Professional Documents

Culture Documents

Introduction To Insurance: Pooja Garg

Uploaded by

invaapOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Insurance: Pooja Garg

Uploaded by

invaapCopyright:

Available Formats

Introduction to Insurance

Pooja Garg

Definition of Insurance

From the viewpoint of an Individual: Insurance is an

economic device whereby an individual substitutes a

certain cost (the premium) in consideration of the

insurer incurring the risk of paying a large sum upon a

given contingency

Features:

Economic device

Premium

Large sum paid by Insurer (Sum Assured)

Payment made only upon a contingency

Definition of Insurance

From the viewpoint of Society: Insurance is an economic

device for reducing and eliminating risk through the

process of spreading the loss among a group of people

who are exposed to it and who agree to insure

themselves against the risk.

Nature of Insurance

Security: It does not decrease the uncertainty for the

individual as to whether the event will occur, nor does

it alter the probability of occurrence but it does

reduce the probability of financial loss connected with

the event.

Sharing/Pooling of risk

Co-operative device

Evaluation of Risk

Payment at Contingency

Insurance is not Gambling

Insurance is not charity

Purpose and Need of Insurance

Uses to an Individual

Provide safety and security

Affords peace of mind

Eliminates dependency

Life Insurance encourages saving

Life Insurance provides profitable investment

Life Insurance fulfills the needs of a person

Old-age needs

Early Death

Disability

Sickness

Readjustment needs

Special Needs e.g Education, Marriage

Tax Savings

Purpose and Need of Insurance

Uses to Business

Uncertainty of Business Losses reduced

Business efficiency increased

Welfare of employees

Enhancement of Credit

Covers consequential losses

Key man identification

Group insurance

Uses to Society

Economic Growth

Protection of Wealth

Increases the savings to GDP ratio

Deep Insurance penetration makes an economy

stable.

How Insurance Works ?

Sharing and Pooling of risk by combining a sufficient

number of homogenous exposures into a group to

make the losses predictable for the group as a whole

and likely big impact on one is reduced to smaller

manageable impacts on all.

How Insurance Works ?

Homogenous exposures compose a set of group of

people

Losses are predicted for the group as a whole

Sharing of proportional risk among each person in a

group

Big impact on one reduced to smaller manageable

impact on all

Examples

1. 400 Houses

Value of each house=Rs. 20,000

Probability of risk=4 houses burn in a year (Degree

of Risk=1%)

Total Loss=Rs. 80,000/400

=Rs.200/person (1% of Value of House)

Examples (Contd.)

Loss Shared in Proportion

A=(1,50,000*2)/400=Rs.750 (3.75% of value of House)

B=(1,50,000*4)/400=Rs.1500

C=(150,000*1)/400=Rs.375

D=(1,50,000*8)/400=Rs.3000

Probability of Risk does not always depend on the value of

house

Application of Probability Theory and

Law of Large Numbers

Measures of Dispersion i.e. Variance and Standard

Deviation are used to calculate the average losses to

be born by the insurer.

The inertia of large numbers is applied while

calculating the probability. The larger the sample, the

smaller the margin of error.

Case Study: Probability Theory

Year

Actual Losses

(Houses that Burn)

Average

Losses

Difference

Difference

Squared

1 7 10 3 9

2 11 10 1 1

3 10 10 0 0

4 9 10 1 1

5 13 10 3 9

20

Variance (s

2

) = 20/5=4

Standard Deviation (s)=2

Estimation of Probability of Number of

Houses Burning Next Year

10 12 14 16 8 6 4

68.27%

95.45%

99.73%

No.of Houses

Burning between Probability

8-12 68.27%

6-14 95.45%

4-16 99.73%

The Role of Insurance in

Economic Development

Pooja Garg

Promote financial stability

By indemnifying those who suffer or harm,

insurance helps stabilize the financial situation of

individuals, families and organizations.

It encourages individuals and firms to invest and

create wealth.

Peach of mind and financial carelessness

Substitutes for and complements

government security programs

Private insurance can relieve pressure on

social insurance system, preserving

government resources for essential social

security.

Pension fund and life insurance

Natural disaster indemnity plan

Facilitates trade and

commerce

Many products and services are produced and

sold only if adequate liability insurance is

available to cover any claims for negligence.

Innovation

Credit enhancement

Helps mobilize savings

Insurance and financial intermediation

Insurance enhance financial system efficiency in

three ways

Reduce transaction costs associated with bringing

together savers and borrowers

Create liquidity

Facilitate economies of scale in investment

Enables risk to be managed

more efficiently

Risk pricing greater the expected loss, higher the

price

Risk transformation risk exposures can be

transferred to an insurer for a price

Risk pooling and reduction

(1) insurers make reasonably accurate estimates as to

the pools overall losses.

(2) insurers diversify their portfolios.

Fosters a more efficient

capital allocation

Insurers will monitor the companies to reduce

risk-increasing behavior and act in the best

interests of their various stakeholders.

A watch-dog role.

Thank You

You might also like

- Credit Card Processing For Microsoft Dynamics AX 2012Document32 pagesCredit Card Processing For Microsoft Dynamics AX 2012Saankhya2030% (1)

- Risk & Risk ManagementDocument29 pagesRisk & Risk ManagementVarun RaoNo ratings yet

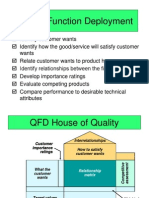

- QFD House of Quality GuideDocument12 pagesQFD House of Quality GuideinvaapNo ratings yet

- Responsibility Accounting: UIAMS, Panjab University Chandigarh Session 16 September, 2013Document27 pagesResponsibility Accounting: UIAMS, Panjab University Chandigarh Session 16 September, 2013Paavni SharmaNo ratings yet

- Insurance Notes 1Document36 pagesInsurance Notes 1sheelaarul07No ratings yet

- Bank of England and The British Empire: A "New World Order"?Document157 pagesBank of England and The British Empire: A "New World Order"?William Litynski100% (6)

- Risk Management in Insurance PDFDocument51 pagesRisk Management in Insurance PDFathar100% (3)

- 10 - Internal Audit Manual For Construction CompaniesDocument4 pages10 - Internal Audit Manual For Construction Companiesdsbisht100% (1)

- Chapter 1Document31 pagesChapter 1YUSLINA BINTI ABDUL GHAN1No ratings yet

- Fundamentals of Bio Medical EngineeringDocument273 pagesFundamentals of Bio Medical Engineeringviasys91% (11)

- Principles of SpectDocument31 pagesPrinciples of Spectinvaap100% (1)

- General InsuranceDocument100 pagesGeneral InsuranceShivani YadavNo ratings yet

- General InsuranceDocument44 pagesGeneral InsuranceVinitGupta100% (1)

- InsuranceDocument53 pagesInsuranceRohit VkNo ratings yet

- Risk Management Lesson 2Document2 pagesRisk Management Lesson 2Ken TuazonNo ratings yet

- New Business CertificateDocument1 pageNew Business CertificateDumitru PetricaNo ratings yet

- Introduction To Insurance ExtendedDocument68 pagesIntroduction To Insurance ExtendedMohamed AhmedNo ratings yet

- Measuring Risk: Advanced Topics: Presented By: Bandeep Manka Neha Gaur Nidhi Shikha Shweta Swati AggarwalDocument60 pagesMeasuring Risk: Advanced Topics: Presented By: Bandeep Manka Neha Gaur Nidhi Shikha Shweta Swati Aggarwalbandeep12No ratings yet

- Nature of InsuranceDocument31 pagesNature of InsurancemeeyaNo ratings yet

- Chapter 1Document33 pagesChapter 1Lina ShawalNo ratings yet

- Chapter Two 0Document28 pagesChapter Two 0Laura StephanieNo ratings yet

- CH 3Document21 pagesCH 3mikiyas zeyedeNo ratings yet

- Principles of Insurance03-05Document66 pagesPrinciples of Insurance03-05ressasanoverNo ratings yet

- Risk Management Executive SummaryDocument53 pagesRisk Management Executive SummaryRohit VkNo ratings yet

- CH 3Document11 pagesCH 3fikruNo ratings yet

- Meaning and Definition of InsuranceDocument40 pagesMeaning and Definition of InsurancekanikaNo ratings yet

- The Role of INSURANCEDocument22 pagesThe Role of INSURANCEJosephine CepedaNo ratings yet

- Overview of Property and Casualty ReinsuranceDocument29 pagesOverview of Property and Casualty ReinsuranceAman AroraNo ratings yet

- Module 1 Introduction of InsuranceDocument16 pagesModule 1 Introduction of InsuranceAniket KaleNo ratings yet

- Introduction of Insurance NOTESDocument7 pagesIntroduction of Insurance NOTESReva JaiswalNo ratings yet

- FINA 420 - Insurance RisksDocument30 pagesFINA 420 - Insurance RisksZiyi YinNo ratings yet

- 4.0 Nature of InsuranceDocument20 pages4.0 Nature of InsuranceNURUL AIN NAJIHAH TUKIRANNo ratings yet

- Insurance Insurance-This Is An Undertaking or Contract Between An Individual or Business and An Insurance AnDocument23 pagesInsurance Insurance-This Is An Undertaking or Contract Between An Individual or Business and An Insurance AnangaNo ratings yet

- POI MaterialDocument11 pagesPOI MaterialMukesh ChoudharyNo ratings yet

- RmiDocument16 pagesRmi29_ramesh170No ratings yet

- Insurance ManagementDocument71 pagesInsurance Managementmesfinabera180No ratings yet

- Insurance: Pooling of LossesDocument12 pagesInsurance: Pooling of LossesNafiz RahmanNo ratings yet

- A Project Report On Consumer PerceptionDocument106 pagesA Project Report On Consumer PerceptionAKSHIT VERMANo ratings yet

- INSURANCES (Livestock)Document41 pagesINSURANCES (Livestock)ÖñkárSátámNo ratings yet

- Insurance MGT NotesDocument36 pagesInsurance MGT NotesHONEY AGRAWALNo ratings yet

- Risk and InsuranceDocument16 pagesRisk and InsurancehafeezhasnainNo ratings yet

- 100 Marks ProjectDocument16 pages100 Marks Projectharshad shuklaNo ratings yet

- UntitledDocument26 pagesUntitledKrishna YadavNo ratings yet

- Insurance & UTIDocument22 pagesInsurance & UTIReeta Singh100% (1)

- RiskDocument49 pagesRiskyosephworkuNo ratings yet

- ch-3 RiskDocument10 pagesch-3 RiskYebegashet AlemayehuNo ratings yet

- Unit 6: Insurance PlanningDocument25 pagesUnit 6: Insurance PlanningneerajguptapdpsNo ratings yet

- IRDADocument18 pagesIRDArameez.amex5067No ratings yet

- United India 1Document57 pagesUnited India 1dhanushvijayakumar09No ratings yet

- Stfrancismidtermrevinsrskmgt Spring 2015Document9 pagesStfrancismidtermrevinsrskmgt Spring 2015Cassandra KinneyNo ratings yet

- SecondDocument257 pagesSecondpmcmbharat264No ratings yet

- Ibis Unit 03Document28 pagesIbis Unit 03bhagyashripande321No ratings yet

- Advantages and disadvantages of insuranceDocument3 pagesAdvantages and disadvantages of insuranceKavithaNo ratings yet

- Kuch BhiDocument13 pagesKuch BhiSAUMYANo ratings yet

- Module II Risk and UncertainityDocument11 pagesModule II Risk and UncertainityJebin JamesNo ratings yet

- CHAPTER 4 - InsuranceDocument134 pagesCHAPTER 4 - InsuranceMuneera Zakaria75% (8)

- Ch1. Risk and Its TreatmentDocument7 pagesCh1. Risk and Its TreatmentRaghda HussienNo ratings yet

- Risk Management Chapter ThreeDocument8 pagesRisk Management Chapter ThreeDaniel filmonNo ratings yet

- St. Mary's University Department of Accounting and Finance Risk Management and Insurance Individual AssignmentDocument8 pagesSt. Mary's University Department of Accounting and Finance Risk Management and Insurance Individual AssignmentBethi KifluNo ratings yet

- INSURANCE MANAGEMENT GUIDEDocument25 pagesINSURANCE MANAGEMENT GUIDEDeepak ParidaNo ratings yet

- Orientation Manual On Micro-Insurance For Microfinance InstitutionsDocument13 pagesOrientation Manual On Micro-Insurance For Microfinance InstitutionssakethmekalaNo ratings yet

- Chapter 3 InsuranceDocument20 pagesChapter 3 InsuranceKeneanNo ratings yet

- Slic InsuranceDocument109 pagesSlic InsuranceAnmol GuptaNo ratings yet

- ULIP Project Report on Security and Investment PlanDocument80 pagesULIP Project Report on Security and Investment Planparag1230100% (1)

- NanotechDocument4 pagesNanotechPaavni SharmaNo ratings yet

- RF ROBOtic ArmDocument79 pagesRF ROBOtic ArminvaapNo ratings yet

- Mobile BankingDocument12 pagesMobile BankingharisheNo ratings yet

- RiskDocument28 pagesRiskinvaapNo ratings yet

- Life Insurance ProductsDocument43 pagesLife Insurance ProductsinvaapNo ratings yet

- Title 250706Document556 pagesTitle 250706callmeasthaNo ratings yet

- Variance AnalysisDocument26 pagesVariance AnalysisinvaapNo ratings yet

- Session 2, 3strategic Cost Management Unit IIDocument35 pagesSession 2, 3strategic Cost Management Unit IIinvaapNo ratings yet

- Basel NormsDocument33 pagesBasel NormsPaavni SharmaNo ratings yet

- Pharmaceutical Industry Aug 12Document34 pagesPharmaceutical Industry Aug 12kermech21607No ratings yet

- MGNT428 Ch09 Cooperative Strategies Lecture - LachowiczDocument36 pagesMGNT428 Ch09 Cooperative Strategies Lecture - LachowiczinvaapNo ratings yet

- JD SFA ContractualDocument1 pageJD SFA ContractualinvaapNo ratings yet

- Methods of Making Payments.Document10 pagesMethods of Making Payments.Princess Augustin0% (1)

- Instructions To Be Followed While Submitting Forms OnlineDocument3 pagesInstructions To Be Followed While Submitting Forms OnlineinvaapNo ratings yet

- Section DDocument37 pagesSection DinvaapNo ratings yet

- BANKING TERMS EXPLAINEDDocument23 pagesBANKING TERMS EXPLAINEDSajal SinghalNo ratings yet

- Topic 5d - Audit of Repairs & Maintenance and Travel & Entertainment ExpensesDocument9 pagesTopic 5d - Audit of Repairs & Maintenance and Travel & Entertainment ExpensesLANGITBIRUNo ratings yet

- Study On SHG in Rural MarketDocument60 pagesStudy On SHG in Rural MarketspindujaNo ratings yet

- Guide to Distressed Investing in IndiaDocument10 pagesGuide to Distressed Investing in IndiacbuhksmkNo ratings yet

- Service Charges ScheduleDocument39 pagesService Charges ScheduleAQUIB SHAFI CHESTI-RMNo ratings yet

- Anil BokilDocument3 pagesAnil BokilNishant GhugeNo ratings yet

- Guidance Note On Audit of Banks by IcaiDocument955 pagesGuidance Note On Audit of Banks by IcaiTekumani Naveen Kumar100% (1)

- Draft of CIF ContractDocument7 pagesDraft of CIF ContractAmita SinwarNo ratings yet

- Slice Super CardDocument12 pagesSlice Super CardManish GangadkarNo ratings yet

- Switch Bills of Lading ExplainedDocument12 pagesSwitch Bills of Lading ExplainedMehul GujarNo ratings yet

- Chapter 6 - Commercial BankDocument32 pagesChapter 6 - Commercial BankĐỉnh Kout NamNo ratings yet

- Indian Institute OF Management Indore: Tender Notice No.: IIMI/Project/05/2017/39 File No. 342Document14 pagesIndian Institute OF Management Indore: Tender Notice No.: IIMI/Project/05/2017/39 File No. 342Mohammed Abdul BaseerNo ratings yet

- CSR Activity ReportDocument15 pagesCSR Activity ReportNilesh NawalNo ratings yet

- Law On PledgeDocument7 pagesLaw On PledgeLesterNo ratings yet

- IR35: How To Stay Compliant To Contractor Rules With Sparta GlobalDocument4 pagesIR35: How To Stay Compliant To Contractor Rules With Sparta GlobalSparta Global0% (1)

- Assume That You Recently Graduated With A Degree in FinanceDocument1 pageAssume That You Recently Graduated With A Degree in FinanceAmit PandeyNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument25 pagesInstructions / Checklist For Filling KYC FormMonishNo ratings yet

- 2.3 Metrobank Vs Junnel's MarketingDocument29 pages2.3 Metrobank Vs Junnel's MarketingMarion Yves MosonesNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewAshu SharmaNo ratings yet

- Bank Reconciliation Statement: Learning OutcomesDocument33 pagesBank Reconciliation Statement: Learning OutcomesAkriti JhaNo ratings yet

- SA Hedge Fund Survey Returns November 2010Document7 pagesSA Hedge Fund Survey Returns November 2010hlbeckleyNo ratings yet

- Sample Stats Accounts DatabaseDocument5 pagesSample Stats Accounts DatabaseAldo CatalanNo ratings yet

- Treasury Management Model for FMCG CompanyDocument5 pagesTreasury Management Model for FMCG CompanyMuntasirNo ratings yet

- International Standard On Auditing 510 Initial Audit Engagements-Opening BalancesDocument13 pagesInternational Standard On Auditing 510 Initial Audit Engagements-Opening BalancesFalah Ud Din SheryarNo ratings yet

- Bustamante v. Sps. RoselDocument1 pageBustamante v. Sps. RoseltemporiariNo ratings yet

- Neon PolityDocument1 pageNeon PolityNirajThakurNo ratings yet