Professional Documents

Culture Documents

Smart Accounting Powerpoint

Uploaded by

wanmustaffa0 ratings0% found this document useful (0 votes)

322 views36 pagesSmart Accounting’ is a systematic process in settling account adjustment and also in preparing account statement. This method presents some measures that must be followed in producing the answer fast and accurate and gain better marks for your examination.

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSmart Accounting’ is a systematic process in settling account adjustment and also in preparing account statement. This method presents some measures that must be followed in producing the answer fast and accurate and gain better marks for your examination.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

322 views36 pagesSmart Accounting Powerpoint

Uploaded by

wanmustaffaSmart Accounting’ is a systematic process in settling account adjustment and also in preparing account statement. This method presents some measures that must be followed in producing the answer fast and accurate and gain better marks for your examination.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 36

NAMA AHLI :

1) WAN MUSTAFFA BIN WAN YUSOFF

2) MORIZA BINTI FIKRI

3) HANIZA BINTI MUHAMMAD

4) AHMAD YASRUDDIN BIN MD YASIN

5) MOHD FIRDAUS MUSTAKIM BIN YAHYA

INTRODUCTION TO SMART ACCOUNTING

Smart Accounting is a systematic process

in settling account adjustment and also in

preparing financial statement. This

method presents some measures that must

be followed in producing the answer fast

and accurate and gain better marks.

SMART ACCOUNTING STEPS

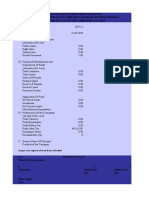

Accounts Debit (RM) Credit (RM)

Debtors &Creditors 15,500 27,500

Provision for doubtful debts 2,000

Furniture 120,000

Office Equipment 86,000

Accumulated Depreciation Funiture 10,400

Inventories (1 January 2012) 22,000

Bank 12,000

Capital 72,000

Purchases & Sales 250,000 370,000

Returns 14,600 13,800

Discount Allowed & Discount Received 5,200 8,500

Carriage Inwards 3,700

Carriage Outwards 2,300

Mortgage 32,000

Advertising 10,500

Insurance 8,400

Interest Received 14,000

550,200 550,200

FIRST STEP: READ THE QUESTION

Mili and Mila opened a business. Below is Trial Balance as at 31 December 2012 for Mili and Mila Enterprise.

SMART ACCOUNTING STEPS

Additional Information:

a) Inventories on 31 December 2012 RM 28,000.

b) Office equipment and furniture is to be depreciated at a

rate 10% using straight line method.

c) Insurance is RM 580 per month.

d) Interest received is advance by RM 500.

e) Bad debts RM 140 to be written off. Provision for doubtful

debts was10% on debtors.

You are required to prepare:

1) Income Statement for the year ending 31 December 2012.

2) Statement of Financial Position as at 31 December 2012.

Business Name

Income statement for the year ended.

RM RM RM

Sales

(-) Return inwards

Net Sales

Less: Costs of goods sold

Opening inventory

Purchases

(-) Return outwards

Net purchases

Wages

Packaging

Import duties

Insurances on purchases

Freight inwards

Purchases costs

Costs of goods available for

(-)Closing inventory

Costs of Goods Sold

SECOND STEP: PROVIDE BLANK FINANCIAL STATEMENT

RM RM RM

Gross profit

Add: Revenues

Discount received

Interest received

Less: Operating expenses

Carriage outwards

Discount allowed

Advertising

Insurances

Net profit

Business Name

Statement of Financial Position as at..

Non-current assets:

Furniture

(-) AD

Current assets:

Accounts receivable

(-) PDD

Total current assets

Total assets

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Current liabilities:

Accounts payable

Bank

Total current liabilities

Working capital

Financed by:

Capital

Add Net profit

Less Drawings

Total equity

Non-current liabilities:

Mortgage

Total equity and liabilities

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Sales 370,000

(-) Return inwards (14,600)

Net Sales

Less: Costs of goods sold

Opening inventory 22,000

Purchases 250,000

(-) Return outwards (13,800)

Net purchases

Wages

Packaging

Import duties

Insurances on purchases

Freight inwards 3,700

Purchases costs

Costs of goods available for

(-)Closing inventory

Costs of Goods Sold

THIRD STEP: FILL IN FINANCIAL STATEMENT WITHOUT ADJUSTMENT

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Gross profit

Add: Revenues

Discount received 8,500

Interest received 14,000

Less: Operating expenses

Carriage outwards 2,300

Discount allowed 5,200

Advertising 10,500

Insurances 8,400

Net profit

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Non-current assets:

Furniture 120,000

(-)PFD 10,400

Office equipment 86,000

Total non-current assets

Current assets:

Accounts receivable 15,500

(-) PDD 2,000

Bank 12,000

Total current assets

Total assets

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Current liabilities:

Accounts payable 27,500

Total current liabilities

Financed by:

Capital 72,000

Add Net profit

Less Drawings

Total equity

Non-current liabilities:

Mortgage 32,000

Total equity and liabilities

FORTH STEP: SOLVE ADJUSTMENT

Additional Information:

a) Inventories on 31 December 2012 RM 28,000.

Record:

* 28,000 SOFP (Inventory)

* 28,000 IS (Inventory)

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Sales 370,000

(-) Return inwards (14,600)

Net Sales

Less: Costs of goods sold

Opening inventory 22,000

Purchases 250,000

(-) Return outwards (13,800)

Net purchases

Wages

Packaging

Import duties

Insurances on purchases

Freight inwards 3,700

Purchases costs

Costs of goods available for

(-)Closing inventory 28,000

Costs of Goods Sold

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Non-current assets:

Furniture 120,000

(-) PFD 10,400

Office equipment 86,000

Total non-current assets

Current assets:

Accounts receivable 15,500

(-) PDD 2,000

Bank 12,000

Inventory 28,000

Total current assets

Total assets

FORTH STEP: SOLVE ADJUSTMENT

Additional Information:

b) Office equipment and furniture is to be depreciated at a rate 10%

using straight line method.

Record:

OE:

* (10% X 86,000 = 8,600) SOFP (AD-OE)

* (10% X 86,000 = 8,600) IS (AD-OE)

FUR:

* (10% X 120,000 = 12,000) SOFP (AD-OE)

* (10% X 120,000 = 12,000) IS (AD-OE)

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Non-current assets:

Furniture 120,000

(-) PFD 10,400

Office equipment 86,000

(-) PFD 8,600

Total non-current assets

Current assets:

Accounts receivable 15,500

(-) PDD 2,000

Bank 12,000

Total current assets

Total assets

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Gross profit

Add: Revenues

Discount received 8,500

Interest received 14,000

Less: Operating expenses

Carriage outwards 2,300

Discount allowed 5,200

Advertising 10,500

Insurances 8,400

Provision for Depreciation (OE) 8,600

Net profit

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Non-current assets:

Furniture 120,000

(-)PFD 22,400 10,400

Office equipment 86,000

(-) PFD 8,600

Total non-current assets

Current assets:

Accounts receivable 15,500

(-) PDD 2,000

Bank 12,000

Total current assets

Total assets

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Gross profit

Add: Revenues

Discount received 8,500

Interest received 14,000

Less: Operating expenses

Carriage outwards 2,300

Discount allowed 5,200

Advertising 10,500

Insurances 8,400

PFD(OE) 8,600

PFD(FUR) 12,000

Net profit

FORTH STEP: SOLVE ADJUSTMENT

Additional Information:

c) Insurance is RM 580 per month.

Record:

* (580 X 12 = 6,960) IS (Insurance)

* (8,400 6,960 = 1,440) SOFP ( Prepaid Insurance)

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Gross profit

Add: Revenues

Discount received 8,500

Interest received 14,000

Less: Operating expenses

Carriage outwards 2,300

Discount allowed 5,200

Advertising 10,500

Insurances 6,960 8,400

PFD(OE) 8,600

PFD(FUR) 12,000

Net profit

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Non-current assets:

Furniture 120,000

(-) PFD 22,400 10,400

Office equipment 86,000

(-) PFD 8,600

Total non-current assets

Current assets:

Accounts receivable 15,500

(-) PDD 2,000

Bank 12,000

Inventory 28,000

Prepaid Insurance 1,440

Total current assets

Total assets

FORTH STEP: SOLVE ADJUSTMENT

Additional Information:

d) Interest received is advance by RM 500.

Record:

* 500 IS (Interest receive)

* 500 SOFP (Prepaid Interest receive)

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Gross profit

Add: Revenues

Discount received 8,500

Interest received 13,500 14,000

Less: Operating expenses

Carriage outwards 2,300

Discount allowed 5,200

Advertising 10,500

Insurances 6,960 8,400

PFD(OE) 8,600

PFD(FUR) 12,000

Net profit

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Current liabilities:

Accounts payable 27,500

Bank 12,000

Prepaid interest received 500

Total current liabilities

Working capital

Financed by:

Capital 72,000

Add Net profit

Less Drawings

Total equity

Non-current liabilities:

Mortgage 32,000

Total equity and liabilities

FORTH STEP: SOLVE ADJUSTMENT

Additional Information:

e) Bad debts RM 140 to be written off.

Record:

* 140 IS (Bad debt)

* 140 SOFP (Bad debt)

Provision for doubtful debts was 10% on debtors

Record:

* (10% X 15,360 = 1,536) SOFP (PDD)

* (2,000-1,536= 464) IS (PDD)

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Gross profit

Add: Revenues

Discount received 8,500

Interest received 13,500 14,000

Less: Operating expenses

Carriage outwards 2,300

Discount allowed 5,200

Advertising 10,500

Insurances 6,960 8,400

PFD(OE) 8,600

PFD(FUR) 12,000

Bad debt 140

Net profit

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Non-current assets:

Furniture 120,000

(-) PFD 22,400 10,400

Office equipment 86,000

(-) PFD 8,600

Total non-current assets

Current assets:

Accounts receivable 15,500

Bad debt 140

15,360

(-) PDD 2,000

Bank 12,000

Inventory 28,000

Prepaid Insurance 1,440

Total current assets

Total assets

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Non-current assets:

Furniture 120,000

(-) PFD 22,400 10,400

Office equipment 86,000

(-) PFD 8,600

Total non-current assets

Current assets:

Accounts receivable 15,500

Bad debt 140

15,360

(-) PDD 1,536 2,000

Bank 12,000

Inventory 28,000

Prepaid Insurance 1,440

Total current assets

Total assets

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Gross profit

Add: Revenues

Discount received 8,500

Interest received 13,500 14,000

PDD (overstated) 464

Less: Operating expenses

Carriage outwards 2,300

Discount allowed 5,200

Advertising 10,500

Insurances 6,960 8,400

Accumulated Depreciation (OE) 8,600

Accumulated Depreciation (FUR) 12,000

Bad debt 140

Net profit

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Sales 370,000

(-) Return inwards (14,600)

Net Sales 355,400

Less: Costs of goods sold

Opening inventory 22,000

Purchases 250,000

(-) Return outwards (13,800)

Net purchases 236,200

Wages

Packaging

Import duties

Insurances on purchases

Freight inwards 3,700 239,900

Costs of goods available for 261,900

(-)Closing inventory (28,000)

Costs of Goods Sold 233,900

FIFTH STEP: COMPLETE FINANCIAL STATEMENT

Mili and Mila Enterprise

Income statement for the year ended 31 Dec. 2012

RM RM RM

Gross profit 121,500

Add: Revenues

Discount received 8,500

Interest received 13,500 14,000

PDD (overstated) 464 22,464

143,964

Less: Operating expenses

Carriage outwards 2,300

Discount allowed 5,200

Advertising 10,500

Insurances 6,960 8,400

PFD(OE) 8,600

PFD(FUR) 12,000

Bad debt 140 45,700

Net profit 98,264

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Non-current assets:

Furniture 120,000

(-) PFD 22,400 10,400 97,600

Office equipment 86,000

(-) PFD 8,600 77,400

Total non-current assets 175,000

Current assets:

Accounts receivable 15,500

Bad debt 140

15,360

(-) PDD 1,536 2,000 13,824

Bank 12,000

Inventory 28,000

Prepaid Insurance 1,440

Total current assets 55,264

Mili and Mila Enterprise

Statement of Financial Position as at 31 Dec. 2012

Current liabilities:

Accounts payable 27,500

Prepaid interest received 500

Total current liabilities 28,000

Working capital 27,264

Total assets 202,264

Financed By:

Capital 72,000

Add Net profit 98,264

Total equity 170,264

Less Drawings

Total equity

Non-current liabilities:

Mortgage 32,000

Total equity and liabilities 202,264

You might also like

- Example Financial StatementDocument4 pagesExample Financial StatementKaithleen Coreen EbaloNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1Puteri Noor SyahiraNo ratings yet

- Financial Accounting & AnalysisDocument2 pagesFinancial Accounting & AnalysisTangerine Ila TomarNo ratings yet

- Schedule III Financial StatementsDocument21 pagesSchedule III Financial StatementsKunal DixitNo ratings yet

- Study of Financial Statement Repaired)Document4 pagesStudy of Financial Statement Repaired)sureshprojectsNo ratings yet

- X Company Financial ReportsDocument21 pagesX Company Financial ReportsChristian Gerard Eleria ØSCNo ratings yet

- Income statement and balance sheet analysisDocument14 pagesIncome statement and balance sheet analysisazade azamiNo ratings yet

- Self-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachDocument2 pagesSelf-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachTeodorico PelenioNo ratings yet

- Akuntansi p5Document7 pagesAkuntansi p5Alche MistNo ratings yet

- Tutorial Chapter: Analysis of Financial Statement: 2018 2019 Current Ratio 1.79 1.55Document14 pagesTutorial Chapter: Analysis of Financial Statement: 2018 2019 Current Ratio 1.79 1.55FISH JELLYNo ratings yet

- Income StatementDocument4 pagesIncome Statementmohammadrezabgh1987No ratings yet

- Income-StatementDocument4 pagesIncome-StatementaguswahyuNo ratings yet

- Accounting & Financial Systems (Lecture 7)Document20 pagesAccounting & Financial Systems (Lecture 7)Right Karl-Maccoy HattohNo ratings yet

- Cash Flow ModuleDocument5 pagesCash Flow ModuleEmzNo ratings yet

- Loss On Sale of An Asset 95780Document4 pagesLoss On Sale of An Asset 95780alok pratap singhNo ratings yet

- Income Statement Iremart2021v2Document4 pagesIncome Statement Iremart2021v2Dv AccountingNo ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- Financial Accounting Week 2Document5 pagesFinancial Accounting Week 2Siva PraveenNo ratings yet

- Tax2-Part1-Lec7 & 8Document9 pagesTax2-Part1-Lec7 & 8Ahmed AdelNo ratings yet

- Income-Statement SampleDocument7 pagesIncome-Statement SampleShilpa NNo ratings yet

- Income Statement Sample1Document7 pagesIncome Statement Sample1Shilpa NNo ratings yet

- Saleem Provided Following Trial Balance On December 31, 2015Document17 pagesSaleem Provided Following Trial Balance On December 31, 2015S Jawad Ul HasanNo ratings yet

- Extra AssessmentDocument8 pagesExtra Assessmentsuba tharaNo ratings yet

- Finance NotesDocument23 pagesFinance NoteschamilasNo ratings yet

- Income-Statement - RAFDocument5 pagesIncome-Statement - RAFTushar M. TareqNo ratings yet

- Topic: Financial Management: Juan CerónDocument25 pagesTopic: Financial Management: Juan CerónJUAN ANTONIO CERON CRUZNo ratings yet

- Prepare The Income Statement, Statement in Changes of Owner's Equity and Balance Sheet.Document4 pagesPrepare The Income Statement, Statement in Changes of Owner's Equity and Balance Sheet.PATRICK JAMES PANGILINANNo ratings yet

- Topic 2 - Assets, Equities and Liabilities (1)Document29 pagesTopic 2 - Assets, Equities and Liabilities (1)ahmadamsyar083No ratings yet

- Lat TakeDocument8 pagesLat TakeCamila Gail GumbanNo ratings yet

- Single StepDocument1 pageSingle StepMerza DyanNo ratings yet

- Ia T23 AnsDocument2 pagesIa T23 Ansckwai0603No ratings yet

- CMA Module 3 - MBA I Sem - Financial Statements Preparation, Analysis and Interpretation (Useful For MBA 1st & BBA 1st)Document100 pagesCMA Module 3 - MBA I Sem - Financial Statements Preparation, Analysis and Interpretation (Useful For MBA 1st & BBA 1st)YOGESH KUMARNo ratings yet

- Financial statements and ratios for businessesDocument19 pagesFinancial statements and ratios for businessesHwang Hong WeiNo ratings yet

- Hempstead Realty Income StatementDocument5 pagesHempstead Realty Income StatementArvin Operania TolentinoNo ratings yet

- Schubert Case - 2Document1 pageSchubert Case - 2Magloire HiolNo ratings yet

- CorpFin 2021 Fall 2 Risk Lecture 11Document27 pagesCorpFin 2021 Fall 2 Risk Lecture 11Krisi ManNo ratings yet

- Cost of Capital: Risk & ReturnDocument27 pagesCost of Capital: Risk & ReturnKrisi ManNo ratings yet

- FA2 - Sem04 ImpairmentDocument5 pagesFA2 - Sem04 Impairmenttitu patriciuNo ratings yet

- Chapter 6Document9 pagesChapter 6Villanueva, Jane G.No ratings yet

- Income StatementDocument5 pagesIncome StatementYudheesh P 1822082No ratings yet

- Income Statement: (Company Name)Document5 pagesIncome Statement: (Company Name)lutfi shuibNo ratings yet

- Income StatementDocument5 pagesIncome StatementTushar M. TareqNo ratings yet

- Income Statement: (Company Name)Document5 pagesIncome Statement: (Company Name)Mohamed RaafatNo ratings yet

- Income StatementDocument5 pagesIncome StatementKj NaveenNo ratings yet

- Income Statement: (Company Name)Document5 pagesIncome Statement: (Company Name)Reca DewantoroNo ratings yet

- Income StatementDocument5 pagesIncome StatementCico BuffNo ratings yet

- Income Statement: (Company Name)Document5 pagesIncome Statement: (Company Name)ivan fadillahNo ratings yet

- Name of The Student: Student ID: Course: CRN: Instructor's Name: DateDocument14 pagesName of The Student: Student ID: Course: CRN: Instructor's Name: DateM shayan JavedNo ratings yet

- NGA-SCE Financial Accounting Analysis AssignmentDocument21 pagesNGA-SCE Financial Accounting Analysis Assignmentmohammad fakhruddinNo ratings yet

- SCorp 26062022Document27 pagesSCorp 26062022Jagmohan TeamentigrityNo ratings yet

- Balance SheetDocument1 pageBalance Sheethillaryonyango044No ratings yet

- PIOCORE 2022 - ThousandDocument7 pagesPIOCORE 2022 - ThousandAbhishek RaiNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- B203B - Accounting and Finance (Part BDocument32 pagesB203B - Accounting and Finance (Part Bahmed helmyNo ratings yet

- CHAPTER 2 StudentDocument10 pagesCHAPTER 2 Studentfelicia tanNo ratings yet

- IAS 7 CASH FLOWDocument6 pagesIAS 7 CASH FLOWErnest NyangiNo ratings yet

- Task 6: Income Statement and Cash Flow StatementDocument3 pagesTask 6: Income Statement and Cash Flow StatementScribdTranslationsNo ratings yet

- 01 ELMS Activity 3Document2 pages01 ELMS Activity 3Gonzaga FamNo ratings yet

- Cash Flow TemplateDocument19 pagesCash Flow TemplateRyou ShinodaNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Partnership Liquidation ExplainedDocument9 pagesPartnership Liquidation ExplainedGab Ignacio100% (1)

- Unit 4: Auditing: What Does An Auditor Do?Document50 pagesUnit 4: Auditing: What Does An Auditor Do?LisantikaNo ratings yet

- Question 3Document13 pagesQuestion 3Yến Hoàng LêNo ratings yet

- Courier C129303 R6 TDK0 CADocument15 pagesCourier C129303 R6 TDK0 CARohan SmithNo ratings yet

- Cfap1 Aafr PK PDFDocument386 pagesCfap1 Aafr PK PDFImran100% (1)

- Part 6Document8 pagesPart 6Amr YoussefNo ratings yet

- IFRS 2 Share-Based PaymentDocument136 pagesIFRS 2 Share-Based PaymentSheikh Aabid RehmatNo ratings yet

- Accounting Cycle HacksDocument14 pagesAccounting Cycle HacksAnonymous mnAAXLkYQCNo ratings yet

- Business Combination: Balance Sheet Item Book Value Book Value Fair Value Anchor Corporation Zink CompanyDocument1 pageBusiness Combination: Balance Sheet Item Book Value Book Value Fair Value Anchor Corporation Zink Companyanggie pheonicaNo ratings yet

- How To Use Financial StatementsDocument80 pagesHow To Use Financial StatementsNguyễn Trung ĐứcNo ratings yet

- Financial Statment TestDocument3 pagesFinancial Statment TestDerick FloresNo ratings yet

- A Comparison of IFRS, US GAAP and Belgian GAAPDocument100 pagesA Comparison of IFRS, US GAAP and Belgian GAAPVoicu Dragomir67% (3)

- Business Transactions and the Accounting Equation ExplainedDocument30 pagesBusiness Transactions and the Accounting Equation ExplainedKen LatiNo ratings yet

- Current Asset Current Asset Contra AssetDocument7 pagesCurrent Asset Current Asset Contra AssetAlexander QuemadaNo ratings yet

- Case 4 - Ratio Analysis - Micro TilesDocument18 pagesCase 4 - Ratio Analysis - Micro TilesAimee ChantengcoNo ratings yet

- Correction: Research and Development Should Be P5,000 Not P50,000Document43 pagesCorrection: Research and Development Should Be P5,000 Not P50,000Dieter LudwigNo ratings yet

- Delta Beverage - CaseDocument16 pagesDelta Beverage - CaseHasan Md ErshadNo ratings yet

- Ahlan Nur Salim - Tugas 3Document4 pagesAhlan Nur Salim - Tugas 3Moe ChannelNo ratings yet

- Model Demonstration Farm Sol.Document2 pagesModel Demonstration Farm Sol.Kumar NareshNo ratings yet

- Accounting Cycle ExercisesDocument15 pagesAccounting Cycle ExercisesEbina WhiteNo ratings yet

- Jpia Business CombiDocument14 pagesJpia Business CombiJamie Rose AragonesNo ratings yet

- LPKR Interim 30 Sep 2023Document175 pagesLPKR Interim 30 Sep 2023Hengkok SiholeNo ratings yet

- Accounting concepts and principles matching testDocument1 pageAccounting concepts and principles matching testFlorante De LeonNo ratings yet

- IAS 29 Illustration - PWCDocument89 pagesIAS 29 Illustration - PWCapi-382850594% (17)

- Fundamentals of AccountingDocument2 pagesFundamentals of AccountingDiane SorianoNo ratings yet

- CH 04Document73 pagesCH 04kevin echiverriNo ratings yet

- RTP - I Group PDFDocument177 pagesRTP - I Group PDFMadan SharmaNo ratings yet

- 13 KiesoDocument69 pages13 KiesoCatharina MellaniNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- Advanced AccountingDocument14 pagesAdvanced AccountingBehbehlynn67% (3)