Professional Documents

Culture Documents

CH 5.palepu Financial Analysis (Analisis Bisnis Dan Valuasi)

Uploaded by

Sorkeep Beud0 ratings0% found this document useful (0 votes)

1K views34 pagesCh 5.Palepu Financial Analysis (Analisis Bisnis dan Valuasi)

Original Title

Ch 5.Palepu Financial Analysis (Analisis Bisnis dan Valuasi)

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCh 5.Palepu Financial Analysis (Analisis Bisnis dan Valuasi)

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views34 pagesCH 5.palepu Financial Analysis (Analisis Bisnis Dan Valuasi)

Uploaded by

Sorkeep BeudCh 5.Palepu Financial Analysis (Analisis Bisnis dan Valuasi)

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 34

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Chapter 5:

Financial

Analysis

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Key Concepts in Chapter 5

There are two primary tools in financial analysis:

Ratio analysis to assess how various line items in

financial statements relate to each other and to

measure relative performance.

Cash flow analysis to evaluate liquidity and the

management of operating, investing, and financing

activities as they relate to cash flow.

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Determinants of Firm Value

and Ratio Analysis

Profitability and growth drive firm value.

Managers can employ four levers to achieve

growth and profit targets:

Operating management

Investment management

Financing strategy

Dividend policy

Ratio analysis seeks to evaluate the firms

effectiveness in these areas.

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Ratio Analysis

Evaluating ratios requires comparison against

some benchmark. Such benchmarks include:

Ratios over time from prior periods (time series)

Ratios of other firms in the industry (cross-sectional)

Some absolute benchmark

Effective ratio analysis must attempt to relate

underlying business factors to the financial

numbers

The text illustrates ratio analysis by applying it to

Wal-Mart stores.

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Measuring Overall Profitability

ROE is a comprehensive measure of and is a

good starting point to systematically analyze firm

performance.

ROE = Net Income / Shareholders equity

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Decomposing Profitability:

Traditional Approach

ROE = ROA * Financial leverage

= Net income

*

Assets

Assets Shareholders equity

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Decomposing Profitability:

Alternative Approach

The traditional approach has some limitations

imposed by the composition of the denominator

and numerator

An alternative approach computes ROE as

ultimately being equal to:

Operating ROA + Spread * Net financial leverage

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Detail of Alternative ROE Decomposition

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Wal-Mart and Target: Comparison

of ROE Components

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Discussion of Results from

Profitability Analysis

Note the differences between key components of the

traditional and alternative FY 2005 ROE decompositions:

Wal-Mart

Traditional

Wal-Mart

Alternative

Target

Traditional

Target

Alternative

Asset

Turnover

2.61 41.6 1.63 2.59

ROA 9.3% 16.10% 7.50% 13.40%

Financial

Leverage

2.43 0.53 2.48 0.56

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Assessing Operating Management:

Income Statement Ratios

Common-sized income statements facilitate

comparisons of key line items across time and

different firms.

Additionally, the following ratios are also helpful:

Gross profit margin

EBITDA margin

NOPAT margin

Recurring NOPAT margin

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Gross Profit Margin

Measures the profitability of sales, less direct

costs of sales:

Gross profit margin = Sales Cost of sales

Sales

The gross profit margin is an indicator of:

The price premium that a firms product commands in

the market

The efficiency of a firms procurement and/or

production process

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

NOPAT and EBITDA Margins

The NOPAT margin provides a comprehensive measure

of operations:

NOPAT margin = NOPAT

Sales

The EBITDA margin eliminates the significant non-cash

expenses of depreciation and amortization along with

interest and taxes:

EBITDA =

Earnings before interest, taxes, depreciation, and amortization

Sales

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

A Comparison of Key Income Statement

Ratios for Wal-Mart and Target

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Decomposing Asset Turnover

Asset management is a key indicator of how

effective a firms management is.

Asset turnover may be broken into two primary

components:

1. Working capital management

2. Long-term asset management

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Working Capital Management

Working capital is the difference between current assets

and current liabilities.

Key ratios useful to analyzing the management of

working capital include:

Operating working capital to sales

Operating working capital turnover

Accounts receivable turnover

Days receivables

Inventory turnover

Days inventory

Accounts payable turnover

Days payables

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Asset Management Ratios for

Wal-Mart and Target

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Financial Leverage Analysis

Borrowing allows a firm to access to capital, but

increases the risk of ownership for equity

holders.

Analysis of leverage can be performed on both

short- and long-term debts:

Liquidity analysis relates to evaluating current

liabilities

Solvency analysis relates to longer term liabilities

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Liquidity Analysis

There are several ratios useful to evaluate a

firms liquidity, including:

Current ratio

Quick ratio

Cash ratio

Operating cash flow ratio

Each of these ratios attempts to measure the

ability of a firm to pay its current obligations.

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Liquidity Analysis

Knowing how the liquidity ratios are calculated allows the user to

understand how to interpret them:

Current ratio = Current assets / Current liabilities

Current liabilities

Quick ratio = Cash + Short-term investments + Accts. receivable

Current liabilities

Cash ratio = Cash + Marketable securities

Current liabilities

Operating cash flow ratio = Cash flows from operations

Current liabilities

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Comparison of Wal-Mart and Target

Liquidity Ratios

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Debt and Coverage Ratios

Beyond short-term survival, solvency measures the ability of a firm

to meet long-term obligations.

Several useful ratios are used to analyze solvency. Three using only

shareholders equity as a denominator are:

Liabilities-to-equity ratio = Total liabilities

Shareholders equity

Debt-to-equity ratio = Short-term debt + Long-term debt

Shareholders equity

Net-debt-to-equity ratio =

Short-term debt + Long-term debt Cash and marketable securities

Shareholders equity

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

More Debt and Coverage Ratios

Two ratios that use debt as a proportion of total capital

are:

Debt-to-capital ratio =

Short-term debt + Long-term debt

Short-term debt + Long-term debt + Shareholders equity

Net-debt-to-net-capital ratio =

Interest bearing liabilities Cash & marketable securities

Interest-bearing liabilities Cash & marketable securities +

Shareholders equity

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

More Debt and Coverage Ratios, contd.

Two ratios that specifically address the ability to pay

interest on debts are:

Interest coverage ratio (earnings basis) =

Net income + Interest expense + Tax expense

Interest expense

Interest coverage ratio (cash flow basis) =

Cash flow from operations + Interest expense + Taxes paid

Interest expense

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Comparison of Wal-Mart and Target

Debt and Coverage Ratios

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Assessing the Sustainable Growth Rate

A comprehensive measure of a firms ratios is the

sustainable growth rate, which uses ROE:

ROE * (1 - Dividend payout ratio)

Where:

Dividend payout ratio = Cash dividends paid

Net income

Sustainable growth rate measures the ability of a firm to

maintain its profitability and financial policies. Its

components may be seen in Figure 5-2.

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Sustainable Growth Rates For

Wal-Mart and Target

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Cash Flow Analysis

The ratio analysis previously discussed used

accrual accounting.

Cash flow analysis can provide further insights

into operating, investing, and financing activities.

All U.S. companies are required to include a

statement of cash flows in their financial

statements.

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Analyzing Cash Flow Information

A number of questions can be answered through

analysis of the statement of cash flows. For example:

Operating activities

How strong is the firms internal cash flow generation?

How well is working capital being managed?

Investing activities

How much cash did the company invest in growth assets?

Financing activities

What type of external financing does the company rely on?

Did the company use internally generated funds for investments?

Did the company use internally generated funds to pay dividends?

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

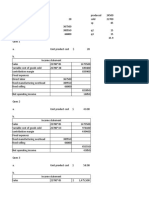

Cash Flow Analysis

Differences in reporting cash flow information allow for

variation across firms that complicate comparisons.

Analysts can make adjustments to net income to arrive

at free cash flows, a commonly used metric for financial

analysis.

Table 5-11 in the next slide illustrates the various

calculations using financial information from Wal-Mart

and Target.

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Copyright (c) 2008 Thomson South-Western, a part of the

Thomson Corporation. Thomson, the Star logo, and

South-Western are trademarks used herein under license.

Chapter 5: Financial Analysis

Palepu & Healy

Concluding Comments

There are two primary tools in financial analysis:

Ratio analysis to assess how various line items in

financial statements relate to each other and to

measure relative performance.

Cash flow analysis to evaluate liquidity and the

management of operating, investing, and financing

activities as they relate to cash flow.

Both forms of analyses must be evaluated while

considering whether firm performance is consistent

with the strategic initiatives of management.

You might also like

- CH 3.palepu (1) Accounting AnalysisDocument26 pagesCH 3.palepu (1) Accounting AnalysisYingying She100% (3)

- CH 8.palepu - Jw.caDocument14 pagesCH 8.palepu - Jw.caFlorensia RestianNo ratings yet

- CH 6.palepuDocument18 pagesCH 6.palepuAristha Purwanthari Sawitri0% (1)

- CH 7.palepuDocument13 pagesCH 7.palepuRavi OlaNo ratings yet

- CH 2.palepu - Jw.caDocument18 pagesCH 2.palepu - Jw.caFlorensia RestianNo ratings yet

- CH 7.palepu - Jw.caDocument13 pagesCH 7.palepu - Jw.caFlorensia RestianNo ratings yet

- CH 12.palepuDocument15 pagesCH 12.palepumclaren685100% (1)

- CH 8 Palepu JW C PDFDocument14 pagesCH 8 Palepu JW C PDFcherry wineNo ratings yet

- Framework For Business Analysis and Valuation Using Financial StatementsDocument9 pagesFramework For Business Analysis and Valuation Using Financial StatementsTubagus Donny SyafardanNo ratings yet

- CH 4.palepu - Jw.caDocument14 pagesCH 4.palepu - Jw.caazizah auliyatusshoffyNo ratings yet

- Tugas 4Document2 pagesTugas 4Nisrina Nur Rachmayani100% (1)

- Financial Shenanigans-Earning ManipulationDocument23 pagesFinancial Shenanigans-Earning ManipulationFani anitaNo ratings yet

- CH 11.palepuDocument15 pagesCH 11.palepumclaren685No ratings yet

- Audi, BMW and Skoda's Research and Development CaseDocument3 pagesAudi, BMW and Skoda's Research and Development CaseJeklin LewaneyNo ratings yet

- ACCT-UB 3 - Financial Statement Analysis Module 5 HomeworkDocument2 pagesACCT-UB 3 - Financial Statement Analysis Module 5 HomeworkpratheekNo ratings yet

- Business Analysis and Valuation Using Financial Statements CH 2& 46 PalepuDocument18 pagesBusiness Analysis and Valuation Using Financial Statements CH 2& 46 PalepuChi Le100% (2)

- Management Control Anthony TOCDocument5 pagesManagement Control Anthony TOCscribdlertoo33% (3)

- Palepu Solutions Chapter 2Document22 pagesPalepu Solutions Chapter 2Nadya Dewanti K100% (1)

- Chapter 01 Solutions PalepuDocument3 pagesChapter 01 Solutions Palepuilhamuh67% (6)

- Solutions of The Audit Process. Principles, Practice and CasesDocument71 pagesSolutions of The Audit Process. Principles, Practice and Casesletuan221290% (10)

- 11 PPT The Audit Process Ed 6 GrayDocument23 pages11 PPT The Audit Process Ed 6 Grayina oktavianiNo ratings yet

- Resume Palepu Chapter 10Document14 pagesResume Palepu Chapter 10Fifi AiniNo ratings yet

- Ais 2015Document5 pagesAis 2015tafraciNo ratings yet

- Accounting theory construction and the development of normative and positive theoriesDocument9 pagesAccounting theory construction and the development of normative and positive theorieslenalena12367% (3)

- Chapter 6 Iain Gray Audit IGSMDocument29 pagesChapter 6 Iain Gray Audit IGSMArif Budiman0% (2)

- Positive Accounting Theory Lecture NotesDocument7 pagesPositive Accounting Theory Lecture NotesKweku_Affir_Hayf_886100% (3)

- Tradeoff Relevance and Reliability Cash Flow EstimatesDocument5 pagesTradeoff Relevance and Reliability Cash Flow EstimatesKrithika NaiduNo ratings yet

- Chapter 9 Prospective AnalysisDocument23 pagesChapter 9 Prospective AnalysisPepper CorianderNo ratings yet

- Ch05 Solutions (10e)Document27 pagesCh05 Solutions (10e)mad_hatter_100% (2)

- Solution Ch8inclassexerciseDocument5 pagesSolution Ch8inclassexerciseAdam100% (1)

- Anthony & Govindarajan - CH 11Document3 pagesAnthony & Govindarajan - CH 11Astha Agarwal100% (1)

- Chapter 5Document56 pagesChapter 5Sugim Winata Einstein100% (1)

- Behavioral Research in Management Accounting The Past, Present, and FutureDocument24 pagesBehavioral Research in Management Accounting The Past, Present, and FutureBabelHardyNo ratings yet

- Solution Manual For Advanced Accounting 4th Edition Jeter, ChaneyDocument7 pagesSolution Manual For Advanced Accounting 4th Edition Jeter, ChaneyAlif Nurjanah0% (2)

- Universiti Utara Malaysia Othman Yeop Abdullah Graduate School of Business (Oyagsb) A201 2020/2021Document2 pagesUniversiti Utara Malaysia Othman Yeop Abdullah Graduate School of Business (Oyagsb) A201 2020/2021fitriNo ratings yet

- Chapter 7 Solution Manual Auditing and Assurance ServicesDocument34 pagesChapter 7 Solution Manual Auditing and Assurance ServicesMāhmõūd Āhmēd100% (2)

- Ch09 TB RankinDocument6 pagesCh09 TB RankinAnton Vitali100% (1)

- Chapter 17Document9 pagesChapter 17Yuxuan Song100% (1)

- Soal Soal TheoryDocument8 pagesSoal Soal TheoryRhovick Van BaLicohollackzsNo ratings yet

- Bill DeBurgerDocument4 pagesBill DeBurgerTatag Adi Sasono50% (2)

- CH - 03financial Statement Analysis Solution Manual CH - 03Document63 pagesCH - 03financial Statement Analysis Solution Manual CH - 03OktarinaNo ratings yet

- Financial Accounting Theory Craig Deegan Chapter 11Document22 pagesFinancial Accounting Theory Craig Deegan Chapter 11Rob26in09100% (1)

- Audit Chapter SolutionsDocument3 pagesAudit Chapter SolutionsJana WrightNo ratings yet

- Accounting history postwar period modern trendsDocument5 pagesAccounting history postwar period modern trendstiyas100% (1)

- Cost Management A Strategic Emphasis Solutions Manual 5th EditionDocument4 pagesCost Management A Strategic Emphasis Solutions Manual 5th EditionGraha MahasiswaNo ratings yet

- Contemporary Issues in Accounting: Solution ManualDocument12 pagesContemporary Issues in Accounting: Solution ManualKeiLiewNo ratings yet

- Auditing Cash Funds and AccountsDocument20 pagesAuditing Cash Funds and AccountsNuts420100% (1)

- Advance Accounting Chapter 15Document3 pagesAdvance Accounting Chapter 15brew167525% (4)

- Tugas 5 (Kelompok 5)Document9 pagesTugas 5 (Kelompok 5)Silviana Ika Susanti67% (3)

- Chapter 3 AnswerDocument34 pagesChapter 3 AnswerMH LeonNo ratings yet

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 10Document24 pagesFinancial Statement Analysis - Concept Questions and Solutions - Chapter 10sakibba80% (5)

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesDocument28 pagesConsolidation Theories, Push-Down Accounting, and Corporate Joint VenturesRiska Azahra NNo ratings yet

- Comparing Planning and Control Systems of Texas Instruments and Hewlett-PackardDocument20 pagesComparing Planning and Control Systems of Texas Instruments and Hewlett-PackardNaveen SinghNo ratings yet

- To Take Into Account 2Document12 pagesTo Take Into Account 2Anii HurtadoNo ratings yet

- Ch. 5 Financial AnalysisDocument34 pagesCh. 5 Financial AnalysisfauziyahNo ratings yet

- CH 5.palepu - Jw.ca Ratio AnalysisDocument34 pagesCH 5.palepu - Jw.ca Ratio Analysiserza gunawanNo ratings yet

- Modul Sesi Ke 14Document34 pagesModul Sesi Ke 14isabellaNo ratings yet

- Framework For Business Analysis and Valuation Using Financial StatementsDocument9 pagesFramework For Business Analysis and Valuation Using Financial StatementsDikaGustianaNo ratings yet

- CH 11.palepuDocument15 pagesCH 11.palepuVYSYAKH ANo ratings yet

- HandoutsDocument17 pagesHandoutsLinh Chi NguyễnNo ratings yet

- Perspectives On Recent Capital Market ResearchDocument1 pagePerspectives On Recent Capital Market ResearchSorkeep BeudNo ratings yet

- Minggu 2-Mandatory IFRS Reporting Around The WorldDocument69 pagesMinggu 2-Mandatory IFRS Reporting Around The WorldSorkeep BeudNo ratings yet

- IFRSDocument24 pagesIFRSAG7777777No ratings yet

- Minggu 5 Kim, Shi IFRS Synch 2011-11-04 Sent To RAST ConfDocument59 pagesMinggu 5 Kim, Shi IFRS Synch 2011-11-04 Sent To RAST ConfSorkeep BeudNo ratings yet

- Scot ch13Document15 pagesScot ch13Indra HadiNo ratings yet

- Baan Company August31,2009Document18 pagesBaan Company August31,2009Sorkeep BeudNo ratings yet

- Notes On ParCorDocument13 pagesNotes On ParCorMaria Katherine EgosNo ratings yet

- Accounting for debt restructuringDocument2 pagesAccounting for debt restructuringklifeNo ratings yet

- Asset Class RotationDocument9 pagesAsset Class RotationsumughanNo ratings yet

- Dig 011179Document8 pagesDig 011179WHRNo ratings yet

- Chapter 9 Plant Assets, Natural Resources and Intangible Assets PDFDocument67 pagesChapter 9 Plant Assets, Natural Resources and Intangible Assets PDFJed Riel BalatanNo ratings yet

- Islamic BankingDocument37 pagesIslamic BankingPinky PicklepinkestNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- MUFTI - _Credo Brands Marketing Limited ProspectusDocument410 pagesMUFTI - _Credo Brands Marketing Limited ProspectusCornburn KNo ratings yet

- SamadhiFX TradingView Chart DiscussionsDocument12 pagesSamadhiFX TradingView Chart DiscussionsKizito EdwardNo ratings yet

- GAAP, IFRS and PFRS: The accounting standardsDocument19 pagesGAAP, IFRS and PFRS: The accounting standardsRafael Ganzon RiveraNo ratings yet

- Example SDN BHDDocument9 pagesExample SDN BHDputery_perakNo ratings yet

- Quiz2 With AnswersDocument11 pagesQuiz2 With AnswersJogja AntiqNo ratings yet

- Stanley Funds ResearchDocument115 pagesStanley Funds ResearchWaleed TariqNo ratings yet

- Depreciation Methods: (Example, Straight Line Depreciation)Document5 pagesDepreciation Methods: (Example, Straight Line Depreciation)munnag01No ratings yet

- Reviewer Bond ValuationDocument10 pagesReviewer Bond ValuationBlueBladeNo ratings yet

- Midterm Exam in Treasury ManagementDocument5 pagesMidterm Exam in Treasury ManagementJoel PangisbanNo ratings yet

- USVI Doc - Approving Hyperion Air As Client (No Flags) Acknowledging Cutler Approved Keeping Epstein As ClientDocument8 pagesUSVI Doc - Approving Hyperion Air As Client (No Flags) Acknowledging Cutler Approved Keeping Epstein As ClientRA Martens100% (1)

- Portfolio Management NotesDocument25 pagesPortfolio Management NotesRigved DarekarNo ratings yet

- Tax Treaty Between SG and PHDocument9 pagesTax Treaty Between SG and PHCarmel LouiseNo ratings yet

- Acc 1 Financial Statement Analysis (Part 2)Document27 pagesAcc 1 Financial Statement Analysis (Part 2)juthi rawnakNo ratings yet

- A Roadmap To Accounting For IncomeTaxes - November 2020Document670 pagesA Roadmap To Accounting For IncomeTaxes - November 2020pravinreddy100% (1)

- Akl 1 - TM7Document4 pagesAkl 1 - TM7Ardhani PrianggaNo ratings yet

- Accounting Balance Sheet ChapterDocument17 pagesAccounting Balance Sheet Chaptersxzhou23No ratings yet

- Franchise Sample ProblemDocument2 pagesFranchise Sample ProblemeiraNo ratings yet

- IFCP - Class 4Document16 pagesIFCP - Class 4Jamal NasirNo ratings yet

- BTG Pactual Research HealthcareDocument8 pagesBTG Pactual Research HealthcareBruno LimaNo ratings yet

- Internal Job Posting 1213 - Corp Fin HyderabadDocument1 pageInternal Job Posting 1213 - Corp Fin HyderabadKalanidhiNo ratings yet

- Chapter 17 - Investment in Associate PDFDocument14 pagesChapter 17 - Investment in Associate PDFTurks100% (1)

- Bracey Company Manufactures and Sells One ProductDocument2 pagesBracey Company Manufactures and Sells One ProductKailash KumarNo ratings yet

- Lecture 3 Risk Aversion and Capital AllocationDocument36 pagesLecture 3 Risk Aversion and Capital AllocationNguyễn Phương ThảoNo ratings yet