Professional Documents

Culture Documents

Classic Pen

Uploaded by

Ankur Mittal0 ratings0% found this document useful (0 votes)

200 views15 pagesClassic pen

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentClassic pen

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

200 views15 pagesClassic Pen

Uploaded by

Ankur MittalClassic pen

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 15

Activity-based cost systems

Case:

The classic pen company

Classic pen company

Facts:

Low-cost producer of traditional BLUE and

BLACK pens

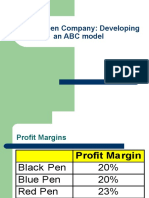

Profit margin: over 20% of sales

Declining trend in operating results

Opportunity for adding new products:

1. Red pen introduced five years before with same

technology at 3% premium

2. Purple pen introduced with 10% premium last

year

Issues before management

Premium products (Red & Purple) more

profitable, but overall profitability is down

Even new products margin declining in face of

competition

Introduction of new pens requires: more

activities (more resources?)

More set-up time (max. for red pen)

More purchasing and scheduling time

Present cost system

Features:

Single overhead absorption rate

Direct labour cost is the base

Rate is 300% of DLC

Previously it was 200% (indicates increase

in indirect expenses)

Traditional cost sheet

Blue Black Red Purple Total

DM 25000 20000 4680 550 50230

DL 10000 8000 1800 200 20000

OH (300% 30000 24000 5400 600 60000

of DL)

Total cost 65000 52000 11880 1350 130230

Sales 75000 60000 13950 1650 150600

Operating 10000 8000 2070 300 20370

income

Margin 13.3 13.3 14.8 18.2 13.5

(%)

ABC

Overhead is not a burden to be allocated on top of

direct labour

Identify activities of indirect and support resource

of the entity

Relate the cost of these activities to the products

for which they are performed

Condition:

large overhead (46% of TC) and multiple products

may be ABC would help

ABC Analysis

Expenses identified: Rs.

Indirect labour 20,000

Fringe benefits 16,000

Computer Systems 10,000

Machinery 8,000

Maintenance 4,000

Energy 2,000

Total 60,000

Forming cost pools

Indirect labour Rs. 20,000 + 40% of fringe

benefit, i.e., Rs.8,000 =

Rs.28,000

Computer expenses Rs.10,000

Machine expenses Rs.8,000+Rs.4,000+Rs.2,000

=Rs.14,000

Activities identified

Scheduling or handling production runs

Production set up

Record keeping

Machine support

Relating activities to activity drivers

Activities Activity drivers

Handling production runs Production runs (150

nos.)

Production set up Setup time (526 hours)

Record keeping No. of products (4)

Machine support Machine hours

(10,000hr)

Allocation of cost to activities

Indirect % share Comp. % share Machine % share Total

labour expenses expenses

Handling 14,000 50% 8,000 80% 22,000

Productio

n run

Prod. set 11,200 40% 11,200

up

Record 2,800 10% 2,000 20% 4,800

keeping

Machine 14,000 100% 14,000

support

Total 28,000 10,000 14,000 52,000

New cost system-ABC

Blue Black Red Purple Total

DM+DL 35,000 28,000 6,480 750 70,230

Fringe benefit 4,000 3,200 720 80 8,000

Overheads

Handling prod. Run 7,333 7,333 5,573 1,760 22,000

Prod. Set up 4,259 1,065 4,855 1,022 11,200

Record keeping 1,200 1,200 1,200 1,200 4,800

Machine support 7,000 5,600 1,260 140 14,000

Total overhead 19,792 15,198 12,888 4,122 52,000

Total cost 58,792 46,398 20,088 4,952 130,230

Sales 75,000 60,000 13,950 1,650 150,600

Profit 16,208 13,602 -6,138 -3,302 20,370

Profit margin(%) 21.6 22.7 -44 -200.1 13.5

Comparison of OH share

Traditional cost system ABC system

Blue - 30,000 Blue - 19,792

Black -24,000 Black 15,198

Red - 5,400 Red -12,888

Purple - 600 Purple 4,122

Comparison of Margin

Traditional cost system ABC system

Blue - 13.3% Blue - 21.6%

Black 13.3% Black 22.7%

Red - 14.8% Red - (-44%)

Purple - 18.2% Purple (-200.1%)

Conclusion

Addition of new products has resulted in

increase of overheads

New product mix means disproportionate

demand on resources of the organisation

due to unequal activity content that goes

into different products

ABC can result in more accurate costing in

such cases

You might also like

- Business CaseDocument4 pagesBusiness CaseJoseph GonzalesNo ratings yet

- Alberta Gauge Company CaseDocument2 pagesAlberta Gauge Company Casenidhu291No ratings yet

- Destin Brass Case AnalysisDocument1 pageDestin Brass Case Analysisfelipevwa100% (1)

- Case Problem 1 - Product MixDocument7 pagesCase Problem 1 - Product Mixgorgory_30% (1)

- Case Study MOPDocument6 pagesCase Study MOPLorenc BogovikuNo ratings yet

- Assignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundDocument5 pagesAssignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundRitika Sharma0% (1)

- Classic Pen CompanyDocument9 pagesClassic Pen Companyabhay_prakash_ranjanNo ratings yet

- Apple Watch (A) - The Launch Case Study Solution: Marginal EconomicsDocument4 pagesApple Watch (A) - The Launch Case Study Solution: Marginal Economicshimani rathore100% (1)

- Activity-Based Costing Classic Pen CaseDocument73 pagesActivity-Based Costing Classic Pen CaseRohin Kesar100% (4)

- Inventory ProblemsDocument6 pagesInventory ProblemsSubhrodeep DasNo ratings yet

- Woodsmith 239 PDFDocument68 pagesWoodsmith 239 PDFdomingo figueroa100% (2)

- Case Study - A Rush To Failure?Document3 pagesCase Study - A Rush To Failure?Nic Sarayba100% (2)

- Classic Pen Company: Syndicate 101Document4 pagesClassic Pen Company: Syndicate 101Silvia WongNo ratings yet

- Harvard Business School Case #103-015 198117 Case Software # XLS-666Document9 pagesHarvard Business School Case #103-015 198117 Case Software # XLS-666saifrahmanNo ratings yet

- Classic Pen Company ScribdDocument8 pagesClassic Pen Company ScribdMadhur BangurNo ratings yet

- Classic Pen Company Activity Based CostingDocument16 pagesClassic Pen Company Activity Based CostingIndahKusumawardhaniNo ratings yet

- C1 - Rosemont MANAC SolutionDocument13 pagesC1 - Rosemont MANAC Solutionkaushal dhapare100% (1)

- MAC Davey Brothers - AkshatDocument4 pagesMAC Davey Brothers - AkshatPRIKSHIT SAINI IPM 2019-24 BatchNo ratings yet

- The Classic Pen CompanyDocument10 pagesThe Classic Pen CompanyParthiban BanNo ratings yet

- Rosemont Health Center Rev01Document7 pagesRosemont Health Center Rev01Amit VishwakarmaNo ratings yet

- Key ElectronicsDocument10 pagesKey ElectronicsAaditya VasnikNo ratings yet

- Project Rosemont Hill Health CenterDocument9 pagesProject Rosemont Hill Health CenterSANDEEP AGRAWALNo ratings yet

- SFRLO SecB Group1 v2Document9 pagesSFRLO SecB Group1 v2Priyanka Kambli100% (1)

- Siemens ElectricDocument6 pagesSiemens ElectricUtsavNo ratings yet

- PIA Hawaii Emirates Easy Jet: Breakeven AnalysisDocument3 pagesPIA Hawaii Emirates Easy Jet: Breakeven AnalysissaadsahilNo ratings yet

- Wilkerson Company Case Numerical Approach SolutionDocument3 pagesWilkerson Company Case Numerical Approach SolutionAbdul Rauf JamroNo ratings yet

- Dave BrothersDocument6 pagesDave BrothersSangtani PareshNo ratings yet

- Garanti Payment Systems:: Digital Transformation StrategyDocument12 pagesGaranti Payment Systems:: Digital Transformation StrategySwarnajit SahaNo ratings yet

- Hospital SupplyDocument3 pagesHospital SupplyJeanne Madrona100% (1)

- Siemens CaseDocument4 pagesSiemens Casespaw1108No ratings yet

- Dakota Office ProductsDocument10 pagesDakota Office ProductsMithun KarthikeyanNo ratings yet

- Report 2Document4 pagesReport 2Trang PhamNo ratings yet

- Case Background: - Mrs. Santha - Owner Small Assembly Shop - Production Line ADocument12 pagesCase Background: - Mrs. Santha - Owner Small Assembly Shop - Production Line AAbhishek KumarNo ratings yet

- Davey Brothers Watch Co. SubmissionDocument13 pagesDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchNo ratings yet

- Design by Kate: The Power of Direct SalesDocument8 pagesDesign by Kate: The Power of Direct SalesSaurabh PalNo ratings yet

- Classic Pen Case CompanyDocument4 pagesClassic Pen Case CompanymokotoNo ratings yet

- Classic Knitwear & Guardian Case StudyDocument15 pagesClassic Knitwear & Guardian Case StudyShambu Nandanan100% (4)

- Wilkerson CompanyDocument4 pagesWilkerson Companyabab1990No ratings yet

- Millichem Solution XDocument6 pagesMillichem Solution XMuhammad JunaidNo ratings yet

- Vaibhav Maheshwari Merrimack Tractors 2011pgp926Document3 pagesVaibhav Maheshwari Merrimack Tractors 2011pgp926studvabzNo ratings yet

- Classic Knitwear CaseDocument4 pagesClassic Knitwear CaseSwapnil JoardarNo ratings yet

- American Connector Company: Case AnalysisDocument5 pagesAmerican Connector Company: Case AnalysisSam SamNo ratings yet

- HRM PPL SectionC GroupBDocument9 pagesHRM PPL SectionC GroupBSHREYANSH PANCHALNo ratings yet

- Davey & Classic Pen CA - Abhishek - .2022B2PGPMX001docxDocument4 pagesDavey & Classic Pen CA - Abhishek - .2022B2PGPMX001docxabhishek pattanayakNo ratings yet

- MM II - Section A - Group #6Document9 pagesMM II - Section A - Group #6Rajat RanjanNo ratings yet

- CMA Individual Assignment Manu M EPGPKC06054Document6 pagesCMA Individual Assignment Manu M EPGPKC06054CH NAIRNo ratings yet

- The ALLTEL Pavilion Case - Strategy and CVP Analysis PDFDocument7 pagesThe ALLTEL Pavilion Case - Strategy and CVP Analysis PDFPritam Kumar NayakNo ratings yet

- 04 Mrudula Ice Cream ParlourDocument4 pages04 Mrudula Ice Cream ParlourSuchit SinghNo ratings yet

- Megacard CorporationDocument16 pagesMegacard CorporationAntariksh ShahwalNo ratings yet

- CHP 2 Production Strategy PG 81Document8 pagesCHP 2 Production Strategy PG 81Chetan Adsul100% (1)

- Group 4 Symphony FinalDocument10 pagesGroup 4 Symphony FinalSachin RajgorNo ratings yet

- Classic Pen CompanyDocument4 pagesClassic Pen Companyfundu1230% (2)

- Case: Supply Chain Management at World Co., LTD: Assignment QuestionsDocument3 pagesCase: Supply Chain Management at World Co., LTD: Assignment QuestionsGirishma baghmare100% (1)

- Dakota Office ProductsDocument10 pagesDakota Office ProductsNidhi BhartiaNo ratings yet

- CitibankDocument2 pagesCitibankNiks Srivastava100% (1)

- Abc - Classic PenDocument14 pagesAbc - Classic PenVinay GoyalNo ratings yet

- Classic Pen Company: Case Analysis - Activity Based Cost System Group - 07Document16 pagesClassic Pen Company: Case Analysis - Activity Based Cost System Group - 07Anupriya Sen100% (1)

- Activity-Based Cost Systems: The Classic Pen Company A Case AnalysisDocument14 pagesActivity-Based Cost Systems: The Classic Pen Company A Case AnalysisSarveshwar Sharma50% (2)

- Classic Pen CaseDocument10 pagesClassic Pen CaseDebendra Kumar NayakNo ratings yet

- Classic Pen SolutionDocument4 pagesClassic Pen SolutionAlaka Kumari PradhanNo ratings yet

- Aashutosh Agrawal - Dushyant Singh - 2020MBA027 - 2020MBA013Document8 pagesAashutosh Agrawal - Dushyant Singh - 2020MBA027 - 2020MBA013Ashita PunjabiNo ratings yet

- Classic Pen Company: Developing An ABC ModelDocument22 pagesClassic Pen Company: Developing An ABC Modeljk kumarNo ratings yet

- ASN Board AssessmentDocument4 pagesASN Board AssessmentAgriSafeNo ratings yet

- CS Country of OriginDocument12 pagesCS Country of OriginShivani AggarwalNo ratings yet

- Inventory Management-Zaheer SwatiDocument6 pagesInventory Management-Zaheer Swatikrishia jainneNo ratings yet

- "Curriculum - Vitae": Manabendra MukherjeeDocument2 pages"Curriculum - Vitae": Manabendra MukherjeetulanishaNo ratings yet

- A Cultural Exploration of Consumers Interactions and Relationships With CelebritiesDocument30 pagesA Cultural Exploration of Consumers Interactions and Relationships With CelebritiesMirela PolicNo ratings yet

- Unit 07 Investigating Travel Agency OperationsDocument6 pagesUnit 07 Investigating Travel Agency OperationsVictor Oscar Nanquen OrtizNo ratings yet

- San Bernardino Bondholders Vs CalpersDocument114 pagesSan Bernardino Bondholders Vs Calpersjon_ortizNo ratings yet

- Role of Young EntrepreneursDocument8 pagesRole of Young EntrepreneursanilambicaNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Core Banking SolutionDocument12 pagesCore Banking SolutionMamta Grover100% (1)

- Retail Strategic Planning and Operations ManagementDocument33 pagesRetail Strategic Planning and Operations ManagementYash JashNo ratings yet

- 2011 JIS CatalogueDocument104 pages2011 JIS Catalogueedhy_03No ratings yet

- Walt DisneyDocument16 pagesWalt Disneychuckd_87No ratings yet

- Test Program ILT-U-2889Document6 pagesTest Program ILT-U-2889John Bedoya0% (1)

- Module 4 QuizDocument3 pagesModule 4 Quizaey de guzmanNo ratings yet

- Pa em TendenciaDocument21 pagesPa em Tendenciasander10100% (1)

- Audit On Accounts Receivable: Oni CosmeticsDocument7 pagesAudit On Accounts Receivable: Oni Cosmeticsjoyce KimNo ratings yet

- LLB Banking NotesDocument14 pagesLLB Banking Notesjagankilari80% (5)

- InspectionDocument32 pagesInspectionmaruf19900100% (1)

- Occupation 3Document14 pagesOccupation 3api-306711329No ratings yet

- Jigless Welding Case StudyDocument11 pagesJigless Welding Case StudyakshaytomarNo ratings yet

- CSR On Yes BankDocument21 pagesCSR On Yes BankSaurabhNo ratings yet

- JP Morgan Sachs &coDocument15 pagesJP Morgan Sachs &coAjeet YadavNo ratings yet

- Hiller's Layoff NoticesDocument6 pagesHiller's Layoff NoticesClickon DetroitNo ratings yet

- Mareng AdvancedDocument33 pagesMareng AdvancedJose LeónNo ratings yet

- Cutover Strategy in SAP FICO PDFDocument6 pagesCutover Strategy in SAP FICO PDFkkka TtNo ratings yet

- MI 0040 Final AssignmentDocument9 pagesMI 0040 Final Assignmentbhandari0148No ratings yet

- Chapter 10 - Advanced VariancesDocument19 pagesChapter 10 - Advanced VariancesVenugopal SreenivasanNo ratings yet