Professional Documents

Culture Documents

C in Training

Uploaded by

fharooksOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C in Training

Uploaded by

fharooksCopyright:

Available Formats

Topics to be covered

Introduction

CENVAT Concept

CENVAT Rules and Terminologies

India Localization in SAP R/3

CENVAT and Sales Process.

India Localization Configurations in SD

Q&A

Conclusion

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

What is CENVAT!?

In India, excise duty is a tax on the manufacture of goods that is levied

when goods leave the place of manufacture. Manufacturers can set off the

duty paid on input materials against their output duty, a procedure known

as CENTRAL VALUE ADDED TAX (CENVAT).

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CENVAT!?

Excise duty is a duty, levied on production or manufacture of goods. It is a

tax levied on manufacture of goods and the liability to pay excise duty

arises immediately on manufacture or production of goods

Once manufacture of goods is complete, excise duty is payable, whether

the goods are sold or self-consumed. Excise duty does not depend on the

end use of the goods.

Excise Duty is a tax on manufacture of goods but for the sake of

administrative convenience, it is collected only on removable of goods from

the factory.

CENVAT Credit

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CENVAT Credit

Rs.100 ED: Rs.10 Rs.500 ED:Rs.50

Raw Material

A

FG-C

Raw Material

B

Rs.50 ED: Rs.5 Input Tax credit availed: Rs.15

Tax liability = OTL CENVAT credit

Rs.35 = Rs.50 Rs 15

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CENVAT!?

Types of excise duties

Under the excise laws, the following are the various types of duties, which are levied: -

Basic duty: This is the basic duty levied under the Central Excise Act.

Special excise duty: This special duty is levied under special circumstances where

the levy of such additional duty is justifiable or found necessary to protect other

industries.

Additional Duty in lieu of Sales Tax : It can be charged on all goods by the central

government to counter balance exemptions from sales tax granted by various State

Governments to the detriment of industries in other States.

Additional Duty on specified items under the Act : If the Tariff Commission set up

by law recommends that in order to protect the interests of industry, the Central

Government may levy additional duties at the rate recommended on specified goods.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CENVAT!?

WHEN AND HOW MUCH CREDIT CAN BE TAKEN

The Cenvat Credit in respect of inputs may be taken immediately on receipt of the

inputs.

The Cenvat credit in respect of Capital Goods received in a factory at any point of

time in a given financial year shall be taken only for an amount not exceeding fifty

percent of the duty paid on such capital goods in the same financial year and the

balance of Cenvat Credit may be taken in any subsequent financial year.

The Cenvat credit shall be allowed even if any inputs or capital goods as such or

after being partially processed are sent to a job worker for further processing,

testing, repair etc. and it is established from the records that the goods are received

back in the factory within180 days of their being sent to a job worker.

Where any inputs are used in the final products which are cleared for export, the

Cenvat Credit in respect of the inputs so used shall be allowed to be utilised towards

payment of duty on any final product cleared for home consumption and where for

any reason such adjustment is not possible, the manufacture shall be allowed refund

of such amount.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CENVAT

Rule 1. Short title, extent and commencement.-

Rule 2. Definitions.-

Act capital goods Customs Tariff Act exempted goods final products first stage

dealer an importer input manufacturer or producer

Rule 3. CENVAT credit.-

Rule 4. Conditions for allowing CENVAT credit.-

Rule 5. Refund of CENVAT credit.-

Rule 6. Obligation of manufacturer of dutiable and exempted goods.-

Rule 7. Documents and accounts.-

Rule 8. Transfer of CENVAT credit.-

Rule 9. Transitional provision

Rule 10. Special dispensation in respect of inputs manufactured in factories located in

specified areas of North East region and Kutch district of Gujarat.-

Rule 11. Power of Central Government to notify goods for deemed CENVAT credit.-

Rule 12. Recovery of CENVAT credit wrongly taken.-

Rule 13. Confiscation and penalty.-

Rule 14. Supplementary provision

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CENVAT

So far

What is Excise Duty and Types of Excise duties?

What are CENVAT Rules?

What is CENVAT credit?

How and when CENVAT is availed?

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

SAP R/3 and CENVAT

CIN Country India Version

India localization (earlier CIN) is no longer add-on component in version SAP 4.7EE

SAP provides following std. tax procedure for country india

Formula based tax procedure TAXINJ

Condition based tax procedure TAXINN

Automatic tax code determination possible for inbound orders

Refer Oss notes 608238 & 607272

CIN data updation directly possible from

Material master

Vendor master

Customer master

Tax/Excise Duty set up for MM & SD

Tax Procedures

Pricing Procedures

CENAVT registers

Transaction Codes

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Tax/Excise Duty set up for MM & SD

Basic Settings

Master Data

Account Determination

Business Transactions

Tools

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Basic Settings

Excise Registration IDs

Company Code Settings

Plant Settings

Excise Groups

Series Groups

Excise Duty Indicators

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Excise Registration IDs

A number assigned to each premises or

location that has registered as a manufacturer

with the excise authorities.

Mention whether AED, SED, CESS

applicable. If blank will not be available for

inputs

Max no. of line

items in outgoing EI

Permits deductible /

non deductible ED

at GR

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Company Code Settings

User can edit

Dr account

during JV

Utilizes from First month for

PLA in JV excise year

Excise invoice

selection

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Plant Settings

Plant defined as Depot

or not

Multiple plants to one

Excise Registration ID

GRs per EI can be set as

below

Multi GR Multi Credit

Multi GR Single credit

Single GR

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Excise Groups

Excise Reg ID linked

to Excise group &

Plant

Depot definition at

Excise Grp & Plant

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Series Groups

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Excise Tax Indicators

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Account Determination

Describe which excise accounts (for excise duty and CENVAT) are to be posted

to for the various transaction types including sub transaction type if any

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

During transactions system determines which G/L accounts to post to by

looking at the:

Excise group, Company code & Chart of accounts

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Tax Procedures

SAP provides following std. tax procedure for country India

Formula based tax procedure TAXINJ

Condition based tax procedure TAXINN

Pricing Procedures

Factory sales and Depot Sales

JINFACT, JDEPOT,JSTKTR w.r.t TAXINN -

JFACT, JINDEP, JINSTK w.r.t TAXINJ

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Excise Registers

Excise Laws require you to maintain a number of registers in a specified

format relating to excise duty. They have to be printed out monthly and

shown to the authorities in the event of an audit. The SAP captures this

requirement.

Type of Registers:

RG23A PART I

RG23A PART II

RG23C PART I

RG23C PART II

RG I

RG23D

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Excise Registers

RG23A: Raw Material

The entries pertaining to quantity will go into RG 23 Part I and that of

duty will go into Part II in the appropriate duty column. i.e. Basic

Excise, SED, Additional duty, etc

RG23C: Capital Goods

RG23CI-Part I entry: Excise stock entry at the time of GR (only

quantity)

RG23CII-Part II entry: Credit entry of Capital goods (only value)

RG-I : Finished Goods (only Quantity)

The finished goods (manufactured, sub-contracted or gained) and sales

or stock transfer are entered in the RG I Register

Register RG I is updated after creation of an excise invoice while

dispatching the goods from the factory premises with reference a

commercial invoice or a pro-forma invoice

RG23D: Depot (this indicates both the Quantity and the amount)

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CIN Master - J1ID

Maintain Chapter IDs

Excise Duty Indicators

Determination of Excise Duty

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Excise rate Determination

Get SSI Yes Is the

duty Customer

Rates. SSI?

No Get Ch ID Get Customer

Of the Excise

Get material indicator

Excep Yes Excp rates

duty Maintained? Get plant

rates Excise

indicator

No Get final

Excise

indicator

Get rate

Based on

Ex Ind & CH ID

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CENVAT Availment and Utilization

On-Line Transactions

Goods

Receipt

Credit CENVAT Sales Excise

on-hold A/c CENVAT on hold Despatch

Invoice Process

for Capital goods

Debit ED Payable A/C

Vendor Excise

Invoice Process

Debit CENVAT A/c Excise Duty

CENVAT Account

Credit CENVAT A/c Payable Account

Credit ED Payable A/C

Fortnightly Transactions

Deposit funds in PLA

Select Excise Duty Utilization

Account

Register Transaction

Credit PLA A/c

PLA Account

Debit PLA A/c

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

CENVAT Utilization

Payment to be made to Excise Department for the Self Removals for

the last month.

Utilization to be done against the last months incoming excise duties

and CVD.

CENVAT utilization to be done before the 5th of next month.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

SAP Transactions

Activity SAP Transactions

Register Updates J1I5

RG23 A (Part I & II and RG I)

Register Extraction J2I5

Register Printing J2I6

Utilization J2IU

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

India Localization: Sales & Distribution

Features: It covers the following

Sales from Factories

Sales from Depots

Stock Transfer

Export Sales

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Factory Process - Materials

In the Process of Manufacturing the Factory uses two kinds of

materials.

Input Material:

Is defined as the one which loses its own identity in the

finished product.

Capital Goods:

Is defined as the one which does NOT lose its own identity in

the finished goods.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Sales from Factory

J1IEX

Capture EI

Excise Invoice

Supplying Plant Dispatch

J1IIN

Add up to Excise Duty Payable A/c

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Factory Process- Registers

The Factory uses the following Excise Registers

RG23 A - Part I (Captures the material A/c)

RG23 A - Part II ( Captures the Duty A/c)

RG23 C - (Captures Capital Goods Duty A/c)

RG 1 - Is a finished Goods Register

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Factory Process- Registers

RG23 A Part I & Part II

Material is received in the factory as for Quality

inspection or for Direct Input.

Material after Quality Inspection or when used as

Direct Input will go into the RG 23 A Registers.

The entries pertaining to quantity will go into RG 23

Part I and that of duty will go into Part II in the

appropriate duty column. i.e. Basic Excise, SED,

Additional duty, etc.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Factory Process- Registers

RG23 C

Purchase of Capital Goods by the factory for manufacturing

purpose are only passed in RG23 C Register.

The excise law permits claiming 50% MODVAT Credit in the

current year and 50% in the next year for Capital Goods.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Factory Process- Registers

RG I

The finished goods(manufactured, sub-contracted or gained) and

sales or stock transfer are entered in the RG I Register.

Register RG I is updated after creation of an excise invoice while

dispatching the goods from the factory premises with reference a

commercial invoice or a pro-forma invoice.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Depot Process:

The RG 23 D register is used to update the excise entries in case of

Exciseable Depots.

The Excise duty is payable when the goods are sent from the factory.

However, it is not levied again when the goods are sent from the

DEPOT.

However, while taking sale from the DEPOT and if price escalations

happen, then the extra excise is paid using a A certificate. These

details are entered in the RG23 D register and excise recovered from

the customer.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Sales From Depot

ME21N MIGO J1IJ

J1IIN J1IG

Excise Invoice

Plant Depot Dispatch

Add up to the Excise Duty Payable A/c

Reduce the Quantity

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Depot Process

Transactions can happen through two scenarios:

Scenario1: Depot receives goods from the companys factory

through stock transfer.

Scenario 2: Depot procures goods directly from external sources.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Depot Process:

For Doing Goods Receipt:

Scenario 1: Stock Transfer

Step1: Do GR (Transaction code:MB01)

Step 2: Excise Invoice Capture at Depot (Transaction Code: J1IG)

Scenario 2:

Step 1: Do GR (Transaction Code: MIGO)

Step 2: Excise Invoice Capture at Depot (Transaction Code: J1IG)

At the time of Sale:

Sales Order Delivery J1IJ (always requires a delivery

number) PGI Billing

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Export Process

In the process of Exports under bond duty is not payable and the

goods move out from the factory against an ARE1.

However, goods not under bond move out of the factory by paying the

duty and refund is separately claimed on showing proof of export I.e.

shipping bill.

In case of Deemed Exports, the same procedure is followed as in

exports, However, the form used is ARE3.

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Important Things to Know

Determination of Excise Rate in Sales and Distribution

Information on Tax Procedure and Conditions

FI Entries related to Excise taking place in SD

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Determination of ED Rate in Sales and Distribution

Settings for the same done through Transaction Code J1ID

Material: Material Chapter ID

Customer Excise Details: Excise Indicator for Customer

Plant Excise Details: Excise Indicator for Plant

Excise Indicator Customer + Excise Indicator Plant = Excise Indicator Final

Material Chapter ID + Excise Indicator Final = Excise Tax Rate

Refer Slide No.27

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

FI Entries related to Excise in SD

During the passing of Billing document to Accounting: (VF02, Release to

Accounting)

Dr Customer Rs. 125/-

Cr Sale Rs. 100/-

Cr Excise Duty Recoverable Rs. 16/-

Cr Taxes Rs.9/-

During creation of Excise Invoice: (J1IIN)

Dr Excise Duty Recoverable Rs.16/-

Cr Excise Duty Payable Rs.16/-

During Monthly Utilization: (J2IU)

Dr Excise Duty Payable Rs. 16/-

Cr CENVAT Clearing Rs.16/-

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Information on Tax Procedure and Conditions

Menu Path:

SPRO Financial Accounting Financial Accounting Global Settings Tax on

Sale and Purchase Define Procedure

Procedure: TAXINJ

The various Condition types applicable in SD are:

Excise Conditions: JMOD, JSED, JAED , JCES, etc.

Tax Conditions:JIN1, JIN2,etc.

Note:

Excise Conditions are statistical. Since, these are determined from SD pricing

procedure

Tax conditions are non-statistical. Since, these are determined from TAXINJ

While defining tax codes (using Transaction Code: FTXP), to maintain Excise

Duty (JMOD) as a changeable field, remove statistical check and maintain 100%

for JMOD. After the changes are made, one has to again put the statistical checks

in procedure TAXINJ

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

Lets Clarify our Doubts

Copyright 2003 Bristlecone, Inc. | April 14 2004 10

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- India Localization & VAT With Respect To SD: Kumar ArmugamDocument47 pagesIndia Localization & VAT With Respect To SD: Kumar ArmugamjkanoongoNo ratings yet

- India Localization With Respect To SD: T.MuthyalappaDocument77 pagesIndia Localization With Respect To SD: T.MuthyalappadavinkuNo ratings yet

- Cin 2Document77 pagesCin 2fharooksNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Sap SD Cin PresentationDocument77 pagesSap SD Cin PresentationGreg ReyNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Nature of SupplyDocument77 pagesNature of SupplybvjayaramNo ratings yet

- OFI GST E-Invoicing Functionality1Document24 pagesOFI GST E-Invoicing Functionality1Rajesh KumarNo ratings yet

- Cin2 FullDocument75 pagesCin2 FullGanesh KumarNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument36 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- Custom Duty in India, Centr...Document3 pagesCustom Duty in India, Centr...sandysharmaNo ratings yet

- ANF5ADocument9 pagesANF5ACharles JacobNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Foreign Trade Policy: A Brief UnderstandingDocument76 pagesForeign Trade Policy: A Brief UnderstandingMilna JosephNo ratings yet

- Opening of Bank Account and Shops and Establishment Registration Number)Document12 pagesOpening of Bank Account and Shops and Establishment Registration Number)yashNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Newdelhi) / (2014) 362 Itr 134 (Aar - Newdelhi) / (2014) 265 CTR 449 (Aar - Newdelhi)Document4 pagesNewdelhi) / (2014) 362 Itr 134 (Aar - Newdelhi) / (2014) 265 CTR 449 (Aar - Newdelhi)Karsin ManochaNo ratings yet

- Impact of The TRAIN Law by PICPA Taxation CPALEDocument46 pagesImpact of The TRAIN Law by PICPA Taxation CPALEJohn LuNo ratings yet

- Activate CIN Master Data Screen in Vendor CreationDocument16 pagesActivate CIN Master Data Screen in Vendor CreationPankaj KumarNo ratings yet

- Kansai Nerolac Software TDSDocument17 pagesKansai Nerolac Software TDSkumargaurav21281No ratings yet

- Uae Corporate Tax Law Highlights Version 3-0-1671055465Document29 pagesUae Corporate Tax Law Highlights Version 3-0-1671055465Jeese VarkeyNo ratings yet

- E Invoice Under GST - NovDocument2 pagesE Invoice Under GST - NovVishwanath HollaNo ratings yet

- Accounting Policies and Notes for Hanuman EstatesDocument3 pagesAccounting Policies and Notes for Hanuman Estatesravibhartia1978No ratings yet

- Chapter 1 - Introduction To GST: Applicability of Utgst ActDocument7 pagesChapter 1 - Introduction To GST: Applicability of Utgst ActSoul of honeyNo ratings yet

- Presentation - Mr. Sanjay Sanghvi - Taxation of EPC Contracts - 21 Dec 2013Document13 pagesPresentation - Mr. Sanjay Sanghvi - Taxation of EPC Contracts - 21 Dec 2013Aayushi AroraNo ratings yet

- 19147gg0787 Sap Cin DocsDocument56 pages19147gg0787 Sap Cin DocsLokesh ModemzNo ratings yet

- PEZA IT Enterprise Registration ApplicationDocument10 pagesPEZA IT Enterprise Registration ApplicationNikki OcampoNo ratings yet

- ITS-R007 - REGISTER FOR EXCISE TAXDocument10 pagesITS-R007 - REGISTER FOR EXCISE TAXsanjay kafleNo ratings yet

- OFI GST ISupplier Functional DocumentDocument27 pagesOFI GST ISupplier Functional Documentsubhani1211No ratings yet

- WHT Rates Tax Year 2023-24 - 230630 - 222611Document2 pagesWHT Rates Tax Year 2023-24 - 230630 - 222611Ammad ArifNo ratings yet

- Withholding Rates Tax Year 2024Document1 pageWithholding Rates Tax Year 2024Maira ShahNo ratings yet

- Mop 22F51933Document22 pagesMop 22F51933paras INSURANCENo ratings yet

- CIN Configuration Guide for Indian Excise DutyDocument16 pagesCIN Configuration Guide for Indian Excise Dutynbhaskar bhaskarNo ratings yet

- Special Economic ZoneDocument24 pagesSpecial Economic ZoneSiva SankariNo ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereIRSNo ratings yet

- Equity Program FAQDocument14 pagesEquity Program FAQNikhil SinghalNo ratings yet

- 32205525-3-2Document13 pages32205525-3-2Pankaj SinghNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument31 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaFreudestein UditNo ratings yet

- Inter GST Chart Book Nov2022Document41 pagesInter GST Chart Book Nov2022Aastha ChauhanNo ratings yet

- CBDT Report Profit Attribution Permanent EstablishmentDocument86 pagesCBDT Report Profit Attribution Permanent Establishmentrameshg1960No ratings yet

- Economic Update 17th May-1Document2 pagesEconomic Update 17th May-1mNo ratings yet

- World Bank Assessment For Doing Business Report-2021: Starting A Business & Paying TaxesDocument12 pagesWorld Bank Assessment For Doing Business Report-2021: Starting A Business & Paying TaxesAdarsh ShettyNo ratings yet

- Idt 5Document5 pagesIdt 5manan agrawalNo ratings yet

- Profit Attribution To PEDocument7 pagesProfit Attribution To PEPiyush AggarwalNo ratings yet

- Anf 5BDocument3 pagesAnf 5BAkash KediaNo ratings yet

- Electronic Filing and Payment SystemDocument33 pagesElectronic Filing and Payment SystemJeannie de leonNo ratings yet

- Analysis of Section 194RDocument52 pagesAnalysis of Section 194RicahimanshumehtaNo ratings yet

- 22I27274_CMP-PolicyScheduleDocument17 pages22I27274_CMP-PolicySchedulePankaj SinghNo ratings yet

- Input Tax Credit GSTDocument21 pagesInput Tax Credit GSTVikky VasvaniNo ratings yet

- The Institute of Chartered Accountants of IndiaDocument42 pagesThe Institute of Chartered Accountants of IndiaXpacNo ratings yet

- (2017) 84 Taxmann - Com 38 (Article) Armâ S Length Attribution of Profits To PE (Part I) - Evolution in Indian JurisprudenceDocument4 pages(2017) 84 Taxmann - Com 38 (Article) Armâ S Length Attribution of Profits To PE (Part I) - Evolution in Indian Jurisprudencesuraj gulipalliNo ratings yet

- Fertilizers and Chemicals Travancore LTD: FACT ForwardDocument35 pagesFertilizers and Chemicals Travancore LTD: FACT ForwardfharooksNo ratings yet

- BPP CO Product Costing v.0Document35 pagesBPP CO Product Costing v.0fharooksNo ratings yet

- Tax ExcDocument30 pagesTax ExcfharooksNo ratings yet

- Central Excise INDIADocument30 pagesCentral Excise INDIAfharooksNo ratings yet

- TAX ExciseDocument30 pagesTAX ExcisefharooksNo ratings yet

- 2SCentral ExciseDocument30 pages2SCentral ExcisefharooksNo ratings yet

- Check Withholding Tax CountriesDocument12 pagesCheck Withholding Tax CountriesfharooksNo ratings yet

- 10 BPP CO Product Costing v.0Document35 pages10 BPP CO Product Costing v.0fharooksNo ratings yet

- Tax ExcDocument30 pagesTax ExcfharooksNo ratings yet

- Check Withholding Tax CountriesDocument12 pagesCheck Withholding Tax CountriesfharooksNo ratings yet

- Central Excise INDIADocument30 pagesCentral Excise INDIAfharooksNo ratings yet

- Cexcise AxDocument30 pagesCexcise AxfharooksNo ratings yet

- Business Process Document - Cost Centre Accounting: Project STARKDocument25 pagesBusiness Process Document - Cost Centre Accounting: Project STARKfharooksNo ratings yet

- 1 Central ExciseDocument30 pages1 Central ExcisefharooksNo ratings yet

- 823Document25 pages823fharooksNo ratings yet

- 823Document25 pages823fharooksNo ratings yet

- Business Process Document - Cost Centre Accounting: Stark SssDocument25 pagesBusiness Process Document - Cost Centre Accounting: Stark Sssfharooks100% (1)

- 823Document25 pages823fharooksNo ratings yet

- Business Process Document - Cost Centre AccountingDocument24 pagesBusiness Process Document - Cost Centre AccountingfharooksNo ratings yet

- Business Process Document - Cost Centre AccountingDocument24 pagesBusiness Process Document - Cost Centre AccountingfharooksNo ratings yet

- Business Process Document - Cost Centre AccountingDocument24 pagesBusiness Process Document - Cost Centre AccountingfharooksNo ratings yet

- Business Process Document - Cost Centre AccountingDocument24 pagesBusiness Process Document - Cost Centre AccountingfharooksNo ratings yet

- Allocation: Posted Amounts Fixed Amount Fixed RateDocument8 pagesAllocation: Posted Amounts Fixed Amount Fixed RatefharooksNo ratings yet

- Cin 1Document77 pagesCin 1fharooksNo ratings yet

- CinDocument77 pagesCinfharooksNo ratings yet

- Certificate of Candidacy SGODocument2 pagesCertificate of Candidacy SGObernardNo ratings yet

- Harassment of Women at the WorkplaceDocument22 pagesHarassment of Women at the WorkplaceAbhinav PrakashNo ratings yet

- People vs. ComilaDocument16 pagesPeople vs. ComilaSheryl OgocNo ratings yet

- Danilo E Paras Vs Commission On Elections COMELEC 264 SCRA 49Document4 pagesDanilo E Paras Vs Commission On Elections COMELEC 264 SCRA 49joshemmancarinoNo ratings yet

- Impact of Corporate Governance in Business OrganisationDocument10 pagesImpact of Corporate Governance in Business Organisationenbassey100% (2)

- Hamer v. SidwayDocument3 pagesHamer v. SidwayAnonymous eJBhs9CgNo ratings yet

- Manufacturer's Warranty and Limitation of ClaimsDocument2 pagesManufacturer's Warranty and Limitation of ClaimsBrandon TrocNo ratings yet

- DiplomacyDocument8 pagesDiplomacyRonnald WanzusiNo ratings yet

- United States v. Juan Carlos Huerta-Moran, Also Known As Francisco Lozano, 352 F.3d 766, 2d Cir. (2003)Document9 pagesUnited States v. Juan Carlos Huerta-Moran, Also Known As Francisco Lozano, 352 F.3d 766, 2d Cir. (2003)Scribd Government DocsNo ratings yet

- 16 - People Vs Chi Chan Liu DigestDocument2 pages16 - People Vs Chi Chan Liu DigestAmberChan100% (1)

- Soriano vs. PeopleDocument3 pagesSoriano vs. Peoplek santosNo ratings yet

- R A 9154 (Intro)Document12 pagesR A 9154 (Intro)David JuanNo ratings yet

- San Miguel Foods Inc. Vs San Miguel Corp Employees UnionDocument2 pagesSan Miguel Foods Inc. Vs San Miguel Corp Employees Unionfay garneth buscatoNo ratings yet

- The Code of Civil Procedure, 1908 Non-Joinder and Misjoinder Parties To SuitsDocument13 pagesThe Code of Civil Procedure, 1908 Non-Joinder and Misjoinder Parties To Suitsnirav doshiNo ratings yet

- Intern Non-Disclosure Agreement: Article I: Scope of AgreementDocument5 pagesIntern Non-Disclosure Agreement: Article I: Scope of Agreementfeel free userNo ratings yet

- Government of Canada: Structure and FunctionDocument7 pagesGovernment of Canada: Structure and FunctionAthena HuynhNo ratings yet

- Consti Case List Secs 6-22Document26 pagesConsti Case List Secs 6-22Matthew WittNo ratings yet

- The Lex Rei Sitae RulesDocument4 pagesThe Lex Rei Sitae RulesApple WormNo ratings yet

- Property MatrixDocument2 pagesProperty MatrixDia MaeNo ratings yet

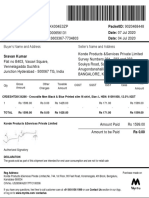

- Gstin Number: Packetid: 9020468448 Invoice Number: Date: 07 Jul 2020 Order Number: Date: 04 Jul 2020Document1 pageGstin Number: Packetid: 9020468448 Invoice Number: Date: 07 Jul 2020 Order Number: Date: 04 Jul 2020Sravan KumarNo ratings yet

- Bureau of Customs V Whelan DigestDocument2 pagesBureau of Customs V Whelan DigestJaypee OrtizNo ratings yet

- Calendar - 2016 08 12Document2 pagesCalendar - 2016 08 12Elden Cunanan BonillaNo ratings yet

- APR - Form 3Document2 pagesAPR - Form 3Michelle Muhrie TablizoNo ratings yet

- AutoPay Output Documents PDFDocument2 pagesAutoPay Output Documents PDFAnonymous QZuBG2IzsNo ratings yet

- Letter 2Document2 pagesLetter 2Scott AsherNo ratings yet

- Vakalatnama Supreme CourtDocument2 pagesVakalatnama Supreme CourtSiddharth Chitturi80% (5)

- CASE #91 Republic of The Philippines vs. Alvin Dimarucot and Nailyn Tañedo-Dimarucot G.R. No. 202069, March 7, 2018 FactsDocument2 pagesCASE #91 Republic of The Philippines vs. Alvin Dimarucot and Nailyn Tañedo-Dimarucot G.R. No. 202069, March 7, 2018 FactsHarleneNo ratings yet

- Brigada Pabasa MOU TemplateDocument3 pagesBrigada Pabasa MOU TemplateNimfa Payosing Palmera100% (10)

- G.R. No. 151857 - Calamba Steel Center Inc. v. Commissioner of Internal RevenueDocument10 pagesG.R. No. 151857 - Calamba Steel Center Inc. v. Commissioner of Internal RevenueLolersNo ratings yet

- in Re Petition To Sign in The Roll of Attorneys, Michael Medado, BM 2540, 2013Document6 pagesin Re Petition To Sign in The Roll of Attorneys, Michael Medado, BM 2540, 2013Christia Sandee SuanNo ratings yet