Professional Documents

Culture Documents

Acconting Canedian Universty

Uploaded by

SherifEl-Shaarawi0 ratings0% found this document useful (0 votes)

28 views42 pagesAccounting is the information system that: measures business activity, processes the data into reports, communicates the results to decision makers. A key product of accounting is a set of reports called financial statements.

Original Description:

Original Title

ACCONTING CANEDIAN UNIVERSTY.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting is the information system that: measures business activity, processes the data into reports, communicates the results to decision makers. A key product of accounting is a set of reports called financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views42 pagesAcconting Canedian Universty

Uploaded by

SherifEl-ShaarawiAccounting is the information system that: measures business activity, processes the data into reports, communicates the results to decision makers. A key product of accounting is a set of reports called financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 42

Objective 1: Define Accounting Vocabulary:

Accounting is the language of business.

Accounting is the information system that:

** measures business activity,

** processes the data into reports,

** communicates the results to decision makers, and

** Presents information in monetary terms.

A key product of accounting is a set of reports called

financial statements.

Objective 2: Define The Users of Financial

Information:

Accounting can be divided into two fields:

(A) Financial Accounting:

Financial accounting provides information for external

decision makers, such as:

** Investors.

** Creditors.

** Taxing Authorities.

** Customers.

** Suppliers.

(B) Managerial Accounting:

Managerial accounting provides information for internal

decision makers, such as:

** Managers.

** Business owners.

Objective 3: Identify the different Types of Business

Organizations:

A business organization can be organized as one

of the following:

(a) Proprietorship.

(b) Partnership.

(c) Corporation.

(d) Limited-liability partnership (LLP) and limited-

liability company (LLC).

(e) Not-for-profit.

(A) Proprietorships:

A proprietorship has a single owner, called a

proprietor, who often manages the business.

(B) Partnerships:

A partnership has two or more owners called partners.

(c) Corporations:

A corporation is a business owned by stockholders, or

shareholders.

Stock is a certificate representing ownership interest in a

corporation.

(D) Limited-Liability Partnerships (LLPs) and

Limited-Liability Companies (LLCs):

In a limited-liability partnership, each member/partner is

liable (obligated) only for his or her own actions and those

under his or her control.

In a limited-liability company, the business -and not the

member of the LLC- is liable for the companys debts.

(E) Not-for-Profits:

A not-for-profit has no owners.

- Comparison of Business Forms

Proprietorship

Partner-

ship

Corporation

LLP/LLC Not-for-

profit

1- Owners

2- Life of the

organization

- Personal

liability of

owners for

the

businesss

debts

*Proprietor:

only one

owner

Limited by

the owners

choice or

death

*Proprietor:

Owner is

personally

liable

Partners:

Two or more

owners

*Limited by

the owners

choice, or

death

Partners are

personally

liable

*Stockholders

generally

many owners

Indefinite

Stockholders

not

personally

liable

*members

Indefinite

* Members

are not

personally

liable

None.

Indefinite

* Fiduciary

liability of

board

members

Objective 4: Describe the Accounting Equation,

and define Assets, Liabilities, and Equity:

The basic tool of accounting is the accounting equation.

It measures the resources of a business and the claims to those

resources.

It takes the following form:

Assets = Liabilities + Equity

Assets:

Assets are economic resources that are expected to benefit the

business in the future. Assets are something the business owns

that has value.

Examples of assets include:

Cash.

Merchandise inventory.

Furniture.

Land.

Liabilities:

Liabilities are claims to economic resources (Assets).

Liabilities are debts payable to outsiders who are known as

creditors.

Liabilities are something the business owes.

Examples:

Accounts payable.

Notes payable.

Bank loans.

Salaries payable.

Equity:

The owners claims to the assets of the business are called equity.

Equity equals what is owned (assets) minus what is owed

(liabilities).

For a proprietorship, the accounting equation can be

written as:

Assets = Liabilities + Owners Equity

Assets = Liabilities + Capital

Capital is the net amount invested in the business by the

owner.

Capital contains the amount earned by income-producing

activities and kept (retained ) for use in the business.

Two types of events that affect capital are:

(1) Revenues:

Revenues are increases in capital.

Revenues earned by delivering goods or services to customers.

Types of revenue are the following:

Sales revenue.

Service revenue.

Interest revenue.

Dividends revenue.

(B) Expenses:

Expenses are the decreases in capital that result from operations.

Some common expenses are:

Rent expense.

Salary expense for employees.

Advertising expense.

Utilities expense for water, electricity, and gas.

Interest expense.

Property tax expense.

When revenues exceed expenses, the result is a profit or

net income.

When expenses exceed revenues, the result is a net loss.

* A third type of transaction that affects capital is the

distribution of cash or other assets to the owner.

Drawings are distributions of capital (usually of cash) to

owners.

Components of capital.

Beginning Capital

Owner Investments

(Plus) Net Income

(Or minus Net loss)

Equals Ending Capital

(Minus) Drawings

Objective 5: Use the Accounting Equation to Analyze

Transactions:

Transaction :

A transaction is an event that affects the financial position

of the business.

Can be measured reliably.

Every transaction impacts at least two items.

The accounting equation balances before and after each

transaction.

Transaction 1: Starting the Business:

Example:

Ahmed started a new business as a proprietorship named

El-Salam Company for Advertising Services. In Jan.1,

2013 Ahmed deposited L.E. 450,000 in ABC Bank by the

name of the business.

Required:

Analyze the proceeding transaction in terms of its effects

on the accounting equation.

Solution:

Owners Type of

Assets = Liabilities + Equity Transaction

Cash = Ahmed, Capital

(1) ( + ) 450,000 -0- (+) 450,000 Owner investment

Note the following:

(1) For each transaction , the amount on the left side of the equation

must equal the amount on the right side.

(2) This transaction increases both:

(a) The assets (cash).

(b) The owners equity ( Ahmed, Capital).

Transaction 2: Purchase of land:

Example:

In Jan.10, 2013 El-Salam Company purchased land for L.E.

150,000 paid in cash.

Required:

Analyze the proceeding transaction in terms of its

effects on the accounting equation.

Solution:

Owners

Assets = Liabilities + Equity

Cash + Land Ahmed, Capital

(1) 450,000 -0- = -0- 450,000

(2) ( - ) 150,000 (+ ) 150,000 _______

Bal. 300,000 150,000 450,000

------------------------------ ------------

450,000 450,000

Note the following:

The purchase of land:

(1) Increases one asset, (Land).

(2) Decreases another asset (Cash).

Transaction 3: Purchase of Office Supplies:

Example:

In Jan 15, El-Salam Company purchased office supplies for

L.E. 5,000 on account from Cairo Company. The Company

will use the supplies in the future.

Required:

Analyze the proceeding transaction in terms of its effect on the

accounting equation.

Solution:

Owners

Assets = Liabilities + Equity

Office Accounts Ahmed

Cash + Supplies + Land Payable + Capital

Bal. 300,000 -0- 150,000 = 450,000

(3) ____ (+) 5,000 _______ (+) 5,000 _______

Bal. 300,000 5,000 150,000 5,000 450,000

--------------------------------------------- -------------------------------

455,000 455,000

Note the following:

(1) Office supplies is an asset, not an expense, because the supplies

arent used up now, but will be in the future.

(2) The liability created by purchasing on account is an Accounts

Payable, which is a short-term liability that will paid in the future.

Transaction 4: Earning of Service Revenue:

Example:

In Jan. 20, El-Salam Company, provided advertising

services to XYZ Company for L.E. 25,000 and

collected this amount in cash.

Required:

Analyze the proceeding transaction in terms of its effect on

the accounting equation.

Solution:

Owners Type of

_ Assets = Liabilities + Equity Transaction

Office Accounts Ahmed

Cash + Supplies + Land Payable + Capital

Bal. 300,000 5,000 150,000 = 5,000 450,000

(4) (+) 25,000 _____ ______ _____ (+) 25,000 Service Revenue

Bal. 325,000 5,000 150,000 5,000 475,000

______________________ __________________

480,000 480,000

Note the following:

This revenue transaction increases both:

(1) Assets (Cash).

(2) Owners equity (Ahmed, Capital).

Transaction 5: Earning of Service Revenue on

Account:

Example:

In Jan. 25, El-Salam Company, provided advertising services

to ABC Company for L.E. 50,000 on account.

Required:

Analyze the proceeding transaction in terms of its effect on

the accounting equation.

Solution:

Owners Type of

Assets = Liabilities Equity Transaction

Accounts Office Accounts Ahmed

Cash + Receivable + Supplies + Land Payable + Capital

Bal. 325,000 -0- 5,000 150,000 = 5,000 475,000

(5) _______ ( +) 50,000 _______ _______ _______ (+ ) 50,000 Service Revenue.

Bal. 325,000 50,000 5,000 150,000 5,000 525,000

----------------------------------------------------------------- --- -----------------------------

530,000 530,000

Note the following:

This revenue transaction increases both:

(1) Assets (Accounts receivable).

(2) Owners equity (Ahmed, Capital).

Transaction 6: Payment of Expenses:

Example:

In Jan. 30, El-Salam Company paid the following expenses

in cash:

Rent L.E. 2,000, Salaries L.E. 5,000, and Utilities L . E.

3,000

Required:

Analyze the proceeding transaction in terms of its effect on

the accounting equation.

Solution:

Owners Type

Assets = Liabilities + Equity Transaction

Accounts Office Accounts Ahmed

Cash + Receivable + Supplies + Land = Payable + Capital

Bal. 325,000 50,000 5,000 150,000 5,000 525,000

(6) ( -) 2,000 (-) 2,000 Rent Expense

(6) ( -) 5,000 = (-) 5,000 Salaries Exp.

(6) (-) 3,000 ______ _______ _______ ______ (-) 3,000 Utilities Exp.

Bal. 315,000 50,000 5,000 150,000 5,000 515,000

------------------------------------------------ --------------------

520,000 520,000

Note the following:

Cash expenses decreases:

(1) assets (Cash).

(2) Owners equity (Ahmed, Capital).

Transaction 7: Payment on Account:

Example:

In Feb. 5, El-Salam Company paid L.E. 3,000 to Cairo Company for

purchased office supplies in transaction (3).

Required:

Analyze the proceeding transaction in terms of its effect on the

accounting equation.

Owners

Assets _______ = Liabilities Equity

Accounts Office Accounts Ahmed,

Cash + Receivable Supplies + Land Payable + Capital

Bal 315,000 50,0000 5,000 150,000 = 5,000 515,000

(7) (-) 3,000 _______ _____ _______ (-) 3,000 _______

Bal. 312,000 50,000 5,000 150,000 2,000 515,000

-------------------------------------------------------- -------------------------------------

517,000 517,000

Note the following:

(1) The payment of cash on account has no effect on office supplies.

(2) It decreases assets (cash), and decreases liabilities (Accounts

Payable)

Transaction 8: Personal Transaction:

Example:

In Feb. 10, Ahmed purchased a new car at a cost of L.E. 150,000

for his personal use paid in cash from his personal funds.

Note the following:

(1) This event is not a transaction of El-Salam Company.

(2) It has no effect on El-Salam Company and, therefore, is not

recorded by the business.

Transaction 9: Collection on Account:

Example:

In Feb. 15, El-Salam Company collected L.E. 30,000 from

ABC Company for which it provided advertising services in

transaction (5).

Required:

Analyze the proceeding transaction in terms of its effect on

the accounting equation.

Solution:

Owners

Assets __________ = Liabilities + Equity

Accounts Office Accounts Ahmed

Cash + Receivable + Supplies + Land Payable + Capital

Bal. 312,000 50,000 5,000 150,000 = 2,000 515,000

(9) (+) 30,000 (-) 30,000 ______ ________ ________ _______

Bal. 342,000 20,000 5,000 150,000 2,000 515,000

-------------------------------------------------------- -----------------------------------

517,000 517,000

Note:

Total assets are unchanged from the preceding total, because El-

Salam Company exchanged one asset (Cash) for another

(Accounts receivable).

Transaction 10: Sale of Land:

In Feb. 25, El-Salam Company sold some of land. The sale price of

L.E. 40,000 is equal to the cost of the land, and received L.E.

40,000 cash.

Required:

Analyze the proceeding transaction in terms of its effect on the

accounting equation.

Solution:

Owners

Assets ___________ = Liabilities + Equity

Accounts Office Accounts Ahmed

Cash + Receivable + Supplies + Land = Payable + Capital

Bal. 342,000 20,000 5,000 150,000 2,000 515,000

(10) (+) 40,000 _______ _______ ( -) 40,000 ________ _________

Bal. 382,000 20,000 5,000 110,000 2,000 515,000

----------------------------------------------------- ------------------------------------

517,000 517,000

Transaction 11: Owner Drawing of Cash:

Example:

In March 5, Ahmed withdrew L.E. 25,000 to purchase new

furniture for personal use.

Required:

Analyze the proceeding transaction in terms of its effect on

the accounting equation.

Solution:

Owners Type of

Assets ____________ = Liabilities + Equity Transaction

Accounts Office Ahmed,

Cash + Receivable + supplies + Land Capital

Bal. 382,000 20,000 5,000 110,000 = 2,000 515,000

(11) (- ) 25,000 ______ ____ _____ _____ (- ) 25,000 Owner withd.

Bal. 357,000 20,000 5,000 110,000 2,000 490,000

------------------------------------------------------- ------------------------

492,000 492,000

Note the following:

(1) Drawings do not represent an expense because they are not

relating to the earning of revenue.

(2) Drawings do not affect the businesss net income or net loss.

Objective 6: Preparing the Financial Statements:

The financial statements summarize the transaction data into a

form that is useful for decision making.

The basic types of financial statements are:

(1) Income statement.

(2) Statement of owners equity.

(3) balance sheet, and

(4) Statement of cash flows.

(1) Income Statement:

The income statement (also called statement of earnings or

statement of operations) presents a summary of a business

entitys revenues and expenses for a period of time.

The income statement tells us whether the business enjoyed net

income or suffered a net loss.

(2) Statement of Owners Equity:

The statement of owners equity shows the changes in capital for a

business entity during a period of time such as month, quarter, or

year.

Capital increases when the business has:

** owner contribution of capital, or

** a net income (revenues exceed expenses).

Capital decreases when the business has:

** a net loss (expenses exceed revenues), or

** owner withdrawals of cash or other assets.

(3) Balance Sheet:

The balance sheet lists a business entitys assets,

liabilities, and owners equity as of a specific date

usually the end of a month, quarter, or year.

Notes:

Each financial statement has a heading that provides three

pieces of data:

(1) Name of the business.

(2) Name of the financial statement.

(3) Date or time period covered by the statement.

Comprehensive Example:

In. Jan.1, 2013 Ali started a new business as a proprietorship

named El-Nasr Company for Cleaning Services, and deposited

L.E.500,000 in XYZ Bank by the name of the business.

During January month the following transactions occurred by El-

Nasr Company:

1- In Jan. 5, 2013 Ali purchased a building for L.E. 200,000 paid

L.E. 150,000 cash.

2- In Jan. 10, El-Nasr Company purchased office supplies from

Alex. Company for L.E. 8,000 on account.

3- In Jan. 12, El-Salam Company, performed cleaning services to

ABC Company for L.E. 20,000 on account.

4- In Jan. 16, El-Nasr Company, performed cleaning services

to clients for L.E. 75,000, and collected L.E. 50,000 cash.

5- In Jan. 20, El-Nasr Company paid L.E. 5,000 to Alex.

Company for purchased office supplies in transaction (2).

6- In Jan. 22, Ali purchased a new car for L.E. 100,000 for the

use in business at cost of L.E. 100,000 paid in cash from his

personal funds.

7- In Jan. 25, El-Nasr Company collected L.E. 20,000 from

ABC Company for which it provided cleaning services in

transaction (3).

8- In Jan. 27, El-Nasr Company, provided cleaning

services to XYZ Company for L.E. 30,000 and

collected this amount in cash.

9- In Jan. 28, El-Nasr Company paid the following

expenses in cash: Rent L.E. 3,000, Salaries L.E.

8,000, and Utilities L . E. 4,000.

10- In Jan 5, Ali withdrew L.E. 10,000 personal use.

Required:

(1) Analyze the proceeding transactions in terms of its

effects on the accounting equation.

(2) Prepare the financial statements.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Credit risk assessment for new hardware businessDocument1 pageCredit risk assessment for new hardware businessJarelyn Doctor0% (1)

- Quick Analysis Worksheet v5.1 - Rental Property - CharaDocument6 pagesQuick Analysis Worksheet v5.1 - Rental Property - CharaCCerberus24No ratings yet

- Selegna Management v. UCPB (2006) DigestDocument2 pagesSelegna Management v. UCPB (2006) Digestspringchicken88No ratings yet

- Nobles Acctg10 PPT 01Document61 pagesNobles Acctg10 PPT 01Tayar ElieNo ratings yet

- MPL FLEX Application Form Rev3Document3 pagesMPL FLEX Application Form Rev3Kimberly Ann RioNo ratings yet

- L0422 Education Loan - SBI Student Loan SchemeDocument20 pagesL0422 Education Loan - SBI Student Loan SchemeSonali DulwaniNo ratings yet

- Business Law - Pledge, Mortgage and AntichresisDocument11 pagesBusiness Law - Pledge, Mortgage and AntichresisrickyNo ratings yet

- Learning Activity Sheets in General Mathematics Week 5Document7 pagesLearning Activity Sheets in General Mathematics Week 5Aguila AlvinNo ratings yet

- Darshan Gandhi - Sem 6 - Roll No-052 - Sec-C - CORPORATE LAWDocument19 pagesDarshan Gandhi - Sem 6 - Roll No-052 - Sec-C - CORPORATE LAWSounak VermaNo ratings yet

- Do American Consumers Need Financial ProtectionDocument6 pagesDo American Consumers Need Financial ProtectionKevinNo ratings yet

- CMBS Basic Overview enDocument79 pagesCMBS Basic Overview enEd HuNo ratings yet

- Mohd Faris Bin Ruslee, Student in Finance Degree, Faculty of Business Management, MARADocument8 pagesMohd Faris Bin Ruslee, Student in Finance Degree, Faculty of Business Management, MARAMuhamad FakriNo ratings yet

- Panel of Insolvency Professionals (IPs) For Appointment As IRP and Liquidator NCLT - New Delhi Bench PDFDocument5 pagesPanel of Insolvency Professionals (IPs) For Appointment As IRP and Liquidator NCLT - New Delhi Bench PDFVbs ReddyNo ratings yet

- Quiz - Receivables FinalDocument1 pageQuiz - Receivables FinalAna Mae HernandezNo ratings yet

- Corporate Insolvency Act SummaryDocument112 pagesCorporate Insolvency Act SummaryJK S1No ratings yet

- Ecuador Bondholder Groups Release Revised Terms - July 13, 2020Document5 pagesEcuador Bondholder Groups Release Revised Terms - July 13, 2020Daniel BasesNo ratings yet

- My Financial Game Plan - Madison OrtegaDocument7 pagesMy Financial Game Plan - Madison Ortegaapi-598690589No ratings yet

- Loan Agreement Corporate SimpleDocument2 pagesLoan Agreement Corporate SimpleJennifer Deleon100% (1)

- Essential Requisites and Provisions of Pledge and MortgageDocument13 pagesEssential Requisites and Provisions of Pledge and Mortgagekristeen yumangNo ratings yet

- Bond ValuationDocument46 pagesBond ValuationNor Shakirah ShariffuddinNo ratings yet

- Balance Sheet of Colgate-Palmolive (India) Limited: Particulars 2021 2020Document42 pagesBalance Sheet of Colgate-Palmolive (India) Limited: Particulars 2021 2020ABHISHEK KHURANANo ratings yet

- Nicole Reese SBA2Document1 pageNicole Reese SBA2ColeReeseNo ratings yet

- Discussion Forum Unit 8Document1 pageDiscussion Forum Unit 8Sindisiwe DlaminiNo ratings yet

- Simple InterestDocument44 pagesSimple InterestKrishna Mohan Kandula100% (1)

- Em Registered FormatDocument288 pagesEm Registered FormatmanjushreyaNo ratings yet

- Sinking Fund MethodDocument3 pagesSinking Fund MethodJoanna DuqueNo ratings yet

- Assigment 14Document8 pagesAssigment 14cecilia angelNo ratings yet

- Trading and Profit Loss Accounts and Balance Sheet of Ram Prasad & SonsDocument36 pagesTrading and Profit Loss Accounts and Balance Sheet of Ram Prasad & SonsManoharNo ratings yet

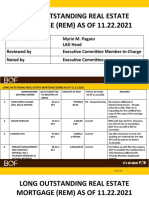

- Real Estate Mortgage ReportDocument3 pagesReal Estate Mortgage ReportApril NNo ratings yet

- Policy PaperDocument16 pagesPolicy Paperapi-284600196No ratings yet