Professional Documents

Culture Documents

CH 01

Uploaded by

sonatalennyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 01

Uploaded by

sonatalennyCopyright:

Available Formats

John Wiley & Sons, Inc.

Financial Accounting, 4e

Weygandt, Kieso, & Kimmel

Prepared by

Gregory K. Lowry

Mercer University

Marianne Bradford

The University of Tennessee

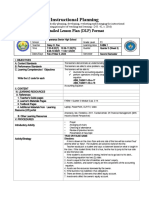

1 Explain the meaning of accounting.

2 Identify the users and uses of accounting.

3 Understand why ethics is a fundamental business

concept.

4 Explain the meaning of generally accepted

accounting principles and the cost principle.

After studying this chapter, you should be able to:

CHAPTER 1

ACCOUNTING

IN ACTION

5 Explain the meaning of the monetary unit

assumption and the economic entity

assumption.

6 State the basic accounting equation and

explain the meaning of assets, liabilities, and

stockholders equity.

7 Analyze the effect of business transactions on

the basic accounting equation.

8 Understand what the four financial

statements are and how they are prepared.

After studying this chapter, you should be able to:

CHAPTER 1

ACCOUNTING

IN ACTION

Accounting

in Action

Ethics - a fundamental

business concept

Generally accepted

accounting principles

Assumptions

Basic accounting

equation

Transaction analysis

Summary of

transactions

Who uses accounting

data?

Brief history of

accounting

Bookkeeping and

accounting

Accounting and you

The accounting

profession

What is

Accounting?

PREVIEW OF CHAPTER 1

Financial

Statements

The Building

Blocks

of Accounting

Using the

Building

Blocks

Income statement

Retained Earnings

statement

Balance sheet

Statement of cash

flows

Accounting is a process of three activities:

1 Identifying

2 Recording

3 Communicating

WHAT IS ACCOUNTING?

Identification

Select economic events

(transactions)

Recording

Record, classify

and summarize

Accounting

Reports

SOFTBYTE

Annual Report

Prepare

accounting

reports

Analyze and interpret

for users

Communication

ILLUSTRATION 1-1

ACCOUNTING PROCESS

QUESTIONS ASKED BY

INTERNAL USERS

Is cash sufficient to pay bills?

Can we afford to give

employee pay raises this year?

What is the cost of

manufacturing each unit of

product?

Which product line is the most

profitable?

QUESTIONS ASKED BY

EXTERNAL USERS

Is the company earning

satisfactory income?

Will the company be

able to pay its debts as

they come due?

How does the company

compare in size and

profitability with

competitors?

BOOKKEEPING DISTINGUISHED

FROM ACCOUNTING

Accounting

1 Includes bookkeeping

2 Also includes much more

Bookkeeping

1 Involves only the recording of economic events

2 Is just one part of accounting

Ethics - standards of conduct by which ones

actions are judged as right or wrong, honest or

dishonest.

Generally Accepted Accounting Principles -

primarily established by the Financial

Accounting Standards Board and the Securities

and Exchange Commission.

Assumptions:

1 Monetary unit - only transaction data that

can be expressed in terms of money is

included in the accounting records.

2 Economic entity - includes any

organization or unit in society.

THE BUILDING BLOCKS

OF ACCOUNTING

1. Recognize an ethical situation and the ethical

issues involved.

Use your personal ethics to identify ethical

situations and issues. Some businesses and

professional organizations provide written codes

of ethics for guidance in some business situations.

ILLUSTRATION 1-4

STEPS IN ANALYZING ETHICS CASES

SOLVING AN ETHICAL DILEMMA

ALT #1

ALT #2

2. Identify and analyze the principal elements in

the situation.

Identify the stakeholders - persons or groups who

may be harmed or benefited. Ask the question:

What are the responsibilities and obligations of

the parties involved?

ILLUSTRATION 1-4

STEPS IN ANALYZING ETHICS CASES

SOLVING AN ETHICAL DILEMMA

ALT #1

ALT #2

3. Identify the alternatives, and weigh the impact

of each alternative on various stakeholders.

Select the most ethical alternative, considering all

the consequences. Sometimes there will be one

right answer. Other situations involve more than

one right solution; these situations require an

evaluation of each and a selection of the best

alternative.

ILLUSTRATION 1-4

STEPS IN ANALYZING ETHICS CASES

SOLVING AN ETHICAL DILEMMA

ALT #1

ALT #2

BUSINESS ENTERPRISES

A business owned by one person is generally a

proprietorship.

A business owned by two or more persons

associated as partners is a partnership.

A business organized as a separate legal entity

under state corporation law and having

ownership divided into transferable shares of

stock is called a corporation.

The Basic Accounting Equation

ILLUSTRATION 1-5

THE BASIC ACCOUNTING EQUATION

Assets = Liabilities + Stockholders

Equity

ASSETS AS A

BUILDING BLOCK

Assets are resources owned by a business.

They are things of value used in carrying out

such activities as production, consumption and

exchange.

The common characteristics possessed by all

assets is the capacity to provide future services

or benefits to the entities that use them.

LIABILITIES AS A

BUILDING BLOCK

Liabilities are claims against assets.

They are existing debts and obligations.

Most claims of creditors attach to total

enterprise assets rather than to the

specific assets provided by the creditor.

STOCKHOLDERS EQUITY

AS A BUILDING BLOCK

The ownership claim on total assets is

known as stockholders equity.

It is equal to total assets minus total

liabilities.

The stockholders equity section of a

corporations balance sheet consists of:

1 Paid-in (contributed) capital

2 Retained earnings

PAID-IN CAPITAL AS

A BUILDING BLOCK

Paid-in capital is the term used to describe

the total amount paid in by stockholders.

The principal source of paid-in-capital is

the investment of cash and other assets in

the corporation by stockholders in

exchange for capital stock.

The retained earnings section of the balance

sheet is determined by three items:

1 Revenues

2 Expenses

3 Dividends

RETAINED EARNINGS AS

A BUILDING BLOCK

REVENUES AS A

BUILDING BLOCK

Revenues are the gross increases in

stockholders equity that result from

operating the business.

Generally, revenues result from the sale

of merchandise, the performance of

services, the rental of property, or the

lending of money.

Revenues usually result in an increase in

an asset.

EXPENSES AS A

BUILDING BLOCK

Expenses are the decreases in stockholders

equity that result from operating the business.

They are the cost of assets consumed or

services used in the process of earning revenue.

Examples of expenses include utility expense,

rent expense, supplies expense, and tax

expense.

When revenues exceed expenses, net income

results.

When expenses exceed revenues, a net loss

results.

DIVIDENDS

Net income represents an increase in net

assets which then become available for

distribution to stockholders.

Cash or other assets that are distributed

to stockholders are called dividends.

Dividends reduce retained earnings but

are not corporate expenses.

A corporation decides whether or not to

distribute a dividend after determining its

net income or net loss.

INCREASE DECREASE

Investments by

Stockholders

Revenues

Stockholders

Equity

Dividends to

Stockholders

Expenses

ILLUSTRATION 1-6

INCREASES AND DECREASES IN

STOCKHOLDERS EQUITY

Transactions are the economic events of the

enterprise.

They may be identified as external or internal.

1 External transactions involve economic events

between the company and some outside

enterprise or party.

2 Internal transactions are economic events that

occur entirely within one company.

USING THE BUILDING BLOCKS

TRANSACTION ANALYSIS

We need ten

cases by

Friday

My division

needs 2,500

pounds from

your division

Ray and Barbara Neal decide to open a computer

programming company to be incorporated as

Softbyte, Inc.

They invest $15,000 cash in exchange for $15,000

of common stock.

TRANSACTION ANALYSIS

TRANSACTION 1

There is an increase in the asset Cash, $15,000,

and an equal increase in the stockholders

equity, Common Stock, $15,000.

TRANSACTION ANALYSIS

TRANSACTION 1 SOLUTION

(1) +15,000 = +15,000 Investment

Assets = Liabilities + Stockholders Equity

Common

Cash Stock

TRANSACTION ANALYSIS

TRANSACTION 2

Softbyte purchases computer equipment for $7,000 cash.

Cash is decreased $7,000 and the asset

Equipment is increased $7,000.

TRANSACTION ANALYSIS

TRANSACTION 2 SOLUTION

= Stock

+ $7,000 =

(2) -7,000 +$7,000

Assets = Liabilities +

Stockholders

Common

Cash + Equipment

Old Bal. $15,000 $15,000

New Bal. $ 8,000 $15,000

$15,000

Equity

Softbyte purchases computer paper and other

supplies expected to last several months from

Acme Supply Company for $1,600.

Acme Supply Company agrees to allow Softbyte

to pay this bill in October, a month later.

This transaction is often referred to as a purchase

on account or a credit purchase.

TRANSACTION ANALYSIS

TRANSACTION 3

Acme Supply Company

Softbyte, Inc.

The asset Supplies is increased $1,600 and the liability

Accounts Payable is increased by the same amount.

TRANSACTION ANALYSIS

TRANSACTION 3 SOLUTION

+ = +

$16,600

(3) +$1,600 +$1,600

Assets = Liabilities + Equity

Accounts Common

Cash + Supplies + Equipment = Payable + Stock

Old Bal. $8,000 $7,000 $15,000

New Bal. $8,000 $1,600 + $7,000 $1,600 $15,000

$16,600

Stockholders

Softbyte receives $1,200 cash from customers for

programming services it has provided.

This transaction represents the principal

revenue-producing activity of Softbyte.

TRANSACTION ANALYSIS

TRANSACTION 4

Softbyte, Inc.

Cash is increased $1,200 and Retained

Earnings is increased $1,200.

Assets = Liabilities + Stockholders Equity

Accounts Common

Cash + Supplies + Equipment = Payable + Stock

Old Bal. $8,000 $1,600 $7,000 $1,600 $15,000

New Bal. $9,200 + $1,600 + $7,000 = $1,600 + $15,000

$17,800 $17,800

Retained

Earnings

$1,200

TRANSACTION ANALYSIS

TRANSACTION 4 SOLUTION

(4) +1,200 +1,200 Service

Revenue

Softbyte receives a bill for $250 from the Daily News

for advertising the opening of its business but

postpones payment of the bill until a later date.

Softbyte, Inc.

Daily

New

s

Bill

TRANSACTION ANALYSIS

TRANSACTION 5

Accounts Payable is increased $250, and

Retained Earnings is decreased $250.

TRANSACTION ANALYSIS

TRANSACTION 5 SOLUTION

Assets = Liabilities +

Accounts

Cash + Supplies + Equipment = Payable +

Old Bal. $9,200 $1,600 $7,000 $1,600 $15,000

New Bal. $9,200 + $1,600 + $7,000 = $1,850 + $15,000

$17,800

$17,800

Stockholders Equity

Common

Stock

Retained

Earnings

$ 950

$1,200

(5) +250 -250 Advertising

Expense

Softbyte provides programming services of $3,500

for customers.

Cash amounting to $1,500 is received from

customers, and the balance of $2,000 is billed to

customers on account.

Softbyte, Inc.

Bill

TRANSACTION ANALYSIS

TRANSACTION 6

Accounts Accounts Common Retained

Cash + Receivable + Supplies + Equipment = Payable + Stock + Earnings

Old Bal. $ 9,200 $1,600 $7,000 $1,850 $15,000 $ 950

New Bal. $10,700 + $2,000 + $1,600 + $7,000 = $1,850 + $15,000 + $4,450

(6) +1,500 +2,000 +3,500 Service

Revenue

Cash is increased $1,500; Accounts Receivable is increased

$2,000; and Retained Earnings is increased $3,500.

TRANSACTION ANALYSIS

TRANSACTION 6 SOLUTION

Stockholders Equity Assets = Liabilities +

$21,300 $21,300

Expenses paid in cash for September are store rent,

$600, salaries of employees, $900, and utilities, $200.

Softbyte, Inc.

$600

$900

$200

TRANSACTION ANALYSIS

TRANSACTION 7

Accounts Accounts Common Retained

Cash + Receivable + Supplies + Equipment = Payable + Stock + Earnings

Old Bal. $10,700 $2,000 $1,600 $7,000 $1,850 $15,000 $4,450

New Bal. $ 9,000 + $2,000 + $1,600 + $7,000 = $1,850 + $15,000 + $2,750

(7) -1,700 -600 Rent

-900 Salaries

-200 Utilities

Cash is decreased $1,700 and Retained Earnings

is decreased by $1,700.

TRANSACTION ANALYSIS

TRANSACTION 7 SOLUTION

Stockholders Equity Assets = Liabilities +

$19,600 $19,600

Softbyte pays its Daily News advertising bill of $250

in cash.

Softbyte, Inc.

Daily

New

s

TRANSACTION ANALYSIS

TRANSACTION 8

TRANSACTION ANALYSIS

TRANSACTION 8 SOLUTION

Stockholders Equity Assets = Liabilities +

(8) -250 -250

Accounts Accounts Common Retained

Cash + Receivable + Supplies + Equipment = Payable + Stock + Earnings

Old Bal. $9,000 $2,000 $1,600 $7,000 $1,850 $15,000 $2,750

New Bal. $8,750 + $2,000 + $1,600 + $7,000 = $1,600 + $15,000 + $2,750

Cash is decreased $250 and Accounts Payable is decreased

by $250.

$19,350 $19,350

The sum of $600 in cash is received from customers

who have previously been billed for services in

Transaction 6.

TRANSACTION ANALYSIS

TRANSACTION 9

Softbyte, Inc.

(9) +600 -600

Accounts Accounts Common Retained

Cash + Receivable + Supplies + Equipment = Payable + Stock + Earnings

Old Bal. $8,750 $2,000 $1,600 $7,000 $1,600 $15,000 $2,750

New Bal. $9,350 + $1,400 + $1,600 + $7,000 = $1,600 + $15,000 + $2,750

TRANSACTION ANALYSIS

TRANSACTION 9 SOLUTION

Cash is increased $600 and Accounts Receivable

is decreased by the same amount.

Stockholders Equity Assets = Liabilities +

$19,350 $19,350

The corporation pays a dividend of $1,300 in

cash to Ray and Barbara Neal, the stockholders

of Softbyte, Inc.

Softbyte, Inc.

$1,300

TRANSACTION ANALYSIS

TRANSACTION 10

Cash is decreased $1,300 and Stockholders Equity is

decreased by the same amount.

TRANSACTION ANALYSIS

TRANSACTION 10 SOLUTION

Accounts Accounts Common Retained

Cash + Receivable + Supplies + Equipment = Payable + Stock + Earnings

Old Bal. $9,350 $1,400 $1,600 $7,000 $1,600 $15,000 $2,750

New Bal. $8,050 + $1,400 + $1,600 + $7,000 = $1,600 + $15,000 + $1,450

Stockholders Equity Assets = Liabilities +

$18,050 $18,050

(10) -1,300 -1,300 Dividends

FINANCIAL STATEMENTS

After transactions are identified, recorded, and summarized,

four financial statements are prepared from the summarized

accounting data:

1 An income statement presents the revenues and expenses

and resulting net income or net loss of a company for a

specific period of time.

2 A retained earnings statement summarizes the changes in

retained earnings for a specific period of time.

3 A balance sheet reports the assets, liabilities, and

stockholdersequity of a business enterprise at a specific

date.

4 A statement of cash flows summarizes information

concerning the cash inflows (receipts) and outflows

(payments) for a specific period of time.

SOFTBYTE, INC.

Income Statement

For the Month Ended September 30, 2002

Revenues

Service revenue $ 4,700

Expenses

Salaries expense $ 900

Rent expense 600

Advertising expense 250

Utilities expense 200

Total expenses 1,950

Net income

SOFTBYTE, INC.

Retained Earnings Statement

For the Month Ended September 30, 2002

Retained earnings, September 1 $ 0

Add: Net income

2,750

Less: Dividends 1,300

Retained earnings, September 30 $ 1,450

ILLUSTRATION 1-9 FINANCIAL

STATEMENTS AND THEIR INTERRELATIONSHIPS

Net

income of

$2,750

shown on

the

income

statement

is added

to the

beginning

balance of

retained

earnings

in the

retained

earnings

statement.

Net income

of $2,750 is

determined

from the

information

in the

retained

earnings

column of

the

Summary of

Transactions

(Illustration

1-8).

$ 2,750

2,750

SOFTBYTE, INC.

Retained Earnings Statement

For the Month Ended September 30, 2002

Retained earnings, September 1 $ 0

Add: Net income 2,750

2,750

Less: Dividends 1,300

Retained earnings, September 30

SOFTBYTE, INC.

Balance Sheet

September 30, 2002

Assets

Cash $ 8,050

Accounts receivable 1,400

Supplies 1,600

Equipment 7,000

Total assets $ 18,050

Liabilities and Stockholders Equity

Liabilities

Accounts payable $ 1,600

Stockholders equity

Common stock $ 15,000

Retained earnings 16,450

Total liabilities and stockholders equity $ 18,050

Retained

earnings of

$1,450 at the

end of the

reporting

period

shown in the

retained

earnings

statement is

shown on

the balance

sheet.

The retained

earnings of

$1,450 at the

end of the

reporting period

is shown as the

final total of the

retained

earnings column

of the Summary

of Transactions

(Illustration

1-8).

ILLUSTRATION 1-9 FINANCIAL

STATEMENTS AND THEIR INTERRELATIONSHIPS

$ 1,450

1,450

SOFTBYTE, INC.

Balance Sheet

September 30, 2002

Assets

Cash

Accounts receivable 1,400

Supplies 1,600

Equipment 7,000

Total assets $ 18,050

Liabilities and Stockholders Equity

Liabilities

Accounts payable $ 1,600

Stockholders equity

Common stock $ 15,000

Retained earnings 1,450 16,450

Total liabilities and stockholders equity $ 18,050

SOFTBYTE, INC.

Statement of Cash Flows

For the Month Ended September 30, 2002

Cash flows from operating activities

Cash receipts from revenues $ 3,300

Cash payments for expenses (1,950)

Net cash provided by operating activities 1,350

Cash flows from investing activities

Purchase of equipment (7,000)

Cash flows from financing activities

Sale of common stock $ 15,000

Payment of cash dividends (1,300) 13,700

Net increase in cash 8,050

Cash at the beginning of the period 0

Cash at the end of the period

Cash of $8,050 on

the balance sheet

is reported on the

statement of cash

flows.

Cash of $8,050

on the balance

sheet and

statement of cash

flows is shown as

the final total of

the cash column

of the Summary

of Transactions

(Illustration 1-8).

ILLUSTRATION 1-9 FINANCIAL

STATEMENTS AND THEIR INTERRELATIONSHIPS

$ 8,050

$8,050

APPENDIX A

THE ACCOUNTING PROFESSION

In public accounting, you would offer

expert service to the general public.

Areas of public accounting:

Auditing

Taxation

Management consulting

APPENDIX A

THE ACCOUNTING PROFESSION

In private (managerial) accounting, you would

be involved in one of the following activities:

General accounting

Cost accounting

Budgeting

Accounting information systems

Tax accounting

Internal auditing

APPENDIX A

THE ACCOUNTING PROFESSION

Not-for profit organizations also need

sound financial reporting and control.

Donors want information about how well

the organization has met its objectives and

whether continued support is justified.

Hospitals and colleges must make decisions

about the allocation of funds.

Governmental units must provide

information to citizens, employees,

creditors and legislators.

COPYRIGHT

Copyright 2003 John Wiley & Sons, Inc. All rights reserved. Reproduction or

translation of this work beyond that named in Section 117 of the 1976 United

States Copyright Act without the express written consent of the copyright owner is

unlawful. Request for further information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. The purchaser may make back-up copies

for his/her own use only and not for distribution or resale. The Publisher assumes

no responsibility for errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.

CHAPTER 1

ACCOUNTING IN ACTION

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bsbfia401 2Document2 pagesBsbfia401 2nattyNo ratings yet

- St. Saviour's ULURP LetterDocument3 pagesSt. Saviour's ULURP LetterChristina WilkinsonNo ratings yet

- IAS 2 Inventories SummaryDocument16 pagesIAS 2 Inventories SummaryCorinne GohocNo ratings yet

- Principles of Economics - 1 - 2Document81 pagesPrinciples of Economics - 1 - 2KENMOGNE TAMO MARTIALNo ratings yet

- Govt ch3Document21 pagesGovt ch3Belay MekonenNo ratings yet

- SIC 31 GuidanceDocument4 pagesSIC 31 GuidanceFrancisCzeasarChuaNo ratings yet

- DLP Fundamentals of Accounting 1 - Q3 - W3Document5 pagesDLP Fundamentals of Accounting 1 - Q3 - W3Daisy PaoNo ratings yet

- Balaji Wafers (FINAL)Document38 pagesBalaji Wafers (FINAL)Urja BhavsarNo ratings yet

- LECTURE-03c Source of CapitalsDocument55 pagesLECTURE-03c Source of CapitalsNurhayati Faiszah IsmailNo ratings yet

- 2022 PDFDocument2 pages2022 PDFPreeti VirmaniNo ratings yet

- Competency Framework SMA-FINALDocument39 pagesCompetency Framework SMA-FINALAbubakar IsmailNo ratings yet

- Government AccountsDocument36 pagesGovernment AccountskunalNo ratings yet

- Entrepreneurial India: An Overview of Pre - Post Independence and Contemporary Small-Scale EnterprisesDocument8 pagesEntrepreneurial India: An Overview of Pre - Post Independence and Contemporary Small-Scale EnterprisesInternational Journal of Creative Mathematical Sciences and TechnologyNo ratings yet

- Bank StatementDocument1 pageBank StatementLatoya WilsonNo ratings yet

- KnightFrank - India Real Estate H2 2020Document150 pagesKnightFrank - India Real Estate H2 2020Swanand KulkarniNo ratings yet

- School Year 2021 ScheduleDocument35 pagesSchool Year 2021 ScheduleThảo NgọcNo ratings yet

- Creating A BudgetDocument2 pagesCreating A BudgetLaci NunesNo ratings yet

- Airbus A3XX PowerpointDocument31 pagesAirbus A3XX PowerpointRashidNo ratings yet

- Tax Invoice: (Original For Recipient)Document3 pagesTax Invoice: (Original For Recipient)Apurv MathurNo ratings yet

- Keputusan Lokasi Fasilitas Dalam Jaringan DistribusiDocument44 pagesKeputusan Lokasi Fasilitas Dalam Jaringan DistribusiEman Muhammad AriefNo ratings yet

- Risk Appetite Framework for South African InstituteDocument19 pagesRisk Appetite Framework for South African Institutemuratandac3357No ratings yet

- Jun 2004 - Qns Mod BDocument13 pagesJun 2004 - Qns Mod BHubbak Khan100% (1)

- LUV Financial Solutions TOB v2.2 - Consumer Direct - FeeDocument1 pageLUV Financial Solutions TOB v2.2 - Consumer Direct - FeeFreddie WilliamsNo ratings yet

- Accountancy: Class: XiDocument8 pagesAccountancy: Class: XiSanskarNo ratings yet

- Batumi State Maritime Academy Faculty of Navigation: Makharadze Handmade GuitarsDocument15 pagesBatumi State Maritime Academy Faculty of Navigation: Makharadze Handmade GuitarsSulxani NataridzeNo ratings yet

- Creating Value in Service EconomyDocument34 pagesCreating Value in Service EconomyAzeem100% (1)

- Philippine Corporation Code and Business Laws OverviewDocument131 pagesPhilippine Corporation Code and Business Laws OverviewEdrian CabagueNo ratings yet

- Calculate Simple Interest Future and Present ValuesDocument21 pagesCalculate Simple Interest Future and Present ValuesアンジェロドンNo ratings yet

- Procurement Manager - Projects - Swiber Offshore Construction Pte LTDDocument2 pagesProcurement Manager - Projects - Swiber Offshore Construction Pte LTDparthibanemails5779No ratings yet

- Chapter 2 - Consumer BehaviourDocument95 pagesChapter 2 - Consumer BehaviourRt NeemaNo ratings yet