Professional Documents

Culture Documents

Leverage - Operating & FInancial

Uploaded by

AmitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leverage - Operating & FInancial

Uploaded by

AmitCopyright:

Available Formats

16-1

Chapter 16

Operating and

Financial Leverage

Pearson Education Limited 2004

Fundamentals of Financial Management, 12/e

Created by: Gregory A. Kuhlemeyer, Ph.D.

Carroll College, Waukesha, WI

16-2

After studying Chapter 16,

you should be able to:

Define operating and financial leverage and identify

causes of both.

Calculate a firms operating break-even (quantity)

point and break-even (sales) point .

Define, calculate, and interpret a firm's degree of

operating, financial, and total leverage.

Understand EBIT-EPS break-even, or indifference,

analysis, and construct and interpret an EBIT-EPS

chart.

Define, discuss, and quantify total firm risk and its

two components, business risk and financial risk.

Understand what is involved in determining the

appropriate amount of financial leverage for a firm.

16-3

Operating and

Financial Leverage

Operating Leverage

Financial Leverage

Total Leverage

Cash-Flow Ability to Service Debt

Other Methods of Analysis

Combination of Methods

16-4

Operating Leverage

One potential effect caused by the

presence of operating leverage is

that a change in the volume of sales

results in a more than proportional

change in operating profit (or loss).

Operating Leverage -- The use of

fixed operating costs by the firm.

16-5

Impact of Operating

Leverage on Profits

Firm F Firm V Firm 2F

Sales $10 $11 $19.5

Operating Costs

Fixed 7 2 14

Variable 2 7 3

Operating Profit $ 1 $ 2 $ 2.5

FC/total costs .78 .22 .82

FC/sales .70 .18 .72

(in thousands)

16-6

Impact of Operating

Leverage on Profits

Now, subject each firm to a 50%

increase in sales for next year.

Which firm do you think will be more

sensitive to the change in sales (i.e.,

show the largest percentage change in

operating profit, EBIT)?

[ ] Firm F; [ ] Firm V; [ ] Firm 2F.

16-7

Impact of Operating

Leverage on Profits

Firm F Firm V Firm 2F

Sales $15 $16.5 $29.25

Operating Costs

Fixed 7 2 14

Variable 3 10.5 4.5

Operating Profit $ 5 $ 4 $10.75

Percentage

Change in EBIT* 400% 100% 330%

(in thousands)

* (EBIT

t

- EBIT

t-1

) / EBIT

t-1

16-8

Impact of Operating

Leverage on Profits

Firm F is the most sensitive firm -- for it, a 50%

increase in sales leads to a 400% increase in

EBIT.

Our example reveals that it is a mistake to

assume that the firm with the largest absolute or

relative amount of fixed costs automatically

shows the most dramatic effects of operating

leverage.

Later, we will come up with an easy way to spot

the firm that is most sensitive to the presence of

operating leverage.

16-9

Break-Even Analysis

When studying operating leverage,

profits refers to operating profits before

taxes (i.e., EBIT) and excludes debt

interest and dividend payments.

Break-Even Analysis -- A technique for

studying the relationship among fixed

costs, variable costs, sales volume, and

profits. Also called cost/volume/profit

(C/V/P) analysis.

16-10

Break-Even Chart

QUANTITY PRODUCED AND SOLD

0 1,000 2,000 3,000 4,000 5,000 6,000 7,000

Total Revenues

Profits

Fixed Costs

Variable Costs

Losses

R

E

V

E

N

U

E

S

A

N

D

C

O

S

T

S

(

$

t

h

o

u

s

a

n

d

s

)

175

250

100

50

Total Costs

16-11

Break-Even

(Quantity) Point

How to find the quantity break-even point:

EBIT = P(Q) - V(Q) - FC

EBIT = Q(P - V) - FC

P = Price per unit V = Variable costs per unit

FC = Fixed costs Q = Quantity (units)

produced and sold

Break-Even Point -- The sales volume required

so that total revenues and total costs are

equal; may be in units or in sales dollars.

16-12

Break-Even

(Quantity) Point

Breakeven occurs when EBIT = 0

Q (P - V) - FC = EBIT

Q

BE

(P - V) - FC = 0

Q

BE

(P - V) = FC

Q

BE

= FC / (P - V)

a.k.a. Unit Contribution Margin

16-13

Break-Even (Sales) Point

How to find the sales break-even point:

S

BE

=

FC + (VC

BE

)

S

BE

=

FC + (Q

BE

)(V)

or

S

BE

*

=

FC / [1 - (VC / S) ]

* Refer to text for derivation of the formula

16-14

Break-Even

Point Example

Basket Wonders (BW) wants to

determine both the quantity and sales

break-even points when:

Fixed costs are $100,000

Baskets are sold for $43.75 each

Variable costs are $18.75 per basket

16-15

Break-Even Point (s)

Breakeven occurs when:

Q

BE

= FC / (P - V)

Q

BE

= $100,000 / ($43.75 - $18.75)

Q

BE

= 4,000 Units

S

BE

=

(Q

BE

)(V) + FC

S

BE

=

(4,000 )($18.75) + $100,000

S

BE

= $175,000

16-16

Break-Even Chart

QUANTITY PRODUCED AND SOLD

0 1,000 2,000 3,000 4,000 5,000 6,000 7,000

Total Revenues

Profits

Fixed Costs

Variable Costs

Losses

R

E

V

E

N

U

E

S

A

N

D

C

O

S

T

S

(

$

t

h

o

u

s

a

n

d

s

)

175

250

100

50

Total Costs

16-17

Degree of Operating

Leverage (DOL)

DOL at Q

units of

output

(or sales)

Degree of Operating Leverage -- The

percentage change in a firms operating

profit (EBIT) resulting from a 1 percent

change in output (sales).

=

Percentage change in

operating profit (EBIT)

Percentage change in

output (or sales)

16-18

Computing the DOL

DOL

Q units

Calculating the DOL for a single product

or a single-product firm.

=

Q (P - V)

Q (P - V) - FC

=

Q

Q - Q

BE

16-19

Computing the DOL

DOL

S dollars of sales

Calculating the DOL for a

multiproduct firm.

=

S - VC

S - VC - FC

=

EBIT + FC

EBIT

16-20

Break-Even

Point Example

Lisa Miller wants to determine the degree

of operating leverage at sales levels of

6,000 and 8,000 units. As we did earlier,

we will assume that:

Fixed costs are $100,000

Baskets are sold for $43.75 each

Variable costs are $18.75 per basket

16-21

Computing BWs DOL

DOL

6,000 units

Computation based on the previously

calculated break-even point of 4,000 units

=

6,000

6,000 - 4,000

=

=

3

DOL

8,000 units

8,000

8,000 - 4,000

=

2

16-22

Interpretation of the DOL

A 1% increase in sales above the 8,000

unit level increases EBIT by 2% because

of the existing operating leverage of the

firm.

=

DOL

8,000 units

8,000

8,000 - 4,000

=

2

16-23

Interpretation of the DOL

2,000 4,000 6,000 8,000

1

2

3

4

5

QUANTITY PRODUCED AND SOLD

0

-1

-2

-3

-4

-5

D

E

G

R

E

E

O

F

O

P

E

R

A

T

I

N

G

L

E

V

E

R

A

G

E

(

D

O

L

)

Q

BE

16-24

Interpretation of the DOL

DOL is a quantitative measure of the sensitivity

of a firms operating profit to a change in the

firms sales.

The closer that a firm operates to its break-even

point, the higher is the absolute value of its DOL.

When comparing firms, the firm with the highest

DOL is the firm that will be most sensitive to a

change in sales.

Key Conclusions to be Drawn from the

previous slide and our Discussion of DOL

16-25

DOL and Business Risk

DOL is only one component of business risk

and becomes active only in the presence

of sales and production cost variability.

DOL magnifies the variability of operating

profits and, hence, business risk.

Business Risk -- The inherent uncertainty

in the physical operations of the firm. Its

impact is shown in the variability of the

firms operating income (EBIT).

16-26

Application of DOL for

Our Three Firm Example

Use the data in Slide 16-5 and the

following formula for Firm F:

DOL = [(EBIT + FC)/EBIT]

=

DOL

$10,000 sales

1,000 + 7,000

1,000

=

8.0

16-27

Application of DOL for

Our Three Firm Example

Use the data in Slide 16-5 and the

following formula for Firm V:

DOL = [(EBIT + FC)/EBIT]

=

DOL

$11,000 sales

2,000 + 2,000

2,000

=

2.0

16-28

Application of DOL for

Our Three-Firm Example

Use the data in Slide 16-5 and the

following formula for Firm 2F:

DOL = [(EBIT + FC)/EBIT]

=

DOL

$19,500 sales

2,500 + 14,000

2,500

=

6.6

16-29

Application of DOL for

Our Three-Firm Example

The ranked results indicate that the firm most

sensitive to the presence of operating leverage

is Firm F.

Firm F DOL = 8.0

Firm V DOL = 6.6

Firm 2F DOL = 2.0

Firm F will expect a 400% increase in profit from a 50%

increase in sales (see Slide 16-7 results).

16-30

Financial Leverage

Financial leverage is acquired by

choice.

Used as a means of increasing the

return to common shareholders.

Financial Leverage -- The use of

fixed financing costs by the firm.

The British expression is gearing.

16-31

EBIT-EPS Break-Even,

or Indifference, Analysis

Calculate EPS for a given level of EBIT at a

given financing structure.

EBIT-EPS Break-Even Analysis -- Analysis

of the effect of financing alternatives on

earnings per share. The break-even point is

the EBIT level where EPS is the same for

two (or more) alternatives.

(EBIT - I) (1 - t) - Pref. Div.

# of Common Shares

EPS =

16-32

EBIT-EPS Chart

Current common equity shares = 50,000

$1 million in new financing of either:

All C.S. sold at $20/share (50,000 shares)

All debt with a coupon rate of 10%

All P.S. with a dividend rate of 9%

Expected EBIT = $500,000

Income tax rate is 30%

Basket Wonders has $2 million in LT financing

(100% common stock equity).

16-33

EBIT-EPS Calculation with

New Equity Financing

EBIT $500,000 $150,000*

Interest 0 0

EBT $500,000 $150,000

Taxes (30% x EBT) 150,000 45,000

EAT $350,000 $105,000

Preferred Dividends 0 0

EACS $350,000 $105,000

# of Shares 100,000 100,000

EPS $3.50 $1.05

Common Stock Equity Alternative

* A second analysis using $150,000 EBIT rather than the expected EBIT.

16-34

EBIT-EPS Chart

0 100 200 300 400 500 600 700

EBIT ($ thousands)

E

a

r

n

i

n

g

s

p

e

r

S

h

a

r

e

(

$

)

0

1

2

3

4

5

6

Common

16-35

EBIT-EPS Calculation with

New Debt Financing

EBIT $500,000 $150,000*

Interest 100,000 100,000

EBT $400,000 $ 50,000

Taxes (30% x EBT) 120,000 15,000

EAT $280,000 $ 35,000

Preferred Dividends 0 0

EACS $280,000 $ 35,000

# of Shares 50,000 50,000

EPS $5.60 $0.70

Long-term Debt Alternative

* A second analysis using $150,000 EBIT rather than the expected EBIT.

16-36

EBIT-EPS Chart

0 100 200 300 400 500 600 700

EBIT ($ thousands)

E

a

r

n

i

n

g

s

p

e

r

S

h

a

r

e

(

$

)

0

1

2

3

4

5

6

Common

Debt

Indifference point

between debt and

common stock

financing

16-37

EBIT-EPS Calculation with

New Preferred Financing

EBIT $500,000 $150,000*

Interest 0 0

EBT $500,000 $150,000

Taxes (30% x EBT) 150,000 45,000

EAT $350,000 $105,000

Preferred Dividends 90,000 90,000

EACS $260,000 $ 15,000

# of Shares 50,000 50,000

EPS $5.20 $0.30

Preferred Stock Alternative

* A second analysis using $150,000 EBIT rather than the expected EBIT.

16-38

0 100 200 300 400 500 600 700

EBIT-EPS Chart

EBIT ($ thousands)

E

a

r

n

i

n

g

s

p

e

r

S

h

a

r

e

(

$

)

0

1

2

3

4

5

6

Common

Debt

Indifference point

between preferred

stock and common

stock financing

Preferred

16-39

What About Risk?

0 100 200 300 400 500 600 700

EBIT ($ thousands)

E

a

r

n

i

n

g

s

p

e

r

S

h

a

r

e

(

$

)

0

1

2

3

4

5

6

Common

Debt

Lower risk. Only a small

probability that EPS will

be less if the debt

alternative is chosen.

P

r

o

b

a

b

i

l

i

t

y

o

f

O

c

c

u

r

r

e

n

c

e

(

f

o

r

t

h

e

p

r

o

b

a

b

i

l

i

t

y

d

i

s

t

r

i

b

u

t

i

o

n

)

16-40

What About Risk?

0 100 200 300 400 500 600 700

EBIT ($ thousands)

E

a

r

n

i

n

g

s

p

e

r

S

h

a

r

e

(

$

)

0

1

2

3

4

5

6

Common

Debt

Higher risk. A much larger

probability that EPS will

be less if the debt

alternative is chosen.

P

r

o

b

a

b

i

l

i

t

y

o

f

O

c

c

u

r

r

e

n

c

e

(

f

o

r

t

h

e

p

r

o

b

a

b

i

l

i

t

y

d

i

s

t

r

i

b

u

t

i

o

n

)

16-41

Degree of Financial

Leverage (DFL)

DFL at

EBIT of

X dollars

Degree of Financial Leverage -- The

percentage change in a firms earnings

per share (EPS) resulting from a 1

percent change in operating profit.

=

Percentage change in

earnings per share (EPS)

Percentage change in

operating profit (EBIT)

16-42

Computing the DFL

DFL

EBIT of $X

Calculating the DFL

=

EBIT

EBIT - I - [ PD / (1 - t) ]

EBIT = Earnings before interest and taxes

I = Interest

PD = Preferred dividends

t = Corporate tax rate

16-43

What is the DFL for Each

of the Financing Choices?

DFL

$500,000

Calculating the DFL for NEW equity* alternative

=

$500,000

$500,000 - 0 - [0 / (1 - 0)]

* The calculation is based on the expected EBIT

=

1.00

16-44

What is the DFL for Each

of the Financing Choices?

DFL

$500,000

Calculating the DFL for NEW debt * alternative

=

$500,000

{ $500,000 - 100,000

- [0 / (1 - 0)] }

* The calculation is based on the expected EBIT

=

$500,000 / $400,000

1.25

=

16-45

What is the DFL for Each

of the Financing Choices?

DFL

$500,000

Calculating the DFL for NEW preferred * alternative

=

$500,000

{ $500,000 - 0

- [90,000 / (1 - .30)] }

* The calculation is based on the expected EBIT

=

$500,000 / $400,000

1.35

=

16-46

Variability of EPS

Preferred stock financing will lead to

the greatest variability in earnings per

share based on the DFL.

This is due to the tax deductibility of

interest on debt financing.

DFL

Equity

= 1.00

DFL

Debt

= 1.25

DFL

Preferred

= 1.35

Which financing

method will have

the greatest relative

variability in EPS?

16-47

Financial Risk

Debt increases the probability of cash

insolvency over an all-equity-financed firm. For

example, our example firm must have EBIT of at

least $100,000 to cover the interest payment.

Debt also increased the variability in EPS as the

DFL increased from 1.00 to 1.25.

Financial Risk -- The added variability in

earnings per share (EPS) -- plus the risk of

possible insolvency -- that is induced by the

use of financial leverage.

16-48

Total Firm Risk

CV

EPS

is a measure of relative total firm risk

CV

EBIT

is a measure of relative business risk

The difference, CV

EPS

- CV

EBIT

, is a measure of

relative financial risk

Total Firm Risk -- The variability in earnings per

share (EPS). It is the sum of business plus

financial risk.

Total firm risk = business risk + financial risk

16-49

Degree of Total

Leverage (DTL)

DTL at Q units

(or S dollars)

of output (or

sales)

Degree of Total Leverage -- The

percentage change in a firms earnings

per share (EPS) resulting from a 1

percent change in output (sales).

=

Percentage change in

earnings per share (EPS)

Percentage change in

output (or sales)

16-50

Computing the DTL

DTL

S dollars

of sales

DTL

Q units (or S dollars)

= ( DOL

Q units (or S dollars)

)

x ( DFL

EBIT of X dollars

)

=

EBIT + FC

EBIT - I - [ PD / (1 - t) ]

DTL

Q units

Q (P - V)

Q (P - V) - FC - I - [ PD / (1 - t) ]

=

16-51

DTL Example

Lisa Miller wants to determine the

Degree of Total Leverage at

EBIT=$500,000. As we did earlier, we

will assume that:

Fixed costs are $100,000

Baskets are sold for $43.75 each

Variable costs are $18.75 per basket

16-52

Computing the DTL

for All-Equity Financing

DTL

S dollars

of sales

=

$500,000 + $100,000

$500,000 - 0 - [ 0 / (1 - .3) ]

DTL

S dollars

= (DOL

S dollars

) x (DFL

EBIT of $S

)

DTL

S dollars

= (1.2 ) x ( 1.0* ) = 1.20

=

1.20

*Note: No financial leverage.

16-53

Computing the DTL

for Debt Financing

DTL

S dollars

of sales

=

$500,000 + $100,000

{ $500,000 - $100,000

- [ 0 / (1 - .3) ] }

DTL

S dollars

= (DOL

S dollars

) x (DFL

EBIT of $S

)

DTL

S dollars

= (1.2 ) x ( 1.25* ) = 1.50

=

1.50

*Note: Calculated on Slide 16-44.

16-54

Risk versus Return

Compare the expected EPS to the DTL for

the common stock equity financing

approach to the debt financing approach.

Financing E(EPS) DTL

Equity $3.50 1.20

Debt $5.60 1.50

Greater expected return (higher EPS) comes at

the expense of greater potential risk (higher DTL)!

16-55

What is an Appropriate

Amount of Financial Leverage?

Firms must first analyze their expected future

cash flows.

The greater and more stable the expected future

cash flows, the greater the debt capacity.

Fixed charges include: debt principal and

interest payments, lease payments, and

preferred stock dividends.

Debt Capacity -- The maximum amount of debt

(and other fixed-charge financing) that a firm

can adequately service.

16-56

Coverage Ratios

Interest Coverage

EBIT

Interest expenses

Indicates a firms

ability to cover

interest charges.

Income Statement

Ratios

Coverage Ratios

A ratio value equal to 1

indicates that earnings

are just sufficient to

cover interest charges.

16-57

Coverage Ratios

Debt-service Coverage

EBIT

{ Interest expenses +

[Principal payments / (1-t) ] }

Indicates a firms

ability to cover

interest expenses and

principal payments.

Income Statement

Ratios

Coverage Ratios

Allows us to examine the

ability of the firm to meet

all of its debt payments.

Failure to make principal

payments is also default.

16-58

Coverage Example

Make an examination of the coverage

ratios for Basket Wonders when

EBIT=$500,000. Compare the equity

and the debt financing alternatives.

Assume that:

Interest expenses remain at $100,000

Principal payments of $100,000 are

made yearly for 10 years

16-59

Coverage Example

Compare the interest coverage and debt

burden ratios for equity and debt financing.

Interest Debt-service

Financing Coverage Coverage

Equity Infinite Infinite

Debt 5.00 2.50

The firm actually has greater risk than the interest

coverage ratio initially suggests.

16-60

Coverage Example

-250 0 250 500 750 1,000 1,250

EBIT ($ thousands)

Firm B has a much

smaller probability

of failing to meet its

obligations than Firm A.

Firm B

Firm A

Debt-service burden

= $200,000

P

R

O

B

A

B

I

L

I

T

Y

O

F

O

C

C

U

R

R

E

N

C

E

16-61

Summary of the Coverage

Ratio Discussion

A single ratio value cannot be interpreted

identically for all firms as some firms have

greater debt capacity.

Annual financial lease payments should be

added to both the numerator and

denominator of the debt-service coverage

ratio as financial leases are similar to debt.

The debt-service coverage ratio accounts

for required annual principal payments.

16-62

Other Methods of Analysis

Often, firms are compared to peer institutions in the

same industry.

Large deviations from norms must be justified.

For example, an industrys median debt-to-net-worth

ratio might be used as a benchmark for financial

leverage comparisons.

Capital Structure -- The mix (or proportion) of a

firms permanent long-term financing

represented by debt, preferred stock, and

common stock equity.

16-63

Other Methods of Analysis

Firms may gain insight into the financial

markets evaluation of their firm by

talking with:

Investment bankers

Institutional investors

Investment analysts

Lenders

Surveying Investment Analysts and Lenders

16-64

Other Methods of Analysis

Firms must consider the impact

of any financing decision on the

firms security rating(s).

Security Ratings

You might also like

- Cost of Capital ExplainedDocument18 pagesCost of Capital ExplainedzewdieNo ratings yet

- Financial Planning and Forecasting GuideDocument35 pagesFinancial Planning and Forecasting GuideSaidarshan RevandkarNo ratings yet

- Capital Budgeting With Illustration and TheoryDocument145 pagesCapital Budgeting With Illustration and Theorymmuneebsda50% (2)

- Unit 2 Capital StructureDocument27 pagesUnit 2 Capital StructureNeha RastogiNo ratings yet

- Dividend PolicyDocument44 pagesDividend PolicyShahNawazNo ratings yet

- Chapter 24 - Professional Money Management, Alternative Assets, and Industry EthicsDocument48 pagesChapter 24 - Professional Money Management, Alternative Assets, and Industry Ethicsrrrr110000No ratings yet

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDocument90 pages35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- Working Capital ManagementDocument100 pagesWorking Capital ManagementMrudula V.100% (6)

- Cost of Capital and Capital Structure DecisionsDocument21 pagesCost of Capital and Capital Structure DecisionsGregory MakaliNo ratings yet

- FM S5 Capitalstructure TheoriesDocument36 pagesFM S5 Capitalstructure TheoriesSunny RajoraNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow Statementasherjoe67% (3)

- FM 10.1 Working Cap - IntroDocument31 pagesFM 10.1 Working Cap - IntroKishlay SinghNo ratings yet

- Lec8.Cost of CapitalDocument52 pagesLec8.Cost of Capitalvivek patelNo ratings yet

- Financial ManagementDocument197 pagesFinancial ManagementDEEPAK100% (1)

- Ch01 - International Financial ManagementDocument47 pagesCh01 - International Financial Managementalsatusatusatu100% (1)

- Formulae Sheets: Ps It Orp S It 1 1Document3 pagesFormulae Sheets: Ps It Orp S It 1 1Mengdi ZhangNo ratings yet

- M14 Gitman50803X 14 MF AC14Document70 pagesM14 Gitman50803X 14 MF AC14Joan Marie100% (2)

- Module 3 - Capital BudgetingDocument1 pageModule 3 - Capital BudgetingPrincess Frean VillegasNo ratings yet

- Operating and Financial LeverageDocument3 pagesOperating and Financial Leveragerezwan_haque_2No ratings yet

- The Role of Finacial ManagementDocument25 pagesThe Role of Finacial Managementnitinvohra_capricorn100% (1)

- Chapter 24-Professional Money Management, Alternative Assets, and Industry EthicsDocument10 pagesChapter 24-Professional Money Management, Alternative Assets, and Industry Ethicsrrrr110000No ratings yet

- Management Accounting Ratio Analysis/TITLEDocument13 pagesManagement Accounting Ratio Analysis/TITLEPravin TejasNo ratings yet

- Financial Statement Analysis PPT 3427Document25 pagesFinancial Statement Analysis PPT 3427imroz_alamNo ratings yet

- Breakeven AnalysisDocument30 pagesBreakeven Analysisrameshpersonal2000No ratings yet

- Financial Management Multiple Choice QuestionsDocument31 pagesFinancial Management Multiple Choice QuestionsLaezelie Palaje100% (1)

- Pepsi and Coke Financial ManagementDocument11 pagesPepsi and Coke Financial ManagementNazish Sohail100% (1)

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Chapter 1 To 6 Multiple Choice SolutionsDocument44 pagesChapter 1 To 6 Multiple Choice SolutionsReenal67% (3)

- 13 Ch08 ProblemsDocument12 pages13 Ch08 ProblemsAnonymous TFkK5qWNo ratings yet

- Exercise Financial Ratio AnalysisDocument1 pageExercise Financial Ratio Analysiswalixz_8750% (2)

- Valuation of Bonds and Shares ExplainedDocument40 pagesValuation of Bonds and Shares ExplainedJyoti Bansal67% (3)

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- Financial Planning ForecastingDocument12 pagesFinancial Planning ForecastingAnanda RiskiNo ratings yet

- Cost of CapitalDocument26 pagesCost of CapitalRiti Nayyar100% (1)

- Introduction To Financial Management. 2018Document42 pagesIntroduction To Financial Management. 2018Martin Idowu100% (1)

- Lecture 5 PDFDocument90 pagesLecture 5 PDFsyingNo ratings yet

- Topic - Week 2 Valuation of Bonds MCQDocument6 pagesTopic - Week 2 Valuation of Bonds MCQmail2manshaaNo ratings yet

- Cost of CapitalDocument44 pagesCost of CapitalSubia Hasan50% (4)

- LeveragesDocument51 pagesLeveragesmaitrisharma131295100% (1)

- Stock ValuationDocument74 pagesStock Valuationnarae0% (1)

- Workbook On Ratio AnalysisDocument9 pagesWorkbook On Ratio AnalysisZahid HassanNo ratings yet

- fM-Cost of CapitalDocument46 pagesfM-Cost of CapitalParamjit Sharma100% (8)

- Valuation of Bonds Numericals - KDocument7 pagesValuation of Bonds Numericals - KnidhiNo ratings yet

- Entry Strategy and Strategic AlliancesDocument28 pagesEntry Strategy and Strategic AlliancesRéjouissant FilleNo ratings yet

- CH 12. Risk Evaluation in Capital BudgetingDocument29 pagesCH 12. Risk Evaluation in Capital BudgetingN-aineel DesaiNo ratings yet

- Cash Flow Statements PDFDocument101 pagesCash Flow Statements PDFSubbu ..100% (1)

- Chapter 7 Corporate FinanceDocument25 pagesChapter 7 Corporate FinanceCalistoAmemebeNo ratings yet

- R30 Long Lived AssetsDocument33 pagesR30 Long Lived AssetsSiddhu Sai100% (1)

- Bond & Stock ValuationDocument37 pagesBond & Stock ValuationSara KarenNo ratings yet

- Portfolio ManagementDocument28 pagesPortfolio Managementagarwala4767% (3)

- Time Value Money Calculations University NairobiDocument2 pagesTime Value Money Calculations University NairobiDavidNo ratings yet

- Financial PlanningDocument22 pagesFinancial Planningangshu002085% (13)

- Ratio Analysis: Profitability RatiosDocument10 pagesRatio Analysis: Profitability RatiosREHANRAJNo ratings yet

- Capital Budgeting and Estimating Cash FlowsDocument34 pagesCapital Budgeting and Estimating Cash Flowstjsami0% (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Operating and Financial LeverageDocument64 pagesOperating and Financial Leveragekareena23No ratings yet

- Operating and Financial LeverageDocument63 pagesOperating and Financial LeverageLaraib AsadNo ratings yet

- Topic 7 - Financial Leverage - ExtraDocument57 pagesTopic 7 - Financial Leverage - ExtraBaby KhorNo ratings yet

- Operating and Financial LeverageDocument64 pagesOperating and Financial LeverageVelmuruganKNo ratings yet

- TemaDocument63 pagesTemaPashutza MalaiNo ratings yet

- Advertising PlanningDocument22 pagesAdvertising Planningbey_topsNo ratings yet

- Succession PlanningDocument26 pagesSuccession Planningbey_tops100% (1)

- Anup Kumar PathakDocument9 pagesAnup Kumar Pathakbey_topsNo ratings yet

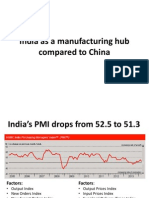

- India As A Manufacturing Hub Compared To ChinaDocument7 pagesIndia As A Manufacturing Hub Compared To Chinabey_topsNo ratings yet

- Comparative Cost AdvantageDocument3 pagesComparative Cost Advantagebey_topsNo ratings yet

- Assessment Centre & Development CentreDocument9 pagesAssessment Centre & Development Centrebey_topsNo ratings yet