Professional Documents

Culture Documents

Chap 002

Uploaded by

ramakrishnaraoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 002

Uploaded by

ramakrishnaraoCopyright:

Available Formats

Hilton Maher Selto

2

Product Costing Systems

Concepts and Design Issues

McGraw-Hill/Irwin

2003 The McGraw-Hill Companies, Inc., All Rights Reserved.

2-3

Product Costs

The cost

assigned to

goods that were

either purchased

or manufactured

for resale.

Period Costs

Costs that are

identified with

the period in

which they are

incurred.

The Meaning of Cost?

The sacrifice

made, usually

measured by the

resources given

up, to achieve a

particular

purpose.

2-4

Manufacturing Companies

There are 3 major categories of manufacturing

costs:

Direct Materials

resources that

can be feasibly

observed being

used to make a

specific product.

Direct Labor

The cost of

paying

employees who

convert direct

materials into

finished product.

Manufacturing

Overhead

Indirect material

Indirect labor

Other overhead

2-5

Manufacturing Companies

Prime Costs include:

Direct Materials

Direct Labor

Manufacturing

Overhead

2-6

Manufacturing Companies

Conversion Costs include:

Direct Materials

Direct Labor

Manufacturing

Overhead

Nonmanufacturing Costs are all the costs not

used to produce products.

2-7

Stages of Production and the

Flow of Costs

Raw Materials

Beg. Inventory

Add: Purchases

= Raw Materials

Available for

Production

Less: Raw Materials

Transferred to

Production

=

Ending Inventory

Work-In-Process

Beg. WIP Inventory

Add: Raw Materials

Transferred In

Direct Labor

Allocated

Manufacturing

Overhead

= Manufacturing

Costs for the Period

Less: Goods Completed

and Transferred to

Finished Goods

=

Ending WIP

Inventory

Finished Goods

Beg. Inventory

Add: Goods Completed

and Transferred from

WIP

= Goods Available for

Sale

Less: Cost of Goods Sold

=

Ending Inventory

2-8

Stages of Production and the

Flow of Costs - Example

Raw Materials

Beg. Inventory

Add: Purchases

= Raw Materials

Available for

Production

Less: Raw Materials

Transferred to

Production

=

Ending Inventory

What is Ending

Inventory in

February?

Axel Electronics makes toasters. On

February 1, Axel has $15,000 of raw

material on hand. Axels purchase

and transfers to the production floor

are indicated below.

Date

Cost of

Purchases

Cost of

Transfers

3-Feb $8,000 $5,000

10-Feb $12,000 $11,000

15-Feb $14,000 $7,000

20-Feb $6,000

22-Feb $9,000

27-Feb $16,000

2-9

Axel Electronics makes toasters. On

February 1, Axel has $15,000 of raw

material on hand. Axels purchase

and transfers to the production floor

are indicated below.

Date

Cost of

Purchases

Cost of

Transfers

3-Feb $8,000 $5,000

10-Feb $12,000 $11,000

15-Feb $14,000 $7,000

20-Feb $6,000

22-Feb $9,000

27-Feb $16,000

Stages of Production and the

Flow of Costs - Example

Now lets look at

Work-in-Process.

Raw Materials

$15,000

Add: 43,000

= $58,000

Less: 45,000

=

$13,000

2-10

Stages of Production and the

Flow of Costs - Example

What is the

amount of cost

transferred to

Finished Goods in

February?

Work-In-Process

Beg. WIP Inventory

Add: Raw Materials

Transferred In

Direct Labor

Allocated

Manufacturing

Overhead

= Manufacturing

Costs for the Period

Less: Goods Completed

and Transferred to

Finished Goods

=

Ending WIP

Inventory

Raw Materials

$15,000

Add: 43,000

= $58,000

Less: 45,000

=

$13,000

On February 1, Axel

had WIP of $30,000

on the factory floor.

During February,

Axel paid $92,000 in

direct labor wages.

Overhead is applied

at 150% of direct

labor. On 2/28,

$22,000 is still in

WIP.

2-11

Stages of Production and the

Flow of Costs - Example

Work-In-Process

$30,000

Add: 45,000

92,000

138,000

= $305,000

Less: 283,000

=

$22,000

On February 1, Axel

had WIP of $30,000

on the factory floor.

During February,

Axel paid $92,000 in

direct labor wages.

Overhead is applied

at 150% of direct

labor. On 2/28,

$22,000 is still in

WIP.

Raw Materials

$15,000

Add: 43,000

= $58,000

Less: 45,000

=

$13,000

Now lets

look at

Finished

Goods.

Transferred

to Finished

Goods

2-12

Stages of Production and the

Flow of Costs - Example

Work-In-Process

$30,000

Add: 45,000

92,000

138,000

= $305,000

Less: 283,000

=

$22,000

On February 1, Axel had Finished Goods of $125,000 on hand.

At the end of February, a physical inventory count revealed

$96,000 in Finished Goods still on hand.

What was Cost of Goods Sold for February?

Raw Materials

$15,000

Add: 43,000

= $58,000

Less: 45,000

=

$13,000

Finished Goods

Beg. Inventory

Add: Goods Completed

and Transferred from

WIP

= Goods Available for

Sale

Less: Cost of Goods Sold

=

Ending Inventory

2-13

Stages of Production and the

Flow of Costs - Example

Work-In-Process

$30,000

Add: 45,000

92,000

138,000

= $305,000

Less: 283,000

=

$22,000

On February 1, Axel had Finished Goods of $125,000 on hand.

At the end of February, a physical inventory count revealed

$96,000 in Finished Goods still on hand.

What was Cost of Goods Sold for February?

Raw Materials

$15,000

Add: 43,000

= $58,000

Less: 45,000

=

$13,000

Finished Goods

$125,000

Add: 283,000

= $408,000

Less: 312,000

=

$96,000

2-14

Production Costs in the

Service Industry

A service provider cannot

inventory services.

The costs of providing the

service can be identified and

accounted for just as in a

manufacturing environment.

Managing and tracking the

costs associated with value-

chain activities can provide

opportunities for improvement.

2-15

Cost Drivers

An Activity is any

discrete task than

an organization

undertakes to make

or deliver a good or

service.

A cost driver is an

activity or event that

causes costs to be

incurred .

2-16

Summary of Variable and Fixed Cost Behavior

Cost In Total Per Unit

Variable Total variable cost is Variable cost per unit remains

proportional to the activity the same over wide ranges

level within the relevant range. of activity.

Fixed Total fixed cost remains the Fixed cost per unit goes

same even when the activity down as activity level goes up.

level changes within the

relevant range.

Cost Behavior

Fixed vs. Variable

2-17

Your total long distance telephone bill is based on

how many minutes you talk.

Minutes Talked

T

o

t

a

l

L

o

n

g

D

i

s

t

a

n

c

e

T

e

l

e

p

h

o

n

e

B

i

l

l

Cost Behavior

Fixed vs. Variable

2-18

Minutes Talked

P

e

r

M

i

n

u

t

e

T

e

l

e

p

h

o

n

e

C

h

a

r

g

e

The cost per minute talked is constant. For

example, 10 cents per minute.

Cost Behavior

Fixed vs. Variable

2-19

Number of Local Calls

M

o

n

t

h

l

y

B

a

s

i

c

T

e

l

e

p

h

o

n

e

B

i

l

l

Cost Behavior

Fixed vs. Variable

Your monthly basic telephone bill is probably fixed and

does not change when you make more local calls.

2-20

Number of Local Calls

M

o

n

t

h

l

y

B

a

s

i

c

T

e

l

e

p

h

o

n

e

B

i

l

l

p

e

r

L

o

c

a

l

C

a

l

l

Cost Behavior

Fixed vs. Variable

The fixed cost per local call decreases as more local

calls are made.

2-21

components

labor

energy

parts

materials

Resources that are acquired specifically for

individual units of product or service

Unit-level

Resources

Directly traceable

to the decision to

produce the level

of output

The Hierarchy of Costs

2-22

Acquired as a result of the decision to make a group,

or batch of similar products.

Batch-level

Materials

Equipment Applicable to the Batch

Specialized Labor

The Hierarchy of Costs

2-23

Acquired as a result of the decision to produce and

sell a specific product or service.

Product-level

Software

Personnel Applicable to that Product or Service

Specialized Equipment

The Hierarchy of Costs

2-24

Acquired as a result of the decision to serve specific

customers.

Customer-level

Software

Personnel Dedicated to Specific Customers

Specialized Equipment

The Hierarchy of Costs

2-25

Labor

Force

Management

Buildings

Land

Busines

s

Support

Services

Resources that are acquired specifically for

individual units of product or service

Facility-level

The Hierarchy of Costs

2-26

Committed costs are fixed costs that are not intended

to vary with production or sales volume.

If we get rid of

John, we can

replace him with a

new professor

making $20,000 a

year less!

That will

certainly

lower our

budgeted

fixed costs.

Committed Costs, Opportunity

Costs, & Sunk Costs

2-27

Well, team, it

looks like we are

gonna be

working

overtime all

week on this job.

Opportunity cost measures what is sacrificed when

one alternative is chosen.

And I passed

up $95,000

with IBM for

this?

Committed Costs, Opportunity

Costs, & Sunk Costs

2-28

Sunk costs are past payments for resources that

cannot be undone.

I dont want to

replace John.

We just spent

$30,000 to train

him on the new

equipment!

But dont you

see? That

$30,000 is

gone. It is

irrelevant to

our decision.

Committed Costs, Opportunity

Costs, & Sunk Costs

2-29

Direct Costs

Assigning resource costs to products and

services through reliable observations and

documentation of resource use.

Some products use

more of a given

resource than

others.

Tracing is often more

effective than using

Average Cost, which

assumes that each

product uses the same

amount of each resource.

Traceability of Resources

2-30

Indirect Costs

Attaching or assigning indirect costs to products,

services, or organizational units by some

reasonable method of averaging.

Applied to costs

that cannot be

efficiently traced.

Methods such as Activity-

Based Costing result in

more tracing and less

allocation.

Example

Traceability of Resources

2-31

Tracing versus Allocating

Costs - Example

Brickley, Inc. makes two products; bricks and play sand.

The products are produced in two separate facilities, and

the plant supervisors work at both plants. Allocate rent

and salaries based on revenues.

Brickleys headquarters is downtown.

Product

Sales Price

per Unit

Bricks 2,000,000 0.75 $

Sand 30,000 tons 90.00 $

Units Produced

& Sold

2-32

The brick operation consumes 70% of the material

purchased. The play sand uses the remaining 30%.

Labor has an average cost of $10 per hour. The brick

operation uses 21,000 labor hours. The play sand

operation uses 14,000 labor hours.

The company pays all utilities on one bill that goes to the

headquarters. Headquarters allocates 50% of the utilities

cost to each product.

Tracing versus Allocating

Costs - Example

2-33

Compute the missing values and

information.

Tracing versus Allocating

Costs - Example

Cost Type Total Cost Bricks Sand

How

Assigned

Sales Revenue 4,200,000 $ ? ? ?

Materials 800,000 ? ? ?

Labor 350,000 ? ? ?

Supervisors 140,000 ? ? ?

Plant Rent 700,000 ? ? ?

Total Utilities 160,000 ? ? ?

2-34

Sales Revenue is TRACED to each product based on

the actual revenue each product generates.

Example: Sand Revenue = 30,000 tons $90 per ton

Cost Type Total Cost Bricks Sand

How

Assigned

Sales Revenue 4,200,000 $ 1,500,000 $ 2,700,000 $ Direct

Materials 800,000 ? ? ?

Labor 350,000 ? ? ?

Supervisors 140,000 ? ? ?

Plant Rent 700,000 ? ? ?

Total Utilities 160,000 ? ? ?

Tracing versus Allocating

Costs - Example

2-35

Tracing versus Allocating

Costs - Example

Material and Labor are traced to each product based

on how much of each resource each product uses.

Example; Bricks labor = 21,000 hours $10 per hour

Cost Type Total Cost Bricks Sand

How

Assigned

Sales Revenue 4,200,000 $ 1,500,000 $ 2,700,000 $ Direct

Materials 800,000 560,000 $ 240,000 $ Direct

Labor 350,000 210,000 $ 140,000 $ Direct

Supervisors 140,000 ? ? ?

Plant Rent 700,000 ? ? ?

Total Utilities 160,000 ? ? ?

2-36

Tracing versus Allocating

Costs - Example

Supervisor salaries and rent are allocated on the basis

of relative revenues. Approximately 35.7% goes to

Bricks. Approximately 64.3% goes to Sand.

Cost Type Total Cost Bricks Sand

How

Assigned

Sales Revenue 4,200,000 $ 1,500,000 $ 2,700,000 $ Direct

Materials 800,000 560,000 $ 240,000 $ Direct

Labor 350,000 210,000 $ 140,000 $ Direct

Supervisors 140,000 50,000 $ 90,000 $ Indirect

Plant Rent 700,000 250,000 $ 450,000 $ Indirect

Total Utilities 160,000 ? ? ?

2-37

Cost Type Total Cost Bricks Sand

How

Assigned

Sales Revenue 4,200,000 $ 1,500,000 $ 2,700,000 $ Direct

Materials 800,000 560,000 $ 240,000 $ Direct

Labor 350,000 210,000 $ 140,000 $ Direct

Supervisors 140,000 50,000 $ 90,000 $ Indirect

Plant Rent 700,000 250,000 $ 450,000 $ Indirect

Total Utilities 160,000 80,000 $ 80,000 $ Indirect

The utilities are allocated from the home office with

50% of the utilities being charged to each product.

Tracing versus Allocating

Costs - Example

2-38

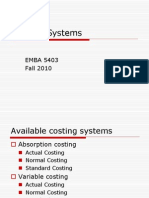

Variable Costing

measures product

cost by the unit-

level resources

used.

Absorption Costing

allocates indirect

costs to products

along with unit-level

and variable costs.

Income-Reporting Effects of

Alternative Product-Costing

Methods

2-39

Absorption

Costing

Variable

Costing

Direct materials

Direct labor Product costs

Product costs Variable mfg. overhead

Fixed mfg. overhead

Period costs

Period costs Selling & admin. exp.

Income-Reporting Effects of

Alternative Product-Costing

Methods

2-40

Absorption Costing vs.

Variable Costing - Example

Howell, Inc. produces a single product with a sales price

of $40 and the following cost information:

2-41

Unit product cost is determined as follows:

Selling and administrative expenses are

always treated as period expenses and deducted from

revenue.

Absorption Costing vs.

Variable Costing - Example

2-42

Absorption Costing

Sales (28,000 $40) 1,120,000 $

Less cost of goods sold:

Beginning inventory - $

Add COGM (30,000 $19) 570,000

Goods available for sale 570,000

Ending inventory (2,000 $19) 38,000 532,000

Gross margin 588,000

Less selling & admin. exp.

Variable (28,000 x $4) 112,000 $

Fixed 250,000 362,000

Net income 226,000 $

Absorption Costing vs.

Variable Costing - Example

Howell, Inc. had no beginning inventory, produced

30,000 units and sold 28,000 units this year.

2-43

Variable Costing

Sales (28,000 $40) 1,120,000 $

Less variable expenses:

Beginning inventory - $

Add COGM (30,000 $12) 360,000

Goods available for sale 360,000

Ending inventory (2,000 $12) 24,000

Variable cost of goods sold 336,000

Variable selling & administrative

expenses (28,000 $4) 112,000 448,000

Contribution margin 672,000

Less fixed expenses:

Manufacturing overhead 210,000 $

Selling & administrative expenses 250,000 460,000

Net income 212,000 $

Absorption Costing vs.

Variable Costing - Example

Variable

costs

only.

All fixed

manufacturing

overhead is

expensed.

2-44

End of Chapter

Hu-man!

I will

absorb

you!

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Journal Entry For Credit Purchase and Cash PurchaseDocument4 pagesJournal Entry For Credit Purchase and Cash PurchaseramakrishnaraoNo ratings yet

- SAP AccountingDocument126 pagesSAP AccountingramakrishnaraoNo ratings yet

- Chapter Five: Activity-Based Costing and Cost Management SystemsDocument39 pagesChapter Five: Activity-Based Costing and Cost Management SystemsramakrishnaraoNo ratings yet

- EMBA 5403 Costing SystemsDocument37 pagesEMBA 5403 Costing SystemsramakrishnaraoNo ratings yet

- 50 Tips For FittnessDocument5 pages50 Tips For FittnessramakrishnaraoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Director Operations Account Manager in Philadelphia PA Resume David SieglerDocument2 pagesDirector Operations Account Manager in Philadelphia PA Resume David SieglerDavidSieglerNo ratings yet

- MAS Concept MapDocument1 pageMAS Concept MapCathlene TitoNo ratings yet

- Ier2015 FRDocument150 pagesIer2015 FRmoisendiaye245No ratings yet

- Exam #2 Practice ProblemsDocument3 pagesExam #2 Practice Problemsbalaji0907No ratings yet

- How To Write Kickass Sales EmailsDocument19 pagesHow To Write Kickass Sales EmailsTawheed Kader100% (9)

- 7 PsDocument51 pages7 PsAmy B. RafaelNo ratings yet

- Management Services - 2: Variable & Absorption CostingDocument11 pagesManagement Services - 2: Variable & Absorption CostingKristine MagsayoNo ratings yet

- HUL Annual Report 2008Document160 pagesHUL Annual Report 2008yashsati100% (1)

- Issue Log Tracker MainDocument151 pagesIssue Log Tracker MainA Uns KhanNo ratings yet

- Lect8.Practical Spatial Economic Modelling Using PECASDocument130 pagesLect8.Practical Spatial Economic Modelling Using PECASLakshan FonsekaNo ratings yet

- Verka Project For MbaDocument65 pagesVerka Project For Mbasatwinder singhNo ratings yet

- Marketing Communications Integrating Off PDFDocument37 pagesMarketing Communications Integrating Off PDFRatih Frayunita Sari100% (1)

- Chap 11Document68 pagesChap 11Kool Bhardwaj100% (1)

- Laporan Bing REDDOORZDocument2 pagesLaporan Bing REDDOORZDesty BhearylNo ratings yet

- Relationship MarketingDocument17 pagesRelationship Marketingkaushik_ranjan_2No ratings yet

- Speaking Telephone RoleplaysDocument2 pagesSpeaking Telephone RoleplaysremimiguelNo ratings yet

- The Sales ContractDocument24 pagesThe Sales ContractasrialiNo ratings yet

- Week 7 Chapter 7: Guest RegistrationDocument12 pagesWeek 7 Chapter 7: Guest RegistrationechxNo ratings yet

- Chan Kharfan 2018 CapstoneDocument43 pagesChan Kharfan 2018 CapstoneHendra PutraNo ratings yet

- Tesla Motors January 2014 Investor PresentationDocument33 pagesTesla Motors January 2014 Investor PresentationotteromNo ratings yet

- Brand Valuation of HappydentDocument22 pagesBrand Valuation of Happydentgm.kayalNo ratings yet

- Rights of An Unpaid Seller Against The GoodsDocument31 pagesRights of An Unpaid Seller Against The GoodsSanaNo ratings yet

- Vivint, Inc. Settlement Agreement W WY AG - FINALDocument5 pagesVivint, Inc. Settlement Agreement W WY AG - FINALKSLcomNo ratings yet

- WIP IA Manual - Audit Program - Sales and ReceivablesDocument10 pagesWIP IA Manual - Audit Program - Sales and ReceivablesMuhammad Faris Ammar Bin ZainuddinNo ratings yet

- Audit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryDocument24 pagesAudit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryrockyrrNo ratings yet

- History of Retail Industry 1Document15 pagesHistory of Retail Industry 1Nisha RaviNo ratings yet

- D.E.I. Expanded Scale Cdei 131059Document3 pagesD.E.I. Expanded Scale Cdei 131059MayLiuNo ratings yet

- Magna Electronics v. Hyundai Mobis Et. Al.Document9 pagesMagna Electronics v. Hyundai Mobis Et. Al.PriorSmartNo ratings yet

- 2017SC - GR195542 - Sec VS Oudine Santos PDFDocument28 pages2017SC - GR195542 - Sec VS Oudine Santos PDFRheneir MoraNo ratings yet

- Mcdonald and Dominos1111Document31 pagesMcdonald and Dominos1111Gulshan PushpNo ratings yet