Professional Documents

Culture Documents

2.recording Process

Uploaded by

wpar815Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2.recording Process

Uploaded by

wpar815Copyright:

Available Formats

The Recording

Process

Learning Objectives

1. Explain what an account is and how it helps in the

recording process.

2. Define debits and credits and explain how they are

used to record economic events.

3. Explain what a journal is and how it helps in the

recording process.

4. Explain what a general ledger is and how it helps

in the recording process.

5. Explain what posting is and how it helps in the

recording process.

6. Explain the purpose and limitations of a trial

balance.

Event Analysis Summary (Review)

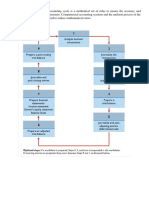

An economic event is analysed.

If recognised, the event will be two-sided,

affecting assets, liabilities and/or equity.

Before, during, and after recognition, there is

equality in terms of the accounting equation

Account Name

Debit / Dr. Credit / Cr.

Record of increases and decreases

in a specific asset, liability, equity,

income, or expense item.

Account

An Account can

be illustrated in a

T-Account form.

LO 1: The Account

Debit = Left

Credit = Right

Account Name

Debit / Dr. Credit / Cr.

If Debits are greater than Credits, the account will

have a debit balance.

$10,000 Transaction #2 $3,000

$15,000

8,000 Transaction #3

Balance

Transaction #1

LO 1: The Account

Account Name

Debit / Dr. Credit / Cr.

If Credits are greater than Debits, the account will

have a credit balance.

$10,000 Transaction #2 $3,000

Balance

Transaction #1

LO 1: The Account

$1,000

8,000 Transaction #3

Double entry system:

Each recordable event affects at least two

accounts.

The increase or decrease to an account is

recorded with a debit or a credit, depending

on the account.

For each recordable event, total dollar debits

must equal total dollar credits.

LO 2: Debits and Credits

Rules of double entry bookkeeping:

A = L + OE

A = L + Share Capital + Income Expenses Dividends

Assets are on the left, so increase them with debits.

Liabilities and equity are on the right, so increase them

with credits.

Equity is increased with share capital and income (including

revenues), so increase these accounts with credits.

But expenses and the Dividends account decrease equity, so

increase these accounts with debits.

LO 2: Debits and Credits

Chapter

3-23

Assets Assets

Debit / Dr. Credit / Cr.

Normal Balance Normal Balance

Chapter

3-24

Liabilities Liabilities

Debit / Dr. Credit / Cr.

Normal Balance Normal Balance

Chapter

3-25

Debit / Dr. Credit / Cr.

Normal Balance

Equity

Normal

Balance

Credit

Normal

Balance

Debit

LO 2: Debits and Credits

Issuance of share capital,

reserves, and income increase

equity (credit).

Dividends and expenses

decrease equity (debit).

LO 2: Debits and Credits

Chapter

3-25

Debit / Dr. Credit / Cr.

Normal Balance Normal Balance

Share Capital Share Capital

Chapter

3-23

Dividends Dividends

Debit / Dr. Credit / Cr.

Normal Balance Normal Balance

Chapter

3-25

Debit / Dr. Credit / Cr.

Normal Balance Normal Balance

Equity Equity

Chapter

3-25

Debit / Dr. Credit / Cr.

Normal Balance

Reserves

What is the normal balance of each of the

following accounts?

Advertising Expense.

Dividend Revenue.

Dividends Receivable.

Share Capital.

Dividends.

Dividends Payable.

LO 2: Debits and Credits CreditsBE2-1, p. 78

(adapted)

Debits:

a. increase both assets and liabilities.

b. decrease both assets and liabilities.

c. increase assets and decrease liabilities.

d. decrease assets and increase liabilities.

Review Question

LO 2: Debits and Credits

Summary

Debits:

a. increase both assets and liabilities.

b. decrease both assets and liabilities.

c. increase assets and decrease liabilities.

d. decrease assets and increase liabilities.

Business documents, such as an invoice, a cheque, or a

cash register tape, provide evidence of a recordable

event.

Journal = book of original entry.

Events are recorded in the journal in chronological order.

Journals contributions to the recording process:

1. Discloses the complete effects of an event.

2. Provides a chronological record.

3. Helps to prevent or locate errors because the debit

and credit amounts can be easily compared.

LO 3: Journalising

For each part of a recordable event, first

determine the appropriate account affected

(conceptual framework/residual analysis), then

apply the rules of debit and credit:

1. The ____ account has incr/decr, which incr/decr A,L, or OE.

2. An incr/decr to A,L, or OE is recorded with a DR/CR.

3. Therefore, DR/CR the ____ account.

LO 3: Journalising

Account Title Ref. Debit Credit Date

Share capital

Journalizing Simple journal entries.

On September 1, stockholders invested $15,000 cash in

exchange for ordinary shares, and Softbyte purchased

computer equipment for $7,000 cash.

Cash Sept. 1 15,000

15,000

General Journal

Computer equipment

Cash

7,000

7,000

Illustration 2-14

LO 3: Journalising

Account Title Ref. Debit Credit Date

8,000

Delivery equipment

Cash

14,000

6,000 Accounts payable

Sept. 1

On July 1, Butler Company purchased a delivery truck

costing $14,000. It paid $8,000 cash and agreed to pay the

remaining $6,000 on account.

General Journal

Illustration 2-15

Compound Journal Entry

LO 3: Journalising

The following transactions occurred during August of

the current year. Determine which accounts are

affected, apply the rules of debit and credit, and

journalise the transactions.

4/8 Paid insurance in advance

for 6 months, $1800.

16/8 Received $9000 from clients

for services rendered in

August.

27/8 Paid secretary $500 salary

for August.

LO 3: Journalising

BE2-5, p. 79 (adapted)

General Ledger

Contains all accounts maintained by a business.

All asset, liability, equity, income and expense

accounts.

LO 4: The Ledger

Illustration 2-16

LO 4: The Ledger

Illustration 2-18

Chart of Accounts

T-account form used in accounting textbooks.

Ledger form used in practice.

Illustration 2-17

LO 4: The Ledger

Standard Form of Account

Posting the

process of

transferring

amounts

from the

journal to the

ledger

accounts.

Illustration 2-19

LO 5: Posting

Posting:

a. normally occurs before journalizing.

b. transfers ledger transaction data to the journal.

c. is an optional step in the recording process.

d. transfers journal entries to ledger accounts.

Review Question

LO 5: Posting

Posting:

a. normally occurs before journalising.

b. transfers ledger transaction data to the journal.

c. is an optional step in the recording process.

d. transfers journal entries to ledger accounts.

Katherine Turner recorded the following

transactions during the month of March.

LO 5: Posting

Post these entries to the Cash account.

A list of accounts

and their

balances at a

given time.

Purpose is to

prove that debits

equal credits.

LO 6: The Trial Balance

Illustration 2-32

The accounts

come from the

ledger of

Christel Ltd at

December 31,

2011.

LO 6: The Trial Balance

Christel Ltd

Trial Balance (in thousands)

December 31, 2011

Selected transactions from the journal of Teresa

Gonzales, investment broker, are presented here:

Date Account titles Debit Credit

Aug 1 Cash 5 000

Share Capital 5 000

10 Cash 2 400

Service Revenue 2 400

12 Office Equipment 5 000

Cash 1 000

Notes Payable 4 000

25 Accounts Receivable 1 600

Service Revenue 1 600

31 Cash 900

Accounts Receivable 900

Required

(a) Post the transactions to T accounts.

(b) Prepare a trial balance as at 31 August 2011.

LO 6: The Trial Balance

E2-9, p. 82

Cash

Aug. 1 5,000 Aug. 12 1,000

10 2,400

31 900

Bal. 7,300

Accounts Receivable

Aug. 25 1,600 Aug. 31 900

Bal. 700

Office Equipment

Aug. 12 5,000

Notes Payable

Aug. 12 4,000

Share CapitalOrdinary

Aug. 1 5,000

Service Revenue

Aug. 10 2,400

25 1,600

Bal. 4,000

LO 6: The Trial BalanceE2-9, p. 82

TERESA GONZALEZ, INVESTMENT BROKER

Trial Balance

August 31, 2011

Debit Credit

Cash $7,300

Accounts Receivable

Office Equipment

Notes Payable

Share CapitalOrdinary

Service Revenue 4,000

$13,000 $13,000

LO 6: The Trial BalanceE2-9, p. 82

The trial balance may balance even when

1. a transaction is not journalized,

2. a correct journal entry is not posted,

3. a journal entry is posted twice,

4. incorrect accounts are used in journalizing or

posting, or

5. offsetting errors are made in recording the amount

of a transaction.

LO 6: The Trial Balance

Limitations of a Trial Balance

A bookkeeper made these errors in journalising and posting:

1. A credit posting of $400 to Accounts Receivable was omitted.

2. A debit posting of $750 for Prepaid Insurance was debited to

Insurance Expense.

3. A collection on account of $100 was journalised and posted as a

debit to Cash $100 and a credit to Service Revenue $100.

4. A credit posting of $300 to Property Taxes Payable was made

twice.

5. A cash purchase of supplies for $250 was journalised and posted

as a debit to Supplies $25 and a credit to Cash $25.

6. A debit of $465 to Advertising Expense was posted as $456.

Required:

For each error, indicate (a) whether the trial balance will

balance; if the trial balance will not balance, indicate (b)

the amount of the difference and (c) the trial balance

column that will have the greater total. Consider each

error separately.

LO 6: The Trial Balance--E2-13,

p. 83

You might also like

- Chapter-2 Theory - 1-21 - Financial AccountingDocument8 pagesChapter-2 Theory - 1-21 - Financial AccountingOmor FarukNo ratings yet

- Usefull File For Accounting.Document150 pagesUsefull File For Accounting.Danes WaranNo ratings yet

- Control Account ReconciliationsDocument3 pagesControl Account ReconciliationsfurqanNo ratings yet

- Journal Ledger and Trial BalenceDocument14 pagesJournal Ledger and Trial BalenceMd. Sojib KhanNo ratings yet

- Bad Debts and Pfbd..Document6 pagesBad Debts and Pfbd..rizwan ul hassanNo ratings yet

- 3Document43 pages3Kevin HaoNo ratings yet

- Financial Accounting 2012 Exam PaperDocument28 pagesFinancial Accounting 2012 Exam PaperJane Fondue100% (1)

- Aggregate Demand WorksheetDocument6 pagesAggregate Demand WorksheetDanaNo ratings yet

- Ch2 Control AccountsDocument21 pagesCh2 Control AccountsahmadNo ratings yet

- Books of Prime Entry and Ledgers - Principles of AccountingDocument10 pagesBooks of Prime Entry and Ledgers - Principles of AccountingAbdulla Maseeh100% (1)

- Notes On Financial AccountingDocument11 pagesNotes On Financial AccountingAbu ZakiNo ratings yet

- AkaunDocument4 pagesAkaunaisyah100% (1)

- Module 2 - Completing The Accounting Cycle DiscussionDocument62 pagesModule 2 - Completing The Accounting Cycle DiscussionErick Monte100% (1)

- SUA 8th Fall 2015 Grading Rubric Student Answer FormDocument14 pagesSUA 8th Fall 2015 Grading Rubric Student Answer FormRamizNo ratings yet

- Solution Past Paper Higher-Series4-08hkDocument16 pagesSolution Past Paper Higher-Series4-08hkJoyce LimNo ratings yet

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoNo ratings yet

- l2.3 RGDP Versus NGDPDocument4 pagesl2.3 RGDP Versus NGDPPhung NhaNo ratings yet

- Accounting Cycle Upto Trial BalanceDocument61 pagesAccounting Cycle Upto Trial BalanceHottie-Hot SoniNo ratings yet

- Chapter 20Document31 pagesChapter 20risnaNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- 2015 MSE Accounting Sample QuestionsDocument12 pages2015 MSE Accounting Sample QuestionsDharniNo ratings yet

- Week 3. Assignment 2 - Journat Entries and Adjustments and Preparing StatmentsDocument3 pagesWeek 3. Assignment 2 - Journat Entries and Adjustments and Preparing Statmentsayush guptaNo ratings yet

- Trading AccountDocument3 pagesTrading AccountRirin GhariniNo ratings yet

- CH 3 Classpack With SolutionsDocument29 pagesCH 3 Classpack With SolutionsjimenaNo ratings yet

- Chapter 03Document12 pagesChapter 03Asim NazirNo ratings yet

- Mankiw - Chap 7Document59 pagesMankiw - Chap 7samNo ratings yet

- f7 2014 Dec QDocument13 pagesf7 2014 Dec QAshraf ValappilNo ratings yet

- FA 2 Chapter 1 Control AccountsDocument19 pagesFA 2 Chapter 1 Control AccountsMhd Amin0% (1)

- Financial Accounting December 2009 Exam PaperDocument10 pagesFinancial Accounting December 2009 Exam Paperkarlr9No ratings yet

- Question # 1 (A) Critically Examine The Difference Between Various Forms of Organization Exists in PakistanDocument14 pagesQuestion # 1 (A) Critically Examine The Difference Between Various Forms of Organization Exists in Pakistanayub_balticNo ratings yet

- CH 01Document56 pagesCH 01lalala010899No ratings yet

- Accounting DictionaryDocument5 pagesAccounting DictionaryShazad HassanNo ratings yet

- Suspense Accounts and Error CorrectionDocument5 pagesSuspense Accounts and Error Correctionludin00No ratings yet

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- Chapter 01Document13 pagesChapter 01Asim NazirNo ratings yet

- IB Economics Macroeconomics Commentary PDFDocument6 pagesIB Economics Macroeconomics Commentary PDFSHUBAN MKNo ratings yet

- Basic Financial StatementsDocument45 pagesBasic Financial StatementsparhNo ratings yet

- Basic Accounting Terminology 101Document2 pagesBasic Accounting Terminology 101ahmie banezNo ratings yet

- Financial Accounting 123Document46 pagesFinancial Accounting 123shekhar87100% (1)

- Control Account Reconciliation StatementDocument8 pagesControl Account Reconciliation StatementVinay JugooNo ratings yet

- PartnershipDocument41 pagesPartnershipBinex67% (3)

- Financial Accounting For ICWADocument944 pagesFinancial Accounting For ICWAAmit Kumar100% (2)

- The Balance SheetDocument14 pagesThe Balance SheetHeherson CustodioNo ratings yet

- Depreciation Accounting Part 2 PDFDocument37 pagesDepreciation Accounting Part 2 PDFShihab MonNo ratings yet

- Assignment Economic Stud 1Document9 pagesAssignment Economic Stud 1Masri Abdul LasiNo ratings yet

- CAF1 IntroductiontoAccounting2016 ST PDFDocument317 pagesCAF1 IntroductiontoAccounting2016 ST PDFshoaibqadri83% (6)

- EconomicsDocument19 pagesEconomicsnekkmatt100% (1)

- Chapter 2 Review Sheet AnswersDocument7 pagesChapter 2 Review Sheet AnswersKenneth DayohNo ratings yet

- Strong Knot Inc A Service Company Performs Adjusting Entries MonthlyDocument2 pagesStrong Knot Inc A Service Company Performs Adjusting Entries MonthlyAmit PandeyNo ratings yet

- 2009 SUA Waren Sports Supply Check Figures ADocument1 page2009 SUA Waren Sports Supply Check Figures ABrandon A. KroonNo ratings yet

- A Revisit On The Fundamentals of AccountingDocument53 pagesA Revisit On The Fundamentals of AccountingGonzalo Jr. Ruales100% (1)

- Role of Income TaxDocument109 pagesRole of Income TaxS. M. IMRAN100% (1)

- Accountants' New World: The Essential Guide to Being a Valued Business PartnerFrom EverandAccountants' New World: The Essential Guide to Being a Valued Business PartnerNo ratings yet

- Accounting Chapter 2Document56 pagesAccounting Chapter 2hnhNo ratings yet

- Fa - Chapter - 2 The Recording ProcessDocument16 pagesFa - Chapter - 2 The Recording ProcessfuriousTaherNo ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- The Recording Process: Accounting Principles, Ninth EditionDocument43 pagesThe Recording Process: Accounting Principles, Ninth EditionindahmuliasariNo ratings yet

- This Study Resource Was: Correct!Document5 pagesThis Study Resource Was: Correct!Angelie De LeonNo ratings yet

- A 2009Document88 pagesA 2009heroic_aliNo ratings yet

- DB Corporation ProspectusDocument657 pagesDB Corporation Prospectusvishalsharma8522No ratings yet

- G.R. No. 176579Document6 pagesG.R. No. 176579Alee AbdulcalimNo ratings yet

- VBM Book!!!Document254 pagesVBM Book!!!Buba AtanasovaNo ratings yet

- Sec Form Ica 7-1: Registration Statement Under Section 7 of The Investment Company ActDocument7 pagesSec Form Ica 7-1: Registration Statement Under Section 7 of The Investment Company ActprimeNo ratings yet

- 8 Powerpoint Guided NotesDocument79 pages8 Powerpoint Guided Notesapi-173610472No ratings yet

- Nautica V YumulDocument3 pagesNautica V YumulPauline CarilloNo ratings yet

- Financial Statement Analysis of ACI Ltd.Document34 pagesFinancial Statement Analysis of ACI Ltd.Saad60% (5)

- Docslide - Us Fof Im Chapter 08 7thDocument20 pagesDocslide - Us Fof Im Chapter 08 7thErnesto Rodriguez DiazNo ratings yet

- Multiple Choice - Stock ValuatingDocument9 pagesMultiple Choice - Stock ValuatingĐào Ngọc Pháp0% (1)

- Updates On Buy Back Offer (Company Update)Document56 pagesUpdates On Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Corporate LiquidationDocument6 pagesCorporate LiquidationJBNo ratings yet

- BGMC International Limited: (Incorporated in The Cayman Islands With Limited Liability)Document2 pagesBGMC International Limited: (Incorporated in The Cayman Islands With Limited Liability)Ang SHNo ratings yet

- Week 1 Tutorial AnswersDocument7 pagesWeek 1 Tutorial AnswersstvnNo ratings yet

- Cash Flow Case StudyDocument6 pagesCash Flow Case StudyvzzrNo ratings yet

- Mergers and TakeoversDocument4 pagesMergers and TakeoversMocanu GabrielaNo ratings yet

- IDPINSEADpresentationslideswordversion 150311Document22 pagesIDPINSEADpresentationslideswordversion 150311Elena GoosNo ratings yet

- SWAT EasyJet PDFDocument10 pagesSWAT EasyJet PDFronda_upld777100% (1)

- Orbe Brazil Fund - Dec2012Document7 pagesOrbe Brazil Fund - Dec2012José Enrique MorenoNo ratings yet

- Third Point - Third Quarter Letter (2010)Document8 pagesThird Point - Third Quarter Letter (2010)thebigpicturecoilNo ratings yet

- Financial Planning and Forecasting ProForma Financial StatementsDocument9 pagesFinancial Planning and Forecasting ProForma Financial StatementsLm MuhammadNo ratings yet

- krisAR 2016 2017Document86 pageskrisAR 2016 2017sharkl123No ratings yet

- Warren BuffettDocument4 pagesWarren BuffettJawahirul MahbubiNo ratings yet

- BMGT 220 Final Exam - Fall 2011Document7 pagesBMGT 220 Final Exam - Fall 2011Geena GaoNo ratings yet

- United Breweries Holdings LimitedDocument7 pagesUnited Breweries Holdings Limitedsalini sasiNo ratings yet

- BUS 393 - Exam 2 - Chapter 4-9Document13 pagesBUS 393 - Exam 2 - Chapter 4-9Nerdy Notes Inc.No ratings yet

- Analysis of Financial StatementsDocument100 pagesAnalysis of Financial Statementsidont100% (1)

- Round 4 PDFDocument15 pagesRound 4 PDFRafaa DalviNo ratings yet

- P6mys 2011 Dec QDocument10 pagesP6mys 2011 Dec QJayden Ooi Yit ChunNo ratings yet