Professional Documents

Culture Documents

Budgetary Control

Uploaded by

NtrvzChoiKshoppeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgetary Control

Uploaded by

NtrvzChoiKshoppeCopyright:

Available Formats

7 - 1

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Managerial Accounting

Second Edition

Weygandt / Kieso / Kimmel

7 - 2

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Budgetary Control and

Responsibility Accounting

7 - 3

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Management Functions

Planning

Directing and Motivating

Controlling

7 - 4

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Budgetary Control

One of the three main

functions of management

is to control.

Budgets are useful in

controlling operations.

7 - 5

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Budgetary Control

The use of budgets to

control operations.

Compare actual results with

planned objectives.

7 - 6

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

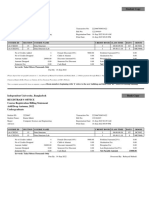

Budgetary Control

Illustration 7-1

Name of

Report

Frequency Purpose Primary Recipient(s)

Sales Weekly Determine whether sales

goals are being met

Top management and sales

manager

Labor Weekly Control direct and indirect

labor costs

Vice president of production

and production department

managers

Scrap Daily Determine efficient use of

materials

Production manager

Department

Overhead costs

Monthly Control overhead costs Department manager

Selling expenses Monthly Control selling expenses Sales manager

Income

Statement

Monthly

and

quarterly

Determine whether

income objectives are

being met

Top manager

Budgetary Control Reporting System

Illustration 7-2

7 - 8

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Static Budget

A projection of budget data

at one level of activity.

Budgeted Production in units (steel ingots) 10,000

Budgeted Costs

Indirect materials $ 250,000

Indirect labor 260,000

Utilities 190,000

Depreciation 280,000

Property taxes 70,000

Supervision 50,000

$1,100,000

Barton Steel (Forging Department)

Manufacturing Overhead Budget (Static)

For the Year Ended December 31, 2002

Illustration 7-6

7 - 9

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Static Budget

7 - 10

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Flexible Budget

A projection

of budget

data for

various

levels of

activity.

Flexible Budget

Illustration 7-13

Fox Manufacturing Company (Finishing Department)

Flexible Monthly Manufacturing Overhead Budget

For the Month Ended January 31, 2002

Activity level

Direct labor hours 8,000 9,000 10,000 11,000 12,000

Variable costs

Indirect materials ($1.50) $12,000 $13,500 $15,000 $16,500 $18,000

Indirect labor ($2.00) 16,000 18,000 20,000 22,000 24,000

Utilities ($.50) 4,000 4,500 5,000 5,500 6,000

Total variable 32,000 36,000 40,000 44,000 48,000

Fixed costs

Depreciation 15,000 15,000 15,000 15,000 15,000

Supervision 10,000 10,000 10,000 10,000 10,000

Property taxes 5,000 5,000 5,000 5,000 5,000

Total fixed 30,000 30,000 30,000 30,000 30,000

Total costs $62,000 $66,000 $70,000 $74,000 $78,000

Flexible Budget at 10,000 and 12,000 Levels

Illustration 7-15

7 - 13

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Management by Exception

The review of budget reports

by management focused

entirely or primarily on

differences between actual

results and planned

objectives.

7 - 14

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Responsibility Reporting System

The preparation of reports

for each level of

responsibility in the

companys organization

chart.

Illustration 7-17

7 - 15

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Controllable Costs

Costs that a manager has the

authority to incur within a

given period of time.

7 - 16

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Responsibility for Controlling Costs

Illustration 7-

17

7 - 17

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Decentralization

Control of operations is

delegated to many managers

throughout the organization.

7 - 18

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Segment

An area of responsibility in

decentralized operations.

7 - 19

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Responsibility Accounting

A part of management

accounting that involves

accumulating and reporting

revenues and costs on the

basis of the manager who

has the authority to make

the day-to-day decisions

about the items.

Illustration 7-20

7 - 21

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Direct Fixed Costs

Costs that relate specifically

to a responsibility center

and are incurred for the

sole benefit of the center.

7 - 22

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Indirect Fixed Costs

Costs that are incurred for

the benefit of more than one

profit center.

7 - 23

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Cost Center

A responsibility center that

incurs costs but does not

directly generate revenues.

Warranty Dept

7 - 24

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Profit Center

A responsibility center that

incurs costs but also

generates revenue.

7 - 25

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Investment Center

A responsibility center that

incurs costs, generates

revenues, and has control

over the investment funds

available for use.

7 - 26

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Illustration 7-

18

7 - 27

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Responsibility Report

Contribution margin less controllable

fixed costs=Controllable Margin.

Illustration 7-22

Difference

Favorable F

Budget Actual Unfavorable U

Sales $1,200,000 $1,150,000 $50,000 U

Variable Costs

Cost of goods sold 500,000 490,000 10,000 F

Selling & administrative 160,000 156,000 4,000 F

Total 660,000 646,000 14,000 F

Contribution margin 540,000 504,000 36,000 U

Controllable fixed costs

Cost of goods sold 100,000 100,000 -0-

Selling & administrative 80,000 80,000 -0-

Total 180,000 180,000 -0-

Controllable margin $ 360,000 $ 324,000 $36,000 U

Mantel Manufacturing Company (Marine Division)

Responsibility Report

For the Year Ended December 31, 2002

7 - 28

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Residual Income

The income that remains after

subtracting from the

controllable margin the

minimum rate of return on a

companys operating assets.

7 - 29

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Return on Investment (ROI)

A measure of managements

effectiveness in utilizing assets

at its disposal in an investment

center.

7 - 30

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

Principles of Performance Evaluation

Managers of responsibility centers

should have direct input into the

process of establishing budget goals of

their area of responsibility.

The evaluation of performance should

be based entirely on matters that are

controllable by the manager being

evaluated.

Top management should support the

evaluation process.

The evaluation process must allow

managers to respond to their

evaluations.

The evaluation should identify both

good and poor performance.

7 - 31

Budgetary

Control

Static Budgets

Flexible Budgets

Responsibility

Accounting

Responsibility

Reports/Cost

Responsibility

Reports -Profit

Investment

Centers

Next

Slide

Previous

Slide

End

Show

COPYRIGHT

Copyright 2002, John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility

for errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.

You might also like

- Peanut 2Document2 pagesPeanut 2NtrvzChoiKshoppeNo ratings yet

- Formulas and concepts for profit, loss, time, distance, speed, partnership and moreDocument9 pagesFormulas and concepts for profit, loss, time, distance, speed, partnership and morePrashanth MohanNo ratings yet

- Surgical InstrumentsDocument15 pagesSurgical Instrumentsapi-3840195No ratings yet

- B1 Reading Comprehension With KeyDocument12 pagesB1 Reading Comprehension With Keyyeyes100% (30)

- Review On First Civilization MesopotamiaDocument1 pageReview On First Civilization MesopotamiaNtrvzChoiKshoppeNo ratings yet

- 501 Word Analogy QuestionsDocument120 pages501 Word Analogy Questionsapi-3740182100% (27)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Katie Tiller ResumeDocument4 pagesKatie Tiller Resumeapi-439032471No ratings yet

- Manual Analizador Fluoruro HachDocument92 pagesManual Analizador Fluoruro HachAitor de IsusiNo ratings yet

- Us Virgin Island WWWWDocument166 pagesUs Virgin Island WWWWErickvannNo ratings yet

- LM1011 Global ReverseLogDocument4 pagesLM1011 Global ReverseLogJustinus HerdianNo ratings yet

- Guiding Childrens Social Development and Learning 8th Edition Kostelnik Test BankDocument16 pagesGuiding Childrens Social Development and Learning 8th Edition Kostelnik Test Bankoglepogy5kobgk100% (27)

- Annamalai International Journal of Business Studies and Research AijbsrDocument2 pagesAnnamalai International Journal of Business Studies and Research AijbsrNisha NishaNo ratings yet

- Hyper-Threading Technology Architecture and Microarchitecture - SummaryDocument4 pagesHyper-Threading Technology Architecture and Microarchitecture - SummaryMuhammad UsmanNo ratings yet

- Software Requirements Specification: Chaitanya Bharathi Institute of TechnologyDocument20 pagesSoftware Requirements Specification: Chaitanya Bharathi Institute of TechnologyHima Bindhu BusireddyNo ratings yet

- En dx300lc 5 Brochure PDFDocument24 pagesEn dx300lc 5 Brochure PDFsaroniNo ratings yet

- AFNOR IPTDS BrochureDocument1 pageAFNOR IPTDS Brochurebdiaconu20048672No ratings yet

- Ir35 For Freelancers by YunojunoDocument17 pagesIr35 For Freelancers by YunojunoOlaf RazzoliNo ratings yet

- EIN CP 575 - 2Document2 pagesEIN CP 575 - 2minhdang03062017No ratings yet

- Algorithms For Image Processing and Computer Vision: J.R. ParkerDocument8 pagesAlgorithms For Image Processing and Computer Vision: J.R. ParkerJiaqian NingNo ratings yet

- DLL - The Firm and Its EnvironmentDocument5 pagesDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- Log File Records Startup Sequence and Rendering CallsDocument334 pagesLog File Records Startup Sequence and Rendering CallsKossay BelkhammarNo ratings yet

- Honda Wave Parts Manual enDocument61 pagesHonda Wave Parts Manual enMurat Kaykun86% (94)

- House Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Document4 pagesHouse Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Raphael Eyitayor TyNo ratings yet

- Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural CitizensDocument2 pagesPradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural Citizenssairam namakkalNo ratings yet

- CR Vs MarubeniDocument15 pagesCR Vs MarubeniSudan TambiacNo ratings yet

- Chapter 3 of David CrystalDocument3 pagesChapter 3 of David CrystalKritika RamchurnNo ratings yet

- 1.each of The Solids Shown in The Diagram Has The Same MassDocument12 pages1.each of The Solids Shown in The Diagram Has The Same MassrehanNo ratings yet

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- Accomplishment Report 2021-2022Document45 pagesAccomplishment Report 2021-2022Emmanuel Ivan GarganeraNo ratings yet

- SQL Guide AdvancedDocument26 pagesSQL Guide AdvancedRustik2020No ratings yet

- PRODUCTDocument82 pagesPRODUCTSrishti AggarwalNo ratings yet

- DLP in Health 4Document15 pagesDLP in Health 4Nina Claire Bustamante100% (1)

- Os PPT-1Document12 pagesOs PPT-1Dhanush MudigereNo ratings yet

- TheEconomist 2023 04 01Document297 pagesTheEconomist 2023 04 01Sh FNo ratings yet

- Moor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsDocument4 pagesMoor, The - Nature - Importance - and - Difficulty - of - Machine - EthicsIrene IturraldeNo ratings yet

- 2nd Pornhub Awards - WikipediaaDocument13 pages2nd Pornhub Awards - WikipediaaParam SinghNo ratings yet