Professional Documents

Culture Documents

Acct105 - Business Accountancy - Module 2

Uploaded by

shashank kejariwal0 ratings0% found this document useful (0 votes)

36 views20 pages.............

Original Title

Acct105 – Business Accountancy- Module 2 (1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document.............

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views20 pagesAcct105 - Business Accountancy - Module 2

Uploaded by

shashank kejariwal.............

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 20

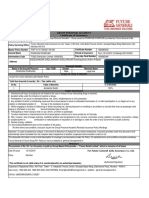

ACCT105 BUSINESS ACCOUNTANCY

MODULE 2

FORMS OF BUSINESS FIRMS

Accounting & Reporting System- Control

and Compliance

Understanding the relationship

between Accounting & other Business

Functions

Most of the worlds work is done through

organisations.

Organisations can be classified largely as

`profit or `non-profit.

They consists of a group of people who work

together to accomplish several objectives

organization uses various resources.

Resources can be financial and non financial.

Financial resources - money, capital or finance either

brought into the business by the owners(s) or borrowed

money from other people or financial institutions.

Non-financial resources - land, labor, capital and

entrepreneurship.

These resources have to be paid for and people in the

organization need information about the amounts of

these resources, and how to finance them and the

results achieved through using them

3

External stakeholders also need similar

information to make judgements about the

organization.

Accounting is a system that provides such

information.

Profit firms do business to - make a profit.

Non-profit firms are into governing, providing

social services, education and health services.

Accounting is basically similar in both types of

organisations.

4

The need forinformation.

Information needs of most organisations are

similar.

Information is processed data used by various

stakeholders to make decisions.

Information can be non-quantitative and

quantitative.

Examples of non-quantitative information would be

the types of new products available for sale,

customer reaction to a particular type of service

offered by a department

5

Examples of Quantitative information the monthly

sales report of a sales department, total wages and

salaries paid to the sales employees in the sales

department, number of items purchased by the

purchasing department.

Accounting uses several types of quantitative

information.

Accounting information is distinguished from the

other types since its usually expressed in monetary

terms.

Example of monetary information in accounting

Sales Rs20lacs, Loan Rs100crores, Wages and

salaries Rs25lacs.

Other business functions - include hiring of

employees (HR Dept),

buying goods in large amount for

resale(Purchase (Procurement) Dept),

selling goods to customers for cash and on

account (Sales Dept),

looking after customer complaints and welfare

(Customer Services Dept),

promotion and display of products (Marketing

Dept),

new product innovation, research and

development(Research & Development Dept).

In all these department accounting information is

derived in quantitative terms after which various

financial reports are prepared for respective

stakeholders.

HR Dept would have 200 employees and the total

wages and salaries bill for a month could be

Rs15lacs, - this amount is information used by the

accounting dept.

Sales Dept would provide the amount of cash and

credit sales for a month and this could be

Rs120lacs, and this information is also useful for

the accounts dept

8

Purchases Dept would show their monthly

purchases were Rs75lacs and this information is

also very useful to the accounting dept.

Marketing Dept would include their monthly

spending included Rs19 lacs which would also

be useful for the accounting dept.

So financial information from each of these

departments is used by the accounting Dept to

prepare financial reports such as Profit and Loss

account and Balance Sheet.

Financial issues associated with planning, production, marketing, and procurement and information technology

A considerable amount of operating information is

required to conduct an organisations day-to-day

activities.

Lets take an example of a make believe automobile

company: Garbar Motors.

This company produces fast and furious vehicles.

These are preferred by university students, sports

and film stars and those who can afford this type of

vehicle.

10

So Garbar motors employees must be paid wages

and salaries and the government requires that

records be maintained for each employee showing

amounts earned, paid, taxes deducted.

accounts department - keeps record of amount of

salaries and wages paid, taxes deducted and paid to

govt, various deductions made to other

organisations.

Sales dept prepares sals reports - which automobiles

are available for sale and each ones cost and selling

price, number of vehicles sold, number of older

models exchanged for newer models.

11

So sales records must be forwarded to the

accounts dept.

The person in the stock room knows which parts

and accessories are on hand and if any part

become old or outdated replacement parts may

be needed for which the accounts dept also

needs to know if purchases need to be paid for.

Amounts owed by the customers to the

automobile company must also be known so if

customers dont pay on time the appropriate

action can be taken.

12

The accounts dept. also needs to know what

the firm owes to outsiders and how this amount

would be paid and how much money it has in

the bank.

Budgets have to be prepared by the production

dept to decide how much vehicles it must buy

or produce in its factory, sales dept. needs to

know how many orders have been received,

marketing dept needs to know how much they

should spend on promotion and marketing in

launching new vehicles and whom they should

hire as models, film stars/sports stars.

13

So based on the budet projections of each

department, the accounts dept also plans in

order to decide whether the respective dept

can go ahead with their targets or they should

make some cuts.

The use of information technology also helps

in making comparisons of previous years

actual data with the current projections and

various simulation exercises can be done by

managers to decide whether their projections

are accurate.

14

Accounting and finance

functions within business

Financial Accounting, Financial

Management, Cost

Accounting, Management

Accounting, Taxation,

Auditing, Green Accounting,

Social Accounting

15

Financial accounting information

Intended for managers and also for the use of

external stakeholders to the business firm.

Involves the preparation of financial statements

such as Trading account, profit and loss account

and balance sheet.

Shows Net profit or Net Loss from operating a

business.

Also provides details of what are owned by the

firm, whom it owes money and finally the owners

share in the business

16

Garbar Motors for example would need to

know how much sales it achieved, what were

its Total Revenues from other sources, the

Total Expenses and finally whether the firm

made a Net Profit or a Net Loss.

The Trading account indicates how well a firm

had traded whereas the profit and loss

account indicates how much revenues have

been earned and the various expenses made

by the firm in earning these revenues.

17

Additionally, the balance sheet of this firm

would indicate what assets were owned and

financed by the firm and also through external

sources, how much money was owed to

outsiders and what was the owners share in

the business.

if the firm needed additional funding, then

external stakeholders such as shareholders,

creditors and banks would need to look at the

profit and loss account and especially the

balance sheet while assessing the firms

ability to be given additional funds.

18

19

20

You might also like

- BSBOPS502 Assessment Support (2) FinalDocument51 pagesBSBOPS502 Assessment Support (2) FinalNikol Cubides88% (8)

- Marketing Strategy of ITC Ltd.Document31 pagesMarketing Strategy of ITC Ltd.akashgarg22294% (93)

- Sample Ques Set 2.1 CPD GTUDocument8 pagesSample Ques Set 2.1 CPD GTUI-become Initiative78% (9)

- Rules of NetiquetteDocument58 pagesRules of NetiquetteSHITTY MAN100% (1)

- Accounting Chap 1 DiscussionDocument7 pagesAccounting Chap 1 DiscussionVicky Le100% (2)

- Acctng 1Document26 pagesAcctng 1Ho Ming LamNo ratings yet

- Wa0010.Document28 pagesWa0010.aqibNo ratings yet

- Objectives and Users of Accounting InformationDocument4 pagesObjectives and Users of Accounting InformationNidhi PrasadNo ratings yet

- Assignment: Principles of AccountingDocument11 pagesAssignment: Principles of Accountingmudassar saeedNo ratings yet

- What Is Information?Document6 pagesWhat Is Information?lezzzzhhhhaaabaybNo ratings yet

- Course: Financial Accounting & AnalysisDocument16 pagesCourse: Financial Accounting & Analysiskarunakar vNo ratings yet

- Both The CourseworksDocument7 pagesBoth The CourseworksUnderstand_Islam10No ratings yet

- ACFrOgCgcoJoISRbbrvcLJKvrsKDFlrOoxqPHjVsbB7HCekvmttN3J l1UYALVPesFLvfr4aE0aQoayJ9Q17wKwnDXMSw0ekVomnFB4hJkggTuWyne4CT0tzG Zk4ZQDXP0pb2 ZMJzczme1vwcODocument43 pagesACFrOgCgcoJoISRbbrvcLJKvrsKDFlrOoxqPHjVsbB7HCekvmttN3J l1UYALVPesFLvfr4aE0aQoayJ9Q17wKwnDXMSw0ekVomnFB4hJkggTuWyne4CT0tzG Zk4ZQDXP0pb2 ZMJzczme1vwcOManleen KaurNo ratings yet

- Ap A1Document23 pagesAp A1Liên ĐỗNo ratings yet

- TACN2 (1)Document7 pagesTACN2 (1)Thu Trang NghiêmNo ratings yet

- Why We Need Accounting: Financial Reporting LanguageDocument4 pagesWhy We Need Accounting: Financial Reporting Languagelaxmi300No ratings yet

- REFERENCE READING 1.1 Finance For ManagerDocument4 pagesREFERENCE READING 1.1 Finance For ManagerDeepak MahatoNo ratings yet

- Acctg Guide QuestionsDocument9 pagesAcctg Guide QuestionsCathNo ratings yet

- FAC1502 Accounting Study Guide QuestionsDocument34 pagesFAC1502 Accounting Study Guide QuestionszinesunduzaNo ratings yet

- General AccountingDocument70 pagesGeneral AccountingPenn CollinsNo ratings yet

- Module-01-The Accounting CycleDocument9 pagesModule-01-The Accounting CycleJade Doel RizalteNo ratings yet

- R2R Unit 1Document16 pagesR2R Unit 1Bhavika ChughNo ratings yet

- Lecture 1 Financial AccountingDocument5 pagesLecture 1 Financial Accountingzubdasyeda8No ratings yet

- Financial AccountingDocument5 pagesFinancial AccountingRiza CabellezaNo ratings yet

- Accounting Fundamentals ExplainedDocument6 pagesAccounting Fundamentals ExplainedNgoni MukukuNo ratings yet

- Unit 1: Balance SheetDocument8 pagesUnit 1: Balance SheetthejeshwarNo ratings yet

- Fabm 1Document4 pagesFabm 1hanhermosilla0528No ratings yet

- 05: Accounting PrinciplesDocument26 pages05: Accounting PrinciplesMarlaNo ratings yet

- Theoretical Framework of AccountingDocument13 pagesTheoretical Framework of Accountingmarksuudi2000No ratings yet

- Introduction To AccountingDocument5 pagesIntroduction To AccountingMardy DahuyagNo ratings yet

- Basic Accounting Module 1Document6 pagesBasic Accounting Module 1rima riveraNo ratings yet

- Introduction To AccountingDocument9 pagesIntroduction To AccountingArmyl Raul CanadaNo ratings yet

- Topic 5 Understanding Accounting SystemDocument20 pagesTopic 5 Understanding Accounting SystemZun NurainiNo ratings yet

- Assignment AccountingDocument12 pagesAssignment AccountingAslamJaved68No ratings yet

- Accounting Basics for B.Com StudentsDocument38 pagesAccounting Basics for B.Com StudentsSummyyaNo ratings yet

- Accounting Thesis LolDocument240 pagesAccounting Thesis LolSteeeeeeeephNo ratings yet

- Phao Intorsuction AcccotuingDocument14 pagesPhao Intorsuction AcccotuingPhạm Thùy DươngNo ratings yet

- Capitalmind Financial Shenanigans Part 1Document17 pagesCapitalmind Financial Shenanigans Part 1abhinavnarayanNo ratings yet

- ABE FMDocument21 pagesABE FMaung sanNo ratings yet

- Why Do We Need Accounting?: Managerial Accounting. Financial Accounting Is Comprised of Information That CompaniesDocument31 pagesWhy Do We Need Accounting?: Managerial Accounting. Financial Accounting Is Comprised of Information That CompaniesPutti Vishal RajNo ratings yet

- Financial TrainingDocument15 pagesFinancial TrainingGismon PereiraNo ratings yet

- Name: Abdul Gani Roll No: 201DDE1184 Course: MCA Year/Sem: 2 / 3 Paper Code: MCA 304 Paper Name: (Principles of Accounting)Document7 pagesName: Abdul Gani Roll No: 201DDE1184 Course: MCA Year/Sem: 2 / 3 Paper Code: MCA 304 Paper Name: (Principles of Accounting)logicballiaNo ratings yet

- Introduction To Accounting: Student's Name: Student's ID: Course Code: Course TitleDocument15 pagesIntroduction To Accounting: Student's Name: Student's ID: Course Code: Course TitleMica BaylonNo ratings yet

- Screenshot 2023-12-26 at 7.44.54 PMDocument79 pagesScreenshot 2023-12-26 at 7.44.54 PMrishivardhan050No ratings yet

- Principles of Accounts 1.0Document6 pagesPrinciples of Accounts 1.0miraaloabiNo ratings yet

- Actg 100Document4 pagesActg 100Klaverine ClarenceNo ratings yet

- Temegnu GizawfinanDocument11 pagesTemegnu GizawfinanTemegnugizawNo ratings yet

- FMPR 2 - Lesson 1Document11 pagesFMPR 2 - Lesson 1jannypagalanNo ratings yet

- Management AccountingDocument10 pagesManagement AccountingMohammad Fayez UddinNo ratings yet

- Chapter-1 Introduction To Accounting and BusinessDocument17 pagesChapter-1 Introduction To Accounting and BusinessTsegaye Belay100% (1)

- Accounting Basics ExplainedDocument5 pagesAccounting Basics ExplainedRooban BalachandranNo ratings yet

- Financial Accounting Basics: Statements, Principles & StandardsDocument18 pagesFinancial Accounting Basics: Statements, Principles & StandardsramakrishnanNo ratings yet

- RevenueAccountsWithDefinition,TypesAndExamplesIndeed.comIndia_1710866202575Document7 pagesRevenueAccountsWithDefinition,TypesAndExamplesIndeed.comIndia_1710866202575williamseugine2008No ratings yet

- Lecture Week 1Document11 pagesLecture Week 1abdul rehmanNo ratings yet

- Financial and Management Accounting NoteDocument394 pagesFinancial and Management Accounting NoteMr DamphaNo ratings yet

- Chapter 2 Accounting Principles and Reporting StandardsDocument23 pagesChapter 2 Accounting Principles and Reporting StandardsCelyn DeañoNo ratings yet

- Chap 1 Financial AcctgDocument6 pagesChap 1 Financial AcctgKunal DattaNo ratings yet

- Pace 215-Project B-Demition 1Document6 pagesPace 215-Project B-Demition 1SELYN DEMITIONNo ratings yet

- Ans.Q1) Accounting Is The Process of Recording Financial Transactions Pertaining To ADocument8 pagesAns.Q1) Accounting Is The Process of Recording Financial Transactions Pertaining To ALavina AgarwalNo ratings yet

- Chapter 1 - Student - Introduction of International Accounting - 2012Document108 pagesChapter 1 - Student - Introduction of International Accounting - 2012Kieu TrangNo ratings yet

- Case Study BSBMGT803Document6 pagesCase Study BSBMGT803Muhammad MubeenNo ratings yet

- Financial Accounting and AnalysisDocument32 pagesFinancial Accounting and AnalysisSafwan HossainNo ratings yet

- Basic Accounting Module 1Document8 pagesBasic Accounting Module 1Darwin Monticer ButanilanNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- NSHM Knowledge Campus Kolkata: M.Sc. Hospitality ManagementDocument19 pagesNSHM Knowledge Campus Kolkata: M.Sc. Hospitality Managementshashank kejariwalNo ratings yet

- Supplementary Examinations 2018Document2 pagesSupplementary Examinations 2018shashank kejariwalNo ratings yet

- Group Personal Accident Certificate of InsuranceDocument2 pagesGroup Personal Accident Certificate of InsuranceSaru PNo ratings yet

- NSHM Knowledge Campus Kolkata: M.Sc. Hospitality ManagementDocument19 pagesNSHM Knowledge Campus Kolkata: M.Sc. Hospitality Managementshashank kejariwalNo ratings yet

- SAARC Jamshed Iqbal M.com. EconomicsDocument14 pagesSAARC Jamshed Iqbal M.com. EconomicssiddhantkamdarNo ratings yet

- Uttar Pradesh: Fundamental of Production Operation Management Tutorial Sheet - 6Document1 pageUttar Pradesh: Fundamental of Production Operation Management Tutorial Sheet - 6shashank kejariwalNo ratings yet

- Theoryofcost 121220121100 Phpapp02Document24 pagesTheoryofcost 121220121100 Phpapp02Dilux Dickson RangeNo ratings yet

- SAARCDocument90 pagesSAARCvenkat761No ratings yet

- ACCT105 - Module 4Document24 pagesACCT105 - Module 4shashank kejariwalNo ratings yet

- ACCT105 - Module 4Document24 pagesACCT105 - Module 4shashank kejariwalNo ratings yet

- Bibliography: 2.marketing Management-Philip Kotler 3.india Today Magazine 5.forbes MagazineDocument1 pageBibliography: 2.marketing Management-Philip Kotler 3.india Today Magazine 5.forbes Magazineshashank kejariwalNo ratings yet

- CSIS expert outlines key lessons of international counterterrorism cooperationDocument13 pagesCSIS expert outlines key lessons of international counterterrorism cooperationshashank kejariwalNo ratings yet

- ACCT105 - Module - 6Document16 pagesACCT105 - Module - 6shashank kejariwalNo ratings yet

- ACCT105 - Module 4Document24 pagesACCT105 - Module 4shashank kejariwalNo ratings yet

- Module - 1 PPPTDocument16 pagesModule - 1 PPPTshashank kejariwalNo ratings yet

- Module - 1 PPPTDocument16 pagesModule - 1 PPPTshashank kejariwalNo ratings yet

- Datesheet of Class XII Exam 2017 PDFDocument5 pagesDatesheet of Class XII Exam 2017 PDFCarl LukeNo ratings yet

- Introduction To Social EnterprisesDocument20 pagesIntroduction To Social EnterprisesS.Rengasamy67% (9)

- THESIS Psychological Meaningfulness and Work Engag PDFDocument72 pagesTHESIS Psychological Meaningfulness and Work Engag PDFJoeven Rey100% (1)

- Income affidavit documentsDocument4 pagesIncome affidavit documentsLawyer Chandresh TiwariNo ratings yet

- Akshay Bheda Bba A 91900424081 Internship ProjectDocument55 pagesAkshay Bheda Bba A 91900424081 Internship ProjectMusic LoverNo ratings yet

- Laws of Tanzania Chapter The LawsDocument9 pagesLaws of Tanzania Chapter The LawsSTEVEN TULA100% (7)

- ConfectionaryDocument29 pagesConfectionaryHabib EjazNo ratings yet

- Leadership Is A ConversationDocument9 pagesLeadership Is A ConversationSuman Kumar ChaudharyNo ratings yet

- Business & Its ObjectivesDocument16 pagesBusiness & Its ObjectivesPavithra SalianNo ratings yet

- FDA Meeting. Human Tumors For Vaccine ManufactureDocument80 pagesFDA Meeting. Human Tumors For Vaccine ManufactureDustin Estes87% (30)

- Kerala Water Authority: Office of The Executive EngineerDocument32 pagesKerala Water Authority: Office of The Executive EngineerKkrkollam KrishnaKumarNo ratings yet

- Developing a Tailored Career Conference Program to Promote Physician Engagement and Career Growth at North Atlantic HospitalDocument17 pagesDeveloping a Tailored Career Conference Program to Promote Physician Engagement and Career Growth at North Atlantic HospitalAshams Joseph Appu0% (1)

- 1834807545hhw Class 12Document22 pages1834807545hhw Class 12Surendra NaikNo ratings yet

- Certified Management Accountants of Alberta: Code of Ethics Rules and Guidelines of Professional ConductDocument35 pagesCertified Management Accountants of Alberta: Code of Ethics Rules and Guidelines of Professional ConductBisma HarianandaNo ratings yet

- Sample Employee Appraisal Reports PDFDocument13 pagesSample Employee Appraisal Reports PDFAnand AgrawalNo ratings yet

- Worklife Balance MadhurikaDocument40 pagesWorklife Balance MadhurikaAmit PasiNo ratings yet

- Escobido 04 Quiz 01Document3 pagesEscobido 04 Quiz 01Kyl ReamonNo ratings yet

- Brickley Zimmerman SmithDocument15 pagesBrickley Zimmerman SmithAbhishek SinghNo ratings yet

- HRM Roles, Competencies & Evolution in OrganizationsDocument4 pagesHRM Roles, Competencies & Evolution in OrganizationsLinh NguyenNo ratings yet

- Department of Labor: DIAMOND MARK V SED INTERNATIONAL IN 2006SOX00044 (DEC 11 2007) 155536 CADEC SDDocument9 pagesDepartment of Labor: DIAMOND MARK V SED INTERNATIONAL IN 2006SOX00044 (DEC 11 2007) 155536 CADEC SDUSA_DepartmentOfLaborNo ratings yet

- Philippine Telegraph and Telephone CompanyDocument3 pagesPhilippine Telegraph and Telephone CompanyRyan RobertsNo ratings yet

- Form Time Sheet KosongDocument5 pagesForm Time Sheet KosongJanu Yayank MangampangNo ratings yet

- Dissertation FinalDocument228 pagesDissertation FinalCynthia V. Marcello100% (1)

- Natinalism& Patritoism IntegrityDocument33 pagesNatinalism& Patritoism IntegrityJehan ChawlaNo ratings yet

- Georgia "Divisive Laws" BillDocument9 pagesGeorgia "Divisive Laws" BillAlex JonesNo ratings yet

- Line Manager Involvement in Learning and Development: Small Beer or Big Deal?Document13 pagesLine Manager Involvement in Learning and Development: Small Beer or Big Deal?NorhajamiahMohdHanafiahNo ratings yet

- A Study On Employee Absenteeism: International Journal of Pure and Applied Mathematics No. 16 2017, 399-405Document8 pagesA Study On Employee Absenteeism: International Journal of Pure and Applied Mathematics No. 16 2017, 399-405Preet RajPuteNo ratings yet

- Revised Project Background Mission Vision and Core Values by Sir ODocument112 pagesRevised Project Background Mission Vision and Core Values by Sir OIvann BustalinioNo ratings yet