. This type of analysis is useful for taking various decisions like change in the level of activity, adding or dropping a product, change in product mix, make or buy decisions, accepting an export offer and so on.

ON THE BASIS OF MANAGERIAL DECISION MAKING contd.

1-43

Opportunity costs: It is the value of benefit sacrificed in favor of an alternative course of action. It is the maximum amount that could be obtained at any given point of time if a resource was sold or put to the most valuable alternative use that would be practicable. Replacement cost: This cost is the cost at which existing items of material or fixed assets can be replaced. Thus this is the cost of replacing existing assets at present or at a future date.

ON THE BASIS OF MANAGERIAL DECISION MAKING contd.

1-44

Relevant and irrelevant costs: Relevant costs are those costs which would be changed by the managerial decision, while irrelevant costs are those which would not be affected by the decision. Example: If a manufacturer is considering closing down of an unprofitable retail sales shop, wages payable to the workers of the shop are relevant in this connection since they will disappear on closing down of the shop. But prepaid rent for the shop or unrecovered costs of any equipment which will have to be scrapped, will be irrelevant costs which must be ignored.

ON THE BASIS OF MANAGERIAL DECISION MAKING contd.

1-45

Sunk costs: These are costs which have been created by a decision that was made in the past that cannot be changed by any decision that will be made in the future. Investment in plant & machinery are prime examples of such costs. Since sunk costs cannot be altered by later decisions, they are irrelevant for decision making. Shutdown costs: A manufacturer or an organization rendering service may have to suspend its operations for a period on account of some temporary difficulties such as shortage of raw materials, non availability of labour etc. During this period though no work is done yet certain fixed costs such as rent and insurance of buildings, depreciation etc. for the entire plant will have to be incurred. Such costs of the idle plant are known as shut down costs.

ON THE BASIS OF MANAGERIAL DECISION MAKING contd.

1-46

Avoidable &Unavoidable costs: Avoidable costs are those which will be eliminated if a segment of the business with which they are directly related is discontinued. Unavoidable costs are those which will not be eliminated with the segment. Such costs are merely reallocated if the segment is discontinued. Example: In case a product is discontinued, salary of the factory manager or factory rent cannot be eliminated. It will simply mean that certain other products will have to absorb a higher amount of such overheads. However salary of clerks or bad debts traceable to the product would be eliminated.

ON THE BASIS OF MANAGERIAL DECISION MAKING contd.

1-47

Imputed costs: These are costs which do not involve any cash outlay. They are not included in cost accounts but are important for taking into consideration while making management decisions. Examples: Interest on internally generated funds, salaries of the proprietor or partner of a partnership firm, rented value of companys own property etc.

ON THE BASIS OF MANAGERIAL DECISION MAKING contd.

1-48

Out of pocket costs: This means the present or future cash expenditure regarding a certain decision which varies depending upon the nature of decision made.

Example: A company has its own trucks for transporting raw materials and finished products from one place to another. It seeks to replace these trucks by employment of public carrier of goods. In making this decision of course , the depreciation of the trucks is not to be considered, but the management must take into account the present expenditure on fuel, salary to drivers and maintenance. Such costs are termed as outof-pocket expenses.

1-49

Methods of Costing

The following are the methods of costing.: Job Costing Batch Costing Process Costing Operating Costing Contract Costing

1-50

Methods of Costing: Job Costing

This costing method is used in firms which work on the basis of job work. There are some manufacturing units which undertake job work and are called as job order units. The main feature of these organizations is that they produce according to the requirements and specifications of the consumers. Each job may be different from the other one. Production is only on specific order and there is no pre demand production. Because of this situation, it is necessary to compute the cost of each job and hence job costing system is used. In this system, each job is treated separately and a job cost sheet is prepared to find out the cost of the job. The job cost sheet helps to compute the cost of the job in a phased manner and finally arrives the total cost of production.

1-51

Methods of Costing: Batch Costing

This method of costing is used in those firms where production is made on continuous basis. Each unit coming out is uniform in all respects and production is made prior to the demand, i.e. in anticipation of demand. One batch of production consists of the units produced from the time machinery is set to the time when it will be shut down for maintenance. For example, if production commences on 1st January 2013 and the machine is shut down for maintenance on 1st April 2013, the number of units produced in this period will be the size of one batch. The total cost incurred during this period will be divided by the number of units produced and unit cost will be worked out. Firms producing consumer goods like television, airconditioners, washing machines etc use batch costing.

1-52

Methods of Costing: Process Costing

Some of the products like sugar, chemicals etc involve continuous production process and hence process costing method is used to work out the cost of production. The meaning of continuous process is that the input introduced in the process I travels through continuous process before finished product is produced. The output of process I becomes input of process II and the output of process II becomes input of the process III. If there is no additional process, the output of process III will be the finished product. In process costing, cost per process is worked out and per unit cost is worked out by dividing the total cost by the number of units. Industries like sugar, edible oil, chemicals are examples of continuous production process and use process costing.

1-53

Methods of Costing: Operating Costing

This type of costing method is used in service sector to work out the cost of services offered to the consumers. For example, operating costing method is used in hospitals, power generating units, transportation sector etc. A cost sheet is prepared to compute the total cost and it is divided by cost units for working out the per unit cost.

1-54

Methods of Costing: Contract Costing

This method of costing is used in construction industry to work out the cost of contract undertaken. For example, cost of constructing a bridge, commercial complex, residential complex, highways etc is worked out by use of this method of costing. Contract costing is actually similar to job costing, the only difference being that in contract costing, one construction job may take several months or even years before they are complete while in job costing, each job may be of a short duration. In contract costing, as each contract may take a long period for completion, the question of computing of profit is to be solved with the help of a well defined and accepted method.

1-55

THANK YOU

You might also like

- Depriciation AccountingDocument42 pagesDepriciation Accountingezek1elNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Activity Based Costing and Just in TimeDocument120 pagesActivity Based Costing and Just in TimePaulo M.P. Harianja100% (2)

- Inventory ValuationDocument25 pagesInventory ValuationKailas Sree Chandran100% (1)

- Absorption Costing, Activity Based Costing & Standard CostingDocument34 pagesAbsorption Costing, Activity Based Costing & Standard CostingMuhammad Sajid SaeedNo ratings yet

- "Accounting Principles: Managerial Accounting" (2011)Document316 pages"Accounting Principles: Managerial Accounting" (2011)textbookequity100% (2)

- Costing FormulaesDocument8 pagesCosting FormulaesNItesh GawasNo ratings yet

- AccountingDocument9 pagesAccountingVaibhav BindrooNo ratings yet

- 7 Costing Formulae Topic WiseDocument86 pages7 Costing Formulae Topic WiseHimanshu Shukla100% (1)

- Matching PrincipleDocument2 pagesMatching Principlejim125No ratings yet

- Cost AccountingDocument29 pagesCost Accountingsskumar82No ratings yet

- Fundamentals of Cost AccountingDocument24 pagesFundamentals of Cost AccountingHarshad100% (10)

- Financial Accounting 3Document47 pagesFinancial Accounting 3Roxana Istrate100% (1)

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- Definition of Job Order CostingDocument8 pagesDefinition of Job Order CostingWondwosen AlemuNo ratings yet

- Cost Accouting-JOCDocument3 pagesCost Accouting-JOCAli ImranNo ratings yet

- Cost and ManagementDocument310 pagesCost and ManagementWaleed Noman100% (1)

- Cuck Cost Accounting PDFDocument119 pagesCuck Cost Accounting PDFaponojecy50% (2)

- Method of CostingDocument21 pagesMethod of CostingLalit Sukhija100% (1)

- Difference Between Financial and Managerial AccountingDocument10 pagesDifference Between Financial and Managerial AccountingRahman Sankai KaharuddinNo ratings yet

- Management & Cost Accounting, Unit 1Document20 pagesManagement & Cost Accounting, Unit 1JITIN01007No ratings yet

- Final Exam - 2020Document10 pagesFinal Exam - 2020mshan lee100% (1)

- Managerial AccountingDocument24 pagesManagerial AccountingLuân Châu100% (4)

- Cost And Management Accounting A Complete Guide - 2021 EditionFrom EverandCost And Management Accounting A Complete Guide - 2021 EditionRating: 3 out of 5 stars3/5 (1)

- Costing Methods for Batch ProductionDocument66 pagesCosting Methods for Batch ProductionDinda syafiraNo ratings yet

- SMChap 007Document86 pagesSMChap 007Huishan Zheng100% (5)

- Chapter 5 Activity Based Costing and Activity Based ManagementDocument69 pagesChapter 5 Activity Based Costing and Activity Based Managementkhushboo100% (2)

- Manufacturing AccountingDocument9 pagesManufacturing AccountingKui MangusNo ratings yet

- Cost Accounting MethodsDocument26 pagesCost Accounting MethodsshaimaNo ratings yet

- Principles of Accounting Chapter 17Document42 pagesPrinciples of Accounting Chapter 17myrentistoodamnhighNo ratings yet

- Differences Between Financial Accounting and Management AccountingDocument2 pagesDifferences Between Financial Accounting and Management AccountingAlexandra100% (1)

- Manufacturing AccountDocument36 pagesManufacturing AccountSaksham RainaNo ratings yet

- Accounting Basics for ManagersDocument53 pagesAccounting Basics for ManagersBUSHRA FATIMA ANo ratings yet

- Notes On Cost AccountingDocument86 pagesNotes On Cost AccountingZeUs100% (2)

- Cost AccountingDocument316 pagesCost Accountinghassan100% (1)

- Manufacturing AccountingDocument15 pagesManufacturing AccountingKanika BakhaiNo ratings yet

- Cost Accounting 2013Document3 pagesCost Accounting 2013GuruKPO0% (1)

- Key financial reporting explainedDocument11 pagesKey financial reporting explainedhemanth727100% (1)

- Ch13. Flexible BudgetDocument36 pagesCh13. Flexible Budgetnicero555No ratings yet

- Accounting: A Simple Guide to Financial and Managerial Accounting for BeginnersFrom EverandAccounting: A Simple Guide to Financial and Managerial Accounting for BeginnersNo ratings yet

- Accounting Communicates Business ResultsDocument60 pagesAccounting Communicates Business Resultsharish100% (1)

- Cost Accounting Imporatant FormulasDocument3 pagesCost Accounting Imporatant FormulassanthimbaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Activity Based CostingDocument36 pagesActivity Based Costingrizwan ziaNo ratings yet

- Projected Balance SheetDocument1 pageProjected Balance Sheetr.jeyashankar9550100% (1)

- Motor Yacht Accounting ProceduresDocument3 pagesMotor Yacht Accounting Proceduresroberto.stepicNo ratings yet

- Management AccountingDocument222 pagesManagement AccountingHemant BishtNo ratings yet

- Cost Accounting Fundamentals for Manufacturing BusinessesDocument21 pagesCost Accounting Fundamentals for Manufacturing Businessesabdullah_0o0No ratings yet

- Full Cost Accounting GuideDocument23 pagesFull Cost Accounting GuideKhan MohammadNo ratings yet

- Methods of Costing and Types of CostingDocument4 pagesMethods of Costing and Types of Costingchandu_jjvrpNo ratings yet

- Double Entry BookkeepingDocument19 pagesDouble Entry BookkeepingCanduman NhsNo ratings yet

- Budget Variance Concepts ExplainedDocument37 pagesBudget Variance Concepts Explainedzms240No ratings yet

- Introduction To Cost Accounting: Prof. Chandrakala.M Department of Commerce Kristu Jayanti College BengaluruDocument11 pagesIntroduction To Cost Accounting: Prof. Chandrakala.M Department of Commerce Kristu Jayanti College BengaluruChandrakala 10No ratings yet

- MCQs UNIT I - Indices, Logarithm, AP & GPDocument2 pagesMCQs UNIT I - Indices, Logarithm, AP & GPhimanshugupta6No ratings yet

- Research MethodologyDocument85 pagesResearch Methodologyhimanshugupta675% (4)

- FX INSTRUMENTS: Spot, Forward & SwapsDocument152 pagesFX INSTRUMENTS: Spot, Forward & Swapshimanshugupta6No ratings yet

- Cost and Management AccountingDocument82 pagesCost and Management Accountinghimanshugupta6100% (1)

- Summer Internship TipsDocument13 pagesSummer Internship Tipshimanshugupta6No ratings yet

- Management AccountingDocument69 pagesManagement Accountinghimanshugupta6No ratings yet

- Summer Training GuidelinesDocument14 pagesSummer Training GuidelinesCrystal GarciaNo ratings yet

- Foreign Exchange ManagementDocument19 pagesForeign Exchange Managementhimanshugupta6No ratings yet

- AccpacDocument147 pagesAccpacscribdmaterials_abcNo ratings yet

- FIN - 536 Assignment Group Otai IIIDocument15 pagesFIN - 536 Assignment Group Otai IIIazwan ayop100% (1)

- Assignment Chapter: 04 & 05: Submitted ToDocument3 pagesAssignment Chapter: 04 & 05: Submitted ToSha D ManNo ratings yet

- Pakistan ES 2016 17 PDF PDFDocument462 pagesPakistan ES 2016 17 PDF PDFAmeer khan VLOGSNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima YojanaDocument4 pagesPradhan Mantri Jeevan Jyoti Bima YojanaEthan HuntNo ratings yet

- Neuro GymDocument13 pagesNeuro Gymrobert Friou80% (5)

- Constant Proportion Portfolio Insurance: Discrete-Time Trading and Gap Risk CoverageDocument24 pagesConstant Proportion Portfolio Insurance: Discrete-Time Trading and Gap Risk CoveragebboyvnNo ratings yet

- Management Summary: 6.1 Personnel PlanDocument24 pagesManagement Summary: 6.1 Personnel Planrichelle andayaNo ratings yet

- Nuclear Opportunity White PaperDocument2 pagesNuclear Opportunity White PaperSam HallNo ratings yet

- Data Stream Global Equity ManualDocument72 pagesData Stream Global Equity Manualfariz888No ratings yet

- Resolve Sales Order Fulfillment IssuesDocument105 pagesResolve Sales Order Fulfillment IssuesJit Ghosh50% (2)

- IAS 38 Summary - Accounting for Intangible AssetsDocument6 pagesIAS 38 Summary - Accounting for Intangible AssetsRey Jr AlipisNo ratings yet

- Steven Guerra ResumeDocument1 pageSteven Guerra Resumeapi-281084241No ratings yet

- Page 18 To 19Document2 pagesPage 18 To 19Judith CastroNo ratings yet

- Chapter 9 SolutionsDocument4 pagesChapter 9 SolutionsVaibhav MehtaNo ratings yet

- CIR Vs Japan AirlinesDocument1 pageCIR Vs Japan AirlinesJR BillonesNo ratings yet

- Study of Cash Flow ManagementDocument14 pagesStudy of Cash Flow Managementsujjish0% (2)

- Aert EgyDocument90 pagesAert Egy65486sfasdkfhoNo ratings yet

- Intermediate Accounting I IntroductionDocument6 pagesIntermediate Accounting I IntroductionJoovs JoovhoNo ratings yet

- Advanced Accounting PDFDocument14 pagesAdvanced Accounting PDFYvette Pauline JovenNo ratings yet

- Toyota Astra Motor PaperDocument52 pagesToyota Astra Motor PaperFariz Alfan Azizi PermadiNo ratings yet

- Hypo Week 9Document2 pagesHypo Week 9Jari JungNo ratings yet

- LIC Jeevan Anurag Educational PlanDocument6 pagesLIC Jeevan Anurag Educational Planshyam_inkNo ratings yet

- BAR Exam Taxation Questions 1994-2006 by TopicDocument86 pagesBAR Exam Taxation Questions 1994-2006 by TopicNoel Alberto OmandapNo ratings yet

- The Autobiography of William Henry Donner (CS)Document166 pagesThe Autobiography of William Henry Donner (CS)Ben DencklaNo ratings yet

- QM CH 5Document18 pagesQM CH 5SaAd Khan0% (1)

- Bond ValuationDocument46 pagesBond ValuationNor Shakirah ShariffuddinNo ratings yet

- Revisionary Test Paper: Group IiiDocument40 pagesRevisionary Test Paper: Group IiiAditya PakalaNo ratings yet

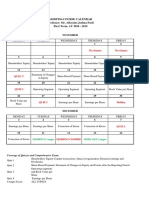

- Modfin4 Course Calendar First Term, AY 2018 - 2019 Professor: Mr. Alloysius Joshua ParilDocument1 pageModfin4 Course Calendar First Term, AY 2018 - 2019 Professor: Mr. Alloysius Joshua ParilRedNo ratings yet