Professional Documents

Culture Documents

Management Accounting: A Business Partner: Lecture # 2

Uploaded by

amnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management Accounting: A Business Partner: Lecture # 2

Uploaded by

amnaCopyright:

Available Formats

MANAGEMENT ACCOUNTING:

A BUSINESS PARTNER

Lecture # 2

16-2

COST OF GOODS SOLD

Merchandiser

Manufacturer

Beginning merchandise

inventory

Beginning finished goods

inventory

Plus purchases

Plus cost of goods

manufactured

Merchandise available for sale

Less ending merchandise

inventory

Cost of good sold

McGraw-Hill/Irwin

Finished goods available for

sale

Less ending finished goods

inventory

Cost of good sold

The McGraw-Hill Companies, Inc., 20

16-3

INVENTORIES OF A

MANUFACTURING BUSINESS

Raw

Raw materials

materials-- inventory

inventoryon

on

hand

handand

andavailable

availablefor

foruse.

use.

Finished

Finished

goodsgoodscompleted

completed

goods

goodsawaiting

awaiting

sale.

sale.

McGraw-Hill/Irwin

Work

Work in

in

process

process-partially

partially

completed

completed

goods.

goods.

The McGraw-Hill Companies, Inc., 20

16-4

FLOW OF COSTS ASSOCIATED

WITH PRODUCTION

Direct

materials

purchased

Direct

materials

used

Materials

Inventory

$$$ $$$

Work in Process

Inventory

$$$ $$$

Direct labor &

Manufacturing Overhead

Cost of goods

manufactured

McGraw-Hill/Irwin

Finished Goods

Inventory

$$$

$$$

Cost of

Goods Sold

$$$

The McGraw-Hill Companies, Inc., 20

16-5

ILLUSTRATION OF ACCOUNTING FOR MANUFACTURING

COSTS

Materials

xx

Accounts Payable

Wages Payable

Cash

Work in Process

Factory Overhead

xx

xx

xx

xx

Work in Process (Direct Labor) xx

Payroll

xx

Factory Overhead (Depr. Bldg) xx

Selling & Admin Exp (Depr. Bldg)

Accum. Depr. Bldg

xx

xx

Factory Overhead (Depr. Mach & Eq)

xx

Accum. Depr. Mach & Eq

xx

McGraw-Hill/Irwin

Factory Overhead (Utilities)

xx

Selling & Admin Exp (Utilities) xx

Accounts Payable

xx

xx

Work in Process (Direct Materials)

Materials

xx

Payroll

xx

Wages Payable

xx

xx

Finished Goods

xx

Work in Process

Accounts Payable

Cash

xx

xx

xx

Accounts Receivable

Sales

xx

xx

Cost of Goods Sold

Finished Goods

xx

Cash

xx

Accounts Receivable

xx

xx

The McGraw-Hill Companies, Inc., 20

16-6

FLOW OF COSTS ASSOCIATED

WITH PRODUCTION

Pure-Ice

Pure-Ice Inc.

Inc. had

had $52,000

$52,000 of

of inventory

inventory in

in

direct

direct materials

materials inventory

inventory on

on January

January 1,

1,

2005.

2005. During

During the

the year,

year, Pure-Ice

Pure-Ice

purchased

purchased $586,000

$586,000 of

of additional

additional direct

direct

materials.

materials. At

At December

December 31,

31, 2005,

2005, $78,000

$78,000

of

of the

the direct

direct materials

materials were

were still

still on

on hand.

hand.

How

How much

much direct

direct material

material was

was

placed

placed into

into production

production during

during 2005?

2005?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 20

16-7

FLOW OF COSTS ASSOCIATED

WITH PRODUCTION

+

=

Beginning materials

inventory

Materials purchased

Materials available to be

placed into production

Materials placed into

production

Ending materials

inventory

McGraw-Hill/Irwin

52,000

586,000

638,000

?

$

78,000

The McGraw-Hill Companies, Inc., 20

16-8

FLOW OF COSTS ASSOCIATED

WITH PRODUCTION

+

=

Beginning materials

inventory

Materials purchased

Materials available to be

placed into production

Materials placed into

production

Ending materials

inventory

McGraw-Hill/Irwin

52,000

586,000

638,000

560,000

$

78,000

The McGraw-Hill Companies, Inc., 20

16-9

FLOW OF COSTS ASSOCIATED

WITH PRODUCTION

In

In addition

addition to

to the

the direct

direct materials,

materials, PurePureIce

Ice incurred

incurred $306,000

$306,000 of

of direct

direct labor

labor cost

cost

during

during 2005.

2005. Manufacturing

Manufacturing overhead

overhead for

for

2005

2005 was

was $724,000.

$724,000.

Pure-Ice

Pure-Ice started

started 2005

2005 with

with $132,000

$132,000 in

in

work

work in

in process.

process. During

During 2005,

2005, units

units

costing

costing $1,480,000

$1,480,000 were

were transferred

transferred to

to

finished

finished goods

goods inventory.

inventory.

What

What is

is the

the ending

ending balance

balance in

in work

work

in

in process

process at

at December

December 31,

31, 2005?

2005?

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 20

16-10

FLOW OF COSTS ASSOCIATED

WITH PRODUCTION

+

=

Be ginning w ork in

proce ss inve ntory

Ma nufa cturing costs

a dde d

Tota l costs in proce ss

duri ng the ye a r

Cost of goods

compl e te d duri ng the

ye a r

Ending w ork in

proce ss inve ntory

Direct Materials

Direct Labor

Manufacturing

Overhead

Total costs added

during the year

McGraw-Hill/Irwin

132,000

1, 590, 000

1, 722, 000

(1, 480, 000)

?

$ 560,000

306,000

724,000

$ 1,590,000

The McGraw-Hill Companies, Inc., 20

16-11

FLOW OF COSTS ASSOCIATED

WITH PRODUCTION

+

=

Beginning work in

process inventory

Manufacturing costs

added

Total costs in process

during the year

Cost of goods

completed during the

year

Ending work in

process inventory

McGraw-Hill/Irwin

132,000

1,590,000

1,722,000

(1,480,000)

$ 242,000

The McGraw-Hill Companies, Inc., 20

16-12

DETERMINING THE COST OF FINISHED GOODS

MANUFACTURED

A

Aschedule

schedule of

of the

the cost

cost

of

of finished

finished goods

goods

manufactured

manufactured is

is

prepared

prepared to

to provide

provide

managers

managers with

with an

an

overview

overview of

of

manufacturing

manufacturing

activities

activities during

during aa

period.

period.

McGraw-Hill/Irwin

The McGraw-Hill Companies, Inc., 20

16-13

CONQUEST, INC.

Schedule of the Cost of Finished Goods Manufactured

For the Year Ended December 31, 2005

Work in process inventory, beg.

Manufacturing cost assigned to

production:

Direct materials

Direct labor

Manufacturing overhead

Total manufacturing costs

Total cost of all work in process

during the year

Less: Work in process

inventory, end of year

Cost of finished goods manufactured

McGraw-Hill/Irwin

30,000

150,000

300,000

360,000

810,000

840,000

(40,000)

800,000

The McGraw-Hill Companies, Inc., 20

16-14

Beginning finished goods

inventory

Add: Cost of finished goods

manufactured

during the year

CONQUEST,

INC.

Schedule of the Cost of Finished Goods Manufactured

Cost of finished goods

For the Year Ended December 31, 2005

available for sale

finished goods

Work in process inventory, beg.Less: Ending

$

30,000

Manufacturing cost assigned to

inventory

production:

Cost

of goods sold

Direct Materials

$

150,000

Direct Labor

Manufacturing overhead

Total manufacturing costs

Total cost of all work in process

during the year

Less: Work in process

inventory, end of year

Cost of finished goods manufactured

McGraw-Hill/Irwin

300,000

360,000

$ 150,000

800,000

950,000

168,000

$ 782,000

810,000

840,000

(40,000)

800,000

The

The cost

cost of

of goods

goods

completed

completedduring

during

the

theperiod

periodis

isused

used

to

tocompute

computeCOGS

COGS

for

for the

theperiod.

period.

The McGraw-Hill Companies, Inc., 20

16-15

The income

statement is

prepared

using

established

financial

accounting

procedures.

McGraw-Hill/Irwin

CONQUEST, INC.

Income Statement

For the Year Ended December 31, 2005

Sales

Cost of goods sold

Gross profit on sales

Operating expenses

Income from operations

Less: Interest expense

Income before income

taxes

Income tax expense

Net income

$ 1,300,000

782,000

$ 518,000

400,000

$ 118,000

18,000

$

$

100,000

30,000

70,000

The McGraw-Hill Companies, Inc., 20

You might also like

- Chap 016Document24 pagesChap 016Amrik SinghNo ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument78 pagesCosts Terms, Concepts and Classifications: Chapter TwoJesus Alberto MarquezNo ratings yet

- Cost Management Concepts and ClassificationsDocument47 pagesCost Management Concepts and ClassificationsAmrik SinghNo ratings yet

- 2 Product Costing Systems Concepts and Design Issues Compatibility ModeDocument73 pages2 Product Costing Systems Concepts and Design Issues Compatibility ModeIamRuzehl VillaverNo ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument34 pagesCosts Terms, Concepts and Classifications: Chapter TwounobtainableNo ratings yet

- Managerial Accounting Concepts and Principles: Irwin/Mcgraw-HillDocument29 pagesManagerial Accounting Concepts and Principles: Irwin/Mcgraw-HillAmrik SinghNo ratings yet

- Introduction To Managerial Accounting & Cost ConceptsDocument51 pagesIntroduction To Managerial Accounting & Cost ConceptsSandra LangNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument55 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsBelajar MembacaNo ratings yet

- Managerial Accounting and Cost ConceptsDocument85 pagesManagerial Accounting and Cost ConceptsCatherine DelRayNo ratings yet

- Calculating COGS and COGMDocument8 pagesCalculating COGS and COGMAhmed HassanNo ratings yet

- Industrial Management IPE 481: Tanveer Hossain Bhuiyan Assistant Professor, Dept. of IPE BuetDocument63 pagesIndustrial Management IPE 481: Tanveer Hossain Bhuiyan Assistant Professor, Dept. of IPE BuetNaimul Hoque ShuvoNo ratings yet

- The Cost of Goods Manufactured ScheduleDocument7 pagesThe Cost of Goods Manufactured ScheduleM Jamal KhanNo ratings yet

- 02.02.2024 Accounting Cycle For A Manufacturing Company1Document34 pages02.02.2024 Accounting Cycle For A Manufacturing Company1Dennis N. IndigNo ratings yet

- Ronald Hilton Chapter 3Document25 pagesRonald Hilton Chapter 3Swati67% (3)

- ACCG200 Lectures 2-11 HandoutDocument108 pagesACCG200 Lectures 2-11 HandoutNikita Singh DhamiNo ratings yet

- Principles of Accounting, Volume 2: Managerial AccountingDocument59 pagesPrinciples of Accounting, Volume 2: Managerial AccountingVo VeraNo ratings yet

- Principles of Accounting Chapter 16Document28 pagesPrinciples of Accounting Chapter 16myrentistoodamnhighNo ratings yet

- FIN600 Module 3 Topic 2Document25 pagesFIN600 Module 3 Topic 2Inés Tetuá TralleroNo ratings yet

- Process Costing Systems ExplainedDocument74 pagesProcess Costing Systems ExplainedKhairul ImamNo ratings yet

- Product Costing: Job and Process OperationsDocument62 pagesProduct Costing: Job and Process OperationsJackNo ratings yet

- CH 18 - Process CostingDocument46 pagesCH 18 - Process CostingafrizkiNo ratings yet

- Product Costing Systems: Concepts and Design Issues: Mcgraw-Hill/IrwinDocument73 pagesProduct Costing Systems: Concepts and Design Issues: Mcgraw-Hill/IrwinFarid MahdaviNo ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument23 pagesCosts Terms, Concepts and Classifications: Chapter TwokorpseeNo ratings yet

- Systems Design: Job-Order CostingDocument25 pagesSystems Design: Job-Order CostingSafriza AhmadNo ratings yet

- Chapter 04 Testbank: StudentDocument43 pagesChapter 04 Testbank: StudentHiền DiệuNo ratings yet

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument44 pagesBasic Cost Management Concepts and Accounting For Mass Customization OperationsRoberto De JesusNo ratings yet

- Passaic County Community College AC-205 Quiz #1Document7 pagesPassaic County Community College AC-205 Quiz #1Giovanna CastilloNo ratings yet

- Job Order Costing Systems DesignDocument24 pagesJob Order Costing Systems DesignSonali Jagath100% (1)

- Cost and Managerial Accounting BasicsDocument59 pagesCost and Managerial Accounting BasicsGlenPalmerNo ratings yet

- Cost Accounting Cost AccumulationDocument57 pagesCost Accounting Cost AccumulationRoi Martin A. De VeyraNo ratings yet

- Chapter 4-Product Costing SystemsDocument17 pagesChapter 4-Product Costing SystemsQuế Hoàng Hoài ThươngNo ratings yet

- Chap 1Document22 pagesChap 1Zara Sikander33% (3)

- Ac102 ch2Document21 pagesAc102 ch2Fisseha GebruNo ratings yet

- Summative Quiz: Costing Calculations and Manufacturing CostsDocument2 pagesSummative Quiz: Costing Calculations and Manufacturing CostsVIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Day 06Document8 pagesDay 06Cy PenalosaNo ratings yet

- Principles of Accounting Chapter 17Document42 pagesPrinciples of Accounting Chapter 17myrentistoodamnhighNo ratings yet

- CH 2 - Cost Terms, Concepts, and ClassificationsDocument78 pagesCH 2 - Cost Terms, Concepts, and ClassificationsLimChanpatiya67% (3)

- Topic 6: Job Order CostingDocument51 pagesTopic 6: Job Order CostingNa RaunaNo ratings yet

- Manufacturing Statement2Document19 pagesManufacturing Statement2istepNo ratings yet

- Discussion - Job CostingDocument3 pagesDiscussion - Job CostingHannah Jane ToribioNo ratings yet

- Overheads AbsorbtionDocument29 pagesOverheads AbsorbtionGaurav AgarwalNo ratings yet

- DocDocument2 pagesDocAzir ShurimaNo ratings yet

- Job Order Costing HandoutsDocument8 pagesJob Order Costing HandoutsHannah Jane Arevalo LafuenteNo ratings yet

- Managerial Accounting and CostDocument19 pagesManagerial Accounting and CostIqra MughalNo ratings yet

- M1 - A3 Calculating Inventory - Finlon Upholstery IncDocument3 pagesM1 - A3 Calculating Inventory - Finlon Upholstery Inczb83100% (1)

- ch-3 To ch-5Document24 pagesch-3 To ch-5Riya DesaiNo ratings yet

- Answers To Exercise Questions - Chapter 2Document7 pagesAnswers To Exercise Questions - Chapter 2reme moNo ratings yet

- Basic Cost Management ConceptsDocument15 pagesBasic Cost Management ConceptsKatCaldwell100% (1)

- 6e Brewer CH02 B EOCDocument12 pages6e Brewer CH02 B EOCLiyanCenNo ratings yet

- Anchor Glass Cost FactorsDocument4 pagesAnchor Glass Cost FactorsJustine Paul Pangasi-anNo ratings yet

- Job Costing Chapter 20 SummaryDocument43 pagesJob Costing Chapter 20 SummaryJitender RawatNo ratings yet

- An Overview of Cost Terms in Chapter 2Document18 pagesAn Overview of Cost Terms in Chapter 2Cesur UğurNo ratings yet

- Cost Accumulation For Job-Shop & Batch Production OperationsDocument60 pagesCost Accumulation For Job-Shop & Batch Production Operationstrillion5No ratings yet

- Practice Questions - Class Excercises 2Document12 pagesPractice Questions - Class Excercises 2Chris With LuvNo ratings yet

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationFrom EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationNo ratings yet

- Practical Guide To Production Planning & Control [Revised Edition]From EverandPractical Guide To Production Planning & Control [Revised Edition]Rating: 1 out of 5 stars1/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Engineering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Introducing and Naming New Products and Brand ExtensionsDocument15 pagesIntroducing and Naming New Products and Brand ExtensionsamnaNo ratings yet

- Integrating Marketing Communications To Build Brand EquityDocument16 pagesIntegrating Marketing Communications To Build Brand EquityamnaNo ratings yet

- Brand Positioning & ValuesDocument31 pagesBrand Positioning & ValuesamnaNo ratings yet

- Lecture 1 Risk & Return OverviewDocument51 pagesLecture 1 Risk & Return OverviewamnaNo ratings yet

- FinalDocument44 pagesFinalamnaNo ratings yet

- Brand Management EssentialsDocument19 pagesBrand Management EssentialsamnaNo ratings yet

- End-Term Project Assignment Digital Media Strategy Components of DMS (Facebook and Instagram)Document1 pageEnd-Term Project Assignment Digital Media Strategy Components of DMS (Facebook and Instagram)amnaNo ratings yet

- Chapter 001Document19 pagesChapter 001amnaNo ratings yet

- Chapter 1Document28 pagesChapter 1shak91No ratings yet

- Demand and Supply Lec 4Document21 pagesDemand and Supply Lec 4amnaNo ratings yet

- Continental AirlinesDocument9 pagesContinental AirlinesamnaNo ratings yet

- 2016 Specimen Paper 2 Mark Scheme PDFDocument8 pages2016 Specimen Paper 2 Mark Scheme PDFSumaira AliNo ratings yet

- David Sm15 Inppt 04Document51 pagesDavid Sm15 Inppt 04Henry Andino VelásquezNo ratings yet

- Business Research Methods: Attitude MeasurementDocument20 pagesBusiness Research Methods: Attitude MeasurementNael Nasir ChiraghNo ratings yet

- 4 Elements If Quran IlahDocument2 pages4 Elements If Quran IlahamnaNo ratings yet

- Management Accounting: A Business Partner: Lecture # 1Document15 pagesManagement Accounting: A Business Partner: Lecture # 1devilroksNo ratings yet

- Business Research MethodsDocument38 pagesBusiness Research MethodsamnaNo ratings yet

- CH 09Document36 pagesCH 09amnaNo ratings yet

- 02-Operation Strategy and CompetitivenessDocument30 pages02-Operation Strategy and CompetitivenessamnaNo ratings yet

- 03 - Process Analysis and SelectionDocument29 pages03 - Process Analysis and SelectionamnaNo ratings yet

- Introduction To Operations ManagementDocument34 pagesIntroduction To Operations ManagementamnaNo ratings yet

- Economics - Theory and Practice: Ninth EditionDocument16 pagesEconomics - Theory and Practice: Ninth EditionJun Virador MagallonNo ratings yet

- USM SWOT Analysis: Page 1 of 2Document2 pagesUSM SWOT Analysis: Page 1 of 2lingt_6No ratings yet

- DFPR1978 PDFDocument76 pagesDFPR1978 PDFricki2010No ratings yet

- Apex IndustriesDocument62 pagesApex IndustriesAlpeshNo ratings yet

- Anuj Verma's asset allocation notesDocument23 pagesAnuj Verma's asset allocation notesSweta HansariaNo ratings yet

- FI Document: List of Update Terminations: SA38 SE38Document11 pagesFI Document: List of Update Terminations: SA38 SE38Manohar G ShankarNo ratings yet

- Fernando Shashen s3655990 Aero2410 Ind AssignmentDocument5 pagesFernando Shashen s3655990 Aero2410 Ind AssignmentShashen FernandoNo ratings yet

- Return On Assets (ROA) - Meaning, Formula, Assumptions and InterpretationDocument4 pagesReturn On Assets (ROA) - Meaning, Formula, Assumptions and Interpretationakashds16No ratings yet

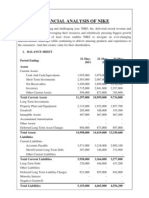

- Financial Analysis of NikeDocument5 pagesFinancial Analysis of NikenimmymathewpkkthlNo ratings yet

- CA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014Document16 pagesCA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014anupNo ratings yet

- Operating and Financial Leverage - XLSX - 0Document6 pagesOperating and Financial Leverage - XLSX - 0maniNo ratings yet

- Ch08 189-220Document32 pagesCh08 189-220vancho_mkdNo ratings yet

- JS Bank Annual Report December 31 2018 1Document328 pagesJS Bank Annual Report December 31 2018 1binraziNo ratings yet

- ACAS Taxation 2 (Income Tax - Full Midterm Coverage)Document15 pagesACAS Taxation 2 (Income Tax - Full Midterm Coverage)Steven OrtizNo ratings yet

- Robusta Coffee Shop A Feasibility StudyDocument26 pagesRobusta Coffee Shop A Feasibility StudysabberNo ratings yet

- Accounting Standards OverviewDocument21 pagesAccounting Standards Overview119936232141No ratings yet

- Monetary Policy India Last 5 YearsDocument28 pagesMonetary Policy India Last 5 YearsPiyush ChitlangiaNo ratings yet

- Economic Entity AssumptionDocument4 pagesEconomic Entity AssumptionNouman KhanNo ratings yet

- Acca Paper P5 Advanced Performance Management Final Mock ExaminationDocument20 pagesAcca Paper P5 Advanced Performance Management Final Mock ExaminationMSA-ACCANo ratings yet

- Shouldice Hospital Case Study SolutionDocument10 pagesShouldice Hospital Case Study SolutionSinta Surya DewiNo ratings yet

- E120 Fall14 HW6Document2 pagesE120 Fall14 HW6kimball_536238392No ratings yet

- Glencore 31 5 11Document6 pagesGlencore 31 5 11Chandra ChadalawadaNo ratings yet

- Role of Merchant Bankers in Capital MarketsDocument23 pagesRole of Merchant Bankers in Capital MarketschandranilNo ratings yet

- Living TrustDocument7 pagesLiving TrustRocketLawyer100% (30)

- A Study On Financial Performance Using Ratio Analysis in Khivraj Motors PVT LTDDocument30 pagesA Study On Financial Performance Using Ratio Analysis in Khivraj Motors PVT LTDvinoth_17588No ratings yet

- Sales Process Max NewDocument67 pagesSales Process Max NewumeshrathoreNo ratings yet

- AJC Case Analysis.Document4 pagesAJC Case Analysis.sunny rahulNo ratings yet

- Empirical Methods: UvA - Lecture - 01 2019Document57 pagesEmpirical Methods: UvA - Lecture - 01 2019Jason SpanoNo ratings yet

- Merger & AcquisitionDocument15 pagesMerger & AcquisitionmadegNo ratings yet

- Dunlop India Limited 2012 PDFDocument10 pagesDunlop India Limited 2012 PDFdidwaniasNo ratings yet

![Practical Guide To Production Planning & Control [Revised Edition]](https://imgv2-2-f.scribdassets.com/img/word_document/235162742/149x198/2a816df8c8/1709920378?v=1)