Professional Documents

Culture Documents

Cost-Volume-Profit Analysis: Slide 3-28

Uploaded by

SambuttOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost-Volume-Profit Analysis: Slide 3-28

Uploaded by

SambuttCopyright:

Available Formats

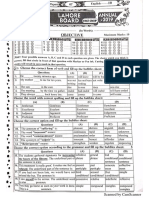

Chapter 3

Cost-Volume-Profit Analysis

Copyright 2003 Pearson Education Canada Inc. Slide 3-28

Cost-Volume-Profit Analysis

Examines the behaviour of total revenues, total costs,

and operating income as changes occur in the output

level, selling price, variable costs or fixed costs

Assumptions of CVP Analysis

1. revenues change in relation to production and sales

2. costs can be divided in variable and fixed categories

3. revenues and costs behave in a linear fashion

4. costs and prices are known

5. if more than one product exists, the sales mix is

constant

6. we can ignore the time value of money

Copyright 2003 Pearson Education Canada Inc. Page 67 Slide 3-29

Contribution Margin

Contribution margin is equal to the difference

between total revenue and total variable costs

Contribution margin per unit

= Selling price - Variable cost per unit

Contribution margin percentage

= Contribution margin per unit / selling price per unit

Total for

Per Unit 2 units %

Revenue $200 $400 100%

Variable costs 120 240 60%

Contribution margin $80 $160 40%

Copyright 2003 Pearson Education Canada Inc. Pages 68 - 69 Slide 3-30

Contribution Margin Income Statement

Income statement that groups line items by cost

behaviour to highlight the contribution margin

Packages Sold

0 1 2 25 40

Revenue $0 $200 $400 $5,000 $8,000

Variable costs 0 120 240 3,000 4,800

Contribution margin 0 80 160 2,000 3,200

Fixed costs 2,000 2,000 2,000 2,000 2,000

Operating income $(2,000) $(1,920) $(1,840) $0 $1,200

Copyright 2003 Pearson Education Canada Inc. Page 69 Slide 3-31

Breakeven Point

Quantity of output where total revenues equal total

costs

Point where operating income equals zero

Breakeven point in units

= Fixed costs / Contribution margin per unit

= $2,000 / $80

= 25 units

Breakeven point in dollars

= Fixed costs / contribution margin %

= $2,000 / 40%

= $5,000

Copyright 2003 Pearson Education Canada Inc. Page 71 Slide 3-32

Cost-Volume-Profit Graph

Total revenues

$10,000 Breakeven

line

Point

$8,000 25 units Total costs

line

$6,000

Operating

income

$4,000

$2,000

Operating

loss

$0

0 10 20 30 40 50

Units Sold

Copyright 2003 Pearson Education Canada Inc. Page 72 Slide 3-33

Target Operating Income

For most firms in the private sector, the main

objective is not to breakeven

Convert after-tax desired net income to its before-tax

equivalent operating income

Target operating income

= Target net income / (1 - tax rate)

Target Unit Sales

= (Fixed costs + Target operating income)

/ Contribution margin per unit

Target Dollar Sales

= (Fixed costs + Target operating income)

/ Contribution margin %

Copyright 2003 Pearson Education Canada Inc. Pages 73 - 75 Slide 3-34

Sensitivity Analysis

sensitivity analysis is a what-if technique that

examines how a result will change if the original

predicted data are not achieved or if an underlying

assumption changes

What will happen to operating income if volume

declines by 5%?

What will happen to operating income if variable

costs increase by 10% per unit?

sensitivity analysis broadens managements

perspectives about possible outcomes

Copyright 2003 Pearson Education Canada Inc. Pages 76 - 77 Slide 3-35

Alternative Cost Structures

CVP helps managers assess the risks and potential

benefits of adopting alternative cost structures

Example: Alternative rental arrangements

Option 2

Option 1 $1,400 Fixed Fee Option 3

$2,000 Fixed Fee + 5% Commission 20% Commission

Rev Rev Rev

$ $ $

Cost Cost Cost

Units Units Units

Breakeven = 25 units Breakeven = 20 units Breakeven = 0 units

Copyright 2003 Pearson Education Canada Inc. Pages 77 - 78 Slide 3-36

Revenue Mix

Revenue mix (or sales mix) is the relative

combination of quantities of products or services

that make up total revenue

Do-All Do-All Superword

Sales mix of Do-All : Superword = 2 : 1

Breakeven point in units

= 30 units 20 units of Do-All

10 units of Superword

Copyright 2003 Pearson Education Canada Inc. Pages 73 - 75 Slide 3-37

Multiple Cost Drivers

In many cases there may be multiple cost drivers

Do-All Software Example

Variable costs: $40 per software package sold

$15 per invoice issued

Operating income

= Revenue ($40 x packages sold) ($15 x invoices

issued) Fixed costs

In cases where there are multiple cost drivers there

are multiple breakeven points

Copyright 2003 Pearson Education Canada Inc. Pages 81 - 82 Slide 3-38

Contribution Margin & Gross Margin

Merchandising Sector

Contribution Margin Gross Margin

Format Format

Revenues $200 Revenues $200

Variable costs:

Cost of goods sold (120+5) 125

Cost of goods sold $120

Other variable 43 163 Gross margin 75

Contribution margin 37 Operating costs (43+19) 62

Fixed costs:

Cost of goods sold 5 Operating income $13

Other fixed 19 24

Operating income $13

Copyright 2003 Pearson Education Canada Inc. Pages 82 - 83 Slide 3-39

Contribution Margin & Gross Margin

Manufacturing Sector

Contribution Margin Gross Margin

Format Format

Revenues $1,000 Revenues $1,000

Variable costs:

Cost of goods sold (250+160) 410

Manufacturing $250

Non-manufacturing 270 520 Gross margin 590

Contribution margin 480 Non-manufacturing (270+138) 408

Fixed costs:

Manufacturing 160 Operating income $182

Non-manufacturing 138 298

Operating income $182

Copyright 2003 Pearson Education Canada Inc. Pages 81 - 82 Slide 3-40

Decision Models and Uncertainty

Managers make predictions and decisions in a world

of uncertainty

Estimate events that are likely to occur and assign

probabilities to each outcome

Probability distribution describes the likelihood of

each mutually exclusive and collectively exhaustive

set of events (must add to 1.00)

Expected value is a weighted average of the

outcomes with the probability of each outcome

serving as the weight

Copyright 2003 Pearson Education Canada Inc. Pages 86 - 87 Slide 3-41

Uncertainty Example

0.5

Probability 0.4

Proposal A: 0.3

Spy Novel 0.2

0.1

1 2 3 4 5 6 7 8 9

Cash Inflow ($000,000)

Expected value

= (0.1*$300,000) + (.02*$350,000) + (.04*$400,000) +

(0.2*$450,000) + (0.1*$500,000)

= $400,000

Copyright 2003 Pearson Education Canada Inc. Page 87 Slide 3-42

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- JDA Demand - Focus 2012Document43 pagesJDA Demand - Focus 2012Abbas Ali Shirazi100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Kon Kia Hai Dogars Edition PDFDocument296 pagesKon Kia Hai Dogars Edition PDFNoman AzizNo ratings yet

- Vault Guide To The Top Insurance EmployersDocument192 pagesVault Guide To The Top Insurance EmployersPatrick AdamsNo ratings yet

- Microsoft® Azure™ SQL Database Step by Step PDFDocument48 pagesMicrosoft® Azure™ SQL Database Step by Step PDFmtamilmaniNo ratings yet

- New Doc 2020-01-15 08.06.54Document2 pagesNew Doc 2020-01-15 08.06.54SambuttNo ratings yet

- SummaryDocument1 pageSummarySambuttNo ratings yet

- A Brief History of The Instinct Theory of MotivationDocument1 pageA Brief History of The Instinct Theory of MotivationSambuttNo ratings yet

- Unique College For GirlsDocument2 pagesUnique College For GirlsSambuttNo ratings yet

- A Closer Look at InstinctsDocument1 pageA Closer Look at InstinctsSambuttNo ratings yet

- Identifying InformationDocument1 pageIdentifying InformationSambuttNo ratings yet

- 11th Biology Pre Board Paper-2Document4 pages11th Biology Pre Board Paper-2SambuttNo ratings yet

- 11 Islamiat Pre Board PaperDocument2 pages11 Islamiat Pre Board PaperSambuttNo ratings yet

- Password of Zip FileDocument1 pagePassword of Zip FileSambuttNo ratings yet

- Observations About Instinct TheoryDocument1 pageObservations About Instinct TheorySambuttNo ratings yet

- 8Document1 page8SambuttNo ratings yet

- Instinct Theory of MotivationDocument1 pageInstinct Theory of MotivationSambuttNo ratings yet

- In HumansDocument1 pageIn HumansSambuttNo ratings yet

- The Senate Shall Not Be Subject To Dissolution But The Term of Its MembersDocument1 pageThe Senate Shall Not Be Subject To Dissolution But The Term of Its MembersSambuttNo ratings yet

- Detail of Further Evidence RequiredDocument1 pageDetail of Further Evidence RequiredSambuttNo ratings yet

- The Senate Shall Consist of OneDocument1 pageThe Senate Shall Consist of OneSambuttNo ratings yet

- (Please Tick Appropriate Box) Yes No: Comments and Future Action DiscussedDocument1 page(Please Tick Appropriate Box) Yes No: Comments and Future Action DiscussedSambuttNo ratings yet

- Substitution of Article 58 of The ConstitutionDocument1 pageSubstitution of Article 58 of The ConstitutionSambuttNo ratings yet

- Parliamentary Election Rules AmendmentDocument1 pageParliamentary Election Rules AmendmentSambuttNo ratings yet

- Of The Members Referred To in Paragrap3Document1 pageOf The Members Referred To in Paragrap3SambuttNo ratings yet

- Lot As To Which Two Members Shall Retire After The First Three YearsDocument1 pageLot As To Which Two Members Shall Retire After The First Three YearsSambuttNo ratings yet

- Of The Members Referred To in Paragrap2Document1 pageOf The Members Referred To in Paragrap2SambuttNo ratings yet

- Of The Members Referred To in ParagraphDocument1 pageOf The Members Referred To in ParagraphSambuttNo ratings yet

- Of The Members Referred To in Paragrap3Document1 pageOf The Members Referred To in Paragrap3SambuttNo ratings yet

- (E) Four Technocrats Including Ulema Shall Be Elected by The Members of Each Provincial Assembly andDocument1 page(E) Four Technocrats Including Ulema Shall Be Elected by The Members of Each Provincial Assembly andSambuttNo ratings yet

- Of The Members Referred To in Paragrap3Document1 pageOf The Members Referred To in Paragrap3SambuttNo ratings yet

- Of The Members Referred To in Paragrap3Document1 pageOf The Members Referred To in Paragrap3SambuttNo ratings yet

- Of The Members Referred To in Paragrap1Document1 pageOf The Members Referred To in Paragrap1SambuttNo ratings yet

- Election To Fill Seats in The Senate Allocated To Each Province Shall Be Held in Accordance With The System of Proportional Representation by Means of The Single Transferable VoteDocument1 pageElection To Fill Seats in The Senate Allocated To Each Province Shall Be Held in Accordance With The System of Proportional Representation by Means of The Single Transferable VoteSambuttNo ratings yet

- How Does FI Integrate With SD and What Is Their Account DeterminationDocument11 pagesHow Does FI Integrate With SD and What Is Their Account DeterminationBiranchi MishraNo ratings yet

- CRMDocument7 pagesCRMDushyant PandaNo ratings yet

- Prince2 - Sample Paper 1Document16 pagesPrince2 - Sample Paper 1ikrudisNo ratings yet

- Supply Chain Management Abbot Pharmaceutical PDFDocument23 pagesSupply Chain Management Abbot Pharmaceutical PDFasees_abidNo ratings yet

- Account StatementDocument46 pagesAccount Statementogagz ogagzNo ratings yet

- Assignment A2 - NUR AZMINA NADIA ROSLIE - 2019222588 - ENT300Document10 pagesAssignment A2 - NUR AZMINA NADIA ROSLIE - 2019222588 - ENT300minadiaNo ratings yet

- Analyzing Transactions and Double Entry LectureDocument40 pagesAnalyzing Transactions and Double Entry LectureSuba ChaluNo ratings yet

- AgribusinessDocument6 pagesAgribusinessshevadanzeNo ratings yet

- 5 Why AnalysisDocument2 pages5 Why Analysislnicolae100% (2)

- CH 01Document23 pagesCH 01Karan MadaanNo ratings yet

- InventoryDocument53 pagesInventoryVinoth KumarNo ratings yet

- Refunds Maceda Law and PD957Document2 pagesRefunds Maceda Law and PD957QUINTO CRISTINA MAENo ratings yet

- 01-9 QCS 2014Document8 pages01-9 QCS 2014Raja Ahmed HassanNo ratings yet

- Edvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFDocument10 pagesEdvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFreg_kata123No ratings yet

- Letter To Builder For VATDocument5 pagesLetter To Builder For VATPrasadNo ratings yet

- Metadesign Draft PresentationDocument12 pagesMetadesign Draft Presentationapi-242436520100% (1)

- FM S Summer Placement Report 2024Document12 pagesFM S Summer Placement Report 2024AladeenNo ratings yet

- General Mcqs On Revenue CycleDocument6 pagesGeneral Mcqs On Revenue CycleMohsin Kamaal100% (1)

- Get Surrounded With Bright Minds: Entourage © 2011Document40 pagesGet Surrounded With Bright Minds: Entourage © 2011Samantha HettiarachchiNo ratings yet

- Pakistan Is Not A Poor Country But in FactDocument5 pagesPakistan Is Not A Poor Country But in Factfsci35No ratings yet

- 048 Barayuga V AupDocument3 pages048 Barayuga V AupJacob DalisayNo ratings yet

- PsychographicsDocument12 pagesPsychographicsirenek100% (2)

- Chapter 4 - Fire InsuranceDocument8 pagesChapter 4 - Fire InsuranceKhandoker Mahmudul HasanNo ratings yet

- Online Customized T-Shirt StoresDocument5 pagesOnline Customized T-Shirt StoresPalash DasNo ratings yet

- Prepaid Shipping TitleDocument2 pagesPrepaid Shipping TitleShivam AroraNo ratings yet

- Bharathiar University MPhil/PhD Management SyllabusDocument22 pagesBharathiar University MPhil/PhD Management SyllabusRisker RaviNo ratings yet

- Βιογραφικά ΟμιλητώνDocument33 pagesΒιογραφικά ΟμιλητώνANDREASNo ratings yet