Professional Documents

Culture Documents

Introduction To Cost Systems and Behavious

Uploaded by

Sarith SagarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Cost Systems and Behavious

Uploaded by

Sarith SagarCopyright:

Available Formats

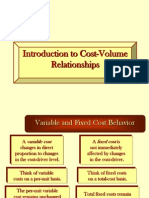

Introduction to Cost behaviour and

Systems

Cost and Cost Terminology

Cost is a resource sacrificed or forgone to achieve

a specific objective.

An actual cost is the cost incurred (a historical cost)

as distinguished from budgeted costs.

A cost object is anything for which a separate

measurement of costs is desired.

Cost and Cost Terminology

Cost

Accumulation

Cost Object

Cost Object

Cost Object

Cost

Assignment

Tracing

Allocating

Direct and Indirect Costs

Direct Costs

Example: Paper on which

Times of I ndia newspaper

is printed

Indirect Costs

Example: Lease cost for

Times building

housing the senior journalists

of its newspaper

COST OBJECT

Example: Times of

India newspaper

Direct and Indirect Costs

Example

Direct Costs:

Maintenance Department 40,000

Personnel Department 20,600

Assembly Department 75,000

Finishing Department 55,000

Assume that Maintenance Department costs are

allocated equally among the production departments.

How much is allocated to each department?

Direct and Indirect Costs

Example

Allocated

20,000

Maintenance

40,000

Assembly

Direct Costs

75,000

Finishing

Direct Costs

55,000

20,000

Cost Behavior Patterns Example

Bicycles by the Sea buys a handlebar

at 52 for each of its bicycles.

What is the total handlebar cost when

1,000 bicycles are assembled?

Cost Behavior Patterns Example

1,000 units 52 = 52,000

What is the total handlebar cost

when 3,500 bicycles are assembled?

3,500 units 52 = 182,000

Cost Behavior Patterns Example

Bicycles by the Sea incurred 94,500 in

a given year for the leasing of its plant.

This is an example of fixed costs with

respect to the number of bicycles assembled.

Cost Behavior Patterns Example

What is the leasing (fixed) cost per bicycle

when Bicycles assembles 1,000 bicycles?

94,500 1,000 = 94.50

What is the leasing (fixed) cost per bicycle

when Bicycles assembles 3,500 bicycles?

94,500 3,500 = 27

Cost Drivers

The cost driver of variable costs is the level

of activity or volume whose change causes

the (variable) costs to change proportionately.

The number of bicycles assembled is a

cost driver of the cost of handlebars.

Relevant Range Example

Assume that fixed (leasing) costs are 94,500

for a year and that they remain the same for a

certain volume range (1,000 to 5,000 bicycles).

1,000 to 5,000 bicycles is the relevant range.

Relevant Range Example

0

20000

40000

60000

80000

100000

120000

0 1000 2000 3000 4000 5000 6000

Volume

F

i

x

e

d

C

o

s

t

s

94,500

Relationships of Types of Costs

Direct

Indirect

Variable Fixed

Total Costs and Unit Costs

Example

What is the unit cost (leasing and handlebars)

when Bicycles assembles 1,000 bicycles?

Total fixed cost 94,500

+ Total variable cost 52,000 = 146,500

146,500 1,000 = 146.50

Total Costs and Unit Costs

Example

0

50000

100000

150000

200000

0 500 1000 1500

Volume

T

o

t

a

l

C

o

s

t

s

94,500

146,500

Use Unit Costs Cautiously

Assume that Bicycles management uses a

unit cost of 146.50 (leasing and wheels).

Management is budgeting costs for

different levels of production.

What is their budgeted cost for an

estimated production of 600 bicycles?

600 146.50 = 87,900

Use Unit Costs Cautiously

What is their budgeted cost for an estimated

production of 3,500 bicycles?

3,500 146.50 = 512,750

What should the budgeted cost be for an

estimated production of 600 bicycles?

Use Unit Costs Cautiously

Total fixed cost 94,500

Total variable cost (52 600) 31,200

Total 125,700

125,700 600 = 209.50

Using a cost of 146.50 per unit would

underestimate actual total costs if output

is below 1,000 units.

Use Unit Costs Cautiously

What should the budgeted cost be for an

estimated production of 3,500 bicycles?

Total fixed cost 94,500

Total variable cost (52 3,500) 182,000

Total 276,500

276,500 3,500 = 79.00

Manufacturing

Manufacturing companies

purchase materials and components and

convert them into finished goods.

A manufacturing company must also develop,

design, market, and distribute its products.

Merchandising

Merchandising companies

purchase and then sell tangible products

without changing their basic form.

Merchandising

Service companies

provide services or intangible

products to their customers.

Labor is the most significant cost category.

Types of Inventory

Manufacturing-sector companies

typically have one or more of the

following three types of inventories:

1. Direct materials inventory

2. Work in process inventory (work

in progress)

3. Finished goods inventory

Types of Inventory

Merchandising-sector companies hold

only one type of inventory the

product in its original purchased form.

Service-sector companies do not

hold inventories of tangible products.

Classification of

Manufacturing Costs

Direct materials costs

Direct manufacturing labor costs

Indirect manufacturing costs

Inventoriable Costs

Inventoriable costs (assets)

become cost of goods sold

after a sale takes place.

Period Costs

Period costs are all costs in the income

statement other than cost of goods sold.

Period costs are recorded as expenses of the

accounting period in which they are incurred.

Flow of Costs Example

Bicycles by the Sea had 50,000 of direct

materials inventory at the beginning of the period.

Purchases during the period amounted to

180,000 and ending inventory was 30,000.

How much direct materials were used?

50,000 + 180,000 30,000 = 200,000

Flow of Costs Example

Direct labor costs incurred were 105,500.

Indirect manufacturing costs were 194,500.

What are the total manufacturing costs incurred?

Direct materials used 200,000

Direct labor 105,500

Indirect manufacturing costs 194,500

Total manufacturing costs 500,000

Flow of Costs Example

Assume that the work in process inventory

at the beginning of the period was 30,000,

and 35,000 at the end of the period.

What is the cost of goods manufactured?

Beginning work in process 30,000

Total manufacturing costs 500,000

Ending work in process 35,000

Cost of goods manufactured 495,000

Flow of Costs Example

Assume that the finished goods inventory

at the beginning of the period was 10,000,

and 15,000 at the end of the period.

What is the cost of goods sold?

Beginning finished goods 10,000

Cost of goods manufactured 495,000

Ending finished goods 15,000

Cost of goods sold 490,000

Flow of Costs Example

Work in Process

Beg. Balance 30,000 495,000

Direct mtls. used 200,000

Direct labor 105,500

Indirect mfg. costs 194,500

Ending Balance 35,000

Flow of Costs Example

Work in Process

495,000

Finished Goods

10,000 490,000

495,000

15,000

Cost of Goods Sold

490,000

Manufacturing Company

Materials

Inventory

Finished

Goods

Inventory

Revenues

Cost of

Goods Sold

INCOME STATEMENT

Period

Costs

Inventoriable

Costs

BALANCE SHEET

Equals Operating Income

when

sales

occur

deduct

Equals Gross Margin

deduct

Work in

Process

Inventory

Merchandising Company

INCOME STATEMENT BALANCE SHEET

when

sales

occur

Inventoriable

Costs

Merchandise

Purchases

Inventory

Revenues

deduct

Cost of

Goods Sold

Equals Gross Margin

deduct

Period

Costs

Equals Operating Income

Prime Costs

Direct

Materials

Direct

Labor

Prime

Costs

+ =

Prime Costs

What are the prime costs for Bicycles by the Sea?

Direct materials used 200,000

+ Direct labor 105,500

= 305,000

Conversion Costs

Direct

Labor

Manufacturing

Overhead

+ =

Conversion

Costs

I ndirect

Labor

I ndirect

Materials

Other

Conversion Costs

What are the conversion costs for

Bicycles by the Sea?

Direct labor 105,500

+ Indirect manufacturing costs 194,500

= 300,000

Measuring Costs

Requires Judgment

Manufacturing labor-cost classifications

vary among companies.

The following distinctions are generally found:

Direct manufacturing labor

Manufacturing overhead

Measuring Costs

Requires Judgment

Manufacturing overhead

Indirect labor Managers salaries Payroll fringe costs

Forklift truck operators (internal handling of materials)

Janitors Rework labor

Overtime premium Idle time

Measuring Costs

Requires Judgment

Overtime premium is usually

considered part of overhead.

Assume that a worker gets 18/hour

for straight time and gets

time and one-half for overtime.

Measuring Costs

Requires Judgment

How much is the overtime premium?

18 50% = 9 per overtime hour

If this worker works 44 hours on a given

week, how much are his gross earnings?

Direct labor 44 hours 18 = 792

Overtime premium 4 hours 9 = 36

Total gross earnings 828

Many Meanings of Product Cost

A product cost is the sum of the costs

assigned to a product for a specific purpose.

1. Pricing and product emphasis decisions

2. Contracting with government agencies

3. Preparing financial statements for external

reporting under generally accepted

accounting principles

A Framework for Cost

Management

Three features of cost accounting

and cost management:

1. Calculating the costs of products

2. Obtaining information

3. Analyzing information

You might also like

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- An Introduction To Cost Terms and Purposes: Session 2Document50 pagesAn Introduction To Cost Terms and Purposes: Session 2sayed_20004No ratings yet

- Evaluating Products and ProcessesDocument33 pagesEvaluating Products and ProcessesGaluh Boga KuswaraNo ratings yet

- 2 Cost StatementDocument6 pages2 Cost StatementAbdallah SadikiNo ratings yet

- Chapter - 01 - Overview - of - Management - Accounting - Doc - Filename UTF-8''Chapter 01 Overview of Management AccountingDocument3 pagesChapter - 01 - Overview - of - Management - Accounting - Doc - Filename UTF-8''Chapter 01 Overview of Management AccountingNasrinTonni AhmedNo ratings yet

- CVP PrintDocument32 pagesCVP Printstef van der veerNo ratings yet

- PGBM01 Financial Management & Costing LectureDocument36 pagesPGBM01 Financial Management & Costing Lecturemohammedakbar88No ratings yet

- Chapter - 2 Cost TermsDocument23 pagesChapter - 2 Cost TermsZubair Chowdhury0% (1)

- Week 9 - 10 - OverheadDocument44 pagesWeek 9 - 10 - OverheadMohammad EhsanNo ratings yet

- Cost Accounting BasicsDocument11 pagesCost Accounting BasicsTejas YeoleNo ratings yet

- Marginal and Absorption Costing 7: This Chapter Covers..Document20 pagesMarginal and Absorption Costing 7: This Chapter Covers..PontuChowdhuryNo ratings yet

- CHAPTER 2 Cost Terms and PurposeDocument31 pagesCHAPTER 2 Cost Terms and PurposeRose McMahonNo ratings yet

- CH 3Document17 pagesCH 3trishanjaliNo ratings yet

- Questions and Answers For MGT 3 000 Level 23Document15 pagesQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNo ratings yet

- ABC System Eliminates Product Cost DistortionDocument16 pagesABC System Eliminates Product Cost DistortionPoint BlankNo ratings yet

- OverheadsDocument28 pagesOverheadsJawad LatifNo ratings yet

- Q.9. Differentiate Direct Cost and Direct Costing?Document10 pagesQ.9. Differentiate Direct Cost and Direct Costing?Hami KhaNNo ratings yet

- Final Assessment: NAME: Sumama Syed Reg No.: 1811339 Class: BBA Open Course: Cost AccountingDocument7 pagesFinal Assessment: NAME: Sumama Syed Reg No.: 1811339 Class: BBA Open Course: Cost AccountingSyed SumamaNo ratings yet

- Handwritten assignment on cost and management accountingDocument6 pagesHandwritten assignment on cost and management accountingJayaKhemaniNo ratings yet

- Unit Cost Calculation: Afzal Ahmed, Fca Finance Controller NagadDocument27 pagesUnit Cost Calculation: Afzal Ahmed, Fca Finance Controller NagadsajedulNo ratings yet

- Question Bank For Ma 1.4Document25 pagesQuestion Bank For Ma 1.4Chitta LeeNo ratings yet

- Untuk Mahasiswa, Pertemuan Ke 2, An Introduction To Cost Terms and PurposesDocument36 pagesUntuk Mahasiswa, Pertemuan Ke 2, An Introduction To Cost Terms and Purposesflypop13No ratings yet

- Lec#5 Week#5 ECODocument33 pagesLec#5 Week#5 ECOZoha MughalNo ratings yet

- Management Accounting My Summery 2'Nd TermDocument24 pagesManagement Accounting My Summery 2'Nd TermAhmedFawzyNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 02Document21 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 02Mr. JalilNo ratings yet

- CHAPTER 3 COST CONCEPTSDocument27 pagesCHAPTER 3 COST CONCEPTSMohamed Ahmed JamaNo ratings yet

- Acct1 8 (1Document9 pagesAcct1 8 (1Thu V A NguyenNo ratings yet

- CostingDocument48 pagesCostingSohini RoyNo ratings yet

- Cost Accounting: Meaning of Contract CostingDocument8 pagesCost Accounting: Meaning of Contract CostingHrishikesh LolekarNo ratings yet

- Cost Concepts Behaviors and MeasurementsDocument47 pagesCost Concepts Behaviors and MeasurementsTricia Marie TumandaNo ratings yet

- Cost Management Concepts and Accounting for Mass Customization OperationsDocument4 pagesCost Management Concepts and Accounting for Mass Customization OperationsNalynCasNo ratings yet

- Product Mix sk2Document22 pagesProduct Mix sk2gr8shankyNo ratings yet

- Pricing Decision ReportDocument36 pagesPricing Decision ReportGirlie MazonNo ratings yet

- Product Costing Analysis ReportDocument9 pagesProduct Costing Analysis ReportDeepti TripathiNo ratings yet

- Cost Management Amd ProductivityDocument64 pagesCost Management Amd ProductivityKai de LeonNo ratings yet

- MFI Staff Guide Break-Even AnalysisDocument7 pagesMFI Staff Guide Break-Even AnalysismhussainNo ratings yet

- Lecture 5-6 Unit Cost CalculationDocument32 pagesLecture 5-6 Unit Cost CalculationAfzal AhmedNo ratings yet

- Marginal and Absorption CostingDocument10 pagesMarginal and Absorption CostingSandip GhoshNo ratings yet

- Weygandt Kieso Kimmel AlyDocument41 pagesWeygandt Kieso Kimmel AlyAssad AssadNo ratings yet

- Cost CH 3Document40 pagesCost CH 3tewodrosbayisaNo ratings yet

- Costsheet 160702125930Document10 pagesCostsheet 160702125930RanDeep SinghNo ratings yet

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDocument26 pagesWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulNo ratings yet

- MARGINAL COSTING (Ai1)Document13 pagesMARGINAL COSTING (Ai1)Iris TitoNo ratings yet

- CAPE Unit 2 - Costing Principles - Elements of CostDocument10 pagesCAPE Unit 2 - Costing Principles - Elements of CostPrecious CodringtonNo ratings yet

- Q1,2,3Document6 pagesQ1,2,3Bhavika JoshiNo ratings yet

- Kashif Ali BhuttoDocument5 pagesKashif Ali Bhuttokashif aliNo ratings yet

- Cost and Management AccountingDocument23 pagesCost and Management AccountingSarvar PathanNo ratings yet

- Overhead AllocationDocument3 pagesOverhead AllocationEdi Kristanta PelawiNo ratings yet

- Cost Analysis of Any Product or ServiceDocument27 pagesCost Analysis of Any Product or ServiceAayushiNo ratings yet

- Chapter 5 - Throughput AccontingDocument20 pagesChapter 5 - Throughput AccontingJeremiah NcubeNo ratings yet

- Costing PresentationDocument16 pagesCosting PresentationSarah Jane Ste MarieNo ratings yet

- Cost and Management Accounting II.Document19 pagesCost and Management Accounting II.Bahar aliyiNo ratings yet

- CVP Analysis Final 1Document92 pagesCVP Analysis Final 1Utsav ChoudhuryNo ratings yet

- Marginal Costing and Cost-Volume-Profit Analysis (CVP)Document65 pagesMarginal Costing and Cost-Volume-Profit Analysis (CVP)Puneesh VikramNo ratings yet

- 8 The Cost of ProductionDocument2 pages8 The Cost of ProductionDaisy Marie A. RoselNo ratings yet

- Aims and Objectives: After Completing This Chapter, You Should Be Able To: CostingDocument21 pagesAims and Objectives: After Completing This Chapter, You Should Be Able To: Costingesubalew yayenaNo ratings yet

- Chapter 4Document45 pagesChapter 4Yanjing Liu67% (3)

- CostDocument36 pagesCostbt21108016 Kehkasha AroraNo ratings yet

- Marginal Costing and CVP Analysis: Group 4Document31 pagesMarginal Costing and CVP Analysis: Group 4Aiman Farhan100% (1)

- CVP Analysis IibsDocument32 pagesCVP Analysis IibsSoumendra RoyNo ratings yet

- MonopolyDocument6 pagesMonopolySarith SagarNo ratings yet

- Markov AnalysisDocument6 pagesMarkov AnalysisSarith SagarNo ratings yet

- Porters 5 ForcesDocument10 pagesPorters 5 ForcesSarith SagarNo ratings yet

- CVP RelationshipDocument14 pagesCVP RelationshipSarith SagarNo ratings yet

- Broadening The Marketing ConceptDocument6 pagesBroadening The Marketing ConceptGhani ThapaNo ratings yet

- Financial Statement Analysis Problem SetDocument7 pagesFinancial Statement Analysis Problem SetSarith SagarNo ratings yet

- Two Means TestDocument15 pagesTwo Means TestSarith SagarNo ratings yet

- CVP RelationshipDocument14 pagesCVP RelationshipSarith SagarNo ratings yet

- The Red-Bearded BaronDocument6 pagesThe Red-Bearded BaronSarith Sagar100% (2)

- Accounting Primer Solutions for 4 CompaniesDocument43 pagesAccounting Primer Solutions for 4 CompaniesSarith SagarNo ratings yet

- DistributionDocument12 pagesDistributionSarith SagarNo ratings yet

- Financial Statement Analysis Problem SetDocument7 pagesFinancial Statement Analysis Problem SetSarith SagarNo ratings yet

- Confidence Interval Estimates for Production Process Paper LengthDocument7 pagesConfidence Interval Estimates for Production Process Paper LengthSarith SagarNo ratings yet

- Confidence Interval Estimates for Production Process Paper LengthDocument7 pagesConfidence Interval Estimates for Production Process Paper LengthSarith SagarNo ratings yet

- CVP RelationshipDocument37 pagesCVP RelationshipSarith SagarNo ratings yet

- CVP RelationshipDocument37 pagesCVP RelationshipSarith SagarNo ratings yet

- Introduction and Overview of Financial SystemDocument25 pagesIntroduction and Overview of Financial SystemSarith SagarNo ratings yet

- Accounting Principles and ConceptsDocument14 pagesAccounting Principles and ConceptsSarith SagarNo ratings yet

- What Business Are We In?: B.V.L.Narayana SPTM112-Apr-09Document11 pagesWhat Business Are We In?: B.V.L.Narayana SPTM112-Apr-09Sarith SagarNo ratings yet

- Accounting PrimerDocument21 pagesAccounting PrimerSarith SagarNo ratings yet

- Understanding Financial Statements - A Basic OverviewDocument49 pagesUnderstanding Financial Statements - A Basic OverviewSarith SagarNo ratings yet

- Assignment 1Document2 pagesAssignment 1Sarith SagarNo ratings yet

- Retail Store Operations Report on Reliance Retail LtdDocument59 pagesRetail Store Operations Report on Reliance Retail LtdKadali Prasad0% (1)

- Sample Project 1Document18 pagesSample Project 1Sarith SagarNo ratings yet

- Paytm Case SolutionDocument16 pagesPaytm Case SolutionAkash GuptaNo ratings yet

- CostsDocument21 pagesCostsdipika_joshi33No ratings yet

- Lamar Advertising (LAMR) : Company DescriptionDocument2 pagesLamar Advertising (LAMR) : Company DescriptionHernan DiazNo ratings yet

- Standalone Balance SheetDocument1 pageStandalone Balance SheetGaurav PhadNo ratings yet

- Financial Management Guide: Investment, Financing and Dividend DecisionsDocument34 pagesFinancial Management Guide: Investment, Financing and Dividend DecisionsLatha VarugheseNo ratings yet

- Book Notes - Chapter 2 - Cost AccountingDocument18 pagesBook Notes - Chapter 2 - Cost AccountingKneetech Romney100% (3)

- Question No. 1 - Sol: Cost & Management Accounting (MGT-402) Mc080204098 Assignment # 2Document2 pagesQuestion No. 1 - Sol: Cost & Management Accounting (MGT-402) Mc080204098 Assignment # 2KamranDanish1979_201No ratings yet

- Ratio AnalysisDocument12 pagesRatio AnalysisShivam VeerNo ratings yet

- Sample Manufacturing Company Limited Consolidated Financial Statements 2011Document36 pagesSample Manufacturing Company Limited Consolidated Financial Statements 2011Susanto Ario100% (1)

- Dabur India Standalone Balance SheetDocument2 pagesDabur India Standalone Balance SheetAshutosh GuptaNo ratings yet

- GBH210790 - Asm1 - 5038Document18 pagesGBH210790 - Asm1 - 5038Pham Thi Khanh Linh (FGW HN)No ratings yet

- Feasibility-Dum ScramnionDocument35 pagesFeasibility-Dum ScramnionApril Loureen Dale TalhaNo ratings yet

- Understanding Corporate Financial Statements and ReportsDocument48 pagesUnderstanding Corporate Financial Statements and ReportsZoya KhanNo ratings yet

- FMSM END GAME NOTES-Executive-RevisionDocument57 pagesFMSM END GAME NOTES-Executive-RevisionRevanthi DNo ratings yet

- SEM II Cost-Accounting Unit 1Document23 pagesSEM II Cost-Accounting Unit 1mahendrabpatelNo ratings yet

- Deffered Tax and Tax Expense and Owner - Cheat SheetDocument5 pagesDeffered Tax and Tax Expense and Owner - Cheat SheetSayorn Monanusa ChinNo ratings yet

- GDP by Income Approach ExplainedDocument15 pagesGDP by Income Approach ExplainedPreetiNo ratings yet

- Gross Profit Variance Analysis ProblemsDocument1 pageGross Profit Variance Analysis Problemspot pooot50% (2)

- Full Download Test Bank For Intermediate Financial Management 13th Edition Eugene F Brigham Phillip R Daves PDF Full ChapterDocument36 pagesFull Download Test Bank For Intermediate Financial Management 13th Edition Eugene F Brigham Phillip R Daves PDF Full Chapterjoshuaperkinsobjpadfmyx100% (17)

- Partnership PracticeDocument1 pagePartnership PracticeIce Voltaire Buban GuiangNo ratings yet

- Net Present Value (NPV)Document4 pagesNet Present Value (NPV)faeeezNo ratings yet

- BBAA3103 Audit IDocument238 pagesBBAA3103 Audit IAnnie100% (1)

- ch17 InvestmentsDocument38 pagesch17 InvestmentsKristine Wali0% (1)

- W3 Module 5 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 3Document6 pagesW3 Module 5 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 3leare ruazaNo ratings yet

- ABSTACT .. 02 Chapter - I: Chapter - Ii Chapter - Iii Chapter - Iv Chapter - V Chapter - ViDocument40 pagesABSTACT .. 02 Chapter - I: Chapter - Ii Chapter - Iii Chapter - Iv Chapter - V Chapter - ViSarat ChandraNo ratings yet

- T04 - Home Office & Branch PDFDocument2 pagesT04 - Home Office & Branch PDFRhislee PabrigaNo ratings yet

- Ratio Analysis PPLDocument11 pagesRatio Analysis PPLCh Ali TariqNo ratings yet

- Pinkerton (A) - ExhibitsDocument7 pagesPinkerton (A) - ExhibitsFarrah ZhaoNo ratings yet

- MOD 04 Cost Volume Profit Analysis (2023)Document102 pagesMOD 04 Cost Volume Profit Analysis (2023)georgiana.ioannouNo ratings yet