Professional Documents

Culture Documents

Final Accounts Explained

Uploaded by

Piyush ShuklaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Accounts Explained

Uploaded by

Piyush ShuklaCopyright:

Available Formats

Final Accounts

2

Chapter Objectives

Identify the objectives of preparing various

final accounts

Understand the treatment of different items in

the preparation of the final accounts

Explain the importance of final accounts

Describe the role of worksheet in preparing

final accounts

September 20, 2014 Prof. Anuj Verma

3

Objectives of Final Accounts

Final accounts refer to the various accounts

and statements that provide information related

to the progress of the business.

These are prepared from the Trial Balance.

They provide the following information:

Profit earned or loss suffered by the business

during a particular accounting period

Financial position of the business

September 20, 2014 Prof. Anuj Verma

4

Accounts and Statements

Comprising Final Accounts

Final accounts with respect to a particular

business are:

Trading account

Profit and Loss account

Balance Sheet

Trading account and Profit and Loss account

are together known as income statements.

Income statements are the final summary of

the accounts that affect the profit and loss

position of the business.

September 20, 2014 Prof. Anuj Verma

5

Trading Account

It shows the overall results of purchasing and

selling of goods.

It includes all the direct expenses incurred in

the business.

It provides gross profit earned by the business,

if total sales is greater than total purchases.

It provides gross loss suffered by the business,

if total sales is less than total purchases.

September 20, 2014 Prof. Anuj Verma

6

Format of Trading Account

Trading Account

Dr. (For the period ended . . . . . . . . ) Cr.

Particulars Amount Particulars Amount

To Opening stock By Sales

To Purchases Less: Sales returns

Less: Purchases returns By Closing stock

To Wages

To Customs and import duty

To Carriage expenses

To Royalty

To Manufacturing expenses

To Packing expenses

Total Total

To gross profit transferred to

profit and loss account

By gross loss transferred

to profit and loss account

September 20, 2014 Prof. Anuj Verma

7

Items on Debit Side of Trading

Account

Opening stock: It refers to the total cost of goods left

unsold at the beginning of the current accounting

period.

Purchases: It refers to the total cost of goods

purchased, both in cash and credit. In case of

purchases returns, first net purchases is computed by

deducting purchases returns from purchases and the

result is then debited to the Trading account.

Wages: It refers to the amount paid to the workers for

manufacturing, loading and unloading of goods.

Customs and import duty: It refers to the amount

paid as customs and import duty when the goods are

purchased from outside the country.

September 20, 2014 Prof. Anuj Verma

8

Items on Debit Side of Trading

Account (cont)

Carriage expenses: It refers to the direct expenses

that are incurred while transferring the purchased

goods from vendor to the factory. These expenses are

also known as freight in, carriage in or cartage.

Royalty: It refers to the amount paid to the owner for

using his rights.

Manufacturing expenses: It refers to the expenses

spent on gas, electricity, water and fuel, which are

required to run the factory.

Packing expenses: It refers to the amount spent in

packing the purchased goods to bring them to factory.

September 20, 2014 Prof. Anuj Verma

9

Items on Credit Side of Trading

Account

Closing stock: It refers to the total cost of the goods

that are left unsold at the end of the accounting

period.

Sales: It refers to the total cost of goods sold, both in

cash and credit. In case of sales returns, first the net

sales is computed by deducting the sales returns from

total sales and the result is then credited to the

Trading account.

September 20, 2014 Prof. Anuj Verma

10

Importance of Trading Account

It provides information related to gross profit and loss

and helps in defining the upper limits for the

operating expenses of the business.

It helps in the computation of gross profit ratio. A

decrease in the gross profit ratio indicates increase in

the purchased cost or decrease in the selling price.

It allows the comparison of opening and closing

stocks of two accounting periods. This helps in

preventing unnecessary investment of funds for the

purchase of inventories.

September 20, 2014 Prof. Anuj Verma

11

Profit and Loss Account

Profit and Loss account shows all incomes and

indirect expenses related to business.

Indirect expenses include those expenses such

as administrative, selling and distribution

expenses that are required for the operation of

business.

Profit and Loss account provides net profit

earned or net loss suffered by the business.

September 20, 2014 Prof. Anuj Verma

12

Format of Profit and Loss Account

Profit and Loss Account

Dr. (For the period ended . . . . . . . . ) Cr.

Particulars Amount Particulars Amount

To Gross loss b/d By Gross profit b/d

To Salaries By Interest received

To Rent By Commission received

To Commission By Discount received

To Advertisements

To Bad debts

To Discount

To Net profit transferred to

Capital Account

To Net loss transferred to

Capital Account

Total Total

September 20, 2014 Prof. Anuj Verma

13

Items on Debit Side of Profit and

Loss Account

Gross loss: It is transferred from the Trading account.

Salaries: It refers to the amount paid to the

employees as their salaries.

Interest paid: It refers to the amount paid as interest

on loans.

Commission paid: It refers to the amount paid as

commission to the agents.

Trade expenses: It refers to the amount spent on

various number of small but important expenses

related to business.

September 20, 2014 Prof. Anuj Verma

14

Items on Debit Side of Profit and

Loss Account (cont)

Printing and stationary: It refers to the amount

spent on printing of bills, invoices, registers, files and

letter heads.

Advertisements: It refers to the amount spent for

attracting customers to buy the products.

Bad debts: It refers to the amount, which is not paid

by the debtors to whom the goods were sold on

credit.

Discount: It refers to the amount, which is reduced

from the list price of goods.

September 20, 2014 Prof. Anuj Verma

15

Items on Credit Side of Profit and

Loss Account

Gross profit: It is transferred from the Trading

account.

Interest received: It refers to the amount received as

interest on investments.

Commission received: It refers to the commission

earned by the business for giving business to others.

September 20, 2014 Prof. Anuj Verma

16

Importance of Profit and Loss

Account

It provides information about net profit earned or net

loss suffered by the business.

It helps in determining whether the business is being

run efficiently or not by comparing the Profit and

Loss account of two accounting periods.

It helps in taking effective control steps by analyzing

the various expenses listed in the Profit and Loss

account of the current year with that of the previous

years.

It allows in the estimation of profits for the coming

years by comparing the profits of previous years.

September 20, 2014 Prof. Anuj Verma

17

Balance Sheet

It is a financial statement that states the

financial position of the business.

It lists the assets and liabilities of a business on

a particular date.

The assets and liabilities on a Balance Sheet

are listed in either of the following two orders:

Liquidity order

Permanency order

September 20, 2014 Prof. Anuj Verma

18

Format of Balance Sheet

Balance Sheet

(As on . . . . . . . . . . . )

Liabilities Amoun

t

Assets Amount

Bank overdraft Cash in Hand

Outstanding expenses Cash at bank

Bills payable Prepaid expenses

Sundry creditors Bills receivables

Long-terms loans Sundry debtors

Capital Closing stock

Raw materials

Work-in-progress

Finished goods

Plant and machinery

Total Total

September 20, 2014 Prof. Anuj Verma

19

Items on Balance Sheet

The left side of Balance Sheet represents the

liabilities of the business.

Liabilities are the claims of the creditors

against the assets of a firm.

The two categories of liabilities are:

Current liabilities: The liabilities that are payable

within a year.

Fixed liabilities: The liabilities that are to be paid

at least after a year.

September 20, 2014 Prof. Anuj Verma

20

Items on Balance Sheet (cont)

The right side of Balance Sheet represents the

assets of the business.

Assets represents the resources acquired by the

business.

The categories of assets are:

Current assets: The assets that can be easily

convertible into cash.

Liquid assets: The assets that can be immediately

convertible into cash without any loss.

September 20, 2014 Prof. Anuj Verma

21

Items on Balance Sheet (cont)

Fixed assets: The assets that are acquired for

carrying out the business and are not meant for

resale.

Intangible assets: The assets like Goodwill and

patents that cannot be seen or touch.

Fictitious assets: The assets that are neither

tangible nor possess a property.

September 20, 2014 Prof. Anuj Verma

22

Adjustment Entries

These are the entries that are made at the end of an

accounting period after closing the books of accounts

and preparing Trail Balance.

Some of the adjustment entries that are required for

the preparation of final accounts are:

Closing stock

Outstanding expenses

Outstanding income

Income received in advance

Depreciation

Bad debts

Interest on capital

Interest on drawings

September 20, 2014 Prof. Anuj Verma

23

Summary

In this chapter, you have:

Identified the objectives of preparing various final

accounts

Understood the treatment of different items in the

preparation of the various final accounts

Explained the importance of various final accounts

September 20, 2014 Prof. Anuj Verma

September 20, 2014 Prof. Anuj Verma 24

Trial Balance of ABC&Co. as on 31 March,2014

Particulars Debit Balance Credit Balance

Opening Stock 1250

Sales 11800

Depreciation 667

Commission earned 211

Insurance 380

Carriage Inwards 300

Furniture 670

Printing Charges 481

Carriage Outwards 200

Capital 9228

Creditors 1780

Bills Payables 541

Plant & Machinery 6230

Returns outwards 1380

Cash 942

Salaries 750

Debtors 1905

Discount allowed 328

Bills Receivables 2730

Wages 1589

Returns Inwards 1659

Bank Overdraft 4000

Purchases 8679

Bad Debts 180

Total 28940 28940

September 20, 2014 Prof. Anuj Verma 25

Expenditure Amount Incomes Amount

Food & Beverages 15500 Sales 26000

Rent 1500

Profit 9000

26000 26000

Trading & Profit & Loss A/c for the year ending 31

July 2009

September 20, 2014 Prof. Anuj Verma 26

Liabilities Amount Assets Amount

Capital: Furniture 10500

Dev Gopal 20000 Utensils 9200

Dev Saran 20000 Equipments 6300

Profits 9000 Security Deposit 10500

Cash 2500

Bank 10000

49000 49000

Balance Sheet as on 31 July 2009

September 20, 2014 Prof. Anuj Verma 27

Particulars Amount Particulars Amount

Furniture 10500 Capital 40000

Utensils 9200 Sales 26000

Equipment 6300

Security Deposit 10500

Food & Beverages 15500

Rent 1500

Cash & Bank 12500

66000 66000

Cash & Bank A/c for the year ending 31 July 2009

September 20, 2014 Prof. Anuj Verma 28

Expenditure Amount Incomes Amount

Materials 150000 Sales 410000

Eatables 58000 Closing stock 10500

Gas & Fuel 36000

Wages 26000

Soft Drinks 60000

Rent 3000

Travelling 15000

Interest on Loan 2500

Miscellaneous 5000

Depreciation:

Uternsils 1840

Furniture 1050

Equipments 945

Profit 61165

420500 420500

Trading & Profit & Loss A/c for the year ending 31

July 2010

September 20, 2014 Prof. Anuj Verma 29

Liabilities Amount Assets Amount

Capital 70165 Furniture 9450

Bank Loan 11500 Utensils 7360

Equipments 5355

Security Deposit 10500

Closing stock 10500

Cash 38500

81665 81665

Balance Sheet as on 31 July 2010

September 20, 2014 Prof. Anuj Verma 30

Particulars Amount Particulars Amount

Materials 150000 Balance b/d 12500

Eatables 58000 Bank Loan 25000

Gas & Fuel 36000 Sales 410000

Wages 26000

Soft Drinks 60000

Rent 3000

Travelling 15000

Interest on Loan 2500

Miscellaneous 5000

Loan repaid 13500

Withdrawal 40000

Balance c/f 38500

447500 447500

Cash & Bank A/c for the year ending 31 July 2010

September 20, 2014 Prof. Anuj Verma 31

Expenditure Amount Incomes Amount

Opening stock 10500 Sales 770000

Materials 400000 Closing stock 18500

Gas & Fuel 50000

Wages 52400

Soft Drinks 84800

Rent 3000

Travelling 23200

Interest on Loan 1150

Miscellaneous 2800

operating 80000

Depreciation:

Uternsils 1472

Furniture 945

Equipments 803.25

Profit 77429.75

788500 788500

Trading & Profit & Loss A/c for the year ending 31

July 2011

September 20, 2014 Prof. Anuj Verma 32

Liabilities Amount Assets Amount

Capital 97595 Furniture 8505

Bank Loan 3500 Utensils 5888

o/s Wages 3600 Equipments 4552

Security Deposit 10500

Closing stock 18500

FD 30000

Cash 26750

104695 104695

Balance Sheet as on 31 July 2011

September 20, 2014 Prof. Anuj Verma 33

Particulars Amount Particulars Amount

Materials 400000 Balance b/d 38500

operating 80000 Sales 770000

Gas & Fuel 50000

Wages 48800

Soft Drinks 84800

Rent 3000

Travelling 23200

Interest on Loan 1150

Miscellaneous 2800

Loan repaid 8000

Withdrawal 50000

FD 30000

Balance c/f 26750

808500 808500

Cash & Bank A/c for the year ending 31 July 2011

September 20, 2014 Prof. Anuj Verma 34

September 20, 2014 Prof. Anuj Verma 35

September 20, 2014 Prof. Anuj Verma 36

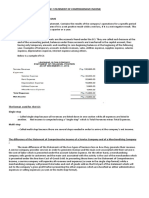

DINDORF COMPANY

Income Statement for the year ----.

Sales 716,935

Sales discounts -6,220

Net sales 710,715

Cost of goods sold 302,990

Depreciation 12,750

Sales salaries 109,325

Selling expense 24,900

Supplies expense 10,265

Insurance expense 4,660

Social Security taxes 9,600

Miscellaneous general expenses 31,000

Interest expense 13,030

Interest income 390

Net income 192,585

September 20, 2014 Prof. Anuj Verma 37

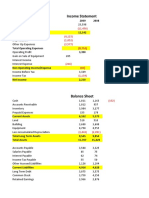

DINDORF COMPANY

Balance Sheet as of January 31, ----.

Liabilities Assets

Accounts payable 118,180 Cash and cash equivalent 119,115

Accrued interest 3,730 Accounts receivable 162,500

Accrued sales salaries 3,575 Merchandise inventory 397,690

Current liabilities 125,485 Supplies inventory 5,210

Prepaid insurance 33,590

Notes payable 143,000 Interest receivable 390

Total liabilities 268,485 Current assets 718,495

Owners Equity

Common stock 300,000 Store equipment 215,000

Retained earnings 314,960 Accumulated depreciation -50,050

Total liabilities

and owners equity 883,445 Total assets 883,445

September 20, 2014 Prof. Anuj Verma 38

Dr. Cr.

5000

5500

4000

500

4000

8000

2000

10000

19500 19500

Cash

Fixed Assets(at Cost)

Inventories

Owners' Equity

Total

Reserve for Doubtful Debts

Axis Corporation's accounts had the following beginning balances

Account

Accounts payable

Accounts Receivable

Accumulated Depreciation

TEST

Max. Time: 40 Mins. Max. Marks: 10

September 20, 2014 Prof. Anuj Verma 39

During the year following transactions occurred:

1. Purchased Inventory on credit Rs. 1500.

2. Salaries paid Rs. 1500.

3. Sold goods for cash Rs. 2000.

4. General expenses paid Rs. 1000.

5. Sold goods on credit Rs. 2500.

6. Collection of accounts receivables Rs. 1800.

7. Paid certain accounts payables Rs. 1500.

8. Closing balance of inventory Rs. 1000.

9. Depreciation Rs. 500.

10. Bad Debts during the year Rs. 300.

Que. 1. Set up ledger accounts and post beginning balances and transactions.

2. Prepare the Trial Balance.

3. Prepare the income statement for the period.

4. Prepare the ending Balance Sheet.

September 20, 2014 Prof. Anuj Verma 40

cash 1500 Op bal 5000

cl bal 5000 inv 1500

6500 6500

Accounts Payable

Op bal 5500 bad debts 300

Sales 2500 cash 1800

cl bal 5900

8000 8000

Accounts Receivable

Op bal 4000

cl bal 4500 Dep 500

4500 4500

Acc Dep

Op bal 500

cl bal 500

500 500

Res for Doudtful debts

Op bal 4000 salary 1500

Sales 2000 Gen exp 1000

A/c Rec 1800 a/c pay 1500

Cl bal 3800

7800 7800

Cash

September 20, 2014 Prof. Anuj Verma 41

Op bal 8000

Cl Bal 8000

8000 8000

Fixed Asset

Op bal 2000 COGS 2500

A/c Pay 1500 Cl bal 1000

3500 3500

Inventories

Op bal 1500

Cl Bal 1500

1500 1500

Salary

Cash 2000

cl bal 4500 A/c Rec 2500

4500 4500

Sales

Op bal 1000

Cl Bal 1000

1000 1000

General Exp

Accv Dep 500

Cl Bal 500

500 500

Depreciation

September 20, 2014 Prof. Anuj Verma 42

A/c Rec 300

Cl Bal 300

300 300

Bad debts

Inv 2500

Cl Bal 2500

2500 2500

COGS

September 20, 2014 Prof. Anuj Verma 43

Dr. Balance Cr. Balance

5000

5900

4500

500

3800

8000

1000

1500

4500

1000

500

300

2500

10000

24500 24500

Genearl Expenses

Depreciation

Bad Debts

COGS

Owners' Equity

Total

Reserve for Doubtful Debts

Cash

Fixed Asseta(cost)

Inventories

Salaries

Sales

Trial Balance

Particulars

Accounts Payables

Accountds Receivables

Accumulated Depreciation

September 20, 2014 Prof. Anuj Verma 44

Amount

4500

2500

1500

1000

500

300

-1300

Depreciation

Bad Debts

Net Loss

Income Statement

Particulars

Sales

COGS

Salaries

General Expenses

September 20, 2014 Prof. Anuj Verma 45

Amount

10000

-1300

8700

5000

500

14200

3500

5900

3800

1000

14200

Balance Sheet

Particulars

Owners' Equity

Net Loss

Net worth

Accounts Payables

Res. For Doudtful Debts

Total

Net Fixed Assets

Accounts Receivables

Cash

Inventories

Total

You might also like

- Understanding Business Accounting For DummiesFrom EverandUnderstanding Business Accounting For DummiesRating: 3.5 out of 5 stars3.5/5 (8)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Urban Water Partners Group ADocument5 pagesUrban Water Partners Group AAman jhaNo ratings yet

- Tally Erp.9Document50 pagesTally Erp.9Jancy Sunish100% (1)

- Trading and Profit Loss AccountDocument8 pagesTrading and Profit Loss AccountOrange Noida100% (1)

- Book Keeping MaterialsDocument64 pagesBook Keeping MaterialsAmanda Watson100% (1)

- Trading AccountDocument12 pagesTrading AccountVinay NaikNo ratings yet

- Fundamentals of PTNGN PDFDocument27 pagesFundamentals of PTNGN PDFEdfrance Delos Reyes0% (1)

- Due - Diligence Checklist - IPO (BOBCAP)Document42 pagesDue - Diligence Checklist - IPO (BOBCAP)vbhammer100% (2)

- TallyDocument180 pagesTallyAbhandra Chaudhary89% (19)

- Final Accounts:: Definition and ExplanationDocument22 pagesFinal Accounts:: Definition and ExplanationAmith LaddaNo ratings yet

- Tata Steel Complete Financial ModelDocument64 pagesTata Steel Complete Financial Modelsiddharth.nt923450% (2)

- Financial StatementsDocument20 pagesFinancial StatementsOmnath BihariNo ratings yet

- Quiz - Chapter 15 - Ppe Part 1 1Document4 pagesQuiz - Chapter 15 - Ppe Part 1 1Rheu Reyes20% (5)

- Equity AnalysisDocument51 pagesEquity Analysisvsnabde100% (3)

- Chapter 8 (Edt) Financial Management EventDocument25 pagesChapter 8 (Edt) Financial Management EventplanetrafeeNo ratings yet

- Week 3 - Corporate LiquidationDocument8 pagesWeek 3 - Corporate LiquidationJanna Mari FriasNo ratings yet

- Final Accounts Guidebook: Objectives, Statements & ImportanceDocument39 pagesFinal Accounts Guidebook: Objectives, Statements & ImportanceAnkit kumarNo ratings yet

- Final AccountsDocument23 pagesFinal AccountsRajat srivastavaNo ratings yet

- Financial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)Document7 pagesFinancial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)yashwini2827No ratings yet

- Final Accounts With Case Solution & Dindorf SolutionDocument39 pagesFinal Accounts With Case Solution & Dindorf SolutionRajat srivastavaNo ratings yet

- Accnts 2021-22Document24 pagesAccnts 2021-22Hari RamNo ratings yet

- Afm Research AssignmentDocument13 pagesAfm Research AssignmentNISHANo ratings yet

- Final AcountsDocument20 pagesFinal Acountskarthikeyan01No ratings yet

- Module 3 Final AccountsDocument31 pagesModule 3 Final Accountskaushalrajsinhjanvar427No ratings yet

- Topic 2 Acc EquationDocument27 pagesTopic 2 Acc EquationAmalMdIsaNo ratings yet

- Topic 2 Accounting EquationDocument27 pagesTopic 2 Accounting EquationHazmanRamleNo ratings yet

- Introduction to Accounting FundamentalsDocument73 pagesIntroduction to Accounting FundamentalsSneha ChhabraNo ratings yet

- Definition and Explanation:: Debit Side ItemsDocument17 pagesDefinition and Explanation:: Debit Side ItemsSovan NandyNo ratings yet

- Accounting For Managers - FinalDocument21 pagesAccounting For Managers - FinalAnuj SharmaNo ratings yet

- Binayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurDocument9 pagesBinayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurkunjapNo ratings yet

- Unit 3 Trading ConcernDocument13 pagesUnit 3 Trading ConcernBell BottleNo ratings yet

- AccountancyDocument45 pagesAccountancyBRISTI SAHANo ratings yet

- Test of Whether Something Is An Asset IsDocument9 pagesTest of Whether Something Is An Asset IsMehrose AhmedNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Final AccountsDocument9 pagesFinal AccountsJack Martin100% (1)

- Financial Accounting (1st Semester)Document143 pagesFinancial Accounting (1st Semester)ngodisha07No ratings yet

- ACCOUNTINGDocument2 pagesACCOUNTINGJustine Dela CruzNo ratings yet

- Financial Statement Theory Notes PDFDocument6 pagesFinancial Statement Theory Notes PDFAejaz MohamedNo ratings yet

- Fabm1 10Document14 pagesFabm1 10Francis Esperanza0% (1)

- FA 1st AssignmentDocument6 pagesFA 1st AssignmentMuhammad AyazNo ratings yet

- Acf100 New ImportantDocument10 pagesAcf100 New ImportantNikunjGuptaNo ratings yet

- Chapter 20Document30 pagesChapter 20soniadhingra1805No ratings yet

- Final Accounts NotesDocument6 pagesFinal Accounts NotesVinay K TanguturNo ratings yet

- Financial Statements SummaryDocument53 pagesFinancial Statements Summaryrachealll100% (1)

- 14 - Financial Statement - I (175 KB) PDFDocument21 pages14 - Financial Statement - I (175 KB) PDFramneekdadwalNo ratings yet

- Capital and Revenue Income and ExpenditureDocument31 pagesCapital and Revenue Income and ExpenditureMahesh Chandra Sharma100% (2)

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithNo ratings yet

- IGCSE ACCOUNTING NOTEsDocument5 pagesIGCSE ACCOUNTING NOTEsDehan YahatugodaNo ratings yet

- Accounting Terms: DirectionDocument5 pagesAccounting Terms: Directionkthesmart4No ratings yet

- VU Lesson 8Document5 pagesVU Lesson 8ranawaseem100% (1)

- Income Statement & Balance Sheet-1Document18 pagesIncome Statement & Balance Sheet-1Shreyasi RanjanNo ratings yet

- Final Accounts AdjustmentsDocument48 pagesFinal Accounts AdjustmentsArsalan QaziNo ratings yet

- Account Titles and ExplanationDocument4 pagesAccount Titles and ExplanationKaye VillaflorNo ratings yet

- Accounting Fundamentals ExplainedDocument17 pagesAccounting Fundamentals ExplainedRaji rajiNo ratings yet

- Chapter 4 Final Accounts PDFDocument32 pagesChapter 4 Final Accounts PDFkamalkavNo ratings yet

- Trading and Profit Loss MCQDocument4 pagesTrading and Profit Loss MCQMohitTagotraNo ratings yet

- Commerce McqsDocument10 pagesCommerce McqsAb GondalNo ratings yet

- (Chapter 1) Accounting Basics and DefinitionsDocument7 pages(Chapter 1) Accounting Basics and DefinitionsHassan AsgharNo ratings yet

- 8 Financial StatementDocument11 pages8 Financial StatementLin Latt Wai AlexaNo ratings yet

- DialogonenninglnnsnInformendenPresupuesto 656053795895abaDocument6 pagesDialogonenninglnnsnInformendenPresupuesto 656053795895abaCONSTRUPETROLNo ratings yet

- CashflowDocument6 pagesCashflowAizia Sarceda Guzman71% (7)

- V ST Francis Square RealtyDocument39 pagesV ST Francis Square Realtyjessica crisostomoNo ratings yet

- Depreciation, ProvisionDocument37 pagesDepreciation, ProvisionSandhyaSharma100% (1)

- 07 Sample PaperDocument42 pages07 Sample Papergaming loverNo ratings yet

- REXEL SA - Research Report - FinalDocument6 pagesREXEL SA - Research Report - FinalGlen BorgNo ratings yet

- Mindray Corporate PPT Final 582013Document25 pagesMindray Corporate PPT Final 582013lobna salahNo ratings yet

- Bulgari Group Q1 2011 Results: May 10th 2011Document10 pagesBulgari Group Q1 2011 Results: May 10th 2011sl7789No ratings yet

- Cambridge O Level Principles of Accounts (7110) : International Accounting Standards (IAS) Guidance For TeachersDocument26 pagesCambridge O Level Principles of Accounts (7110) : International Accounting Standards (IAS) Guidance For TeacherspalashndcNo ratings yet

- Cash Flow SolvedDocument3 pagesCash Flow SolvedRahul BindrooNo ratings yet

- Final ProposalDocument29 pagesFinal ProposalGizaw ZelelewNo ratings yet

- Fundamentals Accounting1Document6 pagesFundamentals Accounting1Hazelle CarmeloNo ratings yet

- Smu Account Assignment SolvedDocument323 pagesSmu Account Assignment SolvedAnupam Rana100% (1)

- Parts of The Feasibility Study: 1. Swot AnalysisDocument25 pagesParts of The Feasibility Study: 1. Swot AnalysisJayCee San MartinNo ratings yet

- Indirect Method Cash Flow Statement for Hill CompanyDocument6 pagesIndirect Method Cash Flow Statement for Hill CompanyJessbel MahilumNo ratings yet

- Vo 11 GXDocument33 pagesVo 11 GXRichard OonNo ratings yet

- A 4.5 FM Notes UNIT 1-2-3Document28 pagesA 4.5 FM Notes UNIT 1-2-3Gaurav vaidyaNo ratings yet

- NFP Assignment SolutionDocument2 pagesNFP Assignment SolutionHabte DebeleNo ratings yet

- CWIP PolicyDocument6 pagesCWIP Policyeswaran69No ratings yet

- Case For Final ExamDocument9 pagesCase For Final ExamMai TranNo ratings yet

- PPE Government Grant Borrowing Cost Intangible AssetsDocument7 pagesPPE Government Grant Borrowing Cost Intangible AssetsLian Garl100% (4)

- AZ Poultry Business PlanDocument39 pagesAZ Poultry Business PlanAbdul HameedtopedgeNo ratings yet

- Investment Incentives For Tourism IndustryDocument27 pagesInvestment Incentives For Tourism Industryqhaibey100% (3)

- BFIN Week Wewe 1-9 11-18Document52 pagesBFIN Week Wewe 1-9 11-18Mark Louie SuarezNo ratings yet

- Financial Management Practice Manual (FMPM)Document13 pagesFinancial Management Practice Manual (FMPM)Muhammad YahyaNo ratings yet