Professional Documents

Culture Documents

Noblesacctg10ppt19 150126092429 Conversion Gate02

Uploaded by

Aarti JCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Noblesacctg10ppt19 150126092429 Conversion Gate02

Uploaded by

Aarti JCopyright:

Available Formats

Job Order

Costing

Chapter 19

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-1

Learning Objectives

1. Distinguish between job order

costing and process costing

2. Record materials and labor

costs in a job order costing

system

3. Calculate the predetermined

overhead allocation rate and

allocate overhead costs

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-2

Learning Objectives

4. Record the completion and

sales of finished goods

5. Adjust for overallocated and

underallocated overhead

6. Calculate job costs for a service

company

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-3

Learning Objective 1

Distinguish between

job order costing and

process costing

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-4

Knowing the Cost of One Unit of

Product Helps Managers to:

Set selling prices that will lead to profits

Compute cost of goods sold for the

income statement

Compute the cost of inventory for the

balance sheet

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-5

Examples of Unit Costs

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-6

Costing Systems

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-7

Four-Step Method to Track

Product Costs

1. Accumulate

2. Assign

3. Allocate

4. Adjust

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-8

Would the following companies most likely use

job order costing or process costing?

1. Paint manufacturer

2. Print shop

3. Caterer

4. Soft drink bottler

5. Yacht builder

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-9

Would the following companies most likely use

job order costing or process costing?

1. Paint manufacturer Process costing

2. Print shop

3. Caterer

4. Soft drink bottler

5. Yacht builder

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-10

Would the following companies most likely use

job order costing or process costing?

1. Paint manufacturer Process costing

2. Print shop Job order costing

3. Caterer

4. Soft drink bottler

5. Yacht builder

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-11

Would the following companies most likely use

job order costing or process costing?

1. Paint manufacturer Process costing

2. Print shop Job order costing

3. Caterer Job order costing

4. Soft drink bottler

5. Yacht builder

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-12

Would the following companies most likely use

job order costing or process costing?

1. Paint manufacturer Process costing

2. Print shop Job order costing

3. Caterer Job order costing

4. Soft drink bottler Process costing

5. Yacht builder

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-13

Would the following companies most likely use

job order costing or process costing?

1. Paint manufacturer Process costing

2. Print shop Job order costing

3. Caterer Job order costing

4. Soft drink bottler Process costing

5. Yacht builder Job order costing

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-14

Learning Objective 2

Record materials and

labor costs in a job

order costing system

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-15

Flow of Product Costs in Job

Order Costing

Exhibit

Exhibit19-2

19-2Flow

Flowof

ofProduct

ProductCosts

Costsin

inJob

JobOrder

OrderCosting

Costing

Job

JobCost

CostRecord

Record

Job

Job2727

Direct

DirectMaterials

Materials

Direct

DirectLabor

Labor

Manufacturing

ManufacturingOverhead

Overhead

Job

JobCost

CostRecord

Record

Job

Job2828

Direct

DirectMaterials

Materials

Direct

DirectLabor

Labor

Manufacturing

ManufacturingOverhead

Overhead

Job Product costs

JobCost

CostRecord

Record

Job for each job are

Job2929

Direct recorded on

DirectMaterials

Materials

Direct individual job cost

DirectLabor

Labor

Manufacturing records

ManufacturingOverhead

Overhead

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-16

Flow of Product Costs in Job

Order Costing

Exhibit

Exhibit19-2

19-2Flow

Flowof

ofProduct

ProductCosts

Costsin

inJob

JobOrder

OrderCosting

Costing

BALANCE SHEET

Work-in-Process Inventory Finished Goods Inventory

Job

JobCost

CostRecord

Record

Job

Job2727 Costs Incurred

Direct Job 27

DirectMaterials

Materials

Direct Job 28

DirectLabor

Labor Job 29

Manufacturing

ManufacturingOverhead

Overhead

Job

JobCost

CostRecord

Record

Job

Job2828 Costs incurred for each job are

Direct

DirectMaterials

Materials added to WIP with debits

Direct

DirectLabor

Labor

Manufacturing

ManufacturingOverhead

Overhead

Job Product costs

JobCost

CostRecord

Record

Job for each job are

Job2929

Direct recorded on

DirectMaterials

Materials

Direct individual job cost

DirectLabor

Labor

Manufacturing records

ManufacturingOverhead

Overhead

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-17

Flow of Product Costs in Job Order

Costing

Exhibit

Exhibit19-2

19-2Flow

Flowof

ofProduct

ProductCosts

Costsin

inJob

JobOrder

OrderCosting

Costing

BALANCE SHEET

Work-in-Process Inventory Finished Goods Inventory

Job

JobCost

CostRecord

Record

Job COGM

Job2727 Costs Incurred COGM

Direct Job 27 Job 27 Job 27

DirectMaterials

Materials

Direct Job 28 Job 28 Job 28

DirectLabor

Labor Job 29

Manufacturing

ManufacturingOverhead

Overhead

Job When the job is completed,

JobCost

CostRecord

Record the costs are transferred out

Job

Job2828 Costs incurred for each job are

of WIP with a credit and

Direct

DirectMaterials

Materials added to WIP with debits

transferred into FG with a debit.

Direct

DirectLabor

Labor This amount is

Manufacturing

ManufacturingOverhead

Overhead called the jobs Cost of Goods

Manufactured (COGM)

Job Product costs

JobCost

CostRecord

Record

Job for each job are

Job2929

Direct recorded on

DirectMaterials

Materials

Direct individual job cost

DirectLabor

Labor

Manufacturing records

ManufacturingOverhead

Overhead

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-18

Flow of Product Costs in Job Order

Costing

Exhibit

Exhibit19-2

19-2Flow

Flowof

ofProduct

ProductCosts

Costsin

inJob

JobOrder

OrderCosting

Costing

BALANCE SHEET INCOME STATEMENT

Work-in-Process Inventory Finished Goods Inventory Cost of Goods Sold

Job

JobCost

CostRecord

Record

Job COGM COGS COGS

Job2727 Costs Incurred COGM

Direct Job 27 Job 27 Job 27 Job 27 Job 27

DirectMaterials

Materials

Direct Job 28 Job 28 Job 28

DirectLabor

Labor Job 29

Manufacturing

ManufacturingOverhead

Overhead

Job When the job is completed, When

When the

the job

job is

is sold,

JobCost

CostRecord

Record the costs are transferred out

sold,

Job the

the costs are transferred out

costs are transferred

Job2828 Costs incurred for each job are

of WIP with a credit and

out

Direct of

of FG

FG with

with aa credit

credit and

DirectMaterials

Materials added to WIP with debits

transferred into FG with a debit.

and

Direct transferred

transferred into

into COGS

DirectLabor

Labor This amount is

COGS

Manufacturing with a debit.

ManufacturingOverhead

Overhead called the jobs Cost of Goods

with a debit.

This

This amount

amount is is the

the jobs

jobs

Manufactured (COGM) Cost

Cost of Goods Sold (COGS).

of Goods Sold (COGS).

Job Product costs

JobCost

CostRecord

Record

Job for each job are

Job2929

Direct recorded on

DirectMaterials

Materials

Direct individual job cost

DirectLabor

Labor

Manufacturing records

ManufacturingOverhead

Overhead

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-19

Purchasing Materials

Transaction 1Materials Purchased: During 2016,

Smart Touch purchased raw materials of $367,000 on

account.

A L + E

=

Raw Materials Inventory

Bal. 70,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-20

Purchasing Materials

Transaction 1Materials Purchased: During 2016,

Smart Touch purchased raw materials of $367,000 on

account.

A L + E

=

RM A/P

Raw Materials Inventory

Bal. 70,000

Trans. 1 367,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-21

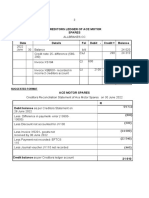

Raw Materials Subsidiary Ledger

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-22

Materials Requisition

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-23

Job Cost RecordDirect

Materials Recorded

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-24

Using Materials

Transaction 2Materials Used: In 2016, Smart

Touch used direct materials costing $355,000 and

indirect materials of $17,000.

A L + E

=

Raw Materials Inventory Work-in-Process Inventory

Bal. 70,000 Bal. 80,000

Trans. 1 367,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-25

Using Materials

Transaction 2Materials Used: In 2016, Smart

Touch used direct materials costing $355,000 and

indirect materials of $17,000.

A L + E

RM = MOH

WIP

Raw Materials Inventory Work-in-Process Inventory

Bal. 70,000 Bal. 80,000

Direct materials

Trans. 1 367,000 Trans. 2 372,000 Trans. 2 355,000

$355,000

Manufacturing Overhead

Indirect materials Trans. 2 17,000

$17,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-26

Job Cost RecordDirect

Labor Recorded

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-27

Labor Costs Incurred

Transaction 3Labor Costs Incurred: During 2016, Smart

Touch incurred total labor costs of $197,000, of which $169,000

was direct labor and $28,000 was indirect labor.

A L + E

=

Work-in-Process Inventory

Bal. 80,000

Trans. 2 355,000

Manufacturing Overhead

Trans. 2 17,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-28

Labor Costs Incurred

Transaction 3Labor Costs Incurred: During 2016, Smart

Touch incurred total labor costs of $197,000, of which $169,000

was direct labor and $28,000 was indirect labor.

A L + E

WIP = Wages MOH

Pay

Wages Payable Work-in-Process Inventory

Trans. 3 197,000 Bal. 80,000

Trans. 2 355,000

Direct labor

Trans. 3 169,000

$169,000

Manufacturing Overhead

Trans. 2 17,000

Indirect labor

Trans. 3 28,000

$28,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-29

Record the following journal entries for Smith

Company:

6. Purchased materials on account, $10,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-30

Record the following journal entries for Smith

Company:

6.Purchased materials on account, $10,000

Raw Materials Inventory 10,000

Accounts Payable 10,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-31

Record the following journal entries for Smith

Company:

7.Used $6,000 in direct materials and $500 in

indirect materials in production.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-32

Record the following journal entries for Smith

Company:

7.Used $6,000 in direct materials and $500 in

indirect materials in production.

Work in Process Inventory 6,000

Manufacturing Overhead 500

Raw Materials Inventory 6,500

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-33

Record the following journal entries for Smith

Company:

8.Incurred $8,000 in labor costs, of which 80% was

direct labor.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-34

Record the following journal entries for Smith

Company:

8.Incurred $8,000 in labor costs, of which 80% was

direct labor.

Work in Process Inventory 6,400

Manufacturing Overhead 1,600

Wages Payable 8,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-35

Learning Objective 3

Calculate the

predetermined

overhead allocation

rate and allocate

overhead costs

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-36

Actual Overhead Costs Incurred

Transaction 4Actual Overhead Costs Incurred:

Depreciation on manufacturing plant and equipment, $20,000.

A L + E

=

Manufacturing Overhead

Trans. 2 17,000

Trans. 3 28,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-37

Actual Overhead Costs Incurred

Transaction 4Actual Overhead Costs Incurred:

Depreciation on manufacturing plant and equipment, $20,000.

A L + E

Accum = MOH

Depr

Manufacturing Overhead

Trans. 2 17,000

Trans. 3 28,000

Trans. 4 20,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-38

Actual Overhead Costs Incurred

Transaction 5Actual Overhead Costs Incurred:

Plant utilities, $7,000.

A L + E

=

Manufacturing Overhead

Trans. 2 17,000

Trans. 3 28,000

Trans. 4 20,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-39

Actual Overhead Costs Incurred

Transaction 5Actual Overhead Costs Incurred:

Paid $7,000 for plant utilities.

A L + E

Cash = MOH

Manufacturing Overhead

Trans. 2 17,000

Trans. 3 28,000

Trans. 4 20,000

Trans. 5 7,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-40

Actual Overhead Costs Incurred

Transaction 6Actual Overhead Costs Incurred:

Plant insurance, $6,000 (previously paid).

A L + E

=

Manufacturing Overhead

Trans. 2 17,000

Trans. 3 28,000

Trans. 4 20,000

Trans. 5 7,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-41

Actual Overhead Costs Incurred

Transaction 6Actual Overhead Costs Incurred:

Plant insurance, $6,000 (previously paid).

A L + E

Prepaid = MOH

Ins

Manufacturing Overhead

Trans. 2 17,000

Trans. 3 28,000

Trans. 4 20,000

Trans. 5 7,000

Trans. 6 6,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-42

Actual Overhead Costs Incurred

Transaction 7Actual Overhead Costs Incurred:

Plant property taxes incurred but not yet paid, $5,000.

A L + E

=

Manufacturing Overhead

Trans. 2 17,000

Trans. 3 28,000

Trans. 4 20,000

Trans. 5 7,000

Trans. 6 6,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-43

Actual Overhead Costs Incurred

Transaction 7Actual Overhead Costs Incurred:

Plant property taxes incurred but not yet paid, $5,000.

A L + E

= Prop Tax MOH

Pay

Manufacturing Overhead

Trans. 2 17,000

Trans. 3 28,000

Trans. 4 20,000

Trans. 5 7,000

Trans. 6 6,000

Trans. 7 5,000

Bal 83,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-44

Steps for Allocating Overhead Costs

1. Calculating the predetermined overhead

rate before the period

2. Allocating overhead during the period

3. Adjusting overhead at the end of the

period

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-45

Predetermined Overhead

Allocation Rate

Total estimated overhead costs

Total estimated quantity of the overhead allocation base

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-46

Traditional Cost Drivers

Direct labor hours (for labor-intensive production

environments)

Direct labor cost (for labor-intensive production

environments)

Machine hours (for machine-intensive production

environments)

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-47

Predetermined Overhead

Allocation Rate

At the end of 2015, Smart Touch estimated that

total overhead costs for 2016 would be $68,000

and direct labor cost would total $170,000.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-48

Predetermined Overhead

Allocation Rate

At the end of 2015, Smart Touch estimated that

total overhead costs for 2016 would be $68,000

and direct labor cost would total $170,000.

Total estimated overhead costs

Total estimated quantity of the overhead allocation base

$ 68,000

$170,000

= 0.40 = 40%

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-49

Allocating Overhead

Actual Quantity

Allocated Predetermined

of the Allocation

Manufacturing = Overhead

Base Used by

Overhead Cost Allocation Rate

Each Job

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-50

Allocating Overhead

Smart Touch Learnings total direct labor cost

for Job 27 was $1,250. How much overhead

should be allocated to Job 27?

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-51

Allocating Overhead

Smart Touch Learnings total direct labor cost

for Job 27 was $1,250. How much overhead

should be allocated to Job 27?

Actual Quantity

Allocated Predetermined

of the Allocation

Manufacturing = Overhead

Base Used by

Overhead Cost Allocation Rate

Each Job

= 40% $1,250

= $500

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-52

Job Cost RecordCompleted

Cost of goods manufactured

Cost of goods manufactured

Total units produced

Total units produced

$4,500

$4,500

15 tablets

15 tablets

= $300 per tablet

= $300 per tablet

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-53

Overhead Allocation

Transaction 8Overhead Allocation: Smart Touchs total

direct labor cost for 2016 was $169,000. Overhead was

allocated based on direct labor cost.

A L + E

=

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-54

Overhead Allocation

Transaction 8Overhead Allocation: Smart Touchs total

direct labor cost for 2016 was $169,000. Overhead was

allocated based on direct labor cost.

A L + E

WIP = MOH

Manufacturing Overhead Work-in-Process Inventory

Trans. 2 17,000 Trans. 8 67,600 Bal. 80,000

Trans. 3 28,000 Trans. 2 355,000

Trans. 4 20,000 Overhead Trans. 3 169,000

Trans. 5 7,000 Allocated Trans. 8 67,600

Trans. 6 6,000 40% $169,000

Trans. 7 5,000

Bal 15,400

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-55

Smith Company expected to incur $10,000 in

manufacturing overhead costs and use 4,000

machine hours for the year. Actual manu-

facturing overhead was $9,700 and the

company used 4,250 machine hours.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-56

9. Calculate the predetermined overhead

allocation rate using machine hours as the

allocation base.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-57

9. Calculate the predetermined overhead

allocation rate using machine hours as the

allocation base.

$10,000

4,000 machine hours

$2.50 per machine hour

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-58

10. How much manufacturing overhead was

allocated during the year?

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-59

10. How much manufacturing overhead was

allocated during the year?

$2.50 per machine hour 4,250 machine hours

= $10,625

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-60

Learning Objective 4

Record the completion

and sales of finished

goods

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-61

Flow of Product Costs in Job

Order Costing

Exhibit

Exhibit19-8

19-8Flow

Flowof

ofProduct

ProductCosts

Costsfor

forJobs

Jobs27,

27,28,

28,and

and29

29

BALANCE SHEET INCOME STATEMENT

Work-in-Process Inventory Finished Goods Inventory Cost of Goods Sold

Job

JobCost

CostRecord

Record

Job COGM COGS COGS

Job2727 Costs Incurred COGM

Direct Job 27 Job 27 Job 27 Job 27 Job 27

DirectMaterials

Materials

Direct

DirectLabor

Labor 4,500 4,500 4,500 4,500 4,500

Manufacturing

ManufacturingOverhead

Overhead Job 28 Job 28 Job 28 Bal

6,000 6,000 6,000 4,500

Job

JobCost

CostRecord

Record Job 29 BalWhen the job is completed, When

Job When the

the job

job isis sold,

sold,

Job2828 the costs are transferred out the

Direct Costs incurred for each job are the costs

costs are

are transferred

transferred out out

DirectMaterials

Materials 3,300 6,000of WIP with a credit and

of

Direct Bal added to WIP with debits of FG

FG with

with aa credit

credit andand

DirectLabor

Labor transferred into FG with a debit. transferred

Manufacturing transferred into

into COGS

COGS

ManufacturingOverhead

Overhead This amount is with

3,300 with aa debit.

debit.

called the jobs Cost of Goods This

This amount

amount is is the

the jobs

jobs

Manufactured (COGM) Cost

Cost ofof Goods

Goods SoldSold (COGS).

(COGS).

Job Product costs

JobCost

CostRecord

Record

Job for each job are

Job2929

Direct recorded on

DirectMaterials

Materials

Direct individual job cost

DirectLabor

Labor

Manufacturing records

ManufacturingOverhead

Overhead

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-62

Jobs Completed

Transaction 9Jobs Completed: The $644,600 Cost of

Goods Manufactured is the cost of all jobs Smart Touch

completed during 2016.

A L + E

=

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-63

Jobs Completed

Transaction 9Jobs Completed: The $644,600 Cost of

Goods Manufactured is the cost of all jobs Smart Touch

completed during 2016.

A L + E

FG =

WIP

Work-in-Process Inventory Finished Goods Inventory

Bal. 80,000 Bal. 0

Trans. 2 355,000 Trans. 9 644,600 Cost of Goods Trans. 9 644,600

Manufactured

Trans. 3 169,000

Trans. 8 67,600

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-64

Jobs Sold

Transaction 10Jobs Sold: During 2016, sales on account

were $1,200,000.

A L + E

=

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-65

Jobs Sold

Transaction 10Jobs Sold: During 2016, sales on account

were $1,200,000

A L + E

A/R = Sales

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-66

Cost of Jobs Sold

Transaction 11Cost of Jobs Sold: The cost of all jobs that

Smart Touch sold during 2016 was $584,600.

A L + E

=

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-67

Cost of Jobs Sold

Transaction 11Cost of Jobs Sold: The cost of all jobs that

Smart Touch sold during 2016 was $584,600.

A L + E

FG = COGS

Finished Goods Inventory Cost of Goods Sold

Bal. 0 Trans. 11 584,600

Trans. 9 644,600 Trans. 11 584,600 Cost of Goods

Sold

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-68

Summary of the Completion and

Sale of Jobs

BALANCE SHEET INCOME STATEMENT

Work-in-Process Inventory Finished Goods Inventory Cost of Goods Sold

Costs Incurred COGM COGM COGS COGS

Bal. 80,000 Bal. Trans. 11

Trans. 2 355,000 Trans. 9 644,600

0 584,600

Trans. 3 169,000

Trans. 9 Trans. 11

Trans. 8 67,600

Bal. 27,000 644,600 584,600

Bal.

60,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-69

The following information pertains to Smith

Company, which you worked with previously in

this chapter:

11.Smith Company completed jobs that cost

$25,000 to manufacture. Record the journal entry.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-70

The following information pertains to Smith

Company, which you worked with previously in

this chapter:

11.Smith Company completed jobs that cost

$25,000 to manufacture. Record the journal entry.

Finished Goods Inventory 25,000

Work-in-Process Inventory 25,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-71

12. Smith Company sold jobs to customers on

account for $52,000 that cost $22,000 to

manufacture. Record the journal entries.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-72

12. Smith Company sold jobs to customers on

account for $52,000 that cost $22,000 to

manufacture. Record the journal entries.

Accounts Receivable 52,000

Sales Revenues 52,000

Cost of Goods Sold 22,000

Finished Goods Inventory 22,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-73

Learning Objective 5

Adjust for

overallocated and

underallocated

overhead

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-74

Manufacturing Overhead Balance

Manufacturing Overhead

Trans. 2 17,000 Trans. 8 67,600 Allocated costs

Trans. 3 28,000

Actual costs Trans. 4 20,000

$83,000 Trans. 5 7,000

Trans. 6 6,000

Trans. 7 5,000

Bal. 15,400

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-75

Adjusting Manufacturing Overhead

Transaction 12Adjusting Manufacturing Overhead: At the

end of 2016, the Manufacturing Overhead account is closed.

A L + E

=

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-76

Adjusting Manufacturing Overhead

Transaction 12Adjusting Manufacturing Overhead: At the

end of 2016, the Manufacturing Overhead account is closed.

A L + E

= COGS

MOH

Manufacturing Overhead Cost of Goods Sold

Trans. 2 17,000 Trans. 8 67,600 Trans. 11 584,600

Trans. 3 28,000 Trans. 12 15,400

Trans. 4 20,000 Bal. 600,000

Trans. 5 7,000

Trans. 6 6,000

Trans. 7 5,000

Bal. 15,400 Underallocated

Trans. 12 15,400 Manufacturing

Bal. 0 Overhead

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-77

Accounting for Manufacturing

Overhead

Exhibit

Exhibit19-9

19-9Accounting

Accountingfor

forManufacturing

ManufacturingOverhead

Overhead

Before the Period

Calculating the Predetermined Overhead Allocation Rate

Predetermined Overhead Total estimated manufacturing costs

Allocation Rate = Total estimated quantity of the overhead allocation base

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-78

Accounting for Manufacturing

Overhead

Exhibit

Exhibit19-9

19-9Accounting

Accountingfor

forManufacturing

ManufacturingOverhead

Overhead

Before the Period

Calculating the Predetermined Overhead Allocation Rate

Predetermined Overhead Total estimated manufacturing costs

Allocation Rate = Total estimated quantity of the overhead allocation base

During the Period

Allocating Overhead

Predetermined Actual Quantity of the

Allocated Manufacturing Overhead Allocation Base Used

=

Overhead Cost Allocation Rate by Each Job

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-79

Accounting for Manufacturing

Overhead

Exhibit

Exhibit19-9

19-9Accounting

Accountingfor

forManufacturing

ManufacturingOverhead

Overhead

Before the Period

Calculating the Predetermined Overhead Allocation Rate

Predetermined Overhead Total estimated manufacturing costs

Allocation Rate = Total estimated quantity of the overhead allocation base

During the Period

Allocating Overhead

Predetermined Actual Quantity of the

Allocated Manufacturing Overhead Allocation Base Used

=

Overhead Cost Allocation Rate by Each Job

At the End of the Period

Adjusting for Overallocated and Underallocated Overhead

Manufacturing Cost of

Journal Entry

Overhead Goods Sold

Actual costs > allocated costs Underallocated Undercosted DR COGS

CR MOH

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-80

Accounting for Manufacturing

Overhead

Exhibit

Exhibit19-9

19-9Accounting

Accountingfor

forManufacturing

ManufacturingOverhead

Overhead

Before the Period

Calculating the Predetermined Overhead Allocation Rate

Predetermined Overhead Total estimated manufacturing costs

Allocation Rate = Total estimated quantity of the overhead allocation base

During the Period

Allocating Overhead

Predetermined Actual Quantity of the

Allocated Manufacturing Overhead Allocation Base Used

=

Overhead Cost Allocation Rate by Each Job

At the End of the Period

Adjusting for Overallocated and Underallocated Overhead

Manufacturing Cost of

Journal Entry

Overhead Goods Sold

Actual costs > allocated costs Underallocated Undercosted DR COGS

CR MOH

Actual costs < allocated costs Overallocated Overcosted DR MOH

CR COGS

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-81

Summary of Journal Entries

A L + E

=

RM A/P

A L + E

RM = MOH

WIP

A L + E

WIP = Wages Pay MOH

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-82

Summary of Journal Entries

(continued)

A L + E

Accum = MOH

Depr

A L + E

Cash = MOH

A L + E

Prepaid = MOH

Insurance

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-83

Summary of Journal Entries

(continued)

A L + E

= Prop Tax MOH

Pay

A L + E

WIP = MOH

A L + E

FG =

WIP

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-84

Summary of Journal Entries

(continued)

A L + E

A/R = Sales

Revenue

A L + E

FG = COGS

A L + E

= COGS

MOH

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-85

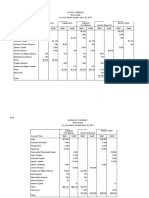

Schedule of Cost of Goods

Manufactured

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-86

Income Statement

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-87

The following information pertains to Smith

Company for the year:

Estimated manufacturing overhead $500,000

Estimated direct labor hours 10,000 hours

Actual manufacturing overhead $550,000

Actual direct labor hours 10,500 hours

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-88

13. Calculate the predetermined overhead

allocation rate using direct labor hours as the

allocation base.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-89

13. Calculate the predetermined overhead

allocation rate using direct labor hours as the

allocation base.

$500,000

10,000 direct labor hours

$50 per direct labor hour

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-90

14. Determine the amount of overhead allocated

during the year. Record the journal entry.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-91

14. Determine the amount of overhead allocated

during the year. Record the journal entry.

$50 per direct labor hour 10,500 hours

= $525,000

Work-in-Process Inventory 525,000

Manufacturing Overhead 525,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-92

15. Determine the amount of underallocated or

overallocated overhead. Record the journal

entry to adjust Manufacturing Overhead.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-93

15. Determine the amount of underallocated or

overallocated overhead. Record the journal

entry to adjust Manufacturing Overhead.

Actual overhead $ 550,000

Allocated overhead 525,000

Underallocated $ 25,000

Cost of Goods Sold 25,000

Manufacturing Overhead 25,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-94

Learning Objective 6

Calculate job costs for

a service company

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-95

Predetermined Overhead Allocation

Rate in a Service Company

Walsh Associates, a law firm, estimates the

following indirect costs for 2016:

Office rent $ 200,000

Office support staff 70,000

Maintaining and updating law library for case research 25,000

Advertisements 3,000

Sponsorship of the symphony 2,000

Total indirect costs $ 300,000

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-96

Predetermined Overhead Allocation

Rate in a Service Company

Walsh uses direct labor hours as the allocation

base because direct labor hours are the main

driver of indirect costs. It is estimated that Walsh

attorneys will work 10,000 direct labor hours in

2016. The predetermined overhead allocation rate

is:

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-97

Predetermined Overhead Allocation

Rate in a Service Company

Walsh uses direct labor hours as the allocation

base because direct labor hours are the main

driver of indirect costs. It is estimated that Walsh

attorneys will work 10,000 direct labor hours in

2016. The predetermined overhead allocation rate

is:

$300,000 expected indirect costs

10,000 expected direct labor hours

= $30 per direct labor hour

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-98

Allocating indirect costs to jobs

Direct labor costs are $50 per hour. Client 367

required 14 direct labor hours. The total costs

assigned to Client 367 are:

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-99

Allocating indirect costs to jobs

Direct labor costs are $50 per hour. Client 367

required 14 direct labor hours. The total costs

assigned to Client 367 are:

Direct labor: 14 hours $50 per hour $

700

Indirect costs: 14 hours $30 per hour

420

Total costs $ 1,120

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-100

Pricing Decisions

The total hourly rate for the company is $80 ($50

per hour for direct labor plus $30 per hour for

indirect costs). If the firm desires a profit equal

to 75% of the firms cost, then the price would

be:

Markup = Total Cost Markup Percentage

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-101

Pricing Decisions

The total hourly rate for the company is $80 ($50

per hour for direct labor plus $30 per hour for

indirect costs). If the firm desires a profit equal

to 75% of the firms cost, then the price would

be:

Markup = Total Cost Markup Percentage

= $80 per hour 75%

= $60 per hour

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-102

Pricing Decisions

The total hourly rate for the company is $80 ($50

per hour for direct labor plus $30 per hour for

indirect costs). If the firm desires a profit equal

to 75% of the firms cost, then the price would

be:

Markup = Total Cost Markup Percentage

= $80 per hour 75%

= $60 per hour

Price = Total Cost + Markup

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-103

Pricing Decisions

The total hourly rate for the company is $80 ($50

per hour for direct labor plus $30 per hour for

indirect costs). If the firm desires a profit equal to

75% of the firms cost, then the price would be:

Markup = Total Cost Markup Percentage

= $80 per hour 75%

= $60 per hour

Price = Total Cost + Markup

= $80 per hour + $60 per hour

= $140 per hour

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-104

Wesson Company is a consulting firm. The firm

expects to have $45,000 in indirect costs

during the year and bill customers for 6,000

hours. The cost of direct labor is $75 per hour.

16.Calculate the predetermined overhead

allocation rate for Wesson.

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-105

Wesson Company is a consulting firm. The firm

expects to have $45,000 in indirect costs

during the year and bill customers for 6,000

hours. The cost of direct labor is $75 per hour.

16.Calculate the predetermined overhead

allocation rate for Wesson.

$45,000

6,000 billable hours

$7.50 per billable hour

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-106

17. Wesson completed a consulting job for

George Peterson and billed the customer for

15 hours. What was the total cost of the

consulting job?

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-107

17. Wesson completed a consulting job for

George Peterson and billed the customer for

15 hours. What was the total cost of the

consulting job?

Direct labor

15 billable hours $75.00 per billable hour = $1,125.00

Indirect costs

15 billable hours $7.50 per billable hour =

112.50

Total cost $1,237.50

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-108

18. If Wesson wants to earn a profit equal to 60%

of the cost of a job, how much should the

company charge Mr. Peterson?

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-109

18. If Wesson wants to earn a profit equal to 60%

of the cost of a job, how much should the

company charge Mr. Peterson?

Profit = 60% of cost

=60% $1,237.50

=$742.50

Price = Cost + Profit

=$1,237.50 + $742.50

=$1,980.00

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-110

Key Terms

Allocation Base

Cost Driver

Job

Job Cost Record

Job Order Costing System

Labor Time Record

Copyright 2014 Pearson Education, Inc. publishing as Prentice Hall 19-111

You might also like

- CostingDocument3 pagesCostingAarti JNo ratings yet

- TFTH C 636639530213947535 31700 2Document55 pagesTFTH C 636639530213947535 31700 2Aarti JNo ratings yet

- American Finance Association, Wiley The Journal of FinanceDocument8 pagesAmerican Finance Association, Wiley The Journal of FinanceAarti JNo ratings yet

- Accounting Homework Help IliskimeDocument1 pageAccounting Homework Help IliskimeAarti JNo ratings yet

- Ch03 Prob3-6ADocument9 pagesCh03 Prob3-6AAarti J100% (1)

- Deegan Chapter 10Document18 pagesDeegan Chapter 10Aarti JNo ratings yet

- Saudi Vision2030Document85 pagesSaudi Vision2030ryx11No ratings yet

- Hi5019 Individual Assignment t1 2019 Qyuykqw5Document5 pagesHi5019 Individual Assignment t1 2019 Qyuykqw5Aarti J50% (2)

- NCK - Annual Report 2017 PDFDocument56 pagesNCK - Annual Report 2017 PDFAarti JNo ratings yet

- Mgt201 Solved Subjective Questions Vuzs TeamDocument12 pagesMgt201 Solved Subjective Questions Vuzs TeamAarti JNo ratings yet

- Caltex Australia CTX 2017 Annual ReportDocument127 pagesCaltex Australia CTX 2017 Annual ReportAarti JNo ratings yet

- 2 Case - 2Document10 pages2 Case - 2Aarti JNo ratings yet

- 1 - Sis40215 CPT Case Studies 3Document61 pages1 - Sis40215 CPT Case Studies 3Aarti J0% (2)

- CR 1845Document90 pagesCR 1845Aarti JNo ratings yet

- CH 07 SMDocument11 pagesCH 07 SMAarti JNo ratings yet

- 6 Capital Market Intermediaries and Their RegulationDocument8 pages6 Capital Market Intermediaries and Their RegulationTushar PatilNo ratings yet

- Case Study Ch03Document3 pagesCase Study Ch03Munya Chawana0% (1)

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Document32 pagesChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNo ratings yet

- Accounting Changes and Errors: HapterDocument46 pagesAccounting Changes and Errors: HapterAarti JNo ratings yet

- Philanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Document2 pagesPhilanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Aarti JNo ratings yet

- Investment Decision MethodDocument44 pagesInvestment Decision MethodashwathNo ratings yet

- Mergers Don't Always Lead To Culture Clashes.Document3 pagesMergers Don't Always Lead To Culture Clashes.Lahiyru100% (3)

- Organizational CultureDocument21 pagesOrganizational CultureAarti JNo ratings yet

- Coles Year in Review 2017Document28 pagesColes Year in Review 2017Aarti JNo ratings yet

- The Whirlpool Europe Case: Investment On ERPDocument8 pagesThe Whirlpool Europe Case: Investment On ERPAarti JNo ratings yet

- Relevant Cost Examples EMBA-garrison Ch.13Document13 pagesRelevant Cost Examples EMBA-garrison Ch.13Aarti JNo ratings yet

- Whirlpool EuropeDocument19 pagesWhirlpool Europejoelgzm0% (1)

- ACCG315Document4 pagesACCG315Joannah Blue0% (1)

- 2010 06 13 - 091545 - Case13 30Document6 pages2010 06 13 - 091545 - Case13 30Sheila Mae Llamada Saycon IINo ratings yet

- MCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Document139 pagesMCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Aarti J100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bar Harbor Blueberry Farm: Purchase JournalDocument3 pagesBar Harbor Blueberry Farm: Purchase JournalSantiNo ratings yet

- Wagwag Enterprises: Practice SetDocument70 pagesWagwag Enterprises: Practice SetRoselynNo ratings yet

- Provisional Balance Sheet of 2021-22Document3 pagesProvisional Balance Sheet of 2021-22Hemendra KapadiaNo ratings yet

- Account Statement From 1 Dec 2015 To 31 May 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 1 Dec 2015 To 31 May 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancevineethNo ratings yet

- Intermediate Accounting 14th Edition Kieso Test BankDocument25 pagesIntermediate Accounting 14th Edition Kieso Test BankReginaGallagherjkrb100% (56)

- 310 CH 6Document24 pages310 CH 6Ashok SharmaNo ratings yet

- Creditors Reconciliation Question Suggested SolutionDocument2 pagesCreditors Reconciliation Question Suggested SolutionShweta SinghNo ratings yet

- Xlookup ExercisesDocument59 pagesXlookup ExercisesSamNo ratings yet

- Edgar Detoya Tax Consultant (Acca101)Document56 pagesEdgar Detoya Tax Consultant (Acca101)Hannah Pearl Flores VillarNo ratings yet

- Lesson 5Document31 pagesLesson 5Glenda DestrizaNo ratings yet

- CH 9: General Principles of Bank ManagementDocument45 pagesCH 9: General Principles of Bank ManagementkunjapNo ratings yet

- CH01 Introduction To Accounting PDFDocument40 pagesCH01 Introduction To Accounting PDFindra6rusadie100% (1)

- Fabm-2 Las Quarter 3Document97 pagesFabm-2 Las Quarter 3Karl Vincent Uy96% (26)

- DISBURSEMENT Voucher SampleDocument16 pagesDISBURSEMENT Voucher SampleRachelle Rellora50% (2)

- Cost Chapter 14Document15 pagesCost Chapter 14Marica ShaneNo ratings yet

- LOGISTICS DEPARTMENT ORGANIZATIONDocument9 pagesLOGISTICS DEPARTMENT ORGANIZATIONAhmed HussainNo ratings yet

- G e A e C A E: Merchandi at TH ND The PeriodDocument8 pagesG e A e C A E: Merchandi at TH ND The Periodkakao67% (3)

- E4-1 Worksheet Title GeneratorDocument7 pagesE4-1 Worksheet Title GeneratorQuynh Cao PhuongNo ratings yet

- Complete Accounting Cycle ExerciseDocument28 pagesComplete Accounting Cycle ExerciseBrian Dillard94% (17)

- Final IME Class Time Table 2012-2013-Sem-IDocument2 pagesFinal IME Class Time Table 2012-2013-Sem-IMJNo ratings yet

- Strategi PemasaranDocument120 pagesStrategi PemasaranRazvi Yudatama100% (2)

- P5-6 Dan P5-8Document13 pagesP5-6 Dan P5-8rama100% (1)

- List Peserta FinalDocument8 pagesList Peserta FinalSyifa AryantiNo ratings yet

- FabmDocument26 pagesFabmErica Napigkit100% (1)

- Tax Chap 14 To 15Document7 pagesTax Chap 14 To 15Jea XeleneNo ratings yet

- Modern Auditing BoyntonDocument3 pagesModern Auditing BoyntonRirinNo ratings yet

- Ulidsonlen 5Document11 pagesUlidsonlen 5api-239547380100% (5)

- Liabilities Are Debts Owed To OutsiderDocument8 pagesLiabilities Are Debts Owed To OutsiderDayu MirahNo ratings yet

- PAYROLL MASTER FOR UNIFIED WORKERS COOPERATIVEDocument36 pagesPAYROLL MASTER FOR UNIFIED WORKERS COOPERATIVETotzkie LumpoyNo ratings yet

- KisikisiDocument7 pagesKisikisijalunasaNo ratings yet