Professional Documents

Culture Documents

Chap 13

Uploaded by

Boo Le0 ratings0% found this document useful (0 votes)

45 views33 pagesChapter 13 ACCOUNTING FOR CORPORATIONS 13 - 2 Privately Held Publicly Held Ownership can be CORPORATE FORM OF ORGANIZATION Existence is separate from owners has rights and privileges.

Original Description:

Original Title

Chap13.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 13 ACCOUNTING FOR CORPORATIONS 13 - 2 Privately Held Publicly Held Ownership can be CORPORATE FORM OF ORGANIZATION Existence is separate from owners has rights and privileges.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views33 pagesChap 13

Uploaded by

Boo LeChapter 13 ACCOUNTING FOR CORPORATIONS 13 - 2 Privately Held Publicly Held Ownership can be CORPORATE FORM OF ORGANIZATION Existence is separate from owners has rights and privileges.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 33

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

Winston Kwok, Ph.D., CPA

McGraw-Hill/I rwin Copyright 2011 by The McGraw-Hill Companies, I nc. All rights reserved.

Chapter 13

ACCOUNTING FOR CORPORATIONS

13 - 2

Privately Held

Publicly Held

Ownership

can be

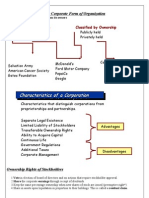

CORPORATE FORM OF ORGANIZATION

Existence is

separate from

owners

An entity

created by law

Has rights and

privileges

C 1

13 - 3

CHARACTERISTICS OF CORPORATIONS

Advantages

Separate legal entity

Limited liability of shareholders

Transferable ownership rights

Continuous life

Lack of mutual agency for shareholders

Ease of capital accumulation

Disadvantages

Governmental regulation

Corporate taxation

C 1

13 - 4

Shareholders

Board of Directors

President, Vice-President,

and Other Officers

Employees of the Corporation

CORPORATE ORGANIZATION AND

MANAGEMENT

C 1

13 - 5

RIGHTS OF SHAREHOLDERS

Vote at shareholders meetings

Sell shares

Purchase additional shares

Receive dividends, if any

Share equally in any assets remaining after

creditors are paid in a liquidation

C 1

13 - 6

Shareholders' Equity

Share capital-Ordinary, par value $.01;

authorized 250,000,000 shares; issued and

outstanding 92,556,295 shares $925,563

BASICS OF SHARE CAPITAL

Total number of shares that a corporation

is authorized to sell or issue.

Total number of shares that has been

sold or issued to shareholders.

C 1

13 - 7

Par value is an

arbitrary amount

assigned to each

share when it is

authorized.

Market price is the

amount that each

share will sell for in

the market.

BASICS OF SHARE CAPITAL

Classes of Shares

Par Value

No-Par Value

Stated Value

C 1

13 - 8

Par Value Share

On September 1, Matrix, Inc. issued 100,000

shares of $2 par value for $25 per share. Lets

record this transaction.

ISSUING PAR VALUE SHARE

Dr Cr

Sept. 1 Cash 2,500,000

Share Capital-Ordinary, $2 par value 200,000

Share Premium-Ordinary 2,300,000

Issued 100,000 ordinary shares.

P 1

13 - 9

Shareholders' Equity with Ordinary Shares

Shareholders' Equity

Share Capital-Ordinary, $2 par value; 500,000 shares

authorized; 100,000 shares issued and

outstanding 200,000 $

Share Premium-Ordinary 2,300,000

Retained earnings 650,000

Total shareholders' equity

3,150,000 $

ISSUING PAR VALUE SHARES

P 1

13 - 10

ISSUING SHARES FOR NONCASH ASSETS

Par Value Shares

On September 1, Matrix, Inc. issued 100,000

shares of $2 par value for land valued at

$2,500,000. Lets record this transaction.

Dr Cr

Sept. 1 Land 2,500,000

Share Capital-Ordinary, $2 par value 200,000

Share Premium-Ordinary 2,300,000

Exchanged 100,000 ordinary shares for land.

P 1

13 - 11

Dividends Shareholders

CASH DIVIDENDS

Corporation

To pay a cash dividend, the

corporation must have:

1. A sufficient balance in

retained earnings; and

2. The cash necessary to

pay the dividend.

75%

22%

0%

20%

40%

60%

80%

100%

Common Preferred

% of Corporations Paying Divends

Regular cash dividends provide a return to investors

and almost always affect the shares market value.

P 2

13 - 12

ACCOUNTING FOR CASH DIVIDENDS

Three important dates

Date of Declaration

Record liability

for dividend.

Date of Record

No entry

required.

Date of Payment

Record payment of

cash to shareholders.

P 2

13 - 13

Date of Declaration

Record liability

for dividend.

Dr Cr

Jan. 19 Retained Earnings 10,000

Ordinary Dividend Payable 10,000

Declared $1 per share cash dividend.

ACCOUNTING FOR CASH DIVIDENDS

On January 19, a $1 per share cash dividend is declared

on Dana, Inc.s 10,000 ordinary shares outstanding. The

dividend will be paid on March 19 to shareholders of

record on February 19.

P 2

13 - 14

No entry required on February 19, the date of record.

Dr Cr

Mar. 19 Ordinary Dividend Payable 10,000

Cash 10,000

Paid $1 per share cash dividend.

Date of Payment

Record payment of

cash to shareholders.

ACCOUNTING FOR CASH DIVIDENDS

On January 19, a $1 per share cash dividend is declared

on Dana, Inc.s 10,000 ordinary shares outstanding. The

dividend will be paid on March 19 to shareholders of

record on February 19.

P 2

13 - 15

SHARE DIVIDENDS OR BONUS ISSUE

Why a share dividend?

Can be used to keep the market price on the shares affordable.

Can provide evidence of managements confidence that

the company is doing well.

A distribution of a corporations own shares to its

shareholders without receiving any cash payment in return.

Capitalization: Transferring a portion of equity from retained

earnings to contributed capital.

P 2

13 - 16

Ordinary Shares

$10 par value

100 shares

Old

Shares

New

Shares

Ordinary Shares

$5 par value

200 shares

SHARE SPLITS

A distribution of additional shares to shareholders

according to their percent ownership.

P 2

13 - 17

PREFERENCE SHARES

A separate class of shares, typically having

priority over ordinary shares in . . .

Dividend distributions

Distribution of assets in case of liquidation

Usually has a stated

dividend rate

Normally has no

voting rights

C 2

13 - 18

vs. Noncumulative Cumulative

Dividends in arrears must

be paid before dividends

may be paid on ordinary

shares. (Normal case)

Undeclared dividends from

current and prior years do

not have to be paid in

future years.

PREFERENCE SHARES

Share Capital-Ordinary, $5 par value; 40,000 shares

authorized, issued and outstanding 200,000 $

Share Capital-Preference, 9%, $100 par value; 1,000

shares authorized, issued and outstanding 100,000

Total Share Capital

300,000 $

Consider the following Shareholders Equity section of

the Balance Sheet. The Board of Directors did not

declare or pay dividends in 2010. In 2011, the Board

declared and paid cash dividends of $42,000.

C2

13 - 19

If Preference Shares Are Noncumulative: Preference Ordinary

Year 2010: No dividends paid. - $ - $

Year 2011:

1. Pay 2011 preference dividend. 9,000 $

2. Remainder goes to ordinary. 33,000 $

If Preference Share Are Cumulative: Preference Ordinary

Year 2010: No dividends paid. - $ - $

Year 2011:

1. Pay 2010 preference dividend in arrears. 9,000 $

2. Pay 2011 preference dividend. 9,000

3. Remainder goes to ordinary. 24,000 $

Totals 18,000 $ 24,000 $

PREFERENCE SHARES

C2

13 - 20

vs. Nonparticipating Participating

Dividends may exceed a

stated amount once

common shareholders

receive a dividend equal to

the preferred stated rate.

Dividends are limited to a

maximum amount each year.

The maximum is usually the

stated dividend rate.

(Normal case)

PREFERENCE SHARES

Reasons for Issuing Preference Shares

To raise capital without sacrificing control

To boost the return earned by ordinary shareholders

through financial leverage

To appeal to investors who may believe the ordinary

shares are too risky or that the expected return on

common stock is too low

C2

13 - 21

TREASURY SHARES

Treasury shares are a companys own shares

that have been acquired. Corporations might

acquire its own shares to:

1. Use their shares to buy other companies.

2. Avoid a hostile takeover.

3. Reissue to employees as compensation.

4. Support the market price.

P 3

13 - 22

PURCHASING TREASURY SHARES

Treasury shares are shown as a reduction in total

shareholders equity on the balance sheet.

Dr Cr

May 8 Treasury Shares-Ordinary 8,000

Cash 8,000

Purchase 2,000 treasury shares

at $4 per share.

On May 8, Whitt, Inc. purchased 2,000 of its own

shares in the open market for $4 per share.

P 3

13 - 23

SELLING TREASURY SHARES AT COST

Dr Cr

June 30 Cash 400

Treasury Shares-Ordinary 400

Sold 100 treasury shares

for $4 per share.

On June 30, Whitt sold 100 shares of

its treasury shares for $4 per share.

P 3

13 - 24

SELLING TREASURY SHARES

ABOVE COST

Dr Cr

July 19 Cash 4,000

Treasury Shares-Ordinary 2,000

Share Premium-Treasury Shares 2,000

Sold 500 treasury shares for $8 per share.

On July 19, Whitt, Inc. sold an additional 500

treasury shares for $8 per share.

P 3

13 - 25

SELLING TREASURY SHARES

BELOW COST

Dr Cr

Aug. 27 Cash 600

1,000

Treasury Shares-Ordinary 1,600

Sold 500 treasury shares for $1.50 per share.

Share Premium-Treasury Shares

On August 27, Whitt sold an additional 400

treasury shares for $1.50 per share.

P 3

13 - 26

STATEMENT OF COMPREHENSIVE INCOME

Statement of

Comprehensive

Income (SCI)

All non-owner

changes in equity +

other comprehensive

income

Can be 2 statements:

Income statement +

SCI

C3

13 - 27

STATEMENT OF CHANGES IN EQUITY

Statement of

Changes in

Equity (SCE)

All owner changes

in equity, including

changes in

accounting policies

Dividends

C3

13 - 28

RESERVES

Most reserves result from accounting standards

to reflect certain measurement changes in equity

rather than the income statement, e.g. asset

revaluation reserve, foreign currency translation

reserve and other statutory reserves.

Retained earnings also called revenue reserves.

Ending Retained Earnings =

Beginning Retained Earnings + Net Income Dividends

A companys cumulative net income less any net losses and

dividends declared since its inception.

C3

13 - 29

EARNINGS PER SHARE

Basic

earnings

per share

=

Net income - Preference dividends

Weighted-average ordinary shares outstanding

Earnings per share is one of the most widely

cited accounting statistics.

A 1

13 - 30

PRICEEARNINGS RATIO

Price

Earnings

Ratio

=

Market value per share

Earnings per share

This ratio reveals information about the stock

markets expectations for a companys future growth

in earnings, dividends, and opportunities.

A 2

13 - 31

DIVIDEND YIELD

Dividend

Yield

=

Annual cash dividends per share

Market value per share

Tells us the annual amount of cash dividends

distributed to ordinary shareholders relative to

the shares market price.

A 3

13 - 32

BOOK VALUE PER

ORDINARY SHARE

Book value per

ordinary share

=

Shareholders equity applicable

to ordinary shares

Number of ordinary

shares outstanding

Reflects the amount of shareholders equity

applicable to ordinary shares on a per share basis.

A 4

13 - 33

END OF CHAPTER 13

You might also like

- Lecture - 9 - Income - and - Equity - NUS ACC1002 2020 SpringDocument43 pagesLecture - 9 - Income - and - Equity - NUS ACC1002 2020 SpringZenyuiNo ratings yet

- Accounting For Corporations IIIDocument25 pagesAccounting For Corporations IIIibrahim mohamedNo ratings yet

- Stock Splits, Stock Dividends and Treasury Stock: in DepthDocument44 pagesStock Splits, Stock Dividends and Treasury Stock: in DepthAkash BafnaNo ratings yet

- RECORDING Shares 1 Issue & DividendsDocument4 pagesRECORDING Shares 1 Issue & DividendsDonald SNo ratings yet

- What We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingDocument39 pagesWhat We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingSunil Kumar SahooNo ratings yet

- Accounting For and Presentation of Owners' EquityDocument26 pagesAccounting For and Presentation of Owners' EquitydanterozaNo ratings yet

- Principles of Accounting Chapter 11Document41 pagesPrinciples of Accounting Chapter 11myrentistoodamnhigh100% (1)

- Accounting For Corporations IIDocument25 pagesAccounting For Corporations IIibrahim mohamedNo ratings yet

- Dividends and stockholders' equity quizDocument3 pagesDividends and stockholders' equity quizLLYOD FRANCIS LAYLAYNo ratings yet

- Chapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsDocument11 pagesChapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsMondy MondyNo ratings yet

- Accounting For Corporation - Retained EarningsDocument50 pagesAccounting For Corporation - Retained EarningsAlessandraNo ratings yet

- Chapter 13 SolutionsDocument45 pagesChapter 13 Solutionsaboodyuae2000No ratings yet

- The Corporate Form of OrganizationDocument7 pagesThe Corporate Form of OrganizationRabie HarounNo ratings yet

- Stock Splits, Stock Dividends and Treasury Stock: in DepthDocument44 pagesStock Splits, Stock Dividends and Treasury Stock: in DepthDaniella PhillipNo ratings yet

- Corporations Part 3Document20 pagesCorporations Part 3Miss LunaNo ratings yet

- Chapter 7 Stockholers Equity FinalDocument77 pagesChapter 7 Stockholers Equity FinalSampanna ShresthaNo ratings yet

- Retained Earnings, Treasury Stock, and The Income StatementDocument43 pagesRetained Earnings, Treasury Stock, and The Income Statementshiawsyan_chanNo ratings yet

- Chapter 13Document11 pagesChapter 13Maya HamdyNo ratings yet

- Dividends ERDocument11 pagesDividends ERMarian Salinas DacuroNo ratings yet

- Dividends PDFDocument41 pagesDividends PDFHarold EspirituNo ratings yet

- Chapter 10Document36 pagesChapter 103bazoNo ratings yet

- 2017 Class 16 EquityDocument35 pages2017 Class 16 EquityChandra Sekhar ChittineniNo ratings yet

- Week 05-06-Ch13 Accounting For Corporation-Old PPT-latest UpdateDocument55 pagesWeek 05-06-Ch13 Accounting For Corporation-Old PPT-latest UpdateziqingyeNo ratings yet

- Acct C.H.10Document6 pagesAcct C.H.10j8noelNo ratings yet

- CH 18: Dividend PolicyDocument55 pagesCH 18: Dividend PolicySaba MalikNo ratings yet

- Financial Accounting: Sources of Capital - Equity and DebtDocument25 pagesFinancial Accounting: Sources of Capital - Equity and DebtJHANVI LAKRANo ratings yet

- Retained Earnings and Treasury TransactionsDocument25 pagesRetained Earnings and Treasury TransactionsMark LouieNo ratings yet

- Confra - Retained EarningsDocument30 pagesConfra - Retained EarningsCharles LapizNo ratings yet

- ACC1002X Optional Questions - SOLUTIONS CHP 10Document5 pagesACC1002X Optional Questions - SOLUTIONS CHP 10edisonctrNo ratings yet

- Equity: Learning ObjectivesDocument32 pagesEquity: Learning ObjectivesAASNo ratings yet

- Corporations: Organization, Stock Transactions, and DividendsDocument37 pagesCorporations: Organization, Stock Transactions, and Dividendsjoseph christopher vicenteNo ratings yet

- Reporting and Analyzing Stockholders' EquityDocument3 pagesReporting and Analyzing Stockholders' EquityAreeba QureshiNo ratings yet

- IASSS16e Ch13.Ab - AzDocument28 pagesIASSS16e Ch13.Ab - AzLovely DungcaNo ratings yet

- Chapter 13Document13 pagesChapter 13Mondy MondyNo ratings yet

- Accounting, Unit 1 - Topic 2 (Students)Document64 pagesAccounting, Unit 1 - Topic 2 (Students)Teal Jacobs100% (1)

- Accounting For and Reporting of Preference SharesDocument19 pagesAccounting For and Reporting of Preference SharesAis Syang DyaNo ratings yet

- Bahan Ajar Dividen EpsDocument7 pagesBahan Ajar Dividen Epscalsey azzahraNo ratings yet

- Chapter 5investments in Equity SecutiriesDocument30 pagesChapter 5investments in Equity SecutiriesAngelica Joy ManaoisNo ratings yet

- Additional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionDocument36 pagesAdditional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionAiiny Nurul 'sinepot'No ratings yet

- Ch10&11. Shareholders' EquityDocument29 pagesCh10&11. Shareholders' EquityHazell DNo ratings yet

- Equity Markets Chapter 10 SummaryDocument36 pagesEquity Markets Chapter 10 SummaryMarwa HassanNo ratings yet

- Company AccountingDocument7 pagesCompany AccountingMsuBrainBoxNo ratings yet

- DividendsDocument12 pagesDividendsAhmed Abdelkader YossifNo ratings yet

- Accounting II Chapters 12, 13, 14 ReviewDocument10 pagesAccounting II Chapters 12, 13, 14 ReviewJacKFrost1889No ratings yet

- CH 11 Exam PracticeDocument20 pagesCH 11 Exam PracticeSvetlanaNo ratings yet

- Corporation Is: Separate Legal Entity Created by Law: Corporations and Stockholders EquityDocument25 pagesCorporation Is: Separate Legal Entity Created by Law: Corporations and Stockholders EquityDhafra Sanchez'sNo ratings yet

- Intermediate AccountingDocument69 pagesIntermediate AccountingYuan ZhongNo ratings yet

- Accounting Capital+Stock+TransactionsDocument17 pagesAccounting Capital+Stock+TransactionsOckouri BarnesNo ratings yet

- Chap 012Document39 pagesChap 012lunara_sNo ratings yet

- Common and Preferred Stock Chapter 13.....Document23 pagesCommon and Preferred Stock Chapter 13.....Muhammad Ayaz100% (1)

- FIN 201 Chapter 02 TheoryDocument24 pagesFIN 201 Chapter 02 TheoryAhmed ShantoNo ratings yet

- Common and Preferred StockDocument14 pagesCommon and Preferred StockMuhammad AyazNo ratings yet

- Chap 011Document125 pagesChap 011Shilpee Haldar MishraNo ratings yet

- Retained EarningsDocument6 pagesRetained EarningsLeslie FaustinoNo ratings yet

- Accounting Principles: Corporations: Dividends, Retained Earnings, and Income ReportingDocument55 pagesAccounting Principles: Corporations: Dividends, Retained Earnings, and Income ReportingWadood AhmedNo ratings yet

- Partial Text 2Document7 pagesPartial Text 2Spring000No ratings yet

- FIN 201 Chapter 02Document27 pagesFIN 201 Chapter 02ImraanHossainAyaanNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Nalysis OF Inancial TatementsDocument43 pagesNalysis OF Inancial TatementsBoo LeNo ratings yet

- Chap 1Document37 pagesChap 1Boo LeNo ratings yet

- Chap 16Document43 pagesChap 16Boo LeNo ratings yet

- Nvestments AND Nternational PerationsDocument34 pagesNvestments AND Nternational PerationsBoo LeNo ratings yet

- Chap 12Document38 pagesChap 12Boo LeNo ratings yet

- Ccounting Nformation YstemsDocument26 pagesCcounting Nformation YstemsBoo LeNo ratings yet

- Chap 8Document33 pagesChap 8Boo LeNo ratings yet

- Chap 9Document36 pagesChap 9Boo LeNo ratings yet

- Chap 11Document25 pagesChap 11Boo LeNo ratings yet

- Chap 14Document35 pagesChap 14Boo LeNo ratings yet

- Chap 6Document40 pagesChap 6Boo LeNo ratings yet

- A A P F S: Djusting Ccounts AND Reparing Inancial TatementsDocument39 pagesA A P F S: Djusting Ccounts AND Reparing Inancial TatementsBoo LeNo ratings yet

- Chap 10Document43 pagesChap 10Boo LeNo ratings yet

- Chap 2Document38 pagesChap 2Boo LeNo ratings yet

- Chap 4Document41 pagesChap 4Boo LeNo ratings yet

- Chap 1Document37 pagesChap 1Boo LeNo ratings yet

- Chap 5Document41 pagesChap 5Boo LeNo ratings yet

- Nalysis OF Inancial TatementsDocument43 pagesNalysis OF Inancial TatementsBoo LeNo ratings yet

- Building An SMB Ecommerce and Digital Marketplace: B2B Platform DesignDocument10 pagesBuilding An SMB Ecommerce and Digital Marketplace: B2B Platform Designsamiksha ayushNo ratings yet

- Amazon - Digital MarketingDocument11 pagesAmazon - Digital MarketingKartik Khandelwal100% (1)

- Cost & Management Accounting EssentialsDocument1 pageCost & Management Accounting EssentialsAkhand RanaNo ratings yet

- Acc CompilationDocument89 pagesAcc CompilationMehedi Hasan DurjoyNo ratings yet

- FAR2 BANK RECONCILIATION StudentDocument7 pagesFAR2 BANK RECONCILIATION StudentCHRISTIAN BETIANo ratings yet

- Acct Statement XX2938 16082023Document5 pagesAcct Statement XX2938 16082023Ganga YadavNo ratings yet

- Global Business School, Hubli - 580025Document58 pagesGlobal Business School, Hubli - 580025Anilkumar AnilNo ratings yet

- Logistik 1Document49 pagesLogistik 1endangNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2RajkumariNo ratings yet

- Customer Satisfaction SurveyDocument6 pagesCustomer Satisfaction SurveyNJ GAMINGNo ratings yet

- Operating Liquidity: Accounts Receivable Inventory Accounts PayableDocument4 pagesOperating Liquidity: Accounts Receivable Inventory Accounts PayableAman Kumar SharmaNo ratings yet

- Calculating Stock Returns, Risk Premiums, and Inflation AdjustmentsDocument0 pagesCalculating Stock Returns, Risk Premiums, and Inflation AdjustmentsJas Chy100% (1)

- Hkcee Economics - 3.5 Unit Subsidy - P.1Document3 pagesHkcee Economics - 3.5 Unit Subsidy - P.1peter wongNo ratings yet

- Factors Affecting Customers Using Modern Retail Stores in BangkokDocument5 pagesFactors Affecting Customers Using Modern Retail Stores in BangkokRahul GheewalaNo ratings yet

- Second Preboards in Auditing - Answer KeyDocument15 pagesSecond Preboards in Auditing - Answer KeyROMAR A. PIGANo ratings yet

- Appraisal - Cost ApproachDocument4 pagesAppraisal - Cost ApproachBaguma Grace GariyoNo ratings yet

- 2015-16 F.4 Form Test 2Document18 pages2015-16 F.4 Form Test 2廖籽藍No ratings yet

- Test Bank For Small Business Management Entrepreneurship and Beyond 5th Edition by HattenDocument14 pagesTest Bank For Small Business Management Entrepreneurship and Beyond 5th Edition by HattenMohammad Brazier100% (25)

- ALDI Growth Announcment FINAL 2.8Document2 pagesALDI Growth Announcment FINAL 2.8Shengulovski IvanNo ratings yet

- OPERATIONS MANAGEMENT - I: Nestle's Factory Sustainability & InvestmentsDocument11 pagesOPERATIONS MANAGEMENT - I: Nestle's Factory Sustainability & InvestmentsramanNo ratings yet

- SIP ReportDocument38 pagesSIP ReportPatel JigarNo ratings yet

- CH 1 MarketingDocument68 pagesCH 1 Marketinganwar muhammedNo ratings yet

- Resume - Hanif Srisubaga Alim - AugustDocument1 pageResume - Hanif Srisubaga Alim - Augustahmad syarifudin sukasihNo ratings yet

- Consumer Study of Paper Boat and Paper Boat Swing: By:-Ashish YadavDocument13 pagesConsumer Study of Paper Boat and Paper Boat Swing: By:-Ashish YadavAshish YadavNo ratings yet

- The State of Product Management Annual Report 2023Document34 pagesThe State of Product Management Annual Report 2023develisa.glendaNo ratings yet

- Joint Optimization NewDocument6 pagesJoint Optimization NewAbdur Rauf ShaikhNo ratings yet

- Jindi ShikhaDocument11 pagesJindi ShikhaShikha TickooNo ratings yet

- DMCC Company Regulations - Jan 2022 - V2Document79 pagesDMCC Company Regulations - Jan 2022 - V2Laila NadifNo ratings yet

- Assessment 2 (Case Study)Document6 pagesAssessment 2 (Case Study)Rishabh KulshreshthaNo ratings yet

- Digital Marketing Boosts Small Business ProfitsDocument13 pagesDigital Marketing Boosts Small Business ProfitsMJ Gomba AdriaticoNo ratings yet