Professional Documents

Culture Documents

Netscape Valuation For IPO... PV of FCFs-2

Uploaded by

aveenobeatnikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Netscape Valuation For IPO... PV of FCFs-2

Uploaded by

aveenobeatnikCopyright:

Available Formats

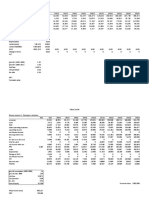

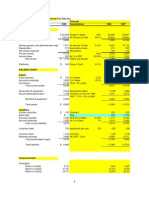

Exhibit TN-1 Discounted Cash Flow Valuation of Netscape Communications Corporation

Actual

1995

$16,625

1,736

14,890

1996

$25,790

2,693

23,097

1997

$40,007

4,177

35,830

1998

$62,061

6,480

55,581

6,115

13,449

9,486

18,284

14,715

24,362

22,827

31,585

35,411

39,370

54,931

46,138

85,211

48,405

Operating income

Taxes

Net income

(4,675)

0

$(4,675)

(4,672)

0

$(4,672)

(3,247)

0

$(3,247)

1,169

0

$1,169

11,440

5

$11,435

32,680

11,111

$21,569

73,862

25,113

$48,749

Cumulative tax loss carry forward

$(4,675)

$(9,347) $(12,594) $(11,426)

Capital expenduture 45.8%

Depreciation

Change NWC

$7,618

918

0

$15,404

3,427

0

$17,157

5,316

0

$16,161

8,246

0

$25,070

12,792

0

$38,889

19,843

0

$60,327

30,782

0

$93,582

47,751

0

$145,170

74,073

0

Free cash flows

Terminal value FCF1/(K-g)

$(11,375) $(13,260) $(13,769) $(10,809)

$(406)

$13,654

$36,471

$56,576

$87,763

Present value of cash flows

Present value of terminal

value

Total present value

$173,587

Revenues g=55%

Cost of Goods Sold 10.4%

Gross Profit

Research and development 36.8%

Other operating expenses

Current shares outstanding

New shares (1995 IPO)

Total shares

Value per share

$883,971

$1,057,558

$10,012

1,424

0

$12,731

2,209

0

Forecast

1999

2000

2001

2002

2003

2004

2005

$96,272 $149,342 $231,666 $359,372 $557,476 $864,785 $1,341,497

10,051

15,592

24,188

37,521

58,205

90,290

140,062

86,220

133,749

207,478

321,851

499,271

774,495

1,201,435

132,184

75,088

205,051

116,481

318,085

180,691

493,430

280,297

114,579

177,739

275,719

38,957

60,431

93,744

$75,622 $117,308 $181,975

427,708

145,421

$282,287

$136,144

$211,190

2,745,481

$ 1bil. Market Value vs. $16mil. Book Value

32,764

5,000

37,764

$28.00

Assumptions

Riskless rate

Discounted rate

Growth rate of sales

Terminal value perpetual

growth rate

Changes in net working

capital

6.71%

12.00%

55.12%

4.00%

0.00%

Cost of revenues

R&D

Other operating expenses

Capital expenditures

Depreciation

10.4% of sales

36.8% of revenues

Decline to 20.9% of sales by 2001

45.8% Decline to 10.8% of revenues by 2001

5.5% of revenues

You might also like

- Analysis of Historical Financials and Projections to Calculate Stock PriceDocument2 pagesAnalysis of Historical Financials and Projections to Calculate Stock Pricemc1012No ratings yet

- NetscapeDocument3 pagesNetscapeulix1985No ratings yet

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesDocument4 pagesDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000No ratings yet

- Tire City AnalysisDocument3 pagesTire City AnalysisKailash HegdeNo ratings yet

- Radio One - Exhibits1-4Document8 pagesRadio One - Exhibits1-4meredith12120% (1)

- The Acquisition of Consolidated Rail Corporation (A)Document15 pagesThe Acquisition of Consolidated Rail Corporation (A)Neetesh ThakurNo ratings yet

- Case IDocument20 pagesCase ICherry KanjanapornsinNo ratings yet

- Netscape IPO ExcelDocument7 pagesNetscape IPO Exceldchristensen5100% (1)

- Netscape HomeworkDocument3 pagesNetscape HomeworkJaime Zulueta0% (2)

- Netscape Growth Rate Needed to Justify $28 Share PriceDocument9 pagesNetscape Growth Rate Needed to Justify $28 Share PriceRasheeq Rayhan100% (1)

- Netscape's Groundbreaking $1 Billion IPODocument28 pagesNetscape's Groundbreaking $1 Billion IPOfjvillegas0% (1)

- Netscape Case SolutionDocument6 pagesNetscape Case SolutionMaksym Malovichko60% (5)

- 1.2. Netscape Sample Soln by A Student in A Previous Offering of The CourseDocument5 pages1.2. Netscape Sample Soln by A Student in A Previous Offering of The CoursehadeshungNo ratings yet

- Netscape's $140 Million IPO in 1995Document5 pagesNetscape's $140 Million IPO in 1995Anonymous F2NHsfqNo ratings yet

- Netscape CaseDocument6 pagesNetscape CaseVikram RathiNo ratings yet

- Investment Banking: Individual Assignment 2Document5 pagesInvestment Banking: Individual Assignment 2Aakash Ladha100% (3)

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesNavinMohanNo ratings yet

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- Radio OneDocument7 pagesRadio OneVvb Satyanarayana0% (1)

- Radio OneDocument1 pageRadio OneTommy Choi100% (1)

- Netscape Initial Public OfferingDocument1 pageNetscape Initial Public Offeringaruncec2001No ratings yet

- Netscape: Simulation Techniques For Company Valuation: CentreDocument4 pagesNetscape: Simulation Techniques For Company Valuation: CentreRia MehtaNo ratings yet

- Bidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIDocument6 pagesBidding For Antamina - : Applied Valuation Case at Handelshøyskolen BIAnh ThoNo ratings yet

- Radio One Inc: M&A Case StudyDocument11 pagesRadio One Inc: M&A Case StudyRishav AgarwalNo ratings yet

- Radio One's Potential Market ValuationDocument24 pagesRadio One's Potential Market Valuationgawadesx0% (1)

- Sampa Video CaseDocument6 pagesSampa Video CaseRahul BhatnagarNo ratings yet

- Particulars 2001 2002 2003 2004: Less LessDocument7 pagesParticulars 2001 2002 2003 2004: Less LessrishabhaaaNo ratings yet

- Sampa Video, Inc. Free Cash Flow Forecast and WACC CalculationsDocument3 pagesSampa Video, Inc. Free Cash Flow Forecast and WACC CalculationsKaustav BhattacharjeeNo ratings yet

- Lecture 6 Clarkson LumberDocument8 pagesLecture 6 Clarkson LumberDevdatta Bhattacharyya100% (1)

- Radio 1 Financial AnalysisDocument5 pagesRadio 1 Financial AnalysisNojoke1No ratings yet

- Clarkson Lumber Financial AnalysisDocument7 pagesClarkson Lumber Financial AnalysisSharon RasheedNo ratings yet

- Netscape ProformaDocument6 pagesNetscape ProformabobscribdNo ratings yet

- The Birth of The Internet Bubble: Netscape IPODocument12 pagesThe Birth of The Internet Bubble: Netscape IPOMridul GreenwoldNo ratings yet

- ESKIMO PIE Case StudyDocument13 pagesESKIMO PIE Case StudyPablo Vera100% (1)

- TCI's Financial Performance and Forecasts 1993-1997Document8 pagesTCI's Financial Performance and Forecasts 1993-1997Kyeli TanNo ratings yet

- Radio One Inc: M&A Case StudyDocument11 pagesRadio One Inc: M&A Case StudyRishav AgarwalNo ratings yet

- CH 02Document31 pagesCH 02singhsinghNo ratings yet

- Cross-Border Valuation of Yell GroupDocument27 pagesCross-Border Valuation of Yell GroupSounak DuttaNo ratings yet

- Clarkson TemplateDocument7 pagesClarkson TemplateJeffery KaoNo ratings yet

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- Tire City IncDocument12 pagesTire City IncMahesh Kumar Meena100% (1)

- BALDWIN Case BarnaliDocument39 pagesBALDWIN Case BarnaliVinay PottiNo ratings yet

- Financial Performance Comparison of Tobacco CompaniesDocument9 pagesFinancial Performance Comparison of Tobacco Companiesjchodgson0% (2)

- Radio OneDocument23 pagesRadio Onepsu0168100% (1)

- ClarksonDocument22 pagesClarksonfrankstandaert8714No ratings yet

- Excel Spreadsheet Sampa VideoDocument5 pagesExcel Spreadsheet Sampa VideoFaith AllenNo ratings yet

- 93-Tire-City 22 22Document26 pages93-Tire-City 22 22Daniel InfanteNo ratings yet

- Yell A Cross Border Acquisition 7 1024Document4 pagesYell A Cross Border Acquisition 7 1024Yusuf SeyhanNo ratings yet

- Eskimo PieDocument2 pagesEskimo Piechch91750% (2)

- Tire City Spreadsheet SolutionDocument6 pagesTire City Spreadsheet Solutionalmasy99100% (1)

- Valuing Cross-Border Yell Group LBODocument17 pagesValuing Cross-Border Yell Group LBOasdhjshfdsjauildgfyh50% (6)

- Netscape Valuation For IPO... PV of FCFsDocument1 pageNetscape Valuation For IPO... PV of FCFsJunaid EliasNo ratings yet

- Interco CaseDocument12 pagesInterco CaseRyan LamNo ratings yet

- Price Per Share: AssumptionsDocument4 pagesPrice Per Share: Assumptions87018701No ratings yet

- Financial Results Up To DateDocument24 pagesFinancial Results Up To DateWilliam HernandezNo ratings yet

- Netscape IPO Excel PDFDocument7 pagesNetscape IPO Excel PDFRishav AgarwalNo ratings yet

- Financial Analysis of Company from 2008-2015Document11 pagesFinancial Analysis of Company from 2008-2015busywaghNo ratings yet

- IntercoDocument1 pageIntercorishabh1981No ratings yet

- Calaveras Vineyards ExhibitsDocument9 pagesCalaveras Vineyards ExhibitsAbhishek Mani TripathiNo ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- Acf Final NotesDocument16 pagesAcf Final NotesaveenobeatnikNo ratings yet

- Butler Lumber Company OutlineDocument2 pagesButler Lumber Company OutlineaveenobeatnikNo ratings yet

- Gov Pol Reading Notes Post MidtermDocument8 pagesGov Pol Reading Notes Post MidtermaveenobeatnikNo ratings yet

- MBF13e Chap06 Pbms - FinalDocument20 pagesMBF13e Chap06 Pbms - Finalaveenobeatnik100% (2)

- Reading+NotesPOLI212topicI Mazower, HowardDocument5 pagesReading+NotesPOLI212topicI Mazower, HowardaveenobeatnikNo ratings yet

- IF1 InClass Workout-2Document7 pagesIF1 InClass Workout-2aveenobeatnikNo ratings yet

- LN06Eiteman743464 13 MBF LN06Document41 pagesLN06Eiteman743464 13 MBF LN06aveenobeatnikNo ratings yet

- Cooper BackgroundDocument2 pagesCooper BackgroundaveenobeatnikNo ratings yet

- O.M Scott Sons NotesDocument8 pagesO.M Scott Sons NotesaveenobeatnikNo ratings yet

- International Finance 2Document30 pagesInternational Finance 2aveenobeatnikNo ratings yet

- LN05Eiteman743464 13 MBF LN05Document52 pagesLN05Eiteman743464 13 MBF LN05aveenobeatnikNo ratings yet

- Government Politics Reading NOtesDocument53 pagesGovernment Politics Reading NOtesaveenobeatnikNo ratings yet

- International Finance I NotesDocument40 pagesInternational Finance I Notesaveenobeatnik100% (1)

- Butler Lumber Company OutlineDocument2 pagesButler Lumber Company OutlineaveenobeatnikNo ratings yet