Professional Documents

Culture Documents

IAPM - I - Introduction of Subject

Uploaded by

Ankit Goel100%(1)100% found this document useful (1 vote)

416 views8 pagesIAPM 1st Module

Original Title

IAPM - I -Introduction of Subject

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIAPM 1st Module

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

416 views8 pagesIAPM - I - Introduction of Subject

Uploaded by

Ankit GoelIAPM 1st Module

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 8

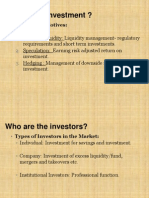

Investment:

Investment is the commitment of the funds to one or more

assets that will be held over some future time period.

Investment is the current commitment of the money for a period

of time to derive future payment that will compensate the

investor for 1) the time the funds are committed 2) expected rate

of inflation 3) the uncertainty of future payment.

Characteristics of the Investment/Attributes to be Considered:

Return

Risk

Safety

Liquidity

Hedge against Inflation

Tax Shelter

Convenience

Various Forms of the Investment

Corporate Securities

Equity Share

Preference Share

Debentures

Corporate Bonds

Commercial Papers

Repos and Reverse Repos

Certificate of Deposits

Deposit in Banks and Non- Banking Companies

Mutual Funds and Other Investment Companies

Post Office Deposit

Life Insurance Policies

Provident Fund Schemes

Government Securities:

Treasury Bills

Government Bonds

Derivatives

Real Estate

Art and Antiques

Foreign Currency Investments

Metals and Stones

Source of Investment Uncertainties:

Economic Specific Factor

Industry Specific Factor

Company Specific Factor

Economic Specific Factors:

Growth Rate of National Income

Inflation

Interest Rates

Government Revenue, Expenditure and Deficits

Exchange Rate

Infrastructure

Natural Circumstances

Political and Economical Policies

Norms of Regulatory Authorities

Dependency on Foreign Countries

International Financial Environment

Approaches to the Investment Decision Making

Fundamental Approach

Technical Approach

Psychological Approach

Academic Approach

Eclectic Approach

Approaches of the Investment

Aggressive Approach

Conservative Approach

Balanced Approach

CAPITAL MARKET

PRIMARY MARKET SECONDARY MARKET

MARKET

Public

Corporate

Existing Stockholders

Other Entities

Stock & Shares

Debentures

Units

Bonds

Warrants

Collective Investment

Instruments

Venture Capital Funds

Global Depository Receipts

Merchant Bankers

Underwriter

Portfolio Manager

Debenture Trustees

Bankers to an Issue

Registrars to an Issue

Share Transfer Agents

Rating Agencies

INSTRUMENTS

MARKET

Recognized Stock

Exchanges

Spot Market

Stock & Shares

Debentures

Units

Bonds

Futures and Options

Derivatives

Stock Brokers

Sub Brokers

INSTRUMENTS

SOURCE OF FUNDS

Individuals

Businesses

Public Sector Entities

MARKET

PARTICIPATNTS

Individuals

Mutual Funds

UTI

Banks

NBFCs

Dev. Institutions

Firms

Foreign Investors

Corporate

LIC

Others

OTHERS

Securities Depositories

Custodians of Securities

SELF REGULATORY

ORGANISATIONS

AMFI

AMBI

ACAI

etc.

INTERMEDIARIES INTERMEDIARIES

Investment Process:

Investment Objective

Investment Strategy

Selection of Securities

Portfolio Construction

Portfolio Evaluation

Portfolio Revision

Common Error in Investment Management

Inadequate Comprehension of Return and Risk

Inappropriate Formulation of Investment Policy

Naive Extrapolation of the Past

Haphazard Decision Making

Untimely Entries and Exit

High Costs

Over Diversification or Under Diversifications

Wrong Attitude towards Losses and Profits

Qualities for Successful Investing

Contrary Thinking

Patience

Diversify

Flexibility and Openness

Decisiveness

You might also like

- Sapm PPT 1 - Introduction To InvestmentDocument57 pagesSapm PPT 1 - Introduction To InvestmentNithin Mathew Jose MBA 2020No ratings yet

- Unit 1 - IAPMDocument17 pagesUnit 1 - IAPMAmish QwertyNo ratings yet

- Venkat Financial MarketsDocument30 pagesVenkat Financial MarketsVenkat GVNo ratings yet

- Presentation1 3Document96 pagesPresentation1 3kahenabiy3No ratings yet

- FMCHAPTER ONE - PPT Power PT Slides - PPT 2Document55 pagesFMCHAPTER ONE - PPT Power PT Slides - PPT 2Alayou TeferaNo ratings yet

- 001 Investment ScenarioDocument19 pages001 Investment ScenariotadegebreyesusNo ratings yet

- Global Investment Opportunities and StrategiesDocument57 pagesGlobal Investment Opportunities and StrategiesRAED100No ratings yet

- INV ALTS & DEC MAKINGDocument22 pagesINV ALTS & DEC MAKINGAnkit GoelNo ratings yet

- ?UTF 8?B?TGVjdHVyZTA4LnBkZg ? 2Document66 pages?UTF 8?B?TGVjdHVyZTA4LnBkZg ? 2MAINY RYANNo ratings yet

- Study of Different Avenues of Investments and Analysis of Investors' BehaviorDocument18 pagesStudy of Different Avenues of Investments and Analysis of Investors' BehaviorAbheyRNo ratings yet

- Investment Scenario ExplainedDocument37 pagesInvestment Scenario ExplainedLokesh GowdaNo ratings yet

- What are securities? - Debentures, Equity Shares, Preference SharesDocument35 pagesWhat are securities? - Debentures, Equity Shares, Preference SharesshaRUKHNo ratings yet

- Chapter 1-2Document40 pagesChapter 1-2jakeNo ratings yet

- Sessions 1 & 2Document22 pagesSessions 1 & 2Bhavya JainNo ratings yet

- Financial YogesDocument15 pagesFinancial Yogesideal assignment helper 2629No ratings yet

- Investment Analysis and Types of Financial AssetsDocument11 pagesInvestment Analysis and Types of Financial Assetshiteshmishra14No ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument54 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownUsman NaeemNo ratings yet

- Introduction To Investment: Investment Analysis and Portfolio Management Acfn 3201 Alemitu A. (MSC)Document14 pagesIntroduction To Investment: Investment Analysis and Portfolio Management Acfn 3201 Alemitu A. (MSC)Bantamkak FikaduNo ratings yet

- Unit - 4 Mutual Funds Credit RatingDocument10 pagesUnit - 4 Mutual Funds Credit RatingKarthick NaikNo ratings yet

- Overview SAPMDocument11 pagesOverview SAPManirbanccim8493No ratings yet

- The Investment Environment and Asset ClassesDocument40 pagesThe Investment Environment and Asset ClassesPSiderNo ratings yet

- The Purpose and Structure of Financial MarketsDocument63 pagesThe Purpose and Structure of Financial MarketsMatteo INTROININo ratings yet

- IFM-Long Term Fin.Document16 pagesIFM-Long Term Fin.Amol DhawaleNo ratings yet

- Managing Short-Term Assets and Liabilities & Foreign Investment DecisionsDocument25 pagesManaging Short-Term Assets and Liabilities & Foreign Investment DecisionsAnjali Sharma100% (2)

- Overview of InvestmentDocument27 pagesOverview of InvestmentNida JavedNo ratings yet

- The Investment Environment - Topic OneDocument39 pagesThe Investment Environment - Topic OneRita NyairoNo ratings yet

- Investment Analysis and Portfolio Management GuideDocument29 pagesInvestment Analysis and Portfolio Management GuideRakibImtiaz100% (1)

- Sa - Investment ScenarioDocument16 pagesSa - Investment Scenarioapi-3757629No ratings yet

- Lecture 1 The Investment EnvironmentDocument43 pagesLecture 1 The Investment Environmentnoobmaster 0206No ratings yet

- Money, Banking & Finance: The Nature of Financial Intermediation K MatthewsDocument25 pagesMoney, Banking & Finance: The Nature of Financial Intermediation K MatthewsMuhammad SarmadNo ratings yet

- International Introduction To Securities and Investment Training Slides New BrandingDocument104 pagesInternational Introduction To Securities and Investment Training Slides New Brandingabraham robe100% (1)

- Introduction To Indian Financial SystemDocument30 pagesIntroduction To Indian Financial SystemMonisha tNo ratings yet

- The Basics of Investing: Know What to Do With Your MoneyDocument8 pagesThe Basics of Investing: Know What to Do With Your Moneysarah123No ratings yet

- Investment MGT: An IntroductionDocument23 pagesInvestment MGT: An IntroductionNakul ParameswarNo ratings yet

- Course: Mba Semester: Iii Subject Code: MF0001 Book Id: B1035 Subject Name: Sapm Unit Number: 1 Unit Title: Investment - A Conceptual FrameworkDocument20 pagesCourse: Mba Semester: Iii Subject Code: MF0001 Book Id: B1035 Subject Name: Sapm Unit Number: 1 Unit Title: Investment - A Conceptual FrameworkAjeet ParmarNo ratings yet

- Chapter 3 Selecting Investments in A Global MarketDocument44 pagesChapter 3 Selecting Investments in A Global MarketRayane M Raba'aNo ratings yet

- Content For Bridge CourseDocument43 pagesContent For Bridge CourseAlinaNo ratings yet

- Chapter 3 FIIMDocument64 pagesChapter 3 FIIMDanielNo ratings yet

- 1understanding InvestmentDocument33 pages1understanding InvestmentSyra Mae CruzNo ratings yet

- Capital Markets: by Ramon G. Del RosarioDocument143 pagesCapital Markets: by Ramon G. Del Rosarioyramjoy08No ratings yet

- Part 7.A - BankingDocument22 pagesPart 7.A - BankingzhengcunzhangNo ratings yet

- SAPM I Unit Anna UniversityDocument28 pagesSAPM I Unit Anna UniversitystandalonembaNo ratings yet

- 1.0 Basic ConceptsDocument16 pages1.0 Basic ConceptsTanvirFaisal420No ratings yet

- Investment: An OverviewDocument12 pagesInvestment: An OverviewVivek ArnoldNo ratings yet

- Security Analysis and Portfolio ManagementDocument24 pagesSecurity Analysis and Portfolio Managementkum_popNo ratings yet

- Prelims Finance MergedDocument149 pagesPrelims Finance MergedBlueBladeNo ratings yet

- Financial System OverviewDocument12 pagesFinancial System OverviewVictor JaniiiNo ratings yet

- Mutualfunds 120919103823 Phpapp01Document32 pagesMutualfunds 120919103823 Phpapp01Divyesh GandhiNo ratings yet

- Importance of Stock MarketDocument4 pagesImportance of Stock MarketRajdeep KaurNo ratings yet

- Security and Portfolio Management: Facilitator-Praveen KumarDocument20 pagesSecurity and Portfolio Management: Facilitator-Praveen KumarSankaran ManickamNo ratings yet

- SWOT Analysis of AssetsDocument4 pagesSWOT Analysis of AssetsAlsafar TravelsNo ratings yet

- Event Driven Hedge Funds PresentationDocument77 pagesEvent Driven Hedge Funds Presentationchuff6675No ratings yet

- SEBI Investor Education WorkshopDocument30 pagesSEBI Investor Education WorkshopkmralokkNo ratings yet

- Lecture Session I Topic: Overview of Financial Markets 1. An Overview of Financial Markets and Institutions MarketDocument42 pagesLecture Session I Topic: Overview of Financial Markets 1. An Overview of Financial Markets and Institutions MarketNishant JainNo ratings yet

- Sources of Foreign CapitalDocument23 pagesSources of Foreign CapitalNyayapati Gautam100% (2)

- Understanding Investment Investment Decision ProcessDocument31 pagesUnderstanding Investment Investment Decision ProcessjunaidNo ratings yet

- CH 2 Investment Alternatives Generic PriciplesDocument34 pagesCH 2 Investment Alternatives Generic PriciplesAbdihamid AliNo ratings yet

- Real EstateDocument14 pagesReal EstateRohan KapleNo ratings yet

- Chapter 1 - IbfDocument12 pagesChapter 1 - IbfMuhib NoharioNo ratings yet

- Three Models of Corporate Governance January 2009Document4 pagesThree Models of Corporate Governance January 2009Shubham AgarwalNo ratings yet

- Article Critique - Advanced Operating SystemDocument2 pagesArticle Critique - Advanced Operating SystemgaylebugayongNo ratings yet

- Ballroom Social Function Booking FormDocument2 pagesBallroom Social Function Booking FormAndriy OstapukNo ratings yet

- Countries of The World Capital Cities, Populations, Sizes and MoreDocument7 pagesCountries of The World Capital Cities, Populations, Sizes and MoreAkshay Chandran100% (1)

- Habib Bank LimitedDocument16 pagesHabib Bank Limitedhasanqureshi3949100% (2)

- Oceanic Bank - Letter From John Aboh - CEODocument1 pageOceanic Bank - Letter From John Aboh - CEOOceanic Bank International PLCNo ratings yet

- Relationship Summary:: MR John Doe 2 Post Alley, SEATTLE, WA 98101Document6 pagesRelationship Summary:: MR John Doe 2 Post Alley, SEATTLE, WA 98101Zheng YangNo ratings yet

- Marketing Mix of HDFC BankDocument2 pagesMarketing Mix of HDFC BankApurva JhaNo ratings yet

- The Community Reinvestment Act in The Age of Fintech and Bank CompetitionDocument28 pagesThe Community Reinvestment Act in The Age of Fintech and Bank CompetitionHyder AliNo ratings yet

- Liquidity Management by Islamic BanksDocument9 pagesLiquidity Management by Islamic BanksMiran shah chowdhury100% (3)

- Wiki SCN Sap Com Wiki Display Locla Febraban PagamentoDocument5 pagesWiki SCN Sap Com Wiki Display Locla Febraban PagamentoJosemar MendesNo ratings yet

- Operations of ZTBLDocument5 pagesOperations of ZTBLmasoom_sooratNo ratings yet

- Nation Wide BankDocument1 pageNation Wide BankShaggy ShagNo ratings yet

- Bank of America V Associated Citizens BankDocument4 pagesBank of America V Associated Citizens BankJuhainah Lanto TanogNo ratings yet

- Accounts Chart ExplainedDocument18 pagesAccounts Chart ExplainedMargerie FrueldaNo ratings yet

- RaastDocument6 pagesRaastLoeyNo ratings yet

- MR - Chijioke Nwokike's CVDocument2 pagesMR - Chijioke Nwokike's CVPrinceezenniaNo ratings yet

- Rose Ackerman SusanDocument16 pagesRose Ackerman SusanIzabela PatriotaNo ratings yet

- Frauds in Indian BankingDocument61 pagesFrauds in Indian BankingPranav ViraNo ratings yet

- Credit CreationDocument25 pagesCredit CreationPrachiNo ratings yet

- Model Bank: SWIFT Message SupportDocument26 pagesModel Bank: SWIFT Message Supportigomez100% (1)

- YMCA Guest WaiverDocument1 pageYMCA Guest Waiverdesertbutterfly78100% (1)

- Islamic FinanceDocument5 pagesIslamic FinanceAbdul Wahid KhanNo ratings yet

- Swift Gpi Overview January 2019Document20 pagesSwift Gpi Overview January 2019Anuj AnandNo ratings yet

- Info Hand 01may2013 ZCCXZVDocument19 pagesInfo Hand 01may2013 ZCCXZVUmesh KamathNo ratings yet

- Gold Business Account StatementDocument4 pagesGold Business Account StatementAnna Hofisi80% (5)

- Oracle Financials Volume I GuideDocument173 pagesOracle Financials Volume I GuideRajendra Pilluda0% (1)

- E BankingDocument102 pagesE BankingSwati Mann60% (5)

- Bank Slip PtsDocument1 pageBank Slip PtsqasimNo ratings yet

- Customer Request Form UpdateDocument2 pagesCustomer Request Form UpdateSaidi ReddyNo ratings yet