Professional Documents

Culture Documents

Statement From William Gordon and Pino Luongo

Uploaded by

State Senator Liz KruegerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement From William Gordon and Pino Luongo

Uploaded by

State Senator Liz KruegerCopyright:

Available Formats

SALES TAX AUTOMATED

COLLECTION

STAC

Media, Inc.

The inevitability of real time sales tax collection has been

acknowledged by national experts for many years

Yet, when virtually all commerce is transacted

electronically, there is no technical reason why sales

taxes cannot be transferred directly to the tax agency

at the close of the transaction. There will be all sorts of

barriers to that, political and otherwise, but none of them

will be technical. It will happen in our lifetimes, and the

cash flow implication for the states will ultimately make it

happen...When electronic commerce is ubiquitous, the

logic (and the dollars) of real time sales tax payment

will become a reality.

The Sales Tax in the 21st Century

Matthew Neal Murray, William

F. Fox Greenwood Publishing

Group, Jan 1, 1997

STAC

Media, Inc.

Page

1

Antiquated sales tax systems lead directly to the loss of

millions of dollars for states and local governments

Noncompliance resulting in significant sales tax

revenue leakage

New York has attributed $1.7 Billion form Sales Tax supression

Software

Floridas annual sales tax gap of taxes collected from

customers but not paid to the state is estimated to be as

much as $2 billion2

Scholars have estimated that in some corners of the

retail market only about half of sales are reported 3

resulting is sales tax losses in every state

Slow remittance of sales tax cash collected

materially negatively impacts state and local cash

generation and costs of doing business

Reduces the millions of dollars of interest float that

Sources:

Report of

the California

Board of Equalization,

Addressing the Tax Gap, Fiscal Years 2011-2012 Through 2013-2014,;

cash

on

handState

would

deliver

Final Report of the Miami-Dade County Grand Jury, Feb. 7, 2011, at page 27; 3Susan Morse, Stewart Karlinsky, and Joseph Bankman, 20

Stan. L. & Poly Rev. 37 (2009).

2

Increases debt

STAC required to satisfy

Media, Inc.

burden costs as more borrowing is

operating cash flow needs

Page

2

UNNECESSARY BURDENS TO BUSINESSES

State imposed sanctions on

businesses are unnecessary

burdens for the merchant.

The system of forced

requirements are structured

in a way that encourages

small and mid sizer

merchants to become

delinquent

STAC

Media, Inc.

Page

3

What is STAC?

Sales Tax Automated Collection (STAC) is a

patented and the only sales tax payment

methodology that would enable the collection

of sales tax from credit and debit transactions

in real time.

STAC methodology uses existing payment

systems, technology, and infrastructure to

create an easy vehicle to remit daily credit

and debit sales tax transactions.

STAC methodology will require no change to

the current sales tax return filing processes.

STAC

Media, Inc.

Page

4

STAC methodology works with both types of Point-of-Sale

(POS) Systems

Stand-alone terminals

(aka countertop or nonintegrated)

Fully Integrated Point-of-Sale

(POS)

Processor

Software/Hardware examples: NCR, Toshiba,

Micros, Epicor

STAC

Media, Inc.

Processor

Makes up 60% of the total number

of merchants. Examples: VeriFone,

Ingenico, Equinox (HyperCom)

Page

7

VeriFones POS Device already accepts sales tax data

today

75 % of New York

State merchants

use terminals like

this to process

CREDIT AND

DEBIT CARDE

sales

STAC

Media, Inc.

Prompting for sales tax is a

core feature

Page

8

STAC methodology applied to the credit abd debit card

transaction and settlement process

PROCESSO

R

sends the

transaction

to a CARD

BRAND

CUSTOMER

makes a

purchase

with a

credit card

STORE

records

card

information

with Pointof- Sale

system and

transmits to

a

PROCESSOR

ISSUER

bills

CUSTOME

R on

their

monthly

statemen

t

CARD BRAND

submits the

transaction

to the

ISSUER

STORE accepts credit card as payment for

goods/services

ISSUER

receives

payment

ISSUER

pays the

CARD

BRAND

CARD

BRAND

pays the

PROCES

SOR

Who is involved in typical

transaction?

CUSTOMER makes a purchase with his/her credit card

CUSTOMER

pays bill

to ISSUER

PROCESSOR

pays sales

tax to the

STATE

STAC methodology enables

sales tax payment process to be

a real time automated process

PROCESSOR processes credit card sales for stores

CARD BRAND includes VISA, MasterCard, Discover,

American Express

ISSUER provides the card to the CUSTOMER and

maintains that account

STAC

Media, Inc.

PROCESSOR

pays the

STORE sale

amount

STATE

receives

payment

Page

9

STAC patented methodology is straightforward and

leverages existing technology and payment process

infrastructure

Sta

rt

Purchases Input

into POS

Calculate

Sales Tax

Transaction Card

Tendered

Approval

Sought

Transaction

Closing

Transaction Added

to Sales

File

Send Sales

File for

Settlement

Separate Revenue

and Tax Portions of

Sales

Transactions(s)

Process at

Transaction

Card

Processor

Receive

Revenue

Payment at

Merchant

Account

US Patent numbers

8321281and 8583518

STAC

Media, Inc.

Receive

Tax

Payment

at

Tax

Account

of

the

State

Processing

technology today

supports

Corporate

Purchasing Cards

which require the

processing and

reporting of sales

tax transaction

amounts.

Page

10

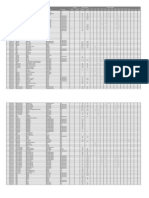

Antiquated sales tax collection system costs states millions

(and some billions) of dollars every year

1,4

00

FY2014 Estimated STAC Incremental State Sales Tax

Dollars by State 1

1,200

Millions of Incremental

Dollars

1,000

800

600

400

200

0

AK AL AR AZ CA CO CT DE FL GA HI IA

60-day Increase in Interest Float

3

60-day Accelerated Sales Tax Receivables

Total

Improved Compliance 4

0

1

0

0

0

17

11

ID

IL

IN KS KY LA MA MD ME MI MN MO MS MT NC ND NE NH NJ NM NV NY OH OK OR PA RI SC SD TN TX UT VA VT WA WI WV

13

WY

9 11 24 120 9 14 0 74 20 10 9 5 31 25 11 12 11 19 16 4 34 19 12 12 0 21 4 6 0 31 8 13 46 32 9 0 35 3 11 3 25 94 7 13 1 41 16 5

4

86 106 234 1,17 87 142 0 732 200 102 91 46 303 250 107 115 106 192 154 40 337 186 117 116 0 210 42 59 0 305 75 130 449 312 91 0 346 32 110 32 246 924 70 132 13 400 162 48 37

76 94 207 1,04 77 125 0 647 177 90 81 41 268 221 94 102 94 169 136 35 298 165 103 102 0 186 37 52 0 270 66 114 397 276 81 0 306 28 98 28 217 817 62 116 11 354 143 43 33

Sources: 1FY2014 enacted state sales tax revenue from The Fiscal Survey of States, Fall 2013 p. 43; 2Estimate based on additional 60 days of

compounded daily interest at 0.50% APR of 67% of sales tax revenue as 67% percent of all point-of-sales (POS) transactions are done with plastic and the

point of sale (POS) retail market makes up 93% of total U.S. retail dollar volume, Javelin Strategy & Research, 2012 and 2013; 3Estimate based on

reduced borrowing costs based on calculation from Collection Days Saved, Thousands Earned, Inc., November 1, 2000 using 60 days acceleration of 67%

of sales tax revenue and borrowing cost of 3.5% APR; 4Applied 5% noncompliance rate to 67% of sales tax revenue based on Evaluation Report of Tax

Compliance,

STAC Office of MN Legislative Auditor, March 2006.

Page

Media, Inc.

15

Implementing STAC methodology would benefit states and localities

Implementing STAC methodology would be another tool

in controlling and targeting new borrowing to keep

debt service affordable and ensuring that the state

abides by the debt limit

Implementing STAC methodology would improve cash

flow position by using existing technology to collect

sales tax in real time

Implementing STAC methodology would reduce sales

tax noncompliance by automating the cash collection

process

Implementing STAC methodology would

demonstrate leadership in tax innovation and

process optimization

STAC

Media, Inc.

Page

16

Current Sales Tax Systems Are Not Working And Broken

Antiquated and costly to administer

Imposes staggering and unnecessary burdens on

businesses

Structured in a way that essentially encourages

small and midsized retail businesses to become

delinquent

After-the-fact enforcement does little to prevent

noncompliance and it is often too much and too late

The increasing prevalence of tax amnesties over the

past decade has been shown to encourage

taxpayers to wait for the next amnesty rather than

perpetually engage in voluntary compliance with the

revenue system1

Source: 1Mikesell and Ross. September 2012. Fast Money: The Contribution of State Tax Amnesties to Public Revenue Systems. The National

Tax Journal, September 2012, 65 (3), 529 562.

STAC

Media, Inc.

Page

19

Background Overview

States are focused on continuing to apply discipline

and best practices to improve the budget and

financial condition of the state and its localities

States and their localities could benefit by gaining

significant incremental ongoing revenue without

raising tax rates by:

Improving sales tax collection efficiency to reduce

borrowing interest payments and to increase float

interest earned

Improving sales tax collection effectiveness to reduce

sales tax leakage due to underreporting, evasion,

errors, and business bankruptcies

Increasing data and reporting capabilities to

mitigate better overall revenue collection risk through

improved auditing and performance analysis

Sales Tax Automated Collection (STAC) methodology

STAC

would enable States to maximize these benefits byPage

Media, Inc.

20

st

moving its sales tax collection process into the 21

two year successful test of STAC

methodology

We have not seen any evidence from the 2 years of

testing and application of the STAC methodology that

it would impose additional burdens on merchants

especially small ones.

In fact, from our experience it appears that the STAC

methodology lessens the burden on the small business

owners as it reduces the 2-3 days a month spent

trying to determine the proper sales tax payments.

STAC

Media, Inc.

Page

5

You might also like

- Ta558909 Fair Taxation Special ReportDocument4 pagesTa558909 Fair Taxation Special ReportsyahrilNo ratings yet

- Taxing E-Commerce: Old Issues, New Media, New OpportunitiesDocument31 pagesTaxing E-Commerce: Old Issues, New Media, New OpportunitiesAdhysty VidyanaNo ratings yet

- International Indirect Tax Guide 2016Document384 pagesInternational Indirect Tax Guide 2016TeoNo ratings yet

- Digital Service Tax Debate FinalDocument9 pagesDigital Service Tax Debate FinalShivi CholaNo ratings yet

- MoP16 Forging A Path To Payments DigitizationDocument8 pagesMoP16 Forging A Path To Payments DigitizationSophie De SaegerNo ratings yet

- MoP19Innovation and Disruption in US Merchant PaymentsDocument9 pagesMoP19Innovation and Disruption in US Merchant PaymentsKantiKiranNo ratings yet

- Research Paper On Value Added TaxDocument8 pagesResearch Paper On Value Added Taxafnkdjwhaedkbq100% (1)

- Automated Payment Transaction Tax ReformDocument16 pagesAutomated Payment Transaction Tax Reformgure gureNo ratings yet

- 2017 GlobalAP 7.12 E-InvoicingDocument34 pages2017 GlobalAP 7.12 E-Invoicinganirban.bit5406No ratings yet

- Building Effective Payment Infrastructure: Korean ExperienceDocument31 pagesBuilding Effective Payment Infrastructure: Korean ExperienceAlbert DrouartNo ratings yet

- Importance of Maintaining Hard Copy Sales Tax RecordsDocument5 pagesImportance of Maintaining Hard Copy Sales Tax RecordsMark MorongeNo ratings yet

- Tax Research Paper TopicsDocument5 pagesTax Research Paper Topicskiitoaulg100% (1)

- KKR - Consolidated Research ReportsDocument60 pagesKKR - Consolidated Research Reportscs.ankur7010No ratings yet

- Retail Tax Ecommerce White PaperDocument5 pagesRetail Tax Ecommerce White PaperArdi ChenNo ratings yet

- Paying Taxes 2020Document50 pagesPaying Taxes 2020Pauline McDonaldNo ratings yet

- Achieving STP for US Corporate ActionsDocument2 pagesAchieving STP for US Corporate Actionscoolmint9999No ratings yet

- Insurance Fraud: You Know There Are Fraudulent Claims. Let's Find Them NowDocument4 pagesInsurance Fraud: You Know There Are Fraudulent Claims. Let's Find Them Nowsantujai26No ratings yet

- Multistate Tax Commission ArticleDocument7 pagesMultistate Tax Commission Articleyfeng1018No ratings yet

- MobiVAT Frame of ReferenceDocument34 pagesMobiVAT Frame of ReferencePatrick G. NgabonzizaNo ratings yet

- 2011 Financial PresentationDocument21 pages2011 Financial Presentationwilliams1370No ratings yet

- Revenue Recognition ThesisDocument7 pagesRevenue Recognition Thesisreneefrancoalbuquerque100% (2)

- Tax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorFrom EverandTax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorNo ratings yet

- Taxes in An E-Commerce Generation: David R. Agrawal William F. FoxDocument26 pagesTaxes in An E-Commerce Generation: David R. Agrawal William F. Fox'Toni Mariyanto'No ratings yet

- How Effecient The Elctroic Invoicing Would Be in Contaning The Shadow EconomyDocument5 pagesHow Effecient The Elctroic Invoicing Would Be in Contaning The Shadow EconomyOsamaNo ratings yet

- DEPARTMENT of The TREASURY Inspector General For Tax Administration Recommendations On Digital CurrenciesDocument31 pagesDEPARTMENT of The TREASURY Inspector General For Tax Administration Recommendations On Digital CurrenciesCrowdfundInsiderNo ratings yet

- ASPAC Indirect Tax Guide 2013Document60 pagesASPAC Indirect Tax Guide 2013culpable2No ratings yet

- Credit Card Markets PDFDocument9 pagesCredit Card Markets PDFtongkiNo ratings yet

- NetChoice Request To Amend UT SJR6Document2 pagesNetChoice Request To Amend UT SJR6UtahPolicyNo ratings yet

- The Information Society: An International JournalDocument7 pagesThe Information Society: An International JournalMehdi MansourianNo ratings yet

- Corporate Tax ThesisDocument79 pagesCorporate Tax ThesisSamuel NgangaNo ratings yet

- Gulp & Go Toll Beverage ServiceDocument25 pagesGulp & Go Toll Beverage ServiceEdoardo SmookedNo ratings yet

- Emerging Tax TrendsDocument10 pagesEmerging Tax TrendsJesreene Lee-BowraNo ratings yet

- Recommendations For Tax ReformsDocument2 pagesRecommendations For Tax ReformsSajjad Ahmed SialNo ratings yet

- 2013 05 Guia Vat Americas PDFDocument211 pages2013 05 Guia Vat Americas PDFPablo Andrés Siredey EscobarNo ratings yet

- Assignment On: Public Finance For Bangladesh PerspectiveDocument6 pagesAssignment On: Public Finance For Bangladesh PerspectiveNazib UllahNo ratings yet

- Machine Learning-Based Predictive Analysis On Electronic Billing Machines To Value Added Tax Revenues GrowthDocument8 pagesMachine Learning-Based Predictive Analysis On Electronic Billing Machines To Value Added Tax Revenues GrowthInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Department of The Treasury: The President's 2009 Budget WillDocument5 pagesDepartment of The Treasury: The President's 2009 Budget Willapi-19777944No ratings yet

- Aberdeen Cloud Research Report 2012Document6 pagesAberdeen Cloud Research Report 2012avalaraNo ratings yet

- Tax FinalDocument3 pagesTax FinalMohammad AliNo ratings yet

- Thesis On Value Added TaxDocument4 pagesThesis On Value Added Taxiapesmiig100% (1)

- Using Information Technology To Improve Tax and Revenue CollectionDocument35 pagesUsing Information Technology To Improve Tax and Revenue Collectionalex_603530016No ratings yet

- Revenue Collection Systems: A Proposal for an Automated Quarry Revenue Collection SystemDocument9 pagesRevenue Collection Systems: A Proposal for an Automated Quarry Revenue Collection SystemKola SamuelNo ratings yet

- Auditing e TaxationDocument6 pagesAuditing e Taxationmehmet1983No ratings yet

- Research Paper On Tax ComplianceDocument8 pagesResearch Paper On Tax Compliancelemvhlrif100% (1)

- Infosys110 D2 - Anna AgnewDocument12 pagesInfosys110 D2 - Anna Agnewaagn132No ratings yet

- E-Commerce Business PlanDocument6 pagesE-Commerce Business PlanAssignmentLab.com100% (1)

- Leveraging Data Analytics To Pursue Recovery of Overpaid Transaction TaxesDocument4 pagesLeveraging Data Analytics To Pursue Recovery of Overpaid Transaction TaxesDeloitte AnalyticsNo ratings yet

- Uganda Management InstituteDocument6 pagesUganda Management InstitutekitstonNo ratings yet

- CCA - 2016-07 - Moelis (Initiation)Document33 pagesCCA - 2016-07 - Moelis (Initiation)Anonymous CH9C8JPi100% (1)

- Ia1 Bda Case StudyDocument13 pagesIa1 Bda Case StudyKeshav BhumarajuNo ratings yet

- Global Fraud Report 2023Document37 pagesGlobal Fraud Report 2023ijul chaniagoNo ratings yet

- International Tax LawDocument9 pagesInternational Tax LawMonisha ChaturvediNo ratings yet

- Paginas Amarelas Case Week 8 ID 23025255Document4 pagesPaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- Statement From ADA Jill MarianiDocument8 pagesStatement From ADA Jill MarianiState Senator Liz KruegerNo ratings yet

- Reaction PaperDocument10 pagesReaction PaperpriyaNo ratings yet

- 1Document12 pages1Chinmay AgrawalNo ratings yet

- Assignment 1Document4 pagesAssignment 1Perbz07No ratings yet

- Improving Tax in Oil and GasDocument2 pagesImproving Tax in Oil and Gasgregory georgeNo ratings yet

- E-commerce Tax Issues ExplainedDocument23 pagesE-commerce Tax Issues ExplainedShiko TharwatNo ratings yet

- Income Tax Management SystemDocument11 pagesIncome Tax Management SystemHrithik khanna K BNo ratings yet

- Senator Krueger Letter To DOT Regarding Cargo BikesDocument2 pagesSenator Krueger Letter To DOT Regarding Cargo BikesState Senator Liz KruegerNo ratings yet

- Krueger - Hoylman-Sigal - Simone MSG City Council TestimonyDocument3 pagesKrueger - Hoylman-Sigal - Simone MSG City Council TestimonyState Senator Liz KruegerNo ratings yet

- Guide To The Inflation Reduction ActDocument3 pagesGuide To The Inflation Reduction ActState Senator Liz KruegerNo ratings yet

- Comments On The Penn Station General Project PlanDocument4 pagesComments On The Penn Station General Project PlanState Senator Liz KruegerNo ratings yet

- Joint Letter To MTA Board Chair Lieber On Subway Station Booth TransactionsDocument4 pagesJoint Letter To MTA Board Chair Lieber On Subway Station Booth TransactionsState Senator Liz KruegerNo ratings yet

- Testimony of /senator Krueger Regarding The Proliferation of Unlicensed Smoke Shops in New York CityDocument3 pagesTestimony of /senator Krueger Regarding The Proliferation of Unlicensed Smoke Shops in New York CityState Senator Liz KruegerNo ratings yet

- Letter From Sen. Krueger On MSG Facial RecognitionDocument1 pageLetter From Sen. Krueger On MSG Facial RecognitionState Senator Liz KruegerNo ratings yet

- Senator Krueger Testimony To The New York City Redistricting CommissionDocument2 pagesSenator Krueger Testimony To The New York City Redistricting CommissionState Senator Liz KruegerNo ratings yet

- Krueger Utility Rights Newsletter Winter 2022Document4 pagesKrueger Utility Rights Newsletter Winter 2022State Senator Liz KruegerNo ratings yet

- Senator Krueger's Albany Update - September 2022Document4 pagesSenator Krueger's Albany Update - September 2022State Senator Liz KruegerNo ratings yet

- Senator Krueger Testimony To The MTA Regarding The CBDTPDocument3 pagesSenator Krueger Testimony To The MTA Regarding The CBDTPState Senator Liz KruegerNo ratings yet

- Testimony Regarding The Penn Station Plan FEISDocument6 pagesTestimony Regarding The Penn Station Plan FEISState Senator Liz KruegerNo ratings yet

- Pet Advocate CardDocument2 pagesPet Advocate CardState Senator Liz KruegerNo ratings yet

- Free and Low-Cost Pet Care Resources For Older AdultsDocument4 pagesFree and Low-Cost Pet Care Resources For Older AdultsState Senator Liz KruegerNo ratings yet

- Letter From Sen. Krueger Re NYC School Budget CutsDocument4 pagesLetter From Sen. Krueger Re NYC School Budget CutsState Senator Liz KruegerNo ratings yet

- Testimony at The Manhattan Borough President's Hearing On The New York Blood CenterDocument3 pagesTestimony at The Manhattan Borough President's Hearing On The New York Blood CenterState Senator Liz KruegerNo ratings yet

- Letter To ESD Re Penn Station DevelopmentDocument3 pagesLetter To ESD Re Penn Station DevelopmentState Senator Liz KruegerNo ratings yet

- 2021-2022 Senior Resource GuideDocument110 pages2021-2022 Senior Resource GuideState Senator Liz KruegerNo ratings yet

- Afghan Refugees LetterDocument5 pagesAfghan Refugees LetterState Senator Liz KruegerNo ratings yet

- Pets Are Family - Advance PlanningDocument10 pagesPets Are Family - Advance PlanningState Senator Liz KruegerNo ratings yet

- FAQs About The NYC Medicare Advantage Plus PlanDocument5 pagesFAQs About The NYC Medicare Advantage Plus PlanState Senator Liz KruegerNo ratings yet

- Pet Care ProxyDocument1 pagePet Care ProxyState Senator Liz KruegerNo ratings yet

- Testimony of Sen. Liz Krueger Regarding Proposed NY Blood Center Development, 10-20-21Document4 pagesTestimony of Sen. Liz Krueger Regarding Proposed NY Blood Center Development, 10-20-21State Senator Liz KruegerNo ratings yet

- Testimony of State Senator Liz Krueger Before The New York City Planning Commission On The New York Blood Center's Application To Develop A Life Sciences HubDocument4 pagesTestimony of State Senator Liz Krueger Before The New York City Planning Commission On The New York Blood Center's Application To Develop A Life Sciences HubState Senator Liz KruegerNo ratings yet

- 2021-2022 Senior Resource GuideDocument110 pages2021-2022 Senior Resource GuideState Senator Liz KruegerNo ratings yet

- Letter To Commissioner Reardon Regarding Unemployment Benefits OverpaymentsDocument2 pagesLetter To Commissioner Reardon Regarding Unemployment Benefits OverpaymentsState Senator Liz KruegerNo ratings yet

- Legislative Letter To DEC Regarding Title V Air PermitsDocument5 pagesLegislative Letter To DEC Regarding Title V Air PermitsState Senator Liz KruegerNo ratings yet

- Letter To Governor Cuomo Regarding Vaccine DistributionDocument2 pagesLetter To Governor Cuomo Regarding Vaccine DistributionState Senator Liz KruegerNo ratings yet

- COVID-19 Emergency Rental Assistance Program (CERAP) Fact SheetDocument3 pagesCOVID-19 Emergency Rental Assistance Program (CERAP) Fact SheetState Senator Liz KruegerNo ratings yet

- Letter To Congressional Leaders Regarding Insurrection at The US CapitolDocument4 pagesLetter To Congressional Leaders Regarding Insurrection at The US CapitolState Senator Liz KruegerNo ratings yet

- List of Acc Crm-Pos and ObmDocument33 pagesList of Acc Crm-Pos and ObmMark Lord Morales BumagatNo ratings yet

- Tech Logic Oakland RFP - Final Document PDFDocument76 pagesTech Logic Oakland RFP - Final Document PDFRecordTrac - City of OaklandNo ratings yet

- The Mobile Money Revolution - NFC Mobile PaymentsDocument22 pagesThe Mobile Money Revolution - NFC Mobile PaymentsITU-T Technology Watch100% (1)

- Gsma Hspa/Lte Devices Tracking February 2011: Approval Frequency (MHZ) Data Rate (MB/S)Document13 pagesGsma Hspa/Lte Devices Tracking February 2011: Approval Frequency (MHZ) Data Rate (MB/S)Luca GiulianiNo ratings yet

- Keyware Technologies - Arrowhead Report - 20 April 2017Document29 pagesKeyware Technologies - Arrowhead Report - 20 April 2017Angus SadpetNo ratings yet

- Sait 2Document72 pagesSait 2ralif.vasileviciNo ratings yet

- McDonalds POS Installation ChecklistDocument6 pagesMcDonalds POS Installation ChecklistRob DenNo ratings yet

- Buypass 31240B Base53.40.00Document85 pagesBuypass 31240B Base53.40.00Burn Na1No ratings yet

- Ss90-Installation GuideDocument87 pagesSs90-Installation Guidealoysobeck1988No ratings yet

- Verifone: C18 Register - Hardware Installation GuideDocument36 pagesVerifone: C18 Register - Hardware Installation GuideT.L. CaldwellNo ratings yet

- Reference Guide: Downloaded From Manuals Search EngineDocument190 pagesReference Guide: Downloaded From Manuals Search EnginemogomNo ratings yet

- R051004PDocument58 pagesR051004PStephen Green100% (1)

- 7342 Parts Identification ManualDocument69 pages7342 Parts Identification ManualJOENo ratings yet

- 2017 PED ExpirationDocument30 pages2017 PED ExpirationJoenet DarmawanNo ratings yet

- HotFixReport 20Document25 pagesHotFixReport 20zeetnezNo ratings yet

- Datasheet MX 880Document3 pagesDatasheet MX 880jorge_chavez01No ratings yet

- Business and Technology Report: Prepared by Ferhat Ünlükal 10/29/2012Document42 pagesBusiness and Technology Report: Prepared by Ferhat Ünlükal 10/29/2012api-172542448No ratings yet

- Bingo - Marketing EnvironmentDocument4 pagesBingo - Marketing EnvironmentFahad MushtaqNo ratings yet

- Geidea. Geidea. Company Profile. Company Profile PDFDocument109 pagesGeidea. Geidea. Company Profile. Company Profile PDFTarek DomiatyNo ratings yet

- 7342 Parts Identification Manual PDFDocument69 pages7342 Parts Identification Manual PDFCameronWhaleNo ratings yet

- CONFIG - USR1 Parameter DescriptionsDocument8 pagesCONFIG - USR1 Parameter Descriptionsxyz_asdfNo ratings yet

- Verifone Unified Driver User NotesDocument33 pagesVerifone Unified Driver User Notesivdl.17.23No ratings yet

- Carbon Mobile5 Datasheet LTR 030818Document1 pageCarbon Mobile5 Datasheet LTR 030818Luis F JaureguiNo ratings yet

- Merchant Payments EcosystemDocument32 pagesMerchant Payments EcosystemAndali AliNo ratings yet

- Verifone Finland Oy Terminal ManualDocument39 pagesVerifone Finland Oy Terminal ManualLeo BoschiazzoNo ratings yet

- Welcome To Clearent Mobile Payment Solution With Restaurant Operation SystemDocument14 pagesWelcome To Clearent Mobile Payment Solution With Restaurant Operation SystemJames LeeNo ratings yet

- 2checkout - SB - Payment Method Coverage - 2021Document26 pages2checkout - SB - Payment Method Coverage - 2021Ryan MichealNo ratings yet

- Et51 Et56 Guide Accessory en UsDocument31 pagesEt51 Et56 Guide Accessory en UsToma HrgNo ratings yet

- 2021 2checkout Wondershare Affiliates Case Study PDFDocument5 pages2021 2checkout Wondershare Affiliates Case Study PDFדרושים בקליקNo ratings yet

- Selling ATM Card Cashout ICQ 747095810 Dumps Pin Emv Chip ATM Skimmers Track2 PinDocument3 pagesSelling ATM Card Cashout ICQ 747095810 Dumps Pin Emv Chip ATM Skimmers Track2 Pinnguyen cuongNo ratings yet