Professional Documents

Culture Documents

Subsidiary Ledger

Uploaded by

AnnaSeptiyani0 ratings0% found this document useful (0 votes)

486 views14 pagesA subsidiary ledger is a group of similar accounts whose combined balances equal the balance in a specific general ledger account. Control accounts are sometimes known as total accounts. A control account act as a summary of the ledger which it controls.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA subsidiary ledger is a group of similar accounts whose combined balances equal the balance in a specific general ledger account. Control accounts are sometimes known as total accounts. A control account act as a summary of the ledger which it controls.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

486 views14 pagesSubsidiary Ledger

Uploaded by

AnnaSeptiyaniA subsidiary ledger is a group of similar accounts whose combined balances equal the balance in a specific general ledger account. Control accounts are sometimes known as total accounts. A control account act as a summary of the ledger which it controls.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

(BUKU BESAR PEMBANTU)

The subledger, or subsidiary ledger, is a subset of

the general ledger used in accounting.

Subsidiary ledger can called book of analys too

Definition :

(Pengertian)

(source : wikipedia )

A subsidiary ledger is a group of similar accounts

whose combined balances equal the balance in a

specific general ledger account. The general ledger

account that summarizes a subsidiary ledger's

account balances is called a control account or

master account.

Control accounts are sometimes known as total

accounts. A control account act as a summary of the

ledger which it controls.

Definition :

(Pengertian)

(source : Dr. T 's Accounting Problems and Tax

Purpose of Subsidiary Ledgers Definition.htm)

Record trasactions

Transaction

There are two control

accounts.

Sales ledger

control account

/ Total debtors

account

Purchases ledger

control account

/ Total creditors

account.

Sources Of Information For Sales Ledger Control Account:

Sales Sales Book

Cash and Cheques received Cash Book

Dishonoured Cheques Cash Book

Discount allowed Cash Book

Bad debts Journal

Sales Ledger Control Account:

It resembles the account of an individual debtor. It is

an account recording in total the transactions

affecting all the debtors.

Note: Sometimes sales ledger control account too

also has small opening credit balance b/d on a sales

ledger control account, in addition to the usual

opening debit balance. It happens when a debtor has

over paid his account or has returned goods after

paying his account or due amount.

Sources Of Information For This Account

Purchases Purchase Book

Purchases Returns Purchase Returns

Book

Cash and cheque paid Cash Book

Discount received Cash Book

Cash refunds from creditors Cash Book

Purchases Ledger Control Account:

It resembles the account of an individual creditor. It

records the transactions effecting all the creditors.

Note: Sometimes it can happen that there is a small

opening Debit balance on a purchases ledger control

account in addition to the usual credit balance. It

happens when the business has overpaid a creditor,

or has returned the goods after paying the due

amount.

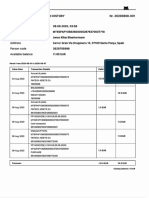

For example Sales Ledger

Control Account:

Subsidiary Ledger

PT. MAJU

TERUS

Rp. 15.000.000

PT. PANTANG

MUNDUR

Rp. 45.500.000

SUM Rp. 60.500.000

List of customer balance :

Acc. Receivable

Rp15.000.000 (23/10)

Rp45.500.000 (25/10)

PT. MAJU TERUS

PT. PANTANG

MUNDUR

Rp.

15.000.000

(23/10)

Rp.

45.500.

000

(25/10)

Rp.

60.500.000

General Ledger

Subsidiary Ledger

CV. SETIA

ABADI

Rp. 6.500.000

CV. SINAR

DUNIA

Rp. 8.000.000

SUM Rp. 14.500.000

List of supplier balance :

Acc. Payable

Rp. 8.000.000 (23/10)

Rp. 6.500.000 (25/10)

CV. SETIA ABADI CV. SINAR DUNIA

Rp.

6.500.000

(25/10)

Rp.

8.000.0

00 (23/10)

Rp.

14.500.000

General Ledger

For example Purchase Ledger

Control Account:

It helps in locating errors.

It helps in checking the arithmetical accuracy of the

ledger it controls.

It gives us readymade figures for Total debtors and

Total creditors on a certain date.

Fraud is made more difficult by the use of control

account.

Advantages Of Control

Account:

A subsidiary ledger provides a company a detailed

record of specific items that are included in the

balance of a general ledger controlling accounting. In

a merchandising company, subsidiary ledgers are

used to track the amounts of receivables from

customers, amounts of money owed to suppliers,

and quantities of products in inventory.

Conclusion :

You might also like

- Merchandising Quiz 1 Answer Key PDFDocument8 pagesMerchandising Quiz 1 Answer Key PDFAngelie JalandoniNo ratings yet

- Roque Quick Auditing Theory Chapter 12 PDFDocument133 pagesRoque Quick Auditing Theory Chapter 12 PDFSherene Faith Carampatan0% (1)

- CA Inter Gr-1 Accounting E-BookDocument200 pagesCA Inter Gr-1 Accounting E-BookShubham KuberkarNo ratings yet

- 1000MCQ With Answer On Accounts & Finance For BankersDocument182 pages1000MCQ With Answer On Accounts & Finance For BankersCITIZEN2No ratings yet

- Chapter 3 Problems - Ia Part 2Document16 pagesChapter 3 Problems - Ia Part 2KathleenCusipagNo ratings yet

- Partnership Exercises Answers and ExplanationsDocument25 pagesPartnership Exercises Answers and Explanationsralphalonzo100% (1)

- Prelim Departmental Exam Reviewer With Answer Key PDFDocument11 pagesPrelim Departmental Exam Reviewer With Answer Key PDFAndrea Marie CalmaNo ratings yet

- Ch05 - ACCOUNTING FOR MERCHANDISING OPERATIONSDocument50 pagesCh05 - ACCOUNTING FOR MERCHANDISING OPERATIONSMahmud TazinNo ratings yet

- Budget Proposal School MiscellaneousDocument9 pagesBudget Proposal School MiscellaneousRomnick PortillanoNo ratings yet

- Treasury Stock ENtriesDocument3 pagesTreasury Stock ENtrieseuphoria2No ratings yet

- Session 6-7 Debit and Credit Rule - MIDTERMDocument13 pagesSession 6-7 Debit and Credit Rule - MIDTERMAnge BoboNo ratings yet

- Public Private Partnership - PPT - OutlineDocument3 pagesPublic Private Partnership - PPT - OutlineJ Ja100% (1)

- Education Service ContractingDocument6 pagesEducation Service ContractingLeonilo C. Dumaguing Jr.No ratings yet

- Questioning Tool: Is A Report That Provides A Detailed Description Makes Up The Balances in The AccountDocument3 pagesQuestioning Tool: Is A Report That Provides A Detailed Description Makes Up The Balances in The AccountNiel Ivan Alliosada Quimbo100% (1)

- Miscellaneous Personnel Benefits Fund (MPBF)Document3 pagesMiscellaneous Personnel Benefits Fund (MPBF)Louise DLNo ratings yet

- Supervising Officer Directing Any Illegal Payment or Disposition of The Funds Shall BeDocument2 pagesSupervising Officer Directing Any Illegal Payment or Disposition of The Funds Shall BeForkensteinNo ratings yet

- Planning for Sustainable TourismDocument15 pagesPlanning for Sustainable TourismChantra Marie Forgosa AmodiaNo ratings yet

- Marketing Strategies and Financial Performance of Retail Outlets in Lucena CityDocument5 pagesMarketing Strategies and Financial Performance of Retail Outlets in Lucena CityJohn Michael CabasaNo ratings yet

- Theory To Practice A Basis For Establishing The Culture of Research in Bulihan National High School (BNHS)Document11 pagesTheory To Practice A Basis For Establishing The Culture of Research in Bulihan National High School (BNHS)International Journal of Innovative Science and Research TechnologyNo ratings yet

- 3-Ramil A. Borreo-2020 PDFDocument17 pages3-Ramil A. Borreo-2020 PDFEUJIR Journal100% (1)

- Kiki's Delivery Service: A ReviewDocument4 pagesKiki's Delivery Service: A ReviewHannah Vivien FerriolNo ratings yet

- Functional Areas of ManagementDocument6 pagesFunctional Areas of ManagementSheena OrtizaNo ratings yet

- FS On Lending BusinessDocument3 pagesFS On Lending BusinessMika FrancoNo ratings yet

- School Head Authorization LetterDocument1 pageSchool Head Authorization LetterVonPatrickCrusperoCoscosNo ratings yet

- ECC2Document2 pagesECC2Dana IsabelleNo ratings yet

- Reflection #1 - DENNIS LAGMAN - Changing-Concept-of-Supervision-and-Instruction-in-the-Philippine-ContextDocument1 pageReflection #1 - DENNIS LAGMAN - Changing-Concept-of-Supervision-and-Instruction-in-the-Philippine-Contextdennis lagmanNo ratings yet

- Comparison of Globe and PLDT - Case StudyDocument5 pagesComparison of Globe and PLDT - Case StudyJuris PenaflorNo ratings yet

- Causes and harms of human traffickingDocument4 pagesCauses and harms of human traffickingCyril Ryan100% (1)

- 4 Elements of StateDocument2 pages4 Elements of StateRaven TolentinoNo ratings yet

- Measuring InflationDocument25 pagesMeasuring InflationAnonymous E9ESAecw8x0% (2)

- Department of Education: Republic of The PhilippinesDocument31 pagesDepartment of Education: Republic of The PhilippinesRichie MayorNo ratings yet

- PEST and SWOT Analysis of MICE Industry in SingaporeDocument5 pagesPEST and SWOT Analysis of MICE Industry in SingaporeMukesh RanaNo ratings yet

- BC 2016 - 2 - Computation and Funding of Terminal Leave Benefits and Monetization of Leave Credits PDFDocument3 pagesBC 2016 - 2 - Computation and Funding of Terminal Leave Benefits and Monetization of Leave Credits PDFGlenn RomanoNo ratings yet

- LCOSHS SSG Action Plan for Student DevelopmentDocument28 pagesLCOSHS SSG Action Plan for Student DevelopmentMarian AlfonsoNo ratings yet

- BAR Digest January-June 2020 IssueDocument40 pagesBAR Digest January-June 2020 IssueAileen Dee100% (1)

- Republic If The PhilippinesDocument7 pagesRepublic If The PhilippinesTawagin Mo Akong MertsNo ratings yet

- Journalism Group 2 ScriptDocument8 pagesJournalism Group 2 ScriptMarvin Paul ChavezNo ratings yet

- Sumi LaoDocument52 pagesSumi Laomigs_mansuetoNo ratings yet

- What Is CooperativeDocument3 pagesWhat Is CooperativeZihBhingszBayongawanNo ratings yet

- Building Nation's Future Through K-12 EducationDocument4 pagesBuilding Nation's Future Through K-12 EducationJoviner Yabres LactamNo ratings yet

- Sample Letter of Intent, Moa, Deed of Donation, Deed of AcceptanceDocument9 pagesSample Letter of Intent, Moa, Deed of Donation, Deed of AcceptanceOgao ES (Region XI - Compostela Valley)No ratings yet

- Job Description of Branch StaffDocument3 pagesJob Description of Branch StaffEleanor JamcoNo ratings yet

- Usm-Kcc Cit Asg Basic LawDocument15 pagesUsm-Kcc Cit Asg Basic LawAlphred Jann NaparanNo ratings yet

- New Income and Business TaxationDocument72 pagesNew Income and Business TaxationGSOCION LOUSELLE LALAINE D.100% (1)

- Republic of The Philippines Department of Education Region V-Bicol Schools Division Office of Catanduanes Virac South District Palta, ViracDocument1 pageRepublic of The Philippines Department of Education Region V-Bicol Schools Division Office of Catanduanes Virac South District Palta, ViracArvie Shayne Tarrago GiananNo ratings yet

- Permit To Conduct SurveyDocument1 pagePermit To Conduct SurveyJay Marasigan HernandezNo ratings yet

- Activity Design For Financial LitracyDocument3 pagesActivity Design For Financial Litracyangelica danie100% (1)

- MOA Internship UplbDocument13 pagesMOA Internship UplbHoward UntalanNo ratings yet

- Accounting Cycle of LoveDocument2 pagesAccounting Cycle of LoveFerdinand VillanuevaNo ratings yet

- Registry of Allotments and Notice of Transfer of Allocation: Appendix 31Document1 pageRegistry of Allotments and Notice of Transfer of Allocation: Appendix 31Tesa GDNo ratings yet

- Philippine Income Classes Guide - Under 40 CharactersDocument1 pagePhilippine Income Classes Guide - Under 40 CharactersJan Eidref MorasaNo ratings yet

- CEST PresentationDocument29 pagesCEST PresentationVanessa TawaliNo ratings yet

- Effects of Tax Reform For Acceleration and InclusionDocument7 pagesEffects of Tax Reform For Acceleration and InclusionKristel Anne Faller VillaruzNo ratings yet

- 5th PAPBE Accreditation Invitation LetterDocument5 pages5th PAPBE Accreditation Invitation LetterfeasprerNo ratings yet

- Tuition Fee Report 2020-21 PDFDocument37 pagesTuition Fee Report 2020-21 PDFDelmy BlahhNo ratings yet

- Case Study Writing TA ASS 2Document9 pagesCase Study Writing TA ASS 2Sravya teluNo ratings yet

- Final Solicitation LetterDocument2 pagesFinal Solicitation LetterBrian Jobim TanNo ratings yet

- Online Education in The PhilippinesDocument3 pagesOnline Education in The PhilippinesRacel M. BenicoNo ratings yet

- Omnibus Sworn Statement - NNNDocument2 pagesOmnibus Sworn Statement - NNNJAY CADAYNo ratings yet

- PICPA Leadership Training Seminar Reinforces Future of AccountingDocument1 pagePICPA Leadership Training Seminar Reinforces Future of Accountingsanglay99No ratings yet

- Chapter 5 (Contemporary World)Document3 pagesChapter 5 (Contemporary World)Anika AlejandroNo ratings yet

- Agrarian Reform in The Duterte AdministrationDocument1 pageAgrarian Reform in The Duterte AdministrationM Azeneth JJNo ratings yet

- 9 PDFDocument3 pages9 PDFJason Vi Lucas100% (1)

- Appendix 49 - Instructions - RPPCVDocument1 pageAppendix 49 - Instructions - RPPCVCENTRAL OFFICE ACCOUNTINGNo ratings yet

- (GEMATMW) InvestagramsDocument3 pages(GEMATMW) InvestagramsCourtney TulioNo ratings yet

- Final Reflection and Course Synthesis: EntrepreneurshipDocument3 pagesFinal Reflection and Course Synthesis: EntrepreneurshipKate Duca0% (1)

- MANAGERDocument8 pagesMANAGERzealousNo ratings yet

- Property Issue Slip: QTY Description Date of Property Unit Value Total Value Purchase NumberDocument1 pageProperty Issue Slip: QTY Description Date of Property Unit Value Total Value Purchase Numbercomelec carmenNo ratings yet

- Action Plan Templete - Goal 5-1Document2 pagesAction Plan Templete - Goal 5-1api-254968708No ratings yet

- General Ledger, Subsidiary LedgerDocument4 pagesGeneral Ledger, Subsidiary LedgerJohn MedinaNo ratings yet

- Journal Accounts To Trial BalanceDocument47 pagesJournal Accounts To Trial Balancebhaskyban100% (1)

- Accounts in Theory and Practice, THE ARTHUR YOUNG ACCOUNTING COLLECTIONDocument320 pagesAccounts in Theory and Practice, THE ARTHUR YOUNG ACCOUNTING COLLECTIONCryhavocandletslipNo ratings yet

- Preparing Partnership Financial StatementsThis concise title "TITLEPreparing Partnership Financial StatementsDocument7 pagesPreparing Partnership Financial StatementsThis concise title "TITLEPreparing Partnership Financial StatementsFakhrul IslamNo ratings yet

- Yasir ProjectDocument58 pagesYasir Projectaminullah muslimNo ratings yet

- Ceguera Technological Colleges: Service-Based Home Business Ideas IncludeDocument4 pagesCeguera Technological Colleges: Service-Based Home Business Ideas IncludeGienelle BermidoNo ratings yet

- AnaCredit Manual Part II Datasets and Data Attributes - enDocument275 pagesAnaCredit Manual Part II Datasets and Data Attributes - ensgjatharNo ratings yet

- PRE BATTERY EXAM 2018 Part 1 FARDocument11 pagesPRE BATTERY EXAM 2018 Part 1 FARFrl RizalNo ratings yet

- Appendix 52 - Instructions - ADADJDocument1 pageAppendix 52 - Instructions - ADADJpdmu regionixNo ratings yet

- What's New PREM V7 - V30Document75 pagesWhat's New PREM V7 - V30Dickson AllelaNo ratings yet

- Test Bank CH 3Document32 pagesTest Bank CH 3Sharmaine Rivera MiguelNo ratings yet

- Unclaimed DepositsDocument2 pagesUnclaimed DepositsRajesh RamachandranNo ratings yet

- Case Chapter 3 - Accounting IntermediateDocument2 pagesCase Chapter 3 - Accounting IntermediateIndra Aminudin100% (3)

- Abm111 - Introduction To AccountingDocument31 pagesAbm111 - Introduction To AccountingAlexandra TabarNo ratings yet

- Oracle Financial FDocument73 pagesOracle Financial Fhiranajam1993No ratings yet

- 4 Questions ReceivablesDocument16 pages4 Questions ReceivablesYafasfasNo ratings yet

- Dissolution - Changes in OwnershipDocument57 pagesDissolution - Changes in OwnershipJean Rae RemiasNo ratings yet

- Quiz - Bank ReconciliationDocument2 pagesQuiz - Bank ReconciliationGaile YabutNo ratings yet

- BlackDocument2 pagesBlacksaxvdx100% (1)

- CAMA Theory and Numericals PDFDocument272 pagesCAMA Theory and Numericals PDFVanshika SoniNo ratings yet

- 09 Bbfa1103 T5Document37 pages09 Bbfa1103 T5djaljdNo ratings yet