Professional Documents

Culture Documents

BRSHow To Manage Budgets & Cash FlowsHow To Manage Budgets & Cash FlowsHow To Manage Budgets & Cash Flows

Uploaded by

Smitha Raj0 ratings0% found this document useful (0 votes)

17 views24 pagesHow ToManage Budgets & Cash FlowsHow ToManage Budgets & Cash FlowsHow ToManage Budgets & Cash Flows

Original Title

BRSHow To

Manage Budgets & Cash FlowsHow To

Manage Budgets & Cash FlowsHow To

Manage Budgets & Cash Flows

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHow ToManage Budgets & Cash FlowsHow ToManage Budgets & Cash FlowsHow ToManage Budgets & Cash Flows

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views24 pagesBRSHow To Manage Budgets & Cash FlowsHow To Manage Budgets & Cash FlowsHow To Manage Budgets & Cash Flows

Uploaded by

Smitha RajHow ToManage Budgets & Cash FlowsHow ToManage Budgets & Cash FlowsHow ToManage Budgets & Cash Flows

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 24

How To

Manage Budgets & Cash Flows

Presented by

Deepak K.J

TPS 22010

About Author

PETER TAYLOR

Senior Project

Manager

Tonbridge, United

Kingdom Information

Technology and

Services

CONTENTS

1. Budget and cashflows: what are they?

2. Introducing business accounts

3. Managing VAT

4. Introducing budgets

5. Budgeting for overheads and capital items

6. Managing cashflows

7. Monitoring performance

8. Using computer to prepare budget and cash flow forecasts

9. Budgeting for all

BUDGET & CASHFLOW

A budget is a financial document used to project future income

and expenses. It plans future saving and spending as well as

planned income and expenses. Budgeting may be carried out by

individuals or by companies to estimate whether or not they can

continue to operate with its projected income and expenses.

Cash flow is the measure of money flowing in and out of your

business at any given time, especially as affecting liquidity. Good

cash flow is achieved by managing cash. resource effectively.

Contd.

Managing the cash

Ensure the business is running profitability.

Collecting receivables- ensuring that to receive payments on

time.

Taking available credit on purchase.

Correct management and financing of capital project.

Increasing sales

Contd.

Why prepare budget for your business

Planning your business- you can plan the development of

your business and make sure that your ideas will work.

Monitoring the progress of your business- you can check the

actual progress against your target.

Managing the business-

INTRODUCING BUSINESS ACCOUNTS

Profit and loss account : It show the summary of the

trading income and expenditure for the period. When dealing

with budgeted profit and loss account it is often useful to

split the transaction into monthly periods. In this way it is

easier to monitor the actual progress of the business

compared with the budget.

Balance sheet : balance sheet is the snapshot of the business

at a point of time. It show asset and liabilities at that

movement. Asset are all the things which belong to the

business. Liabilities are the amount awed by the business to

others.

Contd.

Income and expenditure

Capital income : It is the income that comes from capital, which

is to say, coming from wealth itself, rather than any specific

production or direct work. Capital income includes stock

dividends or any sort of capital gains, as well as income an owner

gets from a business they own.

Revenue income : Income generated by sales of goods or

services. When business sells the goods that it has manufactured

as it trade then this is revenue income.

Capital expenditure: It is the purchase of fixed asset which will

be used by the business and have a lasting effect for several

years.

Revenue expenditure: it is expenditure that is concerned with the

costs of doing business on a day to day basis.

Contd.

Typical profit and loss account

Trading accounts: this is the part of report show gross profit.

gross profit is the difference between the value at which goods

have been sold by the business and cost of those goods.

Overheads: those cost of business which are not directly

related to the level of trade.

Contd.

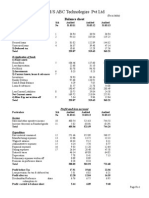

Typical balance sheet

Fixed asset: these are capital asset such as land & buildings,

plant & machinery, goodwill etc.

Current asset: this means the other non capital class of asset

of the business.

Current liabilities: this category includes amounts owed to

suppliers (creditors) etc. and short term financing such as

bank overdraft.

Long term liabilities : are liabilities with a future benefit over

one year, such as long term loans, notes payable that mature

longer than one year.

MANAGING VAT

VAT : it is the net effect of set of input and output tax is to levy a

tax on the value added.

Accounting for VAT

Tax point system: this is the normal system. Under this scheme

the time you must account for vat is fixed by time of supply, or

tax point as it is known.so the Vat must be accounted for in the

VAT period that the goods are sold regardless of the time that the

invoice is actually paid.

Cash accounting scheme: under this system you only account

for the time that the cash transaction take place. If you purchase

goods on credit you are not permitted to reclaim input tax until

you actually pay for the goods.

INTRODUCING BUDGETS

Budgeting is to forecast what is going to happened and see the

financial implications. Then it is forecast to plan the way that the

business will develop in the future. Forecasting budget is the set

of financial plan to build the business.

Links in the budgeting

Sales budget production budget

It is needed to consider the production capacity when setting the

sales budget. It will be no good forecasting sale of your product

at 5000 per week if you can only make 3000.

Contd.

Sales budget cost of sales

There is close links between these two budgets. Ex: it will be no

good setting the selling price of goods at such a level that it is

below the cost of producing an item, and it will lose money on

every item sold.

Overheads sales budget

The overheads of business will be incurred almost whatever the

level of turnover. the cost of overheads will be carried by the

sales of the product.

Contd.

Steps involved in preparing the budget

1. Decide the period that should be covered by budget 1 year.

Also decide what periods the budget is to be divided into- for

example 12 months.

2. Forecast activity levels and income from trading and other

sources for each of the periods.

3. Having establish the level of sales for each month you must

now forecast the cost of sales.

4. Next forecast the level of each of the overhead expenses.

5. Finally confirm that your plan fit into your cash budget

BUDGET FOR

OVERHEADS AND CAPITAL ITEMS

Budgeting for overheads: it is to

consider the indirect costs.

Indirect cost includes

Stationary

Clerical wages

Management & supervisory

salaries

Rent & rates

Travelling

Bank charges

Motor expense

Depreciation

Audit & legal fees

Contd.

Each of the overheads must be considered in turn and relevant figure built into

overhead budget.

Administration budget

12months to 31 march 20xx

Previous years

actual

Current

budget

MATERIALS:

stationary

Sundries

SALARIES & WAGES

management

clerical

EXPENSE

Rent and rates

Telephone

deprecations

Insurance

Bank charges

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

Contd.

Budgeting for capital items

Capital budget deals with the provision of new machines,

extensions to factory, replacement of motor van etc.

How capital expenditure affects profits

By increasing depreciation charges: it will recall that

depreciation reflect the loss in the value of fixed assets

during the period.

By interest charges: investment in new equipment or

buildings will involve some form of finance which will in

turn have an interest charges of some effort.

MANAGING CASHFLOWS

Introduction to cashflows

The Cashflow forecast runs hand in hand with the budgeted profit

and loss account.

The profit and loss account takes account of transactions at the

time that the expenses accrues to the business and the income is

earned.

The cashflow forecast deals with the transactions at the time of

payment.

The cash flow forecast must also take account of capital

expenditure for the equipment for use in business.

Contd.

Preparing cashflow forecasting

The first thing to decide is the period of forecast that might be

three months , six months or an year.it should also decide how

many periods you are going to break the forecast into. A short

forecast can be prepared with a lot of detail and reasonable

degree of accuracy. A forecast looking forward for six or twelve

months and divide into monthly periods is more normal and

should give a good general indication of the cashflow trend of the

business.

MONITORING PERFORMANCE

Monitoring cashflow forecast

In a cashflow forecast there should be projected column and actual column

and at the end of the month it should complete the appropriate column with

actual income received from cash sales and debtors, and the expenditure

actually paid. Then compare how each item has performed against the

forecast. If the difference is substantial it should investigate why.

Monitoring budget

Effective budget monitoring reports provide vital information about

spending patterns that help management to make realistic forecasts of year-

end under or over spends. Monitoring a budget by Comparing of actual

expenditure and actual income against the budgeted income and

expenditure. If there is a big variation from the budgeted figures then you

should rework the cashflow to ensure that the necessary finance will be

available or to provide you with adequate warning so that alternative

arrangement can be planned.

USING COMPUTERS TO PREPARE

BUDGET AND CASHFLOW FORECAST

Using spreadsheets to help to prepare the budget and cashflow. It

can help with complex calculations and you can see at a glance

incomings and outgoings. It also means that any changes to

figures can be automatically updated in calculations by the

spreadsheet so that it does all the hard work. Many math function

are supported in spredsheet to prepare budget.

Advantages of using spreadsheets

Once you have mastered the skill needed for the program it

is quick to use.

It removes the tedious math with its inherent possibilities of

mistakes through human error.

It is easy to modify budget.

Contd.

The use of computer in preparing budget and cashflows

is to be recommended provided that they are used with a

degree of caution. If we know how to use spreadsheet

program it can save a lot of time.

BUDGETING FOR ALL

It is becoming more important that to administrators of public

service organization appreciate the benefit and pitfall of budget

and Cashflow in relationship to them. Budget can be prepared for

many different types of organization- not just business but

schools, hospitals, and domestic households .

Managing school budgets

Managing hospital budget

Managing household budget

Thank You

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Microeconomics 2013 14Document3 pagesMicroeconomics 2013 14Smitha RajNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- THE TUG OF WAR NSE Vs BSEDocument22 pagesTHE TUG OF WAR NSE Vs BSESmitha RajNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Zeus Asset Management IncDocument7 pagesZeus Asset Management IncSmitha RajNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Types of Experimental Designs HandoutDocument2 pagesTypes of Experimental Designs HandoutGanesh BalaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Derivatives Solutions 11Document7 pagesDerivatives Solutions 11Smitha RajNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Groups For Case DiscussionDocument2 pagesGroups For Case DiscussionSmitha RajNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- ABC Technologies Balance Sheet AnalysisDocument3 pagesABC Technologies Balance Sheet AnalysisSmitha RajNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- What Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeDocument3 pagesWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeWhat Is National IncomeSmitha RajNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- MIS - Course Out LineDocument4 pagesMIS - Course Out LineSmitha RajNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Macroeconomics SyllabusMacroeconomics SyllabusMacroeconomics SyllabusMacroeconomics SyllabusMacroeconomics SyllabusDocument2 pagesMacroeconomics SyllabusMacroeconomics SyllabusMacroeconomics SyllabusMacroeconomics SyllabusMacroeconomics SyllabusSmitha RajNo ratings yet

- 16 Personality Factore16 Personality Factore16 Personality Factore16 Personality FactoreDocument2 pages16 Personality Factore16 Personality Factore16 Personality Factore16 Personality FactoreSmitha RajNo ratings yet

- Assignment No 1 - Cost ClassificationDocument7 pagesAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Financial Planning and Control ProblemsDocument10 pagesFinancial Planning and Control ProblemsMoona AwanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- EXAMPLE STDM - Relevant CostDocument7 pagesEXAMPLE STDM - Relevant Costainsyasya 98No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Unit 3Document34 pagesUnit 3Abdii DhufeeraNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Cost relevant for decision makingDocument2 pagesCost relevant for decision makingIZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Unit Rate AnalysisDocument169 pagesUnit Rate AnalysisYasichalew sefineh0% (1)

- ACC 206 Week 3 Assignment Chapter Four and Five ProblemsDocument5 pagesACC 206 Week 3 Assignment Chapter Four and Five Problemshomeworktab0% (1)

- Income Statement 1Document4 pagesIncome Statement 1Mhaye Aguinaldo0% (1)

- Amad NotesDocument96 pagesAmad NotesDalili Kamilia100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assignment Solution Question 2 and 3Document8 pagesAssignment Solution Question 2 and 3Grace Versoni100% (4)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Learning MaterialDocument254 pagesLearning MaterialujjmahaNo ratings yet

- Value Based Management Research Article PDFDocument15 pagesValue Based Management Research Article PDFDr. Purvi DerashriNo ratings yet

- A Project Report On Budgetary Control at Ranna SugarsDocument69 pagesA Project Report On Budgetary Control at Ranna Sugarsanshul5410No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CH 4 Acct LecturesDocument13 pagesCH 4 Acct LecturesthisisforlapNo ratings yet

- Job-Order Costing and Process Cost SystemsDocument40 pagesJob-Order Costing and Process Cost SystemsNHNo ratings yet

- IRR REPUBLIC ACT No. 10752 Expropriation LandDocument13 pagesIRR REPUBLIC ACT No. 10752 Expropriation LanderrolNo ratings yet

- Managerial Assignment 03Document6 pagesManagerial Assignment 03詹鎮豪No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- WRD FinMan 13e - SM 26 (11) - Final PDFDocument52 pagesWRD FinMan 13e - SM 26 (11) - Final PDFRandom VideosNo ratings yet

- Review Questions: Cost Concepts and ClassificationsDocument6 pagesReview Questions: Cost Concepts and ClassificationsArah Opalec64% (11)

- Annotated BB2023 A IAS02 PartA PDFDocument20 pagesAnnotated BB2023 A IAS02 PartA PDFKhutso MabalaNo ratings yet

- Job-Order Costing Explained: Materials, Labor, Overhead AllocationDocument6 pagesJob-Order Costing Explained: Materials, Labor, Overhead Allocationyza0% (3)

- FY19 NCAA Financial Membership ReportDocument79 pagesFY19 NCAA Financial Membership ReportMatt BrownNo ratings yet

- MC#64 S 2016 NIA Revised Guidelines in Preparation of ABC-EPCDocument47 pagesMC#64 S 2016 NIA Revised Guidelines in Preparation of ABC-EPCAnjienette100% (1)

- Marginal and Absorption CostingDocument21 pagesMarginal and Absorption Costingkelvin mboyaNo ratings yet

- Selecting the Right Civil EngineerDocument4 pagesSelecting the Right Civil Engineerjohn roferNo ratings yet

- 9.short Term Decisions ExercicesDocument62 pages9.short Term Decisions ExercicesAbdelmajid JamaneNo ratings yet

- Part 4: Absorption and Variable Costing/Product Costing: Melziel A. Emba University of The East - ManilaDocument129 pagesPart 4: Absorption and Variable Costing/Product Costing: Melziel A. Emba University of The East - Manilarodell pabloNo ratings yet

- Cumene Production PlantDocument72 pagesCumene Production PlantChris Lindsey100% (5)

- Blocher - Chapter 4Document45 pagesBlocher - Chapter 4Ali AquinoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 03 - Estimating Project Time and CostsDocument8 pages03 - Estimating Project Time and CostsAamir ChohanNo ratings yet