Professional Documents

Culture Documents

Agencies Involved in The GDR Issue

Uploaded by

Anand Kumar Suman0 ratings0% found this document useful (0 votes)

194 views17 pagesLead Manager - the firm should be registered with the appropriate regulatory authority in Europe / Singapore or Japan. Indian Legal Counsel - it is a firm that undertakes the legal and Financial Due Diligence of the issuing Companies on behalf of the Lead Manager. Identify the Agencies Convene a Board Meeting to approve the proposed GDR Issue for not exceeding certain value in foreign currency.

Original Description:

Original Title

Agencies Involved in the GDR Issue.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLead Manager - the firm should be registered with the appropriate regulatory authority in Europe / Singapore or Japan. Indian Legal Counsel - it is a firm that undertakes the legal and Financial Due Diligence of the issuing Companies on behalf of the Lead Manager. Identify the Agencies Convene a Board Meeting to approve the proposed GDR Issue for not exceeding certain value in foreign currency.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

194 views17 pagesAgencies Involved in The GDR Issue

Uploaded by

Anand Kumar SumanLead Manager - the firm should be registered with the appropriate regulatory authority in Europe / Singapore or Japan. Indian Legal Counsel - it is a firm that undertakes the legal and Financial Due Diligence of the issuing Companies on behalf of the Lead Manager. Identify the Agencies Convene a Board Meeting to approve the proposed GDR Issue for not exceeding certain value in foreign currency.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 17

Procedure of issuing instruments

Agencies Involved in the GDR Issue

Lead Manager -The firm should be registered with the

appropriate regulatory authority in Europe/ Singapore or

Japan.

Depository Is an Overseas Bank authorised by the Issuing

Company to Issue the GDRs.

Listing Agent - Is a person who is responsible for the listing of

the GDRs at any of the recognized Overseas Stock Exchanges.

Generally the Depository also acts as the Listing Agent.

Agencies Involved in the GDR Issue

contd

Custodian - It is the domestic Bank who holds the underlying

shares/ Bonds Issued against the GDRs.

Indian Legal Counsel - It is a firm that undertakes the Legal

and Financial Due Diligence of the Issuing Companies on

behalf of the Lead Manager. It also assists the Company in

preparation of the Information Memorandum/ offer

document for submitting it with the Overseas Stock Exchange.

Agencies Involved in the GDR Issue

contd

UK Counsel - An overseas legal person who based on the Due

Diligence Report of the Indian Counsel submits its report to

the Overseas Stock Exchange. They also assist the Lead

Manager in preparation of the various documents such as the

Deposit Agreement, Subscription Agreement and vet the

Information Memorandum (IM).

Escrow Agent - An Overseas Bank where an Escrow Account

has to be opened for deposit of the monies received from

Investors against the GDR Issue till the Final Listing Approval is

obtained from the Overseas Stock Exchange

Procedure for Issue of GDRs

Convene a Board Meeting to approve the proposed GDR

Issue for not exceeding certain value in foreign currency.

Convene the EGM for the approval of the shareholders for

the proposed GDR Issue under Sec 81(1A) of the

Companies Act, 1956.

Identify the Agencies

Convene a Board Meeting to approve the Agencies.

Appoint the Agencies and sign the Engagement Letters.

The Indian Legal Counsel to undertake the Due Diligence.

Procedure for Issue of GDRs

contd

Prepare the first draft of the IM in consultation with the

Indian Legal Counsel and submit the same to various Agencies

for their comments thereon.

Prepare the 2

nd

/3

rd

draft of IM incorporating the comments.

The Listing Agent to submit the IM with the overseas Stock

Exchange for their comments and In principle Listing

Approval.

Simultaneously submit draft IM to the Indian Stock Exchanges

where the Issuing Companys shares are listed for In principle

approval for listing of the underlying shares.

Procedure for Issue of GDRs

contd

Hold Board Meeting to approve the Deposit Agreement,

Subscription Agreement and the Escrow Agreement.

On receipt of the comments on the IM from the Overseas

and Indian Stock Exchanges incorporate the same and file

the final IM with Overseas Stock Exchange and obtain Final

Listing.

The Issuing Company can open the Issue for the GDR on

receipt of the In principle Listing Approval from the

Overseas and the Indian Stock Exchanges.

Procedure for Issue of GDRs

contd

Open the Escrow Account with the Escrow Agent and

execute the Escrow Agreement.

In consultation with the Lead Manager to finalize

- whether the GDR will be through public or a private

placement,

- the number of GDRs to be issued.

- the issue price. (the Issue price is normally 5-10 %

discounted prevalent market price of the shares of the

Issuing Company one day prior to the opening of the GDR

Issue.

- number of underlying shares to be issued against

each GDR.

Procedure for Issue of GDRs

contd

On the day of the opening of the Issue execute the Deposit

and Subscription Agreements.

The Issue should be kept open for a minimum period of 3

working days.

Immediately on closing of the Issue convene a Board/

Committee Meeting for allotment of the underlying shares

against the Issue of the GDRs.

Then Deliver the share certificate to the Domestic Custodian

Bank who will in terms of the Agreement instruct the

Overseas Depository Bank to Issue the GDR to Non Resident

Investor against the shares held by the Domestic Custodian

Bank.

Procedure for Issue of GDRs

contd

On receipt of Listing Approval from Overseas Stock Exchange

submit the required documents for Final In principle Listing

approval from Indian Stock Exchange.

After GDRs are listed the Lead Manager to instruct the Escrow

Agent to transfer the Funds to the Companys Account.

The Company can either remit the entire funds or in part as

per its discretion.

Procedure for Issue of GDRs

contd

On obtaining the Final Approval from Indian Stock Exchanges

admit the underlying shares to the depository i.e., NSDL and

CDSL.

Obtain Trading approval.

Intimate the Custodian for converting the physical shares into

Demat.

Bond

14

Figure 24.2 A Bearer Bond and Its Unclipped Coupons Issued

by the Elmira and Williamsport Railroad Company for $500

15

Bonds

The Issuing Process

The mandate

Appointing the lead manager (see the parties involved) and, advised by them, choosing the size, structure and

timing of the bond issue.

Due diligence

Providing and verifying all the information required for the issuer's listing document and the supporting

documentation. Legal advisers lead this work.

Preparation

Preparing the documents including the information memorandum and listing particulars and presenting them to

the UKLA and the Exchange.

Launch

With the due diligence and marketing completed, this is the official announcement of the bond issue when the

lead manager invites the syndicate (see the parties involved) to participate in placing the bonds with investors.

Signing and closing

The signing is when an issuer and their advisers sign and execute all the documents. Shortly after this and the

closing, the issuer receive the proceeds of their bond issue.

Secondary market trading

With the bonds now listed on the London Stock Exchange they are eligible to be traded by investors, either on the

open market or, in the case of Eurobonds, by private deals between institutional investors.

Ref; the London stock Exchange

16

Parties involved

There are a number of parties to every bond issue, each with their own role to play in assisting the

issuer and ensuring the issue's success. Here we summarise the roles of the main players.

Lead manager and syndicate

The lead manager, normally a financial institution such as an investment bank, is responsible for managing

the entire issue process. As well as advising the issuer on the structure and timing of the issue, the lead

manager appoints the syndicate, a group of investment banks that will market and sell (and, usually,

underwrite) the issue.

Legal advisers

Responsible for the due diligence process verifying statements of fact - and for the drafting of the listing

particulars and the supporting documentation.

Paying agents

The paying agent is responsible for receiving a bond's interest payments from the issuer and distributing

them to the bondholders.

Clearing systems and depositary

Euroclear and Clearstream are the two main systems for monitoring and validating the transfer of bonds

('clearing') listed in London in both the primary and secondary markets. Most bonds are issued in bearer

form and held by a depositary (usually a bank) for safe keeping.

Trustee

Appointed by the investors in the notes, the trustee is the representative of the bondholders, charged

with protecting their rights and ensuring the terms of the bond are adhered to.

Fiscal agent

Acts on the behalf of the issuer to ensure the payment of interest and principal.

17

Bonds

The Issuing Process

Typical Time Lines

Mandate Launch Signing Closing

3 to 8 weeks up to 2 weeks up to 1 week

London

Listing

UKLA

LSE

Listing

application

Listing particulars

approved

Listing granted

Listing effective

Application for admission

to trading

Admission granted Trading may begin

*

10 clear business days 2 days

1 day

** 2 days

You might also like

- Securitized Real Estate and 1031 ExchangesFrom EverandSecuritized Real Estate and 1031 ExchangesNo ratings yet

- The Mutual Funds Book: How to Invest in Mutual Funds & Earn High Rates of Returns SafelyFrom EverandThe Mutual Funds Book: How to Invest in Mutual Funds & Earn High Rates of Returns SafelyRating: 5 out of 5 stars5/5 (1)

- Raising a New Generation of Leaders Through SEC RegulationDocument17 pagesRaising a New Generation of Leaders Through SEC RegulationDanielNo ratings yet

- Euro Currency Market Instruments ND Euro DepositsDocument35 pagesEuro Currency Market Instruments ND Euro DepositsVedant Jhunjhunwala100% (4)

- Foreign Institutional Investors and Depository ReceiptsDocument45 pagesForeign Institutional Investors and Depository Receiptssunitha2No ratings yet

- Presentation On ADR GDR and FCCB - 27.02.09Document29 pagesPresentation On ADR GDR and FCCB - 27.02.09darshan22No ratings yet

- Depository System: by DR K S RathoreDocument60 pagesDepository System: by DR K S RathorekishansinghNo ratings yet

- ADR and GDRDocument10 pagesADR and GDRDr. Shiraj SherasiaNo ratings yet

- IPO SDocument23 pagesIPO Skool_hot_sachinNo ratings yet

- Chapter 4 Financial MarketsDocument118 pagesChapter 4 Financial MarketsTamrat KindeNo ratings yet

- Duties and Liabilities of Promoters and DirectorsDocument22 pagesDuties and Liabilities of Promoters and DirectorsVishal ChandakNo ratings yet

- SettlementDocument22 pagesSettlementpavi arasuNo ratings yet

- Issue Management: Unit IiDocument52 pagesIssue Management: Unit IiMurugesan SNo ratings yet

- Secondary MarketDocument16 pagesSecondary MarketTania GhoshNo ratings yet

- Chapter 5Document24 pagesChapter 5PaiNo ratings yet

- Presentation On GDR Issue JHSDJW G DWGDBW dwgd7wbdw Wuid Nfvwyd Wndbwygw2bdn FHWDocument22 pagesPresentation On GDR Issue JHSDJW G DWGDBW dwgd7wbdw Wuid Nfvwyd Wndbwygw2bdn FHWHimanshu JaiswalNo ratings yet

- Adr, GDR, and IdrDocument30 pagesAdr, GDR, and IdrMaheshMuraleedharanNo ratings yet

- What Is Secondary Market?Document25 pagesWhat Is Secondary Market?Gaurav GuptaNo ratings yet

- Depository Receipts ExplainedDocument40 pagesDepository Receipts ExplainedMihir KeniaNo ratings yet

- Market for Indian Depository Receipts (IDRsDocument16 pagesMarket for Indian Depository Receipts (IDRsShivangi MahajanNo ratings yet

- Merchant BankingDocument20 pagesMerchant Bankingpranab paulNo ratings yet

- DR, Adr, GDR, Idr: Group 5 - Circuit BreakersDocument16 pagesDR, Adr, GDR, Idr: Group 5 - Circuit BreakersSaurabh Gupta100% (1)

- Portfolio Management: Prepared By: Imran Malik Manish Gupta Shivangi Bhatnagar Shriya PednekarDocument22 pagesPortfolio Management: Prepared By: Imran Malik Manish Gupta Shivangi Bhatnagar Shriya PednekarimranporscheNo ratings yet

- Global Source of Debt Financing: Presented By: Rudra Sharma Roll:BPT08016Document10 pagesGlobal Source of Debt Financing: Presented By: Rudra Sharma Roll:BPT08016rudkhannalNo ratings yet

- Money Market Instruments in PakistanDocument48 pagesMoney Market Instruments in Pakistanaamna12345689% (44)

- Module 2-IFDocument32 pagesModule 2-IFKunal GadiyaNo ratings yet

- New Issue MarketDocument33 pagesNew Issue MarketParul BajajNo ratings yet

- Debt Capital Market in NigeriaDocument19 pagesDebt Capital Market in NigeriaOyin AyoNo ratings yet

- Underwriting Basics - Definition, Process, Types, CommissionDocument25 pagesUnderwriting Basics - Definition, Process, Types, CommissionGaurav GuptaNo ratings yet

- DRM CH 2 - Futures Markets and Central Counterparties PDFDocument35 pagesDRM CH 2 - Futures Markets and Central Counterparties PDFNeha SinghNo ratings yet

- Export Finance-Countertrade and ForfaitingDocument26 pagesExport Finance-Countertrade and ForfaitingRajat LoyaNo ratings yet

- International Equity Markets ExplainedDocument36 pagesInternational Equity Markets ExplainedVrinda GargNo ratings yet

- New Issue MarketDocument31 pagesNew Issue MarketAashish AnandNo ratings yet

- 2011011536COM15109GE14Unit 1st Instruments of Capital Market Equity, Debt, GDR, ETFs Etcfinancial InstrumentsDocument35 pages2011011536COM15109GE14Unit 1st Instruments of Capital Market Equity, Debt, GDR, ETFs Etcfinancial InstrumentsLone AryanNo ratings yet

- Investment Banking: Presentation OnDocument56 pagesInvestment Banking: Presentation OnPradeep BandiNo ratings yet

- 3 Investment BankingDocument48 pages3 Investment BankingGigiNo ratings yet

- Role of Merchant BanksDocument20 pagesRole of Merchant BanksSai Bhaskar Kannepalli100% (1)

- Investment Analysis and Portfolio Management GuideDocument29 pagesInvestment Analysis and Portfolio Management GuideRakibImtiaz100% (1)

- Primary MarketDocument27 pagesPrimary MarketMrunal Chetan Josih0% (1)

- 2011012708COM15109GE14Unit 2nd Primary Process Process Different Stages and Intermediariesprimary Market ProcessDocument33 pages2011012708COM15109GE14Unit 2nd Primary Process Process Different Stages and Intermediariesprimary Market ProcessLone AryanNo ratings yet

- Understanding ADRs and GDRs: Types, Processes and Benefits /TITLEDocument16 pagesUnderstanding ADRs and GDRs: Types, Processes and Benefits /TITLEPankaj JainNo ratings yet

- Module 2.2 Intermediaries Involved in The Issue ProcessDocument27 pagesModule 2.2 Intermediaries Involved in The Issue ProcesssateeshjorliNo ratings yet

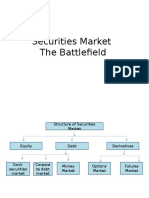

- Securities Market The BattlefieldDocument14 pagesSecurities Market The BattlefieldJagrityTalwarNo ratings yet

- Presentation On Securities Transaction in Secondary Markets: Securities and Exchange CommissionDocument30 pagesPresentation On Securities Transaction in Secondary Markets: Securities and Exchange CommissionAL TuhinNo ratings yet

- MF IntroductionDocument21 pagesMF Introductionutsav mandalNo ratings yet

- Unit - 3 Remaining TopicsDocument10 pagesUnit - 3 Remaining TopicsDev JoshiNo ratings yet

- PrimarymarketDocument28 pagesPrimarymarketmba departmentNo ratings yet

- Money Market Instruments in Pakistan ExplainedDocument48 pagesMoney Market Instruments in Pakistan ExplainedUmair AzizNo ratings yet

- Valuation and Pricing: Ammar HafeezDocument40 pagesValuation and Pricing: Ammar HafeezPriyankaNo ratings yet

- Islamic Capital Market Development and InstrumentsDocument32 pagesIslamic Capital Market Development and InstrumentsSharmila DeviNo ratings yet

- Origin and Merchant Banking in IndiaDocument26 pagesOrigin and Merchant Banking in IndiaTeena PoonachaNo ratings yet

- P3 Time Value of MoneyDocument40 pagesP3 Time Value of MoneyAkshita GroverNo ratings yet

- Raising Finance From Internation MarketDocument69 pagesRaising Finance From Internation MarketPragati GahlotNo ratings yet

- Financial Markets OverviewDocument86 pagesFinancial Markets OverviewAnuska JayswalNo ratings yet

- Ananya FoiDocument17 pagesAnanya FoiAnanya pokhriyalNo ratings yet

- Final FMDocument57 pagesFinal FMRuchi GandhiNo ratings yet

- Debt Capital Market Transactions: Some Key ConsiderationsDocument19 pagesDebt Capital Market Transactions: Some Key ConsiderationsOyin AyoNo ratings yet

- Investment Basics (CORDROS) 2016 - 2017Document34 pagesInvestment Basics (CORDROS) 2016 - 2017Anonymous UFFUqvCNo ratings yet

- IPO Process: Listing NormsDocument16 pagesIPO Process: Listing NormsraghuchanderjointNo ratings yet

- Absorption vs Marginal costingDocument20 pagesAbsorption vs Marginal costingAnand Kumar SumanNo ratings yet

- Agencies Involved in The GDR IssueDocument17 pagesAgencies Involved in The GDR IssueAnand Kumar SumanNo ratings yet

- Fast Food Industry Analysis and Key Success FactorsDocument36 pagesFast Food Industry Analysis and Key Success Factorsquynhanh589No ratings yet

- Organizational Behavior 1: Perception PPT For PGDM (RM) 2010 1Document28 pagesOrganizational Behavior 1: Perception PPT For PGDM (RM) 2010 1Santoshkumar251987No ratings yet

- Fast Food Industry Analysis and Key Success FactorsDocument36 pagesFast Food Industry Analysis and Key Success Factorsquynhanh589No ratings yet

- SRS Hostel Management System (HMS)Document19 pagesSRS Hostel Management System (HMS)sona_meet200243% (7)

- IP Packet Delivery, Forwarding, and RoutingDocument17 pagesIP Packet Delivery, Forwarding, and RoutingAnand Kumar SumanNo ratings yet